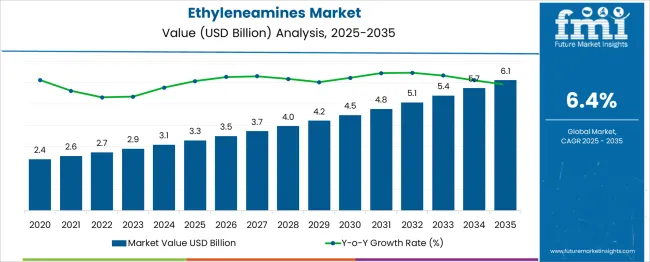

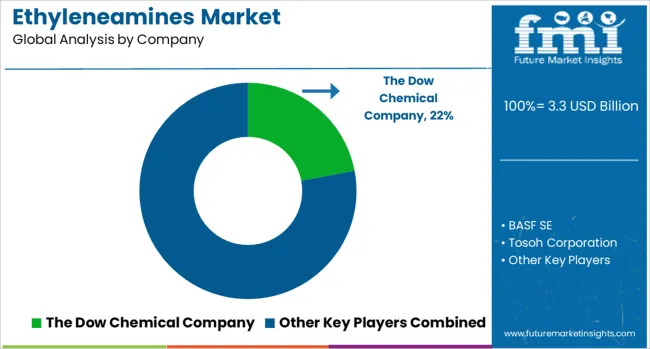

The Ethyleneamines Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. This consistent expansion indicates both market stability and opportunities for strategic market share gains. Between 2025 and 2030, the market will see modest growth from USD 3.3 billion to approximately USD 4.5 billion, with leading manufacturers expected to consolidate their dominance by enhancing production capacities and expanding into high-demand sectors such as water treatment, automotive additives, and crop protection chemicals. However, from 2030 to 2035, the landscape may shift with the entry of regional players, especially from the Asia-Pacific region, which could lead to market share redistribution.

Established companies in North America and Europe could see a slight erosion in share, estimated at 3–5% if they do not adapt to localized pricing pressures and sustainability mandates. Conversely, players investing early in bio-based ethyleneamines and process efficiency may gain competitive ground, particularly in markets like India and Southeast Asia. While the market is growing, the next decade will be pivotal in determining market share shifts. Agility in innovation, supply chain localization, and regulatory compliance will define winners and losers in this evolving space.

| Metric | Value |

|---|---|

| Ethyleneamines Market Estimated Value in (2025 E) | USD 3.3 billion |

| Ethyleneamines Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The ethyleneamines market is experiencing steady growth, propelled by increasing demand across adhesives, automotive fluids, and personal care formulations. Ethyleneamines serve as key intermediates in the production of chelating agents, agrochemicals, and epoxy curing agents, aligning with the growth trajectories of these downstream industries.

Expansion in water treatment and lubricant additives sectors, especially across Asia Pacific, is further driving product consumption. Additionally, regulatory shifts favoring sustainable and low-emission chemicals are influencing product innovation, particularly in bio-based ethyleneamines.

Ongoing investments in production capacity and process optimization among leading manufacturers are enhancing cost efficiency and market competitiveness. Strategic supply chain localization and rising R&D into higher-value derivatives are likely to unlock new application avenues and support long-term market expansion.

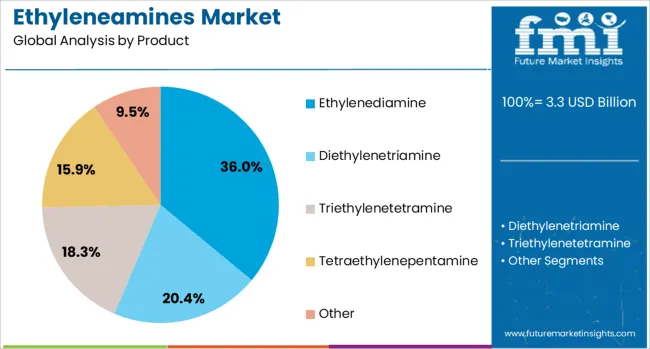

The ethyleneamines market is segmented by product and geographic regions. The product of the ethyleneamines market is divided into Ethylenediamine, Diethylenetriamine, Triethylenetetramine, Tetraethylenepentamine, and Other. Regionally, the ethyleneamines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ethylenediamine is projected to lead the ethyleneamines market with a 36.00% share in 2025. Its dominance is being attributed to its versatility as a building block in chelating agents, particularly EDTA, which finds wide-scale use in cleaning formulations, pharmaceuticals, and industrial water treatment.

The compound’s bifunctional amine structure enables high reactivity, making it ideal for epoxy curing, fuel additives, and corrosion inhibitors. Increased demand from automotive and agricultural sectors, where ethylenediamine-based intermediates enhance performance and durability, is contributing to sustained usage.

Its compatibility with downstream derivatives and cost-effective synthesis routes has ensured continued preference by end-use manufacturers. Moreover, growing emphasis on liquid formulations in crop protection chemicals and the expansion of detergent ingredient portfolios are reinforcing its strong market position across emerging economies.

The ethyleneamines market is expanding steadily due to its diverse applications across adhesives, agrochemicals, fuel additives, water treatment, and personal care industries. These polyamines are known for their reactive properties, making them useful in a range of chemical formulations and performance materials. Industrial growth in manufacturing-intensive economies is driving demand for specialty chemicals where ethyleneamines serve as building blocks. Continued demand in resin modification, lubricant additives, and chelating agents further supports market growth across established and emerging regional chemical supply chains.

The broad applicability of ethyleneamines across key industries such as paper, automotive, agriculture, and construction remains a central growth factor. These compounds serve as intermediates in the formulation of epoxy curing agents, fuel additives, pesticides, and water treatment solutions. In adhesives and sealants, ethyleneamines enhance bonding strength and flexibility. Their chelating properties are also useful in cleaning agents and water softeners, which are in continuous demand from household, industrial, and municipal sectors. As end-use industries seek efficiency and material performance, ethyleneamines are being selected for their functional reactivity and stability. Increased manufacturing activity in fast-developing countries and strategic expansions by chemical producers continue to support the growing consumption of these amines. Long-standing relationships between formulators and suppliers, combined with established supply chains, help maintain the consistent uptake of ethyleneamines across applications. These dynamics ensure that industrial users continue to incorporate them into production lines for performance enhancement and regulatory compliance.

Production of ethyleneamines depends on raw materials such as ethylene dichloride and ammonia, which are influenced by fluctuations in petrochemical feedstock availability and pricing. This volatility in raw input cost structure poses a challenge for producers maintaining pricing and margin stability. Additionally, ethyleneamines require careful handling due to their corrosive and reactive nature. Storage, transportation, and on-site usage necessitate specialized infrastructure, protective equipment, and trained personnel, especially in high-purity or pharmaceutical-grade applications. Small and mid-sized enterprises may face cost pressures due to compliance with handling regulations and environmental management of by-products. High reactivity can also limit shelf life and require tailored packaging solutions. These operational challenges affect supplier flexibility, especially for smaller volumes or niche derivatives. As environmental and workplace safety standards tighten globally, manufacturers are under pressure to align operations with safe production and disposal practices, which adds to the complexity and operational expenditure in the ethyleneamines market.

Ethyleneamines are gaining interest in high-performance resin systems, especially in the context of coatings, adhesives, and composite materials. Their role in epoxy curing, wet strength additives, and reactive thinners is critical in advanced formulations for construction, electronics, and marine industries. As demand grows for strong bonding materials and durable surface finishes, ethyleneamines offer formulation benefits including fast curing, chemical resistance, and enhanced adhesion. Custom blends and derivatives are being explored by formulators to meet new industry requirements related to application temperature, pH tolerance, and substrate compatibility. Coating manufacturers are increasingly collaborating with chemical suppliers to fine-tune amine content for enhanced end-use performance. With evolving needs in protective finishes and high-strength adhesives, particularly in infrastructure and electronics, there is opportunity for ethyleneamine suppliers to develop tailored solutions. Their use in modified polyamide and polyurea systems also opens new possibilities for customized, application-specific formulations in specialized coating markets.

Strict regulations governing chemical manufacturing and waste disposal have a notable impact on the ethyleneamines industry. Production processes generate waste streams that require treatment to prevent environmental damage, particularly nitrogen-rich effluents. Compliance with local and international emission norms often entails investment in waste treatment, closed-loop systems, and emissions monitoring infrastructure. These regulatory burdens can increase operational costs and deter capacity expansion in regions with tight environmental controls. Furthermore, registration of new ethyleneamine derivatives may be delayed by data requirements related to toxicity, persistence, and biodegradability. Restrictions on volatile organic compounds (VOCs) in coatings and adhesives may also affect the use of some ethyleneamine-based systems in certain jurisdictions. These factors present barriers for new entrants and place pressure on established players to maintain transparency and meet compliance expectations. Until more environmentally friendly production and formulation methods are widely adopted, environmental scrutiny will continue to limit market flexibility and pace of expansion.

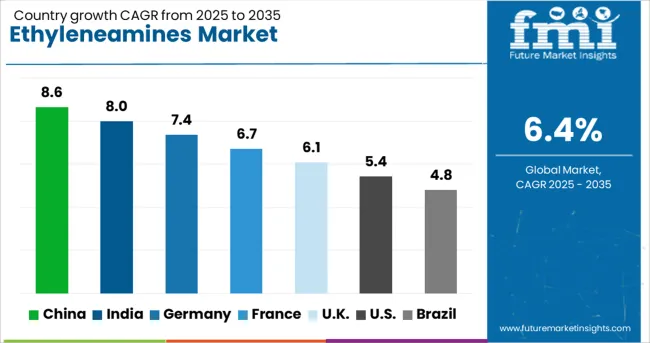

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

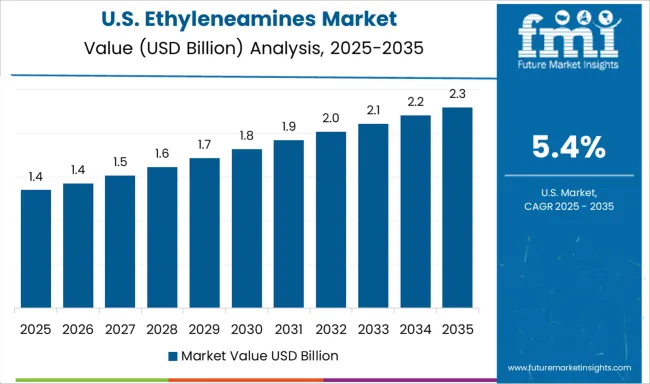

| USA | 5.4% |

| Brazil | 4.8% |

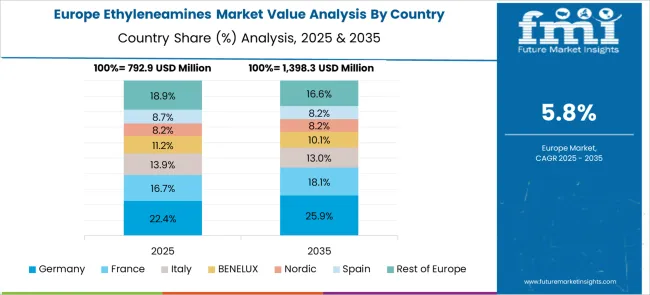

The global ethyleneamines market is expanding at a CAGR of 6.4%, driven by increasing demand across sectors such as agriculture, automotive, pharmaceuticals, and water treatment. China leads with 8.6% growth, supported by large-scale chemical manufacturing capacity and strong domestic consumption. India follows at 8.0%, fueled by the growth of agrochemicals, personal care products, and industrial formulations. Germany records 7.4% growth, reflecting technological advancements and strict environmental regulations shaping high-purity production. The United Kingdom shows steady growth at 6.1%, focusing on specialized applications and import-driven supply chains. The United States, growing at 5.4%, remains a mature market, influenced by regulatory frameworks, innovation in downstream applications, and sustainable production practices. Market dynamics are shaped by raw material availability, end-use diversification, and environmental compliance. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the ethyleneamines market with an 8.6% CAGR, driven by growing demand in agrochemicals, personal care, and water treatment sectors. Domestic chemical manufacturers are expanding production capacity to meet rising local and regional demand. Government policies supporting industrial upgrading and advanced material development are contributing to increased application of ethyleneamines in surfactants and corrosion inhibitors. China is also a major exporter of downstream products, enhancing the need for consistent ethyleneamine supply. Joint ventures with global firms are improving process technology and product quality. The focus on environmental compliance is driving innovation in cleaner production methods. Automotive and electronics sectors are also contributing to demand through use in lubricants and epoxy curing agents.

India is witnessing an 8.0% CAGR in the ethyleneamines market, supported by strong growth in textile chemicals, crop protection agents, and pharmaceuticals. The country’s expanding agriculture and pharmaceutical industries are key end-users of ethyleneamines like DETA and TETA. Domestic manufacturers are increasing output to reduce reliance on imports and meet local demand. Several chemical hubs are offering incentives for new plant setups and technology upgrades. India is also experiencing rising demand from the automotive sector for fuel and lubricant additives. Export potential is growing, especially for ethyleneamine derivatives used in international formulations. Collaborations with global suppliers are helping Indian firms improve process safety and yield optimization. Research institutions are supporting innovation in application areas such as resins and coatings.

Germany is recording a 7.4% CAGR in the ethyleneamines market, fueled by demand in specialty chemicals and industrial cleaning formulations. The country’s advanced manufacturing ecosystem supports high-purity ethyleneamine applications in coatings, adhesives, and resins. Sustainability targets are encouraging the shift toward environmentally friendly formulations, increasing reliance on ethyleneamines in biodegradable surfactants. German firms are focusing on process efficiency and low-emission production technologies. Partnerships with automotive and electronics companies are strengthening demand for ethyleneamines used in epoxy curing and metal treatment chemicals. Regulatory compliance with REACH standards continues to shape product development. Germany also serves as a major exporter of specialty ethyleneamine derivatives across the EU.

The United Kingdom is observing a 6.1% CAGR in the ethyleneamines market as demand rises from sectors such as oil and gas, coatings, and water treatment. Local chemical firms are focusing on product diversification and developing value-added formulations that incorporate ethyleneamines. Infrastructure renewal and industrial maintenance are increasing demand for corrosion inhibitors and cleaning agents. British manufacturers are also adapting to new environmental and safety regulations, which are influencing feedstock selection and process design. Imports continue to supplement domestic production, especially for high-performance applications. Research collaboration with universities is fostering innovation in resin chemistry and fuel additives. The pharmaceutical sector is contributing to modest but steady demand.

The United States is experiencing a 5.4% CAGR in the ethyleneamines market, with demand supported by lubricant additives, water treatment chemicals, and personal care applications. Domestic producers are upgrading plants to meet higher efficiency standards and environmental regulations. The oil and gas industry remains a significant consumer, using ethyleneamines in drilling fluids and corrosion protection. Rising demand for epoxy resins in construction and automotive manufacturing also supports market growth. Technological advancements in process control and purification are improving yield and consistency. Major chemical companies are focusing on product differentiation through tailored grades and custom solutions. Imports fill gaps in specialized derivatives, while exports target markets in Latin America and Asia.

The Ethyleneamines market is experiencing stable growth, driven by their wide-ranging applications in industries such as adhesives, textiles, resins, agrochemicals, and water treatment. These compounds, known for their high reactivity and multifunctional properties, are integral to the formulation of chelating agents, fuel additives, lubricants, and paper wet-strength resins. The rising demand for industrial chemicals, particularly in emerging economies, is playing a key role in market expansion. Key players such as The Dow Chemical Company, BASF SE, Tosoh Corporation, and Huntsman Corporation lead the global market with robust production capacities and established supply chains. These companies focus on consistent product quality and long-term contracts with end-use sectors, allowing them to maintain stable market positions.

Additionally, companies like Delamine B.V. and Diamines & Chemicals Limited serve both domestic and export markets with competitive product portfolios, supporting regional market diversity and resilience. Meanwhile, Akzo Nobel N.V. and other producers are emphasizing reliability and regulatory compliance, especially for ethyleneamines used in crop protection and pharmaceutical intermediates. The market continues to face cost and supply chain challenges related to raw materials like ethylene dichloride and ammonia, but strategic backward integration and operational efficiency have helped major players manage these risks effectively. Overall, with growing demand from multiple industrial segments, the market outlook remains positive.

As mentioned in Huntsman's official March 2025 press release, the company and Zamil Group completed a 27,000-ton/year ethyleneamines plant in Jubail, Saudi Arabia. Operated by Arabian Amines Company, the facility serves the rising global demand, with Huntsman holding exclusive sales and technical rights.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Product | Ethylenediamine, Diethylenetriamine, Triethylenetetramine, Tetraethylenepentamine, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Dow Chemical Company, BASF SE, Tosoh Corporation, Huntsman Corporation, Delamine B.V., Diamines & Chemicals Limited, and Akzo Nobel N.V |

| Additional Attributes | Dollar sales vary by type and application, with EDA, DETA, and TETA dominating, particularly across agrochemicals and resin/adhesive industries. Asia‑Pacific leads in volume, while North America and Europe drive premium pharmaceutical and water-treatment demand. Pricing fluctuates with raw materials and catalyst costs. Growth accelerates via bio‑based formulations, advanced catalysts, and diversity of applications under sustainability and regulatory trends. |

The global ethyleneamines market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the ethyleneamines market is projected to reach USD 6.1 billion by 2035.

The ethyleneamines market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in ethyleneamines market are ethylenediamine, diethylenetriamine, triethylenetetramine, tetraethylenepentamine and other.

In terms of , segment to command 0.0% share in the ethyleneamines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA