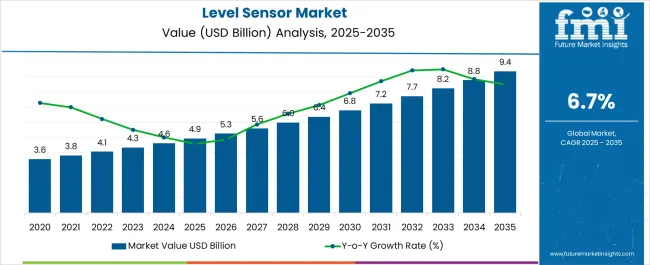

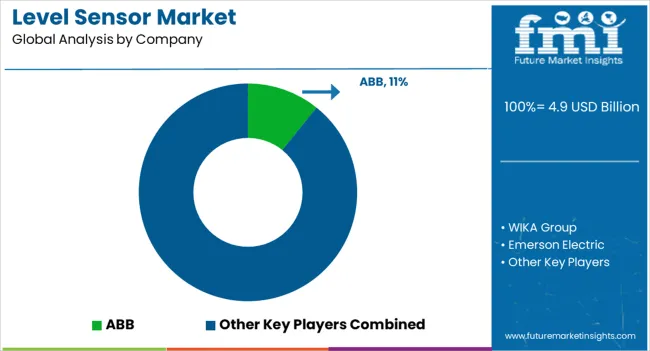

The Level Sensor Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 9.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Level Sensor Market Estimated Value in (2025 E) | USD 4.9 billion |

| Level Sensor Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The level sensor market is witnessing sustained expansion, supported by rising industrial automation, stricter process safety regulations, and the growing need for accurate measurement systems across multiple industries. Reports from industrial automation forums and corporate disclosures have emphasized the importance of reliable sensing technologies in chemical processing, water treatment, oil and gas, and pharmaceuticals, where precise monitoring of liquid and solid levels is critical to operational efficiency and safety.

Advances in sensor technologies, including wireless connectivity, miniaturization, and integration with IoT platforms, have broadened adoption in both legacy and modern industrial facilities. Additionally, regulatory requirements for pollution control and environmental monitoring have reinforced demand for advanced level sensing solutions.

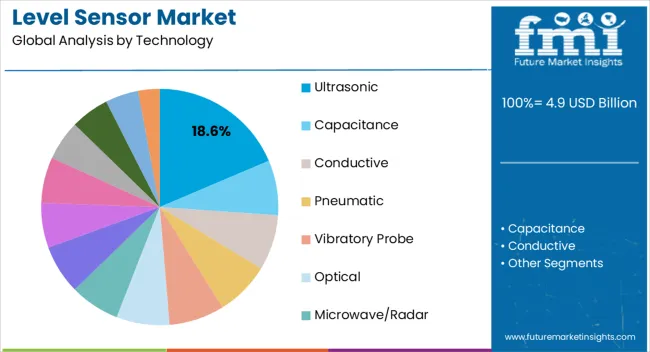

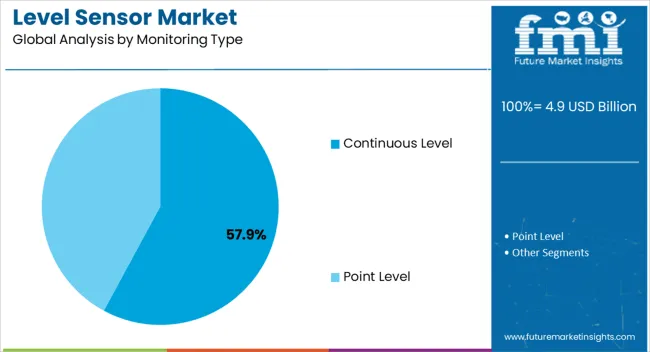

The market outlook remains positive as industries continue investing in digital transformation, predictive maintenance systems, and high-performance monitoring tools. Segmental growth is expected to be led by ultrasonic technology, liquid applications, and continuous level monitoring, reflecting both technological advantages and the critical importance of accuracy and reliability in industrial environments.

The ultrasonic segment is projected to account for 18.6% of the level sensor market revenue in 2025, reflecting its strong position in non-contact sensing applications. Growth of this segment has been supported by ultrasonic technology’s ability to measure levels accurately without direct contact, reducing risks of contamination and wear.

Industries such as food and beverage, pharmaceuticals, and wastewater management have favored ultrasonic sensors due to their reliability in harsh or corrosive environments. Additionally, advancements in digital signal processing have enhanced accuracy, enabling sensors to handle temperature variations and surface turbulence.

Cost-effectiveness compared to radar sensors has also driven wider adoption, particularly in medium-range applications. With manufacturers continuing to integrate wireless communication and self-diagnostic features, ultrasonic level sensors are expected to maintain demand in sectors prioritizing hygiene, durability, and operational efficiency.

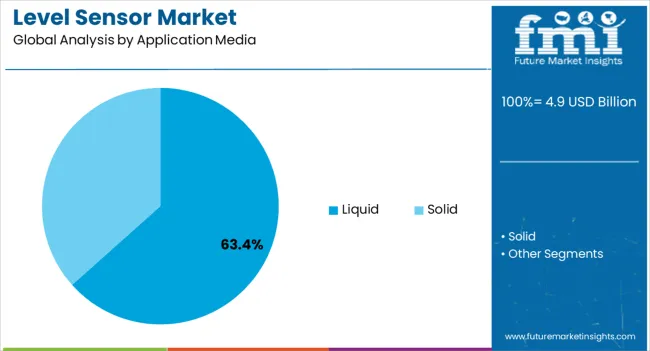

The liquid segment is projected to contribute 63.4% of the level sensor market revenue in 2025, dominating demand due to the widespread need for liquid monitoring across industrial and commercial sectors. Applications in water treatment, chemical storage, oil refining, and beverage production have consistently required precise level monitoring to ensure process safety and quality control.

Regulatory emphasis on water conservation, pollution management, and safe handling of hazardous liquids has further fueled adoption. Technological improvements in both contact and non-contact liquid level sensors have enhanced measurement accuracy, even under varying temperature, pressure, and chemical conditions.

The scalability of liquid-level sensors across small-scale operations and large industrial facilities has also supported their widespread use. As industries modernize and expand digital infrastructure, the liquid segment is expected to sustain its leadership through consistent demand for efficiency, compliance, and process reliability.

The continuous level segment is projected to hold 57.9% of the level sensor market revenue in 2025, maintaining its leading position due to the need for uninterrupted, real-time monitoring. Industries managing bulk materials, storage tanks, and process vessels have prioritized continuous measurement to optimize inventory, prevent overflow, and support predictive maintenance strategies.

Continuous sensors have been favored for their ability to provide real-time data integration with automated systems, ensuring precise control over production processes. Advancements in radar, ultrasonic, and capacitance-based technologies have improved measurement stability and reduced signal interference, making continuous monitoring more reliable in complex environments.

Additionally, the integration of continuous level sensors with IoT platforms has facilitated remote monitoring and data analytics, enhancing decision-making for operators. As industries increasingly prioritize automation and smart factory initiatives, the continuous level segment is expected to remain the preferred monitoring type across global markets.

The global level sensor market was valued at USD 4.9 billion in 2025. The demand for level sensors rose at a CAGR of 6% during the period from 2020 to 2025. Level sensors are becoming a major choice for automation in industries with large-scale manufacturing and storage of liquids or powdered materials.

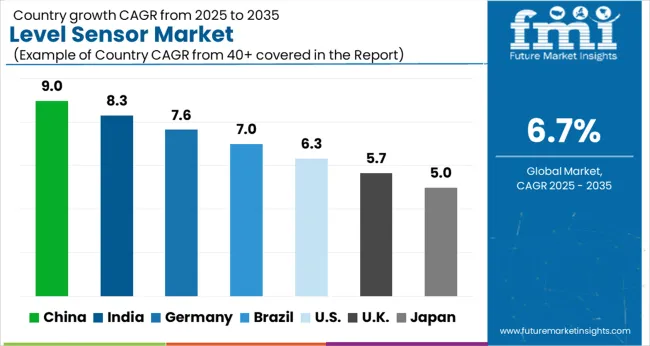

Collectively, Western Europe and the Asia Pacific Excluding Japan regions are likely to account for the majority of revenue shares in the level sensor market by 2035. The oil & gas segment is set to register the highest market share of around 19.7% in the global level sensor market in 2025.

Sensor technology advancements create new growth opportunities for the level sensor market. Continuous developments and implementation of new technologies such as laser and ultrasonic technologies in level sensor devices are creating opportunities for growth for the level sensor market.

The rising adoption of smart sensors capable of self-diagnosis and two-way communication is projected to drive market growth. For instance, applications such as water conservation make use of digital technology and can be connected to microcontrollers to monitor water capacity and usage.

Moreover, growing industrial wireless technology helps to implement various features in level sensors for wastewater treatment and water tank applications. For instance, Vega Grieshaber KG introduced a process sensor ‘PLICSCOM’ with wireless operations.

Plicscom has Bluetooth functionality, which provides diagnostics and facilities operations. This process sensor is used for level measurement in wastewater treatment and pump station applications, as well as stormwater overflow tanks.

The ability to offer higher efficiency, accuracy, maintenance, and easy installation is estimated to augment the level sensor market growth across the globe. Additionally, vendors have been resorting to significant developments in terms of new product launches, which have been suggestive of the same.

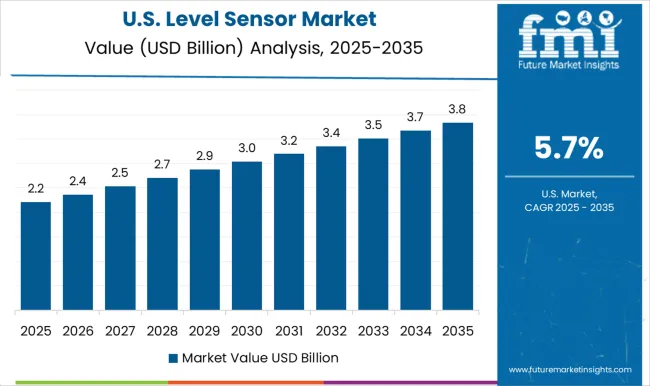

Currently, the United States market anticipates the largest consumption of level sensors in the North American region, and is expected to account for a market share of around 88% in 2025. The United States market for the level sensor is expected to expand 1.4X by 2035.

The United States market witnessed significant growth in level sensor sales, driven by the increased investments in automation and focus on the efficiency of processes across the pharmaceutical, oil, and gas, and food processing industries. Vendors in the region are investing in expanding their level sensor product portfolio to cater to the growing demands.

China is set to register exponential growth of level sensors in the global level sensor market with a CAGR of 10.5% from 2025 to 2035. The Chinese market is anticipated to create an absolute dollar opportunity of USD 4.9 million between 2025 & 2035.

This growth is attributed to the combination of advanced signal conditioning together with packaging techniques and a high-technology sensor that provides an ideal extensive solution for accurate, reliable, and economical level measurements.

Increasing demand in new and existing manufacturing industries in China is expected to boost the performance of the market during the forecast period. The need to detect the presence and absence of bulk solid material over a wide range of material densities is driving the level sensor market growth.

Brazil's market is set to report significant adoption of the level sensor in the Latin America region, and the market size is expected to grow by 1.2X between 2025 & 2035. Brazil's level sensor market is anticipated to create an absolute dollar opportunity of USD 23 million from 2025 to 2035.

Increasing investment in research activities and government initiatives to implement optical fiber technology in level sensing applications is driving the demand in the country. The presence of various small and medium-sized players in the Brazil and rising adoption of industrial wireless technologies in the country is driving the growth of the market.

The rising automatic liquid level sensing technologies trend is estimated to propel the growth of the market in Brazil.

The ultrasonic level sensor segment by technology is projected to dominate the level sensor demand and hold the highest market share of nearly 17% in 2025. The ultrasonic technology segment is expected to register an incremental $ opportunity of USD 4.9 million between 2025 & 2035.

Ultrasonic level sensors measure substance levels based on the travel time of ultrasonic pulses to the surface of the medium and back. When installing the sensor, the typical block distance between the surface of the medium and the source of the ultrasonic pulse has to be considered. Thus, the ultrasonic technology segment is projected to maintain its dominance over the forecast period.

The liquid application media segment accounted for more than half of the overall demand for the level sensor in 2025. The increasing demand for liquid level measurement for chemical and petrochemical industries has been recently driving the growth of the level sensor market.

These are also used to detect the level of water in cooling circuits for nuclear power plants. The need for accurate level sensors and high precision, in industrial as well as commercial applications, is a significant factor driving the growth of the global level sensor market.

The point-level monitoring type segment is likely to witness high CAGR growth of around 6.7% during the forecast period. Increasing usage point level sensor to detect the presence and absence of bulk solid material over a very wide range of material densities is driving the demand.

Point level monitoring type increases the demand for leak detection or preventing run-dry or overspill situations, which is in turn driving the growth of the level sensor market.

In terms of value, the non-contact level sensors by device type are expected to create an incremental opportunity of around USD 863.6 million during the forecast period. Increasing usage of non-contact type level sensor for continuous non-contact level measurements is driving the demand, as compared to contact level sensors.

These sensors possess long lifespans and require less maintenance to make them work properly, along with being corrosion-resistant. These characteristics make users highly prefer the non-contact device type, thereby comprising a key segment of the global level sensor market.

The market size of the oil & gas sector by industry is set to expand by 1.6X by 2035. The oil & gas segment is set to register an absolute dollar opportunity of USD 500 million between 2025 & 2035.

The oil and gas sector is one of the most significant end users of level sensors, globally. With the growing crude oil production in some geographies, such as the United States of America & GCC countries, the need for level sensors is expected to surge. The extensive use of these sensors for downstream processing plants and monitoring storage units has maintained a constant demand for level sensors from the sector.

The global level sensor industry serves a highly fragmented competitive landscape. The market is witnessing a trend of acquisition of small sensor technology vendors by the major players, along with intense competition due to the demand for highly efficient products among the players. Product developments continue to be the key focal point of manufacturers in line with their key strategy to boost their market shareholdings.

| Attributes | Details |

|---|---|

| Market value in 2025 | USD 4.1 billion |

| 2025 Market Value | USD 4.3 billion |

| 2035 Market Value | USD 8.6 billion |

| CAGR% (2025 to 2035) | 7% |

| Share of top 5 players | Around 30% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key regions covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Key countries covered |

United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key market segments covered |

Technology, Application Media, Monitoring Type, Device Type, Industry, Region |

| Key companies profiled |

ABB; WIKA Group; Emerson Electric; Endress+Hauser AG; Anderson-Negele; SICK AG; Aplus Finetek Sensor, Inc.; Pepperl+Fuchs; AMETEK, Inc.; Honeywell International Inc.; Vega Grieshaber Kg; FAFNIR GmbH; Senix Corporation; First Sensor; BinMaster (Garner Industries); Waterline Controls; Ifm Electronic GmbH; PIC GmbH; Nohken, Inc. |

| Customization & pricing | Available upon request |

The global level sensor market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the level sensor market is projected to reach USD 9.4 billion by 2035.

The level sensor market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in level sensor market are ultrasonic, capacitance, conductive, pneumatic, vibratory probe, optical, microwave/radar, magnetostrictive, hydrostatic, magnetic and mechanical probe, guided wave, laser, nuclear, air bubbler and load cell.

In terms of application media, liquid segment to command 63.4% share in the level sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optical Liquid Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Level Floats Market Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Level Transmitter Market Growth – Trends & Forecast 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Level Switches Market Growth - Trends & Forecast 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

Level Measuring Instrument Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA