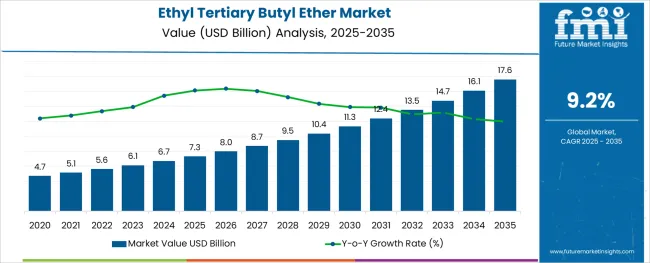

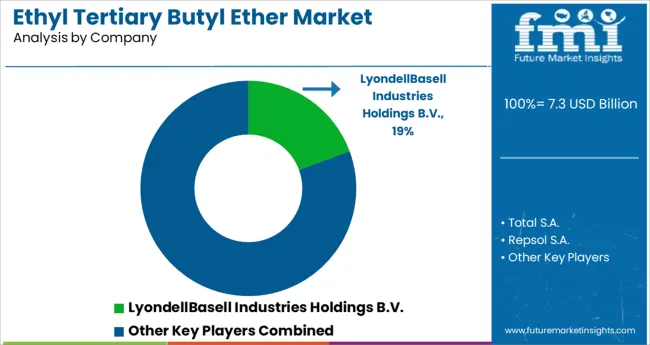

The Ethyl Tertiary Butyl Ether Market is estimated to be valued at USD 7.3 billion in 2025 and is projected to reach USD 17.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

The ethyl tertiary butyl ether (ETBE) market is growing steadily due to its role as an effective oxygenate additive that enhances fuel combustion and reduces harmful emissions. Increasing environmental regulations targeting vehicle emissions have driven demand for cleaner-burning fuels, with ETBE playing a key role in meeting these standards. The rise in petrol consumption in various regions has further fueled the need for fuel additives like ETBE that improve octane ratings and engine performance.

Advances in production processes have improved ETBE purity levels and cost efficiency, encouraging wider adoption across fuel blends. Additionally, the petrochemical industry relies heavily on ETBE as a feedstock or additive, supporting consistent demand.

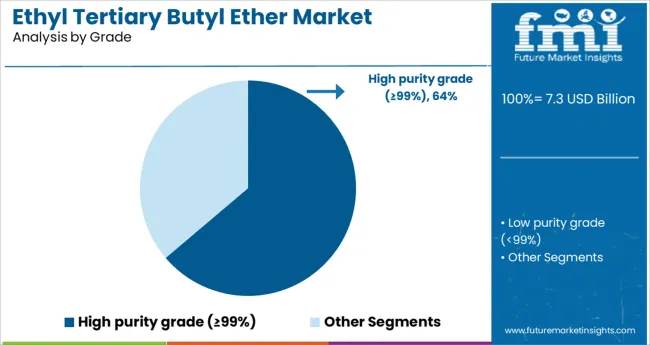

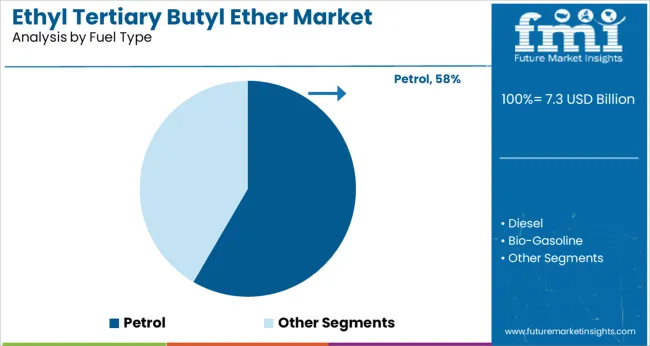

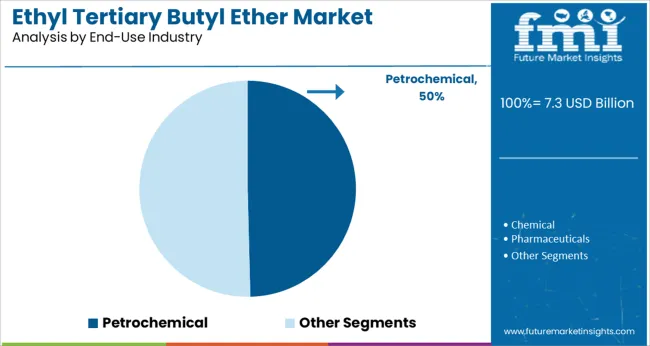

Future growth is expected as governments and fuel producers continue to focus on sustainable and cleaner fuel formulations. Segmental growth is anticipated to be led by the high purity grade (≥99%), petrol as the dominant fuel type, and the petrochemical industry as the largest end-use sector.

The market is segmented by Grade, Fuel Type, and End-Use Industry and region. By Grade, the market is divided into High purity grade (≥99%) and Low purity grade (<99%). In terms of Fuel Type, the market is classified into Petrol, Diesel, and Bio-Gasoline.

Based on End-Use Industry, the market is segmented into Petrochemical, Chemical, Pharmaceuticals, and Paints & Coatings. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The high purity grade segment is projected to hold 63.8% of the ETBE market revenue in 2025, reflecting strong preference for highly pure ETBE in fuel applications. This segment’s growth is driven by the requirement for additives that ensure consistent fuel quality and performance.

High purity ETBE is favored for its ability to provide reliable octane enhancement and compatibility with various petrol formulations. It also meets stringent regulatory standards for fuel additives, minimizing impurities that could affect engine operation.

The demand for premium grade ETBE has increased as fuel producers focus on maximizing efficiency and reducing emissions. Ongoing process optimizations and quality control improvements have supported the expansion of this segment, positioning it as the leading grade in the market.

The petrol segment is expected to account for 58.4% of the ETBE market revenue in 2025, maintaining its dominance as the primary fuel type for ETBE application. This is largely due to ETBE’s effectiveness as an octane booster that improves petrol combustion quality and reduces engine knocking.

Fuel blenders have favored ETBE for petrol formulations because of its miscibility and stability, which help enhance fuel efficiency and reduce pollutant emissions. Increasing petrol vehicle use and stringent fuel quality standards globally have driven consistent demand.

The petrol segment’s growth is further supported by the widespread adoption of ETBE in petrol blends in regions aiming to comply with environmental regulations. As fuel formulation technologies evolve, petrol is expected to remain the mainstay fuel type driving ETBE consumption.

The petrochemical industry segment is projected to hold 49.6% of the ETBE market revenue in 2025, establishing it as the largest end-use sector. This growth is attributed to the industry's extensive use of ETBE as a solvent, intermediate, and additive in various chemical processes.

Petrochemical manufacturers benefit from ETBE’s chemical stability and efficiency in producing high-quality fuels and chemicals. The sector’s continuous expansion, fueled by rising global demand for plastics, resins, and other derivatives, sustains steady ETBE consumption.

Moreover, the drive toward cleaner fuel formulations and biofuel integration has positioned ETBE as a preferred additive in petrochemical operations. With ongoing investments in petrochemical infrastructure and product development, this segment is expected to maintain its market leadership.

Over the years, rising environmental concerns regarding high carbon emission levels and implementation of stringent regulations have generated huge demand for clean and efficient fuels.

This in turn is prompting companies to use gasoline additives like ethyl tertiary butyl ether. Thus, growing demand for clean fuels with high combustion efficiency and lower emission rates will continue to foster the growth of ethyl tertiary butyl ether market.

Ethyl tertiary butyl ether has emerged as an ideal replacement or alternative for several other gasoline additives due to its high-octane number, low vapor pressure, and low boiling point. It is being increasingly added to gasoline to make it more ecofriendly and enhance its efficiency. Addition of ethyl tertiary butyl ether cuts emission by rising the oxygen content of gasoline, so that it burns more completely.

Similarly, increasing demand for unleaded fuels to curb emission levels is expected to provide a strong thrust to the growth of ethyl tertiary butyl ether market. Usage of alkyl lead compounds as octane booster increases vehicle emissions and lead exposure. As a result, there has been a rapid shift towards the use of ethyl tertiary butyl ether and this trend is likely to continue during the forecast period.

Furthermore, rapid growth of end-use industries such as chemicals, petrochemicals and pharmaceutical is likely to push the demand for ethyl tertiary butyl ether during the forthcoming years.

Despite a positive growth outlook, there are various factors that are impeding the growth in ethyl tertiary butyl ether market. Some of these factors include rapid shift towards battery technology and growing concerns regarding the risk to the aquatic ecosystem and water reserves from the disposal of ethyl tertiary butyl ether.

In recent years, there has been a spike in demand for battery powered devices and electric vehicles. This is emerging as a major factor challenging the growth of ethyl tertiary butyl ether market.

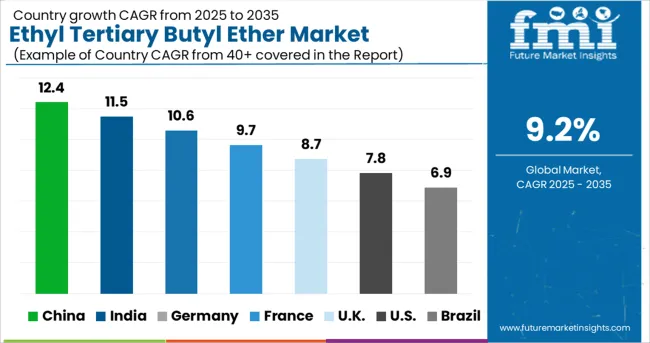

As per FMI, demand in Asia Pacific ethyl tertiary butyl ether market is likely to grow at a relatively higher CAGR during the forecast period, owing to the surge in gasoline production in countries like China, increasing vehicle fleet size, rising demand for industrial chemical derivatives and organic compounds across several industries, favorable government support, and rapid expansion of chemical and petrochemical industries.

Demand for ethyl tertiary butyl ether is especially rising across countries like China and India due to rapid growth of automotive industry, population explosion, and economic growth. These countries are witnessing a sharp rise in the production and sales of automotives. For instance, according to the International Organization of Motor Vehicle Manufacturers, vehicle production in China and India reached around 77621582 and 3394446 respectively in 2024.

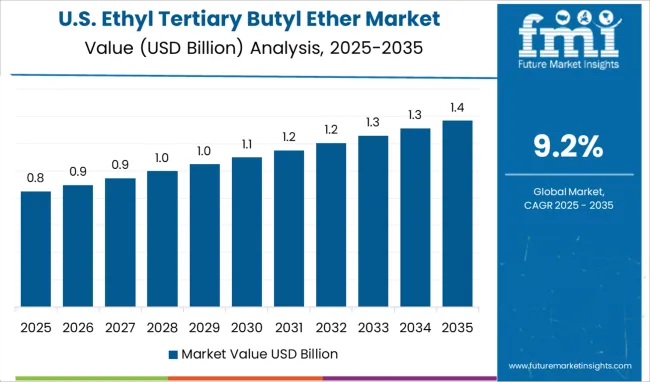

According to Future Market Insights, North America is emerging as a promising market for ethyl tertiary butyl ether, owing to the rising demand for cleaner, rapidly growing automotive industry, increase in government regulations and mandates regarding gasoline fuels, and strong presence of leading ethyl tertiary butyl ether manufacturers.

Within North America, the USA remains the most prominent market for ethyl tertiary butyl ether due to increasing production and consumption of gasoline and growing need for reducing the emission levels of vehicles. According to the USA Energy Information Administration, Americans used about 135 billion gallons of gasoline in 6.721. This is creating robust demand for ethyl tertiary butyl ether.

Similarly, increasing restrictions on the usage of methyl tertiary butyl ether in gasoline production will boost the sales of ethyl tertiary butyl ether in the region during the forecast period.

Some of the key manufacturers of ethyl tertiary butyl ether include LyondellBasell Industries Holdings B.V., Evonik Industries AG, Repsol S.A., Total S.A., SABIC, Braskem, Neste, PCK Raffinerie GmbH, JXTG Nippon Oil & Energy Corporation, PKN ORLEN, Cosmo Oil, and Compañía Española de Petróleos, S.A.U., (CEPSA) among others.

Leading companies are continuously adopting various strategies such as new product launches, acquisitions, mergers, partnerships, and investing in R&D to gain a competitive edge in the ethyl tertiary butyl ether market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.2% from 2025 to 2035 |

| Market Expected Value (2025) | USD 7.3 billion |

| Projected Market Size (2035) | USD 17.6 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Grade, Fuel Type, End-Use Industry, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled |

USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled |

LyondellBasell Industries Holdings B.V.; Evonik Industries AG; Repsol S.A.; Total S.A.; SABIC; Braskem; Neste; PCK Raffinerie GmbH; JXTG Nippon Oil & Energy Corporation; PKN ORLEN; Cosmo Oil; Compañía Española de Petróleos, S.A.U., (CEPSA) |

| Customization | Available Upon Request |

The global ethyl tertiary butyl ether market is estimated to be valued at USD 7.3 billion in 2025.

It is projected to reach USD 17.6 billion by 2035.

The market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types are high purity grade (≥99%) and low purity grade (<99%).

petrol segment is expected to dominate with a 58.4% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Ethylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Ascorbic Acid Market Size and Share Forecast Outlook 2025 to 2035

Ethyl 3-Hydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Tetrafluoroethylene (ETFE) Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Cyanoacetate Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Linalool Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Methyl Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethyleneamines Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Ethylamine Market Analysis - Size, Share & Forecast 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Ethyl Vanillin Market Analysis by Product Type, Form, Application and Region from 2025 to 2035

Ethylene Dichloride Market Growth – Trends & Forecast 2025 to 2035

Ethylene Amines Market Growth - Trends & Forecast 2024 to 2034

Ethyl Cellulose Market

Ethyl Methyl Cellulose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA