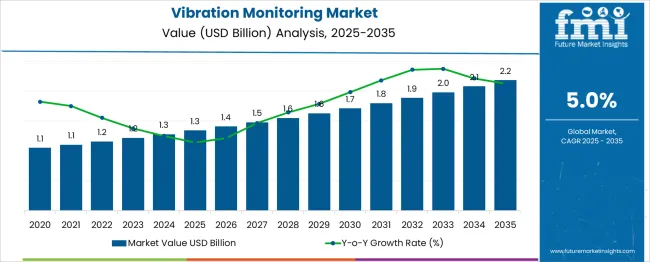

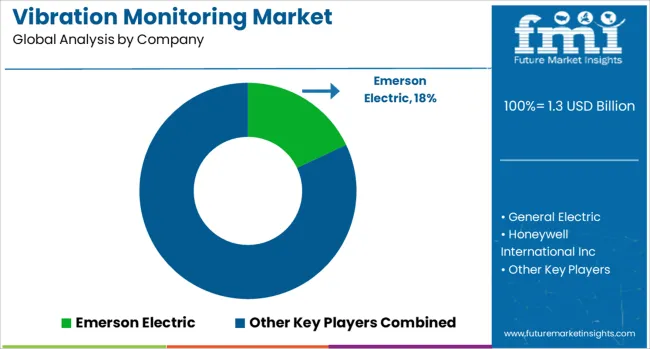

The Vibration Monitoring Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

From 2025 to 2030, the market is expected to rise from USD 1.3 billion to USD 1.7 billion, indicating steady growth driven by predictive maintenance strategies and increasing deployment of condition monitoring systems in industrial sectors. Year-on-year analysis shows gradual increments, with the market reaching USD 1.4 billion in 2026 and USD 1.5 billion in 2027, supported by investments in digital monitoring technologies for critical equipment.

By 2028, the market is forecasted to reach USD 1.6 billion, maintaining this value through 2029 before advancing to USD 1.7 billion by 2030. Demand is anticipated to strengthen as IoT-enabled sensors and cloud-based analytics become more prominent in maintenance operations, improving real-time fault detection and minimizing downtime.

Manufacturers are expected to focus on compact, wireless solutions that integrate seamlessly with industrial automation frameworks. This trajectory positions vibration monitoring as a critical element in the evolution of smart factories, enhancing operational reliability and cost efficiency across sectors like energy, manufacturing, and transportation.

| Metric | Value |

|---|---|

| Vibration Monitoring Market Estimated Value in (2025E) | USD 1.3 billion |

| Vibration Monitoring Market Forecast Value in (2035F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The vibration monitoring market represents a significant component within the broader condition-based maintenance ecosystem. In the condition monitoring market, it holds an estimated share of 28-30%, as vibration analysis is one of the most widely used techniques for early fault detection in machinery. Within the predictive maintenance solutions market, its contribution stands at around 20–22%, driven by its ability to forecast equipment failures and reduce unplanned downtime.

In the industrial automation and control systems market, the share is smaller at 4-5%, since this category includes a wide array of process control and automation technologies. For the asset performance management market, vibration monitoring accounts for about 8-9%, given its integration with asset reliability strategies.

The rotating equipment monitoring market sees the highest share, approximately 35-38%, because vibration analysis is essential for turbines, compressors, pumps, and motors. This market is expanding rapidly due to rising adoption of IoT-enabled sensors, wireless monitoring solutions, and AI-driven analytics for real-time diagnostics. Demand is fueled by industries such as oil and gas, power generation, manufacturing, and aerospace, where operational efficiency and safety are paramount. As digital transformation accelerates, vibration monitoring is set to capture greater share, emerging as a cornerstone of predictive maintenance and smart factory frameworks.

The vibration monitoring market is witnessing sustained growth as industries prioritize predictive maintenance, operational efficiency, and asset longevity to minimize unplanned downtime and optimize productivity. The shift from reactive to condition-based maintenance strategies has significantly elevated the demand for real-time monitoring solutions across sectors such as manufacturing, energy, and transportation.

Increased deployment of Industry 4.0 initiatives and integration of intelligent sensing technologies have further enhanced the scope and accuracy of vibration monitoring systems. The market outlook remains positive, supported by rising investments in smart factories, heightened awareness of equipment health management, and ongoing innovation in sensor miniaturization and wireless communication.

Future opportunities are being shaped by the convergence of advanced analytics, cloud platforms, and machine learning capabilities, paving the way for scalable and intelligent monitoring infrastructures that align with evolving industrial needs.

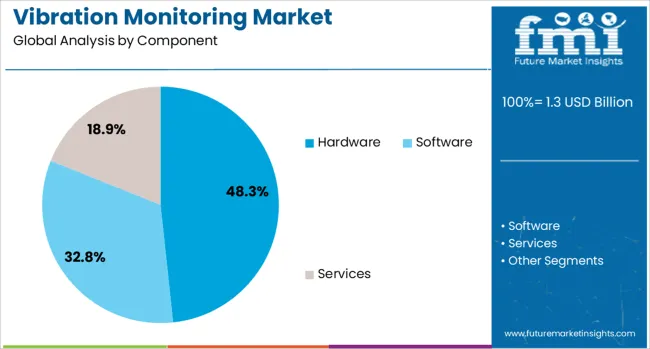

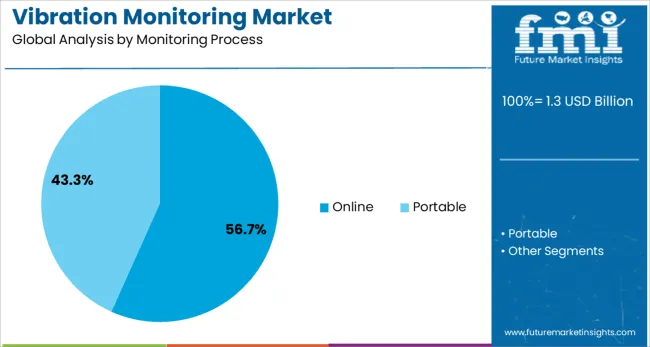

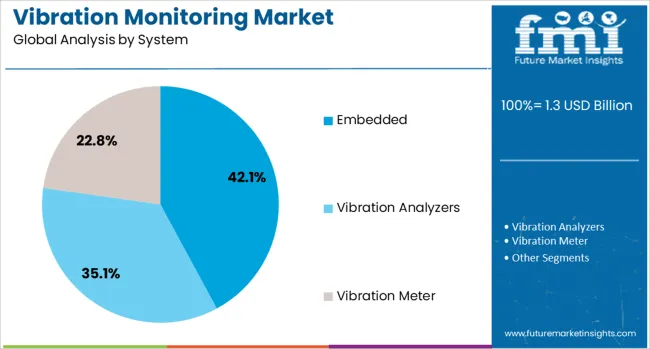

The vibration monitoring market is segmented by component, monitoring process, system, application, and geographic regions. The vibration monitoring market is divided into Hardware, Software, and Services. In terms of the monitoring process, the vibration monitoring market is classified into Online and Portable. Based on the system, the vibration monitoring market is segmented into Embedded, Vibration Analyzers, and Vibration Meters.

By application, the vibration monitoring market is segmented into Oil & Gas, Energy & Power, Metal & Mining, Chemical, Automotive, Food & Beverages, and Others. Regionally, the vibration monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by component, the hardware segment is expected to hold 48.3% of the total market revenue in 2025, making it the leading component. This leadership is attributed to the indispensable role of sensors, transmitters, and data acquisition units in capturing precise and continuous vibration data from critical assets.

The robustness and reliability of hardware components have ensured their continued preference in harsh industrial environments where consistent performance is paramount. Advancements in sensor sensitivity, durability, and connectivity have further reinforced adoption, enabling integration into both legacy equipment and modern machinery.

The ability of hardware to operate autonomously and deliver high-fidelity measurements has strengthened its relevance in predictive maintenance frameworks, securing its dominant share in the market.

In terms of the monitoring process, the online segment is projected to command 56.7% of the market revenue share in 2025, establishing it as the top segment. This prominence is underpinned by the growing need for continuous, real-time asset monitoring in mission-critical operations where downtime results in substantial financial losses.

Online systems have enabled uninterrupted observation of machinery health, allowing for early fault detection and timely intervention without halting operations. The integration of online monitoring with centralized control rooms and advanced analytics platforms has provided superior visibility into asset performance, enhancing decision-making and maintenance scheduling.

This segment’s growth has also been bolstered by its compatibility with remote monitoring solutions, catering to the rising demand for scalable and resilient industrial monitoring systems.

When segmented by system, the embedded segment is forecast to secure 42.1% of the market revenue in 2025, positioning it as the leading system type. The embedded segment’s leadership has been driven by the trend toward integrating sensors and processors directly into machinery to enable localized data processing and autonomous diagnostics.

This approach has minimized the need for external instrumentation and reduced latency in detecting anomalies, contributing to more efficient and reliable operations. The compact design and lower installation complexity of embedded systems have facilitated their deployment across a wide range of industrial assets, particularly in space-constrained or high-vibration environments.

The ability to support advanced features such as edge computing and seamless connectivity with enterprise systems has solidified the embedded segment’s strong foothold in the vibration monitoring market.

The vibration monitoring market is witnessing accelerated adoption across manufacturing, energy, and transportation sectors as industries focus on minimizing unplanned downtime. In 2024, integration of real-time monitoring systems became more common in high-load machinery. By 2025, predictive analytics using vibration patterns enabled proactive maintenance strategies for critical assets. Companies offering reliable, data-integrated solutions with compatibility for both legacy and modern equipment are positioned to gain a competitive edge in this evolving landscape.

The rising emphasis on predictive maintenance has placed vibration monitoring systems at the core of asset management strategies. In 2024, industrial plants adopted advanced monitoring solutions to detect misalignment and bearing wear in rotating equipment before failure occurred.

By 2025, heavy machinery operators in sectors like power generation and oil and gas relied on vibration data for early anomaly detection, reducing costly shutdowns. These developments indicate that predictive maintenance initiatives-not traditional periodic checks-are shaping purchasing decisions. Vendors offering comprehensive systems with accurate data acquisition and integration into centralized maintenance platforms are well positioned to meet the industry's evolving requirements.

The increasing application of wireless vibration sensors presents a significant growth opportunity for industrial monitoring systems. In 2024, facilities in remote or hard-to-access environments began implementing wireless monitoring to eliminate complex cabling and reduce installation time.

By 2025, demand accelerated in industries with distributed assets, such as wind farms and mining operations, where continuous monitoring without infrastructure overhauls was critical. This trend demonstrates that wireless adaptability and simplified deployment are driving adoption. Companies delivering scalable wireless solutions with secure connectivity and long battery life are likely to dominate the next phase of vibration monitoring advancements.

In 2024 and 2025, the cost burden associated with implementing vibration monitoring solutions restricted their use in small and mid-sized plants. Advanced systems equipped with wireless sensors and real-time analytics required significant investment in hardware and specialized software platforms.

Additional expenditure on skilled technicians for installation and calibration further inflated setup costs. This financial challenge was observed to delay adoption in industries such as food processing and textiles, where maintenance budgets are limited. Unless affordable models or subscription-based offerings gain traction, high upfront costs will continue to act as a major barrier to widespread implementation.

In 2024 and 2025, vibration monitoring technologies increasingly adopted wireless sensor networks to optimize machinery diagnostics. These sensors allowed continuous condition tracking without complex wiring, reducing maintenance time and enabling faster decision-making. Remote monitoring solutions gained prominence in sectors like oil and gas, power generation, and automotive manufacturing, where equipment is widely dispersed. Integration with predictive analytics platforms enhanced early fault detection, minimizing downtime and repair expenses.

This evolution positioned wireless solutions as a practical alternative to traditional wired systems, offering a clear opportunity for vendors to strengthen market presence through scalable and cost-effective deployment options.

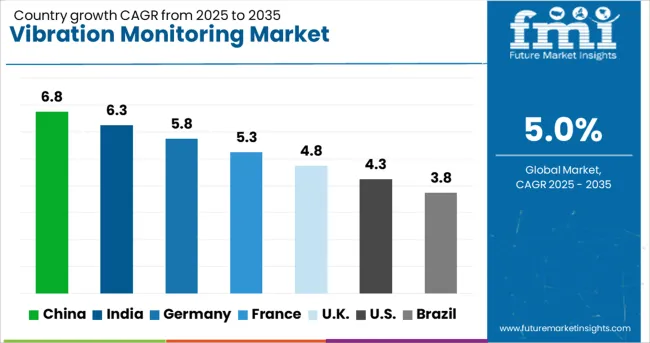

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global vibration monitoring market is expected to grow at a CAGR of 5% from 2025 to 2035. China leads with 6.8%, followed by India at 6.3% and Germany at 5.8%. France posts 5.3%, while the United Kingdom records 4.8%. Growth is driven by predictive maintenance adoption, increased focus on industrial automation, and demand for equipment reliability in manufacturing and energy sectors. China and India dominate due to large-scale industrial expansion, while Germany prioritizes advanced condition monitoring systems. France and the UK emphasize smart sensor integration and wireless monitoring solutions for critical infrastructure applications.

China is projected to grow at 6.8%, supported by rapid industrialization and heavy investment in predictive maintenance solutions. Wireless vibration sensors dominate adoption in large-scale factories and energy facilities. Manufacturers develop AI-driven analytics to enhance early fault detection and reduce downtime. Government-backed initiatives promoting Industry 4.0 accelerate deployment in automotive and heavy engineering sectors.

India is forecast to grow at 6.3%, driven by increasing focus on operational efficiency in power generation and cement sectors. Portable vibration analyzers dominate use in preventive maintenance programs for rotating machinery. Manufacturers introduce cost-effective IoT-based solutions to attract SMEs. Growth of industrial automation and government-driven digitalization programs further expands adoption.

Germany is expected to grow at 5.8%, supported by demand for advanced machine health solutions in automotive and aerospace sectors. Online vibration monitoring systems dominate smart factory deployments. Manufacturers focus on integrating edge computing for real-time data processing. Compliance with EU energy efficiency directives strengthens the adoption of predictive maintenance technologies.

France is projected to grow at 5.3%, driven by adoption in chemical, oil and gas, and energy sectors for reliability improvement. Cloud-based platforms dominate market demand for scalable remote monitoring. Manufacturers invest in low-power wireless sensors to optimize performance in hazardous environments. Predictive analytics integrated with vibration data supports proactive asset management.

The UK is forecast to grow at 4.8%, supported by increasing focus on digital twins and smart asset monitoring in critical infrastructure. Compact vibration sensors dominate installations in offshore energy platforms and rail systems. Manufacturers leverage AI and machine learning to create predictive maintenance algorithms. Rising investment in IIoT ecosystems accelerates adoption across utilities and manufacturing.

The vibration monitoring market is moderately consolidated, with Emerson Electric recognized as a leading player due to its advanced condition monitoring systems, predictive maintenance technologies, and integration with IIoT platforms for industrial automation. The company offers a comprehensive range of wireless and wired vibration sensors, analytics software, and monitoring solutions for critical machinery across oil and gas, manufacturing, and power generation industries.

Key players include General Electric, Honeywell International Inc., National Instruments, AB SKF, Rockwell Automation, Inc., Meggitt, and Analog Devices, Inc. These companies provide vibration monitoring hardware, such as accelerometers and transmitters, along with data acquisition systems and cloud-based platforms that enable real-time performance tracking and failure prediction. Market growth is being driven by the increasing adoption of predictive maintenance strategies, expansion of smart manufacturing, and the need to minimize unplanned downtime in critical operations.

Players are focusing on innovations such as wireless sensor networks, AI-powered analytics, and cloud integration to improve diagnostic accuracy and scalability. Emerging trends include edge computing for real-time fault detection and integration of vibration monitoring with digital twin technologies. North America and Europe currently lead the market due to advanced industrial infrastructure, while Asia-Pacific is expected to see the fastest growth with rising investments in industrial automation.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Component | Hardware, Software, and Services |

| Monitoring Process | Online and Portable |

| System | Embedded, Vibration Analyzers, and Vibration Meter |

| Application | Oil & Gas, Energy & Power, Metal & Mining, Chemical, Automotive, Food & Beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Emerson Electric, General Electric, Honeywell International Inc, National Instruments, AB SKF, Rockwell Automation, Inc, Meggitt, and Analog Devices, Inc |

| Additional Attributes | Dollar sales by system type (portable analyzers, online/continuous monitors), Dollar sales by industry application (manufacturing, energy, transportation), regional demand trends, competitive landscape, buyer preferences for real-time diagnostics and predictive maintenance, integration with IoT and AI maintenance platforms, innovations in edge computing, wireless sensors, and AI-powered anomaly detection systems. |

The global vibration monitoring market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the vibration monitoring market is projected to reach USD 2.2 billion by 2035.

The vibration monitoring market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in vibration monitoring market are hardware, software and services.

In terms of monitoring process, online segment to command 56.7% share in the vibration monitoring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vibration Screening Machine Market Size and Share Forecast Outlook 2025 to 2035

Vibration Damping Levelling Feet Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Vibration Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vibration Isolation System industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Vibration Analyzer Market Growth – Trends & Forecast 2025-2035

Vibration Level Switch Market Analysis by Technology, Industry, Application, and Region through 2035

Vibration Control Systems Market Growth - Trends & Forecast 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Anti-Vibration Mounts Market

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Noise Vibration Harshness (NVH) Testing Market

Noise And Vibration Coatings Market Size and Share Forecast Outlook 2025 to 2035

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA