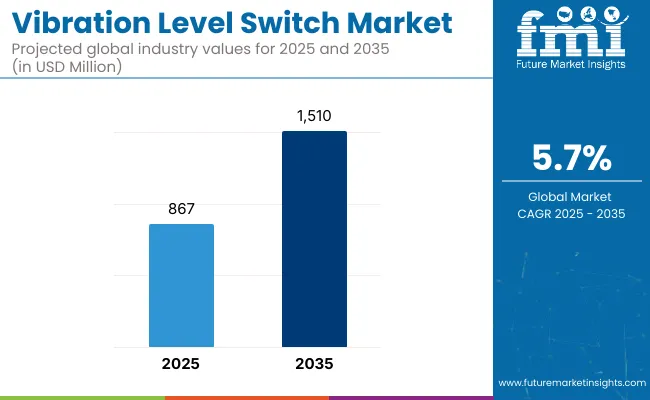

The global vibration level switch market is estimated to account for USD 867 million in 2025. It is anticipated to grow at a CAGR of 5.7% during the assessment period and reach a value of USD 1510 million by 2035.

| Attributes | Description |

|---|---|

| Industry Size (2025E) | USD 867 million |

| Industry Value (2035F) | USD 1510 million |

| Value-based CAGR (2025 to 2035) | 5.7% |

Industry Outlook

As per FMI analysis, the vibration level switch that is projected to see a transition from 2025 to 2035 is indeed this one. Global industrial processes are being increasingly automated, which leads to the need for electronic parts to increase. Not only that, the product of highly standardized materials that provide safety in the workplace is also destined to take the lead in the future.

In the context of the Fourth Industrial Revolution, the networking of machines will give these switches an add-on of the incredible effect of `smart` and predictive maintenance. Having this technology in industries such as chemicals, oil & gas, food & beverage, pharmaceuticals, and water treatment makes it a requisite of the modern era.

The additional demand for green technology and smart sensors will also be a reason for product design innovation. As a result, more versatile and highly sensitive vibration level switches will be developed. The main regions to be the highest determinants of market growth are the Asia-Pacific and Latin America regions, giving reasons for the sources of peripheral and infrastructural development through rapid industrialization.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The market was valued at approximately USD 569.6 million in 2017 and reached around USD 833.8 million by 2023, with a CAGR of 6.6% during this period. | The market is projected to grow from USD 2.29 billion in 2025 to USD 4.33 billion by 2034, exhibiting a CAGR of 7.32%. |

| Adoption of piezoelectric-driven vibration level switches increased, offering benefits like easy installation and reliable point level measurement. | Ongoing technological advancements are enhancing the performance and efficiency of vibration level switches, with a focus on smart manufacturing solutions and IoT integration. |

| Significant demand from the chemical industry, driven by the need for reliable level measurement solutions to ensure safety and efficiency. | Continued growth in industries such as oil and gas, chemicals, water and wastewater, and food and beverage, with an emphasis on automation and safety regulations. |

| Asia Pacific dominated the market, accounting for over 33% share in 2020, primarily due to the surge in chemical and pharmaceutical industries. | North America is projected to have the largest market share by 2032, valued at USD 1.25 billion, driven by advanced manufacturing processes and high adoption of smart technologies. |

Increasing Demand for Vibration Level Switches

The upsurge in the automation and Industry 4.0 sectors is redefining the vibration level switch space in a remarkable way. As industries shift to smart manufacturing, there has been a concomitant uptick in the integration of vibration level switches with IoT, AI, and cloud-based monitoring systems. Given the market focus, process efficiency has become the most significant priority for consumers, whereas the reduction of manual intervention and the minimization of errors in operations, also, are the others.

The emphasis on safety and regulatory compliance is propelling the levels of measurement investment for sectors such as oil and gas, chemicals, and food processing in particular. Consumers are actively searching for the vibration level switches to use which the rules set forth are very demanding in the safety and environmental areas, for example, to avoid spills, overflows, and hazardous incidents. Because of this pressure, manufacturers are forced to innovate by designing advanced sensors that are basically fail-safe and have self-diagnosis features.

The replacement with wireless and battery-operated apparatus is also a significant factor that affects the purchasing decision of many enterprises. Nowadays, people want to get vibration level switches with wireless communication which is an advantage for remote monitoring and pushes maintenance tasks far down to 0. Battery-powered models with low power consumption are becoming increasingly trendy, especially in hazardous surroundings where wired installations become a problem.

The growth of renewable energy and energy-efficient solutions is the main factor that shifts the consumer demand for the vibration level switches towards products that use less energy and are made of environmentally friendly materials. The companies are pouring funds into green technologies while the manufacturers are ramping up their research to birth sensor solutions that are energy-efficient, durable, and recyclable in line with global sustainability goals.

The food and beverage company's growth is acting as a catalyst in the demand for hygienic vibration level switches. The consumer base in this business takes it the most important to have sensors that are made of stainless steel and FDA-approved materials so that they can observe the hygiene requirements. The need for accurate level detection in milk, drink, and packaged food production has thus advanced the penetration of the best quality vibration level switches.

Based on technology, the industry is divided into vibrating forks and vibrating rods. The vibrating fork vibration level switch is more widespread compared to the vibrating rod type, mainly because of its extreme sensitivity, versatility, and capacity to sense a wide range of materials. The vibrating fork level switches are the ones operating based on the piano tines model, which is the fork that vibrates at a distinct frequency and becomes aware of the changes when it is submerged in liquids or solids.

Oil and gas, chemical, food and beverage, and pharmaceutical industries are major users of vibrating fork switches because they are the devices that provide both liquids and bulk solids (e.g. powders and granules) accurate detection. Apart from that, they are more effective under problematic situations, such as the presence of foam, being viscous, and in low-density material, therefore, they are more variable across applications.

Nevertheless, although vibrating rod switches have been practical in the bulk solid scope, they are by and large less sensitive and less suitable in the case of liquid detection. Because of these benefits, vibrating fork level switches are widely accepted in many sectors, thus they have become the best alternative for level measurement that is reliable.

Based on application, the industry is divided into liquids and solids. Solid-supported vibrating level switches are preferred and more deployed than vibrating level switches for liquids because measuring the level of bulk materials requires more appropriate and sustainable options. In industries such as food processing, chemicals, cement, and agriculture, bulk solids like powders, granules, and pellets must be accurately detected to prevent overflows, blockages, or equipment damage.

Among the vibration level switches, vibrating forks and vibrating rods act as the top solutions for these applications because of their capacity to work in dusty, polluted, and material of different densities. Conversely, vibrating level switches for liquids are also in high demand across industries like oil and gas, water treatment plants, and pharmaceuticals, hence their considered acceptance is solid.

However, on many occasions, the level measurement of liquids has beneficial options like float switches, capacitive sensors, and even ultrasonic sensors. In the opposite sphere, solids tend to be the harder ones to detect thus utilizing vibration level switches means that plants achieve both efficient processes and the highest degree of safety during the time of handling bulk materials.

Based on industry, the industry is divided into oil & gas, chemicals, water & wastewater, food & beverages, pharmaceuticals, power generation, metals & mining, and others - cement, pulp & paper, and marine. Vibration level switches are considered the most commonly used type in the oil and gas sector as they are a must for accurate and trustworthy level measurement in extremely hazardous and difficult conditions.

This segment primarily avails the vibration level switches for gauging the liquid quantities in storage tanks, separators, and pipelines, as well as for recognizing solid particles in the refining and drilling processes. The major push for the very long lifespan and explosion-proof level sensors not only comes from safety issues but also the necessity of being compliant with very specific industry standards such as API and ATEX.

The USA is expected to maintain its leadership in the North American vibration level switch industry due to its highly advanced industrial sector and strong focus on automation. The country’s stringent safety regulations in industries like oil and gas, chemicals, and power generation drive the demand for reliable level measurement solutions. Established market players continue to invest in research and development, introducing smarter and more efficient vibration level switches.

China is anticipated to remain the dominant player in the vibration level switch market due to its rapid industrialization and strong manufacturing capabilities. As one of the world’s largest chemical producers, the country relies heavily on level measurement solutions for handling hazardous materials. The increasing adoption of automation and smart technologies in industrial plants is pushing the demand for vibration-level switches.

Japan’s vibration level switch market is driven by its highly advanced automation sector and focus on precision engineering. The country’s leading position in robotics, automotive manufacturing, and high-tech industries creates a strong demand for accurate level measurement solutions. Vibration level switches are increasingly used in applications requiring high reliability, such as semiconductor production and pharmaceutical manufacturing.

Germany, as an industrial powerhouse in Europe, is expected to see steady growth in the vibration level switch market. The country’s strong emphasis on Industry 4.0 and digital transformation in manufacturing processes drives the need for advanced-level measurement solutions. Sectors such as automotive, chemicals, and food processing actively invest in automation technologies, making vibration level switches a crucial component of modern production lines.

India’s vibration level switch market is growing rapidly due to expanding industrialization and infrastructure development. The country’s booming chemical, pharmaceutical, and food and beverage industries require precise level monitoring to ensure product quality and process safety. Government-led initiatives to enhance manufacturing capabilities and improve industrial safety regulations are supporting the increased adoption of vibration-level switches.

Brazil’s market for vibration level switches is largely influenced by the oil and gas sector, which plays a crucial role in the country’s economy. The need for precise level measurement in offshore and onshore drilling is on the rise, thus making the demand for switches that are durable and reliable. The growing food and beverage industry is using high-end level measurements to ensure efficient and high-quality processing.

The industry for vibration level switches has a moderate to high degree of concentration with some major global players controlling major market share. Top manufacturers heavily invest in R&D to bring innovative, automation-friendly, and energy-saving solutions. Their well-established distribution channels and strong brand equity enable them to stay competitive.

Regional and local producers remain on the upswing by providing affordable and tailor-made solutions that meet industry-specific requirements. Rising markets in Asia-Pacific and Latin America see rising competition as new players use technology and government aid to increase their presence. The trend makes the market more diversified while making the competition fiercer among incumbent and emerging players.

Strategic mergers, partnerships, and acquisitions characterize market expansion strategies by industry leaders. Business firms partner with automation solution vendors and industrial IoT companies to create more functionality for products. Since industries call for greater efficiency and safety standards, market leaders emphasize intelligent sensor technologies and wireless connectivity in order to lead and support continued growth in the long run.

Major Developments

The market for vibration level switches is extremely competitive, with major global players constantly innovating to enhance their market positions. Major manufacturers concentrate on improving product reliability, energy efficiency, and compatibility with industrial automation systems. Their strong brand image and large distribution networks provide them with a competitive advantage over regional and emerging players.

Regional and local producers are progressively gaining ground in the market by providing cost-effective and customized solutions based on industry-specific needs. These producers target niche applications and capitalize on wireless technology advances to attract small and mid-sized industries. Their adaptability and price competitiveness generate a dynamic competitive landscape, disrupting large corporations.

Mergers, acquisitions, and partnerships are key drivers of competitive development. Large established companies buy innovative startups and specialist sensor makers to broaden their technology base. Industrial IoT companies and automation solution providers partner with them to strengthen product offerings, enabling smooth integration with contemporary industrial monitoring and control systems.

Market participants focus on research and development to design vibration-level switches with higher durability, accuracy, and self-diagnostic capabilities. The need for intelligent sensors and real-time monitoring solutions pushes innovation, making firms invest in digitalization. Competitive differentiation is becoming more dependent on technological innovation, safety regulation compliance, and customer-focused product development.

Geographical growth and marketing strategies assist firms in consolidating their presence in developing markets. The Asia-Pacific, Latin America, and the Middle East regions offer huge opportunities for growth owing to accelerated industrialization and expanding automation adoption. Firms make investments in local manufacturing, partner with distributors, and educate customers to enter new markets and achieve long-term growth.

With respect to technology, the market is classified into vibrating fork and vibrating rod.

In terms of application, the market is segmented into liquids and solids.

In terms of industry, the market is divided into oil & gas, chemicals, water & wastewater, food & beverages, pharmaceuticals, power generation, metals & mining, and others - cement, pulp & paper, and marine.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The market is anticipated to reach USD 867 million in 2025.

The market is predicted to reach a size of USD 1510 million by 2035.

Prominent players include Dwyer Instruments, Ametek, Emerson Electric, Siemens, and others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Level Switches Market Growth - Trends & Forecast 2025 to 2035

Oil Level Switches Market

Vibration Damping Levelling Feet Market Size and Share Forecast Outlook 2025 to 2035

Float Level Switches Market Size and Share Forecast Outlook 2025 to 2035

Vibration Screening Machine Market Size and Share Forecast Outlook 2025 to 2035

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Level Floats Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Switchrack Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vibration Sensor Market Size and Share Forecast Outlook 2025 to 2035

Switching Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Vibration Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vibration Isolation System industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Vibration Analyzer Market Growth – Trends & Forecast 2025-2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Level Transmitter Market Growth – Trends & Forecast 2025 to 2035

Switched Reluctance Motors Market Growth - Trends & Forecast 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA