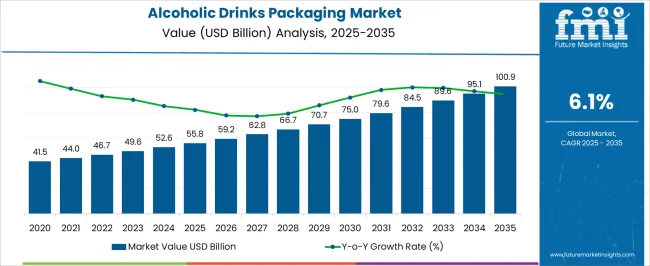

The alcoholic drinks packaging market is projected to grow from USD 55.8 billion in 2025 to USD 100.9 billion by 2035, representing a CAGR of 6.1%. A growth momentum analysis highlights periods of accelerated and steady expansion, reflecting evolving consumer preferences, packaging innovations, and regional market dynamics.

Between 2025 and 2030, the market expands from USD 55.8 billion to USD 75.0 billion, with momentum driven by increased adoption of premium and craft alcoholic beverages, rising disposable income, and urbanization in emerging economies. Innovations such as eco-friendly glass bottles, lightweight cans, and visually appealing labeling enhance product differentiation, contributing to strong demand. This phase also benefits from growth in on-trade and off-trade channels, including e-commerce platforms, which support faster distribution and consumer reach.

From 2030 to 2035, the market further accelerates from USD 75.0 billion to USD 100.9 billion, reflecting sustained momentum from technological innovations, rising consumer inclination toward sustainable and premium packaging, and increased penetration in Asia-Pacific and Latin America. Brand-driven marketing campaigns, seasonal promotions, and regulatory support for recyclable packaging reinforce the growth trajectory.

| Metric | Value |

|---|---|

| Alcoholic Drinks Packaging Market Estimated Value in (2025 E) | USD 55.8 billion |

| Alcoholic Drinks Packaging Market Forecast Value in (2035 F) | USD 100.9 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The alcoholic drinks packaging market is primarily driven by the spirits, wine, and beer market, which accounts for approximately 40–45% of total demand, as bottles, cans, and specialty packaging are essential for beverage safety, branding, and shelf appeal. The glass, plastic, and metal packaging materials market contributes around 20–22%, reflecting the supply of bottles, cans, closures, and labeling materials needed across alcoholic beverages. The luxury and premium packaging market holds roughly 15–17%, driven by demand for decorative, gift-ready, and limited-edition packaging in premium wines and spirits. The e-commerce and retail distribution market contributes approximately 10–12%, as online sales growth and retail expansion require packaging that ensures product protection, aesthetics, and brand differentiation. Lastly, the sustainable packaging market accounts for 5–6%, reflecting the rising adoption of recyclable, biodegradable, and eco-friendly packaging in response to consumer preferences and regulatory pressures. Collectively, these parent markets define the operational, material, and innovation ecosystem of the alcoholic drinks packaging market, enabling manufacturers, distributors, and retailers to deliver safe, visually appealing, and sustainable packaging solutions across global beverage segments.

The alcoholic drinks packaging market is experiencing sustained expansion, supported by the rising global consumption of alcoholic beverages, premiumization trends, and the demand for differentiated branding. Packaging plays a critical role in product positioning, with manufacturers leveraging advanced designs, sustainable materials, and functional enhancements to appeal to evolving consumer preferences.

Market dynamics are being shaped by regulatory considerations around recyclability, health labeling, and responsible consumption messaging, prompting innovations in material selection and printing technologies. While fluctuations in raw material prices and supply chain disruptions have presented operational challenges, strategic procurement and localized production are helping stabilize output.

The premium beverage segment, in particular, is driving higher adoption of high-quality, visually appealing, and eco-friendly packaging formats Over the forecast period, the market is expected to benefit from increased investments in circular economy initiatives, lightweighting techniques, and digital printing capabilities, enabling brand owners to optimize both sustainability performance and consumer engagement while expanding reach in emerging and mature markets alike.

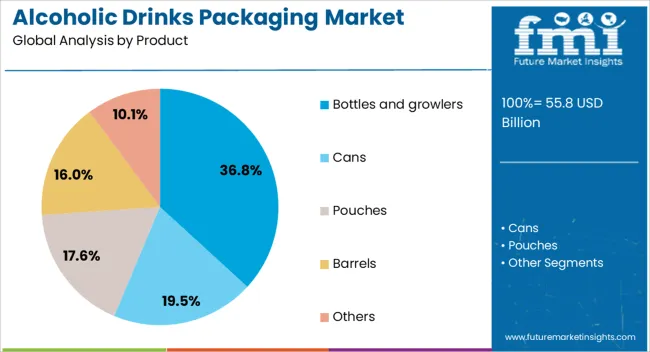

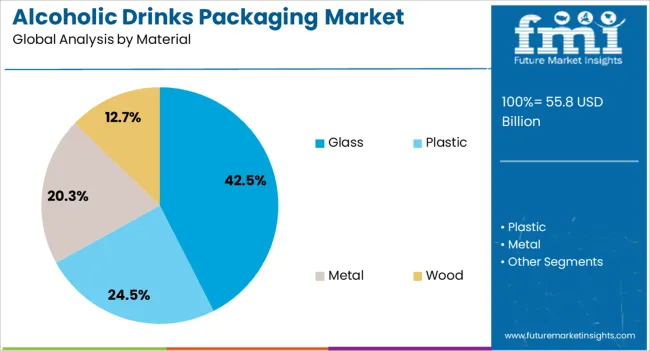

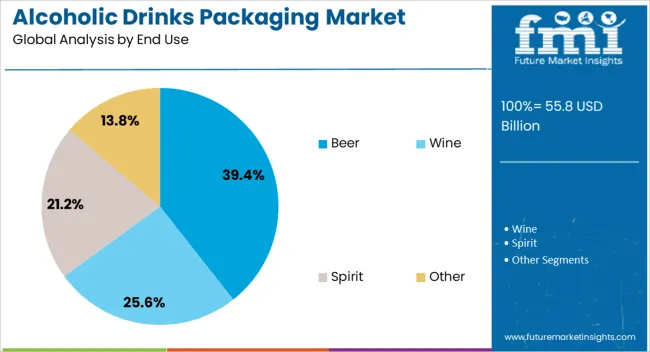

The alcoholic drinks packaging market is segmented by product, material, end use, and geographic regions. By product, alcoholic drinks packaging market is divided into Bottles and growlers, Cans, Pouches, Barrels, and Others. In terms of material, alcoholic drinks packaging market is classified into Glass, Plastic, Metal, and Wood. Based on end use, alcoholic drinks packaging market is segmented into Beer, Wine, Spirit, and Other. Regionally, the alcoholic drinks packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bottles and growlers segment, accounting for 36.8% of the product category, has maintained its leadership due to its strong alignment with premium and traditional alcoholic beverage formats. Glass bottles and growlers are preferred for their ability to preserve product integrity, enhance shelf appeal, and reinforce brand heritage.

Their dominance is further supported by established manufacturing infrastructure and global familiarity with these formats in both retail and on-trade channels. Sustainability initiatives, including reusable growlers and returnable bottle programs, are bolstering their market relevance.

Additionally, technological advancements in embossing, labeling, and printing have allowed brand owners to create distinctive identities that drive consumer recognition Despite competition from alternative formats such as cans and PET, the bottles and growlers segment retains a strong position due to its premium associations and compatibility with diverse alcoholic drink categories, ensuring continued demand across both mature and emerging markets.

The glass segment, representing 42.5% of the material category, leads the market owing to its premium image, inert properties, and recyclability. Glass packaging is valued for its ability to maintain beverage quality without altering taste or aroma, a factor critical for consumer trust in alcoholic drinks. The segment’s dominance is reinforced by global recycling infrastructure and regulatory support for sustainable packaging solutions.

Brand owners are increasingly using lightweight glass technologies to reduce transportation costs and carbon footprint while maintaining product aesthetics. Glass also offers versatile design capabilities, enabling high-end branding through embossing, custom shapes, and specialty closures.

While the production of glass can be energy-intensive, investments in greener furnaces and closed-loop recycling are mitigating environmental concerns Its premium perception, combined with its alignment to sustainability goals and product protection requirements, ensures the glass segment continues to command a leading share in alcoholic drinks packaging.

The beer segment, holding 39.4% of the end-use category, is at the forefront of demand in alcoholic drinks packaging due to high global consumption volumes and a diverse range of brand offerings. Beer packaging requirements emphasize freshness retention, light protection, and portability, factors that favor formats such as glass bottles, growlers, and cans. The segment benefits from established distribution channels, including retail, bars, and restaurants, ensuring widespread product availability.

Seasonal promotions, craft beer expansion, and premiumization trends are further increasing the need for visually distinctive and high-quality packaging. The rise of microbreweries and regional beer brands has also spurred demand for small-batch, custom packaging solutions that enhance brand differentiation.

Sustainability remains a key driver, with increased adoption of returnable bottles, recycled materials, and eco-friendly inks The beer segment’s strong market position is expected to persist, supported by its cultural relevance, continuous innovation in branding, and consistent consumer demand worldwide.

Rising consumer demand for premium and craft alcoholic beverages is driving innovation in packaging solutions that combine aesthetics, functionality, and product protection. Bottles, cans, cartons, and specialty closures are designed to enhance brand appeal, preserve flavor integrity, and ensure safety during storage and transport. Portability, tamper-evident seals, and convenience-oriented formats are increasingly important for on-the-go consumption and gifting occasions. Suppliers offering customizable packaging with design expertise, reliable material sourcing, and quality assurance are well positioned to support breweries, distilleries, and wine producers in differentiating their brands and meeting diverse consumer expectations across retail, hospitality, and e-commerce channels.

Alcohol brands are investing in packaging that communicates quality, authenticity, and craftsmanship. Premium finishes, embossed labels, metallic foils, and unique bottle shapes enhance shelf presence and encourage consumer trial. Functional features such as resealable caps, ergonomic handling, and portion-controlled servings improve convenience, particularly for ready-to-drink cocktails, spirits, and craft beverages. Consumer preference for visually striking and easy-to-use packaging is further fueled by social media trends and gifting occasions. Suppliers providing innovative, design-focused packaging solutions with reliable delivery and technical support help producers strengthen brand recognition, consumer engagement, and market competitiveness.

The market faces constraints from high material costs, including glass, aluminum, and specialty polymers, as well as energy-intensive production processes. Regulatory compliance for labeling, safety standards, and food-contact materials adds complexity, especially for alcoholic beverages with varying ABV levels. Technical challenges include ensuring bottle integrity, tamper evidence, and compatibility with carbonated or flavored drinks. Seasonal spikes in demand, supply chain variability, and quality consistency are additional concerns. Buyers seek suppliers offering certified materials, quality assurance, and reliable production schedules to minimize risks, maintain brand reputation, and ensure safe, high-quality packaging for diverse beverage portfolios.

Opportunities exist in premium packaging, ergonomic bottles, innovative closures, and multi-pack formats that enhance consumer convenience and brand perception. Craft breweries, distilleries, and ready-to-drink beverage producers are increasingly adopting lightweight, travel-friendly, and refillable-inspired designs for differentiated offerings. Specialty finishes, embossed detailing, and personalized labeling appeal to premium and gifting segments. Suppliers providing turnkey design services, technical support, and customizable solutions are well positioned to capture growth opportunities. Collaboration with beverage producers, brand owners, and distributors strengthens innovation, product differentiation, and market reach, enabling adoption of high-performance and visually appealing packaging across alcoholic drinks globally.

The market is trending toward lightweight bottles, cans, and closures that enhance portability, convenience, and shelf impact. Functional designs such as resealable caps, easy-pour spouts, and portion-controlled formats are gaining traction across spirits, wine, beer, and ready-to-drink cocktails. High-end finishes, tactile textures, and visually distinctive designs support premiumization and gifting trends. Travel-friendly formats, multipacks, and ergonomic packaging are increasingly used to meet consumer expectations for convenience and usability. Suppliers providing high-quality, application-ready packaging with technical support, customizable designs, and reliable delivery are best positioned to meet evolving demands, enabling alcoholic beverage brands to combine aesthetic appeal, functional performance, and brand differentiation globally.

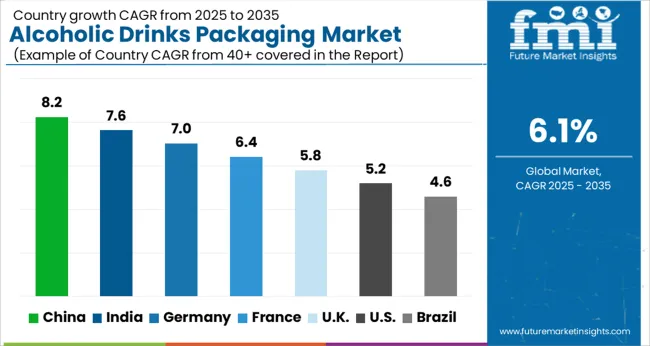

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global alcoholic drinks packaging market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China leads at 8.2%, followed by India at 7.6%, France at 6.4%, the UK at 5.8%, and the USA at 5.2%. Growth is driven by premiumization, urbanization, and expanding retail and e-commerce channels. Demand for high-quality glass bottles, cans, and multi-pack cartons is increasing across spirits, wine, and beer segments. Automation, digital labeling, and precision decoration enhance efficiency, design, and durability. Limited edition, gift, and functional packaging trends further boost consumer appeal and market adoption globally. The analysis includes over 40 countries, with the leading markets shown below.

The alcoholic drinks packaging market in China is projected to grow at a CAGR of 8.2% from 2025 to 2035, driven by rising demand for premium beverages, urbanization, and expanding on-trade and off-trade channels. Consumers increasingly prefer aesthetically appealing, functional, and branded packaging formats such as glass bottles, cans, and multi-pack cartons. Domestic manufacturers are investing in high-precision bottling, labeling, and printing technologies to enhance product presentation and shelf appeal. Industrial hubs in Shanghai, Guangdong, and Jiangsu provide robust production and logistics support. Collaborations with international technology providers help adopt automation, digital decoration, and quality control systems. Limited edition, collector, and gift packaging also enhance premiumization and brand differentiation, while technological advancements ensure improved durability, sealing, and sustainability of alcoholic beverage packaging.

Alcoholic drinks packaging market in India is expected to grow at a CAGR of 7.6% from 2025 to 2035, fueled by increasing consumption of beer, wine, and spirits, urbanization, and rising disposable incomes. Premiumization trends drive demand for aesthetically appealing glass bottles, cans, and multi-pack cartons. Domestic manufacturers are investing in high-speed filling, capping, labeling, and digital decoration technologies to enhance efficiency and visual appeal. Industrial hubs in Maharashtra, Gujarat, and Karnataka support large-scale production and distribution. Expansion of organized retail, e-commerce platforms, and on-trade outlets increases market penetration. Growing interest in limited edition, gift, and festive packaging further drives premium packaging adoption. Collaboration with global packaging technology providers enhances design, durability, and production efficiency. Increasing consumer preference for secure, tamper-evident, and convenient packaging also contributes to sustained market growth.

France market is projected to grow at a CAGR of 6.4% from 2025 to 2035, supported by its strong wine, spirits, and craft beer industries. Demand for premium, innovative, and aesthetically appealing packaging formats, including glass bottles, cartons, and gift packs, is rising. Local manufacturers focus on precision filling, labeling, and high-quality printing technologies to maintain brand identity and product integrity. Collaborations with international packaging technology providers enhance automation, durability, and design innovation. Retail chains, wine shops, and on-trade outlets support strong distribution networks, while e-commerce platforms expand consumer reach. Growing demand for collector editions, limited releases, and luxury packaging for wines and spirits further drives adoption. Compliance with EU regulations for labeling and safety standards encourages manufacturers to upgrade equipment and adopt advanced packaging materials.

The UK market is expected to grow at a CAGR of 5.8% from 2025 to 2035, supported by demand for wine, beer, and spirits across retail and on-trade channels. Consumers increasingly prefer functional, visually appealing packaging, including glass bottles, cans, and multi-pack cartons. Manufacturers are investing in automation, high-speed filling, and digital decoration technologies to improve efficiency, durability, and presentation. Industrial hubs in London, Birmingham, and Manchester provide strong production and logistics support. Growth of e-commerce, direct-to-consumer platforms, and subscription-based liquor services expands accessibility. Limited edition and festive packaging enhance premiumization, while regulatory compliance and product labeling requirements drive equipment modernization. Packaging innovations such as tamper-evident seals, ergonomic designs, and convenience-oriented formats further support adoption.

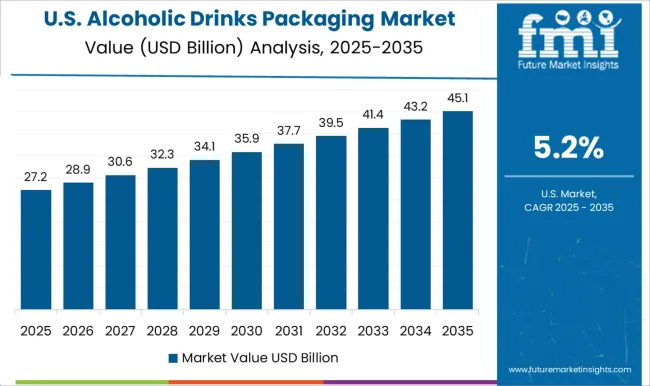

The USA market is projected to grow at a CAGR of 5.2% from 2025 to 2035, fueled by the premium spirits, wine, and craft beer sectors. High-quality packaging, including glass bottles, cans, and gift cartons, is increasingly in demand for brand differentiation. Manufacturers focus on automation, high-speed filling, digital labeling, and precision decoration technologies to ensure durability, aesthetics, and operational efficiency. Industrial hubs in California, New York, and Texas support large-scale production and logistics. The growth of e-commerce, direct-to-consumer platforms, and subscription services enhances market accessibility. Limited edition, collector, and gift packaging trends contribute to premiumization, while regulatory compliance for labeling, safety, and tamper-evidence drives equipment upgrades. Consumer interest in convenient, reusable, and high-quality packaging supports sustained market adoption.

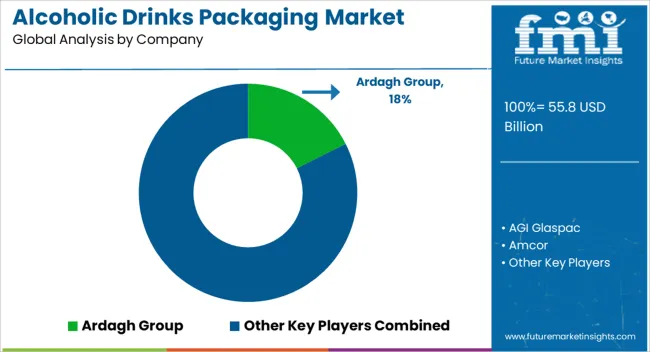

The alcoholic drinks packaging market is driven by rising demand for premiumization, convenience, and brand differentiation in spirits, beer, and wine segments. Packaging formats include glass bottles, metal cans, cartons, closures, and secondary packaging such as boxes and gift sets. Growth is fueled by e-commerce, on-premise consumption trends, and marketing-focused packaging that enhances shelf visibility, brand perception, and consumer experience. Durability, lightweight design, and compliance with beverage safety standards remain critical selection criteria for producers. Competition is defined by material quality, design innovation, and production scalability. Ardagh Group, O-I Glass, and Verallia lead with high-quality glass bottles tailored for spirits, wine, and craft beverages. Ball Corporation, Crown Holdings, and Berry Global differentiate with metal cans and closures emphasizing lightweight performance, printability, and tamper resistance. Flexible packaging and carton specialists such as Tetra Pak Group, SIG Combibloc Group, and DS Smith compete with aseptic cartons, sleeves, and multipacks for ready-to-drink products. Amcor, Graham Packaging, and Encore Glass focus on hybrid materials and custom molding solutions to enhance visual appeal and functionality. Regional and niche players including AGI Glaspac, Big Sky Packaging, Glassworks International, Golden West Packaging, Mondi, Orora Group, PT Packaging, Saxco International, Sealed Air, Smurfit Kappa, TricorBraun, Vetreria Etrusca, and WestRock provide specialized bottles, closures, labels, and secondary packaging for brand differentiation and logistics efficiency. Strategies emphasize design flexibility, lightweight construction, and packaging automation. Innovations include custom embossing, premium finishes, tamper-evident closures, and multi-layer protection for fragile glass. Product brochures highlight material type, volume, closure mechanism, durability, printability, and compatibility with beverage formulations. Packaging configurations, palletization guidelines, and handling recommendations are detailed. Marketing emphasizes aesthetics, functional reliability, and regulatory compliance, reflecting a market focused on premium presentation, operational efficiency, and enhancing consumer appeal.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.8 Billion |

| Product | Bottles and growlers, Cans, Pouches, Barrels, and Others |

| Material | Glass, Plastic, Metal, and Wood |

| End Use | Beer, Wine, Spirit, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ardagh Group, AGI Glaspac, Amcor, Ball Corporation, Berry Global, Big Sky Packaging, Crown Holdings, DS Smith, Encore Glass, Glassworks International, Golden West Packaging, Graham Packaging Company, Mondi, O-I Glass, Orora Group, PT Packaging, Saxco International, Sealed Air, SIG Combibloc Group, Smurfit Kappa, Tetra Pak Group, TricorBraun, Verallia, Vetreria Etrusca, and WestRock |

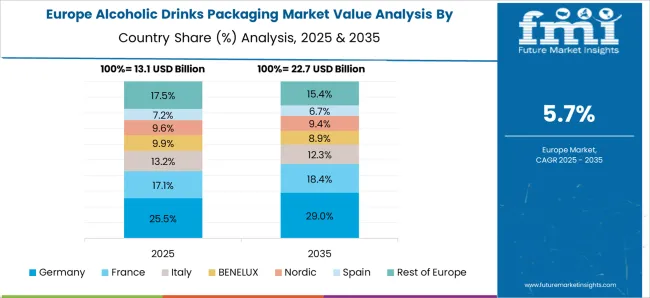

| Additional Attributes | Dollar sales by packaging type (glass bottles, aluminum cans, plastic containers, cartons, closures), material type (glass, metal, plastic, fiber-based), and end-use (beer, wine, spirits, ready-to-drink alcoholic beverages). Demand is driven by premiumization of alcoholic drinks, sustainability initiatives, and regulatory compliance. Regional trends highlight strong growth in Europe and North America due to mature markets and premium beverage consumption, while Asia-Pacific shows rapid expansion fueled by increasing urbanization, rising disposable income, and growing alcohol consumption. |

The global alcoholic drinks packaging market is estimated to be valued at USD 55.8 billion in 2025.

The market size for the alcoholic drinks packaging market is projected to reach USD 100.9 billion by 2035.

The alcoholic drinks packaging market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in alcoholic drinks packaging market are bottles and growlers, cans, pouches, barrels and others.

In terms of material, glass segment to command 42.5% share in the alcoholic drinks packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcoholic Ice Cream Market

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

Canned Alcoholic Beverages Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Premium Alcoholic Beverage Market - Size, Share, and Forecast 2025 to 2035

USA Non-Alcoholic Malt Beverages Market Insights – Trends, Demand & Growth 2025-2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

Europe Non-Alcoholic Malt Beverages Market Insights – Demand & Growth 2025–2035

Pre-mixed/RTD Alcoholic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA