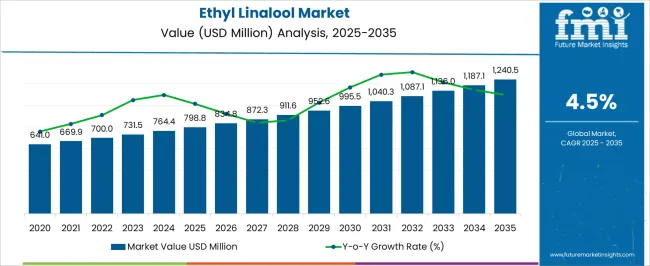

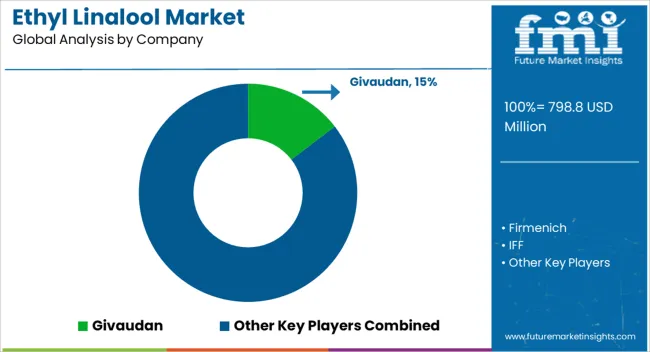

The ethyl linalool market is estimated to be valued at USD 798.8 million in 2025 and is projected to reach USD 1240.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

This growth is anticipated to be influenced by increasing demand in the fragrance, cosmetic, and personal care sectors, where ethyl linalool is widely utilized for its aromatic properties. Over the forecast period, the market is expected to experience steady value increments, as supply chains adapt to evolving consumer preferences and regulatory requirements. Revenue generation is likely to be driven by strategic product positioning, expanded distribution networks, and rising incorporation of natural and synthetic variants across multiple applications. During 2025–2035, the ethyl linalool market is likely to witness consistent year-on-year growth, shaped by global consumption trends and increasing industrial applications.

Market adoption is expected to be supported by manufacturers enhancing formulation efficiency, improving product purity, and catering to demand in perfumery, flavoring, and personal care products. Competitive dynamics are anticipated to evolve as key players diversify offerings, strengthen regional presence, and respond to price fluctuations in raw materials. Overall, the market trajectory indicates a continuous rise in value, reflecting both industrial reliance and emerging niche applications in aroma-based products.

| Metric | Value |

|---|---|

| Ethyl Linalool Market Estimated Value in (2025 E) | USD 798.8 million |

| Ethyl Linalool Market Forecast Value in (2035 F) | USD 1240.5 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The ethyl linalool market is estimated to hold a notable proportion within its parent markets, representing approximately 8-10% of the fragrance ingredients market, around 5-6% of the flavor and fragrance chemicals market, close to 3-4% of the personal care ingredients market, about 2-3% of the cosmetics and toiletries market, and roughly 1-2% of the aromatherapy and essential oils market. Collectively, the cumulative share across these parent segments is observed in the range of 19-25%, reflecting the specialized yet significant role of ethyl linalool in delivering floral, citrus, and sweet aromatic notes in various applications. The market has been driven by its versatility in perfumery, cosmetics, personal care, and flavoring applications, where its quality, consistency, and stability are highly valued.

Adoption is influenced by product formulation requirements, regulatory compliance, and the demand for distinct aromatic profiles across industries. Market participants have focused on producing high-purity ethyl linalool and optimizing supply chains to meet the growing requirements of end-use sectors. As a result, the ethyl linalool market has not only captured a meaningful share within fragrance ingredients and flavor chemicals but has also influenced personal care, cosmetics, and aromatherapy sectors, underlining its essential role in enhancing sensory experiences, product appeal, and formulation versatility.

The ethyl linalool market is gaining traction due to its widespread use in the fragrance, personal care, and household product industries. Known for its pleasant floral scent and compatibility with other aroma compounds, ethyl linalool has become a critical component in modern perfumery and scented formulations. Demand has remained stable amid the growing popularity of personal grooming products and the rise in consumer spending on home ambiance solutions.

The market is further influenced by the increasing need for cost-effective alternatives to natural extracts, driving preference for synthetic variants. Regulatory oversight and concerns over allergenic potential are prompting reformulations and greater scrutiny, yet innovation in formulation chemistry is helping sustain demand.

The market outlook remains positive, supported by robust demand from emerging economies and consistent investment in scent technology across consumer brands. As the global fragrance market continues to expand, ethyl linalool is poised to remain a key aromatic ingredient due to its olfactory appeal and formulation versatility

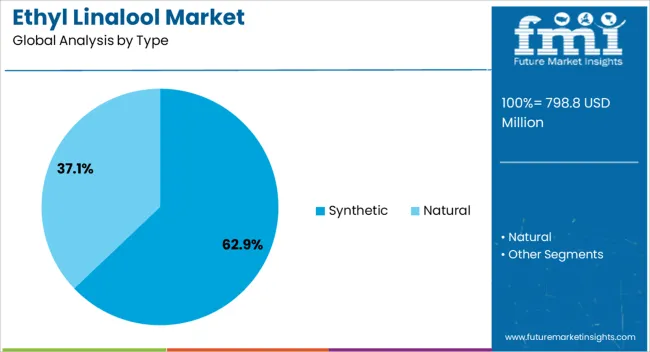

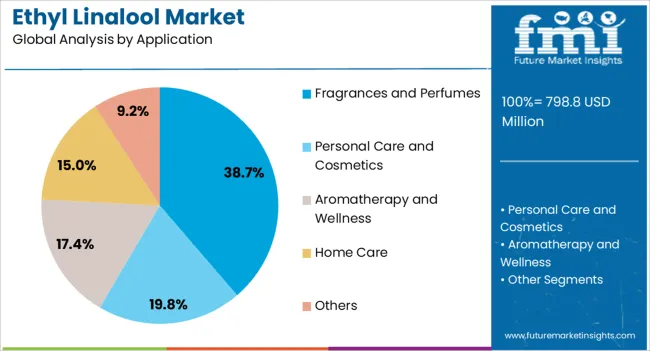

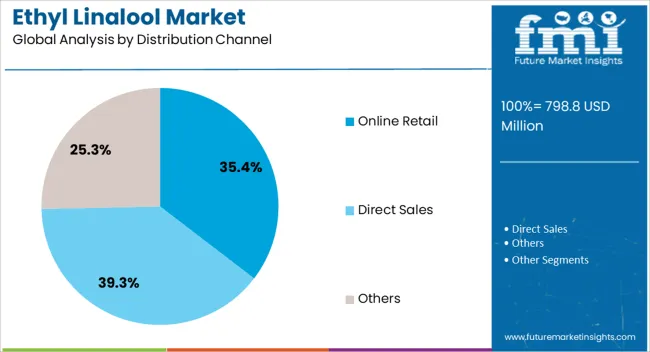

The ethyl linalool market is segmented by type, application, distribution channel, and geographic regions. By type, ethyl linalool market is divided into synthetic and natural. In terms of application, ethyl linalool market is classified into fragrances and perfumes, personal care and cosmetics, aromatherapy and wellness, home care, and others. Based on distribution channel, ethyl linalool market is segmented into online retail, direct sales, and others. Regionally, the ethyl linalool industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic segment dominates the ethyl linalool market with a commanding 62.9% share, largely attributed to its cost-efficiency, consistency, and widespread availability. Synthetic ethyl linalool is widely used by manufacturers aiming to achieve standardized aroma profiles while maintaining price competitiveness in large-scale production.

This segment has benefited from increasing demand in mass-market personal care and household products, where performance and affordability are prioritized. The stability of synthetic compounds under various formulation conditions makes them preferable for use in detergents, cosmetics, and air fresheners.

Moreover, technological advancements in synthetic fragrance development continue to improve scent replication and reduce undesirable byproducts, enhancing consumer safety profiles. While regulatory scrutiny remains high, especially concerning synthetic aroma chemicals, industry compliance and adaptive reformulation practices are enabling this segment to retain its dominant position across global markets

The fragrances and perfumes segment holds a leading 38.7% share of the ethyl linalool market by application, underlining its significance in imparting desirable scent profiles in a wide range of products. Ethyl linalool is highly valued for its soft floral character and compatibility with both natural and synthetic notes, making it a staple in many fragrance formulations.

Demand in this segment is driven by growing consumer interest in personal expression through scent, coupled with rising disposable income in developing economies. The segment continues to benefit from innovation in fine fragrance development, where ethyl linalool plays a vital role in enhancing olfactory complexity and stability.

Regulatory pressures on ingredient transparency have prompted a shift toward safer, well-studied compounds like ethyl linalool, further supporting its usage. With premium and niche perfume brands expanding globally, this segment is expected to witness sustained growth and formulation innovation

Direct sales register 39.3% share in the ethyl linalool market. Ethyl linalool is often directly sold because it is a high-value specialty chemical primarily used in fragrances, flavors, and cosmetics where purity, consistency, and regulatory compliance are critical. Unlike bulk petrochemicals, it has a niche but stable demand from perfumers, personal care formulators, and food & beverage companies that prefer sourcing directly from producers or authorized distributors to ensure authenticity and quality control.

Direct sales also help manufacturers maintain strong relationships with end-users, offer customized grades or blends, and reduce the risk of adulteration in the supply chain. This direct route streamlines logistics, ensures traceability, and preserves brand reputation.

The ethyl linalool market is growing steadily, driven by strong demand in fragrances, personal care, and flavor applications. Opportunities are emerging from expanding cosmetic and food industries, while trends highlight a shift toward natural and authentic aroma and flavor ingredients. Challenges arise from regulatory compliance, production costs, and raw material fluctuations. Overall, ethyl linalool is increasingly becoming an essential component across multiple end-use sectors, offering manufacturers avenues for product differentiation and market expansion while navigating operational and regulatory complexities.

The ethyl linalool market is witnessing significant demand due to its widespread application in fragrances, personal care products, and flavoring agents. Consumer preference for aromatic and flavored products has driven the integration of ethyl linalool in perfumes, cosmetics, soaps, and food additives. Its floral and citrus notes make it highly sought-after in both commercial and premium product lines. Market growth is also being supported by the rising awareness of product quality and sensory appeal, leading manufacturers to enhance formulations with ethyl linalool. The compound’s versatility in multiple end-use industries has increased its incorporation in household cleaning agents, air fresheners, and beverage flavoring, resulting in higher consumption volumes. This demand is further strengthened by the growth of retail and online channels that provide easy access to a variety of scented and flavored products. Consequently, ethyl linalool is increasingly positioned as a critical ingredient in product formulation across global markets.

Significant opportunities in the ethyl linalool market are being created by expanding cosmetic, personal care, and food sectors worldwide. Rising consumer interest in high-quality perfumes and flavor-enhanced food products has prompted manufacturers to include ethyl linalool as a key ingredient. Companies are increasingly exploring partnerships and collaborations with fragrance houses and flavoring specialists to optimize production and meet growing demand. In the food industry, the ingredient is being leveraged to enhance beverages, confectioneries, and baked goods with unique aromatic profiles. The market is also witnessing opportunities for the development of specialty grades tailored for specific applications in cosmetics and gourmet food products. Furthermore, emerging markets in Asia-Pacific and Latin America are demonstrating potential for higher consumption due to rising disposable income and growing preference for premium scents and flavors. These dynamics position ethyl linalool as a lucrative segment for manufacturers targeting diverse end-use industries.

Trends shaping the ethyl linalool market include a clear shift towards natural and clean-label aroma and flavor ingredients. Consumers are increasingly scrutinizing product labels and demanding authentic and recognizable ingredients, leading to higher adoption of ethyl linalool derived from natural sources. In perfumery and personal care products, the trend towards floral and citrus-based scents is boosting its inclusion in premium formulations. Additionally, in food and beverages, ethyl linalool is being leveraged to create distinctive flavor profiles without overwhelming sweetness or artificial notes. E-commerce and direct-to-consumer channels are enabling faster market penetration and product experimentation, while regulatory frameworks are influencing its use in food and cosmetic applications. Overall, these evolving trends reflect a market that is increasingly driven by consumer preferences for aromatic quality, natural sourcing, and differentiated sensory experiences across multiple product categories.

Despite the growing applications, the ethyl linalool market faces challenges related to regulatory compliance and production costs. Strict guidelines for the use of aroma chemicals in food, beverages, and cosmetics necessitate careful monitoring of concentration levels and purity standards. Additionally, fluctuations in raw material prices, particularly linalool sourced from essential oils or synthetic intermediates, can impact production economics and pricing strategies. Manufacturers must navigate complex safety and labeling regulations across various regions, which may hinder market entry or expansion in some countries. Supply chain disruptions, especially for natural linalool feedstocks, pose further challenges, compelling producers to adopt cost-efficient production and sourcing strategies. Consequently, the market requires careful management of quality, compliance, and operational efficiency to maintain competitiveness in global and regional segments.

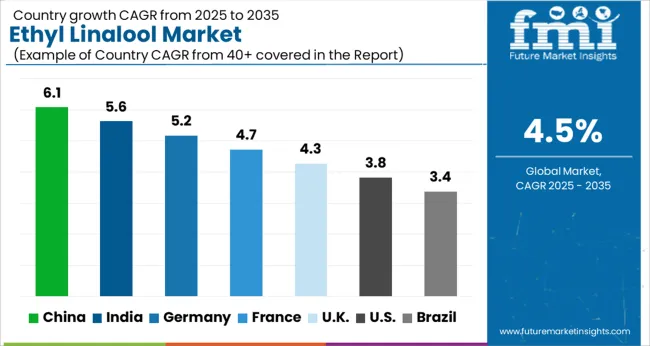

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

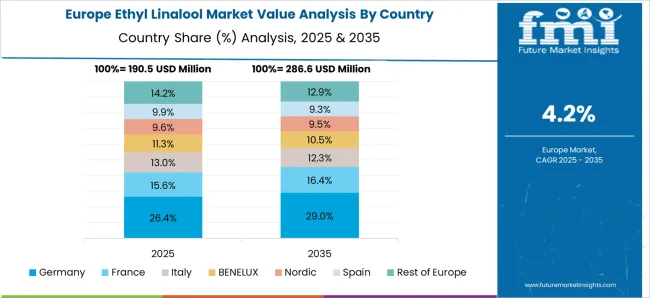

The global ethyl linalool market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads with a growth rate of 6.1%, followed by India at 5.6%, and Germany at 5.2%. The United Kingdom records a growth rate of 4.3%, while the United States shows the slowest growth at 3.8%. Growth is driven by increasing demand in fragrances, cosmetics, and personal care products, along with rising use in flavoring and aromatherapy applications. Emerging markets such as China and India experience higher growth due to rising disposable income, growing middle-class populations, and expanding cosmetics and fragrance industries. Mature markets like the USA, UK, and Germany continue steady growth driven by product innovation, regulatory compliance, and increasing preference for natural and plant-based ingredients. This report includes insights on 40+ countries; the top markets are shown here for reference.

The ethyl linalool market in China is growing at a robust CAGR of 6.1%, fueled by rising consumption of fragrances, cosmetics, and personal care products. Increasing demand for natural and plant-based ingredients in cosmetics and perfumes is driving market expansion. Chinese manufacturers are investing in large-scale production and research to meet the growing domestic and export demand. The aromatherapy and flavoring industries are also contributing to increased consumption, as consumers adopt wellness-oriented lifestyles. As a result, China is witnessing consistent growth in both production capacity and consumption of ethyl linalool, positioning the country as a leading market in Asia.

The ethyl linalool market in India is expanding at a CAGR of 5.6%, supported by growing middle-class populations and rising disposable incomes. Increasing urbanization has led to higher adoption of perfumes, personal care products, and cosmetics, fueling demand for ethyl linalool. Manufacturers are focusing on product innovation and introducing plant-based and natural variants to cater to consumer preferences. Additionally, the food and beverage sector is incorporating ethyl linalool as a flavoring agent, further contributing to market growth. With increasing awareness of wellness and aromatherapy products, the Indian market continues to see a steady rise in consumption and production of ethyl linalool.

The ethyl linalool market in Germany is growing at a 5.2% CAGR, supported by high demand from the fragrance, cosmetic, and personal care industries. German consumers show a preference for natural and eco-friendly ingredients, which has increased the use of ethyl linalool in perfumes and skincare products. The market is also driven by innovations in aromatherapy and flavoring applications. Manufacturers in Germany are adhering to strict regulatory standards, ensuring quality and safety in production. Overall, Germany maintains steady growth due to consumer awareness of wellness, sustainability in ingredients, and a well-established cosmetic and fragrance industry.

The ethyl linalool market in the United Kingdom is growing at a CAGR of 4.3%, with steady demand from cosmetics, fragrances, and personal care sectors. Consumers are increasingly seeking natural and plant-based ingredients, boosting market growth. The aromatherapy and wellness segment is also contributing to rising consumption. UK manufacturers are emphasizing quality, safety, and innovation, including product formulations that meet regulatory requirements. The market is further supported by increasing awareness of fragrance and flavoring applications in food and beverages, ensuring consistent demand for ethyl linalool across multiple end-use industries.

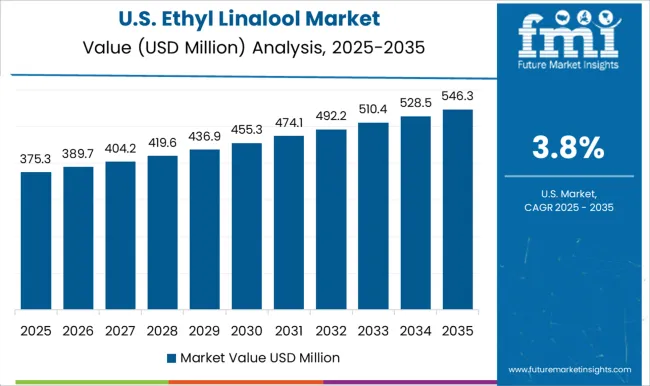

The ethyl linalool market in the United States is growing at a moderate CAGR of 3.8%, with demand primarily from the cosmetics, fragrances, and personal care sectors. US consumers favor natural and plant-based ingredients, which has led to increased adoption of ethyl linalool in perfumes, skincare, and wellness products. Additionally, the food and beverage sector continues to utilize ethyl linalool for flavoring purposes. Manufacturers are investing in quality assurance, sustainable sourcing, and innovation to maintain competitiveness. Overall, market growth in the USA is steady, driven by consumer awareness, regulatory compliance, and multi-industry applications of ethyl linalool.

The ethyl linalool market has been expanding steadily as demand for natural and synthetic fragrance ingredients rises across personal care, cosmetics, and household products. Major players such as Givaudan, Firmenich, and IFF are competing intensely by leveraging their global distribution networks and strong R&D capabilities to develop high-purity ethyl linalool variants suitable for diverse applications. Companies like Symrise and Mane focus on blending innovation with sustainability, providing tailored solutions to perfumers and flavor houses. Market growth is driven by increasing consumer awareness of fragrance quality, growing preference for fine fragrances in personal care products, and the rising adoption of ethyl linalool in flavoring applications for beverages and confectionery.

Additionally, firms such as Takasago, Robertet, and Sensient Technologies are enhancing their portfolios with specialty derivatives and blends to meet varying regional regulatory standards and consumer preferences. Competitive strategies focus on acquisitions, collaborations, and technological advancements to improve product consistency, purity, and scalability, ensuring that global demand is efficiently met. The competitive landscape is characterized by continuous innovation, product differentiation, and expansion of production capabilities. Companies such as Bell Flavors & Fragrances, Vigon International, and Advanced Biotech emphasize high-quality manufacturing and custom formulations to serve niche markets, including aromatherapy, premium fragrances, and specialty food applications.

Smaller suppliers like PerfumersWorld, Parchem Fine & Specialty Chemicals, and Alpha Aromatics are carving a space through targeted product offerings, flexible supply contracts, and rapid delivery solutions. Strategic partnerships and supply chain optimization remain key to gaining market share, while market players invest in advanced purification and synthesis technologies to enhance yield and minimize environmental impact. The adoption of ethyl linalool across multiple industries, coupled with the increasing trend of natural ingredient substitution in synthetic fragrances, positions the market for sustained growth. Companies capable of balancing innovation, regulatory compliance, and cost efficiency are expected to maintain a competitive edge and drive the market forward in the coming years.

| Item | Value |

|---|---|

| Quantitative Units | USD 798.8 million |

| Type | Synthetic and Natural |

| Application | Fragrances and Perfumes, Personal Care and Cosmetics, Aromatherapy and Wellness, Home Care, and Others |

| Distribution Channel | Online Retail, Direct Sales, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Givaudan, Firmenich, IFF, Symrise, Mane, Takasago, Robertet, Sensient Technologies, Bell Flavors & Fragrances, Vigon International, Advanced Biotech, PerfumersWorld, Parchem Fine & Specialty Chemicals, and Alpha Aromatics |

| Additional Attributes | Dollar sales by product type (natural, synthetic) and application (fragrances, personal care, cleaning products, aromatherapy) are key metrics. Trends include rising demand for floral and citrus scents, growth in cosmetics and household products, and increasing adoption in premium and natural formulations. Regional adoption, technological advancements, and consumer preferences are driving market growth. |

The global ethyl linalool market is estimated to be valued at USD 798.8 million in 2025.

The market size for the ethyl linalool market is projected to reach USD 1,240.5 million by 2035.

The ethyl linalool market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in ethyl linalool market are synthetic and natural.

In terms of application, fragrances and perfumes segment to command 38.7% share in the ethyl linalool market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Ethylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Ascorbic Acid Market Size and Share Forecast Outlook 2025 to 2035

Ethyl 3-Hydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Tetrafluoroethylene (ETFE) Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Cyanoacetate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Methyl Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethyleneamines Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Tertiary Butyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Ethylamine Market Analysis - Size, Share & Forecast 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Ethyl Vanillin Market Analysis by Product Type, Form, Application and Region from 2025 to 2035

Ethylene Dichloride Market Growth – Trends & Forecast 2025 to 2035

Ethylene Amines Market Growth - Trends & Forecast 2024 to 2034

Ethyl Cellulose Market

Ethyl Methyl Cellulose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA