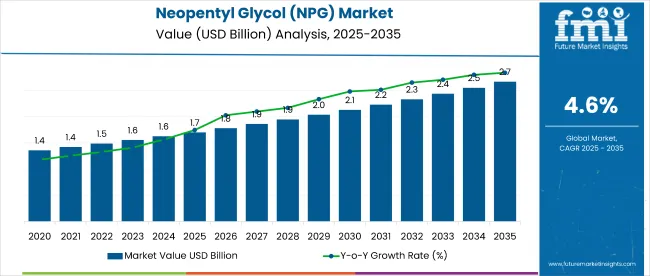

The neopentyl glycol (NPG) market is expected to grow steadily, with a predicted industry size of USD 1.7 billion in 2025, which is expected to reach around USD 2.7 billion by 2035, growing at a CAGR of approximately 4.6%. This is due to increasing demand for high-performance resins, plastics, and coatings.Powder coatings represent a fast-developing application sector.

Solvent-free coatings possess significant environmental advantages over conventional solvent borne systems and rely relatively heavily on NPG for resin crosslinking. As governments increasingly impose stricter VOC emission limits, NPG's application in sustainable, high-performance coatings is developing at a very fast rate.

The automotive industry is another major consumer of NPG. It finds application in both OEM and refinishing paints to enhance resistance to UV light, chemicals, and physical abrasion. With the world's car production recovering and electric vehicle manufacturing on the increase, demand for tough, low-maintenance paints is driving consumption of NPG.

In infrastructure and building construction, resins derived from NPG are employed in exterior building products, pre-coated metal panels, and corrosion-resistant structural parts. Increasing demand for long-lasting infrastructure, especially among the emerging industries, continues to drive demand for advanced materials that have enhanced chemical and weather resistance.

However, the industry is faced with raw material price volatility, especially for isobutyraldehyde and formaldehyde-key precursors to NPG production. Environmental pressures on feed stocks and resin formulations also might precipitate change towards bio-based alternatives, though NPG's superior performance keeps it very much in play in most formulations.

Opportunities are emerging through R&D in bio-based NPG production that aims at minimizing environmental impact and enhancing lifecycle sustainability. The growing use of NPG in UV-curable coatings, plasticizers, and lubricants is also generating new growth corridors, especially in the areas that specialize in lightweight, tough, and low-VOC products.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 4.6% |

NPG is fully registered under REACH, without authorization or restriction entries, and is subject to supplier‑driven classification and food‑contact rules for certain uses.

NPG is an established TSCA chemical with a positive signal on EPA’s safer list but lacks federal exposure limits, requiring case‑by‑case assessment for workplace safety.

NPG is widely listed on national inventories and, in some regions, benefits from reduced regulatory pathways for polymers or confirmed legacy listings.

-market-.webp)

Neopentyl glycol (NPG) is anindustry with growth under intense growth pressure driven by rising demand within a wide range of applications including the automotive, building, and coatings & paints industries. The outstanding properties of NPG, including high thermal stability, resistance to chemicals, and volatility, have led to it becoming an essential raw material in the manufacturing of high-performance resins, lubricants, and plasticizers.

Chemical producers focus on producing high-purity NPG with consistent quality to fulfill the strict specifications of end-use industries. They invest in green process technology and try to supply a consistent supply chain to fulfill mounting global demand.End-Use Industries like automotive, construction, and paints & coatings industries are interested in cost-effective and reliable NPG solutions offering maximum performance in various applications. They are searching for materials offering high efficacy, compliance with environmental regulations, and feasibility to be tailored to particular operational needs.

The industry, between 2020 and 2024, recorded steady demand primarily due to its principal application in the manufacture of high-performance coatings, especially for the automobile and construction industries.As the industry bounced back from the impact of the COVID-19 pandemic, demand for weather-resistant, long-lasting resins grew substantially.

NPG's heat resistance, oxidation stability, and chemical stability rendered it highly desirable as an addition to powder coatings and polyester resins. Raw material cost and volatility and supply chain volatility were challenges facing producers in the Europe and Asia-Pacific regions, respectively.

Increased strategic development in the direction of sustainability, green safety, and formulation innovation are trends that will be witnessed during 2025 to 2035. As low-VOC regulations and green building become more prevalent, uses for NPG in green coatings will increase. Investments in bio-based solutions and process development that reduce carbon footprints by manufacturers are anticipated.

Also, increased investments in infrastructure development across the world, particularly in commercial construction and renewable energy, will drive demand for durable, corrosion-resistant materials-further augmenting the role of NPG in the value chain.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Fueled by coatings, automotive, and construction recovery from the COVID pandemic. | Fostered by green construction trends and world infrastructure expansion. |

| Performance requirements in powder coatings, hard plastics, and polyester resins. | Demand for low-VOC, bio-based, and green coatings and resins. |

| Stable systems with incremental improvements in product stability. | Higher R&D on green chemistry and process efficiency for NPG manufacturing. |

| Strong Asia-Pacific and European presence, recovering from supply shortages. | Growing Middle East and Africa industry , with increased investment in Asia-Pacific. |

| Escalating regulation driving low-VOC coatings and safer solvents. | Increased environmental regulation driving greener alternative NPG. |

| Emphasis on conventional polyester resins and coatings uses. | Emerging NPG for sustainable polymers, green paints, and advanced composites. |

The industry is responsive to changes in the prices of raw materials, especially formaldehyde and isobutyraldehyde. The industry was worth around USD 1.71 billion in 2024. Volatility in the prices of such inputs can have a major influence on the cost of production, and hence it can be difficult for manufacturers to sustain competitive pricing models as well as impact profit margins.

Tight safety and environmental regulations are a significant threat to the business. Compliance with different regional standards necessitates continuous monitoring and adjustment. Non-compliance with such controls can lead to legal sanctions and erosion of brand image, impacting industry position and customer confidence.

Supply chain delays like transport delays or geopolitical tensions can delay the timely supply of raw materials and finished goods. Oversupply in the Chinese industry led to bearish price trends in 2024, while price spikes were experienced in North America due to shortages of supply and high demand from the paints and coatings industry.

Dependence on these core sectors such as automotive, construction, and coatings implies that weakness in these sectors can directly impact demand for neopentyl glycol. Diversifying the customer base across different industries will be able to reduce this risk.

Overall, the industry is subject to risks from raw material price volatility, regulatory issues, supply chain interruptions, technological changes, and economic downturns specific to the industry. Proactive approaches addressing these factors are crucial to maintaining growth and competitiveness in this fast-paced industry.

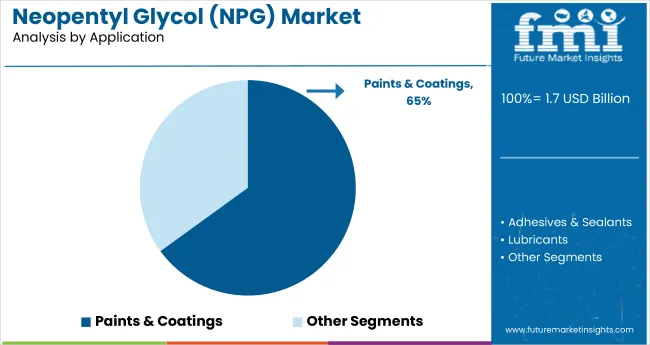

The paints & coatings segment holds the dominant position with 65% of the market share in the application category within the neopentyl glycol (NPG) market. This leadership is driven by NPG's exceptional properties including high thermal stability, chemical resistance, and excellent durability that make it an ideal component in high-performance coating formulations. NPG-based resins provide superior weather resistance, UV stability, and corrosion protection, making them particularly valuable in automotive OEM finishes, industrial coatings, and architectural applications.

The segment's dominance is reinforced by the growing demand for powder coatings and low-VOC formulations that align with increasingly stringent environmental regulations. NPG enables the production of solvent-free coating systems that offer significant environmental advantages while maintaining superior performance characteristics. The expanding construction sector and rising demand for durable, long-lasting coatings in infrastructure development are driving sustained growth in NPG consumption for paints and coatings applications. As manufacturers continue to prioritize sustainable, high-performance coating solutions, the paints & coatings segment is positioned to maintain its market leadership through continued innovation in NPG-based resin technologies.

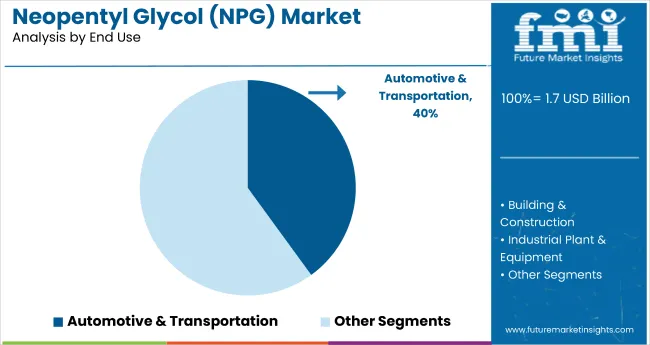

Automotive & transportation dominates the neopentyl glycol market with 40% of the market share, reflecting the critical role NPG plays in producing high-performance automotive coatings and components. This segment's leadership is attributed to the automotive industry's demanding requirements for coatings that provide exceptional resistance to UV radiation, chemicals, and physical abrasion while maintaining aesthetic appeal throughout the vehicle's lifecycle. NPG-based materials are essential in both OEM automotive finishes and refinishing applications where durability and color retention are paramount.

The segment encompasses applications across passenger vehicles, commercial vehicles, and the rapidly expanding electric vehicle market where specialized coatings and insulation materials are increasingly important. The automotive industry's focus on lightweight, durable components and the growing emphasis on vehicle longevity are driving sustained demand for NPG-based solutions. As global vehicle production recovers and electric vehicle manufacturing accelerates, the automotive & transportation segment is expected to strengthen its market position through continued investment in advanced coating technologies and high-performance materials that meet evolving automotive industry standards and consumer expectations.

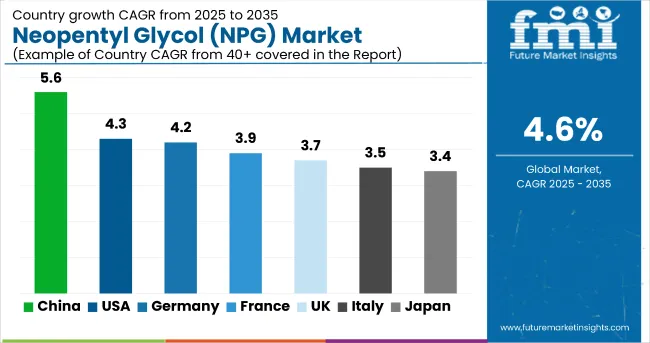

| Countries | CAGR (2025 to 2035 ) |

|---|---|

| USA | 4.3% |

| UK | 3.7% |

| France | 3.9% |

| Germany | 4.2% |

| Italy | 3.5% |

| South Korea | 4.1% |

| Japan | 3.4% |

| China | 5.6% |

| Australia | 3.2% |

| New Zealand | 3% |

The USAindustry is forecasted to exhibit a consistent compound annual growth rate of 4.3% between 2025 and 2035. Growth drivers are robust demand in coatings and resin industries, where NPG is a key building block in alkyd and polyester resins. Increased expenditure on infrastructure and automotive manufacturing are supporting demand in the construction and transport industries.

Stringent environmental regulations are also compelling manufacturers to invest in low-emitting, high-purity NPG products. The presence of key players such as Eastman Chemical Company and BASF Corporation boosts domestic technology enhancement and innovation.

Growing construction of manufacturing facilities in southern and Midwestern regions is likely to improve supply chains and operational efficiency. The USAindustry is also being supported by joint ventures between chemical manufacturers and downstream product formulators in pursuit of performance-optimized applications in high-durability coatings and engineered plastics.

The UKindustry is projected to achieve a CAGR of 3.7% during 2025 to 2035. The growth curve is supported by rising demand for sustainable, robust coatings in commercial and residential construction. Increased use of NPG among powder coatings of furniture, household appliances, and automotive is also a growth driver. Eco-efficient production processes being promoted by regulations in the UK are leading import demand towards high-quality NPG.

Major distributors and specialty chemical companies are solidifying industry access with comparable sourcing routines via European suppliers. Innovation is gradually emerging in the use of NPG in 3D printing resins and performance adhesives, which is creating niche growth niches. UK firms, in the wake of realignment following Brexit, are reorganizing supply chains, creating upgraded direct import links, particularly with German and American producers.

France is expected to register a CAGR of 3.9% over the forecast period in the industry. Growing demand for water-based paints in the industrial and automotive sectors is a key growth driver for the industry. Environmental sustainability and recyclability of materials focus in France is fueling the demand for NPG-based polyesters in green developments. Incentives offered by the government towards green technology and eco-construction are stimulating investments in chemical research, where NPG plays the central role.

The industry benefits from a sophisticated base of chemicals manufacturing, with local subsidiaries active from international suppliers. Specialty plasticizers and synthetic lubricants are opportunities in emerging demand. French distributors' integration of digital supply chain technologies is enhancing NPG import and downstream distribution efficiency and responsiveness.

Germany's industry for NPG will grow by a CAGR of 4.2% between 2025 and 2035. With a dominating presence in the European coatings and automotive sectors, Germany generates sound and stable demand for NPG as a chemical formulation ingredient used in durable coating products.

Established manufacturing infrastructure and highly developed indigenous manufacturing provide the groundwork for high-tech innovation through resin-based technology. Government promotion of industrial upgrading and take-up of environmental chemicals drives the take-up of NPG for high-tech sophisticated composites.

BASF SE remains a leading industry participant, leading process improvements and capacity expansions. Integration of Germany into Central and Eastern European industries also enhances its export-oriented NPG network. More premium applications in powder coatings for electric vehicles and industrial equipment are expected to provide additional growth drivers during the forecast period.

The Italian industry is projected to grow at a 3.5% CAGR from 2025 to 2035. Larger applications in decorative paints, furniture coatings, and building resins are driving demand for NPG. Economic impulses in the northern industrial belts are driving up investment in high-performance and durable building materials, where NPG-based polyesters are being widely used. Dependence on imports continues, though efforts at diversification are ongoing.

Italian specialty chemicals producers are seeking regional formulation partnerships with global NPG suppliers in search of regionally optimized distribution. The growth of premium consumer products and appliance manufacturing is generating secondary demand streams for NPG-based powder coatings. Logistics development and port handling activities will direct southern European supply more effectively.

South Korea's industry is anticipated to register a CAGR of 4.1% during the forecast period. Growth in demand is fueled by advancements in electronic coatings, where NPG ensures thermal stability and chemical resistance. The automotive coating industry is another large consumer, supported by high production volumes in vehicle manufacturing and exports. South Korea's emphasis on high-spec chemicals and value-added manufacturing is fueling innovation with the application of NPG.

Large local firms are in active R&D collaborations with their foreign counterparts. Multinational domestic subsidiaries are investing in process improvement and capacity scaling to meet demand. Trade connections with China and Japan also contribute to the industry's well-balanced supply dynamics across the region.

Japan's industry will grow at a CAGR of 3.4% over 2025 to 2035. The automotive and electronics sectors exhibit steady consumption, with NPG as a performance-enhancing intermediate utilized in resins and plasticizers. Demographics and urban renewal efforts are generating sustained demand for architectural paints, gravitating toward high-durability NPG-based products.

Industry-leading Japanese chemical firms are focusing on product purity and process efficiency as they seek to meet rigorous local quality requirements. Applications of NPG as part of next-generation battery coatings and high-heat plastics are also emerging as a specialty niche. Import patterns remain consistent, primarily imported from regional clusters with highly logistically efficient nodes.

China is projected to lead the world industry with a 5.6% CAGR during 2025 to 2035. Continuing industrialization and urbanization are driving demand for coatings, resins, and synthetic lubricants. NPG's status as a critical intermediate in high-performance coatings positions it favorably in infrastructure, automotive, and consumer goods production. Favorable policies on green building materials and the expanding electric vehicle industry are augmenting industry potential.

Major Chinese manufacturers are expanding NPG production facilities, with in-house operations ranging from raw material synthesis to end-use formulations. Export competitiveness is robust, with growing penetration in Southeast Asia and Europe. Cooperation between domestic research institutions and chemical manufacturers is promoting innovation in green formulations.

The Australian industry is predicted to reach a CAGR of 3.2% over 2025 to 2035. Demand is predominantly driven by the construction and home improvement industries, where weather-resistant coatings play an important role. NPG-based powder coatings are increasingly utilized in coastal buildings and architectural use. Australia's product standards specific to climate drive demand for resin systems with high durability.

Import reliance remains strong, but regional collaboration with Asian manufacturers is steadying the industry. Channels for distribution are changing in order to provide just-in-time delivery systems within principal cities. Industry players are putting increased priority on the certification of products and compliance with performance standards to bolster end-user’s confidence.

New Zealand is anticipated to witness a CAGR of 3% throughout the forecast period in the industry. Development primarily takes place because of increased demand for long-term and eco-friendly coatings for commercial and residential buildings. Environmental consciousness and architectural trends for weather-resistant materials form the basis of NPG consumption in plastic and advanced coatings.

The industry operates through a limited number of specialist distributors in conjunction with local manufacturers, primarily Chinese and Australian. Opportunities for growth are emerging in agricultural machinery coatings and water-resistant sealants. Supply chain efficiencies and web-based purchasing systems are enhancing transparency and reducing lead times.

The industry is a highly consolidated space where global manufacturers are leveraging technological expertise, supply chain optimization skills, and controlled high-purity NPG production capabilities. With the integrated production process, strong R&D support, and well-established global distribution network, these companies are well on their way toward being competitive in this industry. Their strategic expansion into coatings, lubricants, and plasticizers only strengthens their competitive position.

Asian manufacturers such as Wanhua Chemical Group, Mitsubishi Gas Chemical Company, and OXEA GmbH are gaining traction in the industry by increasing their production capacities and optimizing cost efficiencies. This enables them to offer competitive prices with fluctuation in demand in the region, providing them with a strategic advantage in the global industry.

More specialized players in the chemical domain, such as Perstorp Holding AB and Tokyo Chemical Industry Co., Ltd. concentrate on high-purity NPG for specialty applications, like high-performance resins, adhesives and powder coatings. These companies lay their emphasis on product differentiation and innovation for sustainable NPG production in order to increase their industry position.

Smaller companies, like Hefei TNJ Chemical Industry Co. Ltd. and Zouping Fenlian Biotech Co., Ltd., are pursuing regional industry penetration and entering into partnerships with industrial manufacturers. Their cost-effective production model and niche application concentration help them stay competitive in emerging industries.

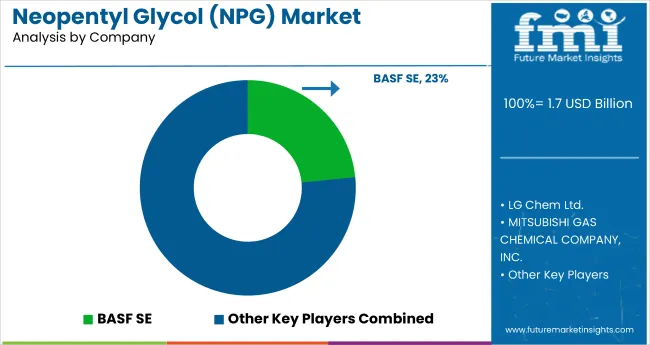

| Company Name | Market Share (%) |

|---|---|

| BASF SE | 20-25% |

| LG Chem Ltd. | 15-20% |

| Eastman Chemical Company | 12-16% |

| Perstorp Holding AB | 10-14% |

| Wanhua Chemical Group | 8-12% |

| Others (combined) | 25-35% |

| Company Name | Key Offerings and Activities |

|---|---|

| BASF SE | Develops high-purity NPG for resins, lubricants, as well as industrial coatings. |

| LG Chem Ltd. | Specializes in eco-friendly and high-performance NPG solutions for adhesives and coatings. |

| Eastman Chemical Company | Expands polyester-based applications with advanced NPG formulations. |

| Perstorp Holding AB | Focuses on sustainable and bio-based NPG solutions for specialty chemicals. |

| Wanhua Chemical Group | Strengthens regional supply chains as well as cost-efficient NPG production. |

BASF SE (20-25%)

A global industry leader in NPG production with high-purity formulations applied in coatings, polyesters, and high-performance resins.

LG Chem Ltd. (15-20%)

Prioritizes sustainable NPG solutions with extensive coverage in Asia-Pacific and European chemical industries.

Eastman Chemical Company (12-16%)

Extends its NPG portfolio with innovation in specialty coatings and polymer additives.

Perstorp Holding AB (10-14%)

Specialized in bio-based NPG formulations, serving increasing environmentally friendly chemicals demand.

Wanhua Chemical Group (8-12%)

Increases cost-effective manufacturing capacity and acquires regional supply agreements for industrial uses.

Other Key Players

The industry is segmented into flake, molten, and slurry.

The industry is segmented into pharmaceutical grade and technical grade.

The industry is segmented into paints & coatings, adhesives & sealants, lubricants, plasticizers, insulation materials, and others.

The industry is segmented into automotive & transportation, building & construction, industrial plant & equipment, furniture & interiors, and others.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South East Asia & Pacific, China, India, Japan, and Middle East and Africa.

The industry is estimated to be USD 1.7 billion in 2025.

Sales are projected to grow significantly, reaching USD 2.7 billion by 2035.

China is expected to experience a 5.6% CAGR.

The flake segment is leading the trend, being widely used in various industrial applications including in the production of resins and plasticizers.

Prominent companies include BASF SE, LG Chem Ltd., Eastman Chemical Company, Perstorp Holding AB, Wanhua Chemical Group, Mitsubishi Gas Chemical Company, OXEA GmbH, Tokyo Chemical Industry Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., and Zouping Fenlian Biotech Co., Ltd.

Table 01: Global Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 02: Global Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 03: Global Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 04: Global Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 05: Global Market Volume (Tons) and Value (US$ million) Analysis and Forecast by Region – 2023 and 2033

Table 06: Global Market Volume (Tons) and Value (US$ million) Analysis and Forecast by Region – 2023 and 2033

Table 07: North America Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 08: North America Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 09: North America Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 10: North America Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 11: North America Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 12: Western Europe Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 13: Western Europe Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 14: Western Europe Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 15: Western Europe Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 16: Western Europe Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 17: Eastern Europe Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 18: Eastern Europe Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 19: Eastern Europe Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 20: Eastern Europe Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 21: Eastern Europe Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 22: Latin America Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 23: Latin America Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 24: Latin America Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 25: Latin America Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 26: Latin America Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 27: South East Asia & Pacific Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 28: South East Asia & Pacific Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 29: South East Asia & Pacific Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 30: South East Asia & Pacific Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 31: South East Asia & Pacific Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 32: China Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 33: China Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 34: China Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 35: China Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 36: India Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 37: India Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 38: India Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 39: India Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 40: Japan Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 41: Japan Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 42: Japan Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 43: Japan Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Table 44: Middle East and Africa Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 45: Middle East and Africa Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Physical Form

Table 46: Middle East and Africa Market Value (US$ million) and Volume (Tons) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Grade

Table 47: Middle East and Africa Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 48: Middle East and Africa Market Value (US$ million) and Volume (Tons) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By End Use Industry

Figure 01: Global Market Split by Physical Form, 2023

Figure 02: Global Market Split by Grade, 2023

Figure 03: Global Market Split by Application, 2023

Figure 04: Global Market Split by End Use Industry, 2023

Figure 05: Global Neopentyl Glycol (NPG) Market Historical Volume (Tons), 2018 to 2022

Figure 06: Global Neopentyl Glycol (NPG) Market Volume (Tons) Forecast, 2023 to 2033

Figure 07: Global Market Historical Value (US$ million), 2018 to 2022

Figure 08: Global Market Value (US$ million) Forecast, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity, 2023 and 2033

Figure 10: Global Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 11: Global Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 12: Global Market Attractiveness by Physical Form, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity by Flake Segment, 2023 to 2033

Figure 14: Global Market Absolute $ Opportunity by Molten Segment, 2023 to 2033

Figure 15: Global Market Absolute $ Opportunity by Slurry Segment, 2023 to 2033

Figure 16: Global Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 17: Global Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 18: Global Market Attractiveness by Grade, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by Pharmaceutical Segment, 2023 to 2033

Figure 20: Global Market Absolute $ Opportunity by Technical Segment, 2023 to 2033

Figure 21: Global Market Share and BPS Analysis by Application– 2023 & 2033

Figure 22: Global Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 23: Global Market Attractiveness by Application, 2018 to 2033

Figure 24: Global Market Absolute $ Opportunity by Paints & Coatings Segment, 2023 to 2033

Figure 25: Global Market Absolute $ Opportunity by Adhesives & Sealants Segment, 2023 to 2033

Figure 26: Global Market Absolute $ Opportunity by Lubricants Segment, 2023 to 2033

Figure 27: Global Market Absolute $ Opportunity by Plasticizers Segment, 2023 to 2033

Figure 28: Global Market Absolute $ Opportunity by Insulation Materials Segment, 2023 to 2033

Figure 29: Global Market Absolute $ Opportunity by Others Segment, 2023 to 2033

Figure 30: Global Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 31: Global Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 32: Global Market Attractiveness by End Use Industry, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by Automotive & Transportation Segment, 2023 to 2033

Figure 34: Global Market Absolute $ Opportunity by Building & Construction Segment, 2023 to 2033

Figure 35: Global Market Absolute $ Opportunity by Industrial Plant & Equipment Segment, 2023 to 2033

Figure 36: Global Market Absolute $ Opportunity by Furniture & Interiors Segment, 2023 to 2033

Figure 37: Global Market Absolute $ Opportunity by Others Segment, 2023 to 2033

Figure 38: Global Market Share and BPS Analysis by Region– 2013, 2023 and 2033

Figure 39: Global Market Y-o-Y Analysis by Region– 2023 and 2033

Figure 40: Global Market Attractiveness Analysis by Region – 2023 and 2033

Figure 41: North America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 42: Western Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 43: Eastern Europe Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 44: Latin America Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 45: South East Asia & Pacific Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 46: China Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 47: India Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 48: Japan Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 49: Middle East and Africa Market Absolute $ Opportunity (US$ million), 2018 to 2033

Figure 50: North America Market Share and BPS Analysis by Country– 2023 & 2033

Figure 51: North America Market Y-o-Y Growth Projections by Country, 2018 to 2033

Figure 52: North America Market Attractiveness by Country, 2018 to 2033

Figure 53: The United States Market Absolute $ Opportunity, 2023 to 2033

Figure 54: Canada Market Absolute $ Opportunity, 2023 to 2033

Figure 55: North America Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 56: North America Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 57: North America Market Attractiveness by Physical Form, 2018 to 2033

Figure 58: North America Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 59: North America Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 60: North America Market Attractiveness by Grade, 2018 to 2033

Figure 61: North America Market Share and BPS Analysis by Application– 2023 & 2033

Figure 62: North America Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 63: North America Market Attractiveness by Application, 2018 to 2033

Figure 64: North America Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 65: North America Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 66: North America Market Attractiveness by End Use Industry, 2018 to 2033

Figure 67: Western Europe Market Share and BPS Analysis by Country– 2023 & 2033

Figure 68: Western Europe Market Y-o-Y Growth Projections by Country, 2018 to 2033

Figure 69: Western Europe Market Attractiveness by Country, 2018 to 2033

Figure 70: Germany Market Absolute $ Opportunity, 2023 to 2033

Figure 71: The United Kingdom Market Absolute $ Opportunity, 2023 to 2033

Figure 72: France Market Absolute $ Opportunity, 2023 to 2033

Figure 73: Italy Market Absolute $ Opportunity, 2023 to 2033

Figure 74: Spain Market Absolute $ Opportunity, 2023 to 2033

Figure 75: Rest of Western Europe Market Absolute $ Opportunity, 2023 to 2033

Figure 76: Western Europe Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 77: Western Europe Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 78: Western Europe Market Attractiveness by Physical Form, 2018 to 2033

Figure 79: Western Europe Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 80: Western Europe Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 81: Western Europe Market Attractiveness by Grade, 2018 to 2033

Figure 82: Western Europe Market Share and BPS Analysis by Application– 2023 & 2033

Figure 83: Western Europe Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 84: Western Europe Market Attractiveness by Application, 2018 to 2033

Figure 85: Western Europe Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 86: Western Europe Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 87: Western Europe Market Attractiveness by End Use Industry, 2018 to 2033

Figure 88: Eastern Europe Market Share and BPS Analysis by Country– 2023 & 2033

Figure 89: Eastern Europe Market Y-o-Y Growth Projections by Country, 2018 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2018 to 2033

Figure 91: Russia Market Absolute $ Opportunity, 2023 to 2033

Figure 92: Poland Market Absolute $ Opportunity, 2023 to 2033

Figure 93: Rest of Eastern Europe Market Absolute $ Opportunity, 2023 to 2033

Figure 94: Eastern Europe Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 95: Eastern Europe Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 96: Eastern Europe Market Attractiveness by Physical Form, 2018 to 2033

Figure 97: Eastern Europe Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 98: Eastern Europe Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 99: Eastern Europe Market Attractiveness by Grade, 2018 to 2033

Figure 100: Eastern Europe Market Share and BPS Analysis by Application– 2023 & 2033

Figure 101: Eastern Europe Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 102: Eastern Europe Market Attractiveness by Application, 2018 to 2033

Figure 103: Eastern Europe Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 104: Eastern Europe Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 105: Eastern Europe Market Attractiveness by End Use Industry, 2018 to 2033

Figure 106: Latin America Market Share and BPS Analysis by Country– 2023 & 2033

Figure 107: Latin America Market Y-o-Y Growth Projections by Country, 2018 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2018 to 2033

Figure 109: Brazil Market Absolute $ Opportunity, 2023 to 2033

Figure 110: Mexico Market Absolute $ Opportunity, 2023 to 2033

Figure 111: Rest of Latin America Market Absolute $ Opportunity, 2023 to 2033

Figure 112: Latin America Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 113: Latin America Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 114: Latin America Market Attractiveness by Physical Form, 2018 to 2033

Figure 115: Latin America Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 116: Latin America Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 117: Latin America Market Attractiveness by Grade, 2018 to 2033

Figure 118: Latin America Market Share and BPS Analysis by Application– 2023 & 2033

Figure 119: Latin America Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 120: Latin America Market Attractiveness by Application, 2018 to 2033

Figure 121: Latin America Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 122: Latin America Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 123: Latin America Market Attractiveness by End Use Industry, 2018 to 2033

Figure 124: South East Asia & Pacific Market Share and BPS Analysis by Country– 2023 & 2033

Figure 125: South East Asia & Pacific Market Y-o-Y Growth Projections by Country, 2018 to 2033

Figure 126: South East Asia & Pacific Market Attractiveness by Country, 2018 to 2033

Figure 127: South Korea Market Absolute $ Opportunity, 2023 to 2033

Figure 128: ASEAN Market Absolute $ Opportunity, 2023 to 2033

Figure 129: ANZ Market Absolute $ Opportunity, 2023 to 2033

Figure 130: Rest of SEAP Market Absolute $ Opportunity, 2023 to 2033

Figure 131: South East Asia & Pacific Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 132: South East Asia & Pacific Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 133: South East Asia & Pacific Market Attractiveness by Physical Form, 2018 to 2033

Figure 134: South East Asia & Pacific Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 135: South East Asia & Pacific Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 136: South East Asia & Pacific Market Attractiveness by Grade, 2018 to 2033

Figure 137: South East Asia & Pacific Market Share and BPS Analysis by Application– 2023 & 2033

Figure 138: South East Asia & Pacific Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 139: South East Asia & Pacific Market Attractiveness by Application, 2018 to 2033

Figure 140: South East Asia & Pacific Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 141: South East Asia & Pacific Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 142: South East Asia & Pacific Market Attractiveness by End Use Industry, 2018 to 2033

Figure 143: China Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 144: China Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 145: China Market Attractiveness by Physical Form, 2018 to 2033

Figure 146: China Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 147: China Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 148: China Market Attractiveness by Grade, 2018 to 2033

Figure 149: China Market Share and BPS Analysis by Application– 2023 & 2033

Figure 150: China Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 151: China Market Attractiveness by Application, 2018 to 2033

Figure 152: China Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 153: China Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 154: China Market Attractiveness by End Use Industry, 2018 to 2033

Figure 155: India Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 156: India Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 157: India Market Attractiveness by Physical Form, 2018 to 2033

Figure 158: India Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 159: India Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 160: India Market Attractiveness by Grade, 2018 to 2033

Figure 161: India Market Share and BPS Analysis by Application– 2023 & 2033

Figure 162: India Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 163: India Market Attractiveness by Application, 2018 to 2033

Figure 164: India Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 165: India Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 166: India Market Attractiveness by End Use Industry, 2018 to 2033

Figure 167: Japan Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 168: Japan Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 169: Japan Market Attractiveness by Physical Form, 2018 to 2033

Figure 170: Japan Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 171: Japan Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 172: Japan Market Attractiveness by Grade, 2018 to 2033

Figure 173: Japan Market Share and BPS Analysis by Application– 2023 & 2033

Figure 174: Japan Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 175: Japan Market Attractiveness by Application, 2018 to 2033

Figure 176: Japan Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 177: Japan Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 178: Japan Market Attractiveness by End Use Industry, 2018 to 2033

Figure 179: Middle East and Africa Market Share and BPS Analysis by Country– 2023 & 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth Projections by Country, 2018 to 2033

Figure 181: Middle East and Africa Market Attractiveness by Country, 2018 to 2033

Figure 182: GCC Countries Market Absolute $ Opportunity, 2023 to 2033

Figure 183: South Africa Market Absolute $ Opportunity, 2023 to 2033

Figure 184: Rest of Middle East and Africa Market Absolute $ Opportunity, 2023 to 2033

Figure 185: Middle East and Africa Market Share and BPS Analysis by Physical Form– 2023 & 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth Projections by Physical Form, 2018 to 2033

Figure 187: Middle East and Africa Market Attractiveness by Physical Form, 2018 to 2033

Figure 188: Middle East and Africa Market Share and BPS Analysis by Grade– 2023 & 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth Projections by Grade, 2018 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Grade, 2018 to 2033

Figure 191: Middle East and Africa Market Share and BPS Analysis by Application– 2023 & 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth Projections by Application, 2018 to 2033

Figure 193: Middle East and Africa Market Attractiveness by Application, 2018 to 2033

Figure 194: Middle East and Africa Market Share and BPS Analysis by End Use Industry– 2023 & 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth Projections by End Use Industry, 2018 to 2033

Figure 196: Middle East and Africa Market Attractiveness by End Use Industry, 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Neopentyl Polyhydric Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glycol Ethers Market Analysis by Type, Application, End Use Industry, and Region 2025 to 2035

Glycol Monostearate Market Insights – Growth & Industrial Applications 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

Thioglycolate Market Analysis Size and Share Forecast Outlook 2025 to 2035

Polyglycolic Acid Market

Thioglycolic Acid Market

Hydroglycolic Extracts Market

Water Glycol Based Electric Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

Butyl Glycol Market Growth - Trends & Forecast 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

E-Series Glycol Ether Market Size and Share Forecast Outlook 2025 to 2035

Hexylene Glycol Market Trends 2025 to 2035

Caprylyl Glycol Market Growth – Trends & Forecast 2024-2034

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Methyl Ether Market

1,3-Butylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA