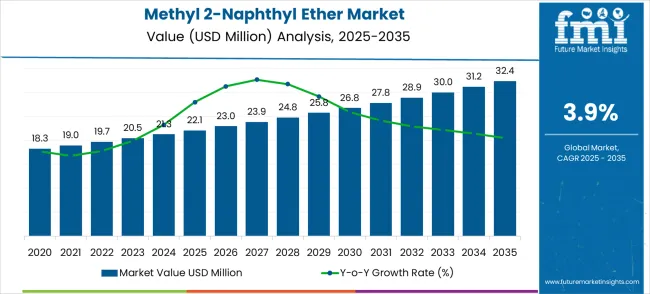

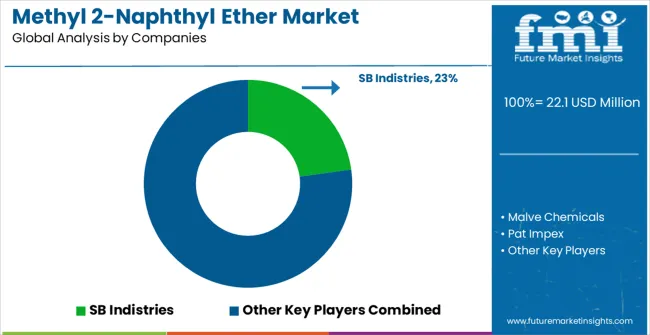

The global methyl 2-naphthyl ether market is anticipated to grow from USD 22.1 million in 2025 to approximately USD 32.4 million by 2035, recording an absolute increase of USD 10.3 million over the forecast period. This translates into a total growth of 46.6%, with the market forecast to expand at a CAGR of 3.9% between 2025 and 2035.

The market size is expected to grow by nearly 1.5X during the same period, supported by increasing demand for specialty aromatic compounds, growing fragrance industry requirements, and rising adoption of high-purity chemical intermediates across the global flavors, fragrances, and pharmaceutical industries.

Between 2025 and 2030, the market is projected to expand from USD 22.1 million to USD 26.8 million, resulting in a value increase of USD 4.7 million, which represents 45.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing specialty chemical demand, rising fragrance industry investments, and growing utilization in pharmaceutical intermediate applications.

Specialty chemical manufacturers and aromatic compound producers are expanding their methyl 2-naphthyl ether production capabilities to address the growing preference for high-purity aromatic ethers in fragrance formulation and pharmaceutical synthesis processes.

From 2030 to 2035, the market is forecast to grow from USD 26.8 million to USD 32.4 million, adding another USD 5.6 million, which constitutes 54.4% of the ten-year expansion. This period is expected to be characterized by the expansion of advanced synthesis technologies, the integration of quality enhancement systems for premium methyl 2-naphthyl ether products, and the development of specialized grade formulations for emerging applications.

The growing focus on product purity and application-specific requirements will drive demand for high-grade methyl 2-naphthyl ether with enhanced quality characteristics and improved synthetic efficiency.

Between 2020 and 2024, the market experienced steady growth, driven by increasing specialty chemical investments and growing recognition of aromatic ether compounds' essential role across fragrance formulation and pharmaceutical intermediate applications.

The market developed as manufacturers recognized the potential for high-purity aromatic ethers to enhance product quality while meeting stringent industry specifications and regulatory requirements. Technological advancement in synthesis methods and purification processes began prioritizing the critical importance of maintaining chemical purity while improving production efficiency and cost-effectiveness.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 22.1 million |

| Forecast Value in (2035F) | USD 32.4 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

Market expansion is being supported by the increasing global demand for specialty aromatic compounds and the corresponding shift toward high-purity chemical intermediates that can provide superior performance characteristics while meeting industry requirements for consistent quality and reliable supply.

Modern fragrance and pharmaceutical companies are increasingly focused on incorporating methyl 2-naphthyl ether to enhance product formulations while satisfying demands for premium aromatic properties and chemical stability. Methyl 2-naphthyl ether's proven ability to deliver distinctive aromatic characteristics, chemical stability, and formulation compatibility makes it an essential compound for specialty fragrance applications and pharmaceutical synthesis processes.

The growing focus on premium fragrance development and pharmaceutical innovation is driving demand for high-quality methyl 2-naphthyl ether products that can support distinctive aromatic profiles and premium formulation positioning across fragrance, pharmaceutical, and specialty chemical categories. Manufacturer preference for compounds that combine aromatic excellence with chemical reliability is creating opportunities for innovative methyl 2-naphthyl ether applications in both traditional and emerging specialty chemical applications.

The rising influence of consumer preference for sophisticated fragrances and advanced pharmaceutical compounds is also contributing to increased adoption of premium methyl 2-naphthyl ether products that can provide authentic high-performance aromatic characteristics.

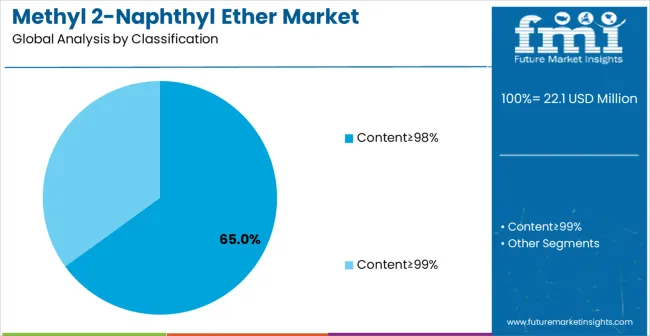

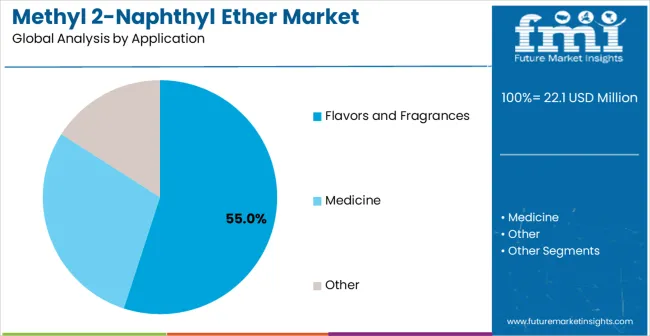

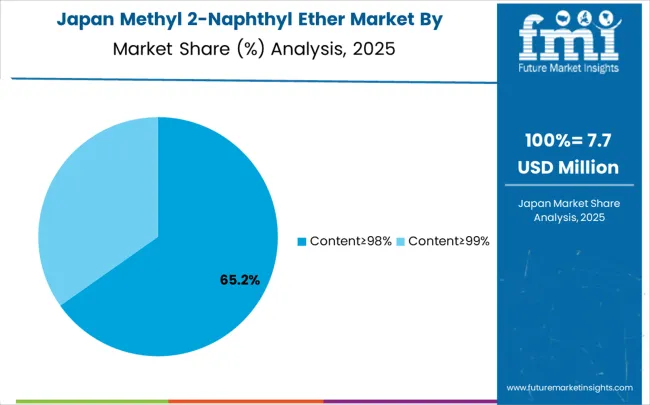

The market is segmented by purity level, application, and region. By purity level, the market is divided into content≥98%, content≥99%, and other purity grades. Based on application, the market is categorized into flavors and fragrances, medicine, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The content≥98% segment is projected to account for 65.0% of the market in 2025, reaffirming its position as the leading purity level category. Fragrance manufacturers and pharmaceutical companies increasingly utilize ≥98% purity methyl 2-naphthyl ether for its superior quality assurance, consistent performance characteristics, and regulatory compliance capabilities across diverse specialty chemical applications. Content≥98% technology's standardized purity specifications and reliable quality control directly address the industry requirements for consistent product performance and efficient formulation processes in commercial chemical manufacturing operations.

This purity segment forms the foundation of modern specialty chemical applications, as it represents the grade with the greatest application versatility and established compatibility across multiple formulation systems. Manufacturer investments in purification optimization and quality enhancement continue to strengthen adoption among specialty chemical producers. With companies prioritizing product reliability and regulatory compliance, content≥98% methyl 2-naphthyl ether aligns with both quality objectives and manufacturing standards requirements, making it the central component of comprehensive specialty chemical sourcing strategies.

Flavors and fragrances applications are projected to account 55.0% share of methyl 2-naphthyl ether demand in 2025, underscoring their critical role as the primary application for aromatic compounds in fragrance formulation and flavor enhancement operations. Fragrance formulators prefer methyl 2-naphthyl ether for its exceptional aromatic properties, stability characteristics, and ability to maintain consistent scent profiles while supporting complex fragrance composition requirements during product development. Positioned as essential ingredients for high-performance fragrance formulations, methyl 2-naphthyl ether offers both aromatic excellence and formulation reliability advantages.

The segment is supported by continuous growth in fragrance industry activities and the growing availability of specialized aromatic compounds that enable enhanced scent complexity and formulation optimization at the product development level. Fragrance manufacturers are investing in premium aromatic ingredients to support luxury product positioning and scent differentiation. As the fragrance industry continues to expand and formulators seek superior aromatic compound solutions, flavors and fragrances applications will continue to dominate the application landscape while supporting product innovation and scent quality strategies.

The market is advancing steadily due to increasing specialty chemical investments and growing demand for aromatic compound solutions that emphasize superior performance characteristics across fragrance formulation and pharmaceutical intermediate applications. The market faces challenges, including complex synthesis requirements for high-purity products, regulatory compliance considerations for chemical intermediates, and competition from alternative aromatic compounds. Innovation in synthesis optimization and purity enhancement technologies continues to influence market development and expansion patterns.

The growing adoption of methyl 2-naphthyl ether in luxury fragrance formulation and premium scent development applications is enabling fragrance manufacturers to develop products that provide distinctive aromatic characteristics while commanding premium positioning and enhanced olfactory experiences. Advanced applications provide superior scent complexity while allowing more sophisticated fragrance development across various consumer categories and luxury segments. Manufacturers are increasingly recognizing the competitive advantages of premium aromatic compound positioning for luxury fragrance development and high-end market penetration.

Modern methyl 2-naphthyl ether suppliers are incorporating advanced synthesis technologies, enhanced purification systems, and quality optimization processes to improve product purity, enhance performance characteristics, and meet industry demands for consistent and reliable specialty chemical intermediates. These programs improve the quality of the product while enabling new applications, including pharmaceutical intermediate synthesis and specialized fragrance formulations. Advanced technology integration also allows suppliers to support premium market positioning and quality leadership beyond traditional commodity aromatic compounds.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| USA | 3.7% |

| UK | 3.3% |

| Japan | 2.9% |

The market is experiencing robust growth globally, with China leading at a 5.3% CAGR through 2035, driven by the rapidly expanding specialty chemical sector, massive investments in fragrance and pharmaceutical manufacturing, and increasing adoption of high-purity chemical intermediates. India follows at 4.9%, supported by a growing pharmaceutical industry, rising fragrance manufacturing, and expanding specialty chemical capabilities.

Germany shows growth at 4.5%, prioritizing advanced chemical technology and premium specialty compound manufacturing. Brazil records 4.1%, focusing on emerging fragrance applications and specialty chemical development.

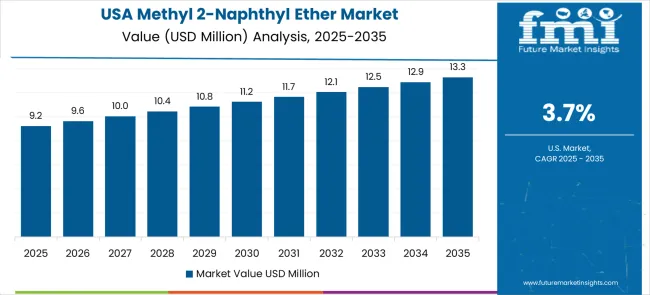

The USA demonstrates 3.7% growth, prioritizing pharmaceutical innovation and specialty chemical advancement. The UK exhibits 3.3% growth, supported by fragrance industry development and advanced chemical capabilities. Japan shows 2.9% growth, prioritizing precision chemical manufacturing excellence and high-quality specialty compound production.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 5.3% through 2035, driven by the rapidly expanding specialty chemical sector and massive investments in fragrance and pharmaceutical manufacturing capabilities across major industrial hubs.

The country's growing chemical industry capacity and increasing adoption of high-purity specialty compounds are creating substantial demand for advanced aromatic intermediates in both established and emerging chemical applications. Major specialty chemical manufacturers and aromatic compound producers are establishing comprehensive synthesis and production capabilities to serve both domestic consumption and export markets.

India is expanding at a CAGR of 4.9%, supported by the growing pharmaceutical industry, increasing fragrance manufacturing, and expanding specialty chemical applications. The country's developing chemical ecosystem and expanding manufacturing capabilities are driving demand for quality specialty compounds across both pharmaceutical intermediates and fragrance applications.

International specialty chemical companies and domestic chemical manufacturers are establishing comprehensive distribution and production capabilities to address growing market demand for high-purity aromatic compounds.

Germany is projected to grow at a CAGR of 4.5% through 2035, driven by the country's advanced chemical technology sector, premium specialty compound manufacturing capabilities, and leadership in precision chemical synthesis solutions.

Germany's sophisticated chemical industry culture and willingness to invest in high-performance specialty compounds are creating substantial demand for both standard and specialized methyl 2-naphthyl ether varieties. Leading chemical companies and specialty manufacturers are establishing comprehensive innovation strategies to serve both European markets and growing international demand.

Brazil is projected to grow at a CAGR of 4.1% through 2035, supported by the country's expanding fragrance industry, growing specialty chemical applications, and increasing adoption of aromatic compounds requiring high-quality chemical intermediates. Brazilian manufacturers and international companies consistently seek reliable specialty compounds that enhance product performance for both domestic applications and regional markets. The country's position as a regional chemical hub continues to drive innovation in specialty chemical applications and quality standards.

The United States is projected to grow at a CAGR of 3.7% through 2035, supported by the country's advanced pharmaceutical sector, specialty chemical innovation capabilities, and established leadership in high-performance chemical intermediate solutions. American pharmaceutical companies and specialty chemical manufacturers prioritize purity, reliability, and regulatory compliance, making methyl 2-naphthyl ether a valuable intermediate for both domestic production and advanced chemical synthesis. The country's comprehensive research capabilities and technical expertise support continued market development.

The United Kingdom is projected to grow at a CAGR of 3.3% through 2035, supported by the country's fragrance industry sector, advanced chemical capabilities, and established expertise in specialty aromatic compound solutions. British manufacturers' focus on innovation, quality, and product excellence creates steady demand for premium methyl 2-naphthyl ether compounds. The country's attention to chemical quality and formulation optimization drives consistent adoption across both traditional fragrance and emerging specialty applications.

Japan is projected to grow at a CAGR of 2.9% through 2035, supported by the country's precision chemical manufacturing excellence, advanced specialty compound expertise, and established reputation for producing superior chemical intermediates while working to enhance synthesis efficiency capabilities and develop next-generation aromatic compound technologies. Japan's specialty chemical industry continues to benefit from its reputation for producing high-quality chemical products while focusing on innovation and manufacturing precision.

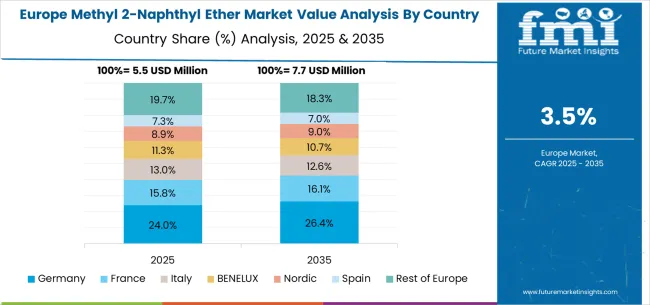

The methyl 2-naphthyl ether market in Europe is projected to grow from USD 5.8 million in 2025 to USD 8.2 million by 2035, registering a CAGR of 3.5% over the forecast period. Germany is expected to maintain its leadership position with a 37.9% market share in 2025, remaining stable at 37.7% by 2035, supported by its advanced chemical technology sector, precision specialty compound manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 22.1% share in 2025, projected to reach 22.4% by 2035, driven by fragrance industry development programs, advanced chemical capabilities, and growing focus on specialty aromatic compound solutions for premium applications. France holds a 16.3% share in 2025, expected to maintain 16.1% by 2035, supported by luxury fragrance industry demand and specialty chemical applications, but facing challenges from market competition and economic considerations.

Italy commands a 12.4% share in 2025, projected to reach 12.6% by 2035, while Spain accounts for 7.2% in 2025, expected to reach 7.4% by 2035. The Netherlands maintains a 4.1% share in 2025, growing to 4.2% by 2035.

The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 15.8% in 2025, declining slightly to 15.4% by 2035, attributed to mixed growth patterns with moderate expansion in some specialty chemical markets balanced by slower growth in smaller countries implementing aromatic compound development programs.

The market is characterized by competition among established specialty chemical companies, specialized aromatic compound manufacturers, and integrated chemical intermediate suppliers. Companies are investing in advanced synthesis technologies, purity enhancement systems, application-specific product development, and comprehensive quality assurance capabilities to deliver consistent, high-purity, and reliable methyl 2-naphthyl ether products. Innovation in synthesis optimization, quality control enhancement, and customized specialty chemical solutions is central to strengthening market position and customer satisfaction.

SB Industries leads the market with a strong focus on specialty chemical innovation and comprehensive aromatic compound solutions, offering sophisticated methyl 2-naphthyl ether products with focus on quality assurance and application versatility excellence. Malve Chemicals provides integrated specialty chemical capabilities with a focus on pharmaceutical intermediates and global chemical distribution networks.

Pat Impex delivers advanced chemical trading and distribution services with a focus on specialty compound sourcing and market development. Ruihai Group specializes in chemical manufacturing and trading with focus on quality control and operational efficiency.

Yancheng Donggang Pharmaceutical and Chemical Development focuses on pharmaceutical intermediates and specialty chemical production with advanced synthesis capabilities. Shanghai Luckysea Chemical emphasizes chemical manufacturing expertise with a focus on aromatic compounds and specialty chemical production.

Methyl 2-naphthyl ether is a highly specialized aromatic chemical compound primarily used in fragrance formulations and pharmaceutical synthesis, valued for its distinctive olfactory properties and chemical stability as an intermediate. With the market projected to grow from USD 22.1 million in 2025 to USD 32.4 million by 2035 at a 3.9% CAGR, this niche specialty chemical serves critical applications in premium fragrance development and pharmaceutical manufacturing where consistent quality and high purity levels are essential. The dominance of ≥98% purity specifications and flavors & fragrances applications reflects the compound's specialized nature and quality requirements.

The market expansion faces challenges including complex synthesis requirements, stringent purity standards, regulatory compliance considerations, and competition from alternative aromatic compounds. Maximizing growth potential requires coordinated efforts across specialty chemical manufacturers and synthesis experts, fragrance and pharmaceutical companies, regulatory agencies and quality standards organizations, research institutions and technology developers, and global supply chain and market access partners.

Advanced Synthesis Technology Development: Invest in optimized synthesis processes for methyl 2-naphthyl ether production, including improved reaction conditions, enhanced catalyst systems, and purification methods that achieve consistent ≥98% purity levels while minimizing production costs and environmental impact. Develop scalable manufacturing processes that can meet both current demand and future growth requirements.

Quality Control and Purity Enhancement: Establish comprehensive quality assurance systems that ensure consistent chemical purity, optical properties, and performance characteristics. Implement advanced analytical testing capabilities, including GC-MS, NMR spectroscopy, and olfactory evaluation, that validate product specifications and support customer quality requirements.

Regulatory Compliance and Documentation: Develop robust regulatory compliance programs that meet international standards for chemical manufacturing, including REACH registration, FDA compliance for pharmaceutical intermediates, and IFRA guidelines for fragrance ingredients. Provide customers with comprehensive safety data sheets, regulatory documentation, and application support.

Sustainable Manufacturing Practices: Implement environmentally responsible manufacturing processes, including waste minimization, solvent recovery systems, and energy-efficient production methods. Develop green chemistry approaches that reduce environmental impact while maintaining product quality and cost competitiveness.

Technical Customer Support: Establish specialized technical support capabilities, including application engineering, formulation assistance, and troubleshooting services that help customers optimize methyl 2-naphthyl ether usage in their specific applications. Provide expertise in handling, storage, and processing requirements.

Application-Specific Formulation Development: Develop expertise in utilizing methyl 2-naphthyl ether's unique olfactory properties for creating distinctive fragrance profiles and complex scent compositions. Invest in perfumery training and technical knowledge that maximizes the compound's aromatic potential while ensuring formulation stability and consumer safety.

Quality Assurance and Testing: Implement comprehensive testing protocols that verify methyl 2-naphthyl ether quality, stability, and performance in final products. Establish analytical capabilities that monitor chemical integrity, olfactory properties, and potential interactions with other formulation components.

Regulatory and Safety Compliance: Ensure thorough understanding of regulatory requirements for fragrance ingredients and pharmaceutical intermediates, including safety assessments, usage restrictions, and labeling requirements. Develop internal expertise in navigating complex regulatory environments across different markets.

Innovation and Product Differentiation: Utilize methyl 2-naphthyl ether's unique properties to create innovative products that differentiate from competitors. Develop signature fragrances or specialized pharmaceutical applications that leverage the compound's distinctive characteristics and performance benefits.

Supply Chain Management: Establish reliable supply relationships with qualified methyl 2-naphthyl ether manufacturers, including backup suppliers, quality agreements, and inventory management systems that ensure consistent product availability while managing costs.

Standards Development and Harmonization: Establish comprehensive quality standards for methyl 2-naphthyl ether, including purity specifications, analytical methods, and performance criteria. Develop international harmonized standards that facilitate global trade and ensure consistent quality expectations across markets.

Safety Assessment and Guidelines: Conduct thorough safety evaluations of methyl 2-naphthyl ether for different applications, including toxicological studies, environmental impact assessments, and exposure limit determinations. Provide clear safety guidelines for handling, processing, and end-use applications.

Regulatory Pathway Optimization: Develop efficient regulatory approval processes for methyl 2-naphthyl ether applications, including streamlined registration procedures, clear documentation requirements, and reasonable review timelines that support innovation while ensuring safety.

International Cooperation: Foster international cooperation on methyl 2-naphthyl ether regulation, including mutual recognition agreements, information sharing protocols, and coordinated safety assessments that reduce regulatory complexity for global suppliers and users.

Industry Guidance and Education: Provide clear guidance documents, training programs, and technical resources that help industry stakeholders understand regulatory requirements and ensure compliance with applicable standards and regulations.

Fundamental Research Programs: Conduct advanced research in aromatic ether chemistry, including synthesis optimization, structure-activity relationships, and novel applications for methyl 2-naphthyl ether. Support collaborative research programs between academia and industry that address current technology limitations and explore new possibilities.

Analytical Method Development: Develop improved analytical methods for methyl 2-naphthyl ether characterization, including enhanced detection techniques, purity analysis, and olfactory evaluation methods. Create standardized testing protocols that support quality control and regulatory compliance.

Process Innovation: Research advanced manufacturing technologies, including continuous flow synthesis, green chemistry approaches, and automated purification systems that improve production efficiency while reducing costs and environmental impact.

Application Research: Investigate new applications for methyl 2-naphthyl ether in emerging markets, including specialty pharmaceuticals, advanced materials, and novel fragrance concepts. Explore structure modifications and derivatives that expand the compound's utility and market potential.

Technology Transfer: Bridge the gap between research developments and commercial applications by providing validation services, pilot-scale testing, and technology transfer support that helps convert laboratory innovations into practical industrial processes.

Global Distribution Networks: Establish reliable distribution capabilities for methyl 2-naphthyl ether, including specialized storage facilities, temperature-controlled transportation, and technical support capabilities that ensure product integrity throughout the supply chain.

Market Development Services: Provide market intelligence, customer identification, and business development support that helps manufacturers identify new opportunities and expand into emerging markets. Support market entry strategies in high-growth regions like China (5.3% CAGR) and India (4.9% CAGR).

Regulatory and Documentation Support: Offer regulatory consulting services that help navigate complex international regulations, prepare registration documents, and obtain necessary approvals for methyl 2-naphthyl ether sales in different markets.

Inventory and Logistics Management: Develop efficient inventory management systems that balance supply reliability with working capital optimization. Provide logistics services that ensure timely delivery while maintaining product quality and minimizing transportation costs.

Customer Financing and Risk Management: Offer financing solutions and risk management services that support customer relationships, including payment terms, credit facilities, and supply contract structures that facilitate business growth while managing commercial risks.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 22.1 million |

| Purity Level | Content≥98%, Content≥99%, Other |

| Application | Flavors and Fragrances, Medicine, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | SB Industries, Malve Chemicals, Pat Impex, Ruihai Group, Yancheng Donggang Pharmaceutical and Chemical Development, Shanghai Luckysea Chemical, and Jiangxi Yuanshangcao Flavor |

| Additional Attributes | Dollar sales by purity level and application, regional demand trends, competitive landscape, technological advancements in chemical synthesis, quality enhancement development initiatives, purity optimization programs, and specialty chemical integration strategies |

The global cholesterol esterase market is estimated to be valued at USD 258.7 million in 2025.

The market size for the cholesterol esterase market is projected to reach USD 601.2 million by 2035.

The cholesterol esterase market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in cholesterol esterase market are microbial-derived cholesterol esterase, animal-derived cholesterol esterase and recombinant cholesterol esterase.

In terms of application, reagent diagnostics segment to command 48.0% share in the cholesterol esterase market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dimethyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Methyl Ether Market

Methylcobalamin Market Size and Share Forecast Outlook 2025 to 2035

Methylparaben Market Forecast and Outlook 2025 to 2035

Methyl Cyclohexane Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Oxovalerate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 2-Fluoro-3-Oxopentanoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Methyl-2-Butenoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ionone Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Market Size and Share Forecast Outlook 2025 to 2035

Methyl Isobutyl Carbinol Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Backhaul Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Access Device Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Peroxide (MEKP) Market Size and Share Forecast Outlook 2025 to 2035

Methyl Oleate Market – Trends & Forecast 2025 to 2035

Methylamine Market Growth – Trends & Forecast 2024-2034

Methyl Cellulose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA