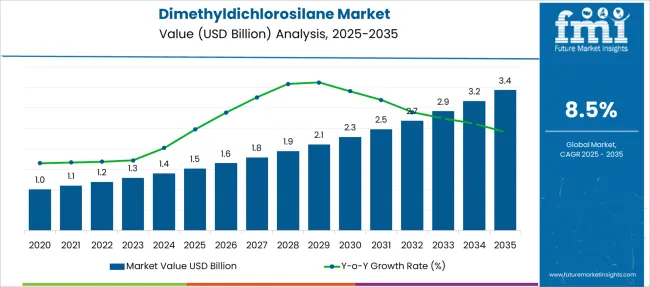

The Dimethyldichlorosilane Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Dimethyldichlorosilane Market Estimated Value in (2025 E) | USD 1.5 billion |

| Dimethyldichlorosilane Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Dimethyldichlorosilane market is experiencing substantial traction, supported by its foundational role in the synthesis of silicone-based polymers and intermediates. This compound serves as a key monomer in the production of linear and cyclic siloxanes, which are further utilized in a broad array of end-use industries including pharmaceuticals, electronics, and construction materials. The market’s current momentum is shaped by increasing precision requirements in downstream applications such as drug formulations, semiconductor encapsulants, and chemical-resistant coatings.

Regulatory emphasis on purity standards, combined with advancements in catalytic conversion technologies, has enhanced production efficiency while improving product consistency. Additionally, the ability to tailor dimethyldichlorosilane through process-based customization has created new growth opportunities for manufacturers catering to niche applications.

With industrial automation and formulation accuracy becoming central to performance-based product development, the market is expected to witness elevated demand across both high-purity and functional-grade segments This trend is likely to accelerate as companies seek scalable, customizable, and compliance-friendly solutions in organosilicon chemistry.

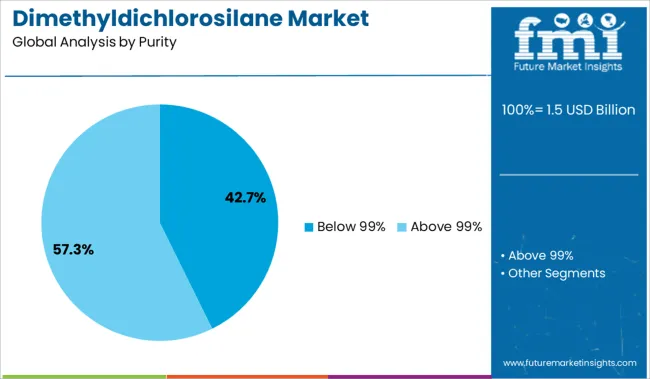

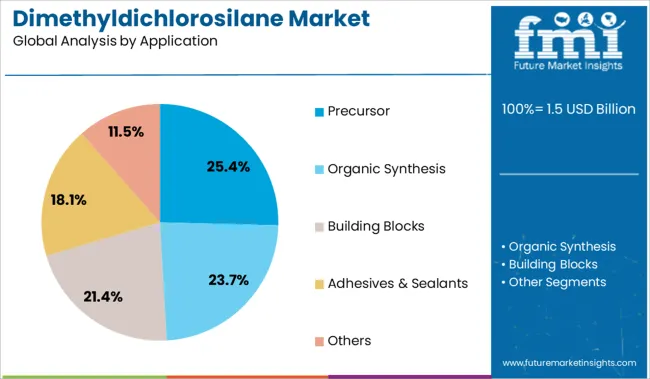

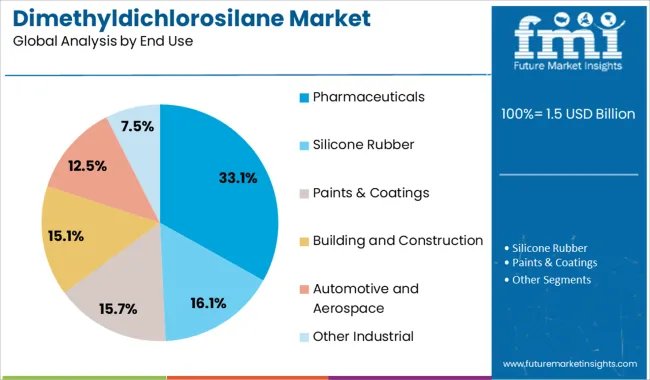

The market is segmented by Purity, Application, and End Use and region. By Purity, the market is divided into Below 99% and Above 99%. In terms of Application, the market is classified into Precursor, Organic Synthesis, Building Blocks, Adhesives & Sealants, and Others. Based on End Use, the market is segmented into Pharmaceuticals, Silicone Rubber, Paints & Coatings, Building and Construction, Automotive and Aerospace, and Other Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The below 99% purity segment is projected to account for 42.7% of the total revenue share in the Dimethyldichlorosilane market in 2025, reflecting its wide acceptance across industrial manufacturing chains. The segment’s dominance is attributed to its suitability for large-scale applications where ultra-high purity is not essential, such as in coatings, sealants, and general polymer synthesis.

Production at this purity level allows for higher throughput and lower cost per unit, which has aligned with the needs of bulk consumers seeking cost-efficient alternatives without sacrificing functional performance. Flexibility in formulation, combined with stable reactivity under controlled conditions, has further contributed to its growing use across chemical intermediates.

The segment is also benefiting from increasing demand in regions focusing on rapid industrial expansion, where high-volume consumption is prioritized over specialized performance As downstream manufacturers continue to expand capacity, the scalability and economic viability of this grade have positioned it as a preferred choice in process-heavy industries.

The precursor segment is expected to hold 25.4% of the total Dimethyldichlorosilane market revenue share in 2025, emerging as a critical application area for the compound. Its key role in the synthesis of silicone polymers and siloxane derivatives has solidified its importance as a foundational building block in organosilicon chemistry.

Demand in this segment has been primarily influenced by the compound’s high reactivity and compatibility with controlled hydrolysis reactions, enabling consistent downstream polymer formation. The ability to modify chain lengths and functional groups at the precursor stage has expanded its application across sectors such as elastomers, adhesives, and performance coatings.

Continuous innovation in silicone-based product development, combined with increasing investments in R&D for next-generation materials, has further enhanced its usage as a customizable precursor The segment is also supported by the chemical industry’s push toward integrated supply chains and vertical production models, ensuring a steady demand for intermediate compounds with controlled synthesis properties.

The pharmaceuticals segment is projected to command 33.1% of the Dimethyldichlorosilane market revenue share in 2025, marking its position as the leading end-use sector. The growing requirement for ultra-clean intermediates and functional siloxanes in drug synthesis and formulation has led to increased utilization of dimethyldichlorosilane in pharmaceutical manufacturing processes. Its role in producing silane coupling agents and silicon-based delivery systems has been instrumental in enhancing bioavailability, formulation stability, and targeted drug delivery.

Strict regulatory requirements around excipient quality and synthetic pathway control have encouraged pharmaceutical manufacturers to rely on consistent and high-performance organosilicon intermediates. The rising demand for specialty drugs, particularly in oncology and neurology, has also elevated the need for precision synthesis enabled by dimethyldichlorosilane.

In addition, collaborations between chemical manufacturers and pharmaceutical innovators have accelerated the compound’s role in supporting advanced drug formulations As regulatory compliance and production scalability become critical in pharma innovation, this end-use segment is expected to remain a major consumer of dimethyldichlorosilane.

The increasing construction activity and the requirement for aesthetically pleasing corporate buildings require the use of large volumes of glass. In order to prevent the adsorption of micro-particles on glass, dimethyldichlorosilane coating is applied to glass.

Given the high-volume requirement of glass used in a multitude of industries such as automobiles, buildings, as well as souvenirs, the dimethyldichlorosilane market is expected to witness growth in the coming future. In addition, the use of dimethyldichlorosilane as sealants for electric motors and aircraft engines is also expected to aid the growth in the demand for dimethyldichlorosilane.

Further, the growing concern regarding automotive pollution as well as fast-depleting fossil fuel reserves is one of the common pain points which is expected to encourage automobile manufacturers to switch to green tires in their automobiles. This is likely to boost the market for dimethyldichlorosilane as dimethyldichlorosilane is the primary raw material used for the manufacture of green tires, fueling the sales of dimethyldichlorosilane.

One of the major deterrents which are adversely impacting the growth of the dimethyldichlorosilane market is the high cost of raw materials/chemicals required for the industrial-scale synthesis of dimethyldichlorosilane.

This increase in raw material costs is a result of fluctuating exchange rates and also environmental protection measures due to which regulation and restriction of chemicals used, including dimethyldichlorosilane by various governments across the world. This pushes the demand for dimethyldichlorosilane.

On the regional front, Asia Pacific is the most dominant market for dimethyldichlorosilane. The demand for dimethyldichlorosilane is primarily from the Indian and Chinese markets. The demand for dimethyldichlorosilane is induced by the fact that there are no stringent regulations for the production and storage of the compound.

Further, the huge market demand for dimethyldichlorosilane by the end users is also stimulating the growth of the market. One of the major factors which are fueling the growth of the market in the Asia Pacific is the booming construction industry and the migration of multinational conglomerates from western nations to Asian countries owing to cheap labor costs.

Europe is the second most dominant market for dimethyldichlorosilane products due to the presence of a large number of automotive manufacturers in the region.

The key players in the Dimethyldichlorosilane market are focusing on variety, price ranges, and quality of additives. This fuels the sales of Dimethyldichlorosilane.

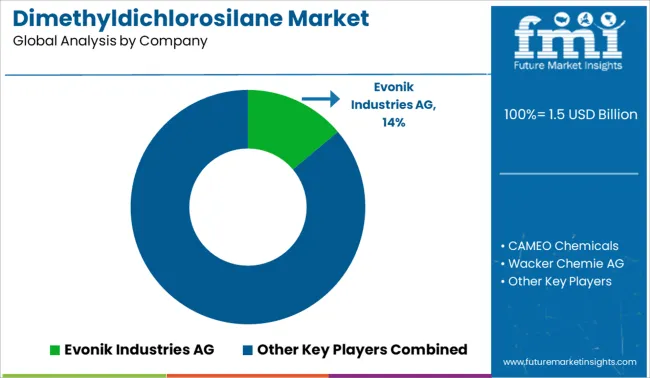

Key players in the dimethyldichlorosilane market include Sigma-Aldrich Inc, Gelest Inc, Dow Corning, Evonik Industries, Wacker Chemie AG, SynQuest Labs Inc, Hoshino Silicon Industry Co. Ltd, DeWolf Chemical, Silar, Qufu Wanda Chemical Industry Co. Ld, Cabot Corporation, Avantor Inc and Toronto Research Chemicals

Recent Market Development:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8.5% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD Million, volume in kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments Covered | Grade, Application, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom., France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates(UAE), Iran, South Africa |

| Key companies profiled | Sigma-Aldrich Inc; Gelest Inc; Dow Corning; Evonik Industries; Wacker Chemie AG; SynQuest Labs Inc; Hoshino Silicon Industry Co. Ltd; DeWolf Chemical; Silar; Qufu Wanda Chemical Industry Co. Ltd; Cabot Corporation; Avantor Inc and Toronto Research Chemicals |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global dimethyldichlorosilane market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the dimethyldichlorosilane market is projected to reach USD 3.4 billion by 2035.

The dimethyldichlorosilane market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in dimethyldichlorosilane market are below 99% and above 99%.

In terms of application, precursor segment to command 25.4% share in the dimethyldichlorosilane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA