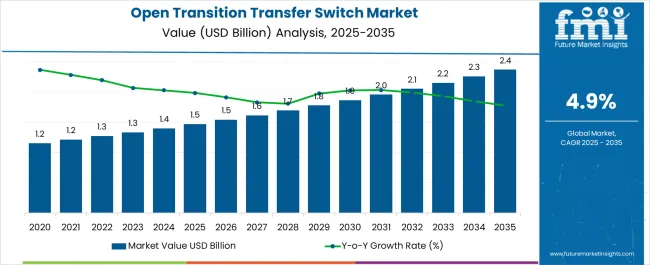

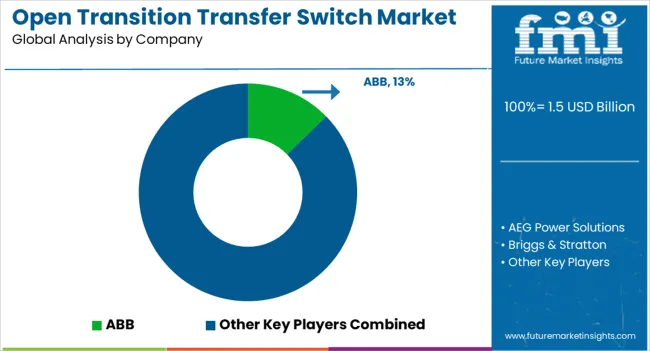

The open transition transfer switch market is expected to grow from USD 1.5 billion in 2025 to USD 2.4 billion by 2035, registering a 4.9% CAGR and generating an absolute dollar opportunity of USD 0.9 billion. Growth is driven by increasing adoption of backup power systems across commercial, industrial, and critical infrastructure facilities, including hospitals, data centers, and manufacturing plants.

Open transition transfer switches ensure rapid load transfer during power interruptions, making them critical for minimizing operational downtime. Technological advancements, such as smart monitoring and integration with renewable and conventional power systems, further support market expansion globally. Analyzing the elasticity of growth versus macroeconomic indicators highlights the market’s sensitivity to economic fluctuations. In periods of economic expansion, increased industrial activity, infrastructure investment, and commercial facility development drive higher demand for reliable power switching solutions.

Conversely, during slowdowns or recessions, capital expenditure on new facilities and power infrastructure may decline, moderating growth temporarily. Energy prices, electricity grid modernization, and government regulations on uninterrupted power supply also influence market elasticity, affecting both deployment pace and adoption strategy. From 2025 to 2035, mature regions such as North America and Europe are expected to provide stable demand, while emerging markets in the Asia Pacific and Latin America are anticipated to contribute growth that is more responsive to macroeconomic conditions. The USD 0.9 billion opportunity demonstrates that market expansion is closely aligned with broader economic trends, with early adoption and regulatory drivers stabilizing growth in varying economic scenarios.

| Metric | Value |

|---|---|

| Open Transition Transfer Switch Market Estimated Value in (2025 E) | USD 1.5 billion |

| Open Transition Transfer Switch Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The open transition transfer switch market is driven by five primary parent markets with specific shares. Commercial buildings lead with 35%, ensuring uninterrupted power supply for offices, malls, and data centers. Industrial facilities contribute 25%, supporting continuous operations in manufacturing, processing, and heavy industries. Healthcare and hospitals account for 15%, where reliable power is critical for patient safety and equipment. Utilities and energy providers represent 15%, integrating switches for grid stability and backup systems. Residential and institutional applications hold 10%, providing consistent electricity for essential services. These segments collectively shape global demand for open transition transfer switches. Recent developments in the open transition transfer switch market focus on automation, safety, and efficiency. Manufacturers are introducing intelligent switches with real-time monitoring, predictive maintenance, and remote operation capabilities.

Enhanced designs reduce transfer times, prevent voltage fluctuations, and improve reliability during outages. Integration with renewable energy systems, smart grids, and backup generators is driving adoption in commercial and industrial sectors. The growing reliance on critical infrastructure, increasing concerns about power outages, and evolving regulatory standards are accelerating deployment. These trends are fostering innovation, enhancing system performance, and expanding market growth globally.

The open transition transfer switch market is experiencing steady demand, primarily due to its suitability for cost-conscious applications where momentary power interruption is acceptable. These switches are widely used in facilities where operational tolerance for short outages is higher, such as certain commercial buildings, light industrial plants, and standby generator systems.

The market has been supported by expanding access to backup power infrastructure and the need for simple, reliable switching solutions. Lower installation and maintenance costs compared to closed transition systems make them attractive in budget-sensitive projects.

Continuous improvements in safety features, switchgear design, and operational controls have enhanced their reliability. As distributed energy adoption and localized power systems expand, the market is expected to grow, supported by demand from small to mid-sized facilities across various regions.

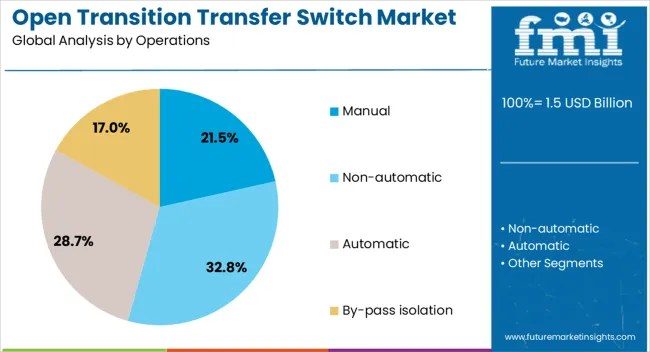

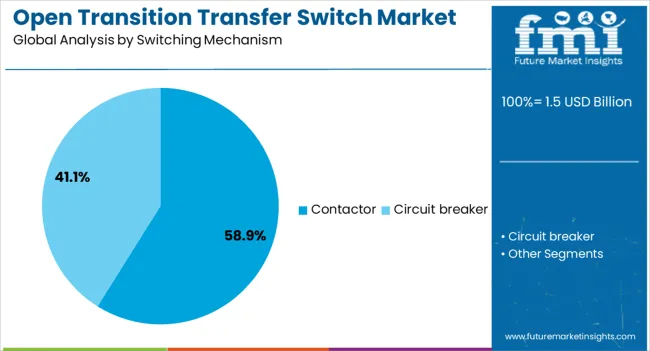

The open transition transfer switch market is segmented by operation, switching mechanism, ampere rating, installation type, and geographic region. By operations, open transition transfer switch market is divided into Manual, Non-automatic, Automatic, and By-pass isolation. In terms of switching mechanism, open transition transfer switch market is classified into Contactor and Circuit breaker.

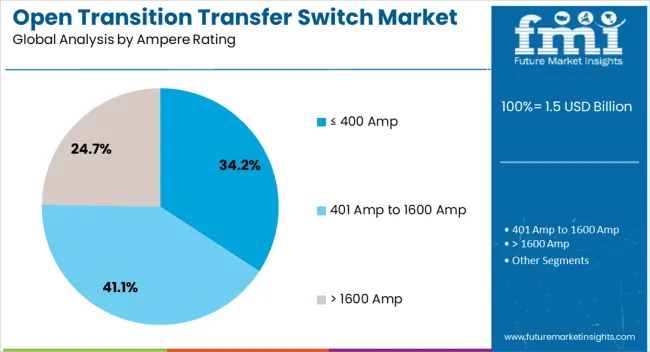

Based on ampere rating, open transition transfer switch market is segmented into ≤ 400 Amp, 401 Amp to 1600 Amp, and > 1600 Amp. By installation, open transition transfer switch market is segmented into Emergency systems, Legally required systems, Critical operations power systems, and Optional standby systems. Regionally, the open transition transfer switch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual segment accounts for approximately 21.5% share in the operations category of the open transition transfer switch market. Its sustained demand is attributed to low complexity, affordability, and ease of operation.

Manual systems are suitable for facilities where backup power activation can be managed by on-site personnel and where an acceptable level of outage tolerance is present. They require minimal electronic components, reducing both initial investment and long-term maintenance costs.

This makes them a preferred choice for rural installations, small commercial sites, and applications with low duty cycles. With continued relevance in cost-sensitive environments, the manual segment is expected to maintain its steady share in the overall market.

The contactor segment dominates the switching mechanism category, representing approximately 58.9% of market share. Fast, reliable switching capabilities and compatibility with a variety of voltage and current ratings support its leadership.

Contactors are widely used in applications requiring consistent performance and quick changeover times. The segment benefits from cost efficiency, compact design, and long service life, making it a popular choice across commercial and industrial applications.

Continuous enhancements in contactor technology, including better arc suppression and increased durability, have strengthened its market position. With broad adaptability and widespread manufacturer support, the segment is expected to retain its leading role.

The ≤ 400 Amp segment holds approximately 34.2% share of the ampere rating category, reflecting its broad application in small to medium-sized facilities. This capacity range offers a practical balance between performance and cost, making it suitable for office buildings, small manufacturing units, and retail spaces.

The segment’s adoption is driven by the proliferation of standby generator systems in urban and semi-urban areas, where compact and efficient solutions are highly sought after.

With ongoing infrastructure development and the need for affordable, reliable power transfer equipment, the ≤ 400 Amp segment is expected to sustain its strong market presence.

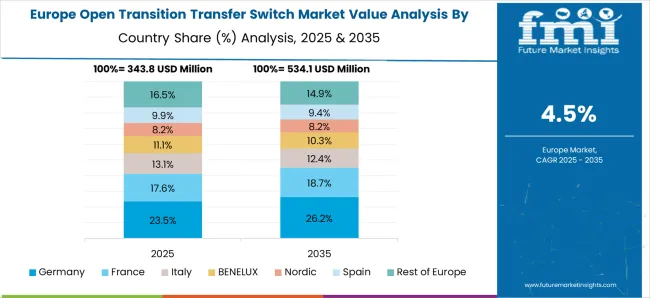

The global open transition transfer switch (OTTS) market is growing due to the need for reliable, cost-effective power switching in commercial, industrial, and utility sectors. North America accounted for 35% of market share in 2024, driven by high adoption in data centers, hospitals, and commercial facilities. Europe focuses on industrial plants and renewable energy integration. OTTS ensures transfer between primary and backup power sources with brief interruptions, typically 0.5–1 second. Industrial automation, rising electricity reliability requirements, and growing power infrastructure modernization are key drivers shaping market growth globally.

Open transition transfer switches are primarily driven by cost-effective power switching solutions for facilities with moderate tolerance for brief interruptions. OTTS offers a lower upfront cost than closed transition switches, making them ideal for industrial plants, commercial buildings, and small data centers. North America leads adoption due to extensive commercial infrastructure, while Europe integrates OTTS into industrial and renewable energy projects. Rising demand for medium-voltage applications, backup power coordination, and automated load shedding in manufacturing and logistics plants is boosting market growth. OTTS enables simplified installation, lower maintenance, and reliable operation, supporting cost-conscious facilities requiring periodic backup power without full continuity.

Key trends include IoT-enabled monitoring, modular switch designs, and integration with building and industrial automation systems. Digital OTTS provide status updates, fault alerts, and remote control, improving operational efficiency. Modular units rated from 100 A to 3,000 A allow scalable deployment across commercial and industrial applications. Asia Pacific is increasingly adopting compact designs for factories and commercial facilities, while Europe emphasizes UL and IEC compliance. Integration with energy management systems enables predictive maintenance, load sequencing, and generator coordination. Lightweight contact materials and low-loss switch mechanisms enhance efficiency and reliability, while adoption of remote diagnostics and predictive analytics is rising globally.

Opportunities in the OTTS market arise from renewable energy adoption, microgrid implementation, and growing electricity demand. OTTS is suitable for solar, wind, and battery-integrated systems where brief power transfer interruptions are acceptable. North America and Europe are expanding OTTS use in smart grid and microgrid projects to optimize load transfer and emergency backup. Industrial plants with distributed energy resources increasingly adopt OTTS for energy management cost savings. Asia Pacific shows potential due to rapid industrialization and small to medium-sized commercial facilities requiring backup power solutions. Suppliers offering modular designs, digital monitoring, and remote operation capabilities can capture contracts across global industrial and commercial sectors.

OTTS adoption faces restraints due to the brief interruption during transfer, which may not be acceptable for sensitive equipment such as high-performance data centers or critical hospital operations. High-voltage units require skilled installation for grounding, protective relays, and generator synchronization. Maintenance of contacts and digital modules adds recurring costs. Regulatory compliance varies by region, with UL, IEC, and local standards affecting installation speed. Some industries opt for closed transition switches despite higher costs to ensure uninterrupted supply. Manufacturers must focus on hybrid solutions, modular designs, and integration with automation systems to expand adoption while mitigating the limitation of brief transfer interruptions.

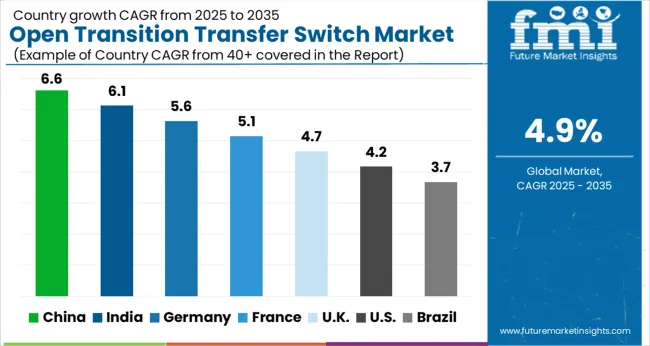

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The open transition transfer switch market is expected to grow at a global CAGR of 4.9% through 2035, driven by the need for reliable power switching, industrial automation, and critical infrastructure support. China leads at 6.6%, a 1.35× multiple of the global benchmark, supported by BRICS-led industrial expansion, modernization of commercial facilities, and adoption of smart power solutions. India follows at 6.1%, a 1.25× multiple, reflecting growth in industrial power systems and urban infrastructure development. Germany records 5.6%, a 1.15× multiple, shaped by OECD-backed safety standards, efficiency improvements, and adoption in commercial applications. The United Kingdom posts 4.7%, slightly below the global rate, with adoption concentrated in industrial and commercial facilities. The United States stands at 4.2%, 0.85× the benchmark, supported by steady demand in data centers, manufacturing plants, and critical infrastructure. BRICS countries drive volume growth, OECD regions emphasize compliance and innovation, while ASEAN markets contribute through expanding industrial and commercial power infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The open transition transfer switch market in China is projected to expand at a CAGR of 6.6%, supported by increasing deployment in industrial, commercial, and data center applications requiring brief power interruptions for maintenance. Manufacturers such as Siemens, Schneider Electric, and ABB are supplying switches with fast transfer times and advanced monitoring systems. Adoption is concentrated in urban industrial hubs and large commercial facilities where operational continuity is critical. Integration with backup generators and renewable energy systems is gaining traction. Government initiatives promoting energy efficiency, smart grids, and reliable power distribution reinforce market growth. Rising investments in data centers and critical infrastructure further encourage adoption of high-performance open transition transfer switches.

The open transition transfer switch market in India is expected to grow at a CAGR of 6.1%, driven by rising demand from hospitals, industrial plants, and commercial buildings requiring brief power transfer capabilities. Companies such as ABB, Schneider Electric, and Larsen Toubro are supplying switches designed for reliability, fast transfer, and minimal disruption. Adoption is concentrated in metropolitan regions and industrial clusters. Increasing infrastructure projects, smart grid initiatives, and renewable energy integration are strengthening market growth. Investments in automation and digital monitoring solutions enhance switch performance and energy efficiency. Market expansion is also supported by growing awareness among end users about reducing downtime and maintaining critical operations.

The open transition transfer switch market in Germany is projected to grow at a CAGR of 5.6%, driven by industrial automation, manufacturing, and commercial infrastructure needs. Leading suppliers including Siemens, ABB, and Eaton are providing switches with advanced control features and fast transfer times. Adoption is concentrated in industrial plants, logistics hubs, and data centers. Government incentives for energy efficiency, industrial reliability, and smart grid integration reinforce market expansion. Technological trends include predictive maintenance, digital monitoring, and hybrid power system integration. The emphasis on uninterrupted power supply and operational continuity in critical sectors continues to drive adoption.

The open transition transfer switch market in the United Kingdom is expected to expand at a CAGR of 4.7%, supported by demand from commercial buildings, hospitals, and industrial sectors. Manufacturers such as Schneider Electric, Eaton, and ABB are supplying fast-switching solutions to ensure minimal power interruption. Adoption is concentrated in urban centers and major industrial hubs. Government initiatives promoting energy efficiency, smart grids, and critical infrastructure resilience encourage market growth. Investment in digital monitoring and automated control systems is further supporting adoption. Applications in data centers and hospital backup power systems are reinforcing the market, while renewable energy integration provides additional growth opportunities.

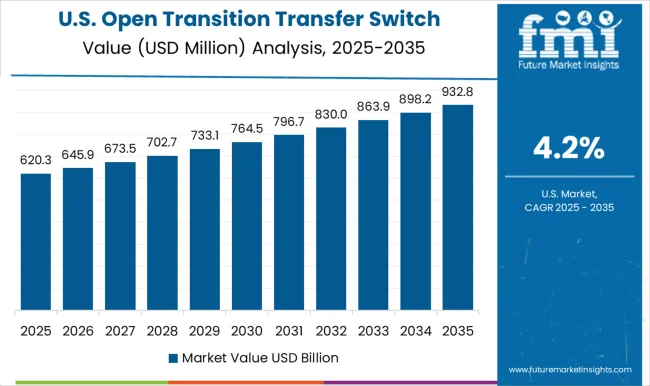

The open transition transfer switch market in the United States is projected to grow at a CAGR of 4.2%, driven by demand from industrial, commercial, and healthcare facilities requiring brief power interruption capabilities. Key suppliers including Eaton, Siemens, and Schneider Electric are providing switches with rapid transfer times and advanced monitoring features. Adoption is concentrated in data centers, hospitals, and industrial facilities, particularly in regions with variable grid reliability. Investments in smart grids, renewable energy integration, and automated monitoring support market growth. Focus on operational continuity and reduction of downtime continues to drive adoption across multiple sectors.

Competition in the open transition transfer switch market is shaped by global electrical equipment providers and specialized manufacturers focusing on reliability, efficiency, and seamless power transfer.

ABB, Eaton, Schneider Electric, and Siemens emphasize advanced switching technology, ensuring minimal interruption during power transitions. Cummins, Caterpillar, and Generac Power Systems highlight scalable solutions for industrial, commercial, and critical power applications, with brochures emphasizing durability and integration capabilities. Briggs & Stratton, Kohler, and General Electric target both residential and commercial segments, promoting compact designs, ease of installation, and safety features. Midwest Electric Products and One Two Three Electric focus on niche applications, offering customizable transfer switches for specific operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Operations | Manual, Non-automatic, Automatic, and By-pass isolation |

| Switching Mechanism | Contactor and Circuit breaker |

| Ampere Rating | ≤ 400 Amp, 401 Amp to 1600 Amp, and > 1600 Amp |

| Installation | Emergency systems, Legally required systems, Critical operations power systems, and Optional standby systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, AEG Power Solutions, Briggs & Stratton, Caterpillar, Cummins, Eaton, General Electric, Generac Power Systems, Kohler, Midwest Electric Products, One Two Three Electric, Schneider Electric, and Siemens |

| Additional Attributes | Dollar sales by switch type and end use, demand dynamics across commercial, industrial, and residential power systems, regional trends in backup and emergency power adoption, innovation in switching speed, reliability, and automation, environmental impact of material use and disposal, and emerging use cases in microgrids, data centers, and renewable integration. |

The global open transition transfer switch market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the open transition transfer switch market is projected to reach USD 2.4 billion by 2035.

The open transition transfer switch market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in open transition transfer switch market are manual, non-automatic, automatic and by-pass isolation.

In terms of switching mechanism, contactor segment to command 58.9% share in the open transition transfer switch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Open Cross Flow Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Open Radio Access Network Market and Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open API Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Top Cartons Market

Open Gear Lubricants Market

Opening Trim Weatherstrips Market

F-Open Scope Market Size and Share Forecast Outlook 2025 to 2035

F-Open Match Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Propene-1,3-Sulfonic Acid Lactone Market Size and Share Forecast Outlook 2025 to 2035

Neopentyl Polyhydric Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Lycopene Market

LNG Open Rack Vaporizer (ORV) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA