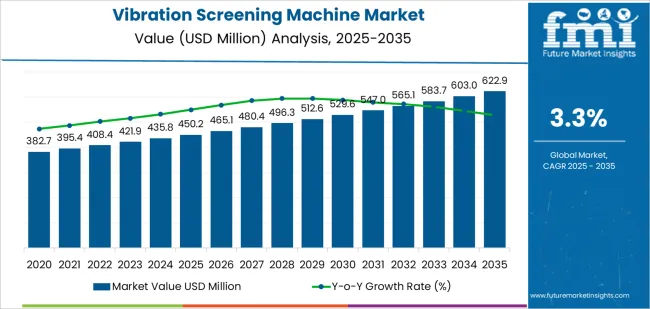

The global vibration screening machine market is projected to grow from USD 450.2 million in 2025 to approximately USD 622.9 million by 2035, recording an absolute increase of USD 172.7 million over the forecast period. This translates into a total growth of 38.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.3% between 2025 and 2035.

The overall vibration screening machine market size is expected to grow by nearly 1.4X during the same period, supported by increasing mining activities, growing demand for efficient material separation technologies across industrial processing operations, and rising investments in agricultural processing infrastructure requiring precise particle size classification. The vibration screening machine market expansion reflects the growing adoption of vibration screening equipment across diverse industries requiring particle separation, material classification, and contaminant removal from bulk materials through mechanical vibration and screening media.

Growing emphasis on operational efficiency is driving demand for screening machines that deliver high throughput, accurate size separation, and minimal maintenance requirements while reducing manual labor and improving process consistency. The development of advanced vibration mechanisms, optimized screen deck designs, and wear-resistant screening media is addressing requirements for handling abrasive materials, processing sticky substances, and achieving fine particle separations previously challenging with conventional screening technologies. Regulatory pressures for workplace safety, dust control, and environmental compliance are creating sustained demand for enclosed screening systems with integrated dust suppression, noise reduction features, and automated material handling capabilities.

The market is characterized by convergence of mechanical engineering, materials science, and automation technologies, with manufacturers developing screening machines incorporating variable frequency drives for vibration adjustment, self-cleaning screen mechanisms preventing blinding, and remote monitoring systems enabling predictive maintenance and performance optimization across distributed processing facilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 450.2 million |

| Market Forecast Value (2035) | USD 622.9 million |

| Forecast CAGR (2025-2035) | 3.3% |

| INDUSTRIAL PROCESSING EXPANSION | TECHNOLOGY & EFFICIENCY ADVANCEMENT | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Mining Activity Growth Continuous expansion of mining operations globally for coal, metallic ores, and industrial minerals requiring efficient material classification and waste separation equipment. Agricultural Processing Modernization Growing mechanization of agricultural processing operations including grain cleaning, seed sorting, and food ingredient separation driving adoption of precision screening equipment. Industrial Material Handling Increasing bulk material processing across chemical, construction materials, and recycling industries requiring reliable particle size separation and quality control. |

Vibration Mechanism Innovation Development of advanced vibration systems including linear motion, circular motion, and elliptical motion patterns optimizing material stratification and screening efficiency for diverse applications. Screen Media Evolution Introduction of polyurethane, rubber, and wire mesh screening surfaces with enhanced wear resistance, blinding prevention, and extended service life reducing maintenance requirements. Automation Integration Implementation of variable frequency drives, automated controls, and sensor-based monitoring enabling process optimization, consistent performance, and remote operation capabilities. |

Workplace Safety Standards Regulatory requirements for dust control, noise reduction, and operator safety driving adoption of enclosed screening systems with integrated safety features and environmental controls. Product Quality Requirements Industry standards mandating precise particle size specifications, contaminant removal, and consistent product characteristics requiring accurate screening equipment. Environmental Compliance Regulations limiting fugitive emissions, noise pollution, and waste generation favoring modern screening equipment with containment features and efficient material handling. |

| Category | Segments Covered |

|---|---|

| By Machine Type | Single-layer Vibration Screening Machine, Multi-layer Vibration Screening Machine |

| By Application | Mining and Metallurgy, Agriculture and Food Processing, Pharmaceuticals, Other |

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

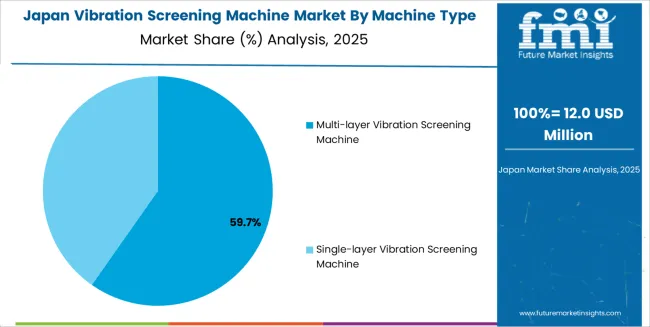

| Multi-layer Vibration Screening Machine | Leader in 2025 with 58.2% market share, expected to maintain dominance through 2035. Multi-deck configurations enabling simultaneous separation into multiple size fractions within single machine reducing equipment footprint and capital costs. Superior processing efficiency handling high throughput applications where multiple product grades required from single feed stream. Widespread adoption across mining operations separating oversize, middlings, and fines in single pass, and agricultural processing producing multiple grain grades simultaneously. Technical advantages include maximized screening area per floor space, reduced material handling between separation stages, and improved overall system efficiency. Growing applications in recycling operations requiring multiple size classifications and construction aggregate production generating diverse product specifications. Momentum: steady growth driven by throughput efficiency advantages and space optimization benefits in industrial processing facilities. Watchouts: higher initial costs compared to single-layer units and increased maintenance complexity with multiple screen decks requiring management. |

| Single-layer Vibration Screening Machine | Established segment serving applications requiring simple size separation into two fractions or scalping operations removing oversize contamination. Cost-effective solution for straightforward screening tasks, material dewatering, and quality control applications where multiple size grades unnecessary. Simpler construction and maintenance compared to multi-layer units supporting adoption in smaller operations and applications with limited technical support capabilities. Growing use in pharmaceutical and food processing where hygiene requirements favor simpler equipment designs with fewer crevices and easier cleaning access. Portable and mobile screening applications predominantly utilize single-layer configurations due to weight and complexity constraints. Flexibility through quick screen media changes supporting diverse applications within single equipment unit. Momentum: stable growth in specialized applications and smaller-scale operations prioritizing simplicity and cost-effectiveness. Watchouts: limited throughput efficiency compared to multi-layer alternatives and requirement for multiple machines when several size fractions needed. |

| Segment | 2025 to 2035 Outlook |

|---|---|

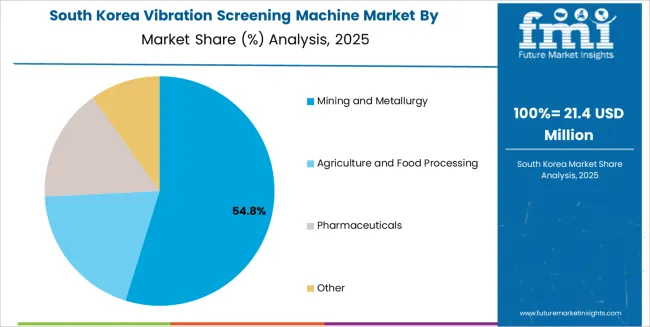

| Mining and Metallurgy | Dominant segment with 52.4% market share in 2025, encompassing coal preparation, metallic ore processing, industrial mineral separation, and aggregate production. Primary driver of vibration screening machine demand with mining operations requiring robust equipment handling abrasive materials, high throughput processing, and continuous operation under demanding conditions. Applications include scalping oversize rocks, classifying crushed ore into size fractions for downstream processing, dewatering mineral concentrates, and separating final products by particle size. Equipment requirements emphasize heavy-duty construction, wear-resistant components, and reliability minimizing unplanned downtime. Growing mechanization in emerging market mining operations and ongoing equipment replacement in mature mining regions sustaining demand. Momentum: steady growth aligned with global mining activity expansion and mineral demand increases supporting industrial production. Watchouts: mining industry cyclicality affecting equipment investment timing and pressure for improved energy efficiency reducing operational costs. |

| Agriculture and Food Processing | Significant segment serving grain cleaning, seed sorting, flour milling, sugar processing, and food ingredient separation applications. Vibration screening machines essential for removing foreign material, separating damaged kernels, and classifying products by size for quality grading. Specialized requirements include food-grade materials, hygienic designs enabling thorough cleaning, and gentle handling preventing product damage. Growing mechanization in developing agricultural economies and quality standard tightening in food processing driving equipment adoption. Technical innovations include self-cleaning screen mechanisms preventing blinding with sticky materials and enclosed designs controlling dust in food processing environments. Seasonal demand patterns and diverse crop types requiring flexible screening solutions adaptable to varying material characteristics. Momentum: moderate growth driven by agricultural mechanization trends and food safety standard evolution. Watchouts: agricultural commodity price volatility affecting farm equipment investments and competition from alternative separation technologies including air classification. |

| Pharmaceuticals | Specialized high-value segment requiring precision screening equipment meeting stringent pharmaceutical manufacturing standards. Applications include active pharmaceutical ingredient processing, powder classification, granulation screening, and contamination removal. Extreme hygiene requirements mandate stainless steel construction, crevice-free designs, complete washdown capabilities, and validation documentation supporting regulatory compliance. Gentle material handling preventing particle degradation and dust containment protecting product quality and operator health. Small batch processing and frequent product changeovers requiring quick screen media replacement and thorough cleaning between production runs. Growing pharmaceutical manufacturing in emerging markets and increasing generic drug production supporting equipment demand. Momentum: stable growth aligned with pharmaceutical industry expansion and generic manufacturing proliferation. Watchouts: stringent qualification requirements extending equipment selection and approval timelines and high precision expectations challenging screening technology capabilities. |

| Other | Diverse applications including chemical processing, construction materials, recycling operations, and specialized industrial screening requirements. Chemical industry applications include pigment classification, polymer powder screening, and catalyst separation. Construction materials sector utilizes screening for sand classification, glass cullet sorting, and plaster processing. Recycling operations employ screening for metal scrap separation, plastic sorting, and waste-derived fuel production. Each application presents unique requirements regarding material characteristics, particle size ranges, and environmental conditions. Custom solutions common given specialized needs and diverse material handling challenges. Growing circular economy emphasis and waste valorization creating opportunities in recycling applications. Momentum: selective growth dependent on specific industry sector performance and emerging application development. Watchouts: fragmented demand across numerous applications limiting standardization benefits and requiring application-specific technical expertise. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Global Mining Expansion Continuous growth in mining activities worldwide for coal, metallic ores, and industrial minerals requiring efficient material classification and waste separation equipment. Infrastructure Development Increasing construction activity globally driving demand for construction aggregates requiring screening equipment for size classification and quality control. Processing Efficiency Demands Growing emphasis on operational efficiency and throughput maximization driving adoption of advanced screening technologies delivering superior separation performance and reliability. |

Capital Investment Constraints Significant upfront costs for industrial screening equipment creating adoption barriers, particularly for smaller operations and during economic downturns affecting capital availability. Maintenance Complexity Wear component replacement requirements, screen media changes, and mechanical maintenance needs affecting total cost of ownership and requiring skilled maintenance personnel. Alternative Technology Competition Competition from alternative separation technologies including air classification, hydrocyclones, and optical sorting for certain applications limiting vibration screening market scope. |

Automation Integration Implementation of automated controls, variable frequency drives, and sensor-based monitoring optimizing vibration parameters, improving screening efficiency, and enabling remote operation. Wear Resistance Innovation Development of advanced screen media materials including polyurethane, ceramic coatings, and specialized alloys extending service life and reducing maintenance frequency. Environmental Compliance Features Integration of dust suppression systems, noise enclosures, and emission controls addressing regulatory requirements and workplace safety standards. Predictive Maintenance Adoption of condition monitoring sensors, vibration analysis, and data analytics enabling predictive maintenance scheduling and reducing unplanned downtime. |

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025-2035) |

|---|---|---|---|

| China | 155.3 | 408.4 | 4.5% |

| India | 12.3 | 20.3 | 4.1% |

| Germany | 382.7 | 512.6 | 3.8% |

| Brazil | 395.4 | 529.5 | 3.5% |

| United States | 421.9 | 565.1 | 3.1% |

| United Kingdom | 435.8 | 583.7 | 2.8% |

| Japan | 465 | 603 | 2.5% |

Revenue from vibration screening machines in China is projected to reach USD 408.4 million by 2035, driven by extensive mining operations and massive construction materials demand creating substantial opportunities for screening equipment across coal preparation, metallic ore processing, and aggregate production applications.

The country's position as the world's largest producer of coal, iron ore, and numerous industrial minerals generates sustained demand for material classification equipment. Government infrastructure investment programs and urbanization driving construction aggregate consumption support screening machine adoption in quarries and sand processing operations. Agricultural modernization initiatives and food processing industry growth create additional demand for screening equipment in grain processing and food ingredient production.

Domestic equipment manufacturers have developed strong capabilities in vibration screening machine design and production, offering competitive pricing and rapid delivery compared to imported alternatives. Technical innovation focus includes automation integration, energy efficiency improvements, and dust control systems addressing environmental compliance requirements. Growing recycling industry and construction waste processing create emerging applications for screening equipment in waste valorization and circular economy initiatives.

Revenue from vibration screening machines in India is expanding to reach USD 20.3 million by 2035, supported by growing coal production and expanding metallic ore mining creating demand for material classification equipment serving domestic mining operations. The country's significant mineral resources and government initiatives promoting mining sector development support ongoing equipment investments. Coal India Limited and other major mining operators implement modern screening equipment improving processing efficiency and product quality.

Growing construction industry and infrastructure development programs drive aggregate demand supporting quarry operations and screening equipment adoption. Agricultural mechanization trends and expanding food processing sector create additional screening equipment demand for grain cleaning and food ingredient processing. Price sensitivity and capital constraints favor equipment offering demonstrated value through productivity improvements and reduced operational costs. Domestic equipment manufacturing capabilities developing with government support for indigenous production reducing import dependence. Technical considerations include adaptation to varying power supply reliability, availability of skilled maintenance personnel, and spare parts supply infrastructure.

Demand for vibration screening machines in Germany is projected to reach USD 512.6 million by 2035, supported by advanced manufacturing sector and engineering expertise in material processing equipment creating sustained demand for precision screening solutions. German equipment manufacturers maintain global leadership in vibration screening technology with exports representing significant portion of production. Domestic market serves diverse applications including mining operations, construction aggregate production, recycling facilities, and specialized industrial processing. The market is characterized by emphasis on equipment quality, technological sophistication, and compliance with stringent European safety and environmental standards.

German manufacturers prioritize innovation in vibration mechanisms, screen media technology, and automation integration. Strong emphasis on energy efficiency and environmental performance drives continuous equipment improvement. Recycling industry expansion and circular economy initiatives create growing demand for screening equipment processing secondary raw materials. Established service infrastructure and skilled workforce support adoption of sophisticated equipment with advanced capabilities. Export markets in Europe, Middle East, and emerging economies provide significant opportunities for German screening equipment manufacturers.

Revenue from vibration screening machines in Brazil is growing to reach USD 529.5 million by 2035, driven by significant mining operations and expanding agricultural processing creating opportunities for screening equipment across metallic ore beneficiation and food processing applications. The country's major iron ore production and growing base metals mining generate sustained demand for material classification equipment. Vale and other mining companies implement modern screening technology improving processing efficiency and product quality.

Agricultural sector expansion and export-oriented food processing support screening equipment adoption for grain cleaning, sugar processing, and other agricultural applications. Growing construction materials industry serving domestic infrastructure development creates additional screening equipment demand in aggregate production. Equipment selection emphasizes robustness handling Brazilian mineral characteristics, reliability under tropical climate conditions, and maintainability given infrastructure challenges in certain mining regions. International equipment suppliers establish local presence through partnerships with Brazilian distributors and service providers ensuring technical support and spare parts availability. Economic considerations favor equipment demonstrating clear productivity improvements and operational cost reductions justifying capital investments.

Revenue from vibration screening machines in United States is projected to reach USD 565.1 million by 2035, supported by diverse mining operations and extensive aggregate production creating sustained demand for screening equipment across coal preparation, metallic ore processing, and construction materials applications. The country's coal industry, despite declining production, maintains significant screening equipment installed base requiring ongoing replacement and upgrades. Growing sand and gravel production serving construction industry supports screening equipment demand in aggregate operations. Expanding recycling industry and waste processing operations create opportunities for screening equipment in secondary material recovery and waste-derived product manufacturing.

Technological sophistication and automation requirements higher than many international markets with emphasis on productivity, minimal operator intervention, and integration with plant control systems. Stringent safety and environmental regulations influence equipment design and operational requirements including dust control, noise suppression, and containment features. Equipment procurement processes emphasize total cost of ownership including energy consumption, maintenance requirements, and production efficiency rather than focusing primarily on initial purchase price. Strong service and support infrastructure critical given North American geography and expectations for rapid response to equipment issues.

The vibration screening machine market in Europe is projected to grow from USD 426.8 million in 2025 to USD 561.2 million by 2035, registering a CAGR of 2.8% over the forecast period. Germany is expected to maintain its leadership position with a 36.4% market share in 2025, projected to expand to 37.2% by 2035, supported by its advanced equipment manufacturing industry and diverse material processing sectors.

The United Kingdom follows with a 27.8% share in 2025, anticipated to reach 28.3% by 2035, driven by aggregate production and recycling industry screening equipment demand. France holds a 18.6% share, while Sweden accounts for 12.4% in 2025, reflecting active mining operations and construction materials production. The Rest of Europe region is projected to maintain approximately 4.8% collectively through 2035, with Poland, Spain, and other countries implementing screening equipment in mining, recycling, and agricultural processing operations.

Japanese vibration screening machine operations reflect the country's emphasis on precision manufacturing and equipment reliability. Industrial processors maintain stringent quality requirements with screening machines expected to deliver consistent particle size separation, minimal contamination, and long-term performance reliability. Equipment manufacturers emphasize robust construction, precision vibration mechanisms, and comprehensive quality control ensuring equipment longevity.

The market demonstrates unique requirements for compact designs suitable for space-constrained Japanese industrial facilities and low-noise operation important in populated industrial areas. Mining operations, though limited domestically, utilize high-quality screening equipment, while food processing and pharmaceutical sectors maintain significant screening equipment installations. Technical preferences include preference for energy-efficient designs, automated operation reducing labor requirements, and easy maintenance enabling rapid servicing minimizing production interruptions. Distribution channels emphasize specialized industrial equipment suppliers providing technical consultation, installation support, and ongoing service. Established relationships between equipment suppliers and industrial processors create stable market dynamics. Export-oriented manufacturing operations utilize screening equipment meeting international quality standards supporting Japanese industrial product reputation.

South Korean vibration screening machine operations reflect the country's industrial diversity and technology adoption. Mining operations including coal and metallic minerals utilize screening equipment for material classification and waste separation. Construction materials industry serving domestic building activity maintains active screening equipment installations in aggregate production facilities. Food processing sector including grain milling and ingredient processing employs screening equipment ensuring product quality and contaminant removal. Equipment procurement emphasizes proven technology, reliable vendor support, and integration capabilities with existing production systems. Domestic equipment manufacturing capabilities exist alongside imports for specialized applications requiring specific technical capabilities. Technical requirements emphasize productivity, quality consistency, and automation supporting Korean manufacturers' operational efficiency objectives.

Environmental regulations drive adoption of enclosed screening systems with dust control and noise reduction features. Market characteristics include preference for established equipment brands, emphasis on comprehensive technical support, and expectations for equipment durability and maintainability. Growing recycling industry and waste processing operations create emerging opportunities for screening equipment in secondary material recovery applications.

The vibration screening machine market demonstrates concentration among established industrial equipment manufacturers and specialized screening technology companies. Profit focus centers on comprehensive solutions including equipment supply, installation support, commissioning assistance, and ongoing service rather than equipment-only transactions. Value migration favors companies demonstrating application expertise, reliable performance in demanding conditions, and strong after-sales support capabilities. Several competitive archetypes define market dynamics: specialized screening equipment manufacturers focusing exclusively on separation technologies with deep engineering expertise in vibration mechanisms and screen media; diversified mining equipment companies offering screening machines as part of comprehensive mineral processing portfolios; industrial equipment conglomerates providing screening solutions alongside complementary material handling equipment; and regional manufacturers serving local markets with cost-competitive alternatives to international brands.

Market differentiation centers on screening efficiency and throughput capabilities, equipment durability and reliability in harsh operating environments, versatility handling diverse material characteristics, and total cost of ownership including energy consumption and maintenance requirements. Switching costs remain moderate to significant with primary barriers including capital investment requirements, installation complexity, operator training needs, and production disruption during equipment changes. Competition intensifies around application-specific expertise recognizing that screening performance depends heavily on proper equipment selection, configuration optimization, and screen media selection for specific material characteristics.

Geographic presence proves valuable given importance of local technical support, spare parts availability, and rapid service response minimizing equipment downtime. Successful companies maintain service networks, comprehensive parts inventories, and trained field service personnel. Technical credibility established through reference installations, performance testing capabilities, and demonstrated expertise in challenging applications. Market segmentation by application creates opportunities for specialized suppliers focusing on particular industries where specific technical requirements and regulatory standards demand deep domain expertise. Innovation focus includes developing more efficient vibration mechanisms delivering superior material stratification, implementing self-cleaning screen surfaces preventing blinding and maintaining throughput, creating modular designs enabling easier maintenance and upgrades, and incorporating smart sensors and controls optimizing performance automatically based on material characteristics and operating conditions.

| Items | Values |

|---|---|

| Quantitative Units | USD 450.2 million |

| Machine Type | Single-layer Vibration Screening Machine, Multi-layer Vibration Screening Machine |

| Application | Mining and Metallurgy, Agriculture and Food Processing, Pharmaceuticals, Other |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | Rhewum, Terex, Nordberg Manufacturing, Fritsch, Russell Finex, VIBRA-SCHULTHEIS, Allgaier, VibraScreener, Linux Magnetics, Metso, Shree Conmix Engineers, Tesab Engineering Limited, Mupi Machinery, Xinxiang Fast Machinery, Jiangxi Hengchang Mining Machinery Equipment Manufacturing Co., Ltd., Quan Neng Sheng Technology Co., Ltd. |

| Additional Attributes | Dollar sales by machine type and application, regional demand across key markets, competitive landscape, material separation technology adoption, industrial processing integration, and screening efficiency development driving mining operations, agricultural processing, and material classification optimization |

By Machine Type

The global vibration screening machine market is estimated to be valued at USD 450.2 million in 2025.

The market size for the vibration screening machine market is projected to reach USD 622.9 million by 2035.

The vibration screening machine market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in vibration screening machine market are multi-layer vibration screening machine and single-layer vibration screening machine.

In terms of application, mining and metallurgy segment to command 52.4% share in the vibration screening machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vibration Damping Levelling Feet Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Vibration Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vibration Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vibration Isolation System industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Vibration Analyzer Market Growth – Trends & Forecast 2025-2035

Vibration Level Switch Market Analysis by Technology, Industry, Application, and Region through 2035

Vibration Control Systems Market Growth - Trends & Forecast 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Anti-Vibration Mounts Market

Noise Vibration Harshness (NVH) Testing Market

Noise And Vibration Coatings Market Size and Share Forecast Outlook 2025 to 2035

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Lab Screening Test Kit Market

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Oral Screening Systems Market

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Carrier Screening Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Cotinine Screening Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA