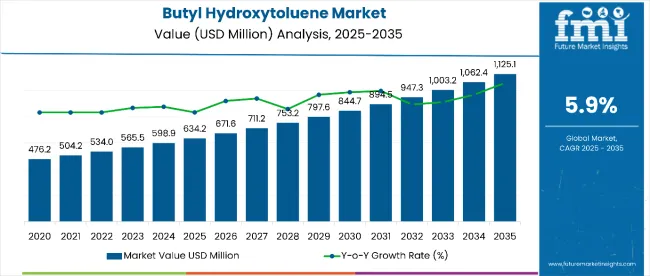

The butyl hydroxytoluene market is estimated to be valued at USD 634.2 million in 2025 and is projected to reach USD 1,125.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 634.2 million |

| Projected Value (2035F) | USD 1,125.1 million |

| CAGR (2025 to 2035) | 5.9% |

The market is expected to add an absolute dollar opportunity of USD 490.9 million during this period, reflecting 1.77 times growth. The evolving market demand is driven by the increasing use of butyl hydroxytoluene as a preservative in food, cosmetics, and pharmaceuticals due to its effective antioxidant properties.

By 2030, the market is projected to reach approximately USD 844.7 million, reflecting an incremental value of USD 210.5 million over the first half of the decade. Between 2030 and 2035, the market is expected to grow further to USD 1,125.1 million, adding another USD 280.4 million, indicating a moderately back-loaded growth trend.

Companies such as BASF SE, Lanxess AG, and Zhejiang NHU are strengthening their market position through extensive research and development, focusing on eco-friendly and high-performance antioxidant formulations. They are actively pursuing strategic collaborations, joint ventures, and partnerships to enhance global reach. Moreover, these companies are leveraging capacity expansions, cutting-edge production technologies, and strict compliance with international regulatory standards to effectively enter emerging markets and meet rising demand.

The butyl Hydroxytoluene (BHT) market holds a significant share across its parent industries, reflecting its widespread use as an antioxidant and stabilizer. In the food and beverage sector, BHT accounts for approximately 50% of the antioxidant usage, ensuring extended shelf life and product stability in processed foods, snacks, and edible oils. In cosmetics and personal care, BHT represents around 30% of the antioxidant segment, protecting lotions, creams, and hair products from oxidation. Pharmaceuticals and nutraceuticals collectively contribute about 15%, while industrial chemical applications account for roughly 5% of the overall BHT demand, emphasizing its functional versatility across sectors.

The market indicates a strong rise in demand for both natural and synthetic antioxidants, driven by increasing consumer awareness of food safety, product stability, and shelf-life extension. Manufacturers are innovating to enhance the biodegradability, safety, and overall efficacy of BHT derivatives, in line with evolving regulatory requirements and eco-focused initiatives. Stricter global regulations on food additives, cosmetics, and pharmaceuticals are prompting companies to reformulate products and adopt cleaner, safer antioxidant solutions. At the same time, growing emphasis on eco-friendly production, renewable sourcing, and green chemistry practices is shaping market strategies, encouraging investment in research and development for high-performance, environment-friendly BHT formulations.

The butyl hydroxytoluene market is growing due to its potent antioxidant properties, which prevent oxidation in food, beverages, cosmetics, and pharmaceutical products. Its effectiveness in extending shelf life and maintaining product quality has made BHT a vital ingredient for manufacturers aiming to ensure stability, safety, and longevity in processed goods.

Rising consumer awareness of food safety, product freshness, and cosmetic quality is further boosting BHT adoption. Supportive regulations promoting the use of approved preservatives along with the rising demand for functional ingredients in processed foods, personal care, and pharmaceutical applications are driving market growth.

Innovations in BHT formulations, including eco-friendly and compliant derivatives, along with expanding production capacities in emerging economies, are enhancing market penetration. With rising demand for high-performance antioxidants across industries, the market outlook remains robust, positioning BHT to meet evolving needs for preservation, stability, and regulatory adherence.

The market is segmented by raw material, application, distribution channel, and region. By raw materials, the market is bifurcated into hydroquinone and chlorophenol. Based on application, the market is segmented into pharmaceuticals, cosmetics and food. By distribution channel, the market is bifurcated into offline and online. Regionally, the market spans across North America, Europe, Asia-Pacific, Latin America, Japan and the Middle East & Africa.

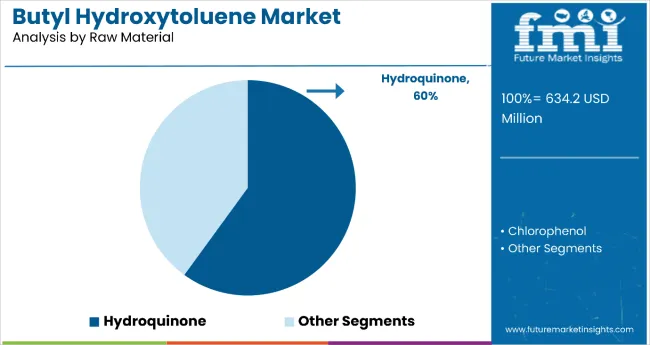

The hydroquinone raw material segment holds a dominant position with 60.0% of the market share, primarily due to its efficacy in stabilizing butyl hydroxytoluene (BHT) formulations. Hydroquinone serves as a critical precursor in antioxidant synthesis, enabling consistent quality and performance across diverse applications, including food preservation, cosmetics stabilization, and pharmaceutical formulations.

The widespread adoption of hydroquinone-based BHT is further supported by its cost-effectiveness, availability, and proven safety profile under regulatory approvals. Manufacturers prefer hydroquinone to optimize reaction yields, maintain oxidative stability, and ensure long-term shelf life in finished products.

Ongoing investments in higher-purity hydroquinone derivatives and supply chain expansion are improving product efficiency and market reach. As industries place greater emphasis on product safety, regulatory compliance, and effective preservation solutions, hydroquinone continues to play a central role in driving growth in the BHT market.

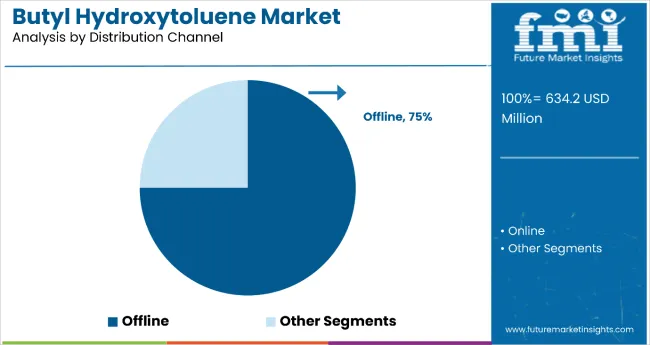

The offline distribution channel dominates with a 75.0% share of the market, reflecting strong relationships between suppliers, distributors, and industrial manufacturers. BHT is primarily procured through traditional channels to ensure quality verification, bulk supply, and adherence to regulatory standards across food, cosmetic, and pharmaceutical sectors.

Industrial buyers favor offline channels due to personalized service, reliable delivery schedules, and the ability to negotiate long-term contracts. Bulk orders, technical support, and adherence to storage and handling guidelines are easier to manage through direct offline distributors compared with digital alternatives.

Companies are utilizing offline networks to broaden regional reach, enhance supply chain resilience, and maintain market presence. Investments in warehousing, distribution logistics, and distributor partnerships further strengthen the offline channel, ensuring consistent supply and effective market penetration across key regions.

The butyl hydroxytoluene market is driven by rising demand for processed foods, long-shelf-life cosmetic products, and stabilized pharmaceutical formulations. Manufacturers are investing in advanced, eco-friendly BHT derivatives and innovative blending techniques to enhance antioxidant efficiency and comply with global regulations. Key trends include improving oxidative stability, reducing degradation, and developing clean-label compatible products. Restraints involve stringent regulatory scrutiny and consumer preference shifts toward natural alternatives. Asia-Pacific leads consumption, reflecting rapid industrial growth and increasing adoption across food, cosmetic, and pharmaceutical sectors.

Rising Demand for Preservation and Stability Drives Market Growth

Food, cosmetic, and pharmaceutical manufacturers are increasingly using BHT to extend shelf life and maintain product integrity. In processed foods, BHT can prevent lipid oxidation and preserve flavor for extended periods, supporting a 25-30% reduction in spoilage compared to non-stabilized products. In cosmetics, BHT prevents rancidity in oils and emulsions, maintaining efficacy over long storage periods. Regulatory approvals and standardized antioxidant performance enhance trust among manufacturers, while growing processed food consumption, cosmetic adoption, and pharmaceutical stability requirements continue to fuel market expansion.

Despite its advantages, market growth faces challenges from raw material availability, price volatility of hydroquinone, and strict regulatory oversight on synthetic antioxidants. Fluctuations in hydroquinone prices can increase production costs by 10-15%, while complex handling and storage requirements extend supply chain cycles. Regulatory restrictions on maximum allowable BHT concentrations in food and cosmetics limit flexibility in formulation. Additionally, price-sensitive markets and competition from natural antioxidants constrain rapid adoption, particularly in emerging regions. These factors collectively temper growth despite strong global demand for shelf-stable and high-performance preservatives.

Recent market trends include the development of biodegradable BHT derivatives, hybrid antioxidant blends, and multifunctional formulations compatible with clean-label standards. Manufacturers are emphasizing eco-friendly production, compliance with global food and cosmetic regulations, and enhanced oxidative resistance to address industry needs while minimizing environmental impact.

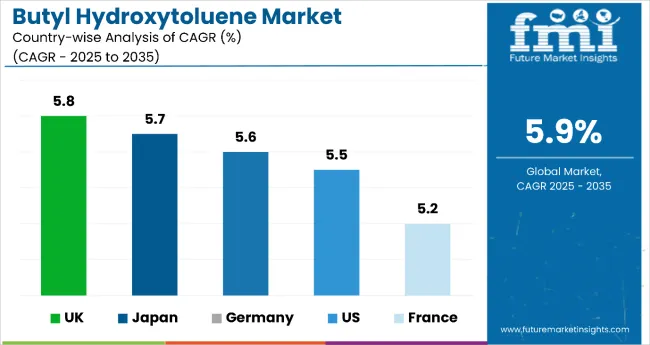

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

| Japan | 5.7% |

| Germany | 5.6% |

| USA | 5.5% |

| France | 5.2% |

In the butyl hydroxytoluene market, the UK leads with a CAGR of 5.8% from 2025 to 2035, slightly above other top global countries. Japan follows at 5.7%, Germany at 5.6%, the USA at 5.5%, and France at 5.2%. Variations reflect regional industrial demand, regulatory environments, and adoption trends across food, cosmetic, and pharmaceutical applications. Europe emphasizes regulatory compliance, Asia-Pacific emphasizes industrial and pharmaceutical demand, while North America shows robust processed food and personal care consumption, highlighting the diverse drivers shaping growth trajectories across these nations.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The BHT market in the UK is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by strong adoption in processed foods, cosmetics, and pharmaceutical products. Demand is concentrated in major urban hubs such as London, Manchester, and Birmingham, where manufacturers focus on high-purity formulations and compliance with stringent EU regulations. Expanding applications in shelf-stable foods and long-lasting cosmetic products are further boosting consumption, while strategic investments in local distribution networks ensure consistent industrial and commercial supply.

Key Statistics

The demand for butyl hydroxytoluene is anticipated to expand at a CAGR of 5.7% from 2025 to 2035, driven by food, cosmetic, and pharmaceutical adoption. Urban centers, including Tokyo, Osaka, and Nagoya, are primary hubs for industrial demand, with an emphasis on oxidative stability and product shelf life. Manufacturers are focusing on high-quality, clean-label BHT derivatives to meet strict domestic regulations. Rising processed food consumption and premium cosmetic formulations are contributing to steady growth, while industrial partnerships enhance distribution efficiency across the country.

Key Statistics

The butyl hydroxytoluene revenue in Germany is expected to increase at a CAGR of 5.6% from 2025 to 2035, driven by applications in food, cosmetics, and industrial chemicals. Key regions such as Frankfurt, Munich, and Hamburg exhibit strong adoption due to regulatory compliance and performance requirements. Manufacturers focus on high-purity BHT for long shelf-life products, supporting industrial standardization. Expansion in specialty food preservation and personal care products ensures continued market relevance, while local production capacities and certified suppliers reinforce supply chain stability across the country.

Key Statistics

The butyl hydroxytoluene market in the USA is estimated to grow at a CAGR of 5.5% from 2025 to 2035, due to steady adoption in processed foods, personal care, and pharmaceuticals. Growing consumer preference for longer shelf-life foods and stabilized personal care products continues to drive adoption, solidifying the USA as a significant player in the global BHT market.

Key Statistics

The butyl hydroxytoluene market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven primarily by premium food and cosmetic applications. Major adoption occurs in Paris, Lyon, and Marseille, where manufacturers focus on high-purity formulations for regulatory compliance and product stability. Growth is supported by specialty food products, long-lasting cosmetics, and pharmaceuticals. Investments in industrial supply chains, high-quality raw materials, and regional partnerships ensure reliable distribution and market access, helping France maintain steady BHT adoption despite tighter regulatory frameworks.

Key Statistics

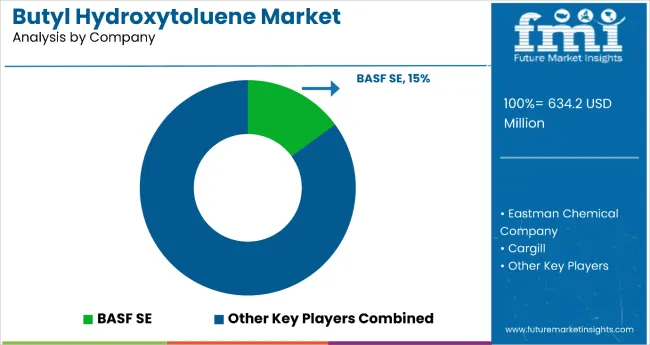

The global butyl hydroxytoluene (BHT) market is characterized by a moderately fragmented competitive landscape, featuring a mix of multinational chemical companies and regional players. Key industry participants include BASF SE, Eastman Chemical Company, LANXESS, Oxiris Chemicals S.A., and Camlin Fine Science. These companies leverage their extensive experience, robust distribution networks, and technological advancements to maintain competitive advantages. Strategic initiatives such as mergers, acquisitions, and research and development investments are pivotal in enhancing product offerings and expanding market reach. The market's growth is further propelled by the increasing demand for BHT in various applications, including food preservation, cosmetics, pharmaceuticals, and industrial products, owing to its effective antioxidant properties.

In the Asia Pacific region, the BHT market is experiencing rapid expansion, driven by industrialization, urbanization, and rising disposable incomes. This region is anticipated to hold the largest market share, with significant contributions from countries like China and India. North America and Europe also represent substantial markets, with established industrial and food processing sectors. However, the market faces challenges such as stringent regulatory standards and increasing consumer preference for clean-label products, which may impact the demand for synthetic antioxidants like BHT. Despite these challenges, BHT's versatility and cost-effectiveness continue to support its widespread use across various industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 634.2 million |

| Raw Material | Hydroquinone and Chlorophenol |

| Application | Pharmaceuticals , Cosmetics, and Food |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Eastern Europe, Western Europe, Japan, South America, Asia-Pacific, Middle East and Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries covered |

| Key Companies Profiled | AppliChem GmbH, VDH Chem Tech Pvt. Ltd., Oxiris Chemicals S.A., Kraft Food Ingredients, S. C. Johnson & Son, Inc., Royal DSM, Sisco Research Laboratories Pvt. Ltd., Eastman, FMC Health and Nutrition, BASF SE, ABF Ingredients Ltd, Cargill, Red Arrow International LLC, Kalsec |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with eco-friendly sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global butyl hydroxytoluene market is estimated to be valued at USD 634.2 million in 2025.

The butyl hydroxytoluene market size is projected to reach USD 1,125.1 million by 2035.

The butyl hydroxytoluene market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The hydroquinone segment is projected to lead the butyl hydroxytoluene market with 60% market share in 2025.

In terms of distribution channel, the offline segment will command 75% share in the butyl hydroxytoluene market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA