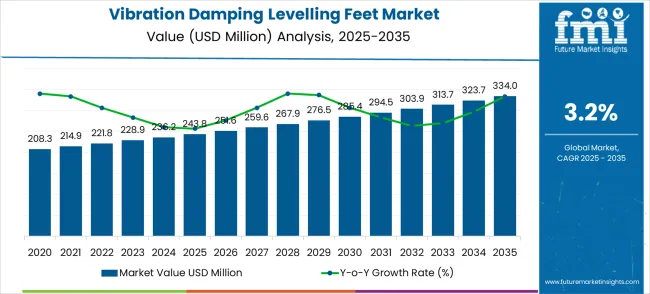

The vibration damping levelling feet market is valued at USD 243.8 million in 2025 and is projected to reach USD 334.0 million by 2035, reflecting a CAGR of 3.2%. Year-on-year (YoY) growth from 2021 to 2025 shows a steady rise in market demand. Starting at USD 208.3 million in 2021, the market grows by 3.2% annually, reaching USD 214.9 million in 2022, USD 221.8 million in 2023, USD 228.9 million in 2024, and USD 236.2 million in 2025. This steady growth is driven by increasing demand across industries such as manufacturing, automotive, and construction, where vibration control and noise reduction are critical for machinery and equipment.

Between 2025 and 2030, the vibration damping levelling feet market is projected to expand from USD 244 million to USD 285.4 million, resulting in a value increase of USD 41.6 million, which represents 46.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for precision manufacturing equipment, product innovation in material science and load distribution technology, and expanding industrial automation across manufacturing facilities. Companies are establishing competitive positions through investment in advanced damping technologies, specialized application engineering, and strategic market expansion across food processing, medical devices, and industrial equipment sectors.

From 2030 to 2035, the market is forecast to grow from USD 285.4 million to USD 334.0 million, adding another USD 48.6 million, which constitutes 53.9% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized applications, including cleanroom environments and precision laboratory equipment tailored to specific vibration control requirements, strategic collaborations between component manufacturers and original equipment manufacturers, and enhanced product positioning with optimized environmental durability and load capacity. The growing emphasis on manufacturing precision and quality control standards will drive demand for advanced levelling solutions across diverse industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 244 million |

| Market Forecast Value (2035) | USD 334.0 million |

| Forecast CAGR (2025-2035) | 3.2% |

The vibration damping levelling feet market expands through reduced equipment downtime and improved manufacturing precision in industrial environments. Rising factory automation demands create consistent need for stable equipment foundations that prevent vibration-induced defects and maintain operational accuracy. Food processing facilities require hygienic, corrosion-resistant solutions that meet stringent cleanliness standards while providing reliable equipment stabilization. Medical device manufacturing drives demand for ultra-precise levelling systems that eliminate micro-vibrations affecting sensitive production processes. Pharmaceutical and electronics industries prioritize contamination-free environments where specialized damping feet prevent particle generation from equipment movement. Growth faces constraints from standardization pressures that limit premium pricing and substitute materials offering comparable performance at lower costs.

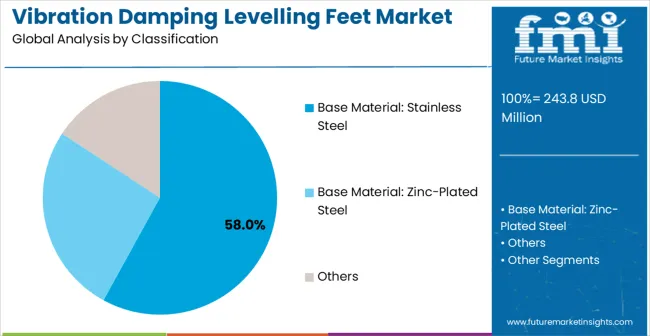

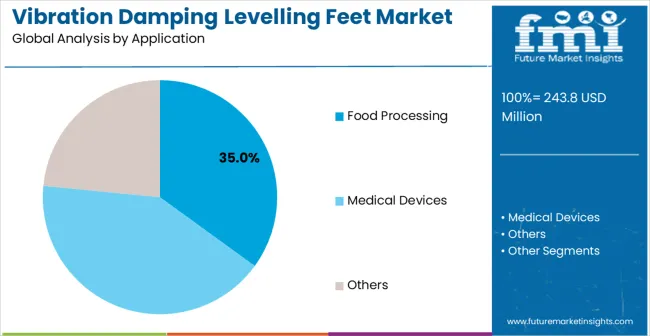

The market is segmented by base material, application, and region. By base material, the market is divided into stainless steel, zinc-plated steel, and others. By application, the market is categorized into food processing, medical devices, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Stainless steel levelling feet are projected to account for 58% of the vibration damping levelling feet market in 2025, reflecting their strong adoption in industries requiring robust, long-lasting, and hygienic support solutions. The material’s exceptional corrosion resistance ensures longevity even in harsh operational environments, including food processing plants, pharmaceutical facilities, and chemical manufacturing units. Stainless steel maintains structural integrity under repeated loading and dynamic vibration conditions, which is critical for machinery stability and operational safety. Its chemical resistance properties prevent degradation or contamination when exposed to cleaning agents, acids, or other reactive substances, making it ideal for hygienic and highly regulated applications. The material also supports adherence to industry-specific safety and sanitary standards, reducing downtime and minimizing replacement cycles. Manufacturers increasingly favor stainless steel levelling feet for their ability to provide consistent performance across varying temperatures, moisture conditions, and high-load environments, enabling enhanced equipment reliability and process efficiency.

Food processing applications are expected to represent 35% of vibration damping levelling feet demand in 2025, reflecting the critical need for hygiene, stability, and operational efficiency. Equipment in this sector, including mixers, conveyors, and packaging machines, is frequently exposed to washdowns, cleaning chemicals, and high humidity. Levelling feet that provide effective vibration damping maintain machinery alignment and stability, preventing operational disruptions and ensuring consistent product quality. Sanitary design features, including smooth surfaces and cleanable construction, reduce contamination risks and meet stringent food safety regulations. Stainless steel and other corrosion-resistant materials are preferred to withstand temperature variations during cooking, cooling, or sterilization processes. These components support load distribution for heavy industrial equipment, preventing uneven wear or operational stress that could compromise safety or efficiency.

The vibration damping levelling feet market is primarily driven by operational efficiency, regulatory compliance, and cost-effectiveness across industrial applications. One of the key drivers is the increasing precision manufacturing requirements, where equipment stabilization plays a critical role in reducing product defects and maintaining tight tolerances. Manufacturing sectors such as automotive, electronics, pharmaceuticals, and food processing rely on vibration damping levelling feet to enhance machine accuracy, extend tool life, and maintain consistent output quality. Regulatory compliance in highly regulated industries, particularly food processing and pharmaceuticals, encourages the adoption of specialized materials such as stainless steel or engineered polymers that meet stringent contamination control and hygiene standards. Companies also focus on cost reduction initiatives by using high-quality vibration damping components to minimize equipment wear, reduce downtime, and extend maintenance intervals, contributing to operational savings.

Despite these growth drivers, the market faces notable restraints. Budgetary limitations often delay capital equipment investments that include specialized levelling hardware, particularly for small and medium enterprises. Integration challenges emerge when retrofitting existing machinery with advanced vibration damping systems, often requiring custom engineering solutions that increase project timelines and costs. Fluctuations in raw material prices, such as stainless steel and specialty polymers, introduce procurement uncertainty, particularly for cost-sensitive buyers who must balance quality and affordability.

Current market trends highlight innovation in materials and design. Modular levelling systems are increasingly preferred, as they enable easier installation, maintenance, and system upgrades. Material innovations emphasize enhanced vibration damping, environmental resistance, and durability to meet diverse industrial conditions. Adoption is accelerating in high-precision sectors and industries with strict quality standards, reflecting a willingness to invest in premium components. The market could face competitive disruption if alternative vibration control technologies, such as active damping systems or polymer-based isolation mounts, achieve comparable performance at lower costs. The market expansion remains closely tied to industrial automation, quality assurance, and operational efficiency imperatives.

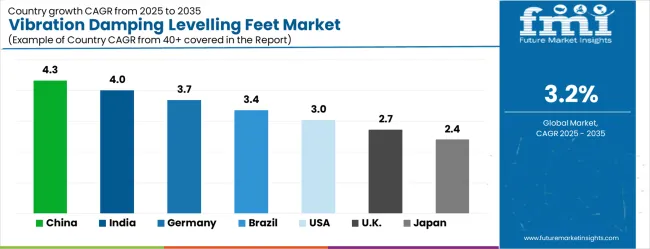

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.0% |

| UK | 2.7% |

| Japan | 2.4% |

The vibration damping levelling feet market is gathering pace worldwide, with China taking the lead thanks to manufacturing expansion and industrial automation adoption. Close behind, India benefits from pharmaceutical sector growth and food processing modernization, positioning itself as a strategic growth hub. Germany shows steady advancement, where precision engineering requirements strengthen its role in the regional supply chain. Brazil is sharpening focus on food processing infrastructure and manufacturing facility upgrades, signaling an ambition to capture niche opportunities. Meanwhile, the USA stands out for its regulatory compliance emphasis, and the UK and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

The vibration damping levelling feet market in China is projected to grow at a CAGR of 4.3% from 2025 to 2035, driven by rapid industrial automation adoption and the extensive modernization of manufacturing facilities. Key industrial hubs in Shanghai, Guangzhou, and Shenzhen contribute significantly to the demand. Chinese manufacturers increasingly implement precision equipment stabilization solutions to ensure operational efficiency and high product quality in automated production lines. The food processing and pharmaceutical sectors, in particular, drive adoption of specialized levelling systems that provide vibration control, improve process reliability, and comply with international hygiene standards. Distribution networks are strengthening through industrial equipment suppliers and specialized component distributors, making advanced stabilization systems accessible to a wide range of manufacturers. Government initiatives aimed at upgrading production technologies further promote adoption of precision mounting solutions and comprehensive vibration management strategies. These factors collectively enhance manufacturing consistency, reduce defect rates, and extend the operational lifespan of critical equipment in high-demand industrial applications.

The vibration damping levelling feet market is projected to expand at a CAGR of 4.0% through 2035, primarily driven by the growing pharmaceutical and food processing sectors in major industrial regions such as Mumbai, Bangalore, and Ahmedabad. Pharmaceutical facilities increasingly adopt specialized levelling solutions to maintain contamination-free environments, ensure precise equipment alignment, and meet Good Manufacturing Practice (GMP) standards. Similarly, the food processing industry relies on vibration damping components to maintain equipment stability during high-speed processing, prevent product quality deviations, and comply with hygiene regulations for both domestic consumption and export markets. Indian companies are investing in upgrading production capacity with high-quality components to ensure competitiveness globally, often sourcing advanced materials through technology partnerships with international suppliers. These investments not only improve operational efficiency but also support long-term cost reductions by minimizing equipment wear, downtime, and maintenance requirements.

The vibration damping levelling feet market in Germany grows at a CAGR of 3.7% through 2035, supported by advanced engineering capabilities in automotive, pharmaceutical, and precision machinery manufacturing. Munich, Stuttgart, and Hamburg, which specialize in automotive, pharmaceutical, and precision machinery manufacturing. German facilities prioritize equipment stabilization to maintain strict tolerance levels, ensure consistent production quality, and extend equipment service life. The country’s strong engineering culture emphasizes both innovation and standardization, enabling manufacturers to offer high-performance levelling solutions tailored for specialized applications while maintaining efficient maintenance protocols. Collaboration between equipment providers and industry associations promotes standardized mounting systems and best practices for vibration control across various industrial sectors. Demand is further reinforced by automotive and precision machining industries, which require robust, reliable components to ensure production accuracy and maintain high-quality benchmarks.

The vibration damping levelling feet market in Brazil shows steady growth, particularly in the food processing sector, with a projected CAGR of 3.4%. The ongoing modernization of food processing facilities in key regions like São Paulo, Rio de Janeiro, and Brasília supports demand for vibration damping solutions. The market’s expansion is supported by increasing investment in advanced production equipment and automation technologies designed to enhance process efficiency, product quality, and operational reliability. Despite economic volatility that can occasionally impact capital expenditure planning, Brazilian manufacturers remain focused on improving productivity and ensuring compliance with international hygiene and export quality standards. Vibration damping levelling feet play a crucial role in stabilizing equipment such as mixers, conveyors, and packaging machinery, reducing vibrations that could compromise product consistency or operational accuracy. The adoption of these components enables manufacturing facilities to meet global standards, enhancing competitiveness in both domestic and international markets.

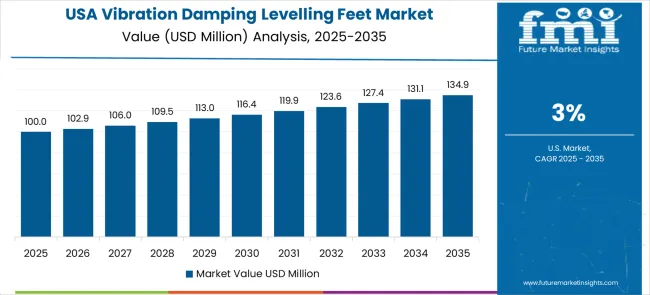

The USA market for vibration damping levelling feet exhibits steady growth, projected at a CAGR of 3.0% through 2035, primarily driven by stringent regulatory compliance requirements across the pharmaceutical and food processing industries. American manufacturing facilities emphasize the use of vibration damping components to ensure contamination-free production environments, maintain precise operational efficiency, and comply with rigorous validation standards such as FDA, GMP, and HACCP. These specialized levelling feet provide critical equipment stabilization in highly automated production lines, reducing vibrations that could compromise product quality or process accuracy. By minimizing equipment wear and operational downtime, they also contribute to lower maintenance costs and extended service life of machinery. The adoption of certified and standardized components enables facilities to demonstrate regulatory compliance effectively while optimizing throughput and production reliability. Industrial equipment distributors and specialized suppliers support this growth by offering technical guidance, customized solutions, and assistance with seamless integration of vibration damping systems into complex manufacturing setups, ensuring consistent operational performance and adherence to industry standards.

The UK vibration damping levelling feet market demonstrates medium growth, projected to expand at a CAGR of 2.7%. Demand is primarily driven by modernization initiatives in the food processing sector and upgrades to pharmaceutical manufacturing facilities. Companies are increasingly investing in advanced equipment stabilization technologies to comply with updated food safety regulations while enhancing production efficiency. High-performance levelling feet provide critical benefits such as improved machine reliability, reduced operational vibrations, and minimized maintenance requirements, contributing to consistent product quality across production lines. Facilities catering to export markets emphasize the adoption of components that meet international hygiene and operational standards, ensuring competitiveness in global supply chains. The market is further supported by the availability of modular and flexible mounting systems, which simplify installation, reduce equipment downtime, and accommodate a wide range of machinery types in diverse processing environments. Additionally, the integration of vibration damping solutions into existing infrastructure allows manufacturers to achieve precise equipment alignment, enhance worker safety, and maintain operational continuity in high-throughput production settings.

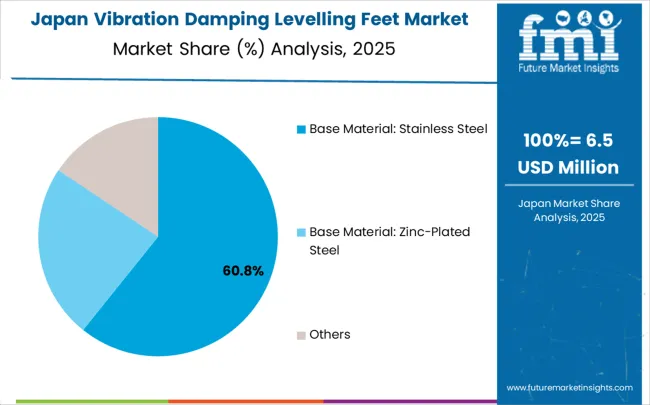

The vibration damping levelling feet market in Japan shows steady growth, projected to expand at a CAGR of 2.4%. The country’s industrial focus on precision manufacturing, cleanroom operations, and high-tech applications drives demand for reliable vibration damping solutions. The market exhibits steady growth, underpinned by well-established industrial infrastructure and widespread adoption of high-precision equipment stabilization systems across electronics, automotive, pharmaceutical, and semiconductor sectors. Japanese manufacturers emphasize ultra-clean, reliable, and consistent components that ensure operational accuracy, product quality, and equipment longevity in demanding production environments. The market places a high priority on solutions that minimize maintenance requirements, extend service life, and provide superior vibration damping performance, particularly in sensitive applications such as semiconductor fabrication and pharmaceutical cleanrooms. Advanced design innovations focus on enhancing load-bearing capabilities, compatibility with complex machinery configurations, and integration with emerging automation technologies. Continuous R&D initiatives drive the development of next-generation levelling feet with improved material properties, environmental resistance, and vibration absorption efficiency.

<

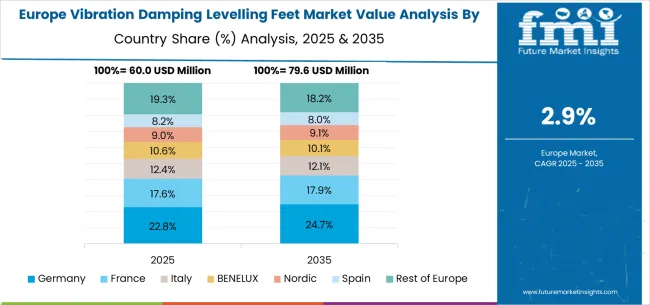

The vibration damping levelling feet market in Europe reflects mature industrial development with Germany leading through precision engineering expertise and comprehensive manufacturing infrastructure. European manufacturers prioritize component quality and regulatory compliance across food processing, pharmaceutical, and precision manufacturing sectors. Germany maintains market leadership through established supply chains and technical expertise, while countries like France and Italy contribute through specialized food processing applications and industrial equipment manufacturing. The UK focuses on regulatory compliance and food safety standards, with Nordic countries emphasizing cleanroom applications and specialized manufacturing requirements. Eastern European markets show growth potential through manufacturing facility modernization and industrial development programs that require advanced equipment stabilization solutions.

In Japan, the vibration damping levelling feet market is largely driven by the stainless steel segment, which accounts for 65% of total market revenues in 2025. The superior corrosion resistance properties in humid manufacturing environments and stringent cleanliness protocols mandated in electronics and pharmaceutical production are key contributing factors. Zinc-plated steel components follow with a 25% share, primarily in general industrial applications that integrate cost-effective solutions with adequate performance characteristics. Thermoplastic materials contribute only 10% as adoption in precision manufacturing applications remains limited.

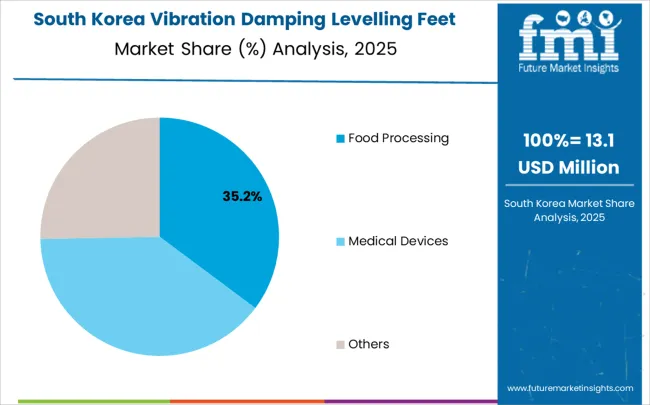

In South Korea, the market is expected to remain dominated by food processing applications, which hold a 40% share in 2025. These applications typically represent the primary demand source where sanitary equipment requirements necessitate specialized component materials and surface treatments. Medical device manufacturing and precision manufacturing each hold 25% market share, with increasing standardization in equipment mounting across diverse production facilities. Laboratory equipment accounts for the remaining 10%, but gradually gains traction in research facility development due to precision measurement requirements and contamination control needs.

The vibration damping levelling feet market consists of approximately 25 meaningful players with moderate concentration where the top five companies control roughly 45% of global market share. Competition focuses on technical innovation, material quality, and application-specific engineering support rather than price-based strategies. The market structure supports both specialized technical leaders and regional suppliers serving specific industrial sectors.

Leaders include ELESA + GANTER with comprehensive product portfolios and established European distribution networks, JW Winco providing engineering-focused solutions with technical application support, and AV Products specializing in precision manufacturing applications. These companies maintain competitive advantages through technical expertise, material innovation capabilities, and long-term customer relationships with industrial equipment manufacturers.

Challengers encompass Nu-Tech Engineering and Sorbothane, companies with specialized technologies and regional market presence, while specialists include AirLoc Schwaderer GmbH and MOVET Components serving niche applications with customized solutions. Emerging players like Sunnex and Haining Chaoyue Seals focus on cost-effective alternatives and regional market development, particularly in Asian manufacturing sectors where price sensitivity remains significant.

Vibration damping levelling feet represent a critical precision component market serving equipment stability and noise reduction across food processing, medical devices, and industrial applications. With the global market valued at $244 million in 2024 and projected to reach $334.0 million by 2030 (3.2% CAGR), this specialized segment faces challenges around technical standardization, material innovation, and regional manufacturing concentration. The market is characterized by established European players (ELESA + GANTER, JW Winco, AirLoc Schwaderer) competing with emerging Asian manufacturers, while diverse base materials (stainless steel, zinc-plated steel) serve different performance and cost requirements across applications.

How Governments Could Enhance Manufacturing Competitiveness and Standards?

Industrial Base Strengthening: Provide targeted manufacturing incentives for precision component production, particularly in regions seeking to reduce dependence on imports. Offer tax credits or grants for facilities producing high-specification vibration control components that serve critical industries like medical devices and food processing.

Technical Skills Development: Fund specialized training programs for machinists and engineers focused on precision manufacturing techniques, material science applications, and vibration control theory. Establish partnerships between technical colleges and component manufacturers to develop skilled workforce pipelines.

Standards and Certification Support: Work with industry bodies to establish harmonized international standards for vibration damping performance, load ratings, and material specifications. Provide funding for small-to-medium manufacturers to achieve ISO certifications and industry-specific approvals (FDA, CE marking).

Export Promotion: Create trade promotion programs that help domestic manufacturers access global supply chains for industrial equipment, particularly in high-growth sectors like pharmaceutical manufacturing and automated food processing systems.

Research Infrastructure: Invest in materials testing laboratories and vibration analysis facilities that can support component innovation, particularly for advanced polymers, composite materials, and smart damping systems with integrated sensors.

How Industry Bodies Could Advance Technical Standards and Market Development?

Performance Standardization: Establish unified testing protocols for vibration attenuation, load capacity, chemical resistance, and durability across different operating environments. Create standardized performance ratings that enable equipment manufacturers to specify components with confidence.

Application Engineering Guidelines: Develop technical guides for proper selection and installation of vibration damping feet across different industries, including load calculations, mounting configurations, and maintenance schedules to prevent equipment failures.

Material Innovation Advocacy: Promote research into advanced damping materials, including bio-based polymers for food-grade applications, high-temperature elastomers for industrial use, and composite materials that combine multiple performance characteristics.

Supply Chain Resilience: Facilitate supplier diversification programs that connect equipment manufacturers with multiple component suppliers, reducing dependence on single sources and improving supply chain stability during disruptions.

Knowledge Transfer: Organize technical seminars and workshops that educate equipment designers and facility engineers on vibration control principles, helping expand market awareness and proper application of damping technologies.

How OEMs and Technology Providers Could Strengthen the Ecosystem?

Integrated Design Solutions: Develop complete vibration control systems that combine levelling feet with complementary technologies like vibration monitoring sensors, automated adjustment mechanisms, and predictive maintenance capabilities for Industry 4.0 applications.

Material Science Innovation: Invest in advanced polymer chemistry and composite materials that offer superior damping characteristics, extended service life, and resistance to aggressive chemicals used in food processing and pharmaceutical manufacturing.

Modular Product Platforms: Create standardized mounting interfaces and modular component systems that allow easy specification and replacement across different equipment types, reducing inventory complexity for equipment manufacturers.

Digital Tools and Selection Software: Provide engineering software that helps equipment designers select optimal damping solutions based on load requirements, vibration frequencies, and environmental conditions, streamlining the design process and reducing specification errors.

Application-Specific Engineering: Develop specialized variants optimized for specific industries - food-grade materials with NSF approval, medical-grade components with biocompatibility certification, and high-temperature versions for industrial processes.

How Suppliers and Manufacturers Could Navigate Market Evolution?

Geographic Manufacturing Strategy: Establish distributed production capabilities that balance cost competitiveness with proximity to key markets, particularly as supply chain resilience becomes increasingly important for critical applications.

Quality and Certification Management: Implement comprehensive quality systems that meet multiple industry standards simultaneously (ISO, FDA, CE) while maintaining cost competitiveness against lower-cost manufacturers lacking proper certifications.

Customer Technical Support: Provide robust application engineering support that helps equipment manufacturers optimize vibration control in their designs, including on-site consultation, prototype development, and performance validation testing.

Product Portfolio Optimization: Develop tiered product offerings - economy versions for cost-sensitive applications, standard industrial grades for general use, and premium variants with advanced materials and extended warranties for critical applications.

Supply Chain Integration: Build strategic partnerships with raw material suppliers, particularly for specialized elastomers and high-performance polymers, ensuring consistent material quality and availability during supply disruptions.

How Investors and Financial Enablers Could Unlock Market Potential?

Manufacturing Automation Investment: Finance advanced manufacturing systems including precision molding equipment, automated assembly lines, and quality control systems that enable consistent production of high-specification components at competitive costs.

Materials Technology Ventures: Back startups developing next-generation damping materials, including smart polymers that adapt to changing conditions, bio-based materials for eco-friendly applications, and nanocomposite materials with enhanced performance characteristics.

Regional Manufacturing Development: Support establishment of regional production hubs that serve local equipment manufacturers while reducing logistics costs and lead times, particularly in emerging markets with growing industrial bases.

Acquisition and Consolidation Opportunities: Finance strategic acquisitions that combine complementary technologies, expand geographic reach, or integrate vertical supply chain capabilities to create more comprehensive vibration control solutions.

Industry 4.0 Integration Funding: Invest in development of connected damping systems that integrate with broader equipment monitoring and maintenance systems, enabling predictive maintenance and optimized performance across industrial facilities.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 244 million |

| Base Material | Stainless Steel, Zinc-Plated Steel, Aluminum Alloy, Thermoplastic Materials |

| Application | Food Processing, Medical Devices, Precision Manufacturing, Laboratory Equipment, Cleanroom Facilities |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ELESA + GANTER, JW Winco, AV Products, Nu-Tech Engineering, Sorbothane, AirLoc Schwaderer GmbH, MOVET Components, Sunnex, Haining Chaoyue Seals |

| Additional Attributes | Dollar sales by material type and load capacity specifications, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and specialized suppliers, adoption patterns for regulatory compliance versus general industrial applications, integration with equipment automation and precision manufacturing systems, innovations in damping material technology and modular mounting systems, and development of application-specific solutions with enhanced environmental resistance and load distribution capabilities. |

The global vibration damping levelling feet market is estimated to be valued at USD 243.8 million in 2025.

The market size for the vibration damping levelling feet market is projected to reach USD 334.0 million by 2035.

The vibration damping levelling feet market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in vibration damping levelling feet market are base material: stainless steel, base material: zinc-plated steel and others.

In terms of application, food processing segment to command 35.0% share in the vibration damping levelling feet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vibration Screening Machine Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Vibration Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vibration Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vibration Isolation System industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Vibration Analyzer Market Growth – Trends & Forecast 2025-2035

Vibration Level Switch Market Analysis by Technology, Industry, Application, and Region through 2035

Vibration Control Systems Market Growth - Trends & Forecast 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Anti-Vibration Mounts Market

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Noise Vibration Harshness (NVH) Testing Market

Noise And Vibration Coatings Market Size and Share Forecast Outlook 2025 to 2035

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Active Damping Smartphone Case Market Growth - Demand & Trends 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA