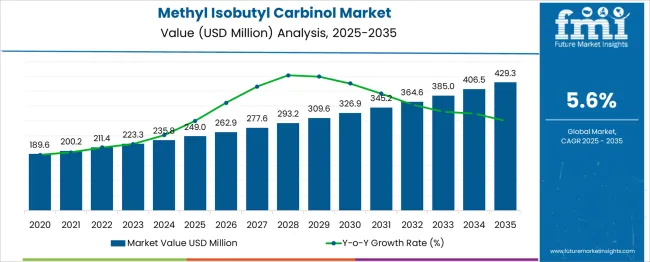

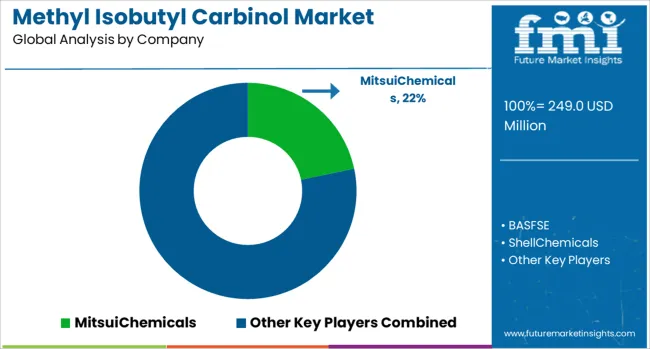

The Methyl Isobutyl Carbinol Market is estimated to be valued at USD 249.0 million in 2025 and is projected to reach USD 429.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. Between 2020 and 2025, the market will increase from USD 189.6 million to USD 249.0 million, generating an absolute dollar opportunity of USD 59.4 million. Growth during this phase is driven by stable demand in mining flotation processes, gradual adoption in chemical synthesis, and steady industrial modernization, laying a strong foundation for the next decade’s gains. From 2025 to 2035, the market will add USD 180.3 million, reaching USD 429.3 million, marking the period of highest incremental growth. Expansion is supported by increased mineral processing, advancements in solvent efficiency, and diversification into new industrial applications.

Post-2030, momentum accelerates as global mining activity scales up and manufacturing processes become more efficient. Over the full 2020–2035 span, the total absolute dollar opportunity will amount to USD 239.7 million, with the majority of the value gains occurring in the latter half, positioning the market for sustained long-term profitability for players ready to capture emerging demand peaks.

| Metric | Value |

|---|---|

| Methyl Isobutyl Carbinol Market Estimated Value in (2025 E) | USD 249.0 million |

| Methyl Isobutyl Carbinol Market Forecast Value in (2035 F) | USD 429.3 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

Rising demand for base metals, especially copper, molybdenum, and zinc, has led to expanded mineral processing activities, reinforcing the need for effective flotation agents like Methyl Isobutyl Carbinol.

Additionally, the global mining sector’s shift toward low-grade ore extraction has amplified the importance of high-efficiency chemical reagents that offer better selectivity and performance. Technical innovations in reagent formulation and the integration of automation in mineral separation are expected to support market expansion.

Growing regulatory emphasis on environmentally compliant and process-optimized flotation chemicals has prompted manufacturers to focus on high-purity offerings that deliver better recovery rates and reduce downstream environmental impact. Furthermore, the compound's usage across other sectors, such as lube oil additives and industrial solvents, continues to offer incremental growth potential, especially in developing economies with expanding industrial output.

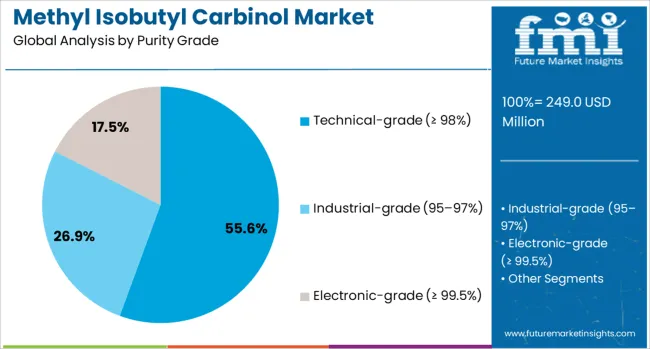

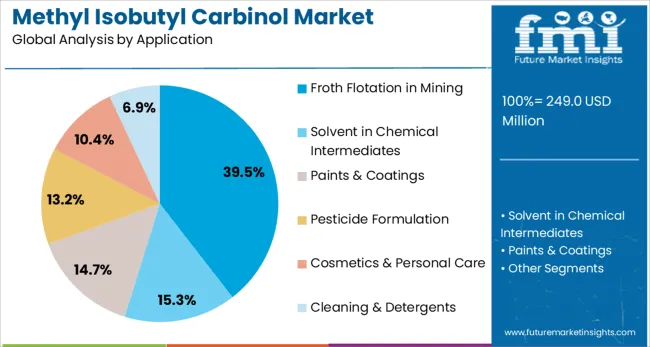

The methyl isobutyl carbinol market is segmented by purity grade, application, grade type, end-use industry, and geographic regions. The methyl isobutyl carbinol market is divided into Technical-grade (≥ 98%), Industrial-grade (95–97%), and Electronic-grade (≥ 99.5%). In terms of application, the methyl isobutyl carbinol market is classified into Froth Flotation in Mining, Solvent in Chemical Intermediates, Paints & Coatings, Pesticide Formulation, Cosmetics & Personal Care, Cleaning & Detergents.

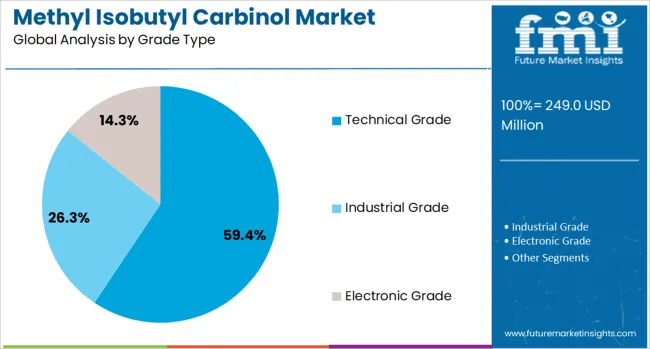

Based on the grade type, the methyl isobutyl carbinol market is segmented into Technical Grade, Industrial Grade, and Electronic Grade. The end-use industry of the methyl isobutyl carbinol market is segmented into Mining & Minerals, Chemical Manufacturing, Automotive Coatings, Agrochemicals, Personal Care Products, and Household Cleaners. Regionally, the methyl isobutyl carbinol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The technical-grade purity segment with a concentration of 98% or more is expected to account for 55.6% of the Methyl Isobutyl Carbinol market revenue share in 2025, positioning it as the dominant purity grade. This leading position is attributed to the widespread adoption of high-purity variants in froth flotation applications where reagent efficiency significantly impacts metal recovery rates.

Technical-grade formulations have demonstrated superior performance in mineral separation, particularly in sulfide ore processing, by improving bubble-particle attachment and enhancing selectivity. The demand for technically refined compounds has also been supported by stringent quality control standards in mining operations, where even minor fluctuations in reagent performance can lead to yield losses.

Furthermore, the production of technical-grade Methyl Isobutyl Carbinol has been optimized for large-scale usage, offering a balance of cost-effectiveness and operational consistency. This has ensured its strong preference across mining-intensive regions with high ore throughput, reinforcing its continued dominance in the purity-based segmentation.

Froth flotation in mining is projected to hold 39.5% of the Methyl Isobutyl Carbinol market revenue share in 2025, reflecting its critical role in ore beneficiation processes. This segment’s dominance is being driven by increased demand for non-ferrous metals, which require efficient separation technologies to extract valuable minerals from complex ores.

Methyl Isobutyl Carbinol is used as a frother to enhance the formation and stability of froth, facilitating the effective separation of minerals such as copper, molybdenum, and zinc. The chemical’s ability to produce fine and stable bubbles leads to improved metallurgical recovery and process control in flotation circuits.

Growth in this segment is also supported by global infrastructure development and electrification trends, which are increasing the demand for key industrial metals. The mining industry’s emphasis on optimizing recovery from low-grade and finely disseminated ores has reinforced reliance on high-performance flotation reagents, further solidifying Methyl Isobutyl Carbinol’s role in flotation-based extraction techniques.

Technical grade is forecast to represent 59.4% of the total revenue share in the Methyl Isobutyl Carbinol market in 2025, making it the most utilized grade type. This segment’s growth is supported by the compound’s consistent use in large-volume industrial applications, particularly within mining operations where cost-efficiency and product performance are equally critical.

Technical grade Methyl Isobutyl Carbinol offers a well-balanced profile of purity and economic feasibility, which aligns well with the bulk processing needs of the mineral flotation industry. The grade’s standardization across multiple production lines has enabled reliable sourcing and formulation, which is vital for ensuring stable supply chains in high-demand geographies.

Its compatibility with automated dosing systems and adaptability to different ore types have further contributed to its widespread use. Additionally, continued advancements in refining processes have improved the overall quality of technical-grade material, enabling it to meet regulatory and operational benchmarks while remaining cost-effective for volume-driven industries.

The methyl isobutyl carbinol market is steadily growing due to its key role as a frother in mineral flotation processes, particularly in copper, molybdenum, and rare earth ore separation. Its excellent frothing properties, low viscosity, and chemical stability make it an essential reagent in mining operations worldwide. Beyond mining, MIBC is used as a solvent in coatings, adhesives, and chemical formulations due to its compatibility with various resins and polymers.

Demand is strongly tied to global mining output, construction activity, and industrial manufacturing. Asia-Pacific leads consumption, supported by large-scale mineral processing facilities in China, Australia, and India. North America and Latin America follow, driven by mining investments and solvent-based product manufacturing. The market faces fluctuations in raw material pricing, particularly acetone and hydrogenation catalysts, which influence production costs. Increasing focus on high-purity grades and stable supply chains is shaping competitive strategies among producers and distributors globally.

Methyl isobutyl carbinol serves multiple industrial functions, with its primary use in the mining sector as a frothing agent for mineral flotation. It enhances the separation efficiency of valuable minerals from ore, allowing for higher recovery rates and reduced processing losses. This makes it vital for copper, lead, zinc, and rare earth extraction. In addition to mining, MIBC functions as a solvent in nitrocellulose lacquers, acrylics, and polyurethane coatings, where it improves flow, leveling, and surface finish. Its use extends to adhesives, sealants, and certain specialty chemicals where controlled evaporation rates are needed. The compound’s chemical stability under various processing conditions ensures consistent performance, making it a trusted choice in industrial applications. The ability to meet industry-specific purity requirements—particularly in mining-grade and technical-grade variants—further broadens its market appeal. Demand patterns closely track mineral commodity prices, infrastructure investment levels, and production cycles in manufacturing sectors that utilize solvent-based systems.

In mineral processing, MIBC plays a critical role in improving process efficiency by enabling stable froth formation, ensuring better mineral-laden bubble attachment, and facilitating the separation of target materials from waste rock. This directly impacts the productivity and cost-effectiveness of mining operations. Its low surface tension and selective frothing behavior make it suitable for complex ore processing, including polymetallic deposits. In the coatings and adhesives sector, MIBC contributes to enhanced film formation, reduced defects, and improved gloss levels in finished products. It also ensures better mixing and compatibility with various resins and additives. Consistency in performance is crucial, especially for large-scale industrial operations where small variations can lead to significant quality deviations. Producers often focus on strict quality control, batch testing, and customization to meet specific client requirements. The dual role of MIBC—as both a mining reagent and an industrial solvent—positions it as a versatile, high-utility chemical in multiple value chains.

Regulations concerning the handling, storage, and disposal of MIBC influence both production and consumption patterns. While MIBC is not classified as a high-toxicity substance, it is subject to occupational exposure limits, chemical safety labeling, and transport regulations under frameworks such as REACH in Europe and TSCA in the United States. Producers must ensure material safety data sheets, hazard communication, and compliance with chemical inventory listings in all operating regions. Environmental concerns focus on minimizing emissions and wastewater contamination during production and application. In mining, responsible chemical usage and tailings management are increasingly important, as regulatory bodies and stakeholders demand greater environmental stewardship. Some jurisdictions are promoting the adoption of more biodegradable frothers, potentially influencing market dynamics in the long term. Manufacturers investing in greener production methods, closed-loop processing, and improved worker safety measures are better positioned to maintain customer trust and long-term supply agreements.

The MIBC market features a mix of global chemical producers and regional suppliers serving mining, coatings, and specialty chemical industries. Competitive advantages are shaped by production capacity, quality consistency, pricing, and customer service. Key players often operate integrated facilities to manage feedstock availability, as MIBC production depends on acetone hydrogenation processes that require a reliable raw material supply. Price volatility in feedstocks, combined with fluctuations in mining activity, can influence profit margins. Distribution efficiency is critical, particularly for mining operations in remote regions where timely delivery is essential to avoid production delays. Companies are increasingly forming long-term supply contracts with mining corporations to secure stable demand. Strategic investments in logistics, regional storage facilities, and technical service teams help strengthen market presence. Collaborations with end-users to optimize frother performance in specific ore processing conditions provide a competitive edge, enabling suppliers to differentiate in a market sensitive to operational efficiency.

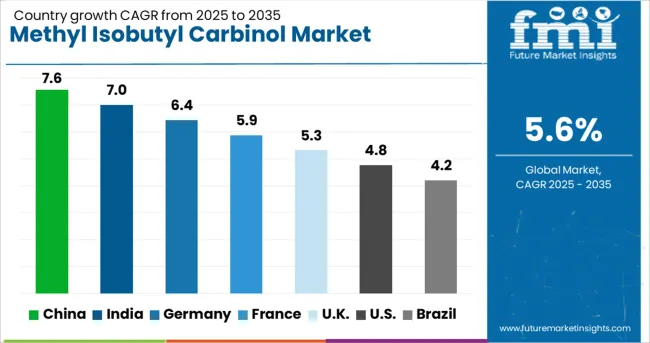

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global methyl isobutyl carbinol (MIBC) market is growing at a CAGR of 5.6%, driven primarily by its widespread use as a flotation agent in mining and as a solvent in paints, coatings, and adhesives. Among BRICS countries, China leads the market with a robust 7.6% growth rate, supported by its extensive chemical manufacturing infrastructure and rising industrial demand. India follows closely at 7.0%, benefiting from expanding mining operations and growing chemical industries. In the OECD region, Germany reports 6.4% growth, reflecting its strong specialty chemical sector and stringent quality standards. The United Kingdom and the United States exhibit steady growth rates of 5.3% and 4.8%, respectively, driven by consistent demand in manufacturing and maintenance applications. These countries influence the global market through their production capacities, regulatory environments, and export activities, which collectively shape supply chains and pricing trends. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the methyl isobutyl carbinol market with a 7.6% growth rate. The chemical industry’s expansion and rising demand for solvents in manufacturing drive this progress. Compared to India, China benefits from a larger industrial base producing coatings, adhesives, and paints that require this compound. Environmental regulations encourage producers to adopt cleaner processes, increasing product quality. Investments in petrochemical infrastructure support supply chain stability. Growing end-use sectors such as automotive and construction further boost market growth.

India’s methyl isobutyl carbinol market expands at 7.0%, driven by growth in pharmaceutical and chemical manufacturing. The country sees increased solvent consumption for coatings and printing inks. Compared to Germany, India focuses on cost-effective production methods to serve domestic and export markets. Efforts to upgrade industrial facilities improve production efficiency. Rising urbanization and infrastructure development support downstream industries reliant on this chemical. Demand from agrochemical sectors also contributes to steady market progress.

Germany shows a steady 6.4% growth rate in the methyl isobutyl carbinol market. Strict quality standards drive demand for high-purity chemicals in coatings and industrial applications. Compared to the United Kingdom, Germany places strong emphasis on sustainable manufacturing techniques. The automotive and construction sectors maintain consistent solvent consumption. R&D investments focus on enhancing product performance and environmental compliance. Export opportunities within Europe help maintain market resilience.

The United Kingdom’s methyl isobutyl carbinol market grows at 5.3%. Demand is supported by pharmaceutical manufacturing and specialty chemical production. Compared to the United States, the UK market values regulatory compliance and product safety highly. Growth in coatings and printing ink industries also contribute to market expansion. Continuous technological improvements aim to reduce emissions during production. Industrial diversification encourages wider solvent application across sectors.

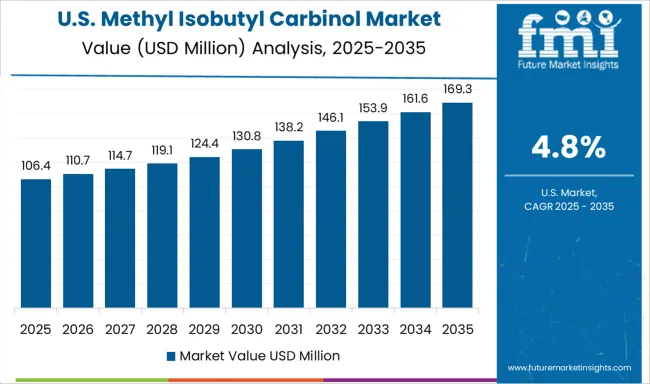

The United States advances in the methyl isobutyl carbinol market at 4.8%. Demand arises mainly from coatings, adhesives, and pharmaceutical sectors. Compared to China, the US focuses on innovations to improve product safety and reduce environmental impact. Market growth benefits from ongoing replacement of older solvents with more efficient options. Industrial expansion in chemical and construction sectors supports steady consumption. Increased adoption of environmentally friendly production methods enhances market outlook.

The methyl isobutyl carbinol (MIBC) market is led by major chemical manufacturers known for their high-quality production capabilities and global supply networks. Mitsui Chemicals leverages its advanced process technology and strong Asian market presence to supply consistent, high-purity MIBC primarily used in froth flotation in mining applications. BASF SE combines broad chemical expertise with extensive R&D efforts, focusing on sustainable production methods and diversified applications including solvents and specialty chemicals. Shell Chemicals benefits from integrated petrochemical operations, ensuring reliable feedstock access and competitive pricing, catering to large-scale industrial demand.

Toray Industries emphasizes innovation in solvent formulations and environmental compliance, supplying MIBC with enhanced purity standards to niche markets. Dow Chemical Company offers extensive global distribution and application development support, targeting mining, paints, and coatings sectors with tailored MIBC grades. Celanese Corporation complements the market with specialty chemical solutions, focusing on process efficiency and product consistency to meet rigorous industry specifications. Competition in this market is driven by feedstock availability, production cost optimization, and regulatory pressures on environmental safety, with players investing in process innovations to improve yield, reduce emissions, and expand downstream applications.

BASF is expanding production capacity and targeting industries like mining and coatings. ExxonMobil is investing in refinery upgrades and improving manufacturing efficiency while ensuring a steady supply worldwide. Other companies focus on developing safer products, forming partnerships, and growing their presence in fast-growing markets such as the Asia-Pacific to meet increasing demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 249.0 Million |

| Purity Grade | Technical-grade (≥ 98%), Industrial-grade (95–97%), and Electronic-grade (≥ 99.5%) |

| Application | Froth Flotation in Mining, Solvent in Chemical Intermediates, Paints & Coatings, Pesticide Formulation, Cosmetics & Personal Care, and Cleaning & Detergents |

| Grade Type | Technical Grade, Industrial Grade, and Electronic Grade |

| End-Use Industry | Mining & Minerals, Chemical Manufacturing, Automotive Coatings, Agrochemicals, Personal Care Products, and Household Cleaners |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MitsuiChemicals, BASFSE, ShellChemicals, TorayIndustries, DowChemicalCompany, and CelaneseCorporation |

| Additional Attributes | Dollar sales in the Methyl Isobutyl Carbinol Market vary by grade including industrial and pharmaceutical, application across froth flotation, solvent extraction, and chemical intermediates, and region covering North America, Europe, and Asia-Pacific. Growth is driven by expanding mining activities, rising chemical manufacturing, and increasing demand for high-purity solvents. |

The global methyl isobutyl carbinol market is estimated to be valued at USD 249.0 million in 2025.

The market size for the methyl isobutyl carbinol market is projected to reach USD 429.3 million by 2035.

The methyl isobutyl carbinol market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in methyl isobutyl carbinol market are technical-grade (≥ 98%), industrial-grade (95–97%) and electronic-grade (≥ 99.5%).

In terms of application, froth flotation in mining segment to command 39.5% share in the methyl isobutyl carbinol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methylcobalamin Market Size and Share Forecast Outlook 2025 to 2035

Methylparaben Market Forecast and Outlook 2025 to 2035

Methyl Cyclohexane Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Oxovalerate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 2-Fluoro-3-Oxopentanoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Methyl-2-Butenoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 2-Naphthyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ionone Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Peroxide (MEKP) Market Size and Share Forecast Outlook 2025 to 2035

Methyl Oleate Market – Trends & Forecast 2025 to 2035

Isobutylene Market Growth – Trends & Forecast 2024-2034

Methylamine Market Growth – Trends & Forecast 2024-2034

Methyl Cellulose Market

Methyl p-hydroxybenzoate Market

Methyl Isopropyl Ketone Market

Methylamines Market

Methylene Diphenyl Di-isocyanate Market

3-Methyl-3-penten-2-one (3M3P) Market Forecast and Outlook 2025 to 2035

Dimethyl Terephthalate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA