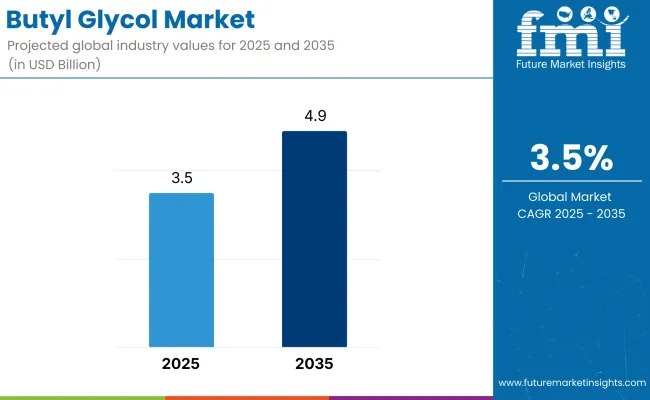

The global butyl glycol market is estimated at USD 3.5 billion in 2025. It is projected to grow at a CAGR of 3.5% during the forecast period, reaching USD 4.9 billion by 2035. The market growth is catalyzed by the expanding application of butyl glycol in paints, coatings, and industrial cleaners, particularly across emerging markets and high-growth construction sectors.

Applications of butyl glycol in paints and coatings have remained foundational due to a surge in demand across construction and automotive sectors. Butyl glycol has been prioritized due to its efficient solvency, moderate evaporation rate, and compatibility with aqueous systems.

In Eastman Chemical Company’s 2025 Q1 earnings transcript, CEO Mark Costa stated that solvent-grade glycol ethers “remain essential in supporting architectural coating systems in Asia-Pacific and the Middle East.” In the same period, BASF SE’s regional performance review recorded double-digit sales growth in coatings solutions across Southeast Asia, underscoring the material’s commercial indispensability.

Butyl glycol’s adoption in the industrial cleaning segment has also intensified. In 2024, Dow Inc. launched its ECOSOLVE formulations-incorporating butyl glycol to meet low-VOC regulatory mandates without compromising efficacy. The product bulletin from Dow’s Performance Materials division emphasized that these cleaners “surpassed EU 2024 VOC thresholds while delivering 15% improved degreasing efficiency compared to legacy solutions.”

Regulatory alignment has remained a key enabler of market continuity. The European Chemicals Agency’s March 2025 REACH report confirmed that butyl glycol maintains full authorization under Annex XVII for its use in low-emission paints and industrial coatings. This status has been welcomed by coatings manufacturers due to growing demand for indoor air quality compliance.

Advancements in additive technology have further reinforced market value. In its 2024 Applied Sciences Innovation Digest, Clariant detailed a new dispersion enhancer that significantly improves butyl glycol’s solubility stability under varied pH conditions. According to Dr. Julia Finke, Clariant’s Head of Dispersant R&D, “this enhancement allows consistent performance in coating systems designed for humid tropical climates.”

Despite elevated feedstock volatility observed in 2025 due to ethylene pricing shifts, stability in downstream demand and supply chain integration by producers has ensured market resilience. Regional momentum, led by India, Vietnam, and Saudi Arabia, is expected to drive future demand due to infrastructure investment, construction growth, and demand for compliant industrial formulations.

Butyl glycol market expansion is accompanied by many industries that integrate more specialized uses in their process, from high-purity solvents to specialty chemical intermediates. Butyl glycol as a colourless viscous liquid, is a versatile chemical compound, acting as an excellent solubilizing agent, evaporating and chemical reactions control-agent. The continuous requirement of the market is led by the relatively high usage of this chemical in the manufacturing of paints and coatings, printing inks, metalworking fluids, and polymer.

Butyl glycol is primarily used as a solvent in the market owing to its high solvency power, a slow evaporation rate, and excellent compatibility with resins and pigments resulting in it being processed by producers worldwide to reap the maximum benefits offered by butyl glycol. In paints, coatings and printing inks, it is a flow, adhesion and film-forming aid that ensures optimal finishes and durability.

The paints and coatings industry remains one of the major consumers of butyl glycol solvents; formulators make use of it in both waterborne and solvent-based coatings. Butyl glycol is also critical to viscosity increase and tooth development that promote pigment dispersion but also dry retardation that allows flowing application and uniformity on the substrate.

Architectural coatings producers employ butyl glycol to improve the workability and levelling characteristics of interior and outdoor paints. With latex-type paints, it acts as a coalescing agent, allowing polymer particles to flow into each other and thus forming a uniform and protective film.

Manufacturers of industrial coatings prefer butyl glycol because it can dissolve resins and additives and yield durable coatings for metals and wood finishes, and in automotive uses. High textile coatings contain butyl glycol for gloss retention, scratch resistance, and corrosion protection in the automotive industry.

Butyl glycol (also called butyldiglycol) is used in the formulation of marine and protective coatings as well to impart resistance to moisture, chemicals, and environmental exposure. High performance anti-corrosive coatings increasingly use butyl glycol to improve coating adhesion and durability and are used in the marine, shipbuilding and offshore industries.

Butyl glycol is utilized as a solvent that improves the pigment distribution, evaporation rate, and clarity of the print in the sector of printing inks industry. Ink formulators prefer butyl glycol for its ability to dissolve a very wide range of resins, which makes it applicable to flexo, gravure and screen-printing inks - all categories that need to manage many different resin solutions.

For ink manufacturers of flexographic it is important to have an ingredient of butyl glycol to have ink for smooth transfer, better control of drying, and lesser viscosity problem. All the packaging industries like labels, flexible packaging and corrugated board prints use butyl glycol based inks to get high definition prints with durable colour stability.

It also makes water-based inks more water-soluble and hence vital for the environmental printing formulations. With a growing number of restrictions being applied to VOC (volatile organic compound) emissions, the manufacturers are seeking low-VOC solvent alternatives for their applications, which has aided the growth in demand butyl glycol in waterborne ink systems.

Butyl glycol is also an important chemical intermediate in the manufacture of polymers, plastics, and metalworking fluids. Its reactivity and compatibility with chemical synthesis makes it a precursor during resin production, plastic formulations and lubrication processes.

The polymer and plastics industry uses butyl glycol as a chemical intermediate in the production of resins, predominantly acrylics, epoxies, and alkyd resins. Manufacturers utilized butyl glycol in the production of plasticizers and polymer additives that enhance the flexibility, durability and chemical resistance of the materials.

Photo credit: Allentown in the country Butyl Glycol is used in plastic manufacturers that produce polyvinyl chloride (PVC) additives, which results in better process ability and impact resistance for plastic films and automotive interiors and construction materials.

Acrylic resin manufactures use butyl glycol to prepare thermoplastic and thermoset polymer formulations. These comprise acrylic-based polymers that are employed in manufacturing optical lenses, adhesives and impact-resistant plastic substances.

Butyl glycol intermediates may be used to improve the cross-linking efficiency of reactive adhesive formulations in the adhesives and sealants industry. Structural adhesives, laminates and sealants Manufacturers: Butyl glycol is an important ingredient in structural adhesives, laminates and sealants manufacturers which promote adhesion efficiency and chemical bonding.

Taste and demand for high-performance and sustainable plastics are the major factors driving the growth of the butyl glycol-based polymer intermediary market. Butyl Glycol: Innovations in Downstream Utility with Tomorrow Industries December 5, 2022 An industry as a whole shifts toward its resinous, lightweight, plastic, flexible, and tough options all manifestly learnt success stories - however recycled butyl glycol is still a heady player in the upper end of polymers.

It is used extensively in formulating cutting fluids, coolants, and lubricants that aid metalworking, machining, and fights corrosion in the metalworking realm. Manufacturers add butyl glycol to water-soluble metalworking fluids, where it serves as a stabilizer, emulsifier and dispersant.

Therefore, butyl glycol is used by cutting fluids manufacturers due to excellent lubrication properties and increased cooling efficiency especially in high-speed machining, grinding and milling applications. Coolants based on glycols minimize deformation and surface damage of metals contributing towards an increased lifespan of machining components and tools.

It is also used in anti-corrosion lubricants and rust-preventive coatings to provide better binding and moisture resistance on metal surfaces. Butyl glycol is a powerful carrier for metalworking fluids in automotive and aerospace sectors including precision machining and surface preparation.

The use of automation and precision machining is growing and along with it, the need for higher performance metalworking fluids is also growing. Their unique properties are ideal for metal fabrication and processing, as Butyl Hydroxystearate formulations provide extreme lubrication, enhanced thermal stability, and lower wear.

North America accounts for the largest share of the butyl glycol market, with the United States and Canada being the largest consumers. The region's construction, automotive, and manufacturing sectors stimulate steady demand for butyl glycol-based paints, coatings, and industrial cleaners.

Moreover, established regulatory agencies like the Environmental Protection Agency (EPA) are getting strict regarding VOC emissions, leading to manufacturers creating low-VOC solvent options. A growing emphasis on sustainability and eco-friendly cleaning solutions is changing market dynamics and pushing enterprises to look at greener formulations to stay compliant with environmental regulations.

Europe continues to be a key market, especially in Germany, France, and the United Kingdom, where industrial production, automotive manufacturing, and architectural coatings drive major demand. Furthermore, the enforcement of stringent chemical regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is pushing towards low emission, water-based formulations that are in line with sustainability objectives.

The strong demand for high-performance cleaning agents, specialty coatings, and chemical intermediates are anticipated to support the market, however, challenges in the form of regulatory compliance and price fluctuations of raw materials may hinder market players.

Butyl glycol market in the Asia-Pacific region is expected to witness the highest-growth segment, led by China, India, Japan, and South Korea. The drive for paints, coatings, and cleaning solvents is stoked by rapid construction, urban infrastructure growth, and increasing industrial output.

China, the leading butyl glycol producer and user, dominates global supply chains with its sophisticated systems for chemical manufacturing. In India, the textile, detergent and pharmaceutical sectors are making a major contribution to regional demand. But growing regulatory scrutiny of chemical emissions and industrial waste is prompting businesses to move toward greener production technologies.

Challenges

Growing regulatory restrictions on VOC emissions and worker safety are key challenges for butyl glycol market. Stringent environmental policies around the world are pressuring manufacturers to reformulate chemical compositions, reduce toxicity levels, and move to different bio-based solvents.

Smaller players in our industry do not have the financial muscle to stay along the evolving regulatory expectations, which mandate huge investments into research and development to comply. Production costs are, thus, sensitive to price fluctuations in raw materials, such as ethylene and propylene derivatives, translating into volatile margins.

Opportunities

Nonetheless, there are some opportunities for the growth of the market. However, butyl glycol-based products are expected to face opportunities across key application zones where manufacturers are constantly seeking for higher performance under stringent environmental compliance and coating manufacturers are striving to turn to eco-friendly industrial cleaners and water-based coatings to curb pollution.

For example, high-performance chemical solvents are used in the manufacture of batteries for these vehicles and in their cooling systems, and the anticipated increase in the adoption of electric vehicles (EVs) is also generating demand for them, providing a new avenue of growth for the suppliers of butyl glycol.

The post-pandemic focus of home and industrial hygiene and sanitation fuelling the demand for industrial cleaning solutions will further complement the butyl glycol consumption. The improved solvency and degreasing properties of cleaning agents aimed at businesses and consumers are bringing in butyl glycol to be one of the most used ingredients in commercial or industrial detergents. Furthermore, the pharmaceutical industry is booming, propelling demand for butyl glycol as an excipient in drug formulations, making it a versatile chemical across various sectors.

From 2020 to 2024, the butyl glycol market expanded consistently, largely spurred by growing demand across paints & coatings, cleaning products, pharmaceuticals, and textiles. Butyl glycol is a water-soluble solvent with low volatility and good miscibility with oils and water, and it became an important compound in extractions of organic compounds and used in industrial and household cleaners, surface coatings, printing inks and synthetic resins.

The boom in construction and automotive industries skyrocket the market demand due to its significant role in improving paint adhesion, extending drying time, and increasing application efficiency. The largest outlet for butyl glycol was in the paints and coatings sector, which added the glycol to water-based and solvent-based formulations for smooth application, long durability, and better film strength.

The cleaning industry capitalized on butyl glycol’s grease-cutting and emulsification properties, so the chemical was widely used as a component in glass cleaners, degreasers, and multi-purpose cleaning agents. The butyl glycol was also used in cosmetic formulations, topical medicines, and industrial drug processing in the pharma and personal care industries.

However, the market was confronted with challenges like strict environmental regulations, increasing concerns about air pollution, and variations in raw materials costs. Regulatory agencies like the EPA (Environmental Protection Agency) and ECHA (European Chemicals Agency) put stringent restrictions on volatile organic compound (VOC) emissions, pushing manufacturers to seek eco-friendly, bio-based alternatives.

These restrictions, along with the negative environmental impact of certain solvents, would limit this in some key markets; however, green chemistry, biodegradable solvents, and sustainable extraction processes developed since have significantly countered this and allowed continued market growth.

However, only a few companies offer butyl glycol, which is likely to cause a fundamental change in the butyl glycol market from 2025 to 2035. They will also move towards low-VOC and biodegradable butyl glycol derivatives with an increased emphasis on high-performance butyl glycol derivatives in line with regulations and environmental initiatives.

The paints & coatings industry remains the largest market for butyl glycol, as demand for low-emission coatings, self-healing paints, and.smart coatings that respond to environmental conditions continues to grow. Nanotechnology-based formulations will be used in automotive and industrial coatings, providing better weather resistance, corrosion protection, and enhanced durability. Growing demand in the construction industry for energy-efficient building materials and zero-VOC formulations is expected to drive demand for bio-based solvents.

Butyl glycol will gradually be displaced in the cleaning and personal care industries by non-toxic, bio-derived solvents that improve air quality and safety and improve biodegradability. Fuel and water additives are a small part of a diverse set of promising cleaner versions of traditional solvents that companies are hoping to make a reality.

A few examples of innovations in the area of cleaner solvents cutting across the plastics space may include plant-based glycol ethers, enzymatic solvent production, and even AI-assisted formulation techniques to create products that perform on par with the existing crowd but that are more environmentally responsible. Smart cleaning solutions and antimicrobial coatings have become mainstream and will open up new applications in the market to support hygiene and sanitation calls around the world.

The drug formulation, sterilization processes, and solvent-based delivery systems are often expected to see increased usage of butyl glycol in the pharmaceutical and medical market. Innovations in bio-compatible solvents and pharmaceutical-grade glycol ethers will be guided by research, leading to greater efficacy, safety, and compliance with regulatory requirements.

In addition, innovations in recycling and circular economy will drive the market with the development of methods to recover butyl glycol, purification of butyl glycol by solvent extraction and processes to manufacture sustainable butyl glycol. Intelligent process optimization, distributed ledger technology for supply chain visibility, and the rise of micro-manufacturing will change the way industries operate, driving cost reduction, operational efficiency, and sustainability.

This growing focus on reducing carbon footprints and improving energy efficiency will also result in the adoption of green manufacturing technologies associated with eco-friendly industrial solvents. They are going to build facilities powered by Renewable energy, which will produce solvents and contribute to economic and environmental sustainability.

To advance the synthesis methods of butyl glycol with minimal waste generation and overall efficiency, research into enzymatic bio-catalysis will be a pathway towards its development [24]. Also, increased availability of biodegradable and non-toxic solvent substitutes will meet the growing consumer need to safer and nature friendly wipes and personal care products. You are schooled until October 2023.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Transitions | 2020 to 2024 |

|---|---|

| Regulatory Landscape | VOC emissions were regulated by governments and safety standards for solvents. |

| Technological Advancements | Industries introduced high-power glycol ethers, synthetic solvents, and sustainable coatings. |

| Industry Applications | Butyl glycol used to have widespread use in paints, coatings, cleaners, pharmaceuticals, and products containing resins. |

| Environmental Sustainability | Businesses experimented with green solvents and waste reduction measures. |

| Market Growth Drivers | The sectors that fuelled demand were construction, automotive, and industrial cleaning. |

| Dynamics of Manufacturing & Supply Chain | Supply chains struggled with shortages of raw materials, regulatory obstacles, and disruptions to logistics. |

| End-User Trends | Consumers sought economical, efficient solvents that met safety standards. |

| Investment in R&D | Funding focused on improving synthetic solvent efficiency, investigating paint additives, and developing cleaner formulations. |

| Infrastructure Development | Butyl glycol was used in industrial coatings, adhesives, and polymer resins. |

| Global Standardization | Regulations differed by region, affecting trade and compliance frameworks. |

| Smart Cleaning & Hygiene Innovations | Butyl glycol was included in multipurpose cleaners, degreasers, and disinfectants. |

| Pharmaceutical & Medical Applications | Butyl glycol was employed in sterilization processes, drug formulations, and medical coatings. |

| Auto & Industrial Coatings | Butyl glycol improved paint adhesion, weather resistance, and corrosion protection. |

| Market Transitions | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter policies will require biodegradable, low-VOC alternatives to butyl glycol and for alternative products to be produced sustainably. |

| Technological Advancements | Future innovations will centre on bio-based solvent generation, AI-assisted formulation, and smart coatings. |

| Industry Applications | Growth would contribute to advanced nanocoatings, AI-optimized cleaning solutions, and bio-based industrial solvents. |

| Environmental Sustainability | Replacing with closed-loop solvent recycling, biodegradable glycol ethers, and carbon-neutral production. |

| Market Growth Drivers | Green building, smart coatings, and personalized home-care solutions will drive growth. |

| Dynamics of Manufacturing & Supply Chain | Companies will invest in localized production, AI-driven logistics, and circular economy-based supply chain models. |

| End-User Trends | As demand progresses, formulations of low-toxicity and bio-compatible solvents, as well as those obtained from plants, will be in focus. |

| Investment in R&D | Investments will shift to bioengineered glycol ethers, AI-driven chemical synthesis, and green alternatives. |

| Infrastructure Development | The global coatings market will trend toward sustainable coatings, antimicrobial surfaces, and VOC-free industrial applications. |

| Global Standardization | A common framework will create standardized solvent safety and environmental criteria and global regulatory policies. |

| Smart Cleaning & Hygiene Innovations | Advanced formulations will include intelligent antimicrobial coatings, self-cleaning surfaces, and AI-driven sanitation. |

| Pharmaceutical & Medical Applications | The next phase will focus on bio-compatible solvents, pharmaceutical-grade glycol ethers, and AI-mediated drug synthesis. |

| Auto & Industrial Coatings | Next-gen coatings will utilize self-healing formulations, nano-engineered barriers, and intelligent protective layers to enhance infrastructure durability. |

Applications of Butyl Glycol in the USA The chronic use of Butyl Glycol in the coatings, cleaning applications, pharmaceuticals, and textiles, elevates the demand for Butyl Glycol in the USA. Butyl Glycol is widely used as a solvent in a variety of applications including paints and coatings, an intermediate for well-known commercial cleaning products, industrial cleaners, and in automotive and construction production and manufacturing.

The soaring construction sector, predominantly in the commercial and residential areas, will further support the demand for Butyl Glycol-based coatings and paints as they offer excellent adhesion, gloss retention, and corrosion resistance. In addition, the increasing awareness regarding hygiene and stringent cleaning regulations in commercial areas, hospitals, and industrial facilities have propelled the usage of Butyl Glycol in surface disinfectants and cleaning agents.

As the environmental regulations are getting stricter per guidelines of the EPA (Environmental Protection Agency), manufacturers are switching to eco-friendly Butyl Glycol formulations that are in compliance with VOC (Volatile Organic Compound) emissions endorsing regulations.

Moreover, rising demand for bio-based solvents in chemical and pharmaceutical industry is anticipated to boost the market growth. Oil & gas sector expansion in US has also boosted Butyl Glycols consumption in hydraulic fracturing fluids and degreasers for cleaning machinery.

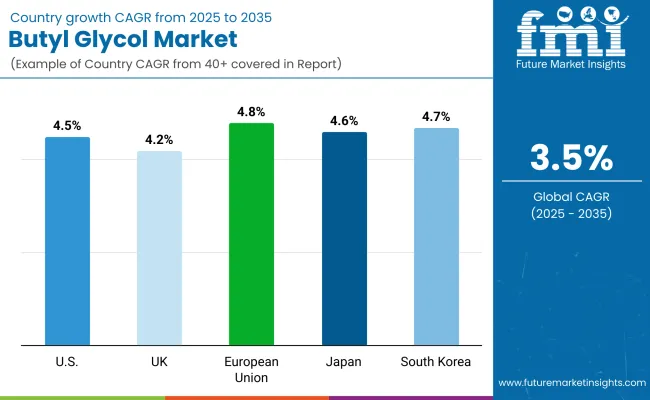

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

On the basis of applications, the market can be broken down into coating, chemical processing, industrial cleaning, and others. Butyl glycol based coatings are consumed in various end use industry such as construction and automotive is the major end use segment, the chemical and pharmaceuticals are its intermediate.

UK focus on sustainability and green chemistry is also driving low-VOC solvent solutions leading manufacturers to invest in eco-friendly Butyl Glycol derivatives. Due to Brexit as suppliers realign their supply chains, imports have been affected, which are catered to by the domestic manufacturing of Butyl Glycol and its derivatives as domestic demand grows.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The solid consumption of the high performance coating and cleaner induced due to the growth in industrial application and also supporting environmental regulations are efficiently pushing the European butyl glycol industry. Regulations such as the EU Green Deal and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) are pushing the market closer towards green, low-VOC Butyl Glycol alternatives.

Region specific data of major industrial countries, such as Germany, France and Italy will be the top consumers of Butyl Glycol owing to the presence of wide industrial, automotive and chemical production sectors. Additionally, the demand for advanced water-based coatings is increasing due to investments in sustainable construction, which is creating a significant market opportunity for Butyl Glycol.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

High-tech manufacturing, automotive coatings and industrial solvents are all strong catalysts propelling Japan goat Butyl Glycol depending on Expansion and Ongoing Development expansion. The Japan Butyl Glycol market is likely to grow at a healthy pace, owing to the presence of hydrocarbons and fragmented industrial ecosystem in electronics, semiconductor cleaning, paints, and pharmaceutical sectors therein.

Butyl Glycol finds application in high performance automotive coatings, corrosion resistant finishes and precision engineered surface treatments owing to the highly developed automotive sector in Japan. The emergence of electric vehicles (EVs) and autonomous vehicles burgeons the need for lightweight; yet, strong; coatings, which in turn will augment the demand for Butyl Glycol formulations.

High-Purity Solvents | Japan | Semiconductor and Electronics - In the cleaning and etching... Butyl Glycol is used in the generation of photoresist cleaning solution, circuit board, and silicon process chemical, the country is a global hub of semiconductor production

Low-VOC or bio-based solvents in Japan (where strict environmental legislations have consequently cultivated the development of greener solvents in line with green chemistry principles). Rising pharmaceuticals research and synthetic chemistry industries have resulted in applying Butyl Glycol as chemical intermediate in drugs synthesis, thereby expanding the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea Butyl Glycol Market Overview Some of the key factors responsible for shaping of South Korea Butyl Glycol market are growth of industrial solvents, petrochemical application, and specialty coatings. South Korea has been a central hub in semiconductor manufacturing, chemical processing, and automotive production, all of which have driven demand for Butyl Glycol-based products.

Major electronics manufacturers like Samsung and SK Hynix are based in South Korea and are making massive investments to produce semiconductors. Butyl Glycol is well-known for its application in semiconductor etch, photoresist strip and printed circuit board (PCB) manufacture & this process is a part of precision cleaning agents; therefore; Butyl Glycol Market is expected to grow significantly in the coming years.

This trend towards ever-shrinking electronic components requires increasingly high-performance cleaning solvents, a fact that can only serve to strengthen the position of Butyl Glycol in the industry.

Hyundai, Kia, and battery manufacturers have seen a huge rise in Butyl Glycol consumption in coating, lacquer and battery cell production due to the boom of the automotive industry. More South Korean electrophiles (green vehicle sort) EVs ordered the need of light technically robust coatings-a power drive for Butyl Glycol formulations.

Furthermore, as one of the largest global petrochemical hanok, the South Korea Butyl Glycol use is concentrated on various high value chemicals such as chemical processing, surfactants, industrial degreasers. Efforts by the government to reduce VOCs consumption and promote sustainability in chemistry are also stimulating the research and development of bio-based, low toxicity Butyl Glycol derivatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

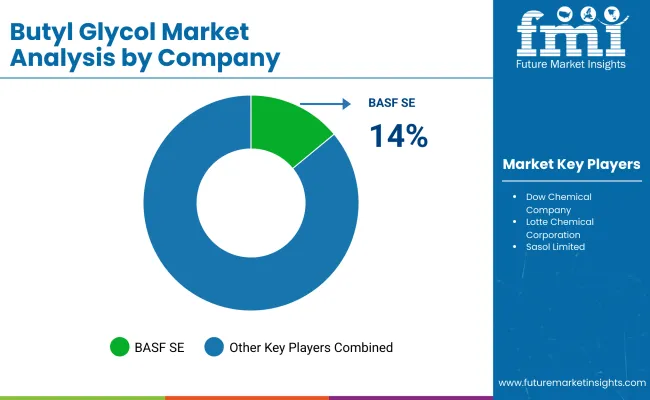

With various chemical makers, the butyl glycol market is fairly residential with several neighbourhood service providers catering to the variety of business applications. Butyl glycol is a very common compound that is used in paints and coatings, cleaning agents, which is anticipated to drive the butyl glycol market during the forecast period. Companies in this sector are characterized by a focus on sustainable production practices, compliance with regulations, as well as growth in emerging markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 14-19% |

| Eastman Chemical Company | 11-16% |

| Dow Chemical Company | 9-13% |

| Lotte Chemical Corporation | 6-10% |

| Sasol Limited | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Makes high-purity butyl glycol for coatings, textiles, and cleaners. Investing in sustainable production technologies. |

| Eastman Chemical Company | By keeping focus on performance and regulatory compliance, we create specialty solvents like butyl glycol. |

| Dow Chemical Company | Provides butyl glycol for paints, inks, and cleaning formulations, with a focus on low-VOC solutions. |

| Lotte Chemical Corporation | Produces butyl glycol for various industrial applications and aims to expand its market presence in the Asia-Pacific region. |

| Sasol Limited | Based in the USA, North America, it offers butyl glycol as part of its solvent portfolio and claims to have the ability to produce and assemble in the most cost-efficient manner through its supply chain. |

Key Company Insights

BASF SE (14-19%)

Tose corp- it is a global leader in the Butyl glycol market, delivering purest-quality solvents for the coatings, cleaners, and textile sectors. The brand continually invests in sustainable and energy-efficient production processes, with a firm international footing.

Eastman Chemical Company (11-16%)

Industrial uses of high-performance solvents and in particular Butyl Glycol | Eastman Chemical Company Regulatory compliance and innovative formulations are at the core of the company's priorities-preparing for the future of end-users.

Dow Chemical Company (9-13%)

Butyl glycol used in paints, inks and cleaning formulations is supplied by the Dow Chemical Company. It is focused on low-VOC and eco-friendly solutions, making it a big player in the market.

Lotte Chemical Corporation (6-10)

One of the key players in the global butyl glycols market, Lotte Chemical Corporation, manufactures the butyl glycol for various industries and aims on expanding its footprint in the Asia-Pacific region. The company is looking to strengthen its international distribution network.

Sasol Limited (4-8%)

As part of its various solvents, Sasol Limited provides butyl glycol. Thus, cost-effective production and supply chain efficiency are important ensuring the business is always present in the market.

The market is further driven by several other companies that contribute to its growth working in an innovative and cost-effective manner. These include:

The Butyl Glycol Market global market potential was USD 3.5 Billion in 2025.

Butyl Glycol Market is projected to hit USD 4.9 Billion by 2035.

As industries seek effective solvents to use in paints, coatings, and cleaning products, the demand for butyl glycol is set to grow. Its wide application in industrial cleaning, automotive coatings and textiles, further supports market growth. There are some other factors like innovative creation of chemical formulations, and increasing demand for green, low-volatil solvent that are propelling its demand.

Europe Union, Japan and South Korea are among the 5 countries where Butyl Glycol Market has seen development.

Solvent and Chemical Intermediate to dominate bulk share through the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Function, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Function, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Function, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Function, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Function, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Function, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Function, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Function, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Function, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Function, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Function, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Function, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Function, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Function, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

1,3-Butylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Butyl Acrylate Market Size and Share Forecast Outlook 2025 to 2035

Butyl Hydroxytoluene Market Analysis Size Share and Forecast Outlook 2025 to 2035

Butyl Stearate Market Size and Share Forecast Outlook 2025 to 2035

Butyl Elastomers Market-Trends & Forecast 2025 to 2035

Butylene-divinyl Fraction Market Growth – Trends & Forecast 2024-2034

N-Butylene Oxide 1,2 Market Size and Share Forecast Outlook 2025 to 2035

Dibutyl Ether Market Growth - Trends & Forecast 2025 to 2035

Competitive Overview of Tributyl Tin Fluoride Market Share

Isobutylene Market Growth – Trends & Forecast 2024-2034

Poly butylene Succinate Market Growth - Trends & Forecast 2025 to 2035

2-tert-Butylcyclohexanol Market Forecast and Outlook 2025 to 2035

4-tert-Butylcyclohexanone Market

Tertiary Butylhydroquinone Market

Acetyl Tributyl Citrate market Size and Share Forecast Outlook 2025 to 2035

Methyl Isobutyl Carbinol Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Tertiary Butyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Highly Reactive Polyisobutylene HR PIB Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA