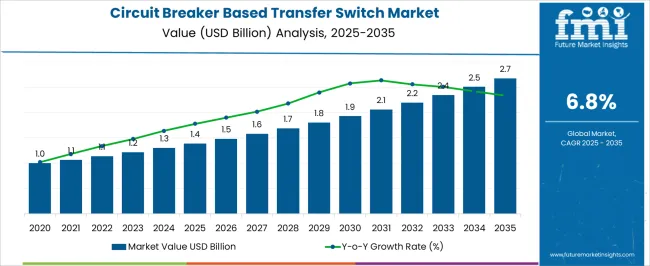

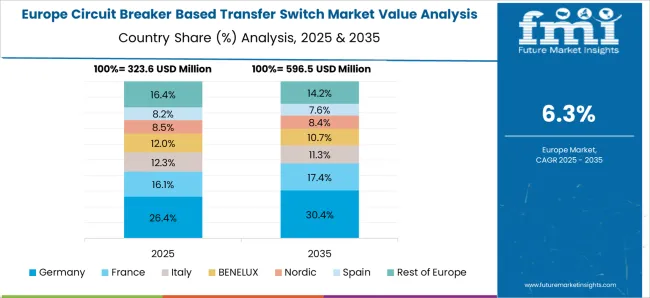

The circuit breaker based transfer switch market, valued at USD 1.4 billion in 2025 and projected to reach USD 2.7 billion by 2035 at a CAGR of 6.8%, demonstrates a notable regional growth imbalance across Asia-Pacific, Europe, and North America. The Asia-Pacific region is expected to lead the market expansion due to accelerating electrification initiatives, rising industrial infrastructure, and increasing adoption of automated power management solutions.

The combination of rapid urban development and industrial modernization drives demand for reliable transfer switching systems, particularly in manufacturing, commercial buildings, and utility-scale installations. Incremental investments in smart grid technologies further reinforce the regional dominance of Asia-Pacific. Europe presents steady growth, supported by stringent electrical safety regulations, modernization of aging grid infrastructure, and increasing integration of renewable energy sources. The emphasis on compliance with IEC standards and advanced monitoring capabilities results in a relatively higher per-unit value contribution, despite slower volumetric growth compared to Asia-Pacific.

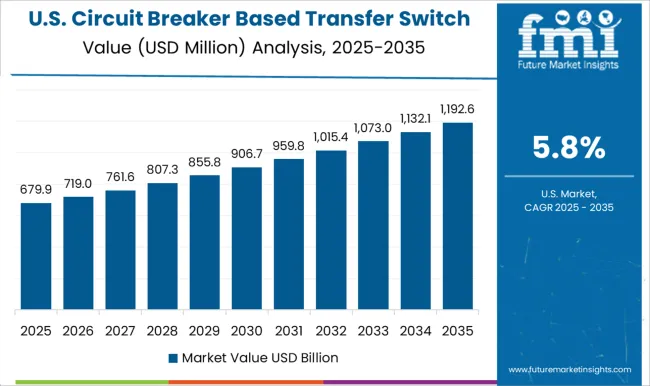

In contrast, North America exhibits moderate growth, primarily driven by the replacement of legacy systems and the deployment of backup power solutions across commercial and residential sectors. Market uptake in North America is influenced by regulatory frameworks from organizations such as the National Electrical Manufacturers Association and regional utility codes, which encourage standardized, high-performance circuit breaker-based transfer switches.

| Metric | Value |

|---|---|

| Circuit Breaker Based Transfer Switch Market Estimated Value in (2025 E) | USD 1.4 billion |

| Circuit Breaker Based Transfer Switch Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The circuit breaker based transfer switch market represents a specialized segment within the global power distribution and electrical protection industry, emphasizing safety, reliability, and automated power transfer. Within the broader transfer switch and switching equipment market, it accounts for about 5.1%, driven by demand from commercial, industrial, and residential power systems. In the electrical distribution and switchgear sector, it holds nearly 4.7%, reflecting adoption for backup power, uninterrupted supply, and load management. Across the standby and emergency power systems segment, the market captures 4.2%, supporting integration with generators and UPS systems. Within the renewable energy integration category, it represents 3.8%, highlighting use in solar, wind, and hybrid energy solutions. In the building and infrastructure electrical management sector, it secures 3.5%, emphasizing operational reliability, regulatory compliance, and energy efficiency. Recent developments in this market have focused on digital control, automation, and enhanced safety features. Innovations include smart transfer switches with real-time monitoring, remote operation, and predictive maintenance capabilities. Key players are collaborating with generator manufacturers, electrical contractors, and facility managers to improve installation efficiency and system integration. Adoption of compact designs, high interrupting capacity breakers, and modular configurations is gaining traction for flexible deployment in diverse applications. The integration with IoT platforms, cloud-based dashboards, and automated alert systems is enhancing operational transparency and response times. These trends demonstrate how automation, digitalization, and reliability are shaping the circuit breaker based transfer switch market.

The current market scenario reflects heightened adoption driven by the need for uninterrupted power supply in mission-critical environments, coupled with advancements in switchgear technology that enhance operational safety and efficiency.

Rising investments in infrastructure modernization, integration of smart monitoring systems, and stricter regulatory requirements for electrical safety are further shaping market momentum. The ability of circuit breaker-based transfer switches to combine switching and protection functions within a single unit is enabling reduced system complexity and maintenance costs.

With growing emphasis on energy reliability, especially in regions with unstable grids or high dependence on backup power systems, the market is positioned for continued growth. Future opportunities are expected from increasing deployment in renewable energy integration, data centers, and high-demand emergency power applications.

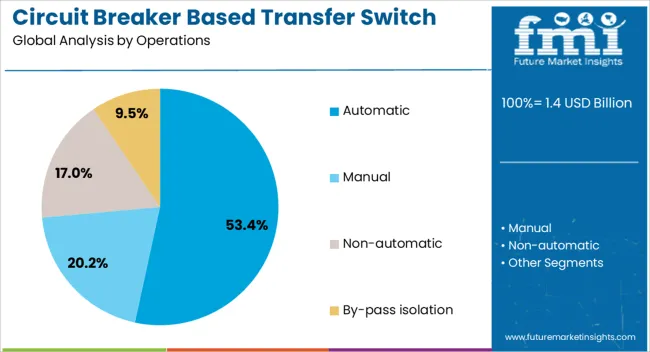

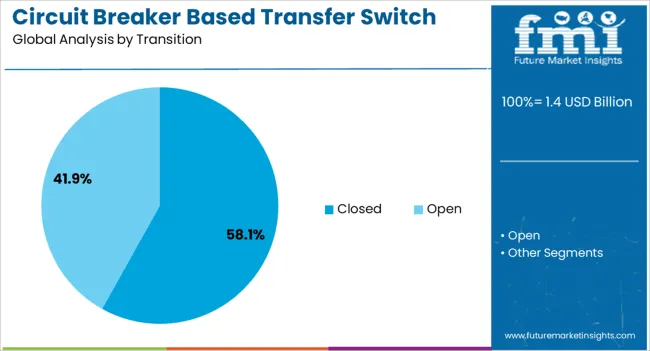

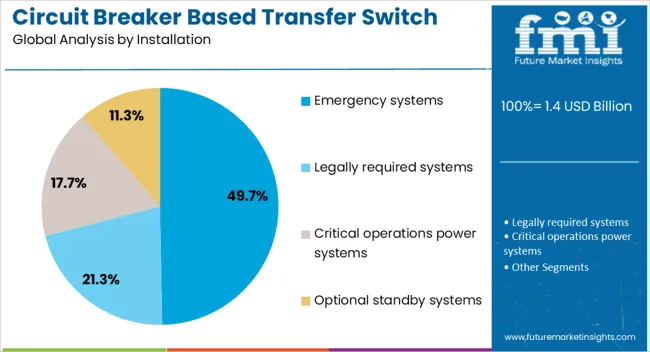

The circuit breaker based transfer switch market is segmented by operations, transition, installation, and geographic regions. By operations, circuit breaker based transfer switch market is divided into automatic, manual, non-automatic, and by-pass isolation. In terms of transition, circuit breaker based transfer switch market is classified into closed and open. Based on installation, circuit breaker based transfer switch market is segmented into emergency systems, legally required systems, critical operations power systems, and optional standby systems. Regionally, the circuit breaker based transfer switch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic operations segment is projected to account for 53.4% of the circuit breaker based transfer switch market revenue in 2025, making it the largest segment by operations type. This dominance is being driven by the ability of automatic systems to provide seamless transfer between power sources without manual intervention, ensuring continuity in critical applications.

The adoption of automatic operation has been reinforced by the need for rapid response in environments such as hospitals, industrial plants, and commercial buildings, where downtime can lead to significant losses. Integration with intelligent control systems allows real-time monitoring, diagnostics, and preventive maintenance, enhancing overall reliability.

The reduced requirement for operator presence and the capability to initiate switching within milliseconds have positioned automatic systems as the preferred choice. Increasing demand for automation in power management is expected to sustain the leadership of this segment in the coming years.

The closed transition segment is anticipated to capture 58.1% of the market revenue in 2025, making it the leading transition type. This leadership is being attributed to the capability of closed transition systems to enable transfer between power sources without any interruption in supply.

Such systems are particularly valued in critical infrastructure, where even momentary power loss can have severe operational impacts. The segment’s growth is further supported by advancements in synchronization technology, which allows for smoother and safer transfers while minimizing electrical disturbances.

Closed transition transfer switches are increasingly being specified for high-performance installations in sectors like healthcare, telecommunications, and manufacturing, where power continuity is essential. The ability to maintain operational stability during source switching is expected to reinforce the preference for closed transition systems in the foreseeable future.

The emergency systems installation segment is expected to hold 49.7% of the market revenue in 2025, emerging as the dominant installation category. This position is being supported by the rising emphasis on ensuring immediate backup power availability in situations such as grid failures, natural disasters, and operational emergencies.

Emergency system installations have gained preference in both public and private facilities where an uninterrupted power supply is a critical safety and operational requirement. The integration of circuit breaker-based transfer switches in emergency setups ensures both power transfer and fault protection in a single mechanism, improving system efficiency.

Growing awareness of disaster preparedness, coupled with regulatory mandates for emergency power systems in essential services, has further driven the adoption of this segment. With the increasing frequency of extreme weather events and power outages, demand for robust emergency installations is expected to remain strong.

The market has witnessed growth due to increasing demand for reliable and uninterrupted power supply across residential, commercial, and industrial sectors. These switches automatically transfer electrical load between primary and backup power sources in case of utility failure, ensuring continuity and safety. Rising adoption of backup generators, renewable energy integration, and critical infrastructure protection has driven market expansion. Manufacturers are focusing on enhancing switching speed, fault tolerance, and remote monitoring capabilities. Emphasis on energy efficiency, compliance with safety standards, and the need for dependable power distribution in hospitals, data centers, and industrial facilities have strengthened the market for advanced circuit breaker based transfer switches globally.

Residential and commercial sectors have been major adopters of circuit breaker based transfer switches to prevent interruptions in essential power supply. Homes with backup generators rely on these switches to maintain continuity during outages, protecting appliances, lighting, and heating systems. Commercial establishments such as office complexes, shopping centers, and hotels implement transfer switches to ensure uninterrupted operations, minimize downtime, and safeguard sensitive equipment. Integration with smart monitoring systems allows real time alerts and remote control of power transfer operations. As urban areas expand and power reliability becomes increasingly important for safety and convenience, the adoption of circuit breaker based transfer switches continues to grow steadily across residential and commercial infrastructure.

Industrial facilities, hospitals, data centers, and other critical infrastructures are significant users of circuit breaker based transfer switches due to their ability to ensure continuous power flow. In manufacturing plants, these switches prevent production halts caused by utility failures, protecting costly machinery and reducing operational losses. Hospitals rely on uninterrupted power to maintain lifesaving equipment and essential services. Data centers require robust power continuity solutions to safeguard sensitive IT infrastructure. The capability of these switches to handle high voltage loads, perform rapid automatic transfers, and integrate with supervisory control systems makes them indispensable for maintaining operational reliability, efficiency, and safety in high priority environments.

Technological developments have enhanced the functionality and efficiency of circuit breaker based transfer switches. Modern devices incorporate digital controls, remote monitoring, and communication interfaces that allow integration with building management and energy management systems. Sensors for load detection, fault monitoring, and predictive maintenance improve performance and reliability. Modular and compact designs facilitate installation in confined spaces, while improved switching mechanisms reduce response time during power interruptions. Advancements in software enable automated load prioritization and scheduling, optimizing energy distribution. These innovations have expanded applicability across sectors, enabling smarter, faster, and more reliable power transfer operations, contributing to the overall growth and competitiveness of the market.

The market is strongly influenced by safety regulations, electrical codes, and international standards. Compliance with IEC, UL, and local electrical standards ensures safe and reliable operation under various conditions. Manufacturers focus on incorporating overload protection, short circuit prevention, and tamper resistant designs to meet regulatory requirements. Routine testing, certification, and adherence to quality standards are essential to gain customer trust and acceptance in critical applications. Growing awareness of workplace safety, electrical hazard prevention, and the need for reliable emergency power solutions have reinforced the demand for compliant, high quality transfer switches. Regulatory alignment ensures the market continues to provide secure and dependable solutions globally.

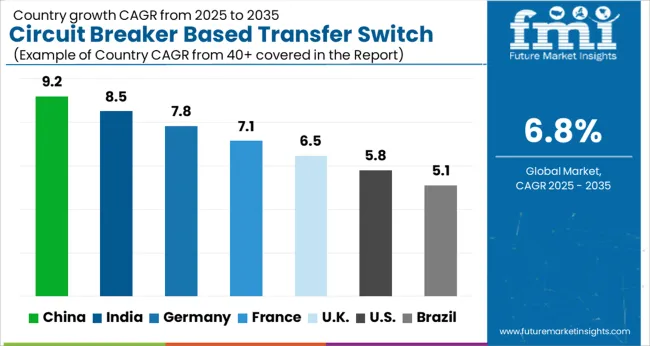

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The market demonstrates consistent growth driven by rising energy infrastructure modernization and reliability demands. India achieves 8.5%, supported by industrial electrification projects and commercial installations. Germany posts 7.8%, where integration into automated power distribution systems fosters steady adoption. China leads with 9.2%, benefiting from large-scale deployment in residential, commercial, and industrial sectors. The United Kingdom records 6.5%, propelled by infrastructure upgrades and energy efficiency initiatives. The United States registers 5.8%, driven by smart grid integration and industrial facility enhancements. Together, these nations represent a diverse combination of deployment, production capabilities, and technological innovation influencing the global landscape of circuit breaker based transfer switches. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 9.2%, supported by growing power infrastructure investments and industrial automation. Adoption has been reinforced by increasing demand for reliable power backup in commercial, industrial, and data center applications. Domestic manufacturers have focused on integrating smart monitoring features and enhancing durability to meet industrial standards. Large scale infrastructure projects and expanding electricity distribution networks have accelerated demand for transfer switches to ensure continuous power supply. Export demand for Chinese systems has also increased due to cost competitiveness and technological advancements. China remains a dominant market for both domestic utilization and international supply of circuit breaker based transfer switches.

India is expected to grow at a CAGR of 8.5% in the market, supported by rising industrial activity and expansion of commercial and infrastructure projects. Adoption has been encouraged by power reliability requirements in urban and semi-urban regions and by renewable energy integration. Domestic companies have collaborated with international technology providers to offer cost effective and durable solutions for industrial and utility applications. Government funded grid modernization projects and increasing data center construction have further accelerated demand. The Indian market is anticipated to continue growth due to increasing awareness of power backup systems and rising investments in electricity distribution networks.

Germany is projected to grow at a CAGR of 7.8% in the market, driven by industrial automation and renewable energy integration. Adoption has been supported by the need for reliable electricity in manufacturing, data centers, and commercial facilities. German manufacturers such as Siemens and ABB provide high quality transfer switches with smart monitoring and fault detection capabilities. Integration of renewable power sources into the grid has further increased the requirement for automated transfer systems. Continuous modernization of electricity distribution and industrial networks ensures sustained market growth across Germany, with both domestic and export oriented demand contributing to industry stability.

The United Kingdom market is expected to grow at a CAGR of 6.5%, influenced by rising demand for reliable power supply in commercial, industrial, and utility sectors. Adoption has been driven by grid modernization, data center expansion, and renewable energy integration. Manufacturers including Schneider Electric and ABB have focused on smart transfer switches with automation, remote monitoring, and fault detection. The market outlook indicates steady growth as replacement cycles and new installations continue in the U K, particularly in sectors where continuous power supply is critical. Demand for durable and technologically advanced solutions is expected to remain a key factor shaping the market.

The market in the United States is projected to expand at a CAGR of 5.8%, supported by aging infrastructure upgrades, industrial expansion, and increasing demand for reliable power in commercial and utility sectors. Adoption has been encouraged by industrial automation, data center growth, and renewable energy integration. U S manufacturers such as Eaton, ABB, and Siemens provide advanced transfer switches with remote monitoring, automation, and fault detection capabilities. Investment in critical infrastructure and replacement of outdated systems ensures steady demand. The U S market is expected to continue growth, particularly in regions prone to power interruptions and where industrial operations require uninterrupted electricity.

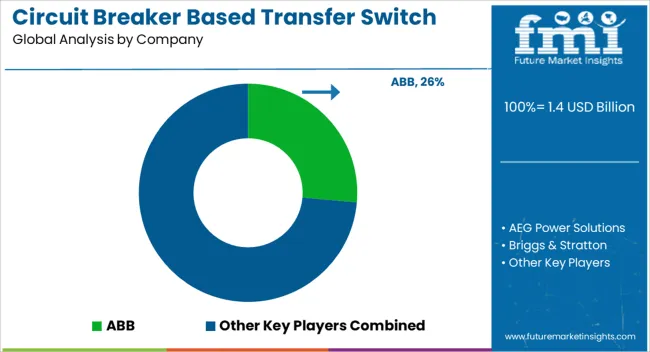

The market is dominated by leading global electrical equipment manufacturers and specialized power solutions providers offering reliable, high-capacity transfer switches for commercial, industrial, and critical power applications. ABB and Schneider Electric leverage extensive portfolios of low- and medium-voltage transfer switches, emphasizing safety, automation, and integration with building management systems. Eaton and Siemens provide robust solutions with modular designs, catering to scalable power distribution needs in industrial and commercial environments. Generac Power Systems, Cummins, Caterpillar, and Kohler focus on integrated solutions, combining generator sets with circuit breaker based transfer switches to ensure uninterrupted power supply for data centers, healthcare, and emergency facilities.

Briggs & Stratton and AEG Power Solutions address smaller-scale and residential applications, emphasizing compact designs and ease of installation. Vertiv Group and Taylor Power Systems enhance competitiveness through advanced monitoring, remote control capabilities, and smart grid compatibility. Market competition is shaped by product reliability, switching speed, voltage range, and compliance with international standards. Integration with energy management systems and renewable energy sources is increasingly driving product development. Strategic alliances with construction, industrial, and energy companies help players expand market reach and strengthen service networks, while R&D investments in intelligent and automated transfer switches remain a critical differentiator in maintaining a competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Operations | Automatic, Manual, Non-automatic, and By-pass isolation |

| Transition | Closed and Open |

| Installation | Emergency systems, Legally required systems, Critical operations power systems, and Optional standby systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, AEG Power Solutions, Briggs & Stratton, Caterpillar, Cummins, DAIER, Eaton, Generac Power Systems, General Electric, Kohler, Midwest Electric Products, One Two Three Electric, Peterson, Schneider Electric, Siemens, Taylor Power Systems, and Vertiv Group |

| Additional Attributes | Dollar sales by switch type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in power backup and transfer system adoption, innovation in safety, automation, and load management, environmental impact of material usage and energy efficiency, and emerging use cases in renewable integration, smart grid connectivity, and emergency power systems. |

The global circuit breaker based transfer switch market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the circuit breaker based transfer switch market is projected to reach USD 2.7 billion by 2035.

The circuit breaker based transfer switch market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in circuit breaker based transfer switch market are automatic, manual, non-automatic and by-pass isolation.

In terms of transition, closed segment to command 58.1% share in the circuit breaker based transfer switch market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Circuit Monitoring Market Analysis – Trends & Forecast 2024-2034

Circuit Protection Kits Market

Circuit Protection Market

Circuit Breaker Test Devices Market Size and Share Forecast Outlook 2025 to 2035

Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

In-circuit Tester Market Size and Share Forecast Outlook 2025 to 2035

Air Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Gas Circuit Breaker Market Growth – Trends & Forecast 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Breathing Circuit Market Report – Growth & Forecast 2024-2034

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Low Voltage Circuit Breakers Market

Ground Fault Circuit Interrupter Market

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Flexible Printed Circuit Boards Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fault Circuit Controller Market Size and Share Forecast Outlook 2025 to 2035

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA