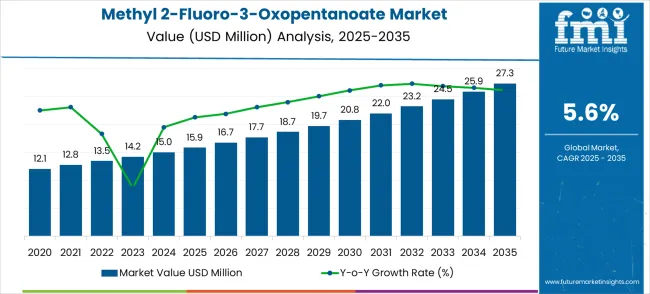

The global methyl 2-fluoro-3-oxopentanoate market is projected to reach USD 27.3 million by 2035, recording an absolute increase of USD 11.4 million over the forecast period. The market is valued at 15 million in 2025 and is set to rise at a CAGR of 5.6% during the assessment period. The market size is expected to grow by nearly 1.72X during the same period, supported by expanding pharmaceutical intermediate applications and increasing demand for specialized fluorinated organic compounds. However, stringent regulatory requirements for handling fluorinated chemicals may constrain market expansion in certain regions.

Between 2025 and 2030, the methyl 2-fluoro-3-oxopentanoate market is projected to expand from USD 15 million to USD 21.2 million, resulting in a value increase of USD 5.3 million, which represents 46.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for pharmaceutical intermediates, product innovation in fluorinated building blocks and specialized organic synthesis reagents, and expanding research applications. Companies are establishing competitive positions through investment in purification technologies, quality assurance systems, and strategic market expansion across pharmaceutical manufacturers, research institutions, and emerging specialty chemical applications.

From 2030 to 2035, the market is forecast to grow from USD 21.2 million to USD 27.3 million, adding another USD 6.1 million, which constitutes 53.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of specialized synthesis applications including advanced pharmaceutical intermediates and custom organic compounds tailored for specific therapeutic targets, strategic collaborations between chemical manufacturers and pharmaceutical companies, and enhanced positioning with purity certification and regulatory compliance. The growing emphasis on precision medicine and targeted drug development will drive demand for high-purity fluorinated intermediates across diverse pharmaceutical research applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 15 million |

| Market Forecast Value (2035) | USD 27.3 million |

| Forecast CAGR (2025-2035) | 5.6% |

The methyl 2-fluoro-3-oxopentanoate market expands through its essential role as a versatile building block in pharmaceutical synthesis and specialized organic chemistry applications. Growing demand stems from increasing pharmaceutical R&D activities focused on fluorinated drug compounds, expanding applications in agrochemical intermediate synthesis, and rising adoption in specialty chemical manufacturing for advanced materials. Research institutions and pharmaceutical companies in North America and Europe represent priority segments driving consumption for drug discovery and development programs. Asia Pacific pharmaceutical manufacturers are emerging as key consumers for generic drug production and contract manufacturing services. Growth faces constraints from regulatory complexity surrounding fluorinated chemical handling and disposal requirements.

The methyl 2-fluoro-3-oxopentanoate market (USD 15.9M → 27.3M by 2035, CAGR ~6%) is driven by rising demand for advanced intermediates in organic synthesis and pharmaceutical applications, with growth concentrated in Asia-Pacific and Europe. Expansion is shaped by the pharmaceutical industry’s move toward fluorinated intermediates, stronger purity requirements (≥99%), and the rising importance of China and India in fine chemical and pharma supply chains. Together, high-purity product demand and application diversification unlock ~USD 11–12M in incremental revenue opportunities by 2035, aligned with the forecast expansion.

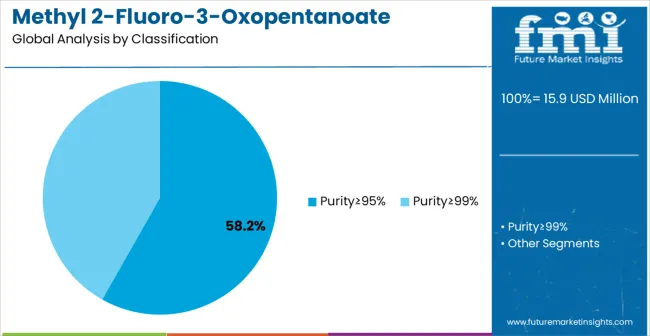

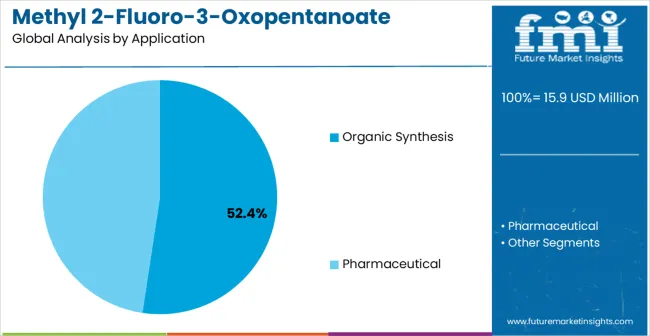

The market is segmented by purity, application, and region. By purity, the market is divided into purity ≥95%, purity ≥99%, and ultra-high purity grades. By application, the market is categorized into organic synthesis, pharmaceutical intermediates, and research chemicals. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Purity ≥99% is projected to hold 58.2% of the methyl 2-fluoro-3-oxopentanoate market in 2025, reflecting its critical role in pharmaceutical synthesis. Regulatory frameworks like FDA and EMA emphasize impurity control, making high-purity grades indispensable. These grades minimize risks of side reactions and ensure consistent reaction outcomes in drug manufacturing. Rising pharmaceutical R&D activities and research-focused applications further strengthen adoption. High-purity standards provide compliance, stability, and reproducibility for advanced synthesis. Manufacturers and contract research organizations prefer ≥99% purity to meet stringent quality requirements while maintaining efficiency, enabling secure drug development pipelines and fostering trust across pharmaceutical supply chains globally.

Organic synthesis applications are projected to represent 52.4% of methyl 2-fluoro-3-oxopentanoate demand in 2025, underscoring its importance as a versatile fluorinated intermediate. Widely adopted in pharmaceutical intermediate synthesis, the compound supports efficient construction of complex molecular frameworks. Research institutions rely on it for designing innovative fluorinated molecules, enhancing reaction pathways, and testing new applications. Contract research and custom synthesis companies also account for growing demand, using it in multi-step reaction chains. Its consistency, scalability, and ability to address diverse molecular targets make it indispensable across industrial, academic, and pharmaceutical research domains, driving growth in global market applications.

Market drivers include expanding pharmaceutical R&D investments in fluorinated drug compounds, growing demand from contract research organizations for specialized building blocks, and increasing applications in agrochemical intermediate synthesis. These factors create demand as pharmaceutical companies seek to improve drug properties through fluorination strategies and research institutions require reliable sources of high-purity intermediates for synthesis programs.

Market restraints encompass stringent regulatory requirements for fluorinated chemical handling and storage, high production costs associated with specialized purification processes, and limited supplier base creating potential supply chain vulnerabilities. Environmental regulations governing fluorinated compound disposal and worker safety requirements add operational complexity and costs for both manufacturers and end-users.

Market trends show accelerated adoption in Asia Pacific pharmaceutical manufacturing, design shifts toward ultra-high purity specifications enabling complex synthesis applications, and integration of advanced analytical testing for batch-to-batch consistency. However, regulatory restrictions on fluorinated chemical imports in certain regions could disrupt established supply chains and limit market expansion opportunities.

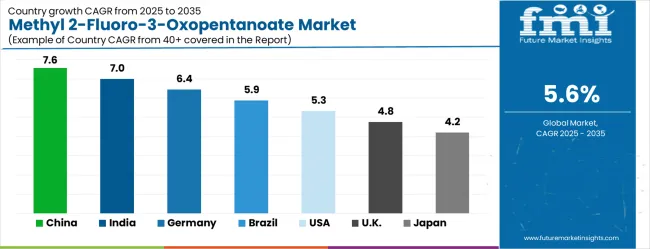

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

| USA | 5.3% |

| UK | 4.8% |

| Japan | 4.2% |

The methyl 2-fluoro-3-oxopentanoate market is gathering pace worldwide, with China taking the lead thanks to expanding pharmaceutical manufacturing capabilities and growing chemical synthesis infrastructure. Close behind, India benefits from increasing generic drug production and rising pharmaceutical R&D investments, positioning itself as a strategic growth hub. Germany shows steady advancement, where integration with established pharmaceutical and chemical industries strengthens its role in the regional supply chain. Brazil is sharpening focus on pharmaceutical intermediate manufacturing and specialty chemical applications, signaling an ambition to capture niche opportunities. Meanwhile, the USA stands out for its advanced research applications, and the UK and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

The methyl 2-fluoro-3-oxopentanoate market in China is projected to grow at a robust CAGR of 7.6% from 2025 to 2035. The demand for this compound is driven by the country's booming pharmaceutical and chemical industries, which use it as an intermediate in the synthesis of various active pharmaceutical ingredients (APIs) and specialty chemicals. China’s vast manufacturing base, coupled with its expanding focus on research and development (R&D), plays a critical role in the growth of this market. The increasing adoption of advanced chemical processes and the shift towards high-value chemicals in the production of agrochemicals and pharmaceuticals further propel market expansion. China’s push for green chemistry and innovations in chemical production processes supports the development of new applications for Methyl 2-Fluoro-3-Oxopentanoate. The rapid growth of the industrial and export sectors, alongside government-backed initiatives to foster high-tech chemical production, ensures that China will continue to maintain its leadership in the Methyl 2-Fluoro-3-Oxopentanoate market.

The methyl 2-fluoro-3-oxopentanoate market in India is set to experience a solid growth trajectory, with a CAGR of 7.0% between 2025 and 2035. The country’s pharmaceutical and agrochemical sectors are significant contributors to the demand for this compound. With an expanding generics market and increasing reliance on specialty chemicals, India remains an important player in the global chemical industry. The government’s efforts to promote chemical manufacturing and pharmaceutical exports, through initiatives such as "Make in India," are further boosting the growth of the methyl 2-fluoro-3-oxopentanoate market. Moreover, India’s thriving chemical industry, coupled with its growing research in organic chemistry and biotechnology, offers substantial opportunities for market expansion. The rising demand for crop protection chemicals, along with the country’s increasing focus on improving its industrial and export capabilities, further accelerates the market for methyl 2-fluoro-3-oxopentanoate. India is positioned to be a major contributor to the growing global demand for this chemical compound.

Germany is expected to witness steady growth in the Methyl 2-Fluoro-3-Oxopentanoate market, with a CAGR of 6.4% from 2025 to 2035. As a leader in the European chemical and pharmaceutical industries, Germany's demand for this compound is primarily driven by its advanced pharmaceutical research and specialty chemicals sectors. The country’s strong focus on high-quality and precision-driven chemical production ensures a consistent need for premium intermediates like methyl 2-fluoro-3-oxopentanoate. The German market also benefits from significant investments in R&D activities, with chemical companies exploring innovative production techniques and enhancing product applications in agriculture and pharmaceuticals. Germany’s well-established regulatory framework, coupled with its commitment to international standards, plays a critical role in boosting demand for high-performance chemicals. Germany’s strategic position in the European Union enhances its market reach and export potential, making it a key hub for methyl 2-fluoro-3-oxopentanoate production and distribution.

The methyl 2-fluoro-3-oxopentanoate market in Brazil is projected to grow at a CAGR of 5.9% from 2025 to 2035, driven by the country’s increasing industrialization and expanding chemical production capabilities. Brazil’s demand for Methyl 2-Fluoro-3-Oxopentanoate stems from its robust pharmaceutical, agrochemical, and manufacturing sectors. With the country’s growing need for specialty chemicals, the market for this compound is expected to rise as Brazil ramps up its production of agrochemicals and pharmaceutical intermediates. Brazil’s strategic role in Latin America’s chemical industry facilitates easy access to regional markets, further promoting demand for high-quality chemical compounds. As Brazil works to enhance its industrial capacity and modernize its manufacturing infrastructure, the adoption of advanced chemical processes and precision manufacturing technologies will play a significant role in driving market growth. The steady increase in investments in the country’s chemical manufacturing plants is expected to further boost the methyl 2-fluoro-3-oxopentanoate market.

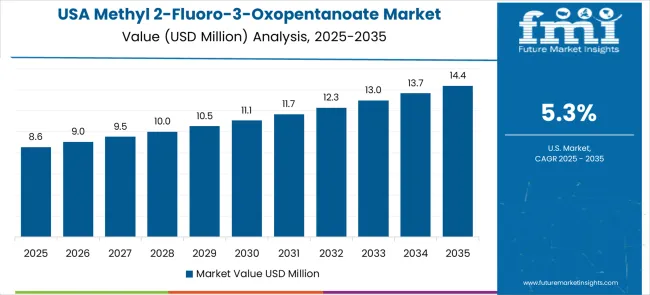

The methyl 2-fluoro-3-oxopentanoate market in the United States is expected to grow at a steady pace of 5.3% CAGR from 2025 to 2035. The growth of this market is closely linked to the booming pharmaceutical, agrochemical, and chemical industries, with the USA remaining a key player in the global chemical market. As the world’s largest pharmaceutical market, the demand for Methyl 2-Fluoro-3-Oxopentanoate in the USA is supported by its extensive use as an intermediate in API production. The USA chemical sector is increasingly focusing on high-performance chemicals and green manufacturing methods, driving the need for advanced chemical intermediates like methyl 2-fluoro-3-oxopentanoate. As the USA continues to be a hub for chemical production and R&D activities, advancements in biotechnology and chemical synthesis are expected to open up new opportunities for this market. Regulatory frameworks and compliance with international standards further contribute to the demand for premium chemicals in the USA

The United Kingdom is expected to witness moderate growth in the methyl 2-fluoro-3-oxopentanoate market, with a projected CAGR of 4.8% from 2025 to 2035. The country’s strong pharmaceutical and chemical industries are the main drivers of this growth, with Methyl 2-Fluoro-3-Oxopentanoate being used as an intermediate in the production of specialty chemicals and active pharmaceutical ingredients (APIs). The UK continues to be a leader in chemical R&D and production, supported by its highly skilled workforce and advanced technological infrastructure. Moreover, the UK’s robust regulatory environment, aligned with global standards, ensures the safe production and distribution of high-quality chemicals. The growing demand for high-value chemical intermediates in the pharmaceutical sector, along with increasing applications in agrochemicals, is expected to contribute to the expansion of the market. Post-Brexit regulatory adjustments and international trade deals are likely to boost the UK’s competitiveness in global chemical markets.

The methyl 2-fluoro-3-oxopentanoate market in Japan is anticipated to grow at a steady 4.2% CAGR through 2035. The demand for this chemical is supported by Japan’s highly advanced pharmaceutical, chemical, and automotive sectors, where it is used as a key intermediate in the production of specialty chemicals and APIs. Japan’s emphasis on technological innovation and precision manufacturing ensures that high-quality intermediates, such as Methyl 2-Fluoro-3-Oxopentanoate, remain in demand across various industries. The country’s strong research and development infrastructure, coupled with its commitment to maintaining global leadership in high-tech manufacturing, plays a crucial role in driving market growth. The expanding pharmaceutical industry in Japan, combined with increasing export activities, presents significant opportunities for the Methyl 2-Fluoro-3-Oxopentanoate market. Japan’s strict quality control standards and its focus on advanced chemical processing technologies further fuel the demand

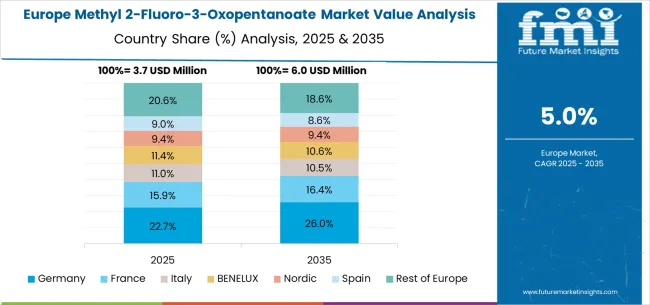

The methyl 2-fluoro-3-oxopentanoate market in Europe demonstrates mature development across established pharmaceutical and chemical manufacturing centers, with Germany maintaining leadership through advanced chemical synthesis capabilities and comprehensive regulatory compliance frameworks supporting high-value pharmaceutical intermediate applications. The region benefits from integrated supply chains, established quality standards, and collaborative research networks connecting academic institutions with pharmaceutical manufacturers. France and Switzerland contribute through specialized pharmaceutical research and development activities, while the United Kingdom maintains strong demand from university research programs and pharmaceutical companies focusing on fluorinated drug development. Netherlands and Belgium serve as important distribution hubs for chemical intermediate supply across European markets, supported by advanced logistics infrastructure and established chemical handling expertise. Nordic countries and Eastern Europe display growing potential driven by expanding pharmaceutical manufacturing capabilities and increasing investment in chemical research infrastructure, creating opportunities for specialized intermediate suppliers to establish market presence across diverse application areas.

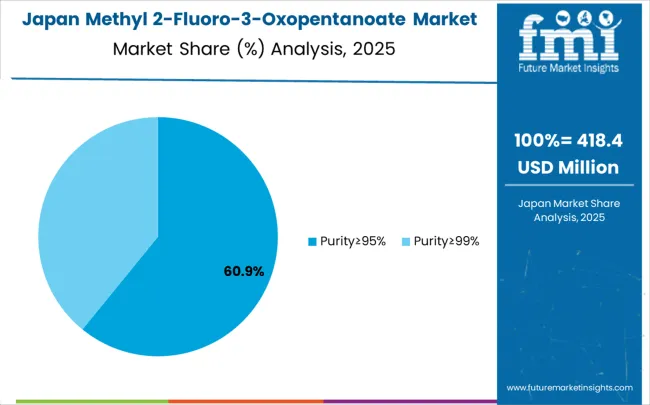

In Japan, the methyl 2-fluoro-3-oxopentanoate market is largely driven by the purity ≥99% segment, which accounts for 72% of total market revenues in 2025. The stringent quality requirements in domestic pharmaceutical manufacturing and research applications contribute to this leading position. Purity ≥95% grades follow with a 23% share, primarily serving specialty chemical synthesis applications and contract manufacturing organizations. Ultra-high purity grades contribute 5% as specialized research applications requiring exceptional purity specifications remain in early adoption stages.

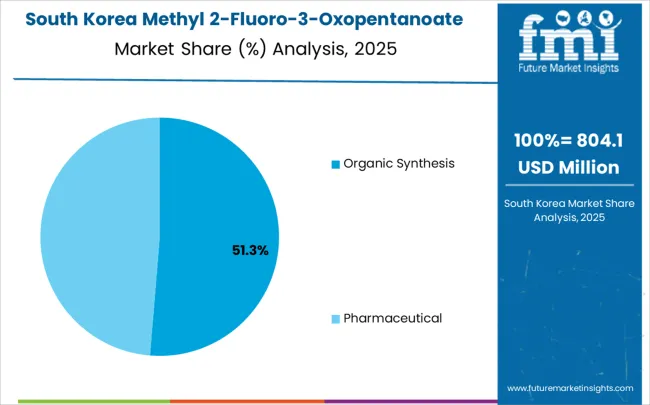

In South Korea, the market is expected to remain dominated by pharmaceutical applications, which hold a 65% share in 2025. These applications are typically pharmaceutical intermediate synthesis requirements where fluorinated building blocks require specialized handling and quality assurance. Organic synthesis and research applications each hold 20% and 15% market share respectively, with increasing standardization in academic research protocols. Specialty chemical applications account for the remaining percentage, but are gradually gaining traction in industrial research models due to expanding chemical manufacturing capabilities and cost efficiency improvements.

The methyl 2-fluoro-3-oxopentanoate market operates with moderate concentration, dominated by a mix of global research chemical suppliers and specialized Chinese manufacturers. Competition is defined by product purity, regulatory certifications, and customer support, as pharmaceutical and academic users emphasize quality assurance and reliable supply over pricing. Leading global players maintain established reputations for technical documentation and compliance, while regional producers strengthen market share through cost competitiveness, tailored synthesis capabilities, and expanding export networks. Strategic partnerships, capacity expansion, and adherence to international standards remain central to competitive differentiation across the value chain.

Anhui Jinquan Biotechnology, China-based, provides large-scale production emphasizing pharmaceutical-grade quality with cost-efficient distribution for Asian markets. Hangzhou ICH Biofarm specializes in high-purity intermediates, targeting research-driven applications and custom synthesis services for pharmaceutical companies. Fangde New Materials focuses on affordable production with growing investments in international certifications to strengthen global competitiveness.

Jostrong (Tianjin) Technology and Tianmen Hengchang Chemical highlight efficiency and reliability, ensuring stable supply for domestic and regional customers. Nanjing Searchem caters to research-oriented buyers, offering specialized grades for academic and pharmaceutical institutions.

Global suppliers including Sigma-Aldrich (Merck), TCI Chemicals, Fluorochem, Adamas Reagent, and Nanjing Vital Chemical dominate with comprehensive portfolios, regulatory-compliant documentation, and strong distribution networks. Their established credibility makes them preferred partners for pharmaceutical manufacturers and research institutions requiring certified intermediates with stringent quality standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 15 million |

| Purity | Purity ≥95%, Purity ≥99%, Ultra-high purity |

| Application | Organic synthesis, Pharmaceutical intermediates, Research chemicals |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | TCI Chemicals, Sigma-Aldrich (Merck), Simagchem Corp, Dayang Chem (Hangzhou), Hebei Chuanghai Biotechnology, Wuhan Han Sheng New Material Technology, Adamas Reagent, Nanjing Vital Chemical, Fluorochem, Anhui Jinquan Biotechnology, Hangzhou ICH Biofarm, Fangde New Materials |

| Additional Attributes | Dollar sales by purity grade and application sector, regional consumption trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, buyer preferences for certified versus standard grade products, integration with pharmaceutical quality systems and regulatory compliance frameworks, innovations in purification technologies and analytical testing methods, and development of specialized packaging solutions with enhanced stability and handling safety features. |

The global methyl 2-fluoro-3-oxopentanoate market is estimated to be valued at USD 15.9 million in 2025.

The market size for the methyl 2-fluoro-3-oxopentanoate market is projected to reach USD 27.3 million by 2035.

The methyl 2-fluoro-3-oxopentanoate market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in methyl 2-fluoro-3-oxopentanoate market are purity≥95% and purity≥99%.

In terms of application, organic synthesis segment to command 52.4% share in the methyl 2-fluoro-3-oxopentanoate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methylcobalamin Market Size and Share Forecast Outlook 2025 to 2035

Methylparaben Market Forecast and Outlook 2025 to 2035

Methyl Cyclohexane Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Oxovalerate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Methyl-2-Butenoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 2-Naphthyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ionone Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Market Size and Share Forecast Outlook 2025 to 2035

Methyl Isobutyl Carbinol Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Peroxide (MEKP) Market Size and Share Forecast Outlook 2025 to 2035

Methyl Oleate Market – Trends & Forecast 2025 to 2035

Methylamine Market Growth – Trends & Forecast 2024-2034

Methyl p-hydroxybenzoate Market

Methyl Cellulose Market

Methyl Isopropyl Ketone Market

Methylamines Market

Methylene Diphenyl Di-isocyanate Market

3-Methyl-3-penten-2-one (3M3P) Market Forecast and Outlook 2025 to 2035

Dimethyl Terephthalate Market Size and Share Forecast Outlook 2025 to 2035

Dimethylolpropionic Acid (DMPA) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA