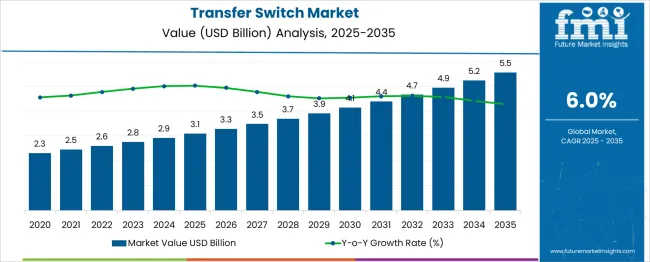

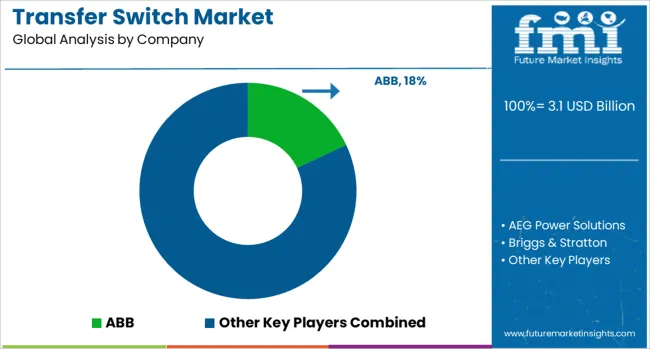

The Transfer Switch Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. This growth reflects rising global demand for reliable power transfer systems in the face of increasing power outages, infrastructure upgrades, and backup power requirements. From 2025 to 2026, the market is expected to increase from USD 3.1 billion to 3.3 billion, indicating a YoY growth of approximately 6.4%. Continued demand from commercial buildings, hospitals, data centers, and industrial facilities supports stable growth through 2030, by which time the market is projected to reach USD 3.9 billion. Annual growth during this period ranges between 6.0% and 6.5%. Between 2030 and 2035, advancements in smart grid integration and rising generator installations contribute to further acceleration, pushing the market to USD 5.5 billion. During this phase, YoY growth remains consistent, supported by government initiatives on grid modernization and energy reliability. This year-on-year expansion highlights the increasing need for uninterrupted power supply across critical sectors, making transfer switches a vital component in global energy management and resilience planning.

| Metric | Value |

|---|---|

| Transfer Switch Market Estimated Value in (2025 E) | USD 3.1 billion |

| Transfer Switch Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The transfer switch market follows a steady S-curve growth pattern, characteristic of a maturing but steadily evolving industrial segment. From 2025 to 2030, the market exhibits the initial accelerated phase, driven by increasing adoption of backup power solutions across residential, commercial, and industrial applications. During this phase, strong infrastructure investments, growing power reliability concerns, and the rising frequency of grid outages globally contribute to consistent year-on-year growth in the 6.0% to 6.5% range. By 2030, as the market reaches around USD 3.9 billion, the curve begins to show signs of moderation, transitioning into the mid-growth phase. Growth continues, but at a slightly more stable pace as major adoption takes hold in key sectors such as healthcare, data centers, and manufacturing. The influence of smart energy systems, IoT-enabled transfer switches, and automation supports long-term relevance without triggering exponential surges. Between 2030 and 2035, the market climbs toward saturation in developed regions but still finds momentum in emerging markets and through product innovation, ending at USD 5.5 billion. The S-curve's trajectory suggests a mature, scalable market where further growth will depend on technological advancement, grid modernization, and energy reliability mandates, rather than untapped basic demand.

The transfer switch market is advancing steadily, driven by the global need for uninterrupted power supply across critical infrastructure and commercial environments. Increased dependence on distributed energy systems, frequent grid instability, and a growing shift toward hybrid power generation have heightened the need for efficient switching solutions.

Regulatory initiatives aimed at modernizing energy grids and disaster-resilient infrastructure are further accelerating investments in automated transfer systems. Urbanization, industrial expansion, and a rising number of data centers and healthcare facilities have reinforced the demand for seamless and efficient power transition.

Innovations in switchgear technology, remote monitoring capabilities, and load management systems are enhancing reliability and safety, setting the stage for further adoption across sectors, prioritizing zero downtime and operational continuity

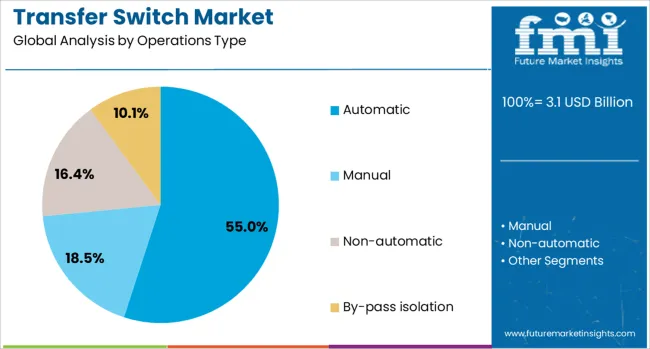

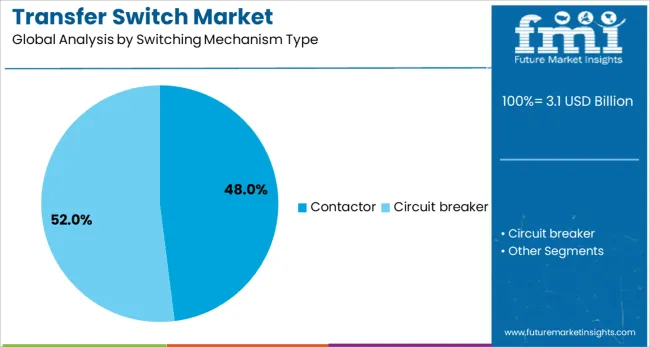

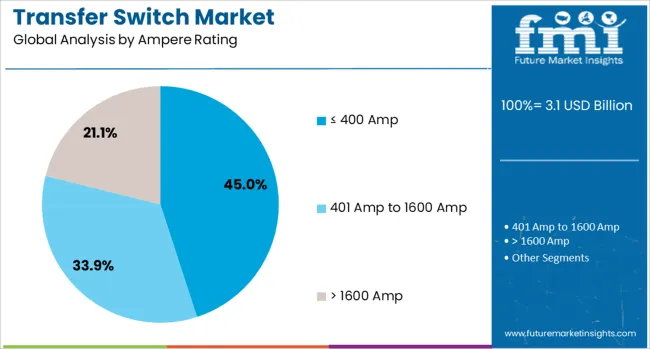

The transfer switch market is segmented by operation type, switching mechanism type, ampere rating, and installation type and geographic regions. By operations type of the transfer switch market is divided into Automatic, Manual, Non-automatic, and By-pass isolation. In terms of switching mechanism type, the transfer switch market is classified into Contactor and Circuit breaker. Based on the ampere rating, the transfer switch market is segmented into ≤ 400 Amp, 401 Amp to 1600 Amp, and > 1600 Amp. The transfer switch market is segmented by installation type into Emergency systems, legally required systems, Critical operations power systems, and Optional standby systems. Regionally, the transfer switch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Automatic transfer switches are projected to account for 55.0% of the total market share by 2025, establishing them as the dominant operations type. This leadership has been attributed to the increasing preference for seamless, hands-free power source transition during outages, especially in critical environments such as hospitals, data centers, and industrial plants.

These switches minimize downtime and human intervention while ensuring high operational safety. Rising integration with backup generators, energy storage systems, and smart grid infrastructure has further supported their deployment.

The automation also enables compliance with safety codes and reduces the risk of operational failure, making it the preferred solution for end-users requiring uninterrupted electricity delivery

Contactor-based switching mechanisms are expected to hold 48.0% of the overall market share in 2025, marking them as the leading switching mechanism type. This segment’s strength stems from their high-speed switching capabilities, arc suppression advantages, and extended mechanical lifespan.

They are increasingly favored in environments requiring frequent load transfers or voltage fluctuations management. Their compact design and simplified maintenance also offer advantages over traditional break-before-make systems.

The growing use of contactor mechanisms in modular panels, smart homes, and medium-scale industries—where cost, reliability, and space efficiency are critical—has reinforced their demand. Continued advancements in coil and insulation technology are further enhancing contactor durability and switching performance

The ≤ 400 Amp segment is anticipated to represent 45.0% of total revenue in the transfer switch market by 2025, positioning it as the leading ampere rating category. This share is largely attributed to widespread application in residential, light commercial, and small industrial setups.

These units are more cost-effective and compact, making them ideal for single-phase and low-load environments. Their adaptability to backup generator systems and compatibility with renewable energy installations has further expanded their use.

Additionally, rising power needs in smaller buildings, telecom towers, and community-level installations have driven adoption. The ≤ 400 Amp switches are also benefiting from improved safety certifications and ease of integration with pre-existing load configurations, which enhances installation flexibility and compliance with local standards

The transfer switch market is expanding as industries, infrastructure, and residential users increase their focus on power continuity. These devices ensure reliable switching between power sources, particularly in locations where interruptions can lead to operational losses or safety risks. Growth is supported by backup power adoption across healthcare, manufacturing, commercial, and data-driven environments. While performance and compatibility are key drivers, supply consistency, installation expertise, and regulatory compliance also shape buyer decisions. Demand for secure, automated, and compact systems is rising across diverse regions.

Transfer switches must be installed and configured according to load type, building design, and safety requirements. Incorrect setup can result in delayed switching, overload damage, or fire risks. This complexity limits do-it-yourself options and makes availability of trained personnel a major consideration. In many regions, a shortage of certified electricians and maintenance professionals delays system deployment. Companies that offer end-to-end support, including site assessment, wiring integration, and after-sales servicing, are preferred by end users aiming to reduce risk and downtime during transition.

Power outages, grid instability, and backup generator usage have driven up demand for reliable switching solutions. Industrial plants, commercial complexes, hospitals, and critical data facilities often cannot afford momentary power loss. In parallel, home users are installing generators and inverter-based systems requiring compact switches to manage transitions. Automatic models are particularly favored in remote or unstaffed locations. As infrastructure expands in remote areas and building codes become more stringent, transfer switches are becoming standard components for both large and small systems.

Electrical safety regulations across regions require strict adherence to switchgear performance, insulation quality, and system compatibility. Certifications are often mandatory before installation in commercial or institutional buildings. Authorities frequently revise protocols in response to fire incidents or system failures, pushing vendors to meet updated mechanical and testing benchmarks. Delays in compliance approval or incorrect documentation can restrict market entry or result in penalties. Suppliers that stay aligned with regional electrical codes and invest in user training are better positioned to maintain continuity and customer confidence.

Transfer switches rely on precise mechanical components, including contactors, sensors, and relay systems. Shortages in copper, control modules, and manufacturing parts have created delays and reduced availability in some markets. Global supply chain interruptions, transportation delays, and dependency on overseas suppliers have further affected timelines. Buyers increasingly value vendors who maintain buffer inventories, diversify sourcing, or have localized manufacturing. Price variability of key components also impacts procurement budgets and bid strategies. Manufacturers focused on stable delivery timelines and procurement planning maintain stronger relationships with critical buyers.

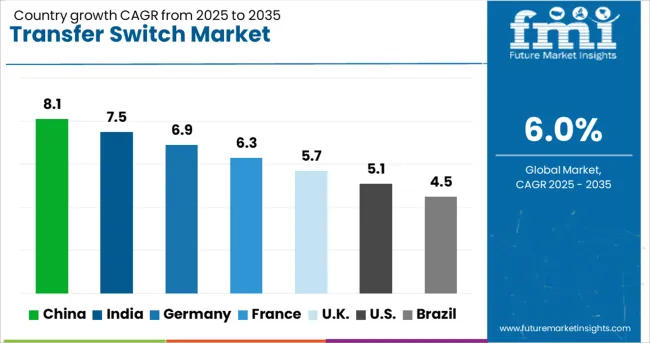

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

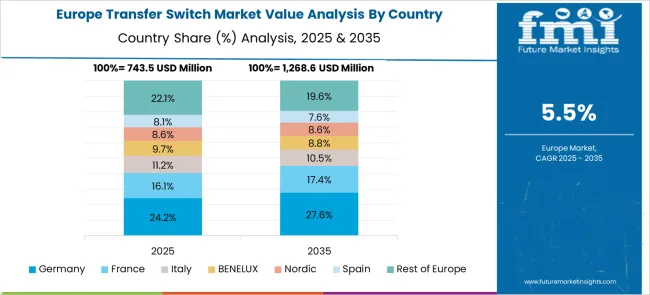

The global transfer switch market is expected to grow at a CAGR of 6.0% through 2035, driven by increasing demand for power reliability, grid resilience, and backup energy systems. Among BRICS nations, China leads with 8.1% growth, supported by rapid infrastructure development and widespread adoption of backup power solutions. India follows at 7.5%, propelled by electrification programs and expansion in commercial and industrial sectors. In the OECD region, Germany reports 6.9% growth, driven by energy-efficient technologies and integration with smart grid systems. France shows solid performance at 6.3%, backed by modernization of power infrastructure and regulatory alignment. The United Kingdom grows at 5.7%, reflecting demand from data centers and healthcare facilities. The United States, a mature market with 5.1% growth, focuses on reliability standards, automation, and emergency preparedness. These countries collectively represent strategic investment zones for next-generation transfer switch technologies. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has led the global transfer switch market with a CAGR of 8.1%, supported by its aggressive push for energy infrastructure upgrades, data center expansions, and industrial automation. The government’s emphasis on resilient power supply in urban and industrial zones has driven installations of automatic and manual transfer switches across commercial buildings, telecom towers, and healthcare facilities. Rapid growth in cloud computing and the construction of hyperscale data centers have raised the demand for high-reliability switchgear systems. Domestic manufacturers are scaling production and localizing designs to support Smart Grid and distributed energy systems. In rural electrification projects, low-voltage transfer switches are used to ensure stable supply from hybrid or backup power sources. The market is also benefiting from the adoption of renewable energy solutions, where transfer switches manage grid-tie and off-grid transitions efficiently.

India's transfer switch market is growing at a CAGR of 7.5%, powered by the country’s electrification goals, rising backup power demand, and the proliferation of commercial infrastructure. The government’s initiatives under "Power for All" and rural electrification have led to widespread use of low- and medium-voltage transfer switches in remote and peri-urban regions. With increasing power outages in urban areas, housing complexes and hospitals are deploying automatic transfer switches to shift between mains and generator supply seamlessly. Growth in telecom, IT, and retail sectors has also supported robust market expansion. Domestic switchgear manufacturers are offering cost-effective solutions suited to India’s variable power quality environment. Additionally, renewable energy installations, especially in industrial parks and smart cities, are incorporating transfer switches to maintain operational continuity during supply variations.

Germany has maintained a steady CAGR of 6.9% in the transfer switch market, driven by energy efficiency policies, data center development, and industrial automation. As part of its energy transition (Energiewende), Germany is enhancing grid resilience, and transfer switches are integral in balancing power supply between renewables and traditional grids. Industrial facilities are increasingly deploying advanced switches to ensure process continuity and prevent downtime due to voltage irregularities. The demand for transfer switches in high-reliability environments—such as airports, logistics hubs, and data centers—continues to grow. German engineering firms are investing in intelligent switchgear technologies with remote monitoring and self-diagnostic capabilities. Compliance with EU directives has also encouraged the use of energy-efficient and compact designs.

The United Kingdom has recorded a CAGR of 5.7% in the transfer switch market, with demand driven by infrastructure resilience, utility modernization, and increasing digital dependence. Automatic transfer switches are widely used in commercial and healthcare facilities to ensure power continuity during outages, particularly as energy reliability becomes a national priority. Infrastructure projects such as railway electrification and tunnel upgrades also use transfer switches to switch between power sources efficiently. Additionally, growth in data centers and telecommunication hubs has increased the demand for intelligent, fast-acting transfer systems. British suppliers are aligning with EU safety and energy standards by producing low-loss, space-efficient units. With the rise of renewable integration and battery storage systems, transfer switches are being deployed to coordinate between grid and auxiliary sources.

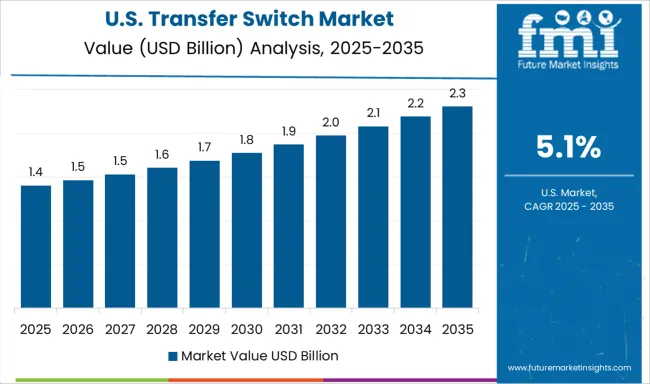

The United States has posted a CAGR of 5.1% in the transfer switch market, fueled by the expansion of backup power systems in commercial, residential, and industrial sectors. Frequent weather-related outages and grid instability in several regions have increased demand for automatic transfer switches in homes, hospitals, and corporate campuses. The oil & gas sector, particularly in Texas and Louisiana, utilizes transfer switches for seamless transitions between grid, generator, and on-site renewable energy sources. Data centers and high-security facilities require redundant power setups, pushing the adoption of dual-input switches and remote-controlled transfer panels. USA manufacturers are focused on NFPA-compliant, smart-enabled switchgear integrated with building management systems. The ongoing trend of microgrids and distributed energy solutions has further propelled the need for efficient source switching.

The transfer switch market supports critical power continuity across residential, commercial, and industrial settings. These switches allow seamless transition between utility power and backup generators, preventing equipment damage or service interruptions. Applications range from data centers and hospitals to manufacturing plants and homes, with demand influenced by backup power installations, grid reliability, and infrastructure expansion. ABB, Eaton, Schneider Electric, Siemens, and General Electric lead the market with a wide selection of automatic and manual transfer switches that are integrated with power management systems. Their offerings often come with UL/IEC certifications, remote monitoring capabilities, and support for low- to medium-voltage operations.

Vertiv Group and AEG Power Solutions target more specialized environments like IT infrastructure and telecoms, where switch reliability under fluctuating loads is crucial. Generac, Cummins, Caterpillar, Kohler, and Briggs & Stratton supply generator-compatible transfer switches tailored for both residential standby and industrial-scale backup systems. These companies leverage their engine and generator expertise to offer matched solutions with fast switchover and protective relay features. Meanwhile, niche and regional players like Midwest Electric Products, One Two Three Electric, and others serve the construction and small business sectors, often emphasizing straightforward installation and compatibility with common breaker panels. As power assurance remains a top priority, vendors offering robust configurations, fault isolation, and ease of integration continue to set the standard.

As mentioned in the official Enphase Energy press release dated June 4, 2025, IQ8P‑3P™ Commercial Microinverters made with domestic content were selected for commercial solar projects in Florida, Rhode Island, and California, totaling nearly 3 MW. These installations qualify for the Inflation Reduction Act’s domestic content bonus tax credit, enhancing project economics and supporting USA manufacturing.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Operations Type | Automatic, Manual, Non-automatic, and By-pass isolation |

| Switching Mechanism Type | Contactor and Circuit breaker |

| Ampere Rating | ≤ 400 Amp, 401 Amp to 1600 Amp, and > 1600 Amp |

| Installation Type | Emergency systems, Legally required systems, Critical operations power systems, and Optional standby systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, AEG Power Solutions, Briggs & Stratton, Caterpillar, Cummins, Eaton, General Electric, Generac Power Systems, Kohler, Midwest Electric Products, One Two Three Electric, Schneider Electric, Siemens, and Vertiv Group |

The global transfer switch market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the transfer switch market is projected to reach USD 5.5 billion by 2035.

The transfer switch market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in transfer switch market are automatic, manual, non-automatic and by-pass isolation.

In terms of switching mechanism type, contactor segment to command 48.0% share in the transfer switch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Contactor-based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Closed Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Circuit Breaker Based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Heat Transfer Film Market Size and Share Forecast Outlook 2025 to 2035

Mass Transfer Trays Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Heat Transfer Film Manufacturers

Heat Transfer Paper Market Analysis - Growth & Demand 2024 to 2034

Human Transferrin Detection Kit Market Size and Share Forecast Outlook 2025 to 2035

Tacky Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Fluid Transfer Solutions Market – Demand & Forecast 2024-2034

Lipid Transfer Proteins Market

Vehicle Transfer Case Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Roll Market Size and Share Forecast Outlook 2025 to 2035

Thermal Transfer Ribbon Market Growth - Demand & Forecast 2025 to 2035

Thermal Transfer Tapes Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA