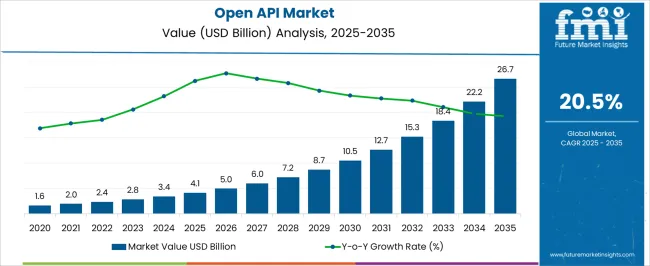

The Open API Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 26.7 billion by 2035, registering a compound annual growth rate (CAGR) of 20.5% over the forecast period.

| Metric | Value |

|---|---|

| Open API Market Estimated Value in (2025 E) | USD 4.1 billion |

| Open API Market Forecast Value in (2035 F) | USD 26.7 billion |

| Forecast CAGR (2025 to 2035) | 20.5% |

The open API market is expanding at a rapid pace, supported by the increasing adoption of digital transformation initiatives across industries and the growing reliance on interconnected software ecosystems. Technology company reports and industry publications have emphasized that open APIs have become foundational in enabling seamless integration between applications, services, and platforms. Enterprises are leveraging APIs to accelerate innovation, enhance customer experiences, and monetize digital assets through API-driven business models.

Cloud computing advancements and the proliferation of mobile and web-based applications have further strengthened the role of APIs as critical enablers of interoperability and scalability. Additionally, government-backed open data initiatives and regulatory requirements in sectors such as banking and healthcare have promoted the adoption of open APIs.

Looking forward, market momentum is expected to be driven by the integration of AI and machine learning capabilities into APIs, the rising importance of API security frameworks, and the growing ecosystem of API marketplaces facilitating cross-industry collaboration.

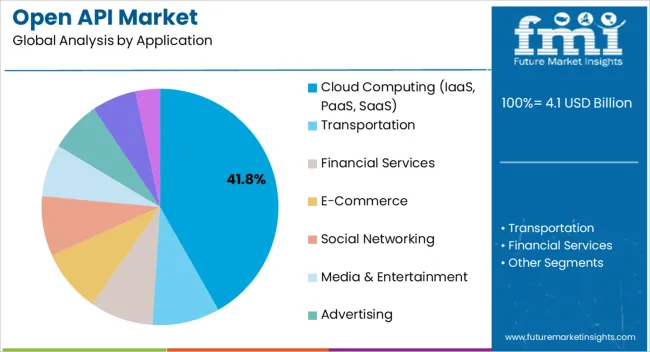

The Cloud Computing (IaaS, PaaS, SaaS) segment is projected to account for 41.80% of the open API market revenue in 2025, establishing itself as the leading application area. Growth in this segment has been underpinned by the central role of APIs in enabling cloud-based service delivery and integration. Open APIs have facilitated interoperability across infrastructure, platform, and software layers, allowing enterprises to deploy and scale applications with greater flexibility.

Cloud providers have prioritized API-first strategies to support modular application development, enabling users to connect services, manage workloads, and extend functionalities seamlessly. Analyst presentations and technology press releases have highlighted that the adoption of multi-cloud and hybrid cloud environments has intensified reliance on APIs for workload portability and data exchange.

Furthermore, APIs have been integral in supporting subscription-based SaaS models, where rapid deployment and customization are essential. With enterprises continuing to accelerate cloud adoption and prioritize digital agility, the Cloud Computing segment is expected to remain at the forefront of open API applications, supported by scalability, innovation, and operational efficiency.

The demand for open API is likely to gain momentum, majorly contributed to features that help in enables third parties to build applications ‘on top’ of the platform, reduction in costs & speeding up time-to-market.

Open API facilitates the adoption of social sharing practices for marketing purposes and syndicates products and services across different platforms, thereby fostering the adoption of open API.

Today APIs are increasingly important as they determine how developers can create new apps that tap into big Web services – social networks such as Facebook or Pinterest, or utilities such as Google Maps or Dropbox.

These APIs provide advantages of time saving and offering user convenience in many cases and the same is expected to sway the open API market future trends. The global open API market size is likely to dwindle as it faces challenges such as management and security issues associated with publishing APIs.

The adoption of open APIs may take a dip as publishing open APIs makes it difficult for organizations to control the experience end users have with their information assets. An API can significantly degrade the functionality of an application if it is overloaded with features, negatively impacting the open API market outlook.

North America is projected to dominate the open API market with a revenue share of 30% in 2025 due to the spiking demand for open API in the healthcare industry, growth is anticipated. Patient-centric healthcare is a growing value-based strategy for healthcare services that has led to better outcomes, higher levels of patient satisfaction, and higher levels of care quality.

Application programming interfaces (APIs) are playing a pivotal role in the delivery of patient-centered healthcare over the past few years.

And the emergence of a wide range of services, including wearable medical devices and remote patient monitoring, is expected to hugely contribute to North America’s open API market share.

The European payment industry's ongoing transition to open APIs has been a gradual process, shaping its open API market share of 21% in 2025. The Spanish banking behemoth BBVA and the French lender Credit Agricole were the forerunners in this direction.

Both banks provided open API access to third parties, enabling them to use core bank functionality to create financial applications, experiment with new business models, or simply enhance user experience.

The open API market size is expanding in the region where the bank's collaboration with the FinTech firm Dwolla to provide real-time payments to BBVA customers is an early example of the advantages of open APIs for BBVA's customers.

Although these initiatives limited the potential for increased innovation, as per the open API market survey, there is a clear trend among European payment players to strengthen their position in the value chain through Open APIs.

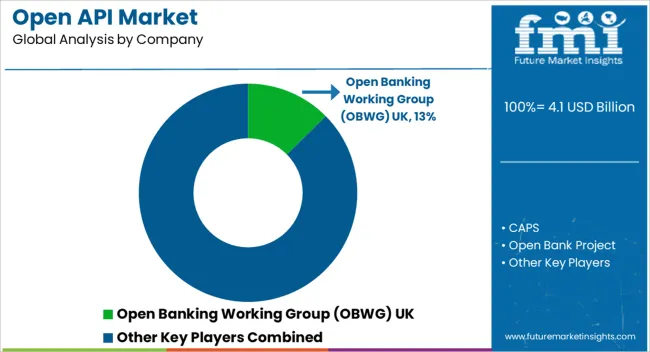

In recent years the market has witnessed a number of industry initiatives with an aim to create standards for APIs growth. There is some evidence that APIs are likely to become a permanent fixture across several industry verticals.

Some of the key API standardization initiatives are – Open Banking Working Group (OBWG) UK, CAPS, Open Bank Project, Open API initiative, IXARIS Open Payment Ecosystem, Open Financial Exchange (OFX), Financial Transaction Services (FinTS), Banking Industry Architecture Network (BIAN) and W3C Web Payments Interest Group.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 20.5% from 2025 to 2035 |

| Open API Market Value (2025) | USD 4.1 billion |

| Open API Market Anticipated Forecast Value (2035) | USD 26.7 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Open Banking Working Group (OBWG) UK; CAPS; Open Bank Project; Open API initiative; IXARIS Open Payment Ecosystem; Open Financial Exchange (OFX); Financial Transaction Services (FinTS); Banking Industry Architecture Network ; (BIAN); W3C Web Payments Interest Group.; Wipro Limited |

| Customization & Pricing | Available Upon Request |

The global open API market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the open API market is projected to reach USD 26.7 billion by 2035.

The open API market is expected to grow at a 20.5% CAGR between 2025 and 2035.

The key product types in open API market are cloud computing (iaas, paas, saas), transportation, financial services, e-commerce, social networking, media & entertainment, advertising, government and others.

In terms of , segment to command 0.0% share in the open API market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Open Radio Access Network Market and Forecast Outlook 2025 to 2035

Open Cycle Aeroderivative Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Open Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Open Mouth Sacks Market Size and Share Forecast Outlook 2025 to 2035

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Open Air Merchandizers and Accessories Market - Industry Innovations & Demand 2025 to 2035

Open Top Cartons Market

Open Gear Lubricants Market

Opening Trim Weatherstrips Market

Neopentyl Polyhydric Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Global Neopentyl Glycol (NPG) Market Analysis – Size, Share & Forecast 2025–2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Lycopene Market

Cyclopentanone Market Size and Share Forecast Outlook 2025 to 2035

Can Opener Market Analysis – Growth & Industry Outlook 2025 to 2035

Easy Open Packaging Market Size and Share Forecast Outlook 2025 to 2035

Twist Open - Twist Close Caps Market Size and Share Forecast Outlook 2025 to 2035

Dicyclopentadiene DCPD Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA