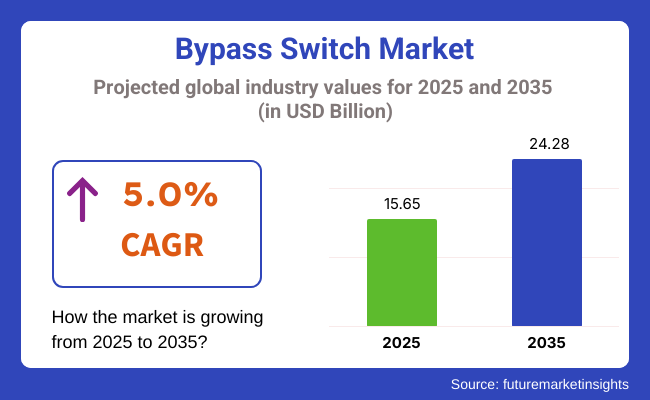

The global bypass switch market is poised for steady growth, increasing from USD 15.65 billion in 2025 to USD 24.28 billion by 2035, reflecting a CAGR of 5.0%. The need for reliable power continuity across sectors such as data centers, industrial automation, telecommunications, and healthcare is fueling sustained demand.

North America remains a technology leader with strong penetration of smart grid-compatible switches, while Asia Pacific-especially China, South Korea, and India-emerges as a high-volume growth region driven by infrastructure upgrades and renewable energy integration.

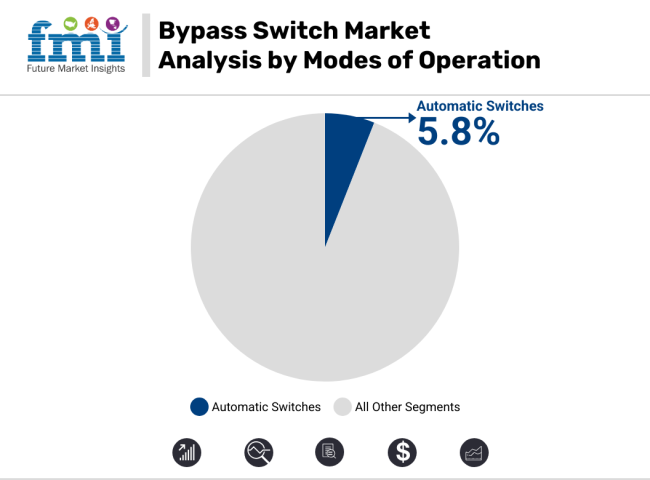

Automatic bypass switches continue to dominate due to their indispensable role in critical facilities where uptime is non-negotiable. Manual and motorized variants serve cost-conscious and space-constrained markets, particularly in Japan and parts of Southeast Asia.

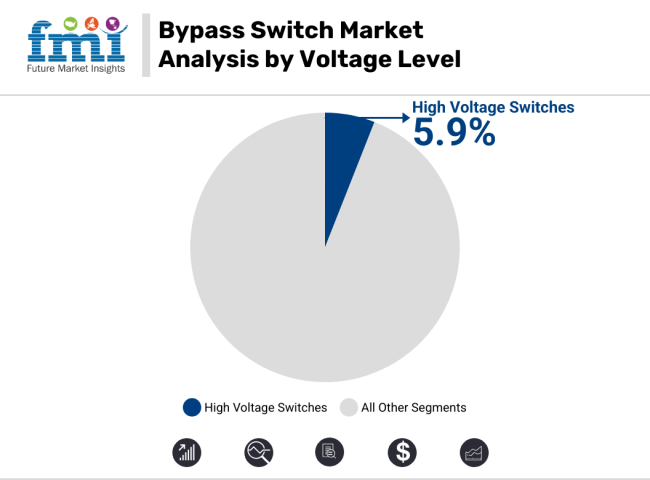

Smart bypass switches, featuring IoT connectivity and AI-powered fault detection, are gaining momentum in the U.S. and Western Europe. Meanwhile, medium-voltage applications remain the industry’s backbone, though high-voltage deployments are rising due to grid-scale solar, wind, and storage projects.

Looking ahead, sustainability targets and carbon-neutral mandates are prompting Western Europe to adopt energy-efficient bypass switchgear with recyclable materials. In contrast, Asia’s market is being reshaped by government-backed initiatives supporting EV infrastructure, microgrids, and industrial automation.

Product strategies are shifting toward modular, scalable, and compact systems that balance performance, cost, and flexibility. Vendors that focus on predictive maintenance, regional compliance, and real-time diagnostics will be best positioned to capture long-term value in this evolving electrical switchgear ecosystem.

Additionally, pricing pressures and material volatility are emerging as critical considerations for manufacturers and end-users alike. The rising cost of copper, aluminum, and semiconductors-key components in bypass switch production-has led to a reassessment of procurement strategies and material sourcing.

Stakeholders in Japan and South Korea, for instance, are showing strong preference for compact, budget-friendly models under USD 3,000, while Western buyers are increasingly willing to pay a premium for smart, energy-efficient systems. As leasing models and modular installations gain traction, particularly in South Korea and parts of Europe, the market is gradually transitioning from one-time capital expenditure to flexible, service-based models, further expanding access to advanced bypass switching technologies.

Automatic bypass switches account for the largest share due to their application in mission-critical environments like data centers, hospitals, and telecom towers, where uninterrupted power supply is non-negotiable. These switches provide seamless power redirection during faults or maintenance without manual intervention, which is vital for minimizing downtime.

Manual and motorized switches, while more affordable, are primarily used in less time-sensitive or lower-load applications. However, their adoption is steady in smaller commercial facilities and price-sensitive regions. The push for IoT-based remote monitoring and predictive maintenance is expected to accelerate the shift toward automated systems globally.

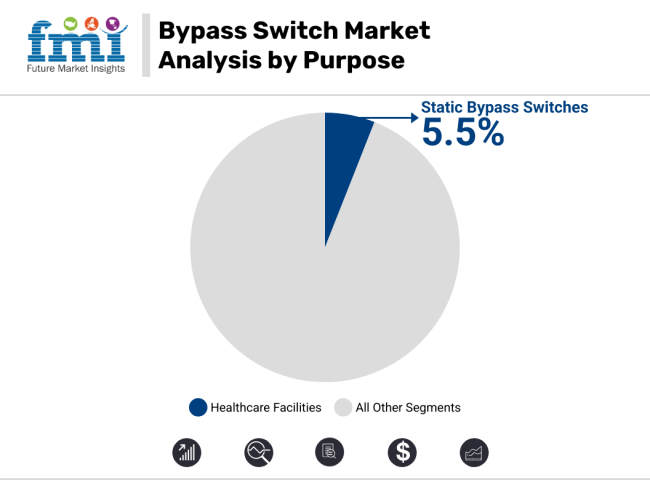

Static bypass switches are growing fastest as they are essential for protecting sensitive equipment and ensuring seamless transfer to backup power during failures. These switches are widely used in UPS systems, industrial automation, and energy-intensive sectors.

Meanwhile, external maintenance bypass switches are witnessing increased deployment in utilities and large industrial plants, where they enable system servicing without interrupting operations. As smart grids and microgrids expand, both categories will benefit from digital integration and automation.

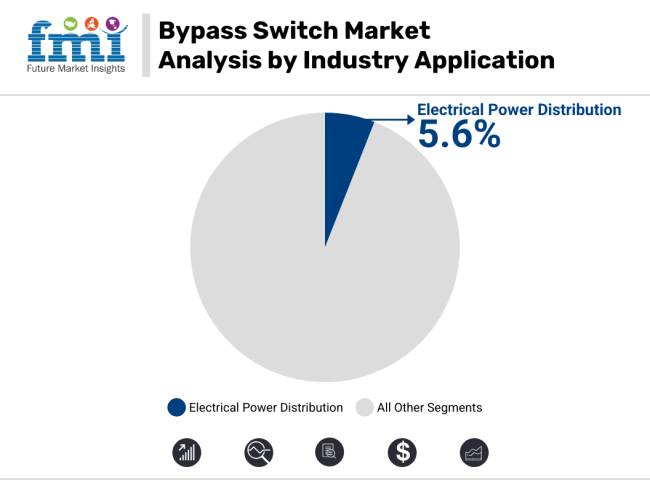

The data center and healthcare sectors remain top adopters of bypass switches due to their need for 24/7 uptime. The energy and utilities sector is experiencing a surge in demand driven by increasing renewable energy projects and smart grid rollouts.

Industrial automation and manufacturing also contribute significantly due to the growing reliance on continuous power for machinery and robotics. Telecom operators, especially in remote or tower-dense geographies, are emerging as high-growth buyers amid 5G expansion.

Medium voltage remains the largest segment, serving widespread applications in commercial and utility-scale infrastructure. However, high voltage bypass switches are gaining ground, supported by increasing investments in transmission infrastructure, solar farms, and wind energy systems. Low voltage systems, while slower in growth, still play a crucial role in residential complexes and small-scale commercial buildings.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, industrial operators, and regulators in the USA, Western Europe, Japan, and South Korea)

Key Priorities of Stakeholders

Regional Variance:

Adoption of Advanced Technologies: High Variance

Convergent and Divergent Perspectives on ROI:

Material Preferences Consensus:

Copper and Aluminium Conductors: Chosen by 65% globally for high conductivity and durability.

Variance:

Price Sensitivity Shared Challenges:

84% reported increasing material and semiconductor costs.

Regional Differences:

Pain Points in the Value Chain Manufacturers:

Distributors:

End-Users (Industrial Operators):

Future Investment Priorities Alignment:

Divergence:

Regulatory Impact

Conclusion: Variance vs. Consensus

Key Variances:

Strategic Insight:

Companies should adopt a region-specific approach, tailoring offerings with smart solutions in the USA, energy-efficient models in Europe, and cost-effective, compact designs in Asia to maximize industry penetration.

| Countries | Government Regulations & Mandatory Certifications |

|---|---|

| USA | Compliance with UL (Underwriters Laboratories) and NEMA standards. OSHA mandates for workplace electrical safety. |

| UK | Must adhere to BS EN standards. Regulated by the Health and Safety Executive (HSE), CE certification is mandatory. |

| France | Requires NF C standards for electrical installations. CE certification is mandatory for all electrical devices. |

| Germany | Follows VDE (Verband der Elektrotechnik) regulations. Compliance with DIN standards and CE certification is essential. |

| Italy | Regulated under CEI standards. CE certification is mandatory for manufacturing and imports. |

| South Korea | Governed by KATS (Korea Agency for Technology and Standards). Mandatory KC (Korea Certification) for electrical safety. |

| Japan | Regulated by JET (Japan Electrical Safety & Environment Technology Laboratories). Compliance with PSE (Product Safety Electrical) certification. |

| China | It requires a CCC (China Compulsory Certificate) for electrical equipment. Additional compliance with GB (Guobiao) standards. |

| Australia-NZ | Follows AS/NZS electrical standards. RCM (Regulatory Compliance Mark) certification is required for industry entry. |

| India | Governed by BIS (Bureau of Indian Standards). ISI certification is mandatory for electrical safety and product compliance. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate growth is driven by increased industrial automation and investments in infrastructure. | Stronger growth is expected due to accelerated industrial digitization and the adoption of smart grids. |

| Supply chain disruptions due to COVID-19 impacted raw material availability and production. | Supply chains are expected to stabilize, but geopolitical factors may create occasional disruptions. |

| There is a growing demand for bypass switches in renewable energy projects. | Further expansion in renewable energy applications, especially solar and wind power integration. |

| Focus on operational reliability and equipment protection. | Emphasis on predictive maintenance using AI and IoT-integrated bypass switches. |

| Adoption of basic bypass switch models, particularly in emerging industries. | The greater shift towards smart bypass switches with remote monitoring and control capabilities. |

| Limited government incentives for advanced electrical infrastructure in some regions. | Increased government support for grid modernization and energy efficiency initiatives. |

| Preference for traditional switchgear in industries with low automation. | Higher adoption of automated switchgear and intelligent bypass solutions. |

The USA bypass switch market is expected to grow at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035. The growing need for continuous power supply solutions across industries like telecoms, data centers, and industrial applications is propelling the USA bypass switch market's strong expansion.

Bypass switches are becoming essential for improving system dependability and decreasing downtime during maintenance or breakdowns, as the USA makes more investments in updating its energy infrastructure. The growing data center sector, which necessitates effective power management systems, is also helping the market. Furthermore, strict laws pertaining to safety and energy efficiency are promoting the use of sophisticated bypass switches, which is propelling the US market's growth.

It is expected that the UK industry will grow at a CAGR of 4.5%. Growing demand for smart grid technologies, increasing adoption of renewable energy sources, and strict government regulations on energy efficiency are key growth contributors.

Bypass switch gears have become increasingly critical to ensuring stable power transmission, particularly with initiatives aimed at decarbonising and having a net-zero carbon footprint by 2050.

In addition, the growth of offshore wind farms along with energy storage projects will propel the demand. Industry growth is likely to be aided by the adoption of energy management solutions and government-funded research on smart grid technologies. Growth is also supported by the increasing penetration of electric vehicles and the extended EV charging infrastructure.

France's industry growth will grow at 4.4% CAGR, between 2025 to 2035. Increasing demand is being fueled by the country’s growing reliance on nuclear energy and the expansion of renewable energy such as wind and solar. Also, government incentives by governments supporting grid modernization and backup power systems drive the growth of the industry.

Furthermore, innovations in digital substations and smart switchgear solutions are driving improvements in grid reliability and operational efficiency. The incorporation of AI-driven predictive maintenance systems and remote monitoring technologies in switchgear is poised to minimize downtime and reduce operational expenditures, thereby also driving the demand for bypass switch gears.

Sales of bypass switches in Germany are likely to increase at a CAGR of 4.6%. The new challenges posed by the decentralized energy landscape, along with the country’s ambitious renewable energy targets under the Energiewende, are expected to spur the deployment of bypass switch gears further.

In addition, investments in industrial automation and grid resilience continue to prop up growth. Growing investments in hydrogen energy projects and the expansion of electric vehicle infrastructure are also contributing significantly to the demand for efficient switch gear systems.

Moreover, smart switch gear technologies like digital monitoring and advanced fault detection systems would further improve the operational reliability, decrease downtime, sense alarms, etc.

Italy's bypass switch gear market growth is expected to be in the range of 4.3%. Better power distribution is important to driving growth, alongside investment in solar and wind energy across the energy mix of countries.

Continued government initiatives supportive of energy efficiency and grid reliability will aid the industry. The emphasis on integrating renewable energy into conventional power grids and support for distributed energy resources in the country is promoting the adoption of bypass switch gears in Italy.

Moreover, the adoption of advanced protection systems, along with resilient power transmission networks, is playing a part in pushing further the growth of industry.

The South Korea market is estimated to grow at a CAGR of 4.7% in the forecasted period. The growth is fueled by investments in renewable energy projects, especially offshore wind farms. The government is focused on carbon neutrality by 2050 and supporting electric vehicle infrastructure, which will create additional demand for bypass switch gears. The growth of smart city initiatives and battery-based energy storage systems is also contributing to the growth of the industry.

Moreover, the growing adoption of grid modernization technology, such as digital substations, artificial intelligence-based fault detection systems, and predictive maintenance technologies in South Korea, is also contributing to the market demand for bypass switch gears.

Japan’s industry is forecasted to grow at a CAGR of 4.8%. The country’s focus on grid resilience, disaster preparedness, and renewable energy integration is driving demand. Post-Fukushima energy diversification efforts and the modernization of aging infrastructure also contribute significantly to industry growth. The adoption of advanced switch gear systems with integrated sensors and real-time monitoring capabilities is enhancing grid reliability.

Furthermore, government initiatives supporting smart energy management systems and renewable energy integration are expected to propel the industry. Japan’s investment in hydrogen infrastructure and microgrids is also positively impacting demand.

China’s bypass switch gear industry is projected to expand at a CAGR of 4.9%. Rapid urbanization, industrial growth, and large-scale renewable energy projects are major growth factors. Additionally, government investments in modernizing the national grid and enhancing power distribution infrastructure further drive industry expansion.

The deployment of smart grid technologies and energy storage solutions supports grid stability, increasing the demand for bypass switch gears. China’s ambitious clean energy targets and growing investments in offshore wind, solar power, and hydropower projects are significant growth drivers. Furthermore, the adoption of digital switch gear systems with remote monitoring capabilities is improving operational efficiency.

Australia is expected to grow at a CAGR of 4.4%. The industry is supported by increasing investments in renewable energy, particularly solar and wind power projects. Grid resilience initiatives and the need for stable power transmission in remote areas contribute to the demand for bypass switch gears.

Additionally, the development of battery storage projects and microgrids to ensure a reliable power supply in off-grid areas further supports industry growth. Technological advancements in switch gear systems, such as real-time monitoring and predictive maintenance, are also expected to enhance industry expansion in Australia.

New Zealand’s industry is forecasted to grow at a CAGR of 4.2%. The country’s emphasis on renewable energy generation, particularly hydropower and wind energy, drives the need for efficient power management systems.

Government support for sustainable energy infrastructure further boosts industry growth. The increasing adoption of smart grid technologies and the integration of digital switch gear systems are enhancing grid reliability.

Additionally, New Zealand’s focus on achieving net-zero emissions and its commitment to a clean energy transition are fostering demand for advanced bypass switch gears. The growing deployment of microgrids and distributed energy

In 2024, the switchgear industry witnessed substantial developments, with leading companies implementing strategic initiatives to strengthen their positions. ABB, a prominent player, introduced the 500 mm panel version of its UniGear ZS1, a medium-voltage air-insulated switchgear. This product launch reflects ABB's dedication to advancing its offerings in line with evolving industry needs.

Siemens made notable progress by upgrading its 8DAB 24 and NXPLUS C 24 switchgear models to serve high-tier industrial applications. Emphasizing sustainability, these products offer reduced carbon emissions throughout their lifecycle. Siemens' stock price saw a significant surge, further demonstrating the company's industry strength.

Schneider Electric introduced the next generation of its SureSeT MV switchgear, specifically tailored for the Canadian industry. This digital-ready product features the EvoPacT circuit breaker, showcasing Schneider's commitment to integrating advanced technologies for improved performance and reliability. The company’s focus on product innovation reinforces its leadership in the switchgear segment.

In the realm of mergers and acquisitions, Siemens acquired Trayer Engineering Corp., a California-based specialist in medium-voltage switchgear. This move is expected to strengthen Siemens' Electrification and Automation Business Unit by incorporating Trayer’s weather-resistant and submersible switchgear technology. The acquisition aligns with the growing industry trend of undergrounding electrical networks to ensure reliable power distribution.

Overall, 2024 has been a transformative year for the switchgear industry, marked by technological advancements, strategic acquisitions, and a clear focus on sustainability. Leading players continue to leverage innovation to meet the increasing demand for efficient and resilient power management solutions.

The switchgear industry belongs to the electrical equipment and power distribution sector, playing a crucial role in energy infrastructure. Its growth is closely tied to macroeconomic factors like industrialization, urbanization, and investments in renewable energy. As countries transition towards cleaner energy sources, the demand for modern, efficient switchgear solutions rises.

Government policies promoting energy efficiency and grid modernization also stimulate industry growth. Emerging economies in Asia-Pacific, particularly India and China, are driving demand with large-scale infrastructure projects. Inflation, raw material costs, and supply chain disruptions can pose challenges, impacting production and pricing.

Additionally, advancements in smart grid technologies and digital switchgear are shaping the industry, providing enhanced monitoring and automation capabilities. Mergers, acquisitions, and technological innovation remain key strategies for major players. Overall, with increasing electricity consumption and the global push for sustainable energy, the switchgear industry is set for steady growth in the coming years.

The switchgear industry offers growth opportunities in renewable energy integration, with rising demand for solutions in solar, wind, and hydro projects. Stakeholders can collaborate with energy developers and governments to expand their industry presence.

Digitalization is a key driver, with utilities adopting smart grids. Investing in digital switchgear with real-time monitoring and predictive maintenance features, and forming partnerships with software providers, can enhance competitiveness.

Sustainability remains crucial, with SF6-free and eco-friendly switchgear gaining traction. Companies can strengthen their industry position by aligning with environmental regulations and collaborating with renewable energy organizations.

Additionally, expanding aftermarket services through predictive maintenance and lifecycle management contracts can ensure recurring revenue and build long-term customer relationships, providing a competitive edge in the evolving industry.

It is segmented into Manual switches, Motorized switches, Automatic Switches

It is divided into Static Bypass Switch, External Maintenance bypass switch

It is divided into Electrical Power Distribution, Uninterrupted Power Supplies, Electrical Maintenance, Industrial Automation, Others

Low Voltage Bypass Switch, Medium Voltage Bypass Switch, High Voltage Bypass Switch

It is divided into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, The Middle East & Africa

Increasing electricity demand, renewable energy projects, smart grid adoption, and infrastructure growth.

ABB Ltd., Siemens AG, Schneider Electric SE, Eaton Corporation, Mitsubishi Electric, GE, Hitachi Ltd., Toshiba, Legrand, Rockwell Automation, and Omron.

It enables smart monitoring, predictive maintenance, and improved operational efficiency.

Companies are focusing on SF6-free, eco-friendly switchgear and energy-efficient solutions.

Asia-Pacific and the Middle East, especially in India, China, and the UAE.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 7: Global Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 9: Global Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 10: Global Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 13: North America Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 15: North America Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 17: North America Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 18: North America Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 19: North America Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 20: North America Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 23: Latin America Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 24: Latin America Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 25: Latin America Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 26: Latin America Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 27: Latin America Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 28: Latin America Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 29: Latin America Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 30: Latin America Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 34: Western Europe Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 36: Western Europe Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 38: Western Europe Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 40: Western Europe Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 52: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 53: East Asia Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 54: East Asia Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 55: East Asia Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 56: East Asia Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 57: East Asia Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 58: East Asia Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 59: East Asia Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 60: East Asia Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 62: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 63: South Asia Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 64: South Asia Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 65: South Asia Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 66: South Asia Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 67: South Asia Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 68: South Asia Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 69: South Asia Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 70: South Asia Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 72: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 73: MEA Market Value (US$ Million) Forecast by By Modes Of Operation, 2018 & 2033

Table 74: MEA Market Volume (Units) Forecast by By Modes Of Operation, 2018 & 2033

Table 75: MEA Market Value (US$ Million) Forecast by By Purpose, 2018 & 2033

Table 76: MEA Market Volume (Units) Forecast by By Purpose, 2018 & 2033

Table 77: MEA Market Value (US$ Million) Forecast by By Industry Application, 2018 & 2033

Table 78: MEA Market Volume (Units) Forecast by By Industry Application, 2018 & 2033

Table 79: MEA Market Value (US$ Million) Forecast by By Voltage Level, 2018 & 2033

Table 80: MEA Market Volume (Units) Forecast by By Voltage Level, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 4: Global Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023-2033

Figure 10: Global Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 11: Global Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 14: Global Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 15: Global Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 18: Global Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 19: Global Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 22: Global Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 23: Global Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 26: Global Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 27: Global Market Attractiveness by By Purpose, 2023-2033

Figure 28: Global Market Attractiveness by By Industry Application, 2023-2033

Figure 29: Global Market Attractiveness by By Voltage Level, 2023-2033

Figure 30: Global Market Attractiveness by Region, 2023-2033

Figure 31: North America Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 32: North America Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 33: North America Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 34: North America Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 40: North America Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 41: North America Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 44: North America Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 45: North America Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 48: North America Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 49: North America Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 52: North America Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 53: North America Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 56: North America Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 57: North America Market Attractiveness by By Purpose, 2023-2033

Figure 58: North America Market Attractiveness by By Industry Application, 2023-2033

Figure 59: North America Market Attractiveness by By Voltage Level, 2023-2033

Figure 60: North America Market Attractiveness by Country, 2023-2033

Figure 61: Latin America Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 62: Latin America Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 63: Latin America Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 64: Latin America Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 70: Latin America Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 71: Latin America Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 74: Latin America Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 75: Latin America Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 78: Latin America Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 79: Latin America Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 82: Latin America Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 83: Latin America Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 86: Latin America Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 87: Latin America Market Attractiveness by By Purpose, 2023-2033

Figure 88: Latin America Market Attractiveness by By Industry Application, 2023-2033

Figure 89: Latin America Market Attractiveness by By Voltage Level, 2023-2033

Figure 90: Latin America Market Attractiveness by Country, 2023-2033

Figure 91: Western Europe Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 92: Western Europe Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 93: Western Europe Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 94: Western Europe Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 101: Western Europe Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 105: Western Europe Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 109: Western Europe Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 113: Western Europe Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 116: Western Europe Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 117: Western Europe Market Attractiveness by By Purpose, 2023-2033

Figure 118: Western Europe Market Attractiveness by By Industry Application, 2023-2033

Figure 119: Western Europe Market Attractiveness by By Voltage Level, 2023-2033

Figure 120: Western Europe Market Attractiveness by Country, 2023-2033

Figure 121: Eastern Europe Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 122: Eastern Europe Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 123: Eastern Europe Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 124: Eastern Europe Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 146: Eastern Europe Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 147: Eastern Europe Market Attractiveness by By Purpose, 2023-2033

Figure 148: Eastern Europe Market Attractiveness by By Industry Application, 2023-2033

Figure 149: Eastern Europe Market Attractiveness by By Voltage Level, 2023-2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023-2033

Figure 151: East Asia Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 152: East Asia Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 153: East Asia Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 154: East Asia Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 157: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 160: East Asia Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 161: East Asia Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 162: East Asia Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 163: East Asia Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 164: East Asia Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 165: East Asia Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 168: East Asia Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 169: East Asia Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 172: East Asia Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 173: East Asia Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 174: East Asia Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 175: East Asia Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 176: East Asia Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 177: East Asia Market Attractiveness by By Purpose, 2023-2033

Figure 178: East Asia Market Attractiveness by By Industry Application, 2023-2033

Figure 179: East Asia Market Attractiveness by By Voltage Level, 2023-2033

Figure 180: East Asia Market Attractiveness by Country, 2023-2033

Figure 181: South Asia Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 182: South Asia Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 183: South Asia Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 184: South Asia Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 185: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 186: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 187: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 188: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 189: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 190: South Asia Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 191: South Asia Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 192: South Asia Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 193: South Asia Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 194: South Asia Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 195: South Asia Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 196: South Asia Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 197: South Asia Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 198: South Asia Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 199: South Asia Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 200: South Asia Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 201: South Asia Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 202: South Asia Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 203: South Asia Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 204: South Asia Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 205: South Asia Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 206: South Asia Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 207: South Asia Market Attractiveness by By Purpose, 2023-2033

Figure 208: South Asia Market Attractiveness by By Industry Application, 2023-2033

Figure 209: South Asia Market Attractiveness by By Voltage Level, 2023-2033

Figure 210: South Asia Market Attractiveness by Country, 2023-2033

Figure 211: MEA Market Value (US$ Million) by By Modes Of Operation, 2023 & 2033

Figure 212: MEA Market Value (US$ Million) by By Purpose, 2023 & 2033

Figure 213: MEA Market Value (US$ Million) by By Industry Application, 2023 & 2033

Figure 214: MEA Market Value (US$ Million) by By Voltage Level, 2023 & 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 217: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023-2033

Figure 220: MEA Market Value (US$ Million) Analysis by By Modes Of Operation, 2018 & 2033

Figure 221: MEA Market Volume (Units) Analysis by By Modes Of Operation, 2018 & 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by By Modes Of Operation, 2023 & 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by By Modes Of Operation, 2023-2033

Figure 224: MEA Market Value (US$ Million) Analysis by By Purpose, 2018 & 2033

Figure 225: MEA Market Volume (Units) Analysis by By Purpose, 2018 & 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by By Purpose, 2023 & 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by By Purpose, 2023-2033

Figure 228: MEA Market Value (US$ Million) Analysis by By Industry Application, 2018 & 2033

Figure 229: MEA Market Volume (Units) Analysis by By Industry Application, 2018 & 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by By Industry Application, 2023 & 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by By Industry Application, 2023-2033

Figure 232: MEA Market Value (US$ Million) Analysis by By Voltage Level, 2018 & 2033

Figure 233: MEA Market Volume (Units) Analysis by By Voltage Level, 2018 & 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by By Voltage Level, 2023 & 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by By Voltage Level, 2023-2033

Figure 236: MEA Market Attractiveness by By Modes Of Operation, 2023-2033

Figure 237: MEA Market Attractiveness by By Purpose, 2023-2033

Figure 238: MEA Market Attractiveness by By Industry Application, 2023-2033

Figure 239: MEA Market Attractiveness by By Voltage Level, 2023-2033

Figure 240: MEA Market Attractiveness by Country, 2023-2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coronary Artery Bypass Grafts Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Bypass System Market – Trends & Forecast 2025 to 2035

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Switchrack Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Switching Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Switched Reluctance Motors Market Growth - Trends & Forecast 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

AC Switchgear Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

Keyboard, Video (monitor), Mouse (KVM) Switch Market Size, Growth, and Forecast for 2025 to 2035

Time Switch Market Analysis Size and Share Forecast Outlook 2025 to 2035

Level Switches Market Growth - Trends & Forecast 2025 to 2035

Rocker Switch Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Vacuum Switches Market

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA