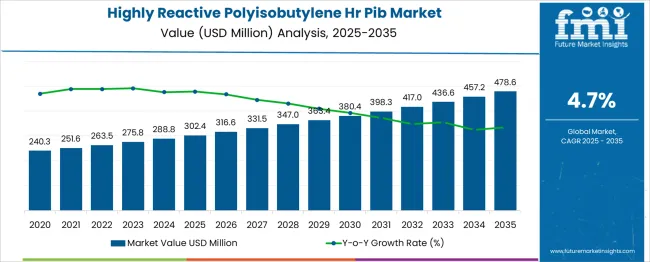

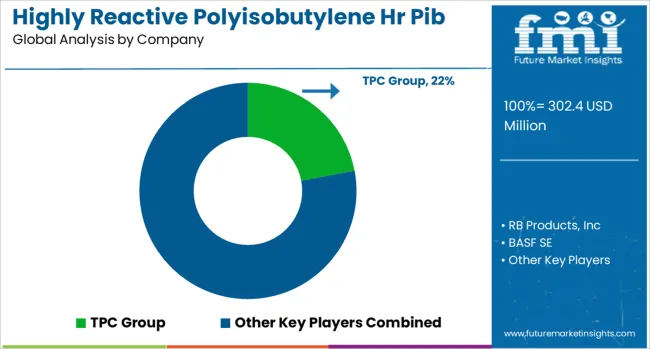

The Highly Reactive Polyisobutylene HR PIB Market is estimated to be valued at USD 302.4 million in 2025 and is projected to reach USD 478.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Between 2021 and 2025, the market expands from USD 251.6 million to USD 302.4 million, contributing an incremental gain of USD 62.1 million, which accounts for roughly 26% of the total projected growth. This growth phase is driven by increasing applications of HR PIB in adhesives, sealants, and rubber compounding, supported by rising demand from the automotive, construction, and packaging sectors, alongside technological advancements enhancing product performance and sustainability.

From 2026 to 2030, the market is expected to advance from USD 316.6 million to USD 380.4 million, representing an overall increase of USD 63.8 million. This period witnesses expansion in industrial usage, particularly in high-performance materials and energy-efficient products, fueled by new grades of HR PIB with improved molecular weight distribution and functionalization that enhance application versatility.

The latter half of the forecast period, from 2031 to 2035, sees the market accelerate from USD 398.3 million to USD 478.6 million, adding USD 80.3 million, driven by increased adoption in emerging markets, expanded production capacities, and emphasis on eco-friendly manufacturing processes. The next few years' multiplier of approximately 2x and consistent momentum indicate a robust outlook for the HR PIB Market, propelled by innovation, diversified end-use sectors, and evolving regulatory frameworks.

| Metric | Value |

|---|---|

| Highly Reactive Polyisobutylene HR PIB Market Estimated Value in (2025 E) | USD 302.4 million |

| Highly Reactive Polyisobutylene HR PIB Market Forecast Value in (2035 F) | USD 478.6 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

HR-PIB’s chemical reactivity and superior thermal stability have made it a preferred base material in engine oils and adhesive systems, particularly for automotive and industrial applications.

The polymer’s ability to enhance viscosity, reduce sludge formation, and extend service life aligns with stringent emission norms and equipment longevity expectations. Additionally, the rising preference for synthetic lubricant components and specialized sealing materials is driving adoption across emerging markets.

Manufacturers are investing in optimized polymerization technologies and capacity expansion to address growing demand from both OEM and aftermarket sectors. As environmental compliance becomes more demanding globally, HR-PIB’s compatibility with low-sulfur and fuel-efficient lubricant formulations is expected to strengthen its market position.

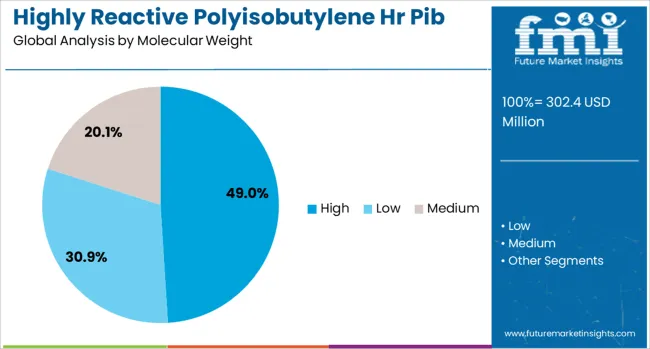

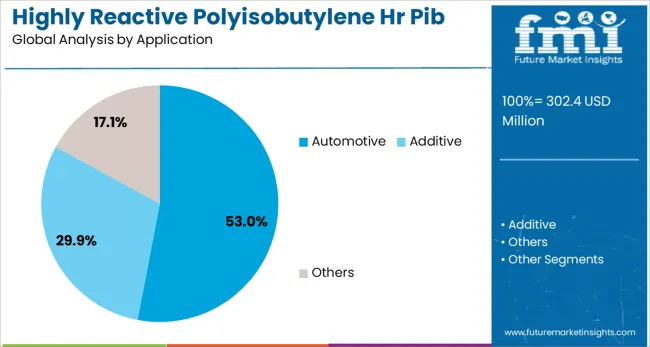

The highly reactive polyisobutylene HR PIB market is segmented by molecular weight, application, and geographic regions. By molecular weight, the highly reactive polyisobutylene HR PIB market is divided into High, Low, and Medium. In terms of application, the highly reactive polyisobutylene HR PIB market is classified into Automotive, Additive, and Others. Regionally, the highly reactive polyisobutylene HR PIB industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high molecular weight HR-PIB segment is expected to account for 49.00% of the market share by 2025, making it the leading grade by molecular weight. This segment’s dominance is driven by its suitability in the formulation of performance-intensive products such as high-viscosity engine oils, fuel system cleaners, and industrial sealants.

High molecular weight HR-PIB exhibits improved tackiness, cohesive strength, and oxidative stability, which are critical for long-duration applications under extreme conditions. Additionally, its enhanced film-forming and water-resistant characteristics have enabled expanded usage in corrosion-inhibiting and pressure-sensitive adhesive solutions.

Demand is also supported by increased consumption of synthetic and semi-synthetic lubricants in automotive and marine sectors, where regulatory mandates continue to push for cleaner, longer-lasting formulations.

The automotive application segment is forecast to lead the HR-PIB market with a 53.00% share by 2025. This leadership is underpinned by HR-PIB’s extensive use in lubricants, fuel additives, and under-hood sealants, where it enhances engine performance and reduces deposit formation.

Its role as a key component in dispersant and detergent packages makes it indispensable for meeting low-emission and fuel-efficiency requirements in both passenger and commercial vehicles. With the growing global vehicle fleet, especially in Asia-Pacific and Latin America, demand for HR-PIB-based lubricants is on the rise.

Furthermore, the increasing shift toward hybrid and electric powertrains is fostering the need for high-performance thermal management fluids and greases, opening new avenues for HR-PIB’s application in next-generation mobility solutions.

The HR PIB market is shaped by rising lubricant additive demand, expanding adhesive and sealant applications, regulatory compliance for cleaner engines, and improvements in manufacturing precision. These dynamics ensure strong future growth potential.

The HR PIB market is experiencing strong demand from the lubricant additive sector due to its superior properties in improving viscosity and thermal stability. Automotive and industrial lubricants rely on HR PIB-based dispersants to enhance engine efficiency and reduce wear, particularly under high-temperature conditions. Increasing vehicle parc and rising demand for premium synthetic oils have amplified the requirement for high-quality additive components. Manufacturers are focusing on consistent molecular weight production to meet OEM standards for fuel economy and extended drain intervals. These factors collectively drive higher consumption of HR PIB across global lubricant formulations, reinforcing its position as a critical performance chemical in modern engine technology.

HR PIB plays a vital role in the production of high-performance adhesives and sealants, particularly for automotive, construction, and packaging applications. Its ability to provide flexibility, adhesion strength, and moisture resistance makes it indispensable for long-lasting bonding solutions. The increasing adoption of lightweight materials in vehicles has further accelerated the need for PIB-based sealants that ensure structural integrity while reducing weight. In industrial applications, PIB-based formulations enhance durability in harsh environments, improving their value proposition for end-users. This trend positions HR PIB as a key enabler in sectors demanding high-strength and reliable bonding technologies worldwide.

Stringent emission regulations have created significant opportunities for HR PIB in fuel and lubricant additives. Its chemical reactivity allows for efficient detergent and dispersant synthesis, critical for maintaining engine cleanliness and reducing deposit formation. With regulatory bodies enforcing lower carbon emissions and extended oil change intervals, OEMs demand advanced additive packages where HR PIB remains a preferred component. Its contribution to improving fuel economy aligns with the automotive industry's pursuit of cleaner and more efficient engines. This regulatory-driven demand is prompting additive manufacturers to secure long-term HR PIB supply agreements, ensuring stable procurement amid growing compliance requirements.

Global emission control measures and stricter fuel economy regulations have indirectly increased reliance on HR PIB-based formulations. Its critical role in producing high-performance lubricants that enhance engine efficiency has positioned it as a preferred material among additive manufacturers. HR PIB enables lower fuel consumption through improved lubrication and deposit control, aligning with evolving performance specifications in automotive and industrial engines. Additionally, its compatibility with modern engine designs requiring low-ash and low-SAPS additives has strengthened its adoption. These regulatory shifts have created a favorable environment for HR PIB demand, as lubricant producers prioritize chemical solutions that support compliance while maintaining operational reliability under severe operating conditions.

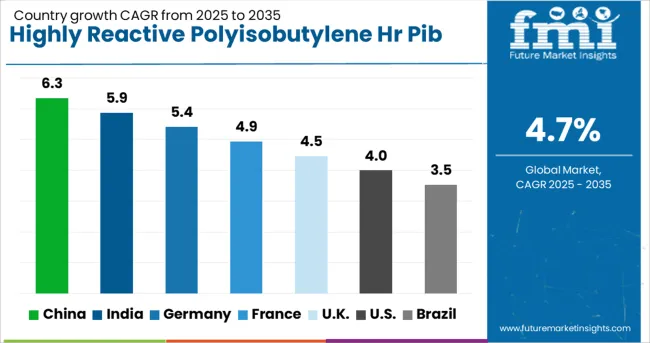

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

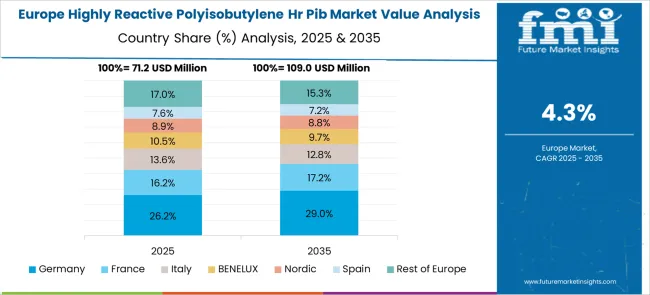

The highly reactive polyisobutylene (HR PIB) market is projected to expand at a global CAGR of 4.7% from 2025 to 2035, supported by increasing demand for performance additives in lubricants, adhesives, and sealants. China leads with a CAGR of 6.3%, driven by large-scale automotive production, growing consumption of advanced lubricants, and strong domestic chemical manufacturing capabilities. India follows at 5.9%, influenced by rising demand for fuel-efficient lubricants, infrastructure-driven adhesive applications, and investments in specialty chemical plants. France grows at 4.9%, reflecting steady adoption of HR PIB in industrial adhesives and packaging sectors, while the United Kingdom achieves 4.5% growth due to demand for moisture-resistant sealants in construction and energy industries. The United States posts 4.0%, supported by advanced lubricant formulation requirements and growing use in high-barrier packaging films. The report examines more than 40 countries, with these markets serving as key benchmarks for global HR PIB utilization strategies and capacity expansion planning across automotive, industrial, and polymer modification segments.

China recorded a CAGR of 5.8% during the 2020–2024 period, which later rose to 6.3% between 2025–2035 as domestic consumption of performance polymers increased significantly. Early growth was primarily influenced by the rising use of HR PIB in premium automotive lubricants and adhesive formulations for industrial applications. This trajectory changed after 2025 as stricter emission regulations and demand for fuel-efficient additives pushed manufacturers to expand HR PIB capacity. The country’s strong chemical infrastructure and focus on high-value specialty products reinforced this growth. Investments in advanced polyisobutylene production technologies and greater utilization in polymer modification further strengthened the market outlook.

India posted a CAGR of about 5.1% between 2020–2024, which climbed to 5.9% during 2025–2035 as industrial demand diversified into new applications. Initial adoption was modest, largely driven by the lubricant additive sector catering to passenger and commercial vehicles. Momentum accelerated in the following decade as increased emphasis on fuel economy and premium engine oils boosted HR PIB consumption. Expanding packaging requirements and wider adoption in adhesive and sealant industries also contributed to higher growth. India’s chemical manufacturing sector received fresh investments, enabling production scale-up for HR PIB to meet both domestic and export requirements.

France maintained a CAGR of nearly 4.3% during 2020–2024, which then improved to 4.9% in the 2025–2035 timeframe due to higher consumption in advanced industrial applications. The earlier phase of growth was constrained by a limited scale of specialty polymer manufacturing, but demand from automotive lubricants provided steady traction. The situation evolved as innovation in performance adhesives and sealants created a strong pull for HR PIB utilization. Supportive regulations for improving energy efficiency in automotive and industrial processes indirectly stimulated demand for advanced lubricants and polymer additives. The introduction of higher-performance packaging materials also played a decisive role in shaping market momentum.

The United Kingdom experienced a CAGR of around 3.8% during 2020–2024, which subsequently increased to 4.5% between 2025–2035, signaling a noticeable acceleration in market performance. This shift occurred as demand transitioned from primarily lubricant-related applications toward diversified uses in polymer modification and industrial adhesives. Early growth was relatively conservative, reflecting limited large-scale consumption, but post-2025 trends highlighted strong engagement from packaging and construction sectors. The introduction of moisture-resistant sealant solutions and specialty adhesive products that incorporate HR PIB boosted industrial uptake. Domestic manufacturers are gradually integrating HR PIB for customized high-barrier polymer formulations to cater to emerging performance requirements.

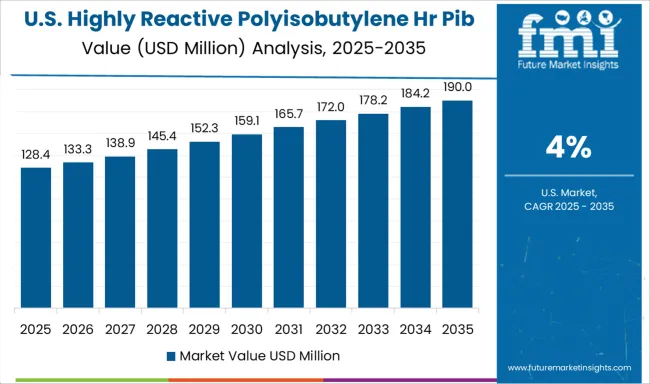

The United States reported a CAGR of about 3.5% during 2020–2024, which advanced to 4.0% during 2025–2035, reflecting a gradual but steady growth path. Early gains were driven by automotive lubricant formulations with high-performance requirements. However, growth momentum strengthened later as HR PIB found increased adoption in polymer engineering and packaging applications. Enhanced focus on fuel efficiency and durability in engine oils spurred incremental demand from lubricant additive producers. The use of HR PIB in high-barrier packaging films gained relevance in food and industrial applications, reinforcing its position in specialty material markets. Investments in production capabilities for tailored HR PIB grades supported future expansion strategies.

TPC Group holds a strong position with extensive production capacity and a diverse product portfolio serving both domestic and export markets. RB Products, Inc. emphasizes customized HR PIB solutions for performance additives, catering to industrial and automotive sectors with a strong distribution network. BASF SE leverages its advanced chemical platforms and global presence to provide consistent quality and innovation in HR PIB formulations. PETRONAS focuses on integration strategies by linking HR PIB production with downstream lubricant operations, ensuring cost efficiency and reliability for end users.

Lanxess has built its presence through research-driven solutions targeting high-performance elastomers and polymer modification requirements, reinforcing its share in specialty chemical markets. Kothari Petrochemicals continues to scale operations in Asia with competitive pricing strategies and technical support for the adhesive and packaging industries. Mayzo targets niche applications by supplying performance polymers with tailored characteristics, addressing demand in sealing and bonding markets. Chinese companies such as Jinzhou SNDA Chemical, Ningbo Hi-Tech Biochemicals, and Shanghai Minglan Chemical emphasize cost competitiveness and regional supply dominance through high-volume manufacturing. Weifang Binhai Petro-chem and Shandong Hongrui New Material Technology strengthen the local value chain by enhancing production capabilities for industrial-grade HR PIB, ensuring faster delivery cycles. Key strategies shaping this competitive landscape include backward integration to secure raw material supply, product diversification for niche polymer applications, and the establishment of regional distribution hubs to optimize logistics and reduce lead times. Strategic collaborations with lubricant additive producers and adhesive manufacturers are also being prioritized to drive long-term demand. Continuous investment in process optimization and controlled molecular weight distribution underscores the industry's transition toward efficiency and quality-driven growth in HR PIB applications globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 302.4 Million |

| Molecular Weight | High, Low, and Medium |

| Application | Automotive, Additive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TPC Group, RB Products, Inc, BASF SE, PETRONAS, Janex, Lanxess, Kothari Petrochemicals, Mayzo, Jinzhou Snda Chemical, Ningbo Hi-Tech Biochemicals, Shanghai Minglan Chemical, Weifang Binhai Petro-chem, and Shandong Hongrui New Material Technology |

| Additional Attributes | Dollar sales by application segments, share by grade and end use, competitive landscape with production capacity, pricing trends by region, growth drivers in lubricant and adhesive sectors, regulatory compliance impact, raw material cost analysis, emerging demand hotspots. |

The global highly reactive polyisobutylene HR PIB market is estimated to be valued at USD 302.4 million in 2025.

The market size for the highly reactive polyisobutylene HR PIB market is projected to reach USD 478.6 million by 2035.

The highly reactive polyisobutylene HR PIB market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in highly reactive polyisobutylene HR PIB market are high, low and medium.

In terms of application, automotive segment to command 53.0% share in the highly reactive polyisobutylene HR PIB market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reactive Tire Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Reactive Hot Melt Adhesive Market Growth – Trends & Forecast 2024-2034

Reactive Diluents Market Growth – Trends & Forecast 2022 to 2032

Reactive Softeners (Textile Industry) Market

Reactive Arthritis Treatment Market Size and Share Forecast Outlook 2025 to 2035

C-Reactive Protein Analyzers Market

HR Tech Consulting Market - Forecast through 2034

HR Analytics Market

HR Tech Market Growth – Trends & Forecast 2024-2034

Chronic Sarcoidosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chromium Zirconium Copper Rod Market Size and Share Forecast Outlook 2025 to 2035

Christmas Tree Valve Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Three Wheeled Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Chronotherapy Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Label Applicator Market Size and Share Forecast Outlook 2025 to 2035

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chromium Polynicotinate Market Size and Share Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chromatin Immunoprecipitation Sequencing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA