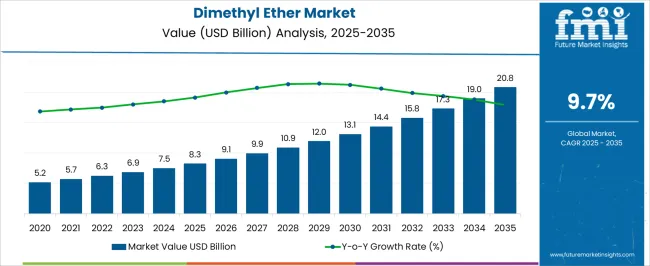

The dimethyl ether market is estimated to be valued at USD 8.3 billion in 2025 and is projected to reach USD 20.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

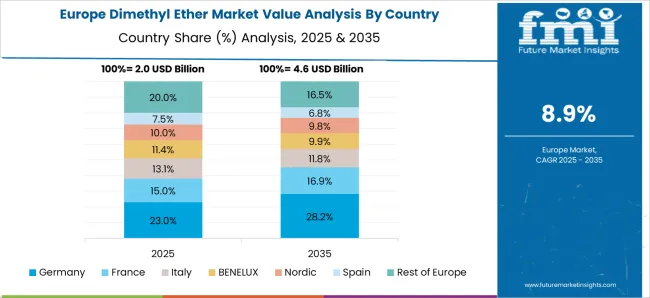

Asia-Pacific is positioned as the dominant growth region, primarily due to its substantial industrial base, high demand for alternative fuels, and supportive government incentives for low-emission energy solutions. Rapid industrialization, increasing transportation fuel demand, and extensive coal-to-DME and natural gas-to-DME conversion infrastructure in countries such as China and India reinforce the region’s leadership in both production and consumption. Europe displays moderate growth, influenced by stringent environmental regulations, higher renewable energy integration, and limited fossil feedstock availability. Adoption is largely concentrated in niche applications, such as transport and chemical intermediates, with policies favoring synthetic and bio-based DME sources. North America demonstrates steady growth driven by natural gas-based production facilities and increasing utilization of DME as a propane alternative for residential and industrial heating. However, slower policy-driven adoption and established conventional fuel infrastructure constrain rapid expansion.

The forecast trajectory from USD 8.3 billion in 2025 to USD 20.8 billion in 2035 underscores Asia-Pacific’s disproportionately large contribution to market expansion, while Europe and North America contribute incrementally. Investment strategies and technological adaptation will continue to shape regional imbalances, highlighting the criticality of localized policies, feedstock economics, and infrastructure readiness in influencing market penetration across regions.

| Metric | Value |

|---|---|

| Dimethyl Ether Market Estimated Value in (2025 E) | USD 8.3 billion |

| Dimethyl Ether Market Forecast Value in (2035 F) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The dimethyl ether market represents a specialized segment within the alternative fuels and chemical intermediates industry, emphasizing clean energy applications and versatile chemical uses. Within the overall synthetic fuels market, it accounts for about 3.7%, driven by adoption in transportation, power generation, and LPG replacement. In the chemical intermediates segment, it holds nearly 4.1%, reflecting use in formaldehyde, acetic acid, and other downstream chemical production. Across the transportation fuel market, the segment captures 3.2%, supporting diesel replacement in compression ignition engines and LPG blending. Within the industrial gas and fuel chemicals category, it represents 2.8%, highlighting adoption in aerosol propellants and refrigeration. In the renewable and sustainable energy solutions sector, it secures 3.0%, emphasizing its potential as a low-carbon fuel derived from biomass, coal gasification, or captured CO2 conversion.

Recent developments in this market have focused on production technology, fuel efficiency, and sustainability. Innovations include catalytic and gas-to-liquid processes to produce dimethyl ether from methanol, biomass, or captured CO2. Key players are collaborating with energy companies, transportation operators, and chemical producers to develop scalable production facilities and expand applications. Engine adaptation for DME as a diesel substitute and use in LPG blends is gaining traction. Additionally, environmental regulations are accelerating adoption due to low particulate emissions and sulfur free characteristics. Research into integrating renewable feedstocks and hybrid gasification pathways is enhancing market viability. These trends demonstrate how efficiency, versatility, and environmental compliance are shaping the dimethyl ether market.

The dimethyl ether market is experiencing steady expansion, driven by its growing role as a cleaner alternative fuel and as a blending component for liquefied petroleum gas (LPG). Industry updates and production reports have pointed to increasing adoption due to its low sulfur content and reduced particulate emissions compared to conventional fuels. Energy sector initiatives to diversify fuel sources and lower carbon footprints have encouraged greater investment in DME production facilities.

Technological advancements in synthesis processes and improvements in storage and transport infrastructure are further enhancing market scalability. In parallel, policy support for alternative fuels, particularly in Asia-Pacific, is contributing to wider commercial uptake.

Looking ahead, the market is expected to benefit from expanding applications in transportation, residential energy, and industrial sectors, with strong momentum in LPG blending and emerging interest in renewable DME production.

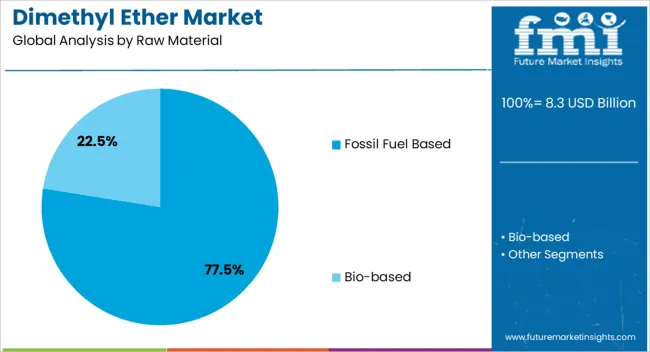

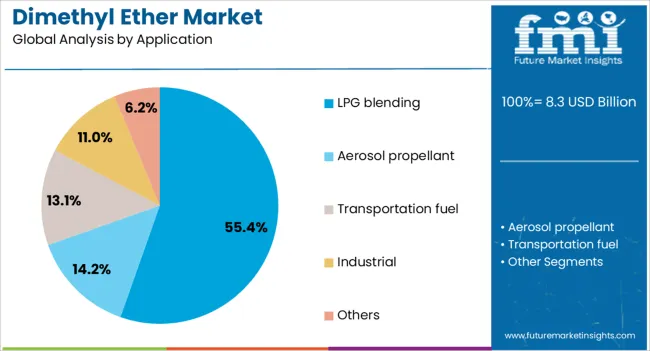

The dimethyl ether market is segmented by raw material, application, and geographic regions. By raw material, dimethyl ether market is divided into fossil fuel based and bio-based. In terms of application, dimethyl ether market is classified into LPG blending, aerosol propellant, transportation fuel, industrial, and others. Regionally, the dimethyl ether industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fossil fuel based segment is projected to account for 77.5% of the dimethyl ether market revenue in 2025, retaining its leading share due to the maturity and cost-efficiency of production pathways. This dominance is supported by the established availability of feedstocks such as natural gas and coal, which enable large-scale manufacturing with predictable supply chains.

Industrial producers have relied on fossil fuel based processes to meet growing demand while maintaining competitive pricing. The segment also benefits from compatibility with existing refinery infrastructure, reducing the need for significant capital investment.

Although renewable DME production is gaining attention, fossil fuel based manufacturing remains the preferred choice for large-volume applications due to its cost advantages and production stability. Continued investments in cleaner extraction and processing technologies are expected to support its position in the near term.

The LPG blending segment is anticipated to hold 55.4% of the dimethyl ether market revenue in 2025, making it the most significant application area. This growth is driven by DME’s ability to improve combustion efficiency and reduce emissions when blended with LPG, particularly in residential cooking and heating applications.

Its high cetane number and clean-burning characteristics make it an effective additive for lowering environmental impact without requiring major modifications to existing LPG infrastructure. Governments in several regions have promoted LPG-DME blends as part of clean energy transition strategies, further stimulating demand.

Additionally, the segment has benefited from the ease of integrating DME into current distribution networks, allowing for scalable deployment across both developed and developing markets. As clean fuel adoption accelerates, the LPG blending segment is expected to remain the primary growth driver for DME consumption.

The market has been gaining momentum as a clean and versatile alternative fuel and chemical feedstock. DME is primarily used in transportation as a diesel substitute, in household cooking applications, and as a raw material in chemical industries for producing olefins and other intermediates. Its high cetane number, low emissions profile, and ability to be synthesized from renewable and fossil-based feedstocks have increased adoption. Market growth is being driven by stringent emission norms, rising demand for sustainable fuels, and technological advances in synthesis and storage.

DME has emerged as a promising alternative to diesel fuel, particularly in urban transportation and heavy-duty vehicles. Its clean-burning properties reduce particulate matter, nitrogen oxides, and greenhouse gas emissions, helping fleets comply with stringent environmental regulations. Public transportation operators, logistics providers, and commercial vehicle manufacturers have been exploring DME blends and pure DME fuels to replace conventional diesel. Adaptation of existing engine designs for DME combustion, along with retrofitting fuel storage and delivery systems, has enabled broader adoption. Additionally, DME’s high cetane number enhances combustion efficiency, engine performance, and fuel economy. Government incentives, low-carbon fuel credits, and emission reduction targets have further accelerated its uptake in the transportation sector, positioning DME as a critical component of the alternative fuel landscape.

In addition to energy applications, DME serves as an intermediate in chemical synthesis, particularly in producing olefins, formaldehyde, and other derivatives. Its utility as a propellant in aerosol sprays, refrigeration, and fire suppression systems adds to market diversity. Industrial users are leveraging DME to reduce reliance on conventional fossil-based chemicals, contributing to sustainability goals. Production of DME from methanol or syngas derived from biomass, natural gas, or coal allows flexible feedstock integration. Refinement in catalytic conversion processes has improved yield, purity, and operational efficiency. As chemical manufacturers seek cleaner, versatile, and cost-effective intermediates, DME adoption in industrial applications continues to expand, driving investment in production and distribution infrastructure.

Technological advancements in DME production and storage are enhancing market feasibility and scalability. Catalytic synthesis from methanol, biomass-derived syngas, and natural gas has been optimized to increase yield and reduce energy consumption. Continuous-flow reactors, membrane separation, and process integration techniques have improved efficiency and product consistency. Storage and transport solutions, including high-pressure tanks and liquefaction systems, are enabling safe handling and broader distribution. Research in hybrid feedstock utilization and renewable synthesis routes is advancing sustainable production, reducing lifecycle emissions. Automation and process monitoring systems have improved operational safety and reliability. These innovations facilitate adoption across transportation, industrial, and domestic applications, enhancing market growth while supporting environmental objectives.

Despite potential, the market faces regulatory and infrastructural challenges. Safety guidelines for handling pressurized DME, certification requirements for fuel use in vehicles, and compliance with environmental standards are critical factors affecting deployment. High initial capital investment for production plants, distribution networks, and retrofitted engines can limit adoption, particularly in emerging markets. Feedstock availability, cost volatility, and logistics for gaseous fuel storage pose operational constraints. Policy support, subsidies, and low-carbon fuel incentives play a crucial role in market expansion. Strategic collaborations between energy producers, industrial users, and regulatory bodies are being implemented to overcome these barriers. Addressing these challenges while leveraging technological advancements is essential for sustainable growth of the DME market globally.

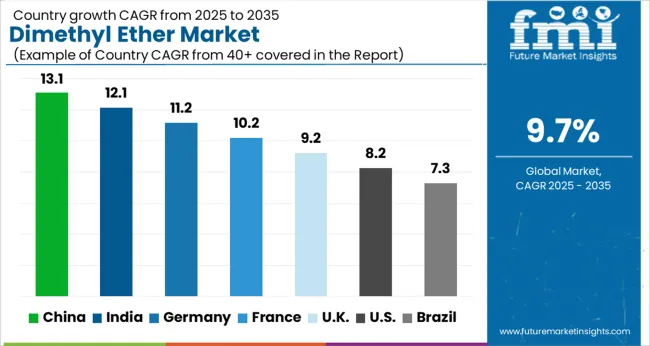

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

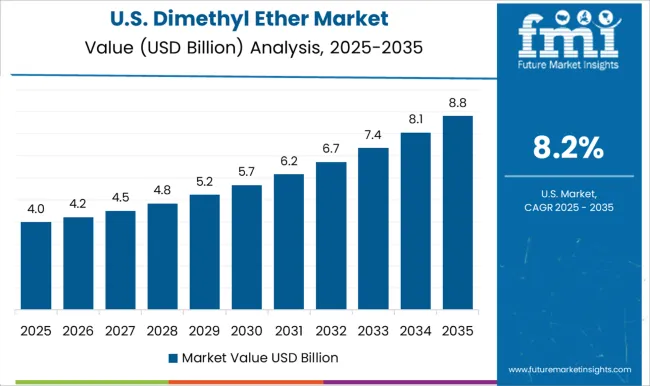

| USA | 8.2% |

| Brazil | 7.3% |

China leads the market with a forecast growth rate of 13.1%, driven by extensive adoption in clean fuel applications, chemical intermediates, and industrial energy solutions. India follows at 12.1%, supported by growing use in alternative fuels and expanding industrial sectors. Germany records 11.2%, fueled by integration of dimethyl ether in sustainable energy strategies and chemical manufacturing processes. The United Kingdom reaches 9.2%, with research initiatives and deployment in green fuel applications contributing to steady development. The United States maintains 8.2%, where industrial and transportation applications support consistent market activity. Together, these nations represent a diverse and evolving landscape influencing global production, deployment, and technological advancements in dimethyl ether. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 13.1%, supported by increasing adoption in transportation fuels, industrial processes, and power generation. Government initiatives promoting cleaner energy sources and emission reductions are accelerating market growth. Industrial applications are leveraging dimethyl ether as an alternative to conventional fuels for boilers and furnaces, while transportation sectors are integrating it as a low-emission fuel. Investment in renewable energy and advanced production technologies is enhancing domestic manufacturing capacity. Rising environmental awareness and policies aimed at decarbonization are expected to provide consistent growth opportunities for market participants in China.

India Dimethyl is expected to grow at a CAGR of 12.1%, driven by increasing demand in industrial, transportation, and energy sectors. Government initiatives encouraging sustainable fuel adoption and emission reduction are positively influencing growth. Dimethyl ether is increasingly used as a substitute for conventional diesel and LPG in industrial applications, improving energy efficiency and reducing carbon emissions. Expansion of production capacities and integration with renewable energy projects are supporting market penetration. Rising awareness of environmental concerns and regulatory frameworks encouraging low-carbon fuels are creating favorable conditions for steady adoption across multiple sectors in India.

Germany is anticipated to grow at a CAGR of 11.2%, backed by strong adoption in industrial, energy, and transportation sectors. Focus on carbon neutrality and renewable energy integration is accelerating market demand. Dimethyl ether is used as a cleaner alternative to fossil fuels in power generation and industrial processes, contributing to emission reduction goals. German manufacturers are investing in production technologies and research to enhance fuel efficiency and quality. Favorable regulatory frameworks, combined with environmental awareness, are encouraging adoption of dimethyl ether as a sustainable energy solution across industries and transportation applications.

The United Kingdom market is projected to grow at a CAGR of 9.2%, fueled by adoption in transportation, industrial energy, and manufacturing applications. Dimethyl ether serves as a cleaner alternative to conventional fuels, helping industries and transport sectors achieve carbon reduction goals. Government support for sustainable energy sources and renewable energy integration is driving production expansion. Technological advancements and collaboration with renewable energy providers are enhancing domestic supply capacity. Rising environmental awareness and stringent emission regulations are creating favorable market conditions for dimethyl ether adoption in multiple sectors across the UK.

The United States is expected to grow at a CAGR of 8.2%, driven by adoption across transportation, industrial, and energy sectors. Dimethyl ether is increasingly used as a substitute for diesel and LPG in industrial boilers, furnaces, and power generation facilities to reduce carbon emissions. Airlines and logistics companies are exploring its potential as a low-emission transportation fuel. Investment in domestic production capacity, along with integration of renewable energy sources, is supporting market growth. Regulatory focus on clean energy and environmental sustainability, combined with technological advancements, is encouraging broader adoption of dimethyl ether across various industrial and transport applications in the United States.

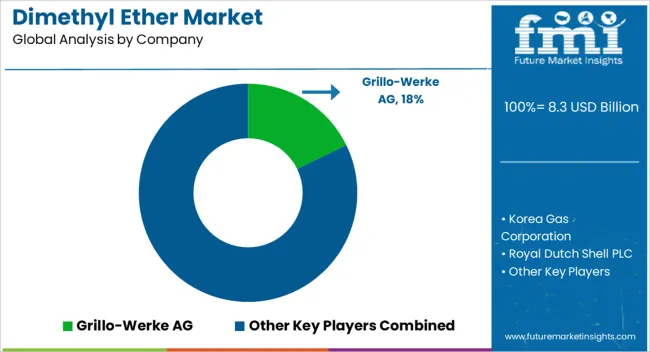

The DME Market is witnessing accelerated growth as industries seek cleaner fuel alternatives and chemical feedstocks. Grillo-Werke AG and Oberon Fuels, Inc. are at the forefront of producing high-purity DME, focusing on applications in transportation fuel, LPG replacement, and aerosol propellants. Korea Gas Corporation and China Energy Ltd. leverage their extensive gas and coal feedstock networks to ensure large-scale and cost-effective DME production, supporting industrial and domestic energy needs. Global giants such as Royal Dutch Shell PLC, Mitsubishi Corporation, and Shenhua Ningxia Coal Industry Group Co. are expanding their DME operations by integrating renewable and low-carbon energy sources, thereby enhancing sustainability and reducing lifecycle greenhouse gas emissions.

Chemical specialists including Akzo Nobel NV, Ltd. and The Chemours Company focus on leveraging DME as a raw material for chemical synthesis, including formaldehyde and acetic acid production. Guangdong JOVO Group Co. and Fuel DME Production Co., Ltd. are contributing through pilot and commercial-scale projects, optimizing production efficiency and distribution. These providers are shaping the DME market by combining feedstock diversity, process innovation, and environmental compliance to meet global energy transition goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.3 billion |

| Raw Material | Fossil Fuel Based and Bio-based |

| Application | LPG blending, Aerosol propellant, Transportation fuel, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grillo-Werke AG, Korea Gas Corporation, Royal Dutch Shell PLC, Shenhua Ningxia Coal Industry Group Co., Oberon Fuels, Inc., Fuel DME Production Co., Ltd., Mitsubishi Corporation, China Energy Ltd., Guangdong JOVO Group Co., Akzo Nobel NV, Ltd., and The Chemours Company |

| Additional Attributes | Dollar sales by product type and application, demand dynamics across energy, chemical, and transportation sectors, regional trends in clean fuel adoption, innovation in production methods, storage, and combustion efficiency, environmental impact of reduced emissions and sustainable sourcing, and emerging use cases in alternative fuels, power generation, and industrial feedstocks. |

The global dimethyl ether market is estimated to be valued at USD 8.3 billion in 2025.

The market size for the dimethyl ether market is projected to reach USD 20.8 billion by 2035.

The dimethyl ether market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in dimethyl ether market are fossil fuel based and bio-based.

In terms of application, lpg blending segment to command 55.4% share in the dimethyl ether market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dimethyl Terephthalate Market Size and Share Forecast Outlook 2025 to 2035

Dimethylolpropionic Acid (DMPA) Market Size and Share Forecast Outlook 2025 to 2035

Dimethyldichlorosilane Market Size and Share Forecast Outlook 2025 to 2035

Dimethyl Carbonate Market - Growth & Demand Outlook 2025 to 2035

The Dimethyl Sulfoxide (DMSO) Market is segmented by raw materials such as black liquor, sulfur, and cotton from 2025 to 2035.

Dimethylformamide (DMF) Market Trends & Forecast 2025 to 2035

Dimethyl Disulphide (DMDS) Market Growth 2025 to 2035

Dimethyl Silicone Market

Polydimethylsiloxane Market Forecast and Outlook 2025 to 2035

3,3-Dimethylacrylic Acid Methyl Ester Market Size and Share Forecast Outlook 2025 to 2035

Lauryl Dimethyl Amine Oxide Market Growth – Trends & Forecast 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Backhaul Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Access Device Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Switch Market

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Netherlands Responsible Tourism Market Insights – Trends, Demand & Growth 2025-2035

Netherlands Micro CHP Market Insights – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA