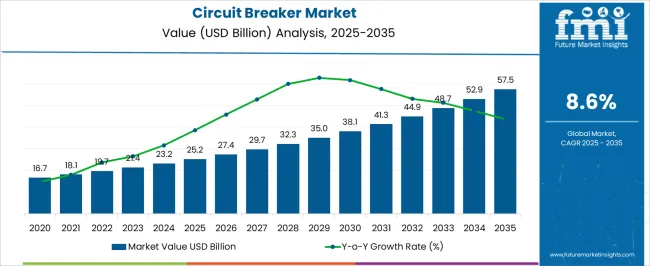

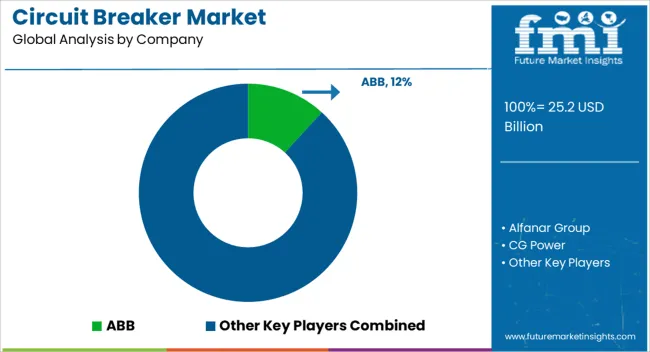

The circuit breaker market is estimated to be valued at USD 25.2 billion in 2025 and is projected to reach USD 57.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

The market demonstrates a steady upward trajectory, supported by increasing electricity demand, infrastructure development, and industrial expansion across emerging and developed economies. Between 2025 and 2030, the market is expected to witness moderate growth driven by investments in renewable energy integration, upgrading aging electrical networks, and rising adoption of low-voltage and medium-voltage breakers in commercial and residential applications. From 2030 to 2035, the growth block intensifies, fueled by large-scale smart grid deployments, industrial automation, and stricter electrical safety regulations.

Utility-scale projects, such as transmission line upgrades and substations, alongside growing industrialization in Asia-Pacific and the Middle East, provide substantial revenue opportunities. Technological differentiation, including air, vacuum, and SF6 circuit breakers, continues to influence adoption patterns. Moreover, urban expansion, electrification of transportation, and retrofitting of existing infrastructure in North America and Europe further propel market expansion, highlighting the interplay of regulatory, industrial, and infrastructure-driven demand throughout the forecast period.

The circuit breaker market is strongly shaped by five interconnected parent markets, each contributing distinctly to overall demand and expansion. The power generation and transmission sector holds the largest share at 35%, driven by the need for reliable protection and distribution of electricity across thermal, hydro, nuclear, and renewable energy power plants. The industrial and manufacturing market contributes 25%, as factories, process plants, and heavy machinery installations require circuit breakers to ensure electrical safety, minimize downtime, and comply with stringent operational standards. The commercial and residential building sector accounts for 20%, with growing urban infrastructure, smart buildings, and automated electrical systems driving demand for low-voltage and miniature circuit breakers.

The renewable energy market holds a 12% share, as solar farms, wind parks, and energy storage installations integrate medium- and high-voltage breakers to protect critical components and maintain grid stability. Finally, the oil and gas sector represents 8%, utilizing circuit breakers to safeguard equipment, pipelines, and offshore and onshore facilities. Collectively, power generation, industrial, and commercial sectors account for 80% of overall demand, emphasizing that large-scale electricity management, safety, and regulatory compliance are the key drivers, while renewable and oil & gas sectors offer complementary growth opportunities for the circuit breaker market globally.

| Metric | Value |

|---|---|

| Circuit Breaker Market Estimated Value in (2025 E) | USD 25.2 billion |

| Circuit Breaker Market Forecast Value in (2035 F) | USD 57.5 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The circuit breaker market is witnessing steady expansion, fueled by rising investments in power infrastructure, grid modernization initiatives, and the growing adoption of renewable energy systems. Industry updates and utility sector reports have underscored the role of circuit breakers in ensuring electrical safety, enhancing system reliability, and meeting increasingly stringent regulatory requirements. Rapid urbanization and industrialization, particularly in emerging economies, have amplified electricity demand, driving the need for advanced protection devices.

Technological innovations, including smart circuit breakers with remote monitoring capabilities, have further strengthened market growth prospects. Additionally, replacement and upgrade programs in mature markets are contributing to sustained demand, as aging infrastructure is replaced with energy-efficient and high-performance units.

Over the coming years, market momentum is expected to be shaped by the integration of intelligent protection systems, expanded electrification projects, and rising deployment in renewable energy installations, with segmental growth led by low-voltage units, 1 to 15 kV rated voltage devices, and 500 to 1,500 A rated current breakers.

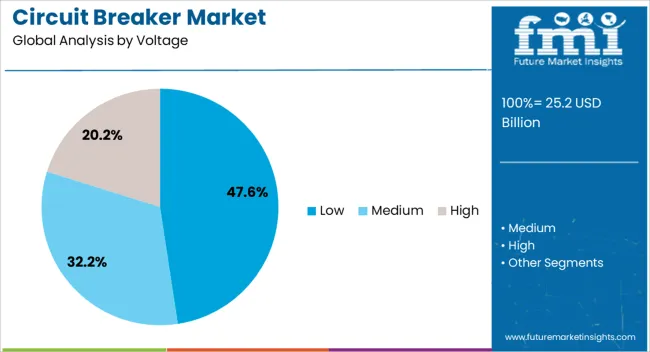

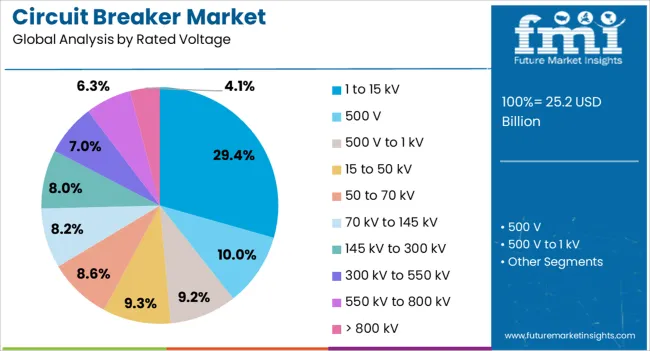

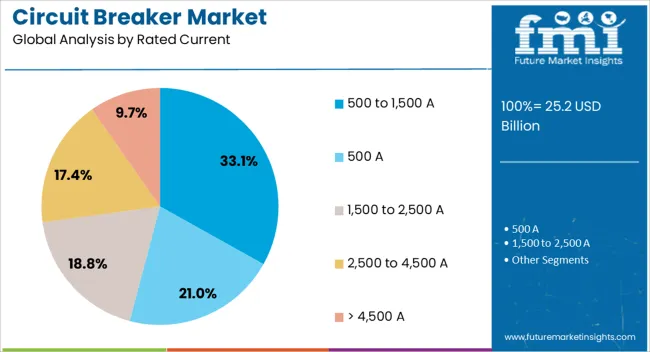

The circuit breaker market is segmented by voltage, rated voltage, rated current, installation, application, end use, and geographic regions. By voltage, circuit breaker market is divided into low, medium, and high. In terms of rated voltage, circuit breaker market is classified into 1 to 15 kV, 500 V, 500 V to 1 kV, 15 to 50 kV, 50 to 70 kV, 70 kV to 145 kV, 145 kV to 300 kV, 300 kV to 550 kV, 550 kV to 800 kV, and > 800 kV. Based on rated current, circuit breaker market is segmented into 500 to 1,500 A, 500 A, 1,500 to 2,500 A, 2,500 to 4,500 A, and > 4,500 A. By installation, circuit breaker market is segmented into outdoor and indoor. By application, circuit breaker market is segmented into power distribution and power transmission. By end use, circuit breaker market is segmented into utility, residential, commercial, and industrial. Regionally, the circuit breaker industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to account for 47.6% of the circuit breaker market revenue in 2025, maintaining its lead due to widespread deployment in residential, commercial, and light industrial applications. Growth in this segment has been driven by the expansion of urban infrastructure, where low voltage distribution systems are standard for power delivery.

Construction sector growth and increasing demand for reliable electrical safety in buildings have amplified the use of low voltage circuit breakers. Additionally, their relatively low cost, ease of installation, and compatibility with a wide range of electrical equipment have strengthened market adoption.

Manufacturers have also introduced compact, energy-efficient designs with enhanced safety features, appealing to modern building requirements. As smart building initiatives and distributed energy systems continue to expand, low voltage circuit breakers are expected to retain a significant share, supported by both new installations and retrofit projects.

The 1 to 15 kV rated voltage segment is anticipated to hold 29.4% of the circuit breaker market revenue in 2025, reflecting its importance in medium-scale power distribution networks. This category serves critical roles in industrial facilities, commercial complexes, and utility substations where medium voltage levels are common.

Growth in this segment has been supported by expanding manufacturing capacity, increasing electrification of transport systems, and renewable integration at the distribution level. These breakers offer the durability, arc-quenching capabilities, and operational safety required in medium voltage environments.

Industry reports have highlighted that infrastructure projects in developing economies, particularly in mining, transport, and urban transit, are driving demand for this rating range. The balance between operational performance, cost, and maintenance efficiency has kept the 1 to 15 kV range a preferred choice for utilities and large facilities, ensuring stable growth in the forecast period.

The 500 to 1,500 A rated current segment is forecasted to capture 33.1% of the circuit breaker market revenue in 2025, leading the current rating spectrum due to its suitability for medium to heavy-duty applications. This range is widely adopted in industrial plants, commercial buildings, and utility feeders where high load capacities need reliable interruption capabilities.

The segment’s growth has been driven by increased industrial automation, higher equipment density in commercial infrastructure, and the need for efficient load management. Manufacturers have enhanced the performance of breakers in this range with features like improved arc-extinguishing chambers and remote operation compatibility.

Additionally, the ability of these breakers to handle significant short-circuit currents while ensuring minimal downtime has reinforced their preference in mission-critical environments. With the continued expansion of industrial production and large-scale commercial infrastructure, the 500 to 1,500 A segment is expected to remain a primary driver of market revenue.

The circuit breaker market is expanding due to rising electricity demand, industrial growth, and renewable energy integration. Commercial, industrial, and power transmission sectors remain the primary growth drivers globally.

The circuit breaker market is witnessing strong growth due to increasing investments in power generation, transmission, and distribution networks worldwide. Rising electricity demand, grid expansions, and replacement of aging infrastructure drive adoption of high- and medium-voltage circuit breakers. Utilities prioritize reliability, rapid fault interruption, and compliance with regional safety standards, ensuring uninterrupted power supply. Smart grids and advanced monitoring systems are integrating circuit breakers with remote operation capabilities to reduce downtime and enhance system stability. Industrial and commercial facilities are deploying breakers to protect electrical equipment and optimize energy management. Government incentives, regulatory mandates, and modernization programs further accelerate installations, making the power transmission sector a key growth driver.

Industrial facilities, including steel, cement, chemical, and automotive plants, are major end-users of circuit breakers. These sectors require reliable protection against overloads, short circuits, and equipment faults to prevent production losses and ensure worker safety. Medium- and low-voltage breakers are critical for distribution boards, machinery, and automation systems. Maintenance programs and predictive monitoring further support lifecycle management, reducing downtime and extending equipment life. Increasing industrialization in emerging economies and investments in process automation amplify demand. Manufacturers focus on delivering breakers that handle high operational loads, tolerate harsh environments, and offer modular designs for flexible installation. Industrial growth, coupled with regulatory compliance, remains a strong catalyst for the market.

The adoption of renewable energy sources such as solar, wind, and energy storage systems is positively impacting the circuit breaker market. These installations require breakers to manage variable loads, protect inverters, and maintain grid stability. Medium- and high-voltage breakers are increasingly deployed to safeguard large-scale solar farms, wind turbines, and battery storage units. Manufacturers are emphasizing corrosion-resistant materials, compact designs, and fast trip mechanisms suitable for outdoor and offshore applications. Integration with monitoring systems and remote operation enhances fault detection and rapid response. Government incentives for clean energy adoption and renewable capacity expansion programs in Asia-Pacific, Europe, and North America are driving circuit breaker demand in the renewable energy sector.

Commercial buildings, smart offices, hospitals, and residential complexes are increasingly relying on advanced circuit breakers to manage complex electrical systems efficiently. Low-voltage breakers protect lighting, HVAC, and smart appliances while ensuring safety compliance. Retrofit programs in older buildings and new construction projects are fueling demand. Features such as adjustable trip settings, remote monitoring, and modularity improve safety, reduce operational disruptions, and simplify maintenance. Developers and facility managers are focusing on reliability, longevity, and energy efficiency when selecting breakers. The rise of automated and connected buildings globally is creating new opportunities for circuit breaker manufacturers, driving product diversification and expansion in the commercial and residential segments.

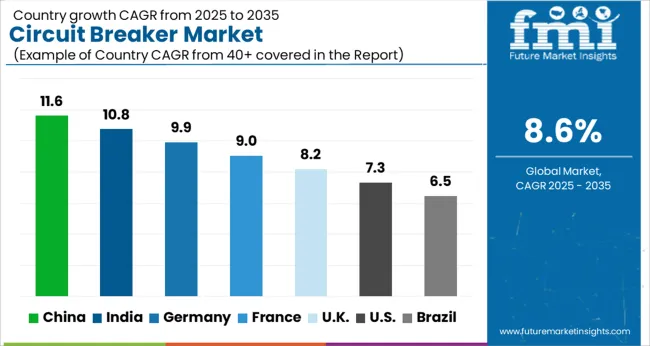

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

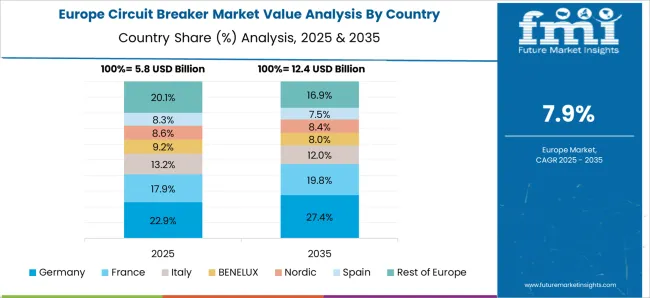

The global circuit breaker market is projected to grow at a CAGR of 8.6% from 2025 to 2035. China leads at 11.6%, followed by India at 10.8%, France at 9.0%, the UK at 8.2%, and the USA at 7.3%. Growth is driven by rising investments in power generation, transmission, and distribution infrastructure, alongside increasing industrial and commercial electricity demand. Asia-Pacific shows rapid expansion due to grid modernization, renewable energy integration, and industrialization, while Europe and North America focus on upgrading aging grids, compliance with safety standards, and smart grid deployment. Advanced breaker technologies, remote monitoring capabilities, and aftermarket services are key enablers for market adoption globally. The analysis includes over 40+ countries, with the leading markets detailed below.

The circuit breaker market in China is projected to grow at a CAGR of 11.6% from 2025 to 2035, driven by rapid expansion in power generation, transmission, and distribution infrastructure. Investments in smart grids, renewable energy integration, and industrial electrification are fueling demand for high-capacity, reliable, and efficient circuit breakers. Domestic manufacturers are scaling production and adopting advanced technologies, including vacuum, SF6, and air-insulated breakers, to meet rising industrial and commercial electricity needs. Government policies promoting grid modernization and safety compliance further accelerate market adoption. Strategic partnerships with international technology providers facilitate knowledge transfer, quality improvement, and development of high-voltage and medium-voltage breakers suitable for diverse applications.

The circuit breaker market in India is expected to grow at a CAGR of 10.8% from 2025 to 2035, supported by industrialization, urban infrastructure projects, and rising electricity demand. The country’s power distribution sector is undergoing upgrades to improve reliability, reduce outages, and integrate renewable energy sources. Domestic manufacturers are expanding capacity and introducing medium- and high-voltage breakers with smart monitoring, remote operation, and protective features for commercial and industrial use. The growth of industrial clusters, metro rail projects, and high-rise buildings is driving adoption of robust, compact, and efficient breakers. Collaboration with international technology providers accelerates the development of innovative, safety-compliant solutions while enhancing operational efficiency.

The circuit breaker market in France is projected to grow at a CAGR of 9.0% from 2025 to 2035, driven by modernization of aging electrical grids, industrial automation, and renewable energy penetration. Utilities and industrial end-users are prioritizing high-performance breakers capable of ensuring safety, minimizing downtime, and supporting smart grid integration. Domestic manufacturers and European suppliers focus on medium- and low-voltage breakers with advanced protection mechanisms, eco-friendly insulation, and compliance with IEC and European safety standards. Replacement and retrofit programs in older urban and industrial infrastructure further support market growth. Investments in energy storage systems, microgrids, and EV charging networks also drive demand for efficient and reliable switching solutions.

The UK circuit breaker market is expected to grow at a CAGR of 8.2% from 2025 to 2035, influenced by infrastructure modernization, renewable energy integration, and industrial electrification. Utilities and commercial sectors are investing in medium- and high-voltage breakers with smart monitoring, fault detection, and energy efficiency features. Domestic manufacturers focus on environmentally friendly solutions, including SF6 alternatives and compact designs for urban and industrial applications. Retrofit and replacement programs targeting aging distribution systems are expanding market opportunities. The growth of data centers, EV infrastructure, and industrial facilities further increases demand for reliable, high-performance breakers. Partnerships with international technology providers enhance R&D capabilities, product reliability, and compliance with European standards.

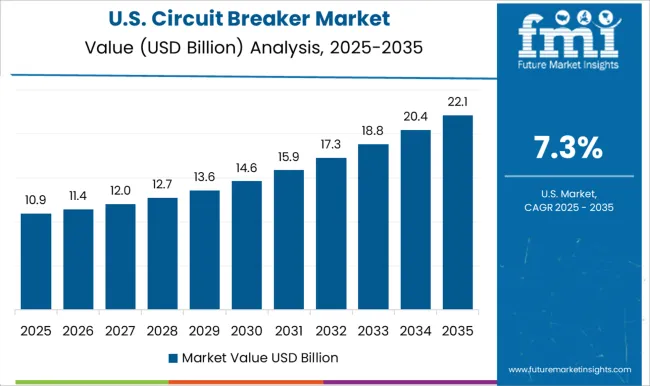

The circuit breaker market in the USA is projected to grow at a CAGR of 7.3% from 2025 to 2035, supported by grid modernization, industrial electrification, and renewable energy capacity expansion. Utilities, industrial facilities, and commercial buildings are replacing outdated breakers with advanced medium- and high-voltage solutions offering protection, energy efficiency, and remote monitoring. Investments in smart grids, microgrids, and EV charging infrastructure are accelerating adoption. Domestic manufacturers are collaborating with global technology partners to develop environmentally friendly, high-reliability solutions. Retrofit programs in aging urban and industrial distribution networks further strengthen demand. Focus on compliance with NEMA and IEEE standards ensures safety, durability, and operational efficiency across sectors.

Competition in the global circuit breaker market is defined by electrical reliability, breaking capacity, and safety compliance across industrial, commercial, and utility applications. ABB leads with a comprehensive portfolio of low-, medium-, and high-voltage breakers featuring smart monitoring, arc flash protection, and environmentally friendly insulation solutions. Eaton differentiates through modular designs, compact solutions, and digital integration for energy management and grid automation. Schneider Electric competes by offering high-performance, IEC- and UL-compliant breakers with advanced protective functions and retrofit options for aging electrical infrastructure. Siemens Energy focuses on scalable breaker solutions for transmission and distribution networks, emphasizing safety, efficiency, and lifecycle support. General Electric (GE) leverages global reach and engineering expertise to provide vacuum, SF6, and air-insulated breakers suitable for diverse applications.

Other key players including Mitsubishi Electric, LS Electric, Toshiba International, HD Hyundai Electric, Powell Industries, Alfanar Group, Kirloskar Electric, WEG, and Sensata Technologies compete through specialized, high-reliability breakers tailored for industrial, renewable energy, and commercial projects. Strategies focus on innovation in compact designs, environmentally friendly alternatives, predictive maintenance, and integration with smart grids. Partnerships with OEMs, utilities, and industrial end-users are leveraged for customized solutions, faster deployment, and compliance with IEEE, NEMA, and IEC standards. Product brochure content is technical and detailed.

Circuit breakers are described with rated voltage, breaking capacity, insulation type, mechanical endurance, and operational lifespan. Medium- and high-voltage variants include SF6, vacuum, and air-insulated technologies, while low-voltage breakers emphasize modularity, compactness, and ease of installation. Protective features, remote monitoring, fault indicators, and maintenance guidelines are detailed. Certifications, performance metrics, and environmental compliance information are highlighted. Applications include industrial plants, commercial buildings, renewable energy projects, and power transmission and distribution networks. Optional accessories, retrofit kits, and lifecycle support services are specified, reflecting a market focused on safety, reliability, efficiency, and compliance across critical electrical systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.2 billion |

| Voltage | Low, Medium, and High |

| Rated Voltage | 1 to 15 kV, 500 V, 500 V to 1 kV, 15 to 50 kV, 50 to 70 kV, 70 kV to 145 kV, 145 kV to 300 kV, 300 kV to 550 kV, 550 kV to 800 kV, and > 800 kV |

| Rated Current | 500 to 1,500 A, 500 A, 1,500 to 2,500 A, 2,500 to 4,500 A, and > 4,500 A |

| Installation | Outdoor and Indoor |

| Application | Power distribution and Power transmission |

| End Use | Utility, Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Alfanar Group, CG Power, Eaton, General Electric, HD Hyundai Electric, Kirloskar Electric, LS Electric, Mitsubishi Electric, Powell Industries, Schneider Electric, Sensata Technologies, Siemens Energy, Toshiba International, and WEG |

| Additional Attributes | Dollar sales, share, and key trends such as demand by voltage type (low, medium, high), adoption in utilities, industrial, and commercial sectors, regional growth rates, regulatory compliance, aftermarket services, and smart grid integration opportunities. |

The global circuit breaker market is estimated to be valued at USD 25.2 billion in 2025.

The market size for the circuit breaker market is projected to reach USD 57.5 billion by 2035.

The circuit breaker market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key application types in circuit breaker market are power distribution and power transmission.

In terms of rated voltage, 1 to 15 kv segment to command 29.4% share in the circuit breaker market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Circuit Breaker Test Devices Market Size and Share Forecast Outlook 2025 to 2035

Circuit Breaker Based Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Air Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Gas Circuit Breaker Market Growth – Trends & Forecast 2025 to 2035

Molded Case Circuit Breaker (MCCB) Market Growth – Trends & Forecast 2023-2033

Low Voltage Circuit Breakers Market

High Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Circuit Materials Market Analysis based on Substrate, Conducting Material, Outer Layer, Application, and Region: Forecast for 2025 and 2035

Circuit Monitoring Market Analysis – Trends & Forecast 2024-2034

Circuit Protection Kits Market

Circuit Protection Market

In-circuit Tester Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Board (PCB) Assembly Market Size and Share Forecast Outlook 2025 to 2035

Printed Circuit Boards (PCB) Market Trends - Demand & Forecast 2025 to 2035

Breathing Circuit Market Report – Growth & Forecast 2024-2034

Ground Fault Circuit Interrupter Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA