The global Polyalkylene Glycol (PAG) market is estimated to reach USD 392.2 million in 2025 and further expand to USD 696.4 million by 2035, registering a CAGR of 5.9% over the forecast period. PAGs are increasingly utilized across industries such as automotive, aerospace, personal care, and lubricants due to their superior solubility, biodegradability, and thermal stability.

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 392.2 million |

| Industry Value (2035F) | USD 696.4 million |

| CAGR (2025 to 2035) | 5.9% |

In 2024, North America witnessed a surge in PAG demand, driven by increased use in synthetic lubricants for EVs and HVAC systems. According to the USA Energy Information Administration (EIA), growth in energy-efficient building systems contributed to PAG use in air-conditioning and compressor oils. In Asia-Pacific, China and South Korea led demand in cosmetics and polyurethane foams, where PAG acts as a key intermediate for surfactants and flexible foams.

In Europe, tightening environmental standards and REACH regulations accelerated the shift to biodegradable lubricants and functional fluids. Manufacturers across Germany and France increased production of water-soluble PAGs to support automotive OEMs and aerospace hydraulic system suppliers.

With increasing emphasis on sustainability and regulatory compliance, biodegradable lubricants made from PAG are gaining traction across industrial and automotive sectors. PAGs offer excellent oxidative stability and are non-toxic, making them ideal for applications in food-grade machinery, marine environments, and eco-sensitive zones.

The push for reducing environmental impact in sectors like forestry, agriculture, and water treatment is accelerating the shift from mineral oils to PAG-based formulations. Key markets such as Europe and North America are witnessing rapid adoption, supported by stringent VOC and emission standards and growing awareness among OEMs and maintenance service providers.

The EV boom is driving demand for high-performance synthetic fluids, where PAG-based lubricants are preferred for thermal stability, dielectric properties, and long service life. PAGs are increasingly used in electric drivetrains, e-compressors, and battery cooling systems.

Their non-conductivity and compatibility with copper materials make them suitable for EV-specific applications. Leading OEMs are partnering with lubricant manufacturers to co-develop formulations tailored for high-voltage environments. As e-mobility expands in Asia, Europe, and North America, PAG usage is expected to surge, especially in vehicles requiring specialized fluids for extended maintenance cycles and thermal management systems.

PAGs are increasingly used in skin care, hair care, and pharmaceutical formulations due to their low toxicity, moisture retention capabilities, and solubility. Their role as humectants, emulsifiers, and dispersants supports applications in creams, ointments, and topical drugs. The trend toward clean-label, non-irritating, and multifunctional ingredients has enhanced PAG’s appeal in cosmeceuticals and OTC formulations.

With rising personal hygiene awareness and growth in the wellness industry, demand is growing, particularly in Asia-Pacific and Latin America. Manufacturers are developing medical-grade PAGs that meet USP and EP standards, expanding their relevance in health, wellness, and life sciences applications.

Lubricants are expected to dominate with 38% of the global PAG market share in 2025, forecast to grow at a CAGR of 5.8% through 2035. PAG-based lubricants are widely used in compressors, gearboxes, and industrial machinery, offering excellent high-temperature stability, water solubility, and shear resistance.

As synthetic lubricants gain traction in EVs, wind turbines, and food-grade applications, OEMs are increasingly selecting PAGs for their extended service life and compatibility with modern system materials. Companies are also blending PAGs with esters and PAOs to enhance performance in sealed-for-life systems and environmentally sensitive zones.

PAGs used in polyurethane (PU) production are projected to account for around 26% market share in 2025, with steady growth expected through 2035. As a polyol feedstock, PAG contributes to the flexibility and resilience of PU foams used in bedding, insulation, and automotive interiors. Rising construction activity and consumer preference for energy-efficient materials support demand in building insulation.

In developing regions, particularly Southeast Asia and Latin America, growing middle-class populations and housing projects are boosting PU consumption, which directly benefits PAG suppliers. Material innovation is also encouraging the development of bio-based PAGs to meet sustainability goals in PU chemistry.

Feedstock Volatility, Cost Barriers, and Product Substitution

Ethylene and propylene oxide price fluctuations considerably affect the production cost. In some developing regions, awareness of PAG's environmental benefits compared to conventional mineral oils is still limited, which is an impediment to adoption. Additional market competition is attributed to ester- and silicone-based fluids used in high performance and temperature-critical applications

Bio-based PAGs, Industrial Automation, and Sustainable Chemistry

PAGs based on bio-sourced glycerine and renewable feedstocks have significant markets in the pharmaceutical, biodegradable greases and personal care formulations sectors. In the area of metal finishing, gearboxes, and hydraulics, PAGs will play a vital role as industrial automation and precision manufacturing continue to grow. Driven by the EU and North America the green chemistry trend in formulation science is predicted to make PAGs an important input for sustainable and circular product design.

Robust demand for automotive, aerospace, and industrial lubricants will continue to drive the growth of the USA polyalkylene glycol market. As synthetic lubricants, PAG-based products are favoured for their superior thermal stability, biodegradability, and service life, specifically in high-performance engine oil and compressor fluid.

A focus on sustainable manufacturing and energy efficiency in the country is driving adoption in refrigeration systems, metalworking fluids, and hydraulic applications. USA chemical companies are also developing customized formulations of PAG for new applications, including 3D printing and CO₂-based cooling technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The United Kingdom is also witnessing gradual growth of polyalkylene glycol market driven by increasing demand for eco-friendly lubricants in manufacturing and transportation. PAGs are gaining traction in wind turbine gear oils, food-grade lubricants, and precision machining as companies look to reduce emissions and improve energy efficiency.

Regulatory harmonization with EU REACH standards and growing emphasis on low-toxicity, non-hazardous fluids are also promoting PAG use. Domestic innovation is also seen in water-soluble PAGs used in textile processing and heat transfer systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Germany, France, and the Netherlands are the key countries in the EU polyalkylene glycol market, owing to the strong presence of the industrial automation, automotive production and environmental regulation. Growing use of synthetic, hypergalactic lubricants in the compressors, gearboxes, and turbines are contributing to positive demand for the same.

Increased adoptions are also due new EU mandates for biodegradable fluids in marine and forestry equipment. Regional PAG blends adapted to renewable energy systems and EV thermal management are a key focus for manufacturers. Innovations across sectors are enabling penetration of foam control agents and surfactant applications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

Japan polyalkylene glycol market is on a steady growth trajectory due to increasing demand from precision engineering, electronics manufacturing, and assembly lines in automotive sector. PAG-based lubricants are preferred owing to their low volatility, oxidation resistance, and compatibility with high-speed, high-load machinery.

Japan’s heavy emphasis on sustainable manufacturing is driving the adoption of PAGs with water-soluble and low-toxicity properties, particularly in metal cutting fluids, robotics and refrigerant compressors. Domestic R&D is also looking at new uses, including carbon capture, energy storage and advanced coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

In South Korea, demand from the automotive, semiconductor, and industrial machinery industries is driving rapid growth in the polyalkylene glycol market. PAGs are widely utilized for cleanroom lubricants, synthetic greases and polymer processing aids.

The country’s drive toward sustainable manufacturing and circular economy practices is propelling the adoption of biodegradable and low-emission lubricant systems. South Korea chemical companies are seeing capacity expansion for the high-purity PAGs used in specialty surfactants and thermal fluids in electronics cooling/battery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

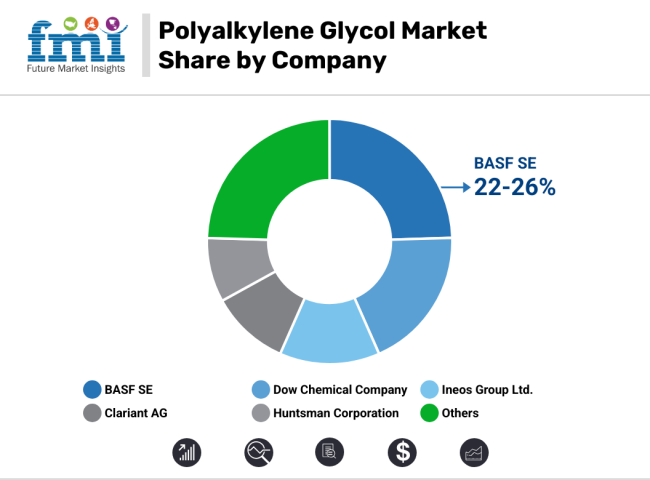

The global PAG market is highly competitive, with companies focusing on eco-friendly, high-performance formulations tailored for specialized industries. Key players are expanding their production capacities in Asia-Pacific to cater to rising demand for lubricants, foams, and surfactants.

Vertical integration and backward linkages into ethylene oxide supply are becoming prevalent strategies to improve profit margins and ensure raw material availability. Investments in bio-based PAGs and research in hybrid polymer systems are enabling product differentiation. Strategic partnerships with OEMs and packaging players are helping suppliers develop PAGs for targeted applications, such as environmentally compliant metalworking fluids and foam control agents in industrial processing.

The overall market size for the polyalkylene glycol market was USD 392.2 million in 2025.

The polyalkylene glycol market is expected to reach USD 696.4 million in 2035.

The demand for polyalkylene glycol will be driven by increasing applications in lubricants, surfactants, and polyurethane foams, rising demand for biodegradable and water-soluble polymers, growing use in automotive and aerospace industries, and advancements in eco-friendly formulations.

The top 5 countries driving the development of the polyalkylene glycol market are the USA, China, Germany, Japan, and South Korea.

The water soluble polyalkylene glycols segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glycol Ethers Market Analysis by Type, Application, End Use Industry, and Region 2025 to 2035

Glycol Monostearate Market Insights – Growth & Industrial Applications 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

Thioglycolate Market Analysis Size and Share Forecast Outlook 2025 to 2035

Polyglycolic Acid Market

Thioglycolic Acid Market

Hydroglycolic Extracts Market

Water Glycol Based Electric Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

Butyl Glycol Market Growth - Trends & Forecast 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

E-Series Glycol Ether Market Size and Share Forecast Outlook 2025 to 2035

Hexylene Glycol Market Trends 2025 to 2035

Caprylyl Glycol Market Growth – Trends & Forecast 2024-2034

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Propylene Glycol Methyl Ether Market

1,3-Butylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Monoethylene Glycol MEG Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA