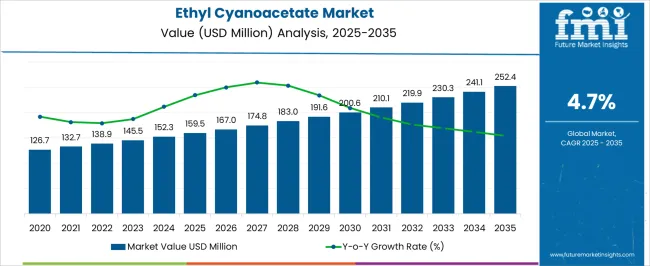

The ethyl cyanoacetate market is estimated to be valued at USD 159.5 million in 2025 and is projected to reach USD 252.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Growth from USD 159.5 million to USD 183.0 million by 2028 suggests early contributions primarily from conventional synthesis routes used in pharmaceutical intermediates and agrochemical formulations. These technologies dominate due to their established efficiency, scalability, and compliance with regulatory requirements, ensuring consistent revenue flow. Between 2028 and 2031, as the market expands to USD 210.1 million, the contribution of advanced catalytic processes becomes more visible. Innovations in green chemistry and enzyme-based synthesis gradually reduce production costs and improve yields, while simultaneously supporting regulatory compliance in industries that require lower residual impurities.

The growing importance of precision chemistry in life sciences applications enhances the role of these advanced technologies, making them key drivers of mid-term growth. From 2031 to 2035, with the market rising to USD 252.4 million, digitalized manufacturing and process automation contribute significantly. Smart monitoring systems and AI-driven optimization of chemical reactions support consistent quality while lowering energy consumption. Technology contributions hence shift from cost-intensive traditional methods toward sustainable, data-integrated systems, ensuring balanced growth across pharmaceutical, polymer, and specialty chemical segments.

| Metric | Value |

|---|---|

| Ethyl Cyanoacetate Market Estimated Value in (2025 E) | USD 159.5 million |

| Ethyl Cyanoacetate Market Forecast Value in (2035 F) | USD 252.4 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The ethyl cyanoacetate market occupies a defined role within the global chemical and specialty intermediates industry, driven by its applications in pharmaceuticals, agrochemicals, and fine chemicals. Within the broader specialty chemicals sector, it accounts for about 3.4%, highlighting its importance in advanced synthesis. In the pharmaceutical intermediates market, its share is close to 2.9%, as it is widely used in the preparation of active pharmaceutical ingredients and heterocyclic compounds. Across the agrochemical intermediates segment, it contributes nearly 2.6%, reflecting its role in manufacturing herbicides, fungicides, and crop protection agents. Within the dye and pigment intermediates industry, it represents 1.8%, supporting the development of high-performance colorants.

In the wider fine chemicals segment, its share is about 2.1%, marking it as a versatile compound with significant cross-industry relevance. Recent developments in the ethyl cyanoacetate market focus on advanced synthesis techniques, sustainable production, and improved purity levels. Manufacturers are investing in cost-effective catalytic processes to optimize yields while reducing environmental impact. Increasing adoption in pharmaceutical R&D is being observed due to its compatibility in producing novel compounds and specialty molecules.

Key producers are strengthening their supply chains in Asia and Europe, ensuring consistent availability for end-use industries. Growing emphasis on greener chemistry has also led to research into renewable raw material sourcing and eco-friendly solvent systems. Partnerships between chemical firms and pharmaceutical companies are accelerating the development of customized formulations, enhancing the application scope of ethyl cyanoacetate in high-value industries.

The ethyl cyanoacetate market is witnessing notable growth, driven by its critical role as an intermediate in the synthesis of a wide range of pharmaceuticals, agrochemicals, and specialty chemicals. Demand is being supported by the increasing complexity of organic synthesis processes and the growing need for high-purity intermediates in regulated industries. Technological advancements in fine chemical manufacturing and purification techniques have allowed producers to deliver consistent product quality, thereby meeting stringent industry standards.

The material’s high reactivity and functional versatility are making it an essential building block in multiple downstream formulations. Rising investments in pharmaceutical R&D and the expansion of active pharmaceutical ingredient production in emerging markets are further contributing to market growth. Regulatory shifts encouraging local sourcing of intermediates are increasing demand from domestic manufacturers in Asia and Europe.

Additionally, ongoing innovation in the synthesis of biologically active compounds is expected to create further opportunities for ethyl cyanoacetate applications. With the global focus on value-added chemical synthesis and pharmaceutical innovation, the market is projected to remain on a strong upward trajectory through the forecast period.

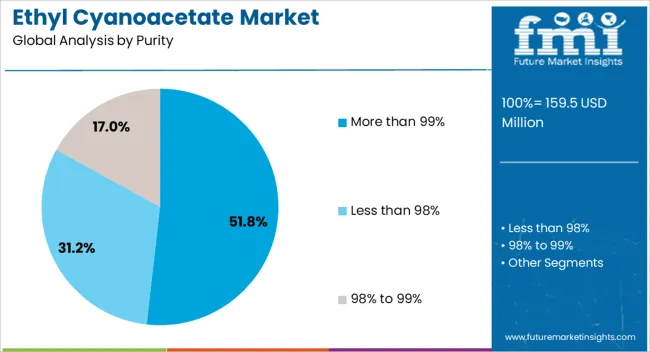

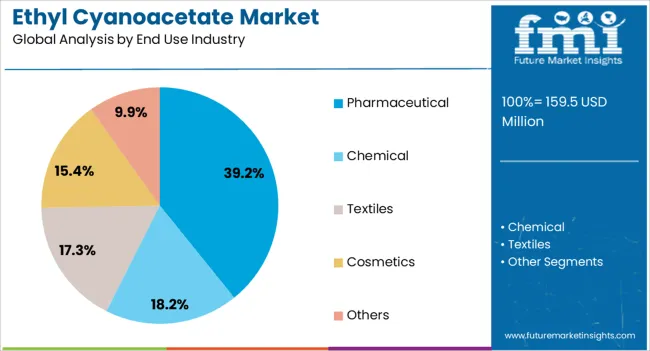

The ethyl cyanoacetate market is segmented by purity, end use industry, and geographic regions. By purity, ethyl cyanoacetate market is divided into More than 99%, Less than 98%, and 98% to 99%. In terms of end use industry, ethyl cyanoacetate market is classified into Pharmaceutical, Chemical, Textiles, Cosmetics, and Others. Regionally, the ethyl cyanoacetate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The more than 99% purity segment is projected to account for 51.8% of the ethyl cyanoacetate market revenue share in 2025, making it the leading purity grade. This segment's dominance is being supported by its suitability for high-precision applications in pharmaceutical synthesis, where impurity thresholds are tightly regulated. The demand for ultra-pure intermediates is rising due to increasingly stringent quality control standards and regulatory requirements across global pharmaceutical manufacturing facilities.

Superior chemical stability and performance characteristics of high-purity ethyl cyanoacetate enable its use in the development of active pharmaceutical ingredients and fine chemicals. Manufacturers are investing in advanced purification and distillation technologies to meet the growing demand for ultra-high purity grades. Additionally, its extended shelf life and consistent reactivity in controlled synthesis conditions make it a preferred choice for formulators and R&D teams.

The segment’s growth is further supported by its adoption in export-grade formulations that require compliance with international pharmacopoeial standards As quality assurance becomes increasingly important across end-use industries, the demand for more than 99% purity ethyl cyanoacetate is expected to continue rising.

The pharmaceutical segment is anticipated to hold 39.2% of the ethyl cyanoacetate market revenue share in 2025, establishing itself as the dominant end use industry. This segment’s leadership is being driven by the widespread use of ethyl cyanoacetate as a key intermediate in the synthesis of pharmaceutical compounds, including active pharmaceutical ingredients and advanced intermediates. Its ability to undergo diverse chemical reactions such as alkylation, condensation, and nitration makes it valuable in the development of therapeutic molecules.

The growing demand for novel drugs, generic formulations, and high-potency compounds is increasing the consumption of reliable intermediates with high chemical integrity. Pharmaceutical manufacturers are increasingly sourcing high-purity raw materials to meet regulatory compliance across major markets, including the United States, Europe, and Japan.

The segment is also benefiting from expanded R&D efforts focused on small molecule synthesis and chemical modification of bioactive scaffolds. As the global pharmaceutical sector continues to prioritize efficiency, quality, and scalability, the demand for ethyl cyanoacetate in drug synthesis workflows is expected to remain strong and sustained.

The market is shaped by its critical role as an intermediate in pharmaceutical, agrochemical, and specialty chemical manufacturing. Its utility in producing active pharmaceutical ingredients, pesticides, and dyes makes it indispensable for multiple end-use industries. Increasing demand for high-performance materials and advanced chemical compounds has supported growth across global supply chains. Stringent regulations on quality and safety influence production standards, while regional production hubs ensure cost competitiveness. Market expansion is further supported by rising investments in chemical R&D and specialty synthesis processes.

Ethyl cyanoacetate has been extensively utilized in the pharmaceutical sector as an intermediate for synthesizing key compounds. Its role in producing APIs such as barbiturates, amino acids, and vitamins ensures steady demand from drug manufacturers. Regulatory compliance and stringent quality benchmarks necessitate high-purity production, driving innovation in refining techniques. The growing prevalence of chronic diseases, coupled with rising demand for affordable generic medicines, sustains consumption levels. Pharmaceutical R&D pipelines continuously generate requirements for intermediates, enhancing market stability. Manufacturers are adopting advanced synthesis processes to ensure consistent product supply and purity. This pharmaceutical-driven demand is expected to remain a dominant factor shaping global market growth in the forecast period.

The agrochemical industry contributes significantly to the consumption of ethyl cyanoacetate due to its role in synthesizing herbicides, pesticides, and fungicides. Its effectiveness as a chemical intermediate ensures high-value applications in crop protection solutions. Global demand for higher agricultural yields and efficient pest management strengthens the need for advanced intermediates. Regulatory approvals and safety considerations guide production and application, making quality and compliance central to market positioning. Growing reliance on agrochemical exports from Asia Pacific boosts regional manufacturing and supply chains. Market players invest in efficient production routes and greener chemical processes to address environmental challenges. Agrochemical-driven applications provide long-term opportunities for sustained market expansion globally.

Beyond pharmaceuticals and agrochemicals, ethyl cyanoacetate finds niche applications in specialty chemicals, dyes, and polymer synthesis. It has been used in the preparation of organic pigments, flavors, and fragrance intermediates. Industrial R&D continues to explore new material science applications where cyanoacetate derivatives offer performance advantages. Specialty chemical manufacturers integrate ethyl cyanoacetate into high-value formulations for coatings, adhesives, and electronic materials. Market expansion is influenced by innovation in polymer chemistry, where cyanoacetate derivatives enhance properties like adhesion and durability. As industries demand specialized compounds with superior characteristics, the versatility of ethyl cyanoacetate strengthens its relevance. These diversified applications provide resilience against dependency on limited end-use sectors.

The market benefits from concentrated production in Asia Pacific, particularly in China and India, which serve as key supply hubs due to cost advantages and strong chemical manufacturing infrastructure. Europe and North America maintain steady demand driven by pharmaceuticals and agrochemicals, though environmental regulations create additional compliance requirements.

Trade dynamics influence supply security, as fluctuations in raw material availability and transportation costs affect pricing trends. Regional partnerships and cross-border agreements support stable market distribution. Investments in local production facilities in emerging economies enhance self-sufficiency while reducing import dependency. These regional dynamics ensure a balanced yet competitive global market landscape for ethyl cyanoacetate.

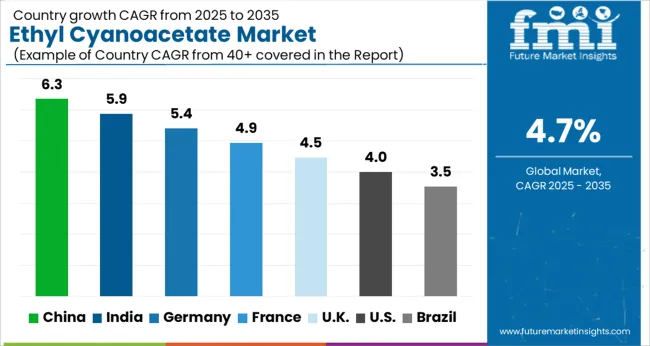

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

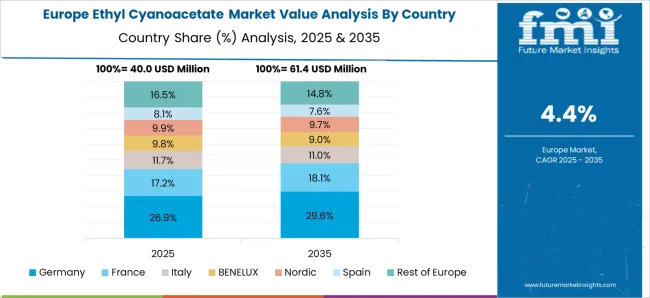

The market is expected to expand at a CAGR of 4.7% from 2025 to 2035. India registered 5.9%, supported by rising applications in pharmaceuticals and chemical synthesis. China remained the leading market at 6.3%, driven by large-scale chemical production and growing export activities. Germany reached 5.4%, reflecting strong demand from specialty chemical and industrial sectors. The United Kingdom stood at 4.5%, where consistent usage in laboratory and research applications influenced growth. The United States recorded 4.0%, showing stable consumption across multiple downstream industries. These regions are producing, expanding, and innovating within the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China, growing at a CAGR of 6.3%, remains the most significant hub for ethyl cyanoacetate production and export worldwide. Its chemical manufacturing ecosystem provides scale, cost competitiveness, and integration across the value chain, making it a preferred supplier for global buyers. Rising demand from domestic agrochemical and pharmaceutical industries strengthens internal consumption, while large export volumes cater to Europe and North America. Local producers are investing in upgraded purification technologies to meet international quality standards, particularly for pharmaceutical-grade intermediates. Strategic partnerships with multinational chemical players support technology transfer and expansion of high-value applications.

India, expanding at a CAGR of 5.9%, demonstrates steady growth backed by its strong agrochemical and specialty chemical industries. Rising adoption of herbicide and pesticide intermediates provides a major growth avenue, while pharmaceutical synthesis adds momentum to demand for high-purity formulations. Domestic producers are enhancing backward integration to secure stable raw material supplies and reduce reliance on imports. Small and medium enterprises play an important role by catering to niche industrial applications and regional demand. The government’s chemical sector development initiatives further boost market expansion.

Germany, with a projected CAGR of 5.4%, is shaped by demand for high-performance applications in pharmaceuticals, coatings, and polymer synthesis. Strong regulatory compliance and emphasis on purity standards drive imports of premium quality ethyl cyanoacetate. Domestic chemical giants and R&D-focused companies are integrating the compound into innovative applications, particularly in fine chemicals and resins. Sustainability in chemical synthesis is also a priority, with companies seeking greener production methods and partnerships with eco-certified suppliers. Germany’s position as a hub for pharmaceutical and specialty chemicals strengthens long-term demand.

The United Kingdom, forecast to grow at a CAGR of 4.5%, is characterized by its reliance on imports to fulfill domestic requirements. Pharmaceutical intermediates remain the largest area of application, with demand from contract manufacturing organizations and specialty drug producers driving adoption. Research partnerships with academic institutions foster innovation in niche chemical derivatives. Market activity also reflects gradual adoption in specialty coatings and resin formulations. Import dependency, combined with price fluctuations from Asian suppliers, creates vulnerabilities, encouraging distributors to diversify sourcing.

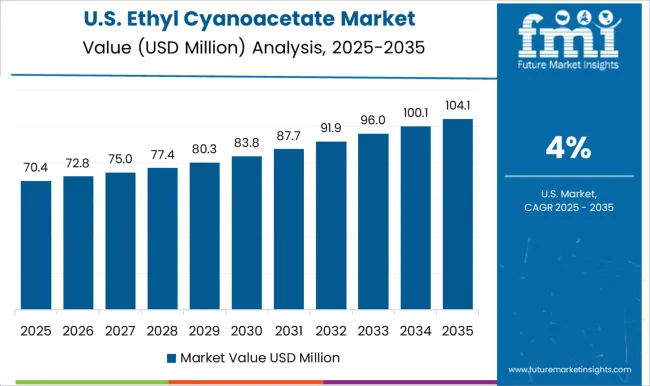

The United States, expected to grow at a CAGR of 4.0%, demonstrates demand primarily from pharmaceutical synthesis, agrochemical R&D, and coatings. While domestic production is limited, imports from Asia meet a majority of demand. The US market is distinguished by its focus on advanced research in fine chemicals, with ethyl cyanoacetate being used in niche drug formulations and specialty polymers. Strategic investments in chemical R&D and collaboration with global suppliers help maintain supply security. Emphasis on regulatory compliance and eco-friendly synthesis methods also influences adoption trends.

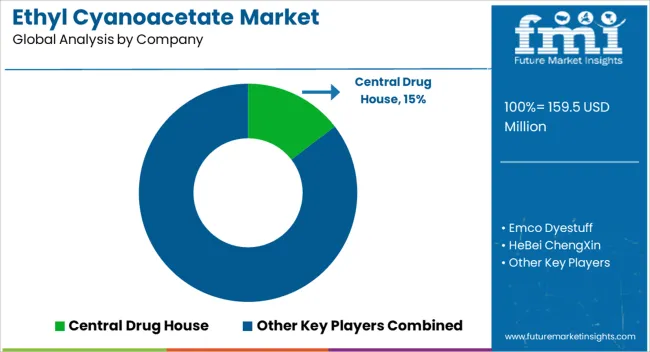

The market is moderately fragmented, with participation from global chemical manufacturers and specialized research-focused suppliers. Merck dominates the premium segment through its global distribution capabilities, high-purity grades, and established reliability among pharmaceutical, agrochemical, and academic research customers. Tokyo Chemical Industry (TCI) and Loba Chemie are also strong players in the laboratory and specialty chemicals domain, supplying smaller quantities for R&D and custom synthesis applications. Regional players such as Hebei Chengxin, Shandong Xinhua Pharma, and Tiande Chemical contribute significantly to large-scale production, particularly in Asia, where cost-effective manufacturing and bulk supply cater to industrial-grade applications. These companies enhance competitiveness by focusing on consistent quality, scalability, and long-term supplier agreements in the pharmaceutical intermediates and dye manufacturing sectors.

Central Drug House, SimSon Pharma, and Sisco Research Laboratories play an important role in the research and academic segment, catering to laboratories and small-scale industries with tailored packaging and quality certifications. Emco Dyestuff and Pravin Dyechem strengthen their presence through product customization and distribution in niche applications such as dyes, pigments, and specialty intermediates. Competitive intensity in this market is driven by purity standards, application versatility, regulatory compliance, and global distribution channels. With rising demand from pharmaceuticals, dyes, and agrochemicals, players increasingly focus on sustainable production methods, supply reliability, and competitive pricing strategies to enhance their market positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 159.5 Million |

| Purity | More than 99%, Less than 98%, and 98% to 99% |

| End Use Industry | Pharmaceutical, Chemical, Textiles, Cosmetics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Central Drug House, Emco Dyestuff, HeBei ChengXin, Loba Chemie, Merck, Pravin Dyechem, Shandong Xinhua Pharma, SimSon Pharma, Sisco Research Laboratories, Tiande Chemical, and Tokyo Chemical Industry |

| Additional Attributes | Dollar sales by product grade and application, demand dynamics across pharmaceuticals, agrochemicals, and specialty chemical sectors, regional trends in intermediate adoption, innovation in synthesis processes, purity enhancement, and cost efficiency, environmental impact of chemical production and waste management, and emerging use cases in active pharmaceutical ingredient development, dye synthesis, and fine chemical manufacturing. |

The global ethyl cyanoacetate market is estimated to be valued at USD 159.5 million in 2025.

The market size for the ethyl cyanoacetate market is projected to reach USD 252.4 million by 2035.

The ethyl cyanoacetate market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in ethyl cyanoacetate market are more than 99%, less than 98% and 98% to 99%.

In terms of end use industry, pharmaceutical segment to command 39.2% share in the ethyl cyanoacetate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

Ethylhexyl Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Ethylbenzene Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Ascorbic Acid Market Size and Share Forecast Outlook 2025 to 2035

Ethyl 3-Hydroxybutyrate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Tetrafluoroethylene (ETFE) Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Linalool Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Methyl Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethyleneamines Market Size and Share Forecast Outlook 2025 to 2035

Ethylhexyl Palmitate Market Size and Share Forecast Outlook 2025 to 2035

Ethyl Tertiary Butyl Ether Market Size and Share Forecast Outlook 2025 to 2035

Ethylamine Market Analysis - Size, Share & Forecast 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Ethyl Vanillin Market Analysis by Product Type, Form, Application and Region from 2025 to 2035

Ethylene Dichloride Market Growth – Trends & Forecast 2025 to 2035

Ethylene Amines Market Growth - Trends & Forecast 2024 to 2034

Ethyl Cellulose Market

Ethyl Methyl Cellulose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA