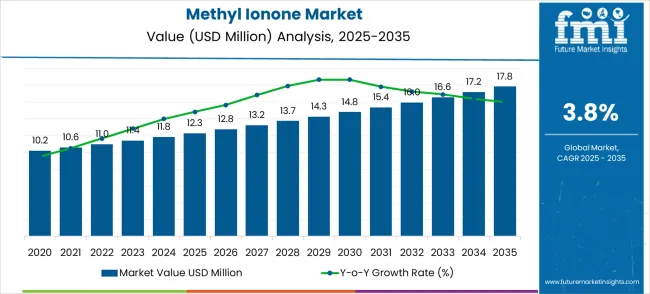

The global methyl ionone market is expected to reach from USD 12.3 million in 2025 to USD 17.8 million by 2035, reflecting a CAGR of 3.8%. The contribution of volume versus price growth highlights the underlying factors driving market expansion. From 2025 to 2030, volume growth plays a dominant role as increasing adoption in perfumes, cosmetics, and flavoring applications drives higher demand. Manufacturers expand production capacity to meet rising consumer preference for high-quality fragrances and flavor formulations. The incremental sales generated through higher volumes create a solid foundation for market growth, contributing significantly to revenue accumulation during this period.

Price growth contributes moderately in the early phase, supported by product differentiation, specialty grades, and premium positioning in niche applications. From 2030 to 2035, volume-driven growth continues but is complemented by modest price increases resulting from innovation, higher purity grades, and regulatory compliance costs. This combination allows suppliers to capture additional revenue per unit while maintaining steady demand. Overall, volume growth accounts for the majority of market expansion, while price increases provide incremental support. Understanding the balance between these two factors helps stakeholders optimize production strategies, pricing models, and supply chain planning. The analysis shows that sustained volume adoption, reinforced by selective price adjustments, will drive long-term value creation in the methyl ionone market over the decade.

The global methyl ionone market is distributed across fragrances and perfumes (40%), personal care and cosmetic products (30%), flavoring applications in food and beverages (14%), household products such as air fresheners and detergents (10%), and niche applications like aromatherapy and luxury formulations (6%). Fragrance and perfume manufacturers dominate adoption due to methyl ionone’s characteristic violet-like scent, enhancing premium perfumes and body sprays. Personal care products use it for long-lasting aroma in soaps, shampoos, and lotions. Flavoring applications employ it for fruity and floral notes in beverages and confections. Household items utilize methyl ionone to improve sensory appeal, while niche applications target premium aromatherapy and luxury cosmetics.

Methyl ionone is used in a range of products including creams, lotions, lipsticks, powders, and hair products, owing to its pleasant scent and stability under varying temperature and pH conditions. As trends in premiumization, experiential beauty, and sensorial cosmetics continue to grow, manufacturers are enhancing product engagement by incorporating high-quality fragrances. This shift is increasing the use of methyl ionone in both luxury and mass-market cosmetic formulations.

Emerging trends include bio-based synthesis, high-purity grades, and enhanced odor stability. Producers are focusing on creating tailored scent profiles, utilizing eco-conscious raw materials, and ensuring compatibility with natural extracts. Premium fragrance lines, luxury personal care products, and innovative flavor applications drive growth. Collaborations between chemical suppliers and perfumers or food manufacturers enable customized formulations, consistent aroma performance, and enhanced consumer experience, promoting steady market expansion globally.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 12.3 million |

| Market Forecast Value (2035) | USD 17.8 million |

| Forecast CAGR (2025-2035) | 3.8% |

The methyl ionone market grows by enabling fragrance manufacturers to create distinctive scent profiles that enhance product differentiation while meeting consumer demand for sophisticated and long-lasting fragrances. Demand drivers include expanding luxury perfume segment requiring premium fragrance ingredients with unique olfactory properties, increasing consumer preference for complex fragrance compositions driving adoption of specialty aroma chemicals, and growing applications in premium cosmetics where methyl ionone provides distinctive floral-woody notes. Priority segments include luxury perfume houses and premium cosmetic manufacturers, with China and India representing key growth geographies due to expanding middle-class consumer base and rising demand for premium beauty products. Market growth faces constraints from limited production capacity for high-purity grades and the need for specialized expertise in fragrance chemistry and regulatory compliance.

The Methyl Ionone market is entering a new phase of growth, driven by demand for premium fragrance ingredients, expanding luxury goods consumption, and evolving sustainability standards across fragrance industries. By 2035, these pathways together can unlock USD 25-32 million in incremental revenue opportunities beyond baseline growth.

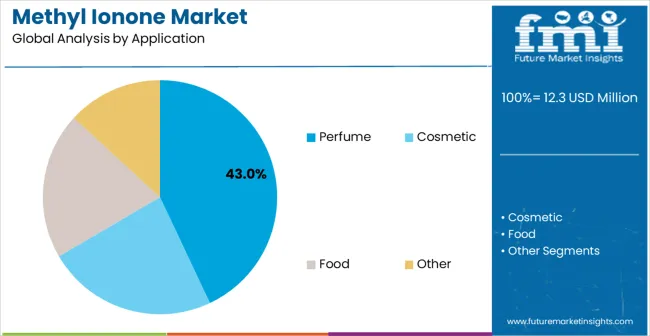

Pathway A - Perfume Applications Leadership (Luxury Fragrance Formulations) The perfume segment already holds the largest share due to its critical role in fine fragrance development and luxury scent creation. Expanding high-purity grades, sustainable sourcing credentials, and specialized fragrance chemistry can consolidate leadership. Opportunity pool: USD 8.5-11.0 million.

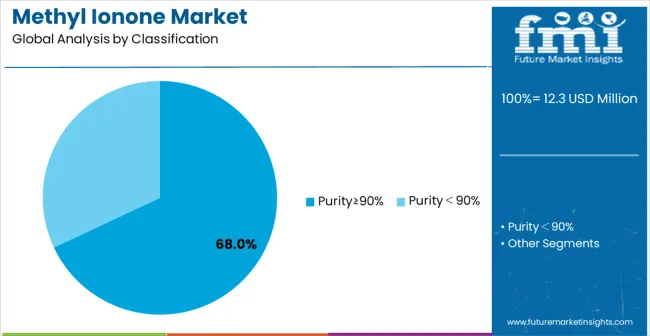

Pathway B - High Purity Grade Dominance (Premium Quality Applications) Purity≥90% applications account for significant market demand. Growing requirements for consistent olfactory performance, especially in luxury perfumery and premium cosmetics, will drive higher adoption of ultra-pure methyl ionone grades. Opportunity pool: USD 6.5-8.5 million.

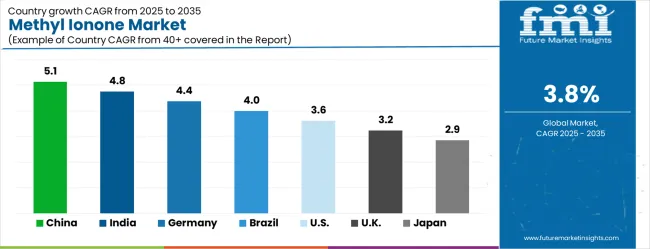

Pathway C - Asia-Pacific Market Expansion (China & India Growth) China and India present the highest growth potential with CAGRs of 5.1% and 4.8% respectively. Targeting expanding luxury goods consumption and growing domestic fragrance manufacturing sectors will accelerate adoption. Opportunity pool: USD 4.8-6.2 million.

Pathway D - Cosmetic Applications (Premium Personal Care) Cosmetic and personal care applications represent significant growth potential with increasing demand for signature scents and premium positioning in beauty products. Opportunity pool: USD 2.8-3.6 million.

Pathway E - Sustainable Production Innovation with increasing consumer demand for sustainable ingredients, there is an opportunity to promote eco-friendly production methods and natural-derived alternatives optimized for environmentally conscious brands. Opportunity pool: USD 1.8-2.3 million.

Pathway F - Food Applications Expansion Food and flavor applications offer growth opportunities in premium food products, specialty beverages, and gourmet applications requiring sophisticated flavor profiles. Opportunity pool: USD 1.2-1.5 million.

Pathway G - Technical Services Revenue Value-added services including fragrance consultation, formulation support, regulatory assistance, and custom production creates additional revenue streams across global fragrance markets. Opportunity pool: USD 0.8-1.0 million.

Pathway H - Niche Perfumery Applications Specialized applications in niche perfumery, artisanal fragrances, and custom scent creation offer premium positioning opportunities in emerging fragrance segments. Opportunity pool: USD 0.6-0.8 million.

The market is segmented by product type, application, end-user, purity grade, and region. By product type, the market is divided into purity≥90% and purity<90%. Based on application, the market is categorized into perfume, cosmetic, food, and other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

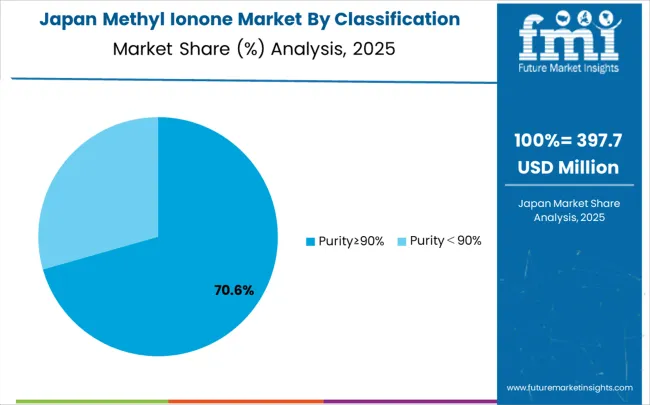

Purity≥90% grade is projected to account for a substantial portion of 68% of the methyl ionone market in 2025. This share is supported by superior olfactory performance characteristics and enhanced formulation stability in premium applications. Purity≥90% methyl ionone provides consistent fragrance profiles that enable perfumers to create sophisticated scent compositions with predictable performance and longevity. The segment enables stakeholders to benefit from premium positioning and enhanced product differentiation for luxury fragrance applications.

Perfume applications are expected to represent the largest share of 43% of the methyl ionone applications in 2025. This dominant share reflects the critical role of methyl ionone as a key fragrance ingredient that appeals to luxury perfume houses and fragrance manufacturers worldwide. The segment provides essential olfactory support for floral and oriental fragrance compositions, contributing distinctive woody-floral notes that enhance fragrance complexity and sophistication. Growing consumer demand for premium fragrances and niche perfumery drives adoption in this application area.

Market drivers include expanding luxury fragrance sector requiring distinctive aroma chemicals for premium scent compositions, increasing consumer sophistication in fragrance preferences driving demand for complex and unique olfactory experiences, and growing applications in premium cosmetics where methyl ionone supports product differentiation through signature scent profiles. These drivers reflect direct stakeholder outcomes including enhanced brand positioning, improved product differentiation, and premium pricing opportunities across multiple fragrance and cosmetic categories.

Market restraints encompass limited production capacity for high-purity grades that constrains supply availability for luxury applications, complex regulatory requirements for fragrance ingredients requiring extensive safety documentation, and price sensitivity in certain market segments limiting adoption of premium-grade materials. Additional constraints include raw material sourcing challenges and the need for specialized storage and handling requirements that increase operational complexity and costs.

Key trends show adoption accelerating in China and India where expanding luxury goods consumption drives demand for premium fragrance ingredients, while formulation shifts toward natural and sustainable alternatives create opportunities for eco-friendly production methods. Consumer preference evolution focuses on authentic and sophisticated fragrance experiences that expand market opportunities for premium aroma chemicals. Market thesis faces risk from synthetic alternatives that could provide similar olfactory properties at lower costs or regulatory restrictions that could limit usage levels in consumer products.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| Brazil | 4.0% |

| USA | 3.6% |

| UK | 3.2% |

| Japan | 2.9% |

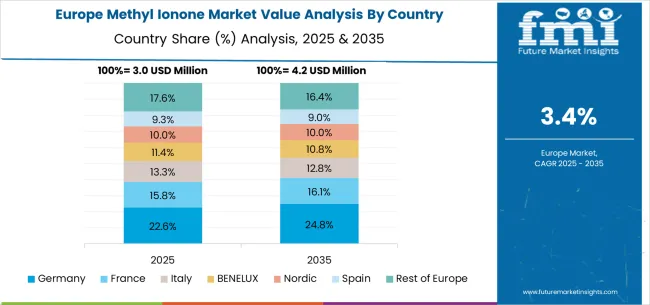

The methyl ionone market shows varied growth dynamics across key countries from 2025-2035. China leads globally with a CAGR of 5.1%, fueled by rapidly expanding luxury goods consumption, growing middle-class demand for premium fragrances, and increasing adoption in domestic cosmetic and perfume manufacturing. India follows closely at 4.8%, driven by rising disposable income, growing beauty consciousness, and expanding domestic fragrance and cosmetic industries supporting premium ingredient adoption. Germany remains Europe's growth engine with 4.4%, leveraging its established fragrance and flavor industry, especially in premium perfumery and specialty chemical production. Brazil records 4.0%, reflecting opportunities in luxury cosmetics and growing consumer preference for sophisticated fragrances despite economic challenges. The United States maintains steady expansion at 3.6%, supported by established luxury perfume market and premium cosmetic segment demand. Growth in the United Kingdom (3.2%) and Japan (2.9%) remains moderate, backed by mature fragrance markets and established perfumery traditions, though comparatively slower due to market saturation.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the methyl ionone market with its rapidly expanding luxury goods sector and substantial growth in premium beauty product consumption. The market is projected to grow at a CAGR of 5.1% through 2035, driven by increasing middle-class affluence, growing consumer sophistication in fragrance preferences, and expanding domestic perfume and cosmetic manufacturing in Shanghai, Guangzhou, and Beijing. Chinese fragrance manufacturers and cosmetic companies are adopting high-purity methyl ionone for premium product formulations and luxury brand positioning, with particular emphasis on sophisticated scent profiles and international quality standards. Rising consumer demand for luxury fragrances and premium cosmetics expand opportunities in fine fragrance and high-end personal care product sectors.

The methyl ionone market in India reflects strong potential based on expanding beauty industry and increasing consumer preference for premium fragrance products. The market is projected to grow at a CAGR of 4.8% through 2035, with growth accelerating through premium product positioning under quality and sophistication constraints, particularly in luxury perfume and premium cosmetic applications in Mumbai, Delhi, and Bangalore. Indian fragrance manufacturers and cosmetic companies are adopting methyl ionone for high-end product formulations and traditional fragrance applications, with growing emphasis on international quality standards and export competitiveness. Industry partnerships with international fragrance suppliers expand access to premium ingredients and technical formulation expertise.

Germany demonstrates established strength in the methyl ionone market through its advanced fragrance and flavor industry and robust perfumery sector. The market shows solid growth at a CAGR of 4.4% through 2035, with established fragrance houses and chemical companies driving demand in Hamburg, Frankfurt, and Munich. German fragrance manufacturers focus on premium applications and specialty formulations, particularly in fine perfumery and luxury cosmetic sectors requiring superior ingredient quality. The country's strong chemical industry infrastructure and established fragrance expertise support consistent market development across European and global fragrance markets.

Brazil's methyl ionone market shows moderate growth potential at a CAGR of 4.0% through 2035, driven by expanding luxury cosmetics sector and growing consumer appreciation for sophisticated fragrances. The market benefits from increasing premium beauty product consumption and fragrance market development, with particular strength in personal care and cosmetic applications. Brazilian fragrance and cosmetic manufacturers adopt methyl ionone for product differentiation and premium positioning, addressing growing consumer demand for sophisticated and long-lasting fragrances. Market development faces challenges from economic conditions and import dependencies that affect ingredient procurement and cost competitiveness.

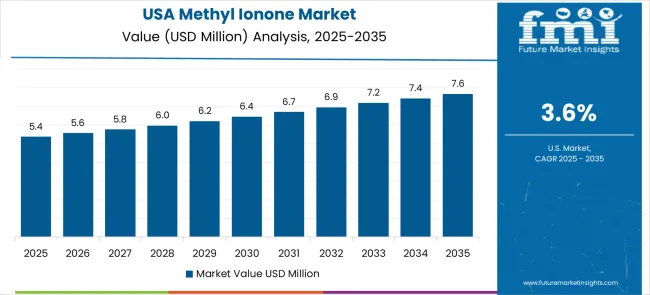

The United States maintains steady growth in the methyl ionone market through its established luxury perfume sector and premium cosmetic industry. Market expansion at a CAGR of 3.6% through 2035 reflects consistent demand from luxury fragrance houses, premium cosmetic manufacturers, and specialty fragrance applications requiring high-quality aroma chemicals. American fragrance companies utilize methyl ionone across fine fragrance, luxury cosmetics, and niche perfumery applications, with particular emphasis on product differentiation and brand positioning. The country's strong luxury goods market and established fragrance industry support stable conditions and continued ingredient innovation.

The United Kingdom demonstrates consistent progress in the methyl ionone market with a CAGR of 3.2% through 2035, supported by established fragrance industry and luxury cosmetic segment. British fragrance houses and cosmetic manufacturers adopt methyl ionone for premium product formulations and heritage fragrance applications, with particular focus on quality and traditional perfumery excellence. The market benefits from strong luxury retail channels and established consumer appreciation for sophisticated fragrances. Development remains steady across fine fragrance and premium cosmetic applications despite economic uncertainties affecting luxury goods consumption.

The methyl ionone market in Japan shows steady development with a CAGR of 2.9% through 2035, as established fragrance companies and cosmetic manufacturers maintain consistent demand for high-quality aroma chemicals. Market growth reflects mature market conditions and sophisticated consumer preferences across perfumery and personal care sectors. Japanese fragrance and cosmetic companies utilize methyl ionone for premium product formulations and distinctive scent profiles, particularly in luxury cosmetics and fine fragrance applications. The market benefits from established fragrance expertise and strong quality standards, with steady growth supported by consumer appreciation for sophisticated and refined fragrances.

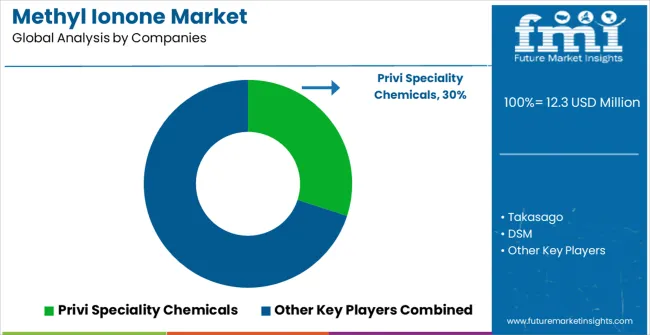

The methyl ionone market consists of 6–10 specialized aroma chemical producers, with the top three companies holding 57–62% of global market share. Growth is driven by increasing demand for fine fragrances, personal care formulations, cosmetics, and home-care products, where methyl ionone is valued for its violet-like, floral-woody scent profile and strong performance as a fixative. Competition centers on aroma purity, consistency, allergen compliance (IFRA), sustainability of feedstocks, and cost efficiency, rather than price alone. Privi Speciality Chemicals leads the market with an 30% share, supported by its leadership in fragrance innovation, secure global supply chains, and deep integration with major perfumery brands.

Other major players such as BASF, Takasago, and DSM maintain strong positions by offering high-quality methyl ionone variants used in premium perfumery, personal care, and household applications. Their advantages stem from advanced synthesis capabilities, strong regulatory compliance, and long-term partnerships with fragrance houses and FMCG manufacturers. BASF and DSM additionally leverage their sustainable chemistry programs to address growing demand for eco-friendly aroma ingredients.

Challengers including Privi Speciality Chemicals and Xinhecheng strengthen market competitiveness—particularly in Asia—by offering cost-effective, high-purity methyl ionone tailored for bulk fragrance production and fast-moving consumer goods. Their rapid scale-up capabilities, competitive pricing, and growing presence across emerging markets support diversification in the global methyl ionone supply landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.3 million |

| Product Type | Purity≥90%, Purity<90% |

| Application | Perfume, Cosmetic, Food, Other |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Givaudan, BASF, Takasago, DSM, Privi Speciality Chemicals, and Xinhecheng |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging suppliers, adoption patterns across fragrance houses and cosmetic manufacturers, integration with sustainable sourcing initiatives and clean beauty trends, innovations in high-purity grades and eco-friendly production processes, and development of specialized fragrance applications with enhanced olfactory performance characteristics. |

The global methyl ionone market is estimated to be valued at USD 12.3 million in 2025.

The market size for the methyl ionone market is projected to reach USD 17.8 million by 2035.

The methyl ionone market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in methyl ionone market are purity≥90% and purity<90%.

In terms of application, perfume segment to command 43.0% share in the methyl ionone market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methylcobalamin Market Size and Share Forecast Outlook 2025 to 2035

Methylparaben Market Forecast and Outlook 2025 to 2035

Methyl Cyclohexane Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Oxovalerate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 2-Fluoro-3-Oxopentanoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 3-Methyl-2-Butenoate Market Size and Share Forecast Outlook 2025 to 2035

Methyl 2-Naphthyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Market Size and Share Forecast Outlook 2025 to 2035

Methyl Isobutyl Carbinol Market Size and Share Forecast Outlook 2025 to 2035

Methyl Ethyl Ketone Peroxide (MEKP) Market Size and Share Forecast Outlook 2025 to 2035

Methyl Oleate Market – Trends & Forecast 2025 to 2035

Methylamine Market Growth – Trends & Forecast 2024-2034

Methyl p-hydroxybenzoate Market

Methyl Cellulose Market

Methyl Isopropyl Ketone Market

Methylamines Market

Methylene Diphenyl Di-isocyanate Market

3-Methyl-3-penten-2-one (3M3P) Market Forecast and Outlook 2025 to 2035

Dimethyl Terephthalate Market Size and Share Forecast Outlook 2025 to 2035

Dimethylolpropionic Acid (DMPA) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA