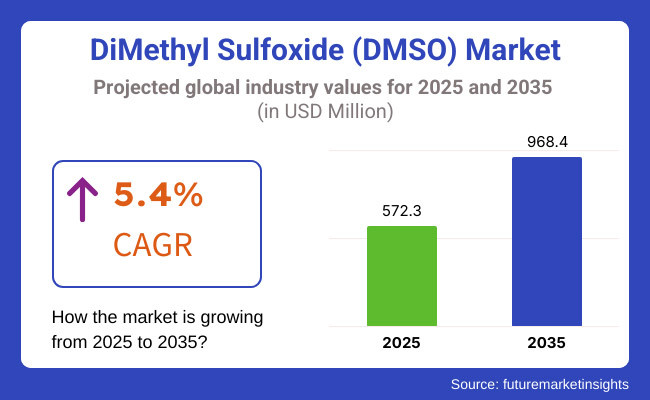

The Dimethyl Sulfoxide (DMSO) market is poised for significant growth over the next decade, with its market size expected to rise from USD 572.3 million in 2025 to USD 968.4 million by 2035, reflecting a CAGR of 5.4%. DMSO, a highly versatile solvent with applications in pharmaceuticals, industrial manufacturing, electronics, and agrochemicals, is gaining momentum due to its unique solvating properties, low toxicity, and bioavailability.

Rather than drug formulation, industrial cleaning agents, and green solvents, the market expansion is also being propelled by the technological advancements and regulatory support for the eco-friendly solvents.

DMSO is widely recognized for its exceptional solvent properties and ability to penetrate biological membranes, making it highly valuable in the pharmaceutical and biotechnology sectors. The problem which the world faces is the fact that people are being diagnosed of chronic ailments which are causing increased R&D for DMSO in the areas of drug delivery and cryopreservation, especially in the field of stem cell and regenerative medicine.

DMSO is not the only industry that has a high contribution from the electronics sector, since it is also used for semiconductor cleaning and circuit board manufacturing. The agrochemical sector gets the advantage from DMSO being used as a carrier solvent for pesticides and herbicides. Likewise, the new rules pertaining to biodegradable and non-toxic solvents would help DMSO to make its way into the industrial cleaning and polymer processing appliances, which in turn would contribute to considerable growth.

Primarily the driving force behind the North American DMSO market is the expansion of the pharmaceutical and biotechnology industries. The United States and Canada are at the forefront of the region because of their significant R&D investments, state-of-the-art healthcare infrastructure, and growing focus on regenerative medicine.

The use of DMSO in applications such as cryopreservation, drug formulation, and biodegradable solvents is witnessing rapid growth. Besides, industrial cleaning, polymer processing, and electronics demand are also supporting the market's expansion.

But the stringent safety laws regarding solvents, which are imposed by the FDA and EPA, could pose compliance obstacles for the manufacturers. Even though there are some regulatory hurdles, the ongoing research related to sustainable solvent applications is expected to provide opportunities for DMSO producers.

The DMSO market in Europe is a product of the environmental sustainability initiatives and strict regulatory policies. Some countries like Germany, France, and the UK are leading the demand through clean technology investments, pharmaceutical R&D, and electronics manufacturing. Additionally, the chemical and coatings industries in the region also depend on DMSO as a greener alternative to the traditional solvents.

In addition, the European Union's biodegradability promotion initiatives are leading to wipes everywhere in industrial cleaning and polymer processing. Aside from the stringent safety measures and production costs being high, the growing popularity of bio-based and low-toxicity chemicals is expected to boost the market's long-term growth in Europe.

Asia-Pacific has been projected to be among the fastest-growing markets for DMSO because of the booming pharmaceutical, electronics, and active chemical sectors. China, Japan, and South Korea are the major consumers of DMSO for semiconductor cleaning, drug production, and pesticide formulations.

In addition, the region's agricultural expansion and rising population are benefiting DMSO in terms of using it as a carrier solvent in agrochemicals. The government's initiative to promote green chemistry is leading to increased investments in biodegradable solvents and sustainable manufacturing. DMSO will naturally grow in the future, led by rapid industrial development and technological advances.

The growth of the DMSO industry in Latin America is driven mainly by the increased pharmaceutical sector, agrochemical, and other industrial applications. Brazil and Mexico are two key markets that extensively use DMSO in fabricating pesticides, developing drugs, and processing polymers. The coming in of eco-friendly solvents is getting immense traction as industries are seeking products that are biodegradable and non-toxic.

However, the challenges facing the sector are overall economic instability, ineffective regulatory systems and sporadic environmental policy enforcement. Notwithstanding these challenges, the anticipated investment hikes in agricultural, health, and industrial modernization sectors are likely to run DMSO demand up, thus making it a semiconductor in regional industrial and scientific developments in the next 10 years.

The growing demand for DMSO in pharmaceuticals, industrial solvents, and polymer applications pushes the Middle East & Africa (MEA) market to expand. Nations such as Saudi Arabia and the UAE have heavily invested in biotechnology, drug manufacturing, and petrochemical industries, all of which resulted in an increase in DMSO consumption. Although expanding healthcare infrastructure and a growing emphasis on sustainable chemical solutions are creating new opportunities.

The current situation is marred by the limited local production capability, high import dependency, and fluctuating raw material costs which are challenges to market stability. Government efforts to diversify the economy and promote industrial development are expected to bring long-term growth, and DMSO will be a key player in that.

Environmental and Safety Regulations

Although considered safe, DMSO is subject to various regulations affecting how it is stored, handled, and transported. To be pharmaceutical grade, DMSO needs to have very low contamination which means companies must go through severe quality control processes that drive up production costs. Besides this, the industrial and environmental restrictions in certain areas such as the European Union and North America impose significant stress on compliance due to factors like solvent emissions and disposal issues.

Some cases require specialized decontamination and transportation of DMSO due to the hygroscopic and penetrative nature that it possesses. Mending machines are pushed to be not only consumer-friendly but also, push synthetic and incense to the market, coaters have to change the tradition to be market compliant and competitive.”

Market Price Volatility

The DMSO market is subject to the shifting costs of raw materials, particularly because of its reliance on sulfur-based feedstock’s. Difficulties in the sulfur supply chain, petrochemical production, and global trading could lead to price instability, which directly affects market profits.

Patents on electronic equipment have been driving up power prices that ordinary consumers are faced with. Market access in certain markets suffers from various variables, including geopolitical issues, trade bans, and environmental decrees that increase costs for DMSO companies. To reduce these risks, manufacturers are evaluating other production methods, sourcing raw materials strategically, and making their supply chain more diverse to try and maintain a successful price stability and a long-term market existence.

Growth in Pharmaceutical Applications

The pharmaceutical industry is one primary focus for the DMSO market besides the increasing application of DMSO in drug delivery, regenerative medicine, and pain management. Due to its unique ability to act as a penetrating agent, DMSO is an excellent choice for some topical and intravenous drug formulations.

Additionally, its application in cryopreservation and stem cell storage is increasing with the advancement of biotechnology and regenerative medicine. In parallel with the growth of high-performance, biocompatible solvents, the prevalence of DMSO-based drug formulations is expected to increase regulatory approval, thus, contributing to long-term market growth in the area.

Expansion in Green Solvent Applications

Faced with the problem of incorporating environmentally friendly solvents, the DMSO has made a mark in the production of chemicals, coatings, adhesives, and industrial cleaning as a predominantly green alternative. It stands out as an eco-friendly solution to the problem of hazardous solvent emission reduction for companies through its low toxicity, its efficacy as a solvent, and its environmental compatibility.

The shift to green chemistry, along with stricter regulations and the need for corporate sustainability is driving investment in DMSO-based formulations. Besides, innovations in bio-based and recyclable solvents are bringing new opportunities for DMSO in the plastics, semiconductors, and specialty chemicals industries which in turn fuels demand and drives growth in industry.

Introduction: For the last few years, there has been a steady growth trend in the Dimethyl Sulfoxide (DMSO) market that has been contributed by wide application in the fields of pharmaceuticals, agrochemicals, electronics, and industrial solvents. The market from 2020 until 2024 soared mainly owing to the rising of the medical sector where DMSO was mainly consumed as a drug carrier, cryo protectant, and anti-inflammatory agent.

The role of DMSO as a solvent in agrochemicals and electronics manufacturing was also significant in driving the expansion of DMSO. The projection for the future of the DMSO market is a rise from USD 572.3 million in 2025 to USD 968.4 million in 2035 with a compound annual growth rate (CAGR) of 5.4%.

The development of biotechnology, the spread of applications in the area of green chemistry, and the increased demand for high purity solvents in the pharmaceutical and the semiconductor industries will be the major forces driving the market in the future.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Framework | Adherence to the regulations of pharmaceutical and industrial solvents, with few territorial restrictions. |

| Technological Developments | Launch of new pharmaceutical-grade DMSO for enhanced medical therapy. |

| Sectoral Demand | Prominent role in pharmaceuticals, agrochemicals, and industrial solvents. |

| Sustainable Approach & Circular Economy | Focus on the reduction of production processes environmental issues. |

| Market Growth Stimulators | Exploding procurements in pharmaceuticals and electronics sectors. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Framework | More rigid environmental and safety rules, promoting the use of greener manufacturing techniques and sustainable sourcing. |

| Technological Developments | A fast-growing figure of bio-based DMSO and higher purification techniques are used in advanced applications. |

| Sectoral Demand | Broader utilization in biotechnologies, semiconductors, and battery electrolyte solutions. |

| Sustainable Approach & Circular Economy | Promotion of sustainable supply chains and eco-friendly manufacturing technologies. |

| Market Growth Stimulators | New inventions in drug delivery systems, more extensive use in lithium-ion batteries, and environment-friendly chemical applications. |

The expansion of the pharmaceutical and biotechnology sector and the increase in the use of DMSO in drug delivery and transdermal formulations are the two most important drivers of the United States dimethyl sulfoxide (DMSO) market. The dominance of the FDA in the approval of DMSO-based drug formulations has put its use in transdermal drug delivery systems on fast track.

Apart from this, the trend of using bio-based solvents in chemical synthesis is also leading to a rise in demand. Besides, the agrochemical industry is growing, and DMSO is a carrier for some pesticides. An increase in the production of semiconductors has also played a vital role in the hike in demand for high-purity DMSO for cleaning and processing applications. The pressure of stringent environmental laws has also led to the transition to the benzoate, non-carcinogenic solvate-structure.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The UK DMSO market is witnessing steady growth, driven by pharmaceutical innovation, growing demand for green solvents, and increasing agrochemical applications. The UK government’s focus on sustainability and stringent VOC regulations are pushing industries to adopt bio-based and non-toxic solvents like DMSO. The pharmaceutical and biotech industries are expanding rapidly, using DMSO in drug formulations and clinical research.

Additionally, the agricultural sector is adopting DMSO as a solvent for pesticides and herbicides. The growth of polymer and resin manufacturing also contributes to market expansion, with DMSO being widely used in high-performance material processing.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

The DMSO market in Europe is on the rise due to adherence to the strict environmental measures, high usage rates in the pharmaceutical industry, and a remarkable jump in electronics manufacturing. The European Green Deal and REACH regulations are advocating the use of green solvent this measure indirectly prompts DMSO to be in much more demand in chemical synthesis.

The pharmaceutical industry is the main factor, while DMSO is used in drug delivery systems and cryopreservation. The sector of electronics is booming, and DMSO is utilized in cleaning semiconductors and printed circuit boards. The need for green agrochemicals is growing, which is also a reason for market DMSO expansion since it is used as an alternative to the usual solvents in pesticide formulations and crop protection applications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

The Japanese DMSO market is flourishing tenaciously and is mainly influenced by the health of the pharmaceutical sector, semiconductor manufacturing, and industrial solvent demand. The strong R&D focus in Japan's pharmaceuticals has increased the use of DMSO in drug delivery and cryopreservation applications. With the electronics sector being at the helm, including semiconductor production and display panel manufacturing, the demand for high purity DMSO as a cleaning and etching solvent is also on the way up.

Embedded in the trend for the chemical sector to switch from conventional to greener solvents more and more DMSO is being utilized in polymer processing and fine chemical synthesis applications. Japan's regulatory thrust for sustainable practices is seconding the efforts of market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The South Korean DMSO market is growing at a very fast pace because of the country's solid semiconductor industry, pharmaceutical innovation, and industrial solvent applications. South Korea is a top global hub for electronics manufacturing, with the likes of Samsung and SK Hynix, who are the main drivers of high-grade DMSO, and in the production and cleaning of circuit lines.

The pharmaceutical sector is also developing, and DMSO is a part of it which is used in drug analysis and medical product preparations. The government turns the mood green by adopting these projects of industry zero-defects which make them change to low-toxicity chemicals. The rise of the Korean chemical industry, which includes resin and polymer manufacturing, acts as an additional driver.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

High Purity DMDS (>99%) Dominates Due to Stringent Industrial Requirements

The most important application of high-purity DMDS (>99%) is in oil refining and petrochemicals, where sulfur-containing compounds perform a major part in hydrocracking and hydrodesulfurization processes. The increased pressure on producing low-sulfur fuels from oil refineries has greatly increased the demand for such desulfurization technologies/ process units. Its usage in chemical synthesis for specialty chemicals and pharmaceuticals is on the rise.

North America and the Middle East are the areas that are notably performing better owing to their manufacturing units of oil refineries that are on the other hand strong. Nonetheless, there is a negative effect on market proliferation due to the factors such as cost constraints and supply chain disruptions, the most urgent step for progress being the innovation in production technique.

Technical Grade DMDS Gains Traction in Agriculture and Industrial Applications

Technical-grade DMDS (typical 95-99 purity) has become frequently used as a soil fumigant in agriculture instead of methyl bromide, following environmental discharge regulations. Its strong pest control characteristics allow it to be an efficient alternative for nematode management in vegetables like tomato and strawberry. It is also a main chemical in the making of polyvinyl chloride and a flame retardant.

The trend towards sustainable agriculture is pushing the growth of the sector, specifically in Europe and North America. But regulatory approaches due to toxicity issues, as well as changing safety standards, might affect market dynamics thus, further research need to be done on the alternatives that would be safer or need to be used with less control technique.

Oil & Gas Industry Leads with Increasing Use in Refinery Operations

The oil and gas industry is the biggest consumer of the DMDS. In refineries, this compound is mainly used for hydrodesulfurization. The need for environmentally friendly fuels and adherence to strict regulations for sulfur emissions are the drivers for adoption mostly in Asia Pacific, North America, and the Middle East.

Not only that but also DMDS can be used for steam cracking processes with the aim of coke minimization in the ethylene production process. With the refineries getting updated to address environmental concerns, the demand is likely also to be high. However, the fluctuating crude oil markets and the B2B operation referrals of oil refineries endure as issues so the key point for future DMDS consumption is the regional refinery expansion projects.

Agriculture Sector Benefits from DMDS as a Soil Fumigant

In the agricultural sector, DMDS is an important soil fumigant, replacing some chemicals like methyl bromide for environmental reasons. The toxin is nematodes, fungal spores, and weed seed, respectively in the damage that they do to various fruit and vegetable productions in North America and Europe.

Regulatory bodies, mainly the EPA and REACH, have approved DMDS-based products under controlled conditions to ensure safe application. Growing anxiety about residues from pesticides and human health implications, however, may affect the long-term use of pesticides. As part of their efforts to enhance the sustainability and effectiveness of DMDS in modern agriculture, manufacturers are focusing on the development of formulation improvements and integrated pest management schemes.

Dimethyl Sulfoxide (DMSO) is a niche product in the market. Although it is a small market, it is full of potential. It is an organic compound, which is chemical solvent, has low toxicity, and is helpful for penetration of biological membranes. The industries that it is found in are in pharmaceuticals, agrochemicals, industrial cleaning and electronics.

The market is dominated by the global chemical manufacturers, while high-purity DMSO production, sustainable resources, and new uses like drug delivery and bio-based solvents are on the development agenda for the main actors. Also, the increase in demand for environmentally friendly and biodegradable solvents is shaping the competitive scene.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Gaylord Chemical Company, LLC | 20-25% |

| Toray Fine Chemicals Co., Ltd. | 15-20% |

| Arkema S.A. | 12-17% |

| Hubei Xingfa Chemicals Group Co., Ltd. | 8-12% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Gaylord Chemical Company, LLC | Leading producer of high-purity DMSO for pharmaceuticals and industrial use, with a focus on regulatory compliance. |

| Toray Fine Chemicals Co., Ltd. | Supplies DMSO for microelectronics and chemical processing, investing in sustainable alternatives. |

| Arkema S.A. | Produces high-purity and industrial-grade DMSO for various industries, expanding global supply chain. |

| Hubei Xingfa Chemicals Group Co., Ltd. | Major player in China, focusing on cost-effective DMSO production for agrochemicals and solvents. |

| Other Companies | Regional manufacturers and niche suppliers contributing to market growth with cost-competitive solutions. |

Key Company Insights

Gaylord Chemical Company, LLC

Gaylord Chemical is the highest worldwide producer of high-purity DMSO, widely used in pharmaceuticals, cryopreservation, and agrochemicals. The company is equipped with the latest technology in refining processes that guarantees low impurity levels thus making these DMSO suitable for drug formulations and biotechnology applications.

With a strong foothold in North America, Gaylord is also expanding its distribution network in Europe and Asia. The company is primarily focused on regulatory compliance and green chemistry, actively looking for bio-based alternatives that will contribute to sustainability.

Toray Fine Chemicals Co., Ltd.

Toray Fine Chemicals is a reliable DMSO supplier for the electronics and chemical processing industries. The company is particularly intersected in semiconductor-grade DMSO, which is a material that used in circuit board cleaning problems or precision chemical synthesis.

Toray is concentrating on sustainable production methods, cutting down carbon emissions, and improving the efficiency of the supply chain. The company is also stretching imagination to the possibilities of new medical applications, for instance drug delivery systems where DMSO acts as a carrier.

Arkema S.A.

Arkema is a diverse chemical producer with a solid base in the industrial and pharmaceutical DMSO market. The company is all about the manufacturing of high-purity DMSO, which is then distributed to biotechnology, electronics, and coatings industries.

The global strategies of Arkema and its commitment to the development of sustainable chemical solutions have made it a green solvent development leader. Arkema, by adding new production capacities in Europe and North America, ensures its presence as a major player in this market.

Hubei Xingfa Chemicals Group Co., Ltd.

Hubei Xingfa Chemicals is one of the biggest names in China when it comes to being a DMSO producer, with deliveries to the agrochemical, pharmaceutical, and industrial solvent markets. The company is utilizing China's' extensive sulfur resources and is thus investing in low-cost production methods.

As a cheap source, it is filling an important role in the Asia-Pacific region, exporting DMSO to customers worldwide. Nevertheless, stricter environmental laws in China could result in a decline in production and a transition to greener methods.

The global Dimethyl Sulfoxide (DMSO) market is projected to reach USD 572.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.4% over the forecast period.

By 2035, the Dimethyl Sulfoxide (DMSO) market is expected to reach USD 968.4 million.

The pharmaceutical segment is expected to dominate due to the increasing use of DMSO as a drug delivery solvent and in medical applications such as anti-inflammatory and cryopreservation solutions.

Key players in the market include Gaylord Chemical Company, Arkema S.A., Hubei Xingfa Chemicals Group, Toray Fine Chemicals, and Yankuang Lunan Chemical.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 4: Global Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 10: North America Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 16: Latin America Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 22: Western Europe Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 23: Western Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 28: Eastern Europe Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 29: Eastern Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 34: South Asia and Pacific Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 35: South Asia and Pacific Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 40: East Asia Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 41: East Asia Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Value (US$ Million) Forecast by Raw Materials, 2018 to 2033

Table 46: Middle East and Africa Volume (Tons) Forecast by Raw Materials, 2018 to 2033

Table 47: Middle East and Africa Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 2: Global Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 9: Global Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 10: Global Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 11: Global Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 12: Global Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Attractiveness by Raw Materials, 2023 to 2033

Figure 17: Global Attractiveness by Application, 2023 to 2033

Figure 18: Global Attractiveness by Region, 2023 to 2033

Figure 19: North America Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 20: North America Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 27: North America Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 28: North America Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 29: North America Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 30: North America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Attractiveness by Raw Materials, 2023 to 2033

Figure 35: North America Attractiveness by Application, 2023 to 2033

Figure 36: North America Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 38: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 45: Latin America Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 46: Latin America Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 47: Latin America Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 48: Latin America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Attractiveness by Raw Materials, 2023 to 2033

Figure 53: Latin America Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 56: Western Europe Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 63: Western Europe Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 64: Western Europe Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 65: Western Europe Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 66: Western Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Attractiveness by Raw Materials, 2023 to 2033

Figure 71: Western Europe Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 74: Eastern Europe Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 81: Eastern Europe Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 82: Eastern Europe Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 83: Eastern Europe Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 84: Eastern Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Attractiveness by Raw Materials, 2023 to 2033

Figure 89: Eastern Europe Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 92: South Asia and Pacific Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 99: South Asia and Pacific Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 100: South Asia and Pacific Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 101: South Asia and Pacific Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 102: South Asia and Pacific Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Attractiveness by Raw Materials, 2023 to 2033

Figure 107: South Asia and Pacific Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 110: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 117: East Asia Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 118: East Asia Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 119: East Asia Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 120: East Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Attractiveness by Raw Materials, 2023 to 2033

Figure 125: East Asia Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Value (US$ Million) by Raw Materials, 2023 to 2033

Figure 128: Middle East and Africa Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Value (US$ Million) Analysis by Raw Materials, 2018 to 2033

Figure 135: Middle East and Africa Volume (Tons) Analysis by Raw Materials, 2018 to 2033

Figure 136: Middle East and Africa Value Share (%) and BPS Analysis by Raw Materials, 2023 to 2033

Figure 137: Middle East and Africa Y-o-Y Growth (%) Projections by Raw Materials, 2023 to 2033

Figure 138: Middle East and Africa Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Attractiveness by Raw Materials, 2023 to 2033

Figure 143: Middle East and Africa Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dimethyl Terephthalate Market Size and Share Forecast Outlook 2025 to 2035

Dimethylolpropionic Acid (DMPA) Market Size and Share Forecast Outlook 2025 to 2035

Dimethyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Dimethyldichlorosilane Market Size and Share Forecast Outlook 2025 to 2035

Dimethyl Carbonate Market - Growth & Demand Outlook 2025 to 2035

Dimethylformamide (DMF) Market Trends & Forecast 2025 to 2035

Dimethyl Disulphide (DMDS) Market Growth 2025 to 2035

Dimethyl Silicone Market

Polydimethylsiloxane Market Forecast and Outlook 2025 to 2035

3,3-Dimethylacrylic Acid Methyl Ester Market Size and Share Forecast Outlook 2025 to 2035

Lauryl Dimethyl Amine Oxide Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA