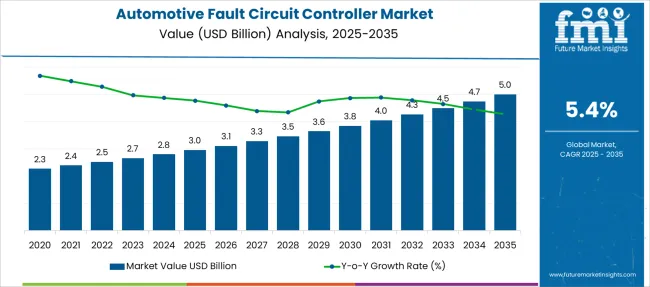

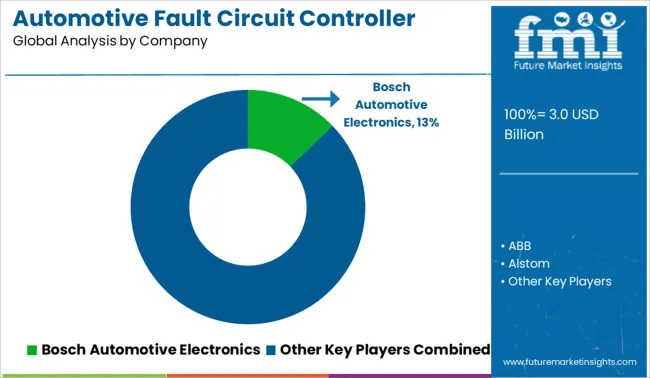

The Automotive Fault Circuit Controller Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Fault Circuit Controller Market Estimated Value in (2025E) | USD 3.0 billion |

| Automotive Fault Circuit Controller Market Forecast Value in (2035F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Automotive Fault Circuit Controller market is experiencing sustained growth, supported by increasing complexity in automotive electrical systems and the growing integration of electronic control units across vehicle platforms. As vehicles transition toward higher levels of automation and electrification, the need for efficient circuit protection and fault detection has become paramount.

Original equipment manufacturers are adopting fault circuit controllers to enhance system safety, reduce failure rates, and ensure uninterrupted vehicle functionality. Regulatory mandates related to vehicle safety and emission controls are further contributing to the widespread incorporation of these components in both internal combustion engine and electric vehicle architectures.

The market is also benefiting from advancements in semiconductor technologies, which have enabled compact, intelligent controllers capable of real-time fault diagnosis and rapid isolation of malfunctioning subsystems. With increasing demand for safer, smarter, and more reliable vehicles, the market is projected to expand steadily, underpinned by long-term trends in connected mobility, safety assurance, and electrification..

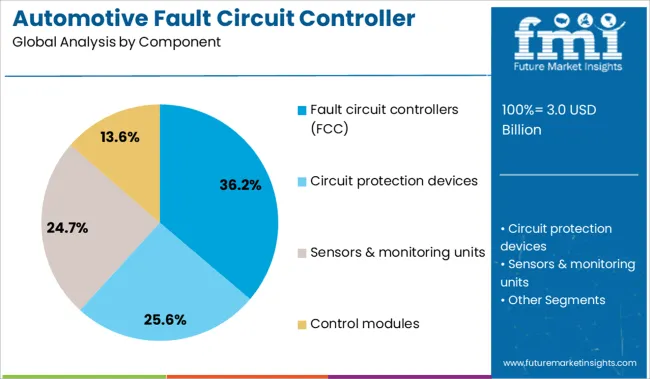

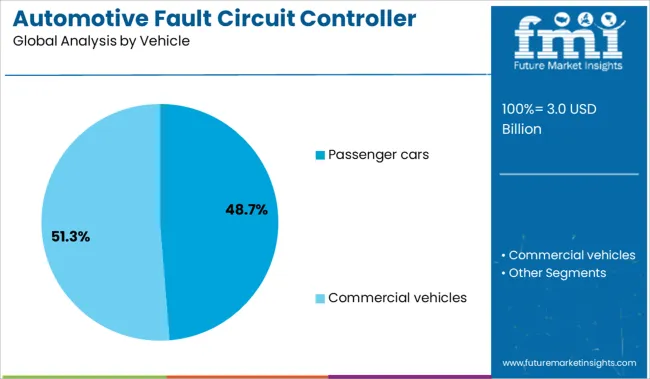

The market is segmented by Component, Vehicle, Application, Technology, and End Use and region. By Component, the market is divided into Fault circuit controllers (FCC), Circuit protection devices, Sensors & monitoring units, and Control modules. In terms of vehicles, the market is classified into Passenger cars, sedans, SUVs, hatchbacks, Commercial vehicles, LCVs (light commercial vehicles), MCVs (medium commercial vehicles), and HCVs (heavy commercial vehicles).

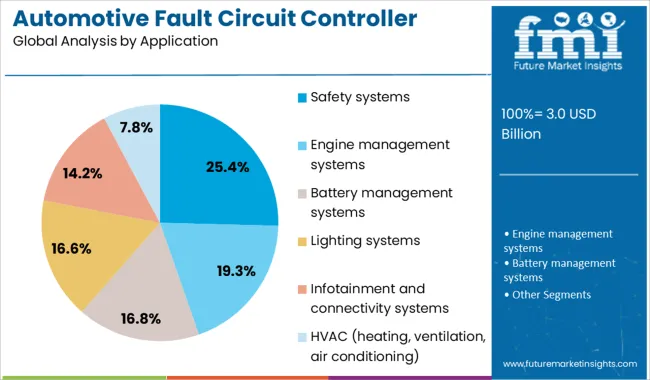

Based on Application, the market is segmented into Safety systems, Engine management systems, Battery management systems, Lighting systems, Infotainment and connectivity systems, and HVAC (heating, ventilation, air conditioning). By Technology, the market is divided into Smart/intelligent fault circuit controllers and Traditional fault circuit controllers.

By End Use, the market is segmented into OEM (original equipment manufacturers) and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fault circuit controllers component segment is projected to hold 36.20% of the Automotive Fault Circuit Controller market revenue share in 2025, establishing it as the leading component category. Growth in this segment has been driven by the increasing adoption of electronically controlled subsystems across modern vehicles, which demand reliable protection mechanisms to mitigate the risks of short circuits, overcurrents, and thermal anomalies.

It has been observed that fault circuit controllers offer a higher level of diagnostic precision and isolation control, making them a preferred choice over traditional fuses and relays. Their ability to enable real-time monitoring and automated response during electrical faults has contributed significantly to their deployment across a wide range of vehicle classes.

Furthermore, the shift toward centralized and software-defined vehicle architectures has accelerated the need for intelligent power distribution, where fault circuit controllers play a central role. As automakers prioritize safety, functional reliability, and system redundancy, the demand for advanced fault control solutions is expected to remain strong, supporting the segment’s continued leadership..

The passenger cars vehicle segment is expected to capture 48.70% of the Automotive Fault Circuit Controller market revenue share in 2025, making it the most dominant vehicle category. This leadership has been attributed to the large global production volume of passenger vehicles and the rising integration of electronic safety and infotainment features.

Passenger cars have increasingly relied on complex wiring systems and electronic control modules, all of which require robust fault detection and protection mechanisms. The surge in demand for electric and hybrid vehicles within this category has further reinforced the necessity of fault circuit controllers to manage high-voltage and low-voltage circuits safely.

Additionally, evolving consumer expectations for connected and autonomous driving experiences have necessitated the use of intelligent circuit controllers to maintain system reliability. As manufacturers aim to improve vehicle safety ratings and reduce warranty costs, the implementation of fault circuit controllers in passenger cars has become a standard design practice, ensuring the segment’s continued dominance in the overall market..

The safety systems application segment is projected to contribute 25.40% of the Automotive Fault Circuit Controller market revenue share in 2025, emerging as the leading application area. The increasing reliance on electronic safety mechanisms such as anti-lock braking systems, electronic stability control, and advanced driver-assistance systems has heightened the importance of reliable fault management.

Fault circuit controllers have been employed to ensure uninterrupted operation of these critical safety functions by detecting anomalies and isolating faults swiftly, thereby preventing system-wide failures. It has been recognized that compliance with stringent vehicle safety regulations and industry standards has compelled manufacturers to adopt fault detection technologies that provide real-time diagnostics and response.

As the safety architecture of modern vehicles continues to evolve, fault circuit controllers have been positioned as integral components for maintaining functional safety across all driving conditions. Their contribution to minimizing risks and ensuring operational integrity has reinforced their significance in safety-focused applications, securing the segment’s leadership position within the market..

Increasing vehicle electronic complexity, stringent safety regulations, and rising EV adoption drive growth. Opportunities lie in advanced diagnostics, integration with autonomous systems, and expansion into emerging automotive markets.

As modern vehicles incorporate more sensors, actuators, and electronic control units, the need for fault circuit controllers intensifies. These controllers monitor electrical systems, detect malfunctions, and isolate circuit issues, improving reliability and safety. Regulatory mandates for onboard diagnostics (OBD), functional safety standards (ISO 26262), and stringent fault detection requirements in markets like Europe and North America further boost market adoption. In electric vehicles and hybrid systems, where voltage and current management are more complex, fault circuit controllers play a critical role in protecting battery systems and power electronics. OEMs increasingly integrate these components into safety architectures, ensuring regulatory compliance and reducing warranty-related failures, paving the way for more robust electrical system oversight.

There are substantial opportunities for growth in integrating fault circuit controllers with advanced driver-assistance systems (ADAS), autonomous vehicle subsystems, and over-the-air diagnostics. As EV production scales, fault controllers tailored for high-voltage battery management and power distribution are in high demand. Moreover, growing automotive industries in Asia-Pacific and Latin America offer untapped potential where increasing vehicle electronic sophistication requires enhanced fault protection. Collaborations between automotive suppliers and tier‑1 system integrators can accelerate product innovation and standardization. Additionally, aftermarket applications in vehicle retrofit, fleet maintenance, and service diagnostics present avenues for broader market penetration. Emphasizing modular, scalable controller designs and expanding aftersales support will help address diverse regional demands and technical skill gaps among service providers.

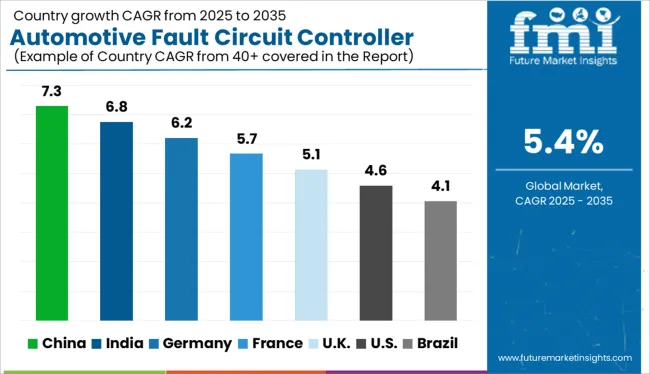

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

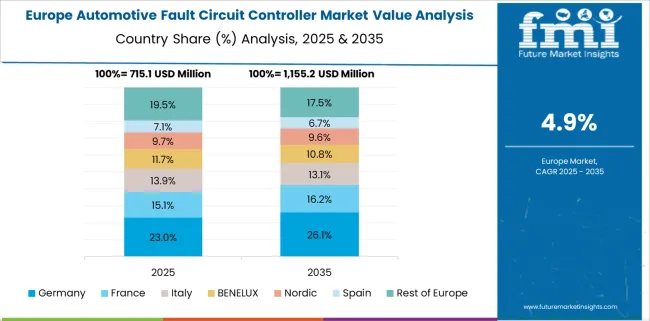

The global automotive fault circuit controller market is projected to grow at a CAGR of 5.4% from 2025 to 2035, driven by rising EV adoption, stringent safety standards, and the increasing complexity of in-vehicle electronics. China leads with a 7.3% CAGR, fueled by rapid electrification, domestic EV production, and local semiconductor development. India follows at 6.8%, supported by automotive electrification policies, component localization, and growth in two- and three-wheeler EV segments. Germany, at 6.2%, reflects strong OEM integration of advanced circuit protection in premium electric platforms. The United Kingdom (5.1%) and the United States (4.6%) show steady demand, aligned with regulatory safety mandates and growing adoption of ADAS and BMS systems.

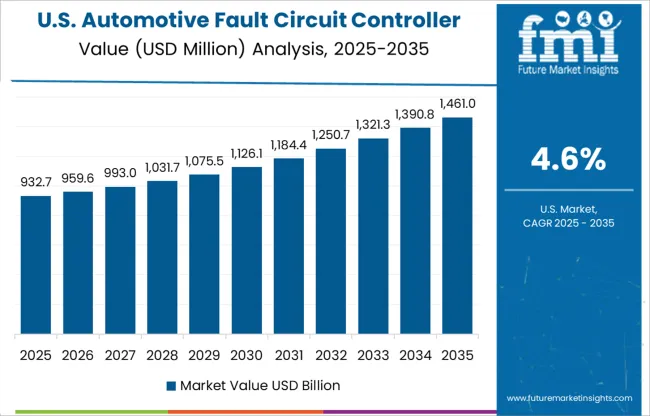

The U.S. automotive fault circuit controller market is projected to grow at a CAGR of 4.6% from 2025 to 2035, with annual growth rates expected to range between 4.2% and 4.9%. This expansion is fueled by the increasing complexity of vehicle electronics, particularly in electric and hybrid models. As automakers prioritize safety, uptime, and diagnostics, fault circuit controllers are becoming vital for preventing voltage surges and managing redundant power channels. Integration with advanced driver-assistance systems (ADAS) and autonomous technologies is further amplifying their relevance. American OEMs are investing in solid-state fault detection modules that offer real-time alerts and predictive diagnostics, especially in long-range EVs and fleet vehicles. These developments aim to enhance safety compliance while minimizing downtime in high-performance vehicle platforms.

From 2025 to 2035, the U.K. automotive fault circuit controller market is set to grow at a CAGR of 5.1%, with year-over-year gains ranging from 4.7% to 5.5%. The shift toward full vehicle electrification, reinforced by government decarbonization targets, is accelerating the need for enhanced safety mechanisms. Fault circuit controllers are increasingly being used in EV power management units to mitigate overheating, short circuits, and current leakage. U.K.-based automotive R&D centers are collaborating with semiconductor companies to develop compact, high-efficiency modules for next-gen electric and hydrogen vehicles. Additionally, government safety mandates are encouraging the use of multi-point fault isolation systems in light commercial and passenger vehicles to meet Euro NCAP standards and post-Brexit regulatory frameworks.

Automotive fault circuit controller market in China is expected to expand at a CAGR of 7.3% from 2025 to 2035, with annual growth rates between 6.8% and 7.7%. As the world’s largest EV producer, China is rapidly integrating fault detection systems across EV architectures to meet national safety protocols and consumer expectations. Domestic OEMs are embedding low-latency fault controllers into battery packs, inverters, and high-voltage buses to minimize electrical hazards. Supported by state policies promoting new energy vehicles (NEVs), local suppliers are launching cost-optimized IC-based controllers for mass-market EVs. Furthermore, Chinese tech startups are introducing AI-driven controllers capable of real-time error logging and fault prediction, aligning with the country’s “Smart Vehicle” development blueprint.

Automotive fault circuit controller market in India is forecast to grow at a CAGR of 6.8% between 2025 and 2035, with yearly growth ranging from 6.3% to 7.2%. With expanding EV adoption under the FAME III policy and state-level EV incentives, fault circuit controllers are being introduced as essential components in battery and motor systems. These units are helping manufacturers address overheating, voltage instability, and fire risks in electric two-wheelers and compact cars. Indian OEMs and Tier-1 suppliers are jointly developing modular, low-cost fault detection units to meet the needs of rural and urban mobility alike. Public transport initiatives and EV fleet deployments are also prioritizing fault protection solutions, particularly for buses and last-mile delivery vehicles in metropolitan areas.

Automotive fault circuit controller market in Germany is expected to grow at a CAGR of 6.2% from 2025 to 2035, with annual growth rates fluctuating between 5.8% and 6.6%. With a strong focus on high-performance vehicles and environmental compliance, German automakers are embedding advanced circuit controllers in EVs, plug-in hybrids, and autonomous test fleets. These controllers are critical for managing heat dissipation and current overloads across highly integrated electronic platforms. Research hubs in Germany are developing AI-assisted fault control systems tailored for high-voltage architectures. The ongoing transition to Software-Defined Vehicles (SDVs) is also driving demand for digital fault controllers capable of interacting with vehicle operating systems and cloud-based diagnostics.

The automotive fault circuit controller market is fragmented, featuring a broad mix of global electronics and automotive component manufacturers competing on innovation, safety standards, and system integration. Tier 1 suppliers like Bosch Automotive Electronics, Denso, and Continental lead through advanced fault detection systems, integration with ADAS, and strong OEM relationships. Tier 2 players such as Infineon Technologies, TE Connectivity, and Mitsubishi Electric focus on semiconductor-driven control technologies and power electronics tailored for electric vehicles and hybrid architectures. Tier 3 companies including Liaoning Rongxin Electric, Superconductor Technologies, and American Superconductor target specialized applications with niche capabilities in fault current limiting and high-voltage protection. Market growth is propelled by rising EV adoption, stricter vehicle safety regulations, and increased complexity in automotive electrical systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Component | Fault circuit controllers (FCC), Circuit protection devices, Sensors & monitoring units, and Control modules |

| Vehicle | Passenger cars, Sedan, SUV, Hatchback, Commercial vehicles, LCVs (light commercial vehicles), MCVs (medium commercial vehicles), and HCVs (heavy commercial vehicles) |

| Application | Safety systems, Engine management systems, Battery management systems, Lighting systems, Infotainment and connectivity systems, and HVAC (heating, ventilation, air conditioning) |

| Technology | Smart/intelligent fault circuit controllers and Traditional fault circuit controllers |

| End Use | OEM (original equipment manufacturers) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Automotive Electronics, ABB, Alstom, American Superconductor, Autoliv, Continental, Denso, Eaton, General Electric (GE), Honeywell International, Infineon Technologies, Liaoning Rongxin Electric Power Electronic Co., Mitsubishi Electric, Nexans, Panasonic, Schneider Electric, Siemens, Superconductor Technologies, TE Connectivity, and Valeo |

| Additional Attributes | Dollar sales by vehicle type and voltage class, integration trends in EVs and advanced driver-assistance systems (ADAS), segmentation by solid-state vs. mechanical controllers, regional demand driven by automotive electrification policies, safety standards impacting design and deployment, OEM vs. aftermarket adoption dynamics, innovations in real-time fault detection and response, and emerging use cases in autonomous and connected vehicles. |

The global automotive fault circuit controller market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the automotive fault circuit controller market is projected to reach USD 5.0 billion by 2035.

The automotive fault circuit controller market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in automotive fault circuit controller market are fault circuit controllers (fcc), circuit protection devices, sensors & monitoring units and control modules.

In terms of vehicle, passenger cars segment to command 48.7% share in the automotive fault circuit controller market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA