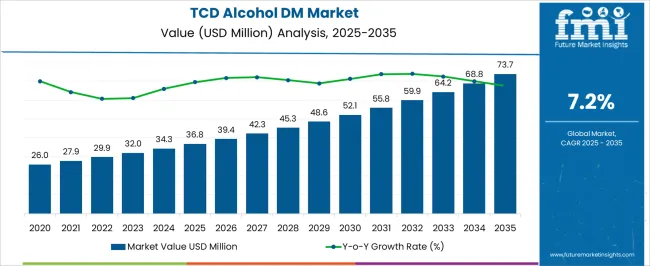

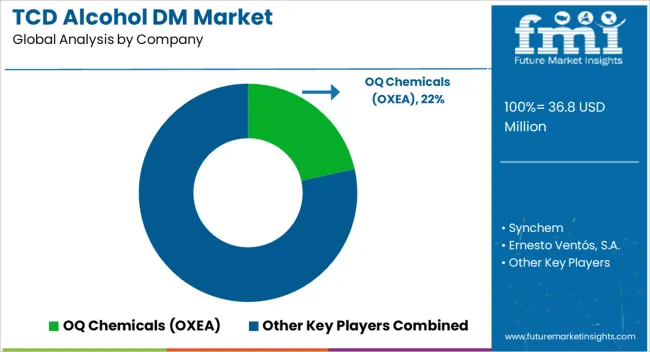

The TCD Alcohol DM Market is estimated to be valued at USD 36.8 million in 2025 and is projected to reach USD 73.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. During the initial phase from 2020 to 2025, the market advances from USD 26.0 million to USD 34.3 million, supported by consistent demand from industrial sectors and growing R&D efforts.

Between 2026 and 2030, the curve rises more sharply as adoption accelerates in high-value applications such as optical materials, high-performance coatings, and energy-curable resins. By 2030, the market surpasses USD 52.1 million, underscoring expanding production capacities and wider commercial acceptance. Beyond 2030, the market continues to grow but at a more measured pace, climbing to USD 68.8 million in 2034 before reaching USD 73.7 million in 2035. The YoY growth line reflects early fluctuations, followed by a stable mid-term pattern and a gradual slowdown in later years, signaling a shift toward maturity.

| Metric | Value |

|---|---|

| TCD Alcohol DM Market Estimated Value in (2025 E) | USD 36.8 million |

| TCD Alcohol DM Market Forecast Value in (2035 F) | USD 73.7 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The TCD Alcohol DM market is growing steadily, driven by increasing demand in specialty coating applications. The focus on advanced surface finishing techniques has highlighted the importance of high-performance materials like TCD Alcohol DM that improve coating durability and appearance.

Industry trends point to the rising use of UV-cure coatings in various sectors, including automotive, electronics, and construction, where fast curing times and strong adhesion are critical. These coatings offer environmental benefits by reducing volatile organic compound emissions, aligning with stricter regulatory standards worldwide.

Technological advancements have enabled better formulation flexibility and improved end-product performance, which has expanded application possibilities. Increasing investment in innovative coatings and finishing processes supports future market growth. Segmental growth is primarily fueled by the UV Cure Coatings application, which leads due to its widespread adoption and performance advantages.

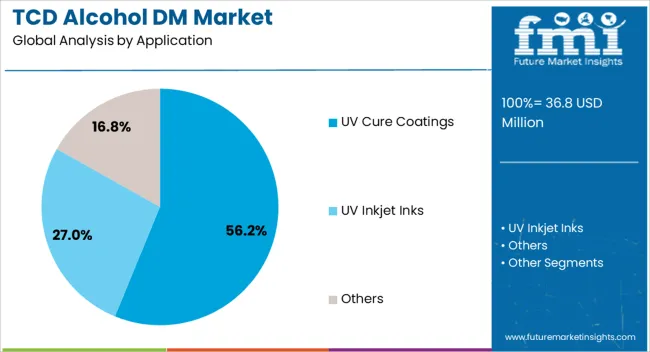

The TCD alcohol DM market is segmented by application and geographic regions. By application, the TCD alcohol DM market is divided into UV Cure Coatings, UV Inkjet Inks, and Others. Regionally, the TCD alcohol DM industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The UV Cure Coatings application segment is projected to hold 56.2% of the TCD Alcohol DM market revenue in 2025, solidifying its position as the dominant segment. Growth of this application has been driven by the demand for rapid curing technologies that improve production efficiency and reduce energy consumption.

UV cure coatings provide excellent resistance to abrasion and chemicals, making them suitable for high-performance surfaces. Industries adopting UV cure coatings benefit from reduced environmental impact and improved coating longevity.

The segment's expansion is supported by ongoing innovations in coating chemistry that enhance cure speed and final finish quality. As manufacturers seek sustainable and efficient coating solutions, the UV Cure Coatings application is expected to maintain its leading market share.

TCD Alcohol DM is increasingly integrated across UV-curable coatings, electronics, and specialty resins. Growth is supported by regulatory compliance, supply chain strategies, and collaborative innovation with downstream industries.

TCD Alcohol DM has gained traction as a vital raw material for UV-curable coatings, adhesives, and inks due to its excellent transparency, resistance to yellowing, and durability. Demand is increasing in packaging, automotive, and electronics where rapid curing and superior performance are necessary. Manufacturers value its ability to improve scratch resistance and enhance optical clarity, which is critical in high-end consumer goods. The growing popularity of UV-curable technologies across industrial production has expanded the scope of TCD Alcohol DM, reinforcing its importance in performance-driven formulations. Its use ensures stronger bonds, improved coating lifespans, and faster curing, which directly influences efficiency in manufacturing environments and increases confidence in end-product quality.

Electronics and optical materials represent a growing demand base for TCD Alcohol DM, particularly in precision coatings, photoresists, and display technologies. Its high refractive index and resistance to thermal degradation make it ideal for light-guiding applications and optical lenses. As the demand for advanced displays and optical components increases, TCD Alcohol DM is being prioritized for performance-critical roles where consistency and clarity are essential. Its role in circuit board coatings and semiconductor processes also highlights its growing industrial integration. These applications emphasize the adaptability of TCD Alcohol DM across high-value industries, ensuring a continued rise in demand where functional performance cannot be compromised.

Regulatory requirements on chemical safety and production standards have influenced adoption trends for TCD Alcohol DM. Producers are focusing on maintaining compliance with international chemical safety frameworks, ensuring global acceptance and usage in diverse industries. End users in coatings and adhesives markets are increasingly prioritizing materials that demonstrate stability, durability, and regulatory compliance. This dynamic has reinforced the position of TCD Alcohol DM as a reliable choice for companies aiming to meet stricter guidelines without sacrificing performance. Global supply chains are also adapting to ensure certifications, traceability, and documentation, which make procurement easier for multinational manufacturers. These factors collectively strengthen the commercial outlook for this specialty chemical.

Companies in the TCD Alcohol DM space are investing in capacity expansion, cost optimization, and collaborative agreements with downstream industries to capture greater share. Strategic partnerships with coating, resin, and adhesive producers are allowing manufacturers to co-develop tailored solutions that enhance curing efficiency and material durability. Emphasis is placed on securing stable raw material supply chains and leveraging technical expertise to ensure high-quality production. Competitive dynamics are shaped by a focus on price competitiveness, consistent supply, and collaborative research. This environment has encouraged firms to differentiate offerings through customer-specific performance improvements, ensuring stronger adoption in industrial, electronic, and packaging applications.

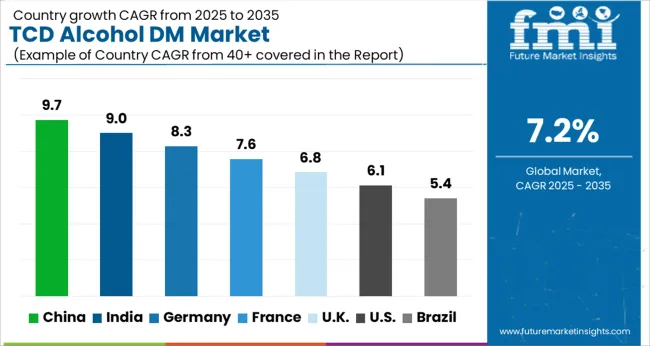

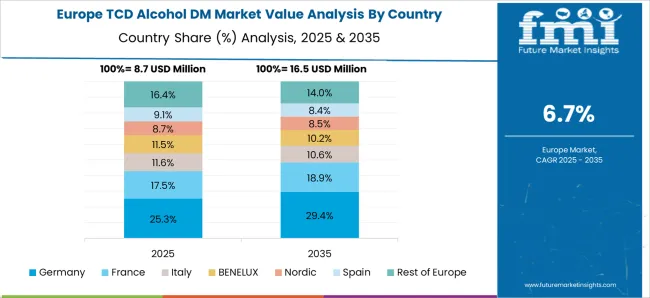

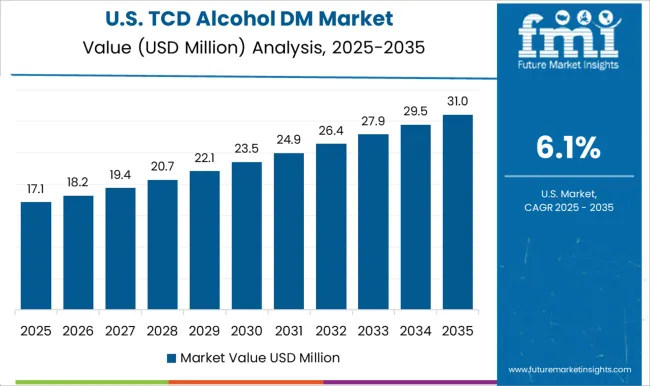

The TCD Alcohol DM market is projected to expand at a global CAGR of 7.2% from 2025 to 2035, supported by increasing demand for UV-curable coatings, optical resins, and specialty adhesives across diverse industries. China leads with a CAGR of 9.7%, driven by rapid electronics manufacturing, large-scale adoption in packaging, and rising use in high-performance coatings. India follows at 9.0%, fueled by growth in automotive coatings, industrial adhesives, and demand for advanced materials in consumer goods. France achieves a CAGR of 7.6%, supported by use in precision coatings, photoresists, and packaging films. The United Kingdom posts 6.8% growth, reflecting expanding demand in specialty adhesives and optoelectronic materials. The United States grows at 6.1%, supported by replacement demand in coatings and rising use in electronics, though adoption is moderated by an established industrial base. The analysis spans more than 40 countries, with these highlighted markets serving as benchmarks for resin innovation, optical material integration, and performance-driven specialty chemical adoption in the global TCD Alcohol DM industry.

China is projected to advance at a CAGR of 9.7% during 2025–2035, notably higher than the global average of 7.2%. Between 2020 and 2024, the CAGR was around 7.8%, supported by early adoption in coatings, adhesives, and optical resins for electronic displays. The subsequent rise is explained by large-scale investment in packaging materials, semiconductor manufacturing, and specialty coatings, where demand for UV-curable systems continues to accelerate. Domestic producers are also scaling up manufacturing capacity to reduce reliance on imports, ensuring stable supply for high-demand industries. China’s growing export of processed chemicals further reinforces its position as a hub for TCD Alcohol DM usage.

India is expected to grow at a CAGR of 9.0% between 2025–2035, surpassing the global benchmark of 7.2%. From 2020 to 2024, CAGR was about 6.5%, when demand largely stemmed from automotive coatings and adhesives for construction. The improvement toward 9.0% is explained by rising consumption of UV-curable resins in electronics assembly, consumer goods packaging, and industrial printing. Local manufacturers have increased output capacity while multinationals are investing in joint ventures to meet rising domestic demand. Growing exports of coated packaging films and regional investments in specialty materials production are shaping long-term adoption patterns across diverse industries.

France is forecast to achieve a CAGR of 7.6% during 2025–2035, higher than the global 7.2%. In 2020–2024, growth was closer to 5.8%, largely driven by niche adoption in specialty coatings and adhesives. The jump to 7.6% is supported by demand from high-performance polymers in automotive and aerospace, as well as precision applications in packaging and printing. French manufacturers are increasingly partnering with electronics and polymer firms to expand application areas. Strong government backing for industrial R&D and chemical safety standards has also contributed to stable adoption. This transition positions France as an important European hub for performance-based chemical intermediates.

The United Kingdom is projected to post a CAGR of 6.8% between 2025–2035, slightly below the global average of 7.2%. From 2020–2024, CAGR stood at about 5.2%, when adoption was concentrated in niche adhesive and resin applications. The increase to 6.8% reflects growing use in specialty packaging, advanced coatings, and optoelectronic materials. Expansion in the renewable energy and electronics sectors has also spurred incremental demand for UV-curable monomers. However, the growth pace is moderated by a mature chemicals industry and higher import reliance compared to continental Europe. Enhanced focus on lifecycle efficiency and adoption in healthcare-related packaging are supporting gradual market expansion.

The United States is anticipated to register a CAGR of 6.1% between 2025–2035, below the global rate of 7.2%. From 2020–2024, CAGR was about 4.9%, reflecting selective use in coatings and adhesives. The improvement to 6.1% is attributed to demand from electronics, automotive resins, and high-performance adhesives in infrastructure. Growing reliance on UV-curable technologies in printing and packaging has also pushed incremental growth. While domestic producers emphasize product innovation, adoption has been gradual due to competition from established resin systems. Nonetheless, increased focus on lifecycle efficiency and performance durability is creating new opportunities across industrial segments.

OQ Chemicals (OXEA) plays a leading role with an extensive portfolio of oxo derivatives, ensuring a stable global supply of TCD Alcohol DM and related intermediates. Synchem emphasizes niche chemical synthesis, catering to custom requirements in coatings and UV-curable applications. Ernesto Ventós, S.A., leverages its strong fragrance and flavor distribution network to expand into specialty chemical markets. Mil-Spec Industries Corporation competes by serving high-performance industrial requirements with tailored chemical solutions. Indukern integrates its fragrance and flavor business with specialty chemical distribution, ensuring a wide reach across multiple geographies. Moellhausen S.P.A. builds strength through its expertise in raw material sourcing for perfumery and specialty applications, making TCD Alcohol DM more accessible to European customers.

Tokyo Chemical Industry Co., Ltd (TCI) is globally recognized for supplying laboratory and specialty-grade chemicals, providing TCD Alcohol DM for research and advanced applications. Prodasynth focuses on the synthesis of specialty intermediates, supporting growth in polymers and resins. LLUCH ESSENCE, S.L. capitalizes on its fragrance and essential oils background to expand chemical distribution capabilities in Southern Europe. Penta Manufacturing Company provides cost-effective specialty chemicals for coatings, adhesives, and industrial applications. Soditas operates in niche supply segments, catering to regional requirements with targeted distribution strategies. Competitive strategies revolve around scaling high-purity production, building regional supply chains, and forming partnerships with downstream users in resins, coatings, and specialty polymers. Companies are prioritizing R&D-driven improvements, reliable distribution channels, and price competitiveness to strengthen their share. Expansion into performance materials, combined with strategic collaborations with resin and coatings manufacturers, is expected to define the future competitive landscape of the TCD Alcohol DM industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.8 Million |

| Application | UV Cure Coatings, UV Inkjet Inks, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OQ Chemicals (OXEA), Synchem, Ernesto Ventós, S.A., Mil-Spec Industries Corporation, Indukern - F&F, Moellhausen S.P.A, Tokyo Chemical Industry Co., Ltd, Prodasynth, LLUCH ESSENCE, S L, Penta Manufacturing Company, and Soditas |

| Additional Attributes | Dollar sales, share, demand trends in coatings and adhesives, regional consumption patterns, competitor strategies, regulatory drivers, pricing benchmarks, and growth opportunities. |

The global TCD alcohol DM market is estimated to be valued at USD 36.8 million in 2025.

The market size for the TCD alcohol DM market is projected to reach USD 73.7 million by 2035.

The TCD alcohol DM market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in TCD alcohol DM market are uv cure coatings, uv inkjet inks and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Dehydrogenase Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Based Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alcoholic Flavors Market Size, Growth, and Forecast for 2025 to 2035

Alcoholic Hepatitis Treatment Market Analysis - Size, Share & Forecast 2025 to 2035

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Assessing Alcohol Packaging Market Share & Industry Trends

Alcohol Ethoxylates Market Demand & Growth 2025-2035

Alcohol Packaging Market from 2024 to 2034

Alcoholic Ice Cream Market

Bioalcohols Market Size and Share Forecast Outlook 2025 to 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Non-Alcoholic Beer Market Insights - Trends, Demand & Growth 2025 to 2035

Non-Alcoholic Steatohepatitis Clinical Trials Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Non-Alcoholic Malt Beverages Market Size, Growth, and Forecast for 2025 to 2035

Non-alcoholic Steatohepatitis Drugs Pipeline Market Outlook 2025 to 2035

Low-alcohol Beverages Market Analysis by Type, Distribution Channel, Packaging Format and Region through 2035

Industry Share & Competitive Positioning in Non-Alcoholic Malt Beverages

Oxo Alcohols Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA