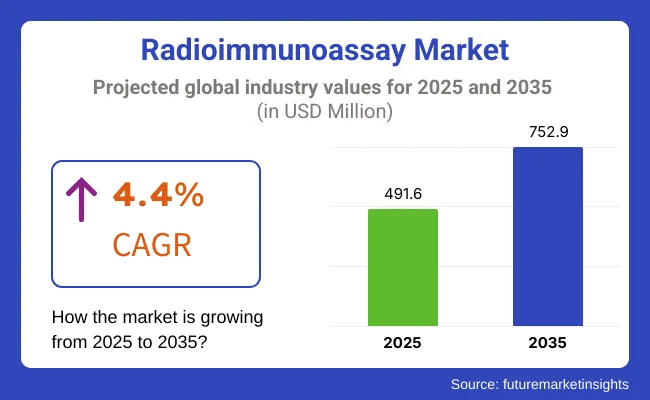

The global radioimmunoassay market is estimated to be valued at USD 491.6 million in 2025 and is projected to reach USD 752.9 million by 2035, registering a CAGR of 4.4% over the forecast period.

The radioimmunoassay market has maintained steady growth, driven by the increasing demand for highly sensitive assays to quantify hormones, drugs, and viral antigens in clinical and research settings. RIA has remained an important diagnostic tool due to its proven accuracy and ability to detect low concentrations of analytes that are not easily measured by other methods. Advances in radiolabeled reagents, automated gamma counters, and assay protocols have improved throughput and reproducibility, supporting wider adoption in endocrinology and infectious disease testing.

Hospitals and diagnostic laboratories have continued to invest in RIA infrastructure to complement immunoassay portfolios and meet specialized testing needs. Regulatory standards and accreditation frameworks have reinforced the importance of quality control and standardized procedures, sustaining procurement of validated kits and reagents.

Product Analysis: Kits & Reagents

Kits & Reagents holds a revenue share of 72.1% has been attributed to kits and reagents, reflecting their indispensable role in performing reliable radioimmunoassays. The segment is driven by the consistent need for validated reagents, radiolabeled antigens, and calibration standards to ensure reproducibility and compliance with regulatory requirements.

Hospitals and reference laboratories have prioritized procurement of commercial kits to reduce variability and streamline workflows. Advances in reagent stability and packaging have supported improved shelf life and ease of handling, further driving adoption. Manufacturers have focused on developing disease-specific panels to address a wide range of testing needs, strengthening customer loyalty and recurring purchasing patterns.

Endocrinology and Infectious Disease holds cumulative revenue share of 52.3% has been attributed to endocrinology and infectious disease applications, underscoring their importance in routine diagnostic testing. The segment driven by the need for precise measurement of hormones such as insulin, cortisol, and thyroid markers, which are critical for diagnosis and treatment monitoring. Infectious disease applications have expanded as RIA remains a preferred method for detecting viral antigens and antibodies in certain epidemiological and surveillance contexts.

Clinical guidelines and accreditation standards have reinforced RIA as a reliable method where high sensitivity is required. Hospitals and diagnostic centers have integrated RIA protocols to complement enzyme-linked immunoassays, supporting broader assay coverage.

Hospitals have accounted for 39.4% of market revenue, driven by their role as primary providers of comprehensive diagnostic services. Utilization has been reinforced by centralized laboratory infrastructure, which supports high-volume testing and adherence to stringent quality standards. Hospitals have prioritized RIA adoption to address specialized endocrinology and infectious disease diagnostics not fully covered by alternative immunoassay platforms.

Training programs and quality control protocols have strengthened staff competency and ensured regulatory compliance. Reimbursement policies in many regions have recognized RIA as an essential diagnostic tool, supporting consistent test volumes. Investments in laboratory automation and integrated information systems have further streamlined workflows and reporting.

Alternative Diagnostics Methods Hinders the Market Growth

The market faces competition from alternative diagnostic technologies such as stable free radicals, fluorochromes, chemiluminescence precursors, enzyme inhibitors, and methods. These are easy to handle, can give qualitative and quantitative information and easy to discard post experiment. This competition can limit market penetration and slow down the growth of radioimmunoassay, particularly in regions where other technologies are more established.

It is largely restricted to immunoassays, the need for expensive reagents and equipment and the requirements for licensing and containment. Another important problem is disposal of radioactive waste management, special training and license required and expensive instrumentation.

Development of Precise and Easy to Use Diagnostics Tools has Lucrative Opportunity in the Market

Growing needs for sensitive and specific diagnostic assays are driving sizeable opportunities for the radioimmunoassay (RIA) market. Technologies of automated RIA platforms, microfluidics, and AI-interpretable data are enhancing the accuracy and speed of the test. An increased emphasis on precision medicine and biomarker-directed diagnostics is extending applications of RIA in targeted health care.

Research organizations, pharma, and diagnostic organizations are coming together to create the next generation of RIA kits that are more secure and better performing. Telehealth and home diagnostic services growth is fueling the demand for laboratory tests based on RIA, particularly hormone analysis and cancer diagnostics. The use of low-radiation RIA technologies and eco-friendly diagnostics is emerging, creating new market opportunities for expansion.

Advancements in Automation and AI-Powered RIA Systems: RIA laboratories are enhancing precision, minimizing the workload of human intervention, and optimizing efficiency through the use of robotics and data analysis based on AI. Automated platforms are streamlining reagent use and high-throughput sample processing, reducing laboratory operations to a minimum.

Expansion of Biomarker-Based RIA Tests: The need for early disease detection and customized treatment planning is fueling research in RIA-based biomarker assays in oncology, neurology, and infectious disease therapy. Scientists are investigating new biomarkers to identify cancer at an early stage, with an objective to enhance the survival rate of patients.

Increase of AI and Machine Learning in RIA Data Interpretation: Artificial intelligence-based image processing and pattern recognition technologies are improving the precision of RIA test results, allowing for quicker and more accurate diagnostics of hormone disorders, cancer, and infectious diseases. Clinicians are employing AI-based predictive modeling to better evaluate patient risk profiles.

Low-Radiation and Eco-Friendly RIA Solution Development: Innovators are developing radiation-free or low-radioactive immunoassays that meet regulatory needs without sacrificing the high sensitivity and specificity of classic RIA methodologies. Biopharma firms are investing in hybrid diagnostic platforms blending RIA with non-radioactive detection technologies for improved safety and efficiency.

Market Outlook

Chronic diseases like obesity, diabetes, and cardiovascular diseases have dropped the United States into a severe issue. All these are conditions that need radioimmunoassay for diagnosis and treatment. Those are some of the essential characteristics that may make it appealing and thus the demand for radioimmunoassays in the United States healthcare system.

The USA is a competitive market for medical devices, wherein there are a number of manufacturers and suppliers which make radioimmunoassay kits and accessories. The demand for radioimmunoassay on the USA market looks for assurance in invasive diagnosis equipment.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 1.6% |

Market Outlook

Germany possesses a strong, well-educated medical system, doctors, researchers, and technicians. The staff easily knows adequately about how to handle and translate radioimmunoassay information, thus ensuring that this kind of technology is acceptable by the research and clinical practice environment. Large immunodiagnostic kit producing industries in Germany are one of the factors that contribute extravagantly to its advantage to own the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.9% |

Market Outlook

The country's swiftly expanding middle class has boosted expenditure on healthcare and disposable money. The need for better-quality healthcare goods, like radioimmunoassay, has increased as a result of demographic shifts. The rising middle class's increased disposable income has helped the Chinese economy expand.

The Chinese population is second largest in world making it a huge market for disease diagnostics, RIA being able to identify high level of sensitivity is prominently used for diagnosis many china a large market for radioimmunoassay.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

Market Outlook

India's market for radioimmunoassay is expanding because healthcare providers and researchers are responding to the increasing infectious disease burden and emphasis on molecular diagnostics. Growing diagnostic laboratories, expanded access to healthcare, and the strong pharma industry are promoting demand for inexpensive and scalable extraction systems. Government efforts to spur research and encourage local production contribute further to the size of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

Market Outlook

The radioimmunoassay market of Brazil is observing gradual growth with the nation attempting to tackle growing instances of contagious illnesses such as Zika and dengue. Involvements made by governments for public health facilities and advancement of biotechnology-based research activities are boosting demands for effective diagnostics devices. Advances made in health infrastructures as well as heightening awareness concerning molecular diagnostics are compelling adoption even within clinical as well as research realms.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 1.1% |

The competitive landscape has been shaped by companies investing in assay innovation, reagent portfolio expansion, and partnerships with diagnostic laboratories to maintain market share. Leading manufacturers have focused on developing disease-specific RIA kits, improving radiolabel stability, and automating workflows to reduce manual errors. Strategic collaborations with hospitals and research institutions have been pursued to validate performance and secure long-term supply contracts.

Key Development:

Kits & Reagents, Instruments, Consumables, Services

Oncology, Cardiology, Endocrinology, Infectious Disease, Autoimmune Disease, Therapeutic Drug Monitoring, Drug of Abuse and Others

Serum, Plasma, Urine, Saliva, Cell Culture Sample

Research Use Only and Clinical Use

Hospital, Specialty Clinics, Academic and Research Institute, Diagnostics Laboratories, Reference Laboratories, Cancer Research Institutes and Veterinary Hospitals

North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa

The overall market size for radioimmunoassay market was USD 491.6 million in 2025.

The Radioimmunoassay Market is expected to reach USD 752.9 million in 2035.

Advancements in automated RIA systems are streamlining laboratory workflows and boosting market expansion.

The top key players that drives the development of radioimmunoassay market are PerkinElmer Inc., Berthold Technologies GmbH & Co.KG, Siemens Healthineers, Montreal Biotech, DIAsource Abbexa, IBL International GmbH, Creative Biolabs, MP BIOMEDICALS, ALPCO, Padyab Teb Co., Merck KGaA, NovoLytiX GmbH, Beckman Coulter, Inc., DiaSorin S.p.A., DRG INSTRUMENTS GMBH EUROIMMUN Medizinische Labordiagnostika AG.

Kits & Reagents in product type of radioimmunoassay market is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA