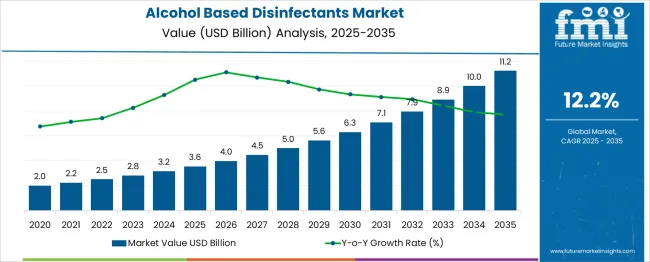

The Alcohol Based Disinfectants Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.2% over the forecast period. During the first five-year phase from 2025 to 2030, the market progresses from USD 3.6 billion to USD 6.3 billion, achieving an incremental gain of USD 2.7 billion. This accounts for 35.5% of the total projected growth, positioning the initial half-decade as a critical foundation for market acceleration.

Year-on-year increments during this period show progressive scaling: USD 0.4 billion in 2026, USD 0.5 billion in 2027, and rising toward USD 0.7 billion by 2030, highlighting consistent demand expansion across healthcare, food processing, and industrial sanitation segments. The pace of growth in this early phase is driven by infection control protocols, heightened institutional procurement, and regulatory emphasis on hygiene compliance. The remaining growth of USD 4.9 billion (64.5%) is projected to occur between 2030 and 2035, signaling sharper adoption curves tied to industrial automation, clinical sterilization needs, and wider integration of alcohol-based formulations in emerging markets. Strategic capacity expansion during the first five years will be essential for capturing this accelerating demand curve.

| Metric | Value |

|---|---|

| Alcohol Based Disinfectants Market Estimated Value in (2025 E) | USD 3.6 billion |

| Alcohol Based Disinfectants Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

The alcohol-based disinfectants market occupies a significant role within multiple hygiene and infection control categories. In the surface disinfectants market, it holds a dominant share of approximately 55–60%, as alcohol formulations are widely used for rapid microbial kill on surfaces. Within the household cleaning and hygiene products market, its share is around 8–10%, since detergents, floor cleaners, and other non-disinfectant products make up the majority.

In the industrial and institutional cleaning chemicals market, alcohol-based disinfectants contribute about 12–14%, driven by usage in food processing, hospitality, and commercial facilities. The healthcare and medical disinfection products market accounts for a larger share of 35–40%, as hospitals, clinics, and laboratories rely on alcohol solutions for instrument and surface sanitization. For the infection prevention and control solutions market, the share is nearly 20–22%, given alcohol’s effectiveness in reducing contamination risk.

Increasing awareness of hygiene, stringent healthcare regulations, and high demand from the pharmaceutical and food industries drive market growth. Alcohol-based disinfectants are preferred for their quick evaporation, strong antimicrobial properties, and compatibility with sensitive surfaces. Continued innovation in non-staining, skin-friendly, and fragrance-enhanced formulations, along with rising institutional demand, positions this market for strong growth and sustained dominance within these parent markets.

The alcohol based disinfectants market is witnessing steady growth as hygiene awareness, regulatory focus on infection prevention, and institutional demand converge to drive adoption. Increased healthcare spending, heightened sensitivity to hospital-acquired infections, and emphasis on surface and hand disinfection have positioned alcohol based solutions as a preferred choice.

Ethanol and isopropanol-based products are being favored for their broad-spectrum antimicrobial properties and quick action. The future outlook is supported by the expansion of healthcare infrastructure, rising consumer inclination toward hygiene maintenance in domestic and commercial settings, and innovations in formulation and delivery formats that enhance user convenience and safety.

The growing role of regulatory guidelines and institutional procurement policies emphasizing efficacy and compliance is paving the way for wider market penetration and sustained demand.

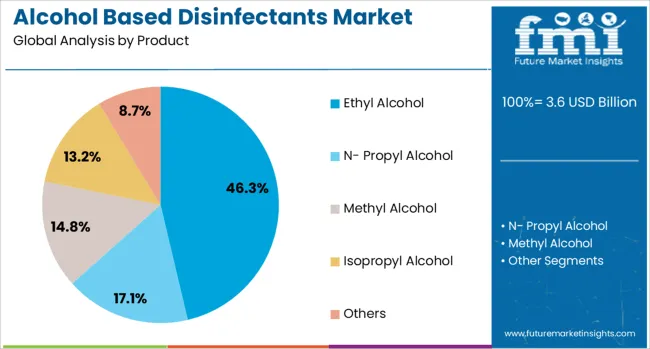

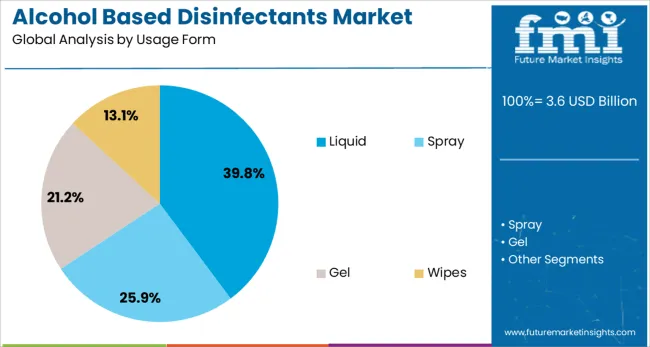

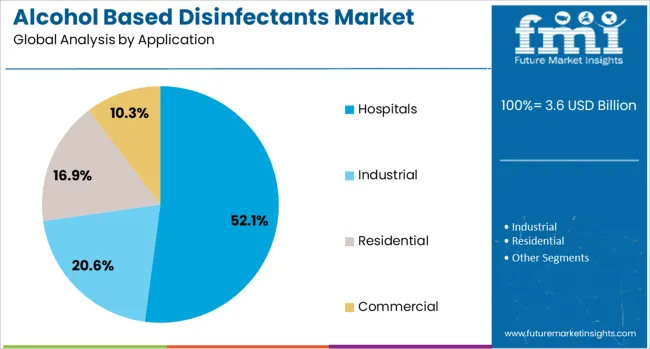

The alcohol based disinfectants market is segmented by product, usage form, application, and geographic regions. The product of the alcohol based disinfectants market is divided into Ethyl Alcohol, N-Propyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, and Others. In terms of usage, the alcohol-based disinfectants market is classified into Liquid, Spray, Gel, and Wipes. Based on the application of the alcohol based disinfectants, the market is segmented into Hospitals, Industrial, Residential, and Commercial. Regionally, the alcohol based disinfectants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, ethyl alcohol is projected to hold 46.30% of the total market revenue in 2025, making it the leading product segment. This dominance is attributed to its proven effectiveness against a wide range of pathogens and its acceptance across healthcare, commercial, and domestic environments.

Its relatively lower toxicity compared to alternatives has encouraged use in hand sanitizers and surface disinfectants, enhancing safety for frequent applications. Ethyl alcohol’s favorable regulatory standing and ready availability have also strengthened its adoption by manufacturers seeking to comply with stringent disinfection standards.

The ability to blend effectively with other active ingredients and maintain stability over time has further solidified its role as the preferred choice for high efficacy, user friendly disinfectant formulations.

In terms of usage form, liquid formulations are expected to account for 39.8% of the market revenue in 2025, retaining their position as the top segment. This prominence is driven by their ease of application, rapid action, and versatility across various surfaces and environments.

Liquids are being favored in healthcare and institutional settings due to their ability to cover large areas efficiently and penetrate hard-to-reach spots, ensuring thorough disinfection. Additionally, advancements in dispensing technologies and packaging formats have enhanced convenience and minimized wastage, reinforcing their preference.

The continued reliance of hospitals and commercial facilities on bulk liquid disinfectants for cost-effective and compliant hygiene management has ensured the sustained leadership of this segment.

When segmented by application, hospitals are forecast to capture 52.1% of the market revenue in 2025, establishing themselves as the dominant application segment. This leadership is supported by the critical need to maintain stringent hygiene standards to prevent healthcare-associated infections and safeguard patient and staff safety.

Institutional procurement policies prioritizing proven, effective disinfectants have driven consistent demand within hospital settings. The high frequency of cleaning protocols and the need for both surface and hand disinfection have further amplified usage.

Growing healthcare infrastructure and increased regulatory scrutiny of infection control practices have reinforced the importance of reliable disinfectant solutions in hospital operations. The sector’s scale, compliance needs, and focus on patient outcomes have combined to sustain hospitals as the leading consumer of alcohol based disinfectants.

Rapidly expanding healthcare regulations, heightened hygiene awareness post‑2023 pandemic phases, and broader institutional adoption have stimulated the global alcohol‑based disinfectants market. In 2024 and 2025, rising demand across clinics, food processing units, and households has been observed, while cost volatility and regulatory concerns are curbing supply chains. Innovation in product forms and packaging formats, along with growing interest in skin‑gentle formulations, has been noticed. However, competition from quaternary ammonium and peroxide‑based alternatives remains a limiting force. Market players are perceived to be leveraging brand strength and distribution leverage to maintain leadership.

Growth in the alcohol‑based disinfectants market has been driven by enforcement of hygiene mandates in healthcare and public domains. In 2024 hospitals and clinics were required to comply with stricter infection control protocols, increasing usage of alcohol‑based solutions. Consumer behaviour shifts were witnessed after the pandemic, as heightened awareness of pathogen transmission led to more routine use in homes and food services. Increasing prevalence of healthcare‑associated infections further strengthened procurement of fast‑acting disinfectants. The impact of these regulatory and behavioural changes has been considered pivotal in sustaining high volume demand through 2025.

Opportunities have been seen in bulk contract supply arrangements with institutions and industrial clients. In 2025 agreements were secured by key players such as Ecolab and Reckitt Benckiser to provide large‑volume disinfectants to hospitals and food processors. Growth in the food and beverage industry and expanded industrial hygiene standards have opened long‑term supply contracts. Expansion of e‑commerce channels has been noted, allowing smaller brands to enter personal care segments. It is believed that niche formulations (e.g. fragrance‑added gels, non‑sticky foams) offer differentiation. These developments are thought to present attractive avenues for specialized brands.

A trend has been identified in development and adoption of gentle formulations that reduce skin irritation. In 2024 several brands launched gel and foam variants with moisturizers or milder alcohol blends. These formats were claimed to appeal to frequent‑use settings such as schools and offices. Smaller companies were noted to position products as dermatologically tested and fragrance‑light. Packaging innovations like pump dispensers and travel‑size formats gained traction in 2025, particularly in domestic markets. It is considered that appealing to consumer convenience and user experience is shaping product design direction.

Restraints in the market have included volatile ethanol and isopropanol pricing and competition from alternative disinfectant chemistries. In 2024‑2025, swings in polysilicon and alcohol feedstock costs affected production expenses and forced contract renegotiations. Alternatives such as quaternary ammonium compounds and hydrogen‑peroxide‑based formulations gained share in institutional clientele. These substitutes were regarded as safer or more environmentally acceptable in some regions. Skin irritation concerns and flammability regulations added compliance costs. It is thought that smaller manufacturers without vertically integrated supply chains were most exposed to these headwinds.

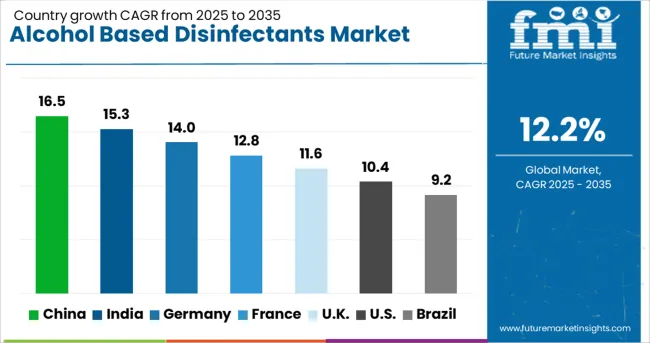

| Country | CAGR |

|---|---|

| China | 16.5% |

| India | 15.3% |

| Germany | 14.0% |

| France | 12.8% |

| UK | 11.6% |

| USA | 10.4% |

| Brazil | 9.2% |

The global alcohol-based disinfectants market is projected to grow at a CAGR of 12.2% from 2025 to 2035. China leads with 16.5%, followed by India at 15.3% and Germany at 14.0%. France records 12.8%, while the United Kingdom posts 11.6%. Growth is driven by rising infection control requirements, expansion of healthcare infrastructure, and increased use of sanitization products across industrial and commercial sectors. China and India dominate due to strong pharmaceutical production and urban healthcare demand, while Germany emphasizes hospital-grade disinfectants. France and the UK prioritize eco-compliant, high-purity formulations for institutional and consumer hygiene.

The alcohol-based disinfectants market in China is forecast to grow at 16.5%, driven by large-scale adoption in hospitals, pharmaceutical facilities, and public spaces. Ethanol-based solutions dominate healthcare applications for their broad antimicrobial spectrum. Manufacturers focus on rapid-drying disinfectants to improve operational efficiency. Increased export opportunities for sanitization products further strengthen China’s leadership in global hygiene markets.

The alcohol-based disinfectants market in India is projected to grow at 15.3%, fueled by rising healthcare expenditure and infection control mandates. Isopropyl alcohol-based formulations dominate pharmaceutical manufacturing and laboratory applications. Manufacturers develop cost-effective bulk solutions to cater to hospitals and clinics. Growing demand from educational institutions and hospitality sectors supports sustained consumption.

The alcohol-based disinfectants market in Germany is expected to grow at 14.0%, supported by stringent EU hygiene regulations and rising nosocomial infection prevention measures. Gel-based and spray disinfectants dominate hospital-grade applications. Manufacturers introduce fragrance-free, dermatologically tested variants for sensitive environments. Automated disinfection systems integrated with alcohol-based solutions improve efficiency in high-traffic areas.

The alcohol-based disinfectants market in France is forecast to grow at 12.8%, driven by healthcare facility upgrades and demand for household sanitization products. Dual-purpose disinfectants dominate adoption for multi-surface cleaning in residential and institutional settings. Manufacturers emphasize biodegradable formulations to align with EU environmental goals. Premium branding in retail markets supports strong consumer loyalty.

The alcohol-based disinfectants market in the UK is projected to grow at 11.6%, driven by healthcare modernization initiatives and expansion of infection prevention programs. Foam-based disinfectants dominate portable and on-the-go hygiene applications. Manufacturers develop non-staining, quick-dry products for clinical and retail markets. Strategic collaborations with healthcare organizations enhance distribution efficiency across the country.

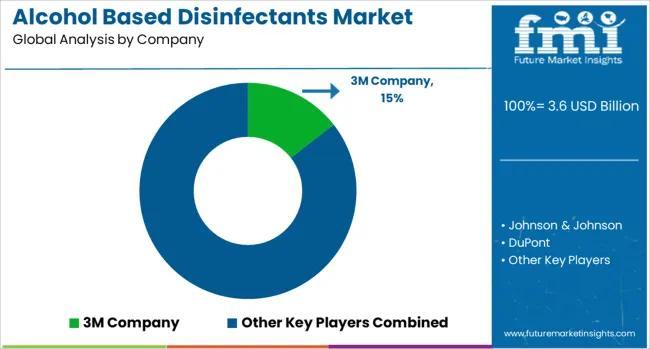

The alcohol-based disinfectants market is moderately consolidated, with 3M Company recognized as a leading player for its extensive portfolio of surface and hand disinfectants widely used in healthcare, industrial, and institutional settings. The company leverages advanced formulations and strong global distribution channels to maintain its leadership in hygiene and infection control solutions. Key players include Johnson & Johnson, DuPont, BODE Chemie GmbH, Reckitt Benckiser, Ecolab Inc., Acuro, and Organics Limited.

These companies provide alcohol-based sanitizers and disinfectants designed for effective microbial elimination on hands, medical instruments, and high-touch surfaces. Their offerings are formulated with ethanol or isopropanol and enhanced with skin conditioners or surface protectants to meet varying application needs across sectors. Market growth is driven by heightened awareness of infection prevention, stringent hygiene regulations in healthcare facilities, and the continuing emphasis on sanitization in commercial and residential spaces.

Manufacturers are investing in advanced quick-dry formulations, skin-friendly products, and packaging innovations such as touchless dispensers and portable packs to improve user convenience. Additionally, sustainability trends are influencing product development, with companies exploring eco-friendly packaging and bio-based alcohol sources. While North America and Europe dominate the market due to strong institutional demand, Asia-Pacific shows rapid growth supported by rising healthcare investments and increased public health initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Product | Ethyl Alcohol, N- Propyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, and Others |

| Usage Form | Liquid, Spray, Gel, and Wipes |

| Application | Hospitals, Industrial, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Johnson & Johnson, DuPont, BODE Chemie GmbH, Reckitt Benckiser, Ecolab Inc., Acuro, and Organics Limited |

| Additional Attributes | Dollar sales by alcohol type and form (ethyl, isopropyl; sprays, gels), regional demand trends (North America largest, Asia-Pacific fastest), competitive landscape, consumer preference for portable skin-friendly solutions, integration with smart hygiene systems, innovations in biodegradable blends, moisturizer-infused sanitizers, and advanced antimicrobial technologies. |

The global alcohol based disinfectants market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the alcohol based disinfectants market is projected to reach USD 11.2 billion by 2035.

The alcohol based disinfectants market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in alcohol based disinfectants market are ethyl alcohol, n- propyl alcohol, methyl alcohol, isopropyl alcohol and others.

In terms of usage form, liquid segment to command 39.8% share in the alcohol based disinfectants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcohol Packaging Market Forecast and Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

TCD Alcohol DM Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

Oxo Alcohols Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA