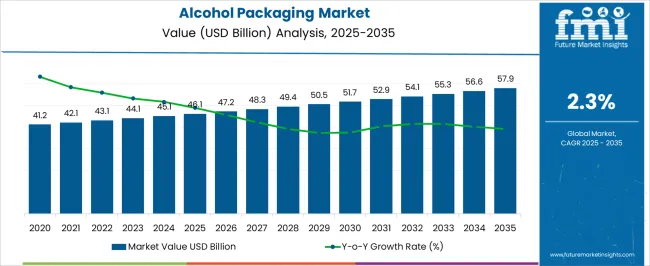

The alcohol packaging market is projected to grow from USD 46.1 billion in 2025 to USD 57.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 2.3%. This expansion highlights the steady yet evolving role of packaging in enhancing product preservation, safety, branding, and consumer engagement across the global alcohol industry. The market’s progress is supported by growing consumption of spirits, beer, and wine in both developed and emerging economies, coupled with rising investments by producers in packaging innovation aimed at differentiation and compliance with evolving regulations.

Glass bottles continue to dominate alcohol packaging due to their premium perception, ability to preserve flavor integrity, and strong association with authenticity and quality among consumers. However, lightweighting trends and the adoption of recycled glass are influencing supply chains, as producers seek to balance tradition with sustainability goals. In parallel, metal cans are gaining share, particularly in beer and ready-to-drink (RTD) beverages, where convenience, portability, and extended shelf life are critical purchase determinants. Plastic formats and flexible pouches, though less prominent, are finding niche acceptance in cost-sensitive and emerging segments, driven by affordability and transport efficiency.

Another defining dynamic is the growing importance of eco-friendly packaging solutions. Consumer awareness and tightening environmental regulations have accelerated the push toward recyclable, biodegradable, and reusable materials in alcohol packaging. Producers are responding by adopting recycled paperboard for cartons, reducing single-use plastics, and leveraging innovations such as compostable closures and labels. The shift toward circular economy practices is particularly evident in Europe and North America, where premium alcohol brands increasingly emphasize packaging sustainability as a core element of brand identity.

The role of design and branding is also central to the market’s growth. Alcohol packaging serves not only a functional role but also a marketing tool that influences consumer perception and purchase decisions. Premiumization in spirits and wines has driven demand for custom bottle shapes, embossed labeling, metallic finishes, and interactive packaging, such as QR codes, that enable traceability and storytelling. Craft breweries and artisanal distilleries, especially in North America and Europe, are heavily investing in packaging innovation to stand out in competitive retail environments. From a regional perspective, the Asia-Pacific is emerging as the fastest-growing market, supported by rising disposable incomes, shifts in urban lifestyles, and growing consumption of premium alcoholic beverages in China, India, and Southeast Asia. Europe remains a leading hub, driven by strong wine and spirits consumption alongside stringent sustainability mandates. North America continues to witness innovation in RTD beverages and craft beer packaging, while Latin America and Africa offer opportunities amid increasing local production and expanding distribution networks.

| Metric | Value |

|---|---|

| Alcohol Packaging Market Estimated Value in (2025 E) | USD 46.1 billion |

| Alcohol Packaging Market Forecast Value in (2035 F) | USD 57.9 billion |

| Forecast CAGR (2025 to 2035) | 2.3% |

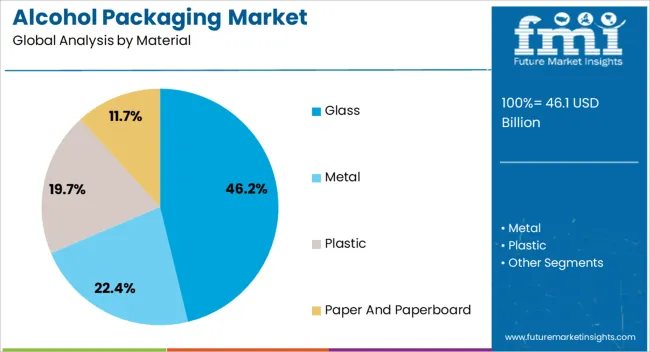

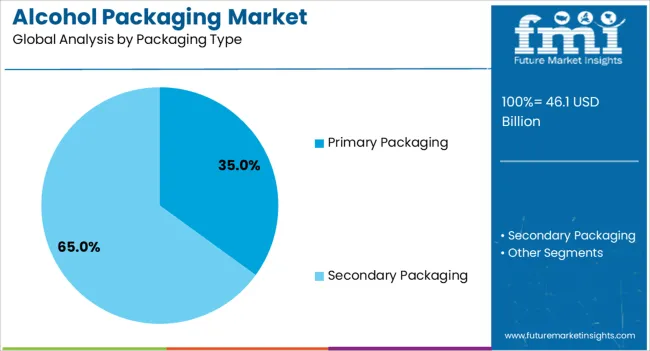

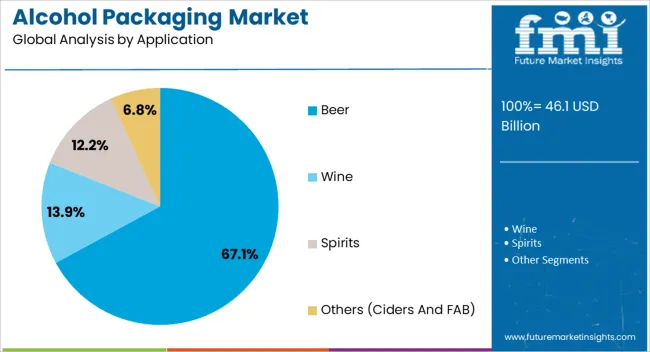

The market is segmented by Material, Packaging Type, and Application and region. By Material, the market is divided into Glass, Metal, Plastic, and Paper And Paperboard. In terms of Packaging Type, the market is classified into Primary Packaging and Secondary Packaging. Based on Application, the market is segmented into Beer, Wine, Spirits, and Others (Ciders And FAB). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass material segment is projected to hold 46.20% of the Alcohol Packaging market revenue share in 2025, making it the leading material type. This growth has been driven by the premium perception of glass packaging, which is associated with quality, authenticity, and sustainability. Glass provides excellent barrier properties, ensuring product stability and shelf life, which is particularly critical for alcoholic beverages.

The segment has benefited from innovations in design, color, and shape, allowing brands to differentiate products and enhance consumer appeal. Consumer preference for reusable and recyclable materials has further reinforced the adoption of glass packaging.

Additionally, glass packaging supports premiumization strategies in the beverage industry and aligns with increasing regulatory emphasis on environmentally friendly materials As a result, glass remains the preferred choice for alcoholic beverage packaging, sustaining its dominant market position.

The primary packaging segment is expected to account for 35.00% of the Alcohol Packaging market revenue share in 2025, establishing it as the leading packaging type. This growth is influenced by the necessity to protect and preserve the beverage, maintain product quality, and enhance brand visibility.

Primary packaging is critical in influencing consumer purchase decisions through design, labeling, and overall presentation. Technological improvements have enabled better sealing, lightweight solutions, and ease of handling, which contribute to operational efficiency across production and distribution channels.

Increasing adoption of glass and other premium materials in primary packaging has strengthened its role in maintaining product integrity while aligning with sustainability initiatives The demand for visually appealing and functional primary packaging continues to rise as brands aim to create distinctive identities and improve shelf impact, supporting the continued growth of this segment.

The beer application segment is anticipated to hold 67.10% of the Alcohol Packaging market revenue share in 2025, making it the leading application. The segment’s growth is driven by the expanding global beer consumption and the proliferation of craft and premium beer products.

Packaging innovations are increasingly being utilized to enhance brand appeal, ensure product freshness, and improve convenience for consumers. The preference for glass bottles and cans in beer packaging supports durability, temperature stability, and visual branding opportunities.

Additionally, the rise of on-the-go consumption and retail promotions has fueled demand for packaging solutions that combine functionality with aesthetic appeal The beer segment benefits from a strong alignment between consumer preferences, product quality, and packaging innovation, reinforcing its leading market position and supporting continued growth across multiple regions.

The alcohol packaging market has historically developed at a CAGR of 1.10%. However, sales have started to advance at a slightly faster pace, displaying a CAGR of 2.30% from 2025 to 2035.

| Attributes | Details |

|---|---|

| Market Historical CAGR for 2020 to 2025 | 1.10% |

Opportunities for alcohol makers are envisioned to boost. This is due to increased affordability, new flavors, and packaging options as top companies continue to evolve their portfolios and enhance consumer experiences.

Opportunities in the alcohol industry are anticipated due to the increasing use of environmentally friendly packaging in can manufacturing and alcoholic beverage production.

Alcoholic drink companies increasingly prefer metal packaging due to its superior hermetic sealing and high mechanical strength, taking advantage of the opportunistic alcohol packaging.

Environmental concerns in manufacturing, transportation, and disposal of alcoholic drink packaging, including greenhouse gas emissions, improper disposal, and low recycling rates, hinder market growth.

Popularity of Craft Beers Offers a Fertile Ground for Custom Packaging

Owing to the demand for high-end alcoholic drinks, especially craft beer, the alcohol industry is predicted to develop significantly in the upcoming decade. The requirement for unique packaging solutions to set these goods apart in a competitive market also contributes to this.

Shim drinks and low-alcohol cocktails are becoming a growing trend, appealing to health-conscious customers who want a lighter, more moderate drinking experience. This is foreseen to have a positive influence on the alcohol packaging industry.

Shim drink producers are responding to this nascent market sector by developing innovative and useful packaging options that highlight the distinctive qualities of their products on retail shelves.

Since bespoke container solutions for craft beer and other beverages enable producers to reach a new customer base and increase their industry share, the market is anticipated to rise.

Adoption of Wine Boxes Widespread in Social Gatherings

Wine boxes, made from paper, paperboard, and wood, protect wine bottles from damage during transportation and storage. The global trend of increasing wine consumption and the demand for efficient packaging in the wine industry is anticipated to influence the wine industry in the forthcoming decade.

The demand for alcoholic beverages among young consumers has grown significantly due to the rise in alcohol-serving facilities in both developed and developing regions. Manufacturers are now opting for wine boxes to meet the bulk demand efficiently and provide a hassle-free experience for consumers. This makes it an efficient choice for large social gatherings.

Rise in Party Culture Caters to the Demand for Beer Kegs

The demand for beer kegs is foreseen to surge due to the increasing consumption of beer among Gen-Z and millennials, as well as the trend of hosting house parties. A recent study in the United States revealed that approximately 70% of men prefer beer over other hard liquors.

The beer industry has experienced maturation due to the popularity of craft beer and home brewing, influenced by the food and beverage industry. This trend is anticipated to continue as more people discover the benefits of using beer kegs.

The rise in party culture has heightened the demand for beer kegs for bulk consumption, attracting consumers who value convenience and bulk packaging. This has created a strong consumer base for the beer keg industry, and with the industry's continuous growth, the beer keg system market is predicted to grow significantly.

The following part offers an in-depth analysis of different segments of the alcohol packaging market. There is significant demand for glass material, while the need for beer packaging in the alcohol packaging segment is anticipated to increase in 2025.

| Attributes | Details |

|---|---|

| Top Material | Glass |

| Market share in 2025 | 46.2% |

The demand for glass as a prominent material for drink packaging is experiencing a 46.2% market share growth in 2025. Glass, being 100% recyclable, is used in liquor packaging due to its quality and durability, with the demand for new glass containers desired to increase.

The liquor industry and the adoption of premium packaging solutions are forcing a surge in demand for glass liquor bottles. These glass bottles offer a lustrous appearance and meet unique, high-end, ornamental, and classy industrial standards, attracting customers on retail shelves. The trend of Premiumization has led to a surge in demand for other materials, such as plastic and metal.

In recent years, the beverage industry has emphasized the significance of product packaging material and design, with glass bottles becoming a popular choice due to their enhanced appearance, richness, and protection from external factors.

Manufacturers are introducing unique designs and new materials, such as cosmetic flint glass, to meet rising demand, which is envisioned to boost the growth of the glass alcohol bottles market in the forthcoming decade.

| Attributes | Details |

|---|---|

| Top Application | Beer |

| Market share in 2025 | 67.1% |

The demand for beer packaging is augmenting due to the popularity of beer, which holds a market share of 67.1% in 2025.

The beer packaging sector is amplifying due to its global popularity and innovative approaches. Despite the popularity of wine and coffee, beer remains the third most consumed beverage globally, after water and tea. This is due to its refreshing taste, a wide variety of options, and social aspect of consumption. The high demand for beer is forcing the need for liquor packaging to transport beverages to consumers.

Consumers are becoming more environmentally conscious, leading to a surge in demand for sustainable beer packaging. Key manufacturers are using eco-friendly and recycled materials to meet this demand and develop their customer base.

With rising cardiovascular disease cases, there is a growing interest in healthy beverage options, with non-alcoholic beer being a suitable alternative due to its lower calorie content and little to no hangover effect. The beer consumption trend is hoped to increase beer packaging demand.

Based on statistical data, industries in the United States and France are set to develop significantly in the upcoming decade. Simultaneously, the spirit packaging industry in India and China is on track to skyrocket. Spain’s liquor packaging sector is anticipated to grow sluggishly in the upcoming decade.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| United States | 0.80% |

| Spain | 2.40% |

| China | 4.20% |

| India | 5.10% |

| France | 1.20% |

The United States is anticipated to hold a CAGR of 0.8% from 2025 to 2035 in the alcohol packaging market.

The United States beer industry is experiencing growth due to the growing craft beer demand and the rise of microbreweries, while the demand for premium packaging is also increasing.

The craft beer industry in the United States is experiencing growth, leading to an increase in demand for beer packaging. The Brewers Association reports around 8,275 craft breweries, including 2,058 microbreweries, in the United States.

Americans favor craft beers with unique flavors and local appeal, leading to a need for distinctive packaging that reflects the brand's identity. Small breweries are experimenting with materials and designs to create standout packaging.

The alcohol packaging market in Spain is estimated to develop at a CAGR of 2.4%, with producers developing innovative packaging options.

Sangria, a popular Spanish beverage, is a refreshing mix of red wine, brandy, orange slices, and sparkling soda, enjoyed with friends over tapas. Mixed cocktail packs are increasingly popular in Spain, creating a favorable field of development for manufacturers.

The industry in Spain is witnessing a ripple in the demand for low-alcohol-content drinks due to consumption and the need for convenient packaging options.

The companies in Spain are investing in research and development to improve can designs and shapes. This has resulted in the expansion of many companies, particularly in the growing popularity of mixed packaging cocktails.

China is on the brink of a significant market expansion in liquor packaging, with a projected CAGR of 4.2% from 2025 to 2035.

China's alcohol consumption history is diverse, with traditional rice liquor "Baijiu" being a popular choice. However, over the past decade, there has been a growing demand for wine, imported beer, and spirits from local customers.

Alcohol consumption in Chinese culture is traditionally accepted during social events like spring festivals and weddings. It is now increasingly popular for stress relief, social interaction, and nurturing good relations between supervisors and employees despite its long-standing tradition.

China's growing middle class has compelled a shift towards sophisticated and diverse alcoholic drinks. This has led to growth in the alcohol market, which is anticipated to continue in the coming decade.

The demand for alcohol packaging in France is envisioned to register a CAGR of 1.2% over the subsequent decade. Wine packaging is becoming increasingly popular in France as the country's population consumes a lot of wine during various occasions such as festive seasons, picnics, and corporate and social events. Furthermore, the demand for reliable packaging is also increasing to ensure that wine is delivered safely and quickly.

The wine industry is experiencing a trend towards ready-to-drink beverages, which is positively impacting the sales of convenient wine packaging. Key parties in France are responding to the wine trend by domestic production of wine packaging to meet the growing demand from winemakers.

The wineries in France are also focusing on unique wine packaging designs and distinct wine packaging. Further, manufacturers are investing in the latest technology to improve their manufacturing process efficiencies.

The demand for alcoholic beverage packaging in India is foreseen to experience a CAGR of 5.1% from 2025 to 2035.

India's alcohol box manufacturers are gaining popularity for their high-quality packaging solutions. They cater to diverse customer needs and provide customized solutions to meet unique client requirements in recent years.

The luxury liquor packaging industry in India is inflating due to the increasing demand for bespoke and individualized solutions. This trend is creating new opportunities for suppliers in the high-class clientele market.

Industry players are focusing on sustainable efforts to develop their customer base as customers seek eco-friendly packaging solutions due to environmental awareness. Manufacturers are investing in sustainable practices to meet these changing needs.

Alcohol packaging manufacturers are employing diverse strategies to stay ahead of competitors. These include partnerships, mergers, acquisitions, and collaborative approaches. By working together, the top players in the liquor industry can benefit from each other's strengths and gain a competitive advantage.

To create brand loyalty, alcohol manufacturers are focusing on developing strong brand identities through effective marketing initiatives. By establishing a unique brand image, the market players can differentiate themselves from competitors and build a loyal customer base.

In addition to brand building, manufacturers are investing in their manufacturing processes, automating where possible, and optimizing their supply chain to keep up with rising demand. By streamlining their operations, the liquor makers can be more efficient and cost-effective, ultimately benefiting their customers.

Recent Developments in the Alcohol Packaging Market

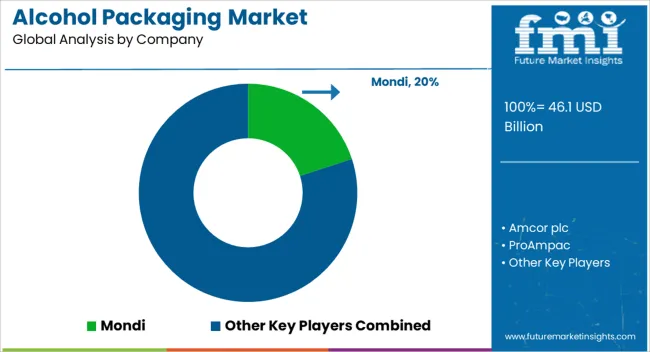

The global alcohol packaging market is estimated to be valued at USD 46.1 billion in 2025.

The market size for the alcohol packaging market is projected to reach USD 57.9 billion by 2035.

The alcohol packaging market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in alcohol packaging market are glass, metal, plastic and paper and paperboard.

In terms of packaging type, primary packaging segment to command 35.0% share in the alcohol packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Alcohol Packaging Market Share & Industry Trends

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

Oxo Alcohols Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA