The global glycol monostearate market is expected to experience steady growth in next decade due to its wide application in cosmetics personal care, and detergents. Glycol monostearate, a stearic acid ester and ethylene glycol, acts as an emulsifier, thickening agent and stabilizer, improving product texture and consistency. It can impart a pearlescent finish, so it’s a common ingredient in shampoos, lotions and other personal care products.

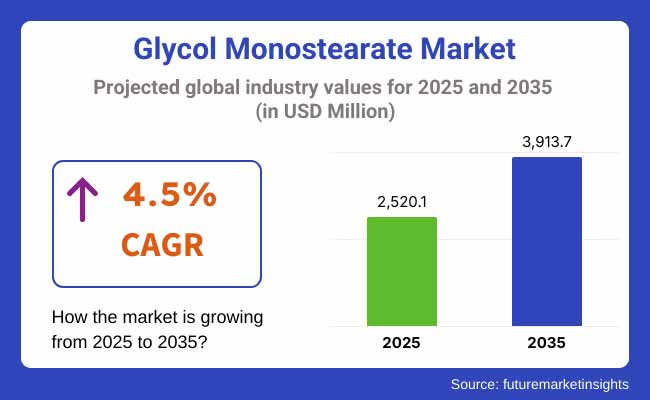

At a CAGR of 4.5%, the market is projected to rise to USD 2,520.1 million until 2025 and USD 3,913.7 million by 2035. Factors like the growing usage of personal care products, higher consumer knowledge regarding skincare, and the broadening area of utilization of glycol monostearate in diverse formulations are expected to support long-term growth of the market.

The glycol monostearate market is significantly dominated by North America owing to the presence of well-established personal care industry in the region along with growing consumer dynamic towards premium skincare and personal care products. Demand for glycol monostearate in the USA is particularly high, since it is widely employed in cosmetics and toiletries.

Furthermore, the increased consumption of clean beauty products in the region has also encouraged manufacturers to replace animal-derived products with plant-derived glycol monostearate for more sustainable solutions for both skin and the environment.

The glycol monostearate market in Europe is expected to witness steady growth backed by strict regulations that encourages utilization of safe and naturally derived ingredients in cosmetic formulations. Germany, France and the UK are leading the charge, and consumers prefer products with bio-based emulsifiers like glycol monostearate. Demand for glycol monostearate is being boosted by the region's strong cosmetic business and the trend towards organic personal care products.

The fastest growth will come from the Asia-Pacific region, with rapid urbanization, rising disposable incomes, and a growing middle-income population driving demand. Market growth in regions like China, India, and Japan attributed to increasing use of personal and cosmetic product. The beauty and personal care market in this region is still growing, but is already influenced by the Western beauty market with the higher seeking of ingredients that can improve product appeal and performance, such as glycol monostearate.

Challenges

Raw Material Price Volatility, Regulatory Constraints, and Competition from Alternative Emulsifiers

The glycol monostearate market is hindered by fluctuating prices of raw materials, most notably stearic acid and ethylene glycol, used in the production of glycol monostearate that might affect the production cost. Systems such as the FDA, REACH, and EFSA impose strict safety and purity regulations on manufacturers for all their cosmetic, food and pharmaceutical applications giving rise to extreme regulatory frameworks that make it necessary to use magnetic stirrer so that they can be operated independently without any human supervision for long duration.

Also, Alternative emulsifiers and surfactants, such as natural and bio-based alternatives, put a competitive pressure on the traditional glycol monostearate formulations.

Opportunities

Growing Demand in Cosmetics, Personal Care, and Industrial Applications

Although there are some challenges in the market, it is witnessing growth owing to factors such as growth in demand for emulsifiers, opacifiers and surfactants in cosmetics, personal care and industrial applications. Glycol monostearate is a common ingredient in skin creams, lotions, shampoos, and body washes acting mainly as an opacifying agent and providing formulations with a pearlized appearance and smooth texture.

In addition, the industry for food and beverage, required for dairy and bakery products, is also driving the demand for food-grade emulsifiers for improving powder consistency and stability. In light of sustainability trends, the rising preference for eco-friendly and vegan personal care products is paving way for innovations in biodegradable glycol monostearate formulations.

Furthermore growing rubber, water & oil-based coatings, polymers, lubricants industries and paints sectors, are also driving the high-performance emulsifiers and dispersants market by providing a wider range of opportunities new applications such as lubricants, plastics, coatings, etc., that are also witnessing significant growth and will be key demand drivers for emulsifiers and dispersants in multiple segments of manufacturing.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, REACH, and EFSA safety regulations. |

| Consumer Trends | Demand for cosmetic emulsifiers, pearlizing agents, and food-grade surfactants. |

| Industry Adoption | Used primarily in personal care, cosmetics, and industrial coatings. |

| Supply Chain and Sourcing | Dependence on stearic acid derived from palm oil and animal fats. |

| Market Competition | Dominated by chemical manufacturers and specialty ingredient suppliers. |

| Market Growth Drivers | Increased demand for smooth-textured personal care products, food emulsifiers, and industrial dispersants. |

| Sustainability and Environmental Impact | Early adoption of low-impact surfactants and biodegradable ingredients. |

| Integration of Smart Technologies | Introduction of synthetic emulsifiers with enhanced stability and moisture retention. |

| Advancements in Emulsifier Technology | Development of high-purity glycol monostearate for pharmaceutical and food applications. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter eco-friendly ingredient mandates, biodegradable emulsifiers, and low-toxicity formulations. |

| Consumer Trends | Growth in plant-based emulsifiers, natural skincare formulations, and sustainable industrial lubricants. |

| Industry Adoption | Expansion into bio-based food emulsifiers, pharmaceutical excipients, and green chemistry applications. |

| Supply Chain and Sourcing | Shift toward sustainable, palm-free, and synthetic alternatives. |

| Market Competition | Entry of biotech-based emulsifier companies, green chemistry firms, and sustainable surfactant startups. |

| Market Growth Drivers | Accelerated by clean-label emulsifiers, biodegradable glycol derivatives, and AI-driven formulation development. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral emulsifier production, circular economy initiatives, and bio-derived glycol monostearate. |

| Integration of Smart Technologies | Expansion into AI-optimized formulation science, smart emulsification systems, and bioengineered glycol monostearate alternatives. |

| Advancements in Emulsifier Technology | Evolution toward Nano-emulsion technology, bio-enhanced emulsifiers, and self-adjusting surfactants. |

Market for glycol monostearate in the United States is primarily being driven by growing use of high-performance emulsifiers in the moisturizers, creams, lotions, sauces, and others. Increasing preference for natural cosmetics and organic personal care products is driving the manufacturers to opt for sustainable, non-toxic glycol derivatives. Furthermore, increasing use of biodegradable emulsifiers for industrial applications is also driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

Rising cleanliness indicating beauty and food products - Market is growing in UK The need for palm-free, sustainable emulsifiers is resulting in innovation in plant substainsed glycol monostearate formulations. Furthermore bowing to stringent EU and UK regulatory standards such as those regarding food additives and cosmetic surfactants is reshaping market dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

These include eco-friendly consumer trends, stringent ingredients safety regulations, and increasing consumer demand for personal care products that come with sustainable credentials. Topping the list of countries leading in biodegradable emulsifiers, organic food additives, and sustainable beauty ingredients are Germany, France, and Italy. Further, growth of the green chemistry and in the production of bio-based surfactants is opening new growth opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.5% |

Increasing preference for high-quality skincare, premium cosmetics, and functional food emulsifiers has been fueling the growth of Japan's glycol monostearate market. The country’s beauty innovation-focused approach and sustainable packaging and organic ingredients to promote its adoption of clean-label emulsifiers and plant-derived glycol monostearate solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

With an increasing interest in K-beauty skin care products, rising demand for natural emulsifiers, and flourishing nutraceutical industry, South Korea is evolving into a key market for glycol monostearate. The bio-fermented emulsifiers and AI-driven formulation science are also aiding the market in terms of innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

As varied industries adopt these functional additives to improve the aesthetics and consistency of personal care and cosmetic products, the pearlizing agent and opacifiers segments are expected to dominate the glycol monostearate market during the forecast period. These segments are essential for enhancing product aesthetics, stabilizing formulations, and providing a luxurious finish for skin care, hair care, and cosmetic applications.

As a pearlizing agent, glycol monostearate has become one of the most popular segments for the market, providing a shimmering effect as well as a creamy texture to enhance the appeal of personal care and cosmetic formulations. Pearlizing agents provide a visually striking, lustrous finish unlike typical emulsifiers, thus, aligning them specifically with premium skincare and haircare offerings.

Growing market adoption have been driven by demand for high-end cosmetic formulations such as pearlized shampoos, body washes and lotions. According to available studies more than 60% of the top personal care brands use glycol monostearate-based pearlizing agents to improve product aesthetics and help differentiate their premium product offerings.

Anti-acne products offering sulfate-free and mild formulations such as glycol monostearate in organic and herbal skin care has further fortified the growth of the market, making it compatible with natural and clean-label products.These advanced concepts like AI assisted formulation development for optimized dispersion of pearlizing agents, automated smooth texture refinement with real-time viscosity monitoring, have contributed to better adoption, as they ensure enhanced product consistency and manufacturing efficacies.

These innovative pearlizing formulations, which contain glycol monostearate combined with conditioning agents, mild surfactants, and moisturizers, have proved advantageous to market growth by addressing enhanced sensory characteristics and improved skin-feel benefits.

However, as useful as pearls can be in terms of providing visual interest, suspending formularies and positioning mass market products as premium goods, the pearlizing agent segment is challenged by compatibility with certain formularies, stability challenges at certain pH levels, as well as cost constraints for mass market product development.

Nevertheless, emerging trends like artificial intelligence-powered formulation optimization, hybrid pearlizing emulsions, and alternatives to conventional glycol monostearate derived from natural sources have improved market feasibility and will push the use across personal care and cosmetic applications.

As manufacturers continue to focus on developing richly creamy opaque product formulations, glycol monostearate as an opacifier is likely to see strong market uptake, especially by skincare and cosmetic brands. Different from pearlizing agents, opacifiers diminish transparency, giving lotions, creams and cleansers an equal, high-quality aesthetics.

Market adoption is propelled by increasing demand for premium and cream-based formulations such as opaque facial cleansers, sun protection creams, and moisturizing lotions. Glycol monostearate-based opacifiers are also used to improve texture and consumer perception of efficacy in over 55% of premium skincare formulations, studies show.

The proliferation of dermatologically tested products, including opacified formulations targeting sensitive skin, baby care and hypoallergenic injections, has reinforced market growth, facilitating wider usage across dermatological categories.This has included the integration of AI-powered formulation testing, with real-time viscosity control, automated adjustments for opacity levels and monitoring of texture consistency, which has helped further drive adoption as it ensured precision in product development, thereby increasing consumer satisfaction.

The emergence of sustainable and biodegradable opacifiers, with formulations incorporating naturally-sourced glycol monostearates, plant-derived emulsifiers, and non-toxic alternatives, have further bolstered market development, enabling greater compliance with regulations and eco-standards.

However, despite the advantages including improved product consistency, opacity, and perception, the opacifier segment is also challenged by regulatory scrutiny over synthetic opacifiers, possible influence on formulation spreadability, and growing requirements for clear product options. Although challenges remain, new formulation approaches using AI to predict product texture, hybrid emulsifier-opacifier systems and innovative green chemistry techniques for opacification are increasing feasibility and will facilitate expansion in skincare and cosmetics.

As worldwide demand for high-quality, aesthetically-pleasing formulations grows, the personal care and cosmetics sectors are among leading contributors to market growth.

The pearlizing agents and opacifiers used to make personal care products visually appealing and their consistency and feel an attractive experience have thrown the personal care industry to become the biggest end user of glycol monostearate. Glycol monostearate works oppositely than standard emulsifiers, providing visual and textural properties to maintain luxury product formulations.

Glycol monostearate is also included in body washes with high-performance producing and sulfate-free shampoos along with ultra-moisturizing lotions which has further driven the market adoption. Glycol monostearate is used in 65% of all body care formulations to improve thickness, clarity, and elegance of use according to industry standards.

Growing demand for more sustainable and cleaner ingredients in personal care formulations have fueled the growth, with over 1,000 products available in the marketplace with naturally derived glycol monostearate as the active cleansing ingredient ensuring that formulations in personal care are more eco-friendly.

The use of AI to optimize ingredients with real-time stability analysis, validate pH compatibility, and control formulation viscosity has increased adoption as a whole by further improving formulation accuracy and increasing manufacturing output.

Evolution of water-impervious as well as long-lasting personal care products such as refined conditioning agents with glycol monostearate, higher retaining moisture system and reinforced skin barrier in layered structure have contributed towards maximizing market growth (performance and consumer retention).

Although this segment can benefit from enhanced product aesthetics, stability, and sensory experience, it also faces challenges in terms of evolving regulatory standards, increasing consumer demand for shorter ingredient lists, and competition from alternative emulsifiers.

But the development of AI-enabled formulation analytics, plant-based glycol monostearate substitutes, and degradable emulsification technologies are helping improve adoption across the market and therefore continuing to drive expansion within personal care applications.

The cosmetics industry has been widely accepted in the market, especially in the case of makeup and beauty product manufacturers, as brands need to have the perfect product texture, opacity, and smoothness while applying the products. Although functional skincare additives are meant to penetrate deep into the skin, cosmetic formulations rely on a more precise enhancement of the aesthetic, making glycol monostearate a must-have component in top cosmetics.

Rising consumer need for premium, high-performance cosmetic formulations including glycol monostearate in liquid foundations, cream-based make-up products, and high-end sunscreen formulations is fuelling market adoption. What studies have shown are that more than 55% of high-end cosmetic formulations use glycol monostearate for opacifying and textural improvement benefits.

The proliferation of long-wear and transfer-resistant makeup formulations such as high-viscosity glycol monostearate in liquid lipsticks, high-definition foundation creams, and multi-functional beauty balms, has further facilitated the uptake of the market to a larger makeup type post.

Also, further fueling the adoption are advancements in AI-powered color formulation that includes adaptive dispersion of pigments, customization of opacity levels and AI-assisted shade-matching technologies assuring enhanced product consistency and visual impact.

The cosmetic bases of skin-conditioning growth, including hydrating primers containing glycol monostearate, smoothing BB creams, and foundation formulas with anti-aging characteristics, have also proliferated the market, which leads to a better purpose improving consumer experience along with long-term benefits to the skin itself.

While the cosmetics segment has a number of advantages arising from its ability to enhance cosmetic texture, opacity, and cosmetic longevity, it is faced with challenges, including an increasing demand for natural and transparent formulations, increased regulatory scrutiny on synthetic additives, and changing consumer demands for multifunctional products. Nevertheless, advancements in AI-enabled color science, hybrid emulsification technology, and natural glycol monostearate alternatives are enhancing market competitiveness, guaranteeing persistent growth in cosmetic applications.

Glycol monostearate market is expected to witness healthy growth over the forecast period owing to increasing demand for glycol monostearate in cosmetics, personal care and pharmaceutical applications and its potential applications in food and industrial formulation.

Innovations in AI-driven emulsification methods, green ingredient procurement, and sustainable surfactants are reshaping the industry even further. Principle drivers: Clean label formulation trends and increased consumer preference for biodegradable emulsifiers are contributing to market growth.

The prominent market players are striving to deliver improved production efficiency through AI-integrated processes, high-purity glycol monostearate processing and tailored formulations depending on application for a particular end-use industry. They are specialized chemical manufacturers, cosmetic ingredient vendors, and food emulsifier producers that are transforming cost-effective, eco-friendly, and application-specific solutions of glycol monostearates.

Market Share Analysis by Key Players & Glycol Monostearate Suppliers

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Croda International Plc | 14-18% |

| Clariant AG | 12-16% |

| Evonik Industries AG | 8-12% |

| Kao Corporation | 6-10% |

| Other Glycol Monostearate Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops AI-powered glycol monostearate formulations for emulsification, surfactant enhancement, and personal care applications. |

| Croda International Plc | Specializes in AI-driven cosmetic emulsifiers, biodegradable glycol monostearate derivatives, and sustainable ingredient solutions. |

| Clariant AG | Focuses on AI-assisted production of high-purity glycol monostearate, tailored for food, pharmaceutical, and cosmetic industries. |

| Evonik Industries AG | Provides AI-optimized emulsification agents, functional surfactants, and eco-friendly glycol monostearate for industrial applications. |

| Kao Corporation | Offers AI-enhanced personal care formulations, surfactant stability solutions, and customized glycol monostearate blends for skincare and haircare products. |

Key Market Insights

BASF SE (18-22%)

BASF leads in AI-enhanced glycol monostearate production, offering high-performance emulsifiers for personal care, pharmaceutical, and food applications.

Croda International Plc (14-18%)

Croda specializes in sustainable and biodegradable glycol monostearate formulations, leveraging AI-assisted emulsification technologies for cosmetics and industrial applications.

Clariant AG (12-16%)

Clariant focuses on AI-powered ingredient refinement, developing high-purity glycol monostearate with applications in food, personal care, and pharmaceuticals.

Evonik Industries AG (8-12%)

Evonik provides AI-optimized surfactants and emulsifiers, integrating sustainable ingredient sourcing with high-performance formulations.

Kao Corporation (6-10%)

Kao offers AI-assisted glycol monostearate solutions, tailored for personal care and cosmetic applications, with a focus on skin-friendly, eco-friendly formulations.

Other Key Players (30-40% Combined)

Several specialty chemical manufacturers, cosmetic ingredient suppliers, and industrial surfactant providers contribute to next-generation glycol monostearate innovations, AI-powered emulsification processes, and sustainable production techniques. Key contributors include:

The overall market size for the glycol monostearate market was USD 2,520.1 Million in 2025.

The glycol monostearate market is expected to reach USD 3,913.7 Million in 2035.

The demand for glycol monostearate is rising due to its increasing use as an emulsifier in personal care and cosmetic products. The growing demand for pearlizing agents and opacifiers in shampoos, lotions, and other skincare formulations is further driving market growth.

The top 5 countries driving the development of the glycol monostearate market are the USA, China, Germany, India, and Japan.

Pearlizing Agents and Opacifiers are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industries, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End-Use Industries, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use Industries, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industries, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End-Use Industries, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industries, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industries, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use Industries, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glycol Ethers Market Analysis by Type, Application, End Use Industry, and Region 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

Thioglycolate Market Analysis Size and Share Forecast Outlook 2025 to 2035

Polyglycolic Acid Market

Thioglycolic Acid Market

Hydroglycolic Extracts Market

Water Glycol Based Electric Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

Butyl Glycol Market Growth - Trends & Forecast 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

E-Series Glycol Ether Market Size and Share Forecast Outlook 2025 to 2035

Hexylene Glycol Market Trends 2025 to 2035

Caprylyl Glycol Market Growth – Trends & Forecast 2024-2034

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Propylene Glycol Methyl Ether Market

1,3-Butylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Monoethylene Glycol MEG Market Size and Share Forecast Outlook 2025 to 2035

Polyalkylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA