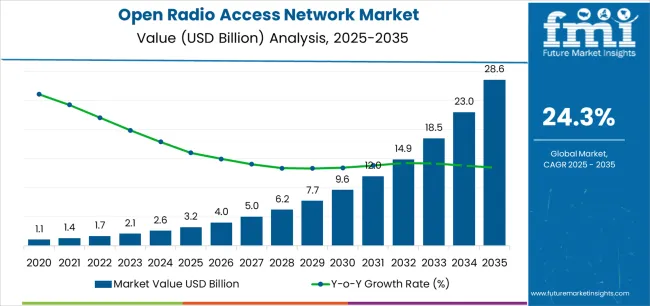

The Open Radio Access Network Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 28.6 billion by 2035, registering a compound annual growth rate (CAGR) of 24.3% over the forecast period.

The open radio access network (O-RAN) market is experiencing robust expansion driven by the global shift toward network virtualization, interoperability, and cost-efficient 5G deployment. Market momentum is being supported by growing adoption of open standards that enable operators to reduce vendor dependency and enhance network flexibility. Hardware and software disaggregation is improving scalability and network optimization while lowering operational expenses.

Industry collaboration among telecom operators, system integrators, and technology providers is accelerating ecosystem maturity. The future outlook is characterized by strong integration of artificial intelligence, cloud-native architectures, and edge computing into O-RAN solutions, enabling enhanced automation and dynamic resource management.

Regulatory support for open network frameworks and increased private 5G deployment across enterprises are expected to further expand the market footprint Growth rationale is centered on the ability of O-RAN systems to deliver cost efficiency, interoperability, and rapid scalability, making them a cornerstone in the evolution of next-generation mobile infrastructure worldwide.

| Metric | Value |

|---|---|

| Open Radio Access Network Market Estimated Value in (2025 E) | USD 3.2 billion |

| Open Radio Access Network Market Forecast Value in (2035 F) | USD 28.6 billion |

| Forecast CAGR (2025 to 2035) | 24.3% |

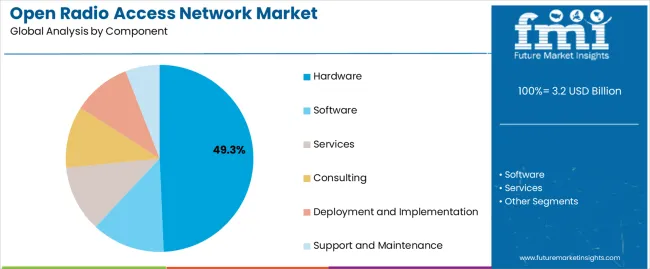

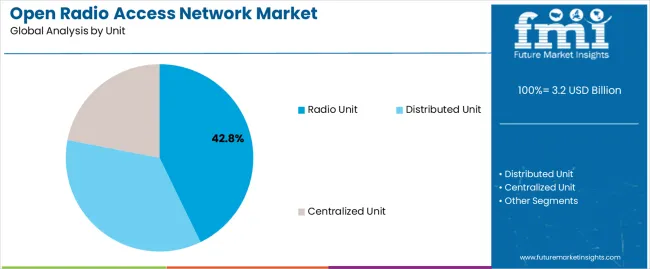

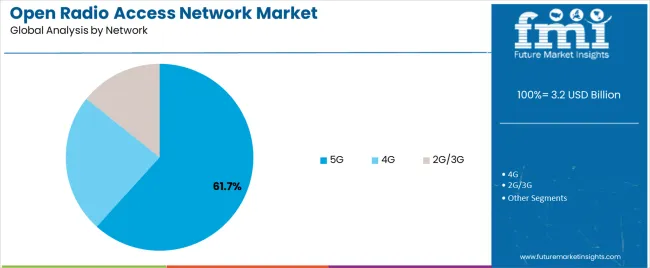

The market is segmented by Component, Unit, Network, and Frequency and region. By Component, the market is divided into Hardware, Software, Services, Consulting, Deployment and Implementation, and Support and Maintenance. In terms of Unit, the market is classified into Radio Unit, Distributed Unit, and Centralized Unit. Based on Network, the market is segmented into 5G, 4G, and 2G/3G. By Frequency, the market is divided into Sub-6 GHz and mmWave. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, accounting for 49.30% of the component category, has been leading due to its indispensable role in network deployment and performance reliability. Adoption has been driven by the increasing demand for high-capacity baseband units, antennas, and radio units that ensure low latency and efficient data transmission.

Advancements in semiconductor technology and modular hardware design have enhanced performance while enabling seamless integration with software-defined components. The segment’s dominance is reinforced by investments from telecom operators focused on large-scale 5G rollout and modernization of existing infrastructure.

Strategic partnerships between equipment manufacturers and network operators are ensuring product standardization and interoperability across multi-vendor environments Continuous innovation in power efficiency, compact design, and cost optimization is expected to sustain the hardware segment’s leading position within the O-RAN ecosystem over the forecast period.

The radio unit segment, holding 42.80% of the unit category, has maintained leadership as it forms the critical interface between digital baseband processing and the wireless interface. Its high share is supported by the rapid adoption of massive MIMO and beamforming technologies that enhance coverage and capacity in dense urban environments.

Market growth is being reinforced by the scalability of O-RAN architectures, which allow flexible deployment of radio units across multiple frequency bands. Manufacturing advancements and open interface standards have reduced integration complexity while promoting cost efficiency for telecom operators.

Continuous innovation in spectrum efficiency and energy-saving radio designs has strengthened the segment’s competitiveness With increasing 5G densification and private network deployment, the radio unit segment is projected to remain pivotal in supporting network performance and ensuring operational flexibility across diversified deployment models.

The 5G segment, representing 61.70% of the network category, has emerged as the dominant network type due to accelerated global rollout and growing enterprise adoption of next-generation connectivity. Its leadership is being driven by the requirement for ultra-low latency, high bandwidth, and network slicing capabilities that align with O-RAN’s modular and open design.

Integration of cloud-native cores and edge computing is enabling enhanced automation and dynamic spectrum allocation. Telecom operators are leveraging O-RAN frameworks to reduce capital expenditure and expedite time-to-market for 5G services.

Collaborative initiatives among operators, vendors, and open-source communities are fostering rapid technological evolution and global standardization As 5G adoption expands across manufacturing, transportation, and smart city applications, the segment is expected to sustain its market share, reinforcing its position as the central growth driver within the open radio access network landscape.

| Attributes | Details |

|---|---|

| Top Component | Hardware |

| CAGR from 2025 to 2035 | 70.5% |

| Attributes | Details |

|---|---|

| Top Unit | Radio Unit |

| CAGR from 2025 to 2035 | 70.3% |

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 70.9% |

| United Kingdom | 71.8% |

| China | 71.7% |

| Japan | 72.5% |

| South Korea | 73.4% |

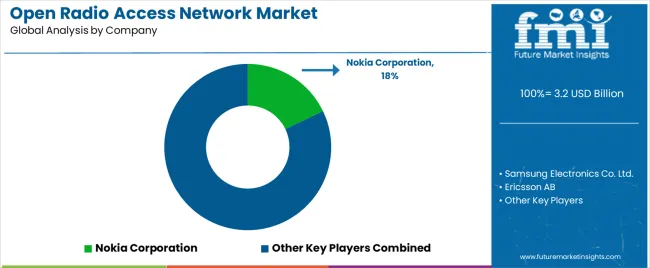

The market is expected to grow significantly in the coming years as more operators adopt O-RAN technology in their networks. The market is highly competitive, with several large vendors and a growing number of smaller players offering O-RAN solutions.

The market is expected to become even more competitive as more vendors are entering and existing vendors are expanding their offerings. Large vendors are expected to dominate the market due to their established relationships with operators and their ability to offer end-to-end solutions.

However, smaller vendors are also expected to gain market share as operators seek more innovative and cost-effective solutions. The key players in the market are offering a range of solutions, including virtualized radio access network (vRAN) solutions, hardware and software solutions, and cloud-based solutions.

Recent Development in the Open Radio Access Network Market:

In 2025, To enhance their 5G network capabilities, Nokia and AT&T have teamed up to create an RIC software platform. They have successfully conducted trials using external applications, known as 'xApps', at the edge of AT&T's live 5G mmWave network on an Open Cloud Platform.

The global open radio access network market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the open radio access network market is projected to reach USD 28.6 billion by 2035.

The open radio access network market is expected to grow at a 24.3% CAGR between 2025 and 2035.

The key product types in open radio access network market are hardware, software, services, consulting, deployment and implementation and support and maintenance.

In terms of unit, radio unit segment to command 42.8% share in the open radio access network market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud-RAN (Radio Access Network) Market Size and Share Forecast Outlook 2025 to 2035

Virtualized Radio Access Network Market Size and Share Forecast Outlook 2025 to 2035

Network Access Control (NAC) Market Size and Share Forecast Outlook 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Radiotherapy Patient Positioning Accessories Market Trends – Forecast 2025 to 2035

Radiopharmaceutical Dispensing System Market Size and Share Forecast Outlook 2025 to 2035

Open Cross Flow Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Radiopharmaceutical Market Forecast and Outlook 2025 to 2035

Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Radio-Fluoroscopy Systems Market Size and Share Forecast Outlook 2025 to 2035

Radiosynthesis Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radio Frequency Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Access Control as a Service Market Size and Share Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Radioactive Iodine Ablation Therapy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA