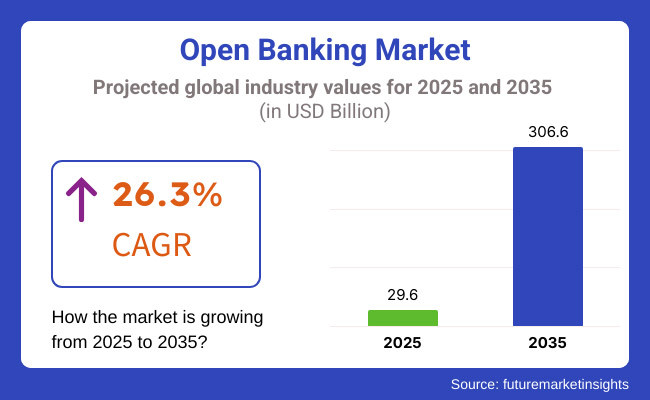

The global open banking market is poised for extraordinary growth, with its valuation projected to rise from approximately USD 29.6 billion in 2025 to nearly USD 306.6 billion by 2035. This corresponds to a remarkable CAGR of 26.3% during the forecast period. The rapid expansion is primarily driven by the growing demand for enhanced financial services, increased regulatory support for data sharing, and the widespread adoption of digital banking solutions.

Open banking enables secure sharing of financial data between banks and third-party providers through application programming interfaces (APIs), fostering innovation in financial products and services. This ecosystem encourages competition, transparency, and customer-centric solutions by allowing fintech companies to offer personalized financial management tools, payment services, and lending platforms. Consumers benefit from improved convenience, enhanced control over their data, and access to innovative services tailored to their specific needs.

The rising adoption of smartphones and internet penetration worldwide has accelerated digital banking services, creating a conducive environment for open banking solutions. Moreover, government initiatives and regulations, such as the revised Payment Services Directive (PSD2) in Europe and similar frameworks globally, mandate banks to share customer data securely, thereby catalyzing market growth. Financial institutions increasingly recognize open banking as a strategic opportunity to expand their offerings, improve customer engagement, and enhance operational efficiency.

Market segmentation encompasses various services such as payment initiation services, account information services, and open data services. Payment initiation services dominate due to the convenience and security they provide in enabling direct bank payments, reducing reliance on traditional card networks. Account information services also hold significant market share by offering customers aggregated views of their financial data, facilitating better financial planning and management.

In January 2024, Flinks introduced significant updates to its Open Banking solution, Flinks Connect, enhancing the user experience with a modernized interface and improved functionality. These updates include faster connections and increased transparency around data security protocols, addressing evolving consumer expectations in the fintech landscape. Flinks Connect 2.0 aims to provide businesses with a seamless and secure platform for financial data connectivity, facilitating smoother integrations and fostering trust among users.

Sustainability and security are critical focus areas within the market. Providers emphasize robust cybersecurity measures to protect sensitive financial data and build consumer trust. Additionally, the development of open banking platforms that support inclusive financial services contributes to broader economic participation and sustainability.

Despite significant growth prospects, challenges such as data privacy concerns, complex legacy banking systems, and regulatory compliance complexities may restrain market penetration in certain regions. However, ongoing technological advancements, strategic collaborations, and increasing consumer awareness are expected to mitigate these barriers.

The Open Banking Platforms segment is anticipated to hold a dominant market share of around 50% in 2025, driven by the widespread adoption of API-based financial ecosystems. These platforms enable banks, fintech companies, and digital payment providers to seamlessly integrate financial data, payments, and customer experiences.

Industry leaders such as Plaid, Tink (Visa), and TrueLayer have established themselves by offering secure, scalable, and compliant API-driven solutions that support a growing range of third-party integrations. Regulatory frameworks like Europe’s PSD2 and Australia’s CDR are critical in encouraging banks to open their data securely, fostering transparency and competition.

The proliferation of open banking APIs supports use cases from instant transfers to recurring payments across various sectors, enhancing real-time financial services and personalized banking experiences. This evolving landscape fosters innovation, enabling new entrants to offer value-added services that reduce costs and improve convenience. As consumer demand for seamless, personalized financial solutions grows, the Open Banking Platforms segment is positioned for sustained growth and disruption within the global financial services market.

The cloud-based deployment segment is expected to secure a significant market share of approximately 55% in 2025, emerging as the fastest-growing deployment model for open banking solutions. Cloud-native platforms offer unparalleled scalability, cost-efficiency, and enhanced security compared to traditional on-premise systems.

Major technology providers like AWS, Microsoft Azure, and Google Cloud are collaborating with financial institutions to deliver robust, API-driven services capable of handling vast financial datasets and complying with stringent data security regulations. Cloud deployment enables real-time money transfers, advanced machine learning for fraud detection, and seamless software updates without the complexity of maintaining local infrastructure.

While on-premise solutions remain essential for organizations with strict data privacy and regulatory needs, cloud-based systems dominate due to their flexibility and ease of integration. As the financial industry continues to digitize and demands for agile, secure, and scalable infrastructure increase, cloud deployment is expected to lead market growth throughout the forecast period.

FinTech firms drive disruption by covering customers more successfully and sustainably with the help of open banking frameworks. The integration of third-party suppliers (TPPs) is extremely relevant, as it allows digital payments, financial analytics, and credit scoring services to be accessed by the customers first, gaining higher levels of market adoption and innovation on behalf of suppliers. Individuals become the direct beneficiaries through the facility of personalized products, thereby enjoying increased financial transparency and better data management.

A further driver of the market is digital payments, which are now real-time, and finance that is embedded within other solutions. The enactment of regulative bodies such as PSD2 in Europe and similar setups globally is the leading factor that will breathe new life into the market and help it reach the level of open banking, which is now given to the users in the form of competitive financial products, and these products are much more accessible.

Open Banking Market Contract Analysis

| Company | Contract/Release Details |

|---|---|

| Santander UK | Announced a partnership with an open banking firm to enhance its payment solutions, aiming to provide faster and more secure payment options for customers. |

| European Payments Initiative (EPI) | Launched "Wero," a European electronic wallet operational in Germany and France, designed to rival global payment systems like Visa and Mastercard. Initial features include person-to-person payments, with plans to expand to e-commerce and in-store payments by 2026. |

| USA Consumer Financial Protection Bureau (CFPB) | Finalized new open banking rules to facilitate the transfer of consumer bank data between financial entities, aiming to foster competition and enhance consumer data rights. |

| New Zealand Government | Committed to implementing open banking by June 2026 as part of a broader initiative to increase competition in the consumer banking sector, following a report indicating inadequate competition among major banks. |

The rapid growth of the open banking market continued from the year 2020 until the year 2024, with some notable features being very strong public governance, rising fintech adoption rates, and changing consumer behavior toward seeking almost seamless financial services. Governments and other financial authorities across the globe pushed for the creation of a data-sharing framework that will allow third-party providers to offer personalized banking solutions.

API-driven banking has brought in increased competition that features innovations in digital payments, lending, and financial management tools. Globalization and increases in cross-border standards and frameworks promoting open banking will further increase global financial connectivity; blockchain will enhance security and trust.

Open finance will extend beyond banking to capture insurance, investments, and pensions and redefine the financial ecosystems of the future. Increased expectations will be following consumers with a more fine-tuned hyper-personalization and more frictionless financial experiences; mega partnerships among traditional banks, fintechs, and tech giants will propel the market into this next stage of growth.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments and regulators launched open banking regulations that compelled banks to securely share customers' data with APIs. | Policy makers fortify regulatory systems, imposing standardized usage of APIs, automated consent management, and data protection legislation for greater transparency and security. |

| Banks and fintech firms came together to design open APIs that facilitated seamless third-party integrations for digital payment, lending, and financial management. | API-driven ecosystems powered by AI reshape banking services, taking advantage of real-time data sharing, predictive analysis, and blockchain for secure and transparent transactions. |

| Consumers were presented with tailored banking experiences through fintech applications, including budgeting functions and AI-driven financial insights. | Hyper-personalized financial solutions emerge, utilizing AI and behavior analysis to create dynamic, real-time financial solutions in response to individual needs. |

| Banks added API security capabilities, such as multi-factor authentication (MFA) and strong customer authentication (SCA). | Fraud detection by AI and biometric authentication become the norms in the industry, preventing identity theft and cyber attacks in advance in real-time. |

| Companies adopted open banking platforms to provide embedded finance services, enhancing customer interactions and financial inclusivity. | BaaS transforms into decentralized financial platforms enabling non-banking companies to provide end-to-end financial products based on AI and blockchain. |

| Open banking adoption was different across regions, with Europe taking the lead through PSD2 compliance and North America and Asia following with incremental adoption. | Interoperability frameworks globally create frictionless cross-border open banking ecosystems, facilitating international financial transactions with increased efficiency and security. |

| Growing consumer demand for financial transparency, fintech innovation, and regulatory requirements drove market growth. | AI-based financial services, decentralized banking systems, and real-time cross-border payments drive industry growth. Governments and financial institutions invest in digital banking infrastructure to improve economic inclusion. |

Data security and privacy concerns are the key risk factors in the open banking market. The manager of third-party providers (TPPs) is at serious risk because any vulnerabilities in these APIs will expose sensitive consumer information to hackers who may also sell it for criminal purposes. The damages caused by malicious data handling and breaches of data protection regulations can be devastating to a firm. Strong encryption, authentication protocols, and compliance with frameworks like PSD2 in Europe and CCPA in the USA are essential to prevent this risk.

Compliance burdens made governmental and regional challenges for financial institutions. In contrast to some areas, banks' and fintechs' statutory obligations due to PSD2 and Open Banking UK open banking come less or more freely to the banks and fintech in question. Companies dealing globally need to read through different forms of regulations that might increase operating difficulty and budget.

Shopping customers and consumers still need help in tackling this issue. The major reason is that when it comes to data sharing, the customers believe that the data will be misused by third-party organizations. The build-up of trust comes with the progressive investment of financial institutions and fintech companies in customer education, transparency, and user-friendly consent management systems.

Market rivalry and standardization are yet another risk. The open banking ecosystem contains various traditional banks, fintech startups, payment service providers, and big tech companies, all rushing to grab a more significant portion of the market. The fragmentation of the global API standard and data-sharing protocols may lead to interoperability issues, which prevents the seamless integration of different financial services.

Cyber threats and frauds are risks of high concern since cybercriminals are targeting open banking APIs. Phishing scams and counterfeit third-party applications. Operational losses are mainly due to unprotected data breaches, identity theft, and unauthorized access to data other than the ones the user agreed to.

However, operational losses can also occur due to fraud involving the software or a company not being compliant with the data protection laws. In the open banking environment, strong fraud detection mechanisms, real-time monitoring, and AI-driven anomaly detection are key to reducing financial crime risks.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 25.5% |

| Germany | 24.1% |

| UK | 25.6% |

| China | 27.2% |

| India | 27.4% |

Unlike in Europe, where Open Banking is regulated through mandates, private-sector cooperation propels the USA landscape. Plaid, Finicity (Mastercard), and MX Technologies are a few of the industry's top players building secure data-sharing networks so that banks and other financial institutions can leverage their digital banking expertise.

Consumer demand for real-time payments, AI-based financial intelligence, and P2P lending is also propelling Open Banking. Further, the Consumer Financial Protection Bureau (CFPB) is also developing guidelines for Open Banking, providing a uniform method for secure sharing of financial information. FMI believes the USA market will achieve 25.5% CAGR in the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Fintech-Driven Innovation | Market leaders like Plaid and MX Technologies facilitate API-based financial data-sharing, which enhances Open Banking applications. |

| Regulatory Evolution | Consumer Financial Protection Bureau (CFPB) is working on Open Banking regulations to make financial data-sharing organized and secure. |

| Digital Payment Uptake | Increasing demand for real-time payments, AI-powered financial analysis, and embedded finance drives Open Banking services. |

Banks in Germany, such as Deutsche Bank, Commerzbank, and N26, are collaboratively working alongside fintech companies to simplify Open Banking products. With this coming together, products and services like personal finance management via artificial intelligence and peer-to-peer lending applications are hassle-free.

Germany's robust data protection laws, such as the General Data Protection Regulation (GDPR), also increase customer trust in Open Banking through secure money transfers. Small and medium-sized businesses (SMEs) also enjoy API-based banking services with greater credit and business process accessibility.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| PSD2 Regulatory Compliance | PSD2 compliance by the German banks enables standardized and secure open banking information sharing. |

| Fintech Partnerships | Banks collaborate with fintech players to provide improved customer experience in online lending, artificial intelligence-driven financial planning, and API banking. |

| Robust Customer Trust in Online Finance | Germany's data protection regulations (GDPR) enable a robust generation of consumer trust in Open Banking platforms. |

China's open banking is developing at a quick pace with improved digital finance services, increasing mobile payments, and increasingly integrated AI banking applications. Large banks such as the Industrial and Commercial Bank of China (ICBC) and Alibaba's Ant Group are using Open Banking APIs to enhance access to finance.

China's fintech industry is the sector's leading growth driver, fueled by AI-based risk analysis solutions and emerging credit scoring systems that enable financial inclusion. Government support for digital finance innovation also drives open banking adoption.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Robust Fintech Ecosystem | Some of the leaders in API-led financial services are Ant Group and Tencent, forcing the adoption of open banking. |

| Government-Supported Digital Finance | Regulatory bodies drive digital banking innovation, creating Open Banking infrastructure. |

| AI-Powered Financial Services | Artificial intelligence-based risk assessment and non-traditional credit scoring increase access to financial services. |

Reserve Bank of India (RBI) has an important role in Open Banking evolution through secure data sharing among banks, non-banking finance companies (NBFCs), and fintech players.The country's fintech industry continues to grow strongly, with Razorpay, Paytm, and PhonePe launching Open Banking APIs to enable embedded finance, digital lending, and auto-credit underwriting. Aadhaar-based eKYC and DigiLocker on a large scale also simplify financial transactions and security. FMI is of the view that the Indian market will grow at 27.4% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government-Supported Digital Infrastructure | Innovations like the Account Aggregator architecture and UPI augment Open Banking convenience. |

| Increased Fintech Adoption | Firms like Razorpay and Paytm use Open Banking APIs to drive embedded finance and other lending products. |

| Increased Smartphone Penetration | Over 1 billion smartphone users power digital banking adoption, which powers Open Banking convenience. |

The UK is among the world's most advanced Open Banking economies, with strong regulatory controls ensuring financial data security and competition. Banks are mandated by the Competition and Markets Authority (CMA) to provide Open Banking services, enabling consumers to enjoy customized financial products.

British banks like Barclays, HSBC, and Lloyds have rolled out Open Banking APIs to make digital payments, credit reports, and AI-driven personal money management more seamless. The country's vibrant fintech landscape, embodied by names like Revolut and Starling Bank, further propels the Open Banking revolution.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Regulatory Leadership | The UK mandates banks' use of Open Banking, which compels transparency and competition. |

| Strong Fintech Landscape | Big fintech companies like Revolut incorporate Open Banking APIs into AI-powered financial services. |

| Consumer Adoption of Digital Payments | The UK's contactless payment infrastructure lends itself to the seamless embedding of Open Banking. |

The Open Banking market is highly competitive and driven by innovations in APIs, regulatory frameworks, and collaborations between banks and fintechs. Given these considerations, businesses look for secure and scalable solutions that can optimize the sharing of financial data, payment processing, and digital banking services.

Market leaders such as Plaid, Tink, TrueLayer, and Finicity dominate the open banking APIs for account aggregation, payment initiation, and financial data enrichment. Plaid and Tink focus on providing smooth API integrations, while TrueLayer and Finicity use a partnership-based strategy to work with global financial institutions to ensure maximum data privacy and compliance.

New fintechs such as Yapily, MX Technologies, and Token.io are gaining attention with their specific solutions in embedded finance, real-time payments, and lending powered by open banking. At the same time, the older banks are trying to implement Open Banking technologies to modernize digital services and enhance customer engagement.

The market is being shaped by the adoption of cloud-based infrastructure, AI-enabled fraud checks, and the opening up of various global markets through regulatory means. Major cloud vendors such as AWS, Microsoft Azure, and Google Cloud are the backbone upon which any Open Banking ecosystem is secured and scaled. In this rapidly expanding industry, organizations that keep working on innovation and compliance while looking toward cross-border financial integration will be well-positioned with respect to existing regulations and to accelerate adoption.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Plaid | 20-25% |

| Tink (Visa) | 15-20% |

| Finicity (Mastercard) | 12-16% |

| TrueLayer | 10-14% |

| Yapily | 8-12% |

| Other Companies (Combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Plaid | API-driven financial data aggregation, bank connectivity, and account verification solutions. |

| Tink (Visa) | Open Banking API infrastructure for payment initiation, data enrichment, and digital banking. |

| Finicity (Mastercard) | Consumer-permissioned data sharing, lending solutions, and AI-powered financial insights. |

| TrueLayer | Seamless API integration for financial services, payments, and digital identity verification. |

| Yapily | Enterprise-focused Open Banking infrastructure enabling real-time payments and financial analytics. |

Plaid (20-25%)

Plaid is a leading Open Banking provider, offering robust API connectivity for financial data aggregation, payments, and account verification across banks and fintech platforms.

Tink (Visa) (15-20%)

Acquired by Visa, Tink provides Open Banking APIs that enable seamless payment initiation, financial data access, and risk assessment solutions across Europe.

Finicity (Mastercard) (12-16%)

As a subsidiary of Mastercard, Finicity specializes in consumer-permissioned financial data sharing, lending decisioning, and AI-driven insights for banks and fintech firms.

TrueLayer (10-14%)

TrueLayer focuses on real-time financial data access and payments, allowing businesses to enhance digital onboarding, fraud prevention, and open finance capabilities.

Yapily (8-12%)

Yapily offers enterprise-grade Open Banking infrastructure, empowering businesses with real-time payments, account verification, and financial analytics solutions.

Other Key Players (30-40% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 29.6 billion |

| Projected Market Size (2035) | USD 306.6 billion |

| CAGR (2025 to 2035) | 26.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Solution Types Analyzed (Segment 1) | Open Banking Platforms, API-Based, App-Based, Open Banking Services |

| Deployment Modes Covered (Segment 2) | Cloud, On-Premises |

| End Users Covered (Segment 3) | Central Banks, Retail & Commercial Banks, Investment Banks, Insurance, Credit Unions, Mortgage Providers, Wealth Management, Fintechs, Payment Service Providers |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, South Korea, Australia |

| Key Players Influencing the Market | Plaid, Tink (Visa), Finicity (Mastercard), TrueLayer, Yapily, MX Technologies, Token.io, Flinks, Bud Financial, OpenWrks |

| Additional Attributes | Dollar sales by solution and deployment, regulatory impact by region, fintech collaboration trends, API security innovations, cross-border integration, AI-enabled financial services |

| Customization and Pricing | Customization and Pricing Available on Request |

The market is projected to witness a CAGR of 26.3% between 2025 and 2035.

The market’s worth is at USD 29.6 billion in 2025.

The worth is anticipated to reach USD 306.6 billion by 2035 end.

East Asia is set to record the highest CAGR of 28.1% in the assessment period.

The key players operating in the industry include Finleap Connect, Finastra, FormFree Holdings Corporation, Jack Henry & Associates, Inc., MineralTree, Inc., NCR Corporation, Banco Bilbao Vizcaya Argentaria, S.A., DemystData, Ltd., Mambu, and Credit Agricole.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel , 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Services, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 17: Global Market Attractiveness by Services, 2024 to 2034

Figure 18: Global Market Attractiveness by Deployment, 2024 to 2034

Figure 19: Global Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Services, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 37: North America Market Attractiveness by Services, 2024 to 2034

Figure 38: North America Market Attractiveness by Deployment, 2024 to 2034

Figure 39: North America Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Services, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 57: Latin America Market Attractiveness by Services, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Deployment, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Services, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Services, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Services, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Services, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Services, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Services, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Deployment, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Services, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 137: East Asia Market Attractiveness by Services, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Deployment, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Services, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Distribution Channel , 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel , 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel , 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel , 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Services, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Deployment, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Distribution Channel , 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Open Cross Flow Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Open Radio Access Network Market and Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Open API Market Size and Share Forecast Outlook 2025 to 2035

Banking as a Service (BaaS) Platform Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Banking & BaaS – Revolutionizing European FinTech

Open Top Cartons Market

Open Gear Lubricants Market

Opening Trim Weatherstrips Market

F-Open Scope Market Size and Share Forecast Outlook 2025 to 2035

F-Open Match Rifle Scope Market Size and Share Forecast Outlook 2025 to 2035

Propene-1,3-Sulfonic Acid Lactone Market Size and Share Forecast Outlook 2025 to 2035

Neopentyl Polyhydric Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA