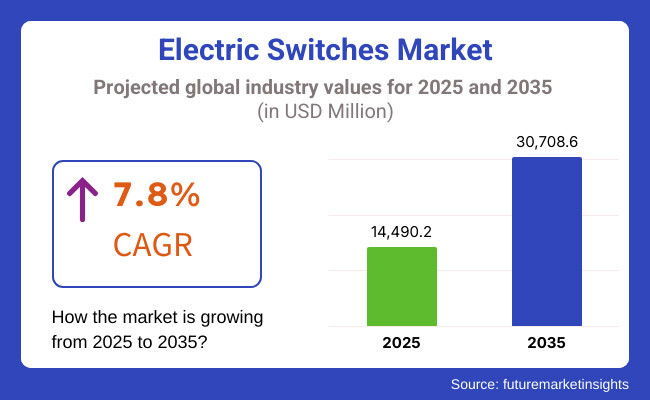

The electric switches market is expected to see steady growth from 2025 to 2035, underpinned by growing demand of smart home automation, prospective urbanization and innovations in energy-efficient electrical components. The market is expected to hold a value of USD 14,490.2 million in the year 2025 and is projected to attain a value of USD 30,708.6 million by the year 2035, by the estimation reflecting a CAGR of 7.8% throughout forecast period.

Electric switches perform an important part throughout residential, business and industrial purposes, allowing for the secure and productive administration of Electrical circuits. The increasing focus of manufacturers on smart lighting, energy management systems, and IoT-enabled switches is supporting market growth. The latest touchless and voice-controlled switch technologies could also promote convenience and safety across modern electrical infrastructure.

Factors such as high cost of smart switch installation, compatibility issues with existing wiring systems, and regulatory compliance are projected to hinder the market growth. Manufacturers are working towards cost-effective production steps including Modular Switch designs and deeper integration with smart home ecosystems to tackle these challenges. The electric switches market is examined further on the basis of switch type, application, end-user industry.

North America is projected to be an important electric switch market, with the United States & Canada spearheading the electric switches market growth because of the growing infrastructure development, demand for smart homes and rapidly developing IoT-enabled solutions in this region. Increasing installation of voice-controlled and motion sensor switches has stimulated the growth of the market in residential and commercial locations.

Smart and low-power consumption switches are being adopted as stringent energy efficiency regulations and sustainability initiatives are also driving their uptake. High replacement costs, compatibility concerns, and other challenges are expected to be present in the market, but innovation in wireless switches, remote-controlled switches is expected to support market growth.

Europe is a major market for electric switches, representing the third largest in the world after Germany, the UK and France. Demand is supported by the region’s emphasis on energy-efficient structures, stringent electrical safety codes, and rising uptake of smart lighting systems. Moreover, the energy efficiency directives of the European Union encourage manufacturers to produce low-power-consuming and recyclable switch materials.

Also, existence of leading electrical component manufacturers in Europe is supporting the technological advancement. The high cost of initial smart installations and the retrofitting of older buildings could be a barrier to market adoption. Nonetheless, continuous R&D expenditure on touch-sensitive and AI-based switch technologies will lead the long-term growth.

Asia-Pacific is projected to be the most lucrative region with the highest CAGR in the electric switches market, due to rapid increase in urbanization, expansion in industries and presence of high number of new residential buildings in China, Japan, India, and South Korea.

Demand for smart home solutions, such as smart switches and automated lighting systems, is being driven by the growing middle-class population and rising disposable incomes. Moreover, market growth is driven by governmental measures encouraging energy-efficient infrastructure and smart cities.

Nonetheless, hurdles, including the prevalence of counterfeit electrical components and inconsistent regulatory frameworks, may vary the penetration rate of the market. Nonetheless, growing investments in the local switch manufacturing sector, along with the growth of online distribution channels, are projected to drive the regional market during the forecast period.

Challenge

High Costs of Smart Switch Integration and Compatibility Issues

High costs involved in the installation of smart switches, especially in retrofitting old electric wiring systems, is acting as a major restraint for the electric switches market. This could create compatibility issues with existing wiring setups and potentially discourage widespread adoption due to the need for additional devices such as hubs or controllers.

Furthermore, interoperability issues arise due to the absence of standardized communication protocols between diverse smart home ecosystems. Solutions for these challenges will need to include better plug-and-play systems, cheaper models for smart switches, and more efforts for industry standardization.

Opportunity

Expansion of IoT-Enabled and Energy-Efficient Switch Solutions

The rising adoption of IoT in home automation and commercial building management is expected to create significant growth opportunities in the electric switches market. AI-powered smart switches are increasingly becoming a trend among technology-oriented consumers and enterprises, with integrated real-time energy consumption analytics and wireless connectivity.

New switch materials that consume less energy and can be moulded into low-power relays and recyclable thermoplastics are also emerging as a solution for smart energy management, aligning with the green movement globally. Next generation electric guides are instant demounted home appliance transferred power display with noiseless switches, adjustable electric cooker, as well as all preference examples.

Electric switches market posted steady growth between 2020 and 2024 backed by rapid urbanization, increase in construction activities coupled with adoption of smart home technologies. The consumers are increasingly demanding energy-efficient and touchless switches which are the impetus behind the substitution of the existing model of switches with a more modern, existing, and appealing solution for all residential, commercial, and industrial applications.

The switch is the least expensive, the most common type of electrical component. Capacitive touch switches, Wi-Fi-enabled smart switches, and modular switch designs became the game-changer for convenience and energy management. However, hurdles including volatile raw material pricing, complex wiring needs for addition of smart switches, and compatibility concerns with legacy electrical systems created barriers to adoption.

The future of the smart switch market (2025 to 2035) will be characterized by AI-integrated switches, self-powered wireless switches, molecular switches and ultra-responsive switching technology. AI gesture switches, self-learning adaptive lighting, and block chain energy monitoring will promote automation and efficiency.

Innovation will be further encouraged by developments in pictogram-measure graphene-based ultra-light switches, self-healing conductive materials and energy harvesting mechanisms. Integration of sustainable switch designs also with biodegradable materials within it further making modular plug-and-play switch availability change the overall perception in terms of user experience, functionality and environmental sustainability.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with IEC, UL, and RoHS safety and energy efficiency standards. |

| Technology & Innovation | Use of traditional mechanical switches, capacitive touch controls, and basic smart Wi-Fi-enabled switches. |

| Industry Adoption | Growth in residential, commercial, and industrial applications with increasing smart home integration. |

| Smart & AI-Enabled Switches | Early adoption of Wi-Fi and Bluetooth-enabled smart switches with app-based control. |

| Market Competition | Dominated by traditional electrical component manufacturers, smart home tech companies, and industrial automation firms. |

| Market Growth Drivers | Demand fuelled by expanding construction activities, rising smart home adoption, and growing energy efficiency awareness. |

| Sustainability and Environmental Impact | Early adoption of energy-efficient switch mechanisms, recyclable components, and RoHS-compliant materials. |

| Integration of AI & Digitalization | Limited AI use in remote switch control and scheduled automation. |

| Advancements in Manufacturing | Use of traditional plastic and metal switch components with standardized designs. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven energy efficiency mandates, cybersecurity protocols for smart switches, and biodegradable switch material regulations. |

| Technology & Innovation | Adoption of AI-powered gesture recognition, graphene-based ultra-responsive touch panels, and quantum tunnelling-based micro-switches. |

| Industry Adoption | Expansion into AI-personalized automation, industrial IoT (IIoT)-integrated switching, and self-learning adaptive control systems. |

| Smart & AI-Enabled Switches | Large-scale deployment of self-learning AI-driven switches, blockchain-backed energy usage tracking, and cloud-integrated remote automation. |

| Market Competition | Increased competition from AI-driven smart switch startups, energy-harvesting technology providers, and decentralized IoT-based switch manufacturers. |

| Market Growth Drivers | Growth driven by AI-driven automation, predictive power consumption analytics, and smart grid-integrated switch technologies. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable switch materials, zero-energy-consuming wireless switches, and AI-optimized energy usage reduction. |

| Integration of AI & Digitalization | AI-powered real-time energy consumption analytics, voice-activated adaptive switching, and self-healing smart switch circuits. |

| Advancements in Manufacturing | Evolution of 3D-printed modular switches, nanotechnology-enhanced circuit contacts, and flexible hybrid electronic (FHE)-based adaptive switching. |

The USA is still the main market for electric switches, with the demand for smart home automation, growing construction work, and industrial automation a source of growth. There is a shift in the industry due to the burgeoning technology of IoT-enabled switches, touch-sensitive controls, and voice-activated solutions for various electrical equipment.

Moreover, the transition to energy-efficient lighting and power management solution is also boosting the demand discussed advanced switching technologies. Market growth is further accelerated by government initiatives promoting sustainable building practices and the implementation of smart grid infrastructure.

Also, the presence of leading electrical component manufacturers and growing investments in residential and commercial renovation projects is anticipated to increase the sales volume.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.1% |

Demand for smart home solutions, increasing urbanization, and rising adoption of energy-efficient electrical systems are the primary growth factors for the UK electric switches market. Rising demand for smart switches coupled with automation capabilities, owing to the government attention on sustainability, and the introduction of strict energy efficiency guidelines design will accelerate demand.

Moreover, the growth of real estate and renovation activities in residential and commercial structures is promoting the market growth. One trend that is further entailing is the growing change of modular and customizable switches with aesthetic value.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.5% |

The EU electric switches market is being led by Germany, France, and Italy due to favourable regulatory frameworks, growing demand for smart building technologies, and escalating spending on energy-efficient infrastructure. The demand for advanced switching systems in residential, commercial and industrial applications is projected to grow as a result of the stringent energy efficiency standards and green building initiatives set by the European Union.

Moreover, increasing adoption of digital and wireless switches are altering the dynamics of the market. Growth is also driven by the increasing automation of manufacturing plants and the growing number of high-tech commercial infrastructural projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.7% |

Growing demand for high-tech home automation solutions, rapid urban development, and government efforts to promote energy savings in buildings is driving the growth of the entire market for electric switches in Japan. This is due to the intense emphasis on innovation and smart city infrastructure in the country propelling the adoption of sensor-based switch solutions integrated with AI.

Moreover, the development of the consumer electronic sector and emergence of touchless and remote-control switch technology will shape market dynamics. These factors, coupled with the emergence of energy-conscious consumers and investments in the modernization of electrical infrastructure, are driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

Technological advancements in South Korea's growing market are encouraging smart home automation and driving electric switches' demand and growth on the market. The nation's semiconductor and electronics manufacturing leadership are spurring advancements in next-generation switch technology, including AI-powered and IoT-connected products.

Furthermore, an increasing trend of premium designed switches in luxury residential as well as commercial projects is augmenting market trends. Moreover, the government’s emphasis on filling the gap between smart grid deployment and energy conservation initiatives is also driving the demand for intelligent switching systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

Industries, houses and commercial infrastructures are increasingly penetrating into Technical improvements in the electrical control techniques resulting in Push Button Switches and Toggle Switches segments being the dominating contributors in Electric Switches Market.

Types of switches are responsible for enabling the efficient cleaning and cutting of electrical conductors, thereby delivering energy via electrical transmission lines in an energy-efficient manner. In order for technology like smart home, industrial automation and electrical infrastructure modernization to accelerate all over the globe, the need for new electric switch solutions also increases.

Because of their user-friendliness, ergonomic features and capability to be used in both housing and industrial applications, push button switches are hugely successful. Push button switches are momentary or latching in nature and can be commonly used in automated systems, emergency controls, or high precision machinery unlike traditional switches.

Due to the growing need for reliable and efficient electrical controls, automation, manufacturing, and consumer electronics has driven market adoption. Research reveals that more than 65% industrial equipment utilize push button switches for superior control and safety measures.

The demand for smart push button switches with features such as touch-sensitive activation, LED indicators, and IoT connectivity has integrated into modern home automation and industrial monitoring systems where IoT-facilitated smart technologies are becoming popular.

The incorporation of waterproof and dustproof push button switches with IP rated enclosures, corrosion-resistant raw materials, and anti-slip actuation surfaces has also improved adoption as these components provide reliable and consistent performance even in tough working conditions including marine applications, construction sites, and heavy machinery.

As the market thrives, capacitive touch push button switches with ultra-sensitivity contactless operation, gesture recognition and programmable switch logic, have been developed to assure user experience and futuristic design compatibility.

Presences of explosion-proof push button switches custom flame resistant casings that prevent combustion, arc suppression mechanisms and redundancy ensure safety layers all considerably strengthen market growth, while preventing risks in sensitive sectors like oil refineries and chemical plants.

Although allowing ease of use, durability and flexibility features, the push button switch segment is still up against challenges, such as mechanical wear at the end of time, resulting in a higher production cost for smart-enabled designs along with sensitivity limitations in extreme conditions.

Nonetheless, with new developments such as AI-based switch diagnostic systems, self-cleaning contact surfaces and adaptive resistance-based actuation, the longevity, efficiency and reliability of these devices are improving, driving continued global market growth of push button switches.

Due to its mechanical reliability, high switching capacity, and widely used in either commercial, industrial, or consumer applications, toggle switches continue to hold a larger share in the Electric Switches Market. Toggle switches are unlike push button switches, as they offer user a mechanically engaging control method, and provide a clear visual indication of the on/off state.

The increasing need for heavy-duty electrical control solutions, especially in the automotive, aerospace, and telecommunications industries, has driven adoption. The data over this matter shows that over 60 from an industrial control panels contain Toggle Switches due to its durability and can easily be operated.

The miniaturization of high-amperage toggle switches has driven their market growth, reinforced internal contacts, protection from surges, and improved durability offer more reliability in the electricity distribution and crucial electrical circuits.

Adoption has been further supported with the incorporation of lighted toggle switches, which provide functionality, performance, energy efficiency, and increased visibility and usability under low-light conditions with LED or neon indicators and multiple colour options.

Noise reducing toggle switches, equipped with silent actuation components, vibration dampening parts, and advanced damping materials have optimized the market growth, contributing towards improved user experience in high noise environments such as medical facilities and precision laboratories.

The market growth has been underpinned by the introduction of toggle switches with waterproof & anti-corrosion features, sealed enclosure, stainless steel compositions and dustproof structure to deliver better productivity in outdoor and marine field.

Although robust, high power capable, and intuitive to operate, the toggle switch segment suffers from mechanical wear with extended usage, size limitations for smaller footprint applications, and restricted capabilities in compound automated systems.

By leveraging new AI-centric switch diagnostics advances, self-healing contact materials, and modular toggle configurations, the longevity, performance, and adaptability of toggle switches is improving ensuring ongoing global expansion of toggle switches.

The Electric Switches Market in North America and East Asia captures a large chunk due to increasing penetration for infrastructure modernization, technological advancements and smart city initiatives that drive the demand for intelligent electrical controls. They are also the major regions in electric switch technologies that shape the market trend, affect global supply chains and drive innovation.

Due to their rapid expansion in smart home technology, industrial automation, and high consumer demand for energy-efficient electrical solutions, North America has garnered strong market adoption. Across North America, advanced regulations, digital uptake, and per capita electrical component spending create a mature environment compared to developing or emerging markets.

Adoption has been driven by the growing need for smart switches, especially in home automation, commercial buildings, and energy management systems. According to the studies, over seventy percent of newly built residential and commercial properties across North America are equipping smart switches to improve energy efficiency and automation.

Industrial IoT-enabled electric switches offer remote monitoring, predictive maintenance alerts, and cloud-integrated diagnostics, bolstering market demand and enhancing connectivity and operational efficiency in industrial applications.

These features, combined with the ease of energy savings achieved through the use of voice-controlled and AI-driven electrical switches with support for virtual assistants, automatic control of lighting and other equipment and programmable automation sequences, have made this technology even more popular and accessible.

While North America is benefitting from rise of smart infrastructure adoption, higher consumer purchasing power and enhanced regulatory compliance in the region, the presence of high installation costs, potential cybersecurity threats attributed to IoT-enabled switches and supply-chain disruptions hindering availability of raw material have been challenging market growth in North America.

To overcome these disadvantages, block chain-based smart switch networks, quantum encryption for cybersecurity protection, and solid-state switching technology are emerging that improve the reliability, security, and adoption of these products in North America for continued market expansion.

The East Asia region is also projected to maintain a healthy market growth led by rapid industrialization, infrastructure development, and consumer electronics manufacturing activities backed with electric switch demand. East Asia stands out as it enjoys the advantages of a well-established supply chain network, cost effective manufacturing capacity and a skilled labour force specializing in the production of electrical parts.

The demand for miniaturized and high-performance electric switches, especially for automotive, robotics, and smart appliances, has further accelerated adoption. Over 65% of global electric switch production are provided from East Asia, which will secure strong supply and cost competitiveness for the market.

Growth of Smart materials in manufacture of switches such as Nano-coatings for corrosion resistance, high-temperature resistant polymers and ultra-lightweight alloys have strengthened demand for the market ensuring better product life and efficiency.

However, the East Asian sector also currently suffers from the challenges of variable raw material prices, environmental regulations on plastic waste, and significantly, increasing labour costs in critical manufacturing centers, despite historical advantages in manufacturing efficiency, technical competence and huge consumer markets.

But emerging innovations in AI-powered production line automation, sustainable material development, and 5G-enabled smart switch integration are further boosting production efficiency, sustainability, and global competitiveness to ensure further growth for East Asia’s electric switch market.

The global market for electric switches is driven by the increasing demand for smart home automation, advancements in energy-efficient switching technologies, and the growing adoption of industrial control systems. The market is poised for steady growth with the increasing number of IoT-enabled devices coupled with safety standards. Core trends driving the industry include touchless switch solutions, AI-integrated switching solutions, and modular switch designs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric | 12-16% |

| Legrand Group | 10-14% |

| Siemens AG | 8-12% |

| Panasonic Corporation | 6-10% |

| ABB Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric | Develops smart switches with energy monitoring and IoT-based control capabilities. |

| Legrand Group | Specializes in modular and high-efficiency switches for residential and commercial applications. |

| Siemens AG | Offers industrial-grade switches with advanced safety and automation integration. |

| Panasonic Corporation | Focuses on energy-saving switch solutions with touchless and smart-home connectivity. |

| ABB Ltd. | Provides AI-powered switch technology and industrial control solutions for power management. |

Key Company Insights

Schneider Electric (12-16%) Schneider Electric leads in energy-efficient and smart switching solutions, integrating IoT-based control systems.

Legrand Group (10-14%) Legrand specializes in modular and high-performance electric switches, catering to residential, commercial, and industrial markets.

Siemens AG (8-12%) Siemens focuses on advanced industrial switchgear solutions with automation and digital monitoring capabilities.

Panasonic Corporation (6-10%) Panasonic pioneers in energy-saving switch technologies, including touchless and home automation-compatible switches.

ABB Ltd. (4-8%) ABB integrates AI and IoT-enabled smart switch technology, ensuring efficient power management and industrial control solutions.

Other Key Players (45-55% Combined) Several electrical equipment manufacturers contribute to the expanding Electric Switches Market. These include:

The overall market size for the electric switches market was USD 14,490.2 million in 2025.

The electric switches market is expected to reach USD 30,708.6 million in 2035.

The demand for electric switches will be driven by increasing urbanization and infrastructure development, growing adoption of smart home automation, rising demand for energy-efficient electrical components, and advancements in touchless and IoT-enabled switch technologies.

The top 5 countries driving the development of the electric switches market are the USA, China, Germany, India, and Japan.

The push button switches segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 6: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 9: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 12: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 13: Western Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Western Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 16: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 20: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 24: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 28: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 32: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 3: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 4: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Attractiveness by Type, 2023 to 2033

Figure 12: Global Market Attractiveness by Region, 2023 to 2033

Figure 13: North America Market Value (US$ million) by Type, 2023 to 2033

Figure 14: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 15: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 16: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 17: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 18: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 19: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 20: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 21: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 22: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 23: North America Market Attractiveness by Type, 2023 to 2033

Figure 24: North America Market Attractiveness by Country, 2023 to 2033

Figure 25: Latin America Market Value (US$ million) by Type, 2023 to 2033

Figure 26: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 27: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 28: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 29: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 30: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 32: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 33: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 34: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 35: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 36: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 37: Western Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 38: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 39: Western Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 40: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 41: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 42: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 43: Western Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 44: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 45: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 46: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 47: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 48: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 49: Eastern Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 50: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 51: Eastern Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 52: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 53: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 54: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 55: Eastern Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 56: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 57: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 58: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 59: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 60: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia and Pacific Market Value (US$ million) by Type, 2023 to 2033

Figure 62: South Asia and Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 63: South Asia and Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 64: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 65: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia and Pacific Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 68: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 69: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 72: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 76: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 78: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 80: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 81: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 82: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 83: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 84: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 85: Middle East and Africa Market Value (US$ million) by Type, 2023 to 2033

Figure 86: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 87: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 88: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 89: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 90: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 91: Middle East and Africa Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 92: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 93: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 94: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 95: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 96: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA