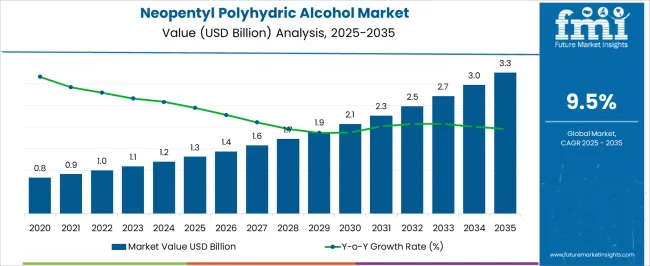

The Neopentyl Polyhydric Alcohol Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Neopentyl Polyhydric Alcohol Market Estimated Value in (2025 E) | USD 1.3 billion |

| Neopentyl Polyhydric Alcohol Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The neopentyl polyhydric alcohol market is experiencing steady growth, supported by its increasing use in high-performance resins, coatings, and chemical intermediates. The demand is being driven by the material’s superior chemical stability, enhanced heat resistance, and excellent compatibility with various polymer systems, which make it a preferred choice for advanced coating and industrial applications.

Rising investments in construction, automotive, and electronics sectors are further fueling adoption, as these industries require durable, high-quality coatings and resins that extend the lifespan of materials and improve operational efficiency. Technological advancements in formulation and processing have enabled manufacturers to tailor performance characteristics to specific application needs, thereby increasing product versatility.

Environmental and regulatory considerations are also influencing growth, as neopentyl polyhydric alcohols are used to produce low-VOC coatings and sustainable polymer solutions The market is expected to expand steadily over the next decade, driven by rising industrialization, demand for high-performance materials, and the focus on environmentally compliant chemical solutions that offer both functional and economic benefits.

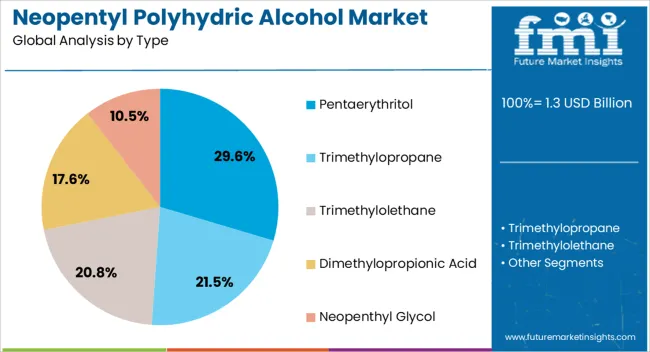

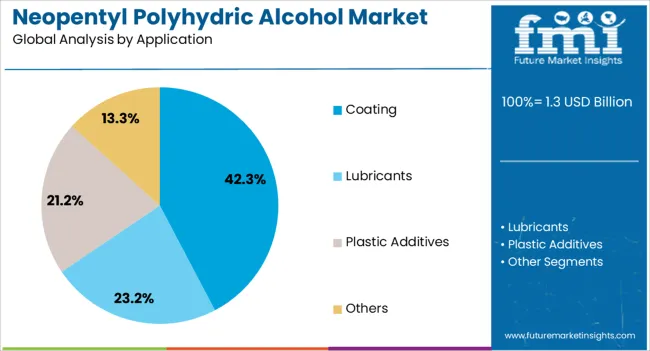

The neopentyl polyhydric alcohol market is segmented by type, application, and geographic regions. By type, neopentyl polyhydric alcohol market is divided into Pentaerythritol, Trimethylopropane, Trimethylolethane, Dimethylopropionic Acid, and Neopenthyl Glycol. In terms of application, neopentyl polyhydric alcohol market is classified into Coating, Lubricants, Plastic Additives, and Others. Regionally, the neopentyl polyhydric alcohol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pentaerythritol segment is projected to hold 29.6% of the neopentyl polyhydric alcohol market revenue share in 2025, making it the leading type. Its dominance is being supported by excellent thermal and chemical stability, which enhances the performance of resins, coatings, and adhesives. Pentaerythritol is widely preferred due to its ability to improve crosslinking density in polymer networks, resulting in coatings with superior hardness, durability, and chemical resistance.

The material is also highly compatible with a range of formulations, allowing for versatile applications in industrial and commercial sectors. Growth is being further driven by increasing use in high-performance paints and protective coatings where long-term stability and resistance to environmental degradation are critical.

The segment benefits from a robust supply chain and established production technologies, ensuring consistent quality and availability Rising demand for premium resins and coatings in automotive, construction, and electronics industries is expected to reinforce the leading position of pentaerythritol in the global market over the coming years.

The coating application segment is anticipated to account for 42.3% of the neopentyl polyhydric alcohol market revenue share in 2025, establishing it as the dominant application area. Its leadership is being driven by the growing need for durable, high-performance coatings in industrial, automotive, and construction applications. Neopentyl polyhydric alcohols are used extensively in resin formulations to enhance chemical and heat resistance, flexibility, and adhesion properties of coatings.

Increasing emphasis on sustainable and low-VOC solutions is further supporting adoption, as these materials enable environmentally friendly formulations without compromising performance. Rising investments in infrastructure, automotive production, and protective coatings for industrial equipment are accelerating demand.

The ability to improve weathering resistance, surface hardness, and long-term stability in coatings makes this segment a preferred choice for manufacturers and formulators As end-use industries continue to prioritize high-quality and environmentally compliant coatings, the segment is expected to maintain its market leadership and drive overall growth for neopentyl polyhydric alcohols globally.

Above mentioned types of neopentyl polyhydric alcohols find applications in automotive, construction and finished part of OEM. Hence, the demand for this chemical highly relates to the economic conditions of region as end user industries contribute a major part of country’s GDP.

Polyester resin manufacturing industry makes use of trimethylopropane and trimethylolethane as branching agents. Trimethylopropane also find application in automotive and baked product finishes of OEM parts. Pentaerythritol is mainly used in architectural coatings applications. Polyhydric alcohols are often blended in process while manufacturing of coating resins to balance cost and properties.

Neopenthyl glycol is estimated to be the fastest growing segment during upcoming years owing to to its usage in architectural aluminium and will be followed by pentaerythritol and trimethylopropane.

Increasing construction industry in developing economies of world like China is driving the market. Western Europe and China together account for a major chunk of revenue generated by Neopentyl polyhydric alcohols manufacturers. High use of polyester resins for powder coatings especially on architectural aluminium makes Europe an attractive market for neopentyl glycols.

Other geographies identified with high usage of polyster resins for powder coatings include Brazil, South Africa, Southeast Asia, Middle East and Australia. United States is not estimated to be an attractive market for neopentyl polyhric alcohols because of the lower usage of powder coating on aluminium. This is mainly due to extreme weather conditions that buildings are exposed to in United States.

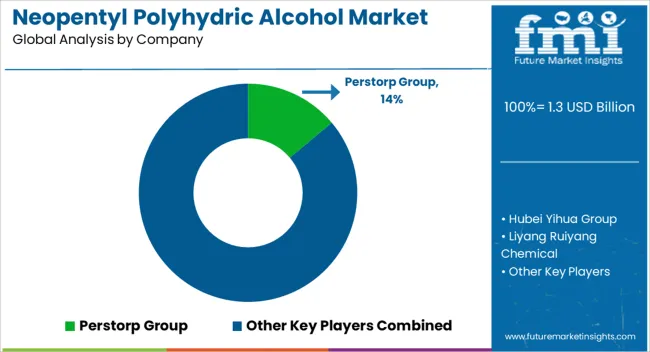

Major players identified in this market include Lubrizol, Kuraray, Perstorp group, and BASF SE.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Neopentyl polyhydric alcohols is a chemical and is of 5 type which include

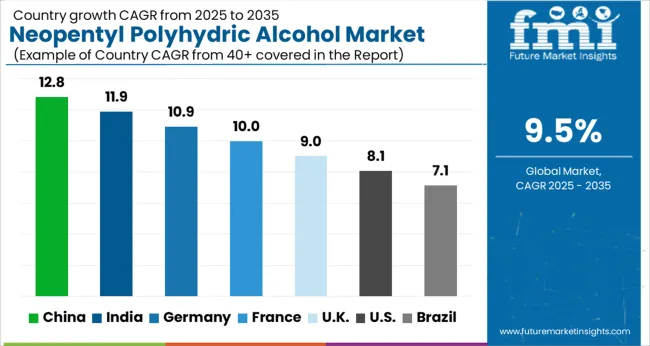

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

The Neopentyl Polyhydric Alcohol Market is expected to register a CAGR of 9.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.8%, followed by India at 11.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.1%, yet still underscores a broadly positive trajectory for the global Neopentyl Polyhydric Alcohol Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.9%. The USA Neopentyl Polyhydric Alcohol Market is estimated to be valued at USD 456.9 million in 2025 and is anticipated to reach a valuation of USD 993.2 million by 2035. Sales are projected to rise at a CAGR of 8.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 71.6 million and USD 40.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type | Pentaerythritol, Trimethylopropane, Trimethylolethane, Dimethylopropionic Acid, and Neopenthyl Glycol |

| Application | Coating, Lubricants, Plastic Additives, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Perstorp Group, Hubei Yihua Group, Liyang Ruiyang Chemical, Lanxess, Oxea, BASF, LCY, Puyang Pengxin, Ercros SA, Metafrax, Chemanol, MKS Marmara Entegre Kimya, GEO Specialty Chemicals, and Mitsubishi Gas Chemical |

The global neopentyl polyhydric alcohol market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the neopentyl polyhydric alcohol market is projected to reach USD 3.3 billion by 2035.

The neopentyl polyhydric alcohol market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in neopentyl polyhydric alcohol market are pentaerythritol, trimethylopropane, trimethylolethane, dimethylopropionic acid and neopenthyl glycol.

In terms of application, coating segment to command 42.3% share in the neopentyl polyhydric alcohol market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Alcohol Packaging Market Forecast and Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA