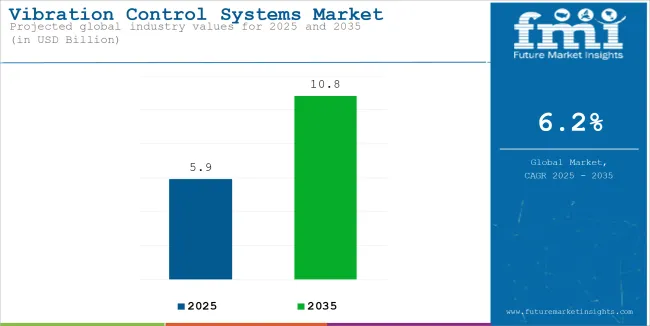

The global sales of vibration control systems are estimated to be worth USD 5.9 billion in 2025 and are anticipated to reach a value of USD 10.8 billion by 2035. Sales are projected to rise at a CAGR of 6.2% over the forecast period between 2025 and 2035. The revenue generated by vibration control systems in 2024 was USD 5.6 billion. The industry is anticipated to exhibit a Y-o-Y growth of 5.8% in 2025.

Vibration control systems are an integral part of any machinery or equipment that is sensitive to vibrations. These systems are widely used in a variety of applications including aerospace, medical, and chemical industries that require high levels of accuracy and stability. The inclusion of high-tech materials in the components increases the ability and longevity of the systems in harsh environments.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 5.9 billion |

| Market Value, 2035 | USD 10.8 billion |

| Value CAGR (2025 to 2035) | 6.2% |

This market is expected to offer an incremental opportunity of USD 4.9 billion and is expected to grow 1.8X by 2035, driven by increasing uptake in the healthcare industry for preventing disruptions in DNA sequencing microarrays and magnetic resonance imaging scanners.

Furthermore, new technologies, including web-based continuous machine condition monitoring and active Noise and Vibration Control (ANVC) systems for aircraft, would provide vast opportunities for growth. These new technologies improve the performance of the vibration control system, as well as broaden its application to those industries that require high accuracy but with reduced noise during operations.

Demand for vibration control systems will increase manifold with increasing requirements of precision and stable operation in various sectors. The industry is gaining towards more advanced active solutions for vibration control, primarily for high-performance applications.

Sales of these systems will go higher because of high-tech industries where even the slightest vibrations can result in major operation inefficiencies or failure. The demand surge is also being driven by the growing focus on minimizing downtime and enhancing the lifespan of machinery through improved vibration control solutions.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the vibration control systems market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 5.7%, followed by a slightly higher growth rate of 6.1% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 5.7% (2024 to 2034) |

| H2 | 6.1% (2024 to 2034) |

| H1 | 5.9% (2025 to 2035) |

| H2 | 6.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 5.9% in the first half and remain relatively moderate at 5.5% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), the market witnessed an increase of 40 BPS.

Growing demand for vibration control systems in aerospace, automotive, and electronics sectors presents significant opportunities

Motion control systems, which are used in fixed-wing aircraft, aid in minimizing the tremble and quiver in the helicopter fuselage generated by the main rotor. In addition, the swelling needs for passenger comfort and convenience in aircraft is also anticipated to spur segment growth over the years. These systems are largely used in the aerospace and defense industry to prevent the cracking of windshields, or damage to doors, or cargo. Hence, several prominent players are consistently investing in reexploring the designs of VCS.

The aerospace and defense industry also makes heavy use of vibration control systems to lessen vibrations that could crack the windshield, window glass, doors, or cargo. The global market is broken down into sub-segments, such as motion control and vibration control, which are based on the many types of systems available. Over the past several years, there has been a rise in demand for vibration control systems in the automotive sector, power plants, and the oil and gas industry. There has been a rise in the demand for vibration control systems in the energy sector as a result of their ability to mitigate vibration and shock.

In addition, there has been a significant shift toward the use of vibration controller techniques in the electronics and electrical sectors, which includes the manufacturing of industrial goods. Isolating electronic instruments and measuring equipment from vibrations is a common adoption of vibration control systems in the manufacturing sector. The presence of large manufacturers in the Chinese regional market also contributes to the region's rapid development. Increased demand for vibration control systems is anticipated to be spurred by the region's low cost of capital and abundant supply of low-priced labor and materials.

Rising demand across oil & gas, utilities, and transportation sectors fuels growth in vibration control systems, driving product innovation

Industry expansion in sectors such as oil and gas, utilities, transportation, and others has raised the need for vibration control systems. The growing demand for vibration control systems has driven manufacturers to come up with new product types, including absorbers, dampers, and isolating pads. Sales of vibration controllers have been boosted by macroeconomic factors such as rising per capita utility spending, increased government spending on important end-use industries, and others.

Several factors, including rising awareness of the importance of protecting mechanical structures, increasing interest in and implementation of active vibration control systems across a wide range of industries, expanding global markets for automobiles and airplanes, and a pressing desire to enhance travelers' experiences, are driving the vibration control systems market forward.

Optimistic expansion in major end-use industries is helping manufacturers improve income, and rising demand for vibration control systems such isolators, hangers, and mounts are allowing manufacturers to diversify their product lines.

Advancements in anti-vibration control systems fuel growth in medical, and industrial sectors, overcoming component reliability

Anti-vibration control systems have recently entered usage in the aviation industry in response to the decreased reliability of a wide variety of components. This hinders the expansion of the vibration control systems market. Several developments, such as web-based continuous machine status monitoring and active Vibration Control (AVC) systems in airplanes, are opening new opportunities for the vibration control systems sector.

Vehicle powertrain and other electrical systems were the original inspirations for VCS. These systems are being used in a variety of fields, including aerospace and defense, oil and gas, and mining and quarrying.

Vibration controllers are also gaining popularity in the medical field. Pharmaceutical companies have started using these systems to lessen the vibrational impact on sensitive medical and scientific instruments like magnetic resonance imaging scanners and DNA sequencing microarrays

The global vibration control systems system market recorded a CAGR of 3.9% during the historical period between 2020 and 2024. The growth of vibration control systems market was positive as it reached a value of USD 3 billion in 2024 from USD 2.5 billion in 2020.

Between 2020 and 2024, the vibration control systems market faced unique challenges, including evolving industrial demands and the imperative to enhance operational resilience. The imperative drivers for both semiconductor and renewable energy sectors turned out to necessitate precision, in chip-making, and in wind turbine-related stability.

To meet such needs, firms began investing in more adaptive solutions in vibration control with an emphasis on customization and reliability to meet the needs of such critical sectors. Industry-specific needs were the factors that helped the market to cope with the vagaries of the period.

Technological innovations in the 2025-2035 period will be likely to push the vibration control systems market forward significantly, further fueled by sustainability. Nanomaterials and advanced composites are ready to be developed to improve vibration control efficiency.

This will enable superior damping while reducing weight for better performance in aerospace and medical applications. Integration of smart technologies in manufacturing processes would allow for real-time monitoring and predictive maintenance, thus ensuring that the operations do not stop. Such developments would take into account worldwide trends toward efficiency in energy and reduced environmental effects and would push the market forward, thus opening new opportunities for growth.

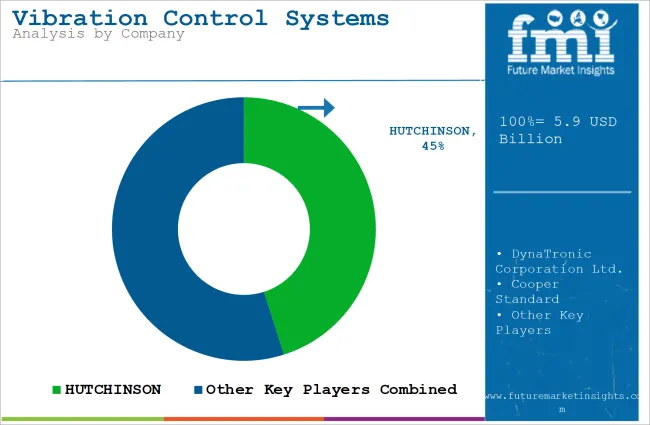

Tier 1 companies comprise market leaders with a market revenue of above USD 120 million capturing a significant market share of 25-30% in the vibration control systems market. These market leaders are characterized by extensive expertise in manufacturing across a range of packaging formats and have a wide geographic reach, with a strong foundation of consumers.

They offer an extensive range of series, which includes recycling and manufacturing with the latest technology to meet regulatory requirements and deliver quality. Prominent companies within Tier 1 include Brüel & Kjær Sound & Vibration Measurement, LORD Corporation, and MTS Systems.

Tier 2 and other includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 120 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 2 share segment. They are small-scale players and have limited geographical reach.Tier 2, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis for the vibration control systems market for different countries. Market demand analysis on key countries is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 74.1% through 2035. In East Asia, China is projected to witness a CAGR of 5.7% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| The USA | 5.5% |

| UK | 6.6% |

| China | 5.7% |

| Japan | 6.1% |

| India | 6.3% |

The USA vibration control systems market is poised for robust growth, fueled by advancements in industries such as aerospace, automotive, and manufacturing. The market benefits from ongoing innovation in active vibration control systems, which are pivotal in reducing noise and enhancing performance. The integration of advanced piezoelectric materials and the use of smart sensors are transforming vibration management in sensitive applications, such as aviation and high-performance machinery. Companies such as Moog Inc. are leading the way with their cutting-edge solutions designed to improve the structural integrity and reliability of aerospace systems.

In addition, the increasing demand for precision manufacturing, particularly in sectors like semiconductor production and medical equipment, is driving the adoption of vibration control technologies. As industries place greater emphasis on minimizing operational disruptions and improving product quality, USA manufacturers are increasingly integrating these systems into their production lines. With technological advancements and growing industry reliance on high-performance systems, the market is expected to see continued growth, solidifying its role as a critical component in maintaining efficiency and safety across key sectors.

The automotive and transportation industry, where vibration control is one of the vital elements for quality and safety in vehicles, happens to be one of the fastest-growing industries in this regard. Moreover, the other growing cause of demand is China being the world leader in renewable energy, specifically wind power, which escalated the demand for vibration control in turbines and allied configurations.

In 2023, China is projected to import around 564 million metric tons of crude oil, which shows a slight increase from approximately 508 million tons last year. The increase puts emphasis on the growing energy demands of its industrial sectors, which are expected to lead in the adoption of vibration control technologies. Other than that, government initiatives toward modernizing its infrastructure and supporting innovations in technology help to support demand in VCS.

India's transport sector is seeing huge expansion, with significant developments in both high-speed rail and automotive manufacturing. The Mumbai-Ahmedabad High-Speed Rail project is India's first bullet train project, covering a distance of about 508 kilometers. As of March 2024, the project has achieved 41.7% physical progress, with 173 km of viaduct and 308 km of pier work completed in Gujarat.

In the automotive sector, India is seeing a big build-up in the capacity of vehicle production. Light vehicle production capacity will increase from 6.8 million units in 2023 to 10 million units by 2031. This is driven by both domestic and international automakers building new plants in India.

Developments like these again underscore the rapidly mounting need for highly specialized and intelligent vibration control systems to ensure high-speed trains' and vehicles' stability, safety, and performance. Innovative vibration damping solutions must therefore be designed and integrated in order to adapt to the changing requirements of India's growing transportation infrastructure.

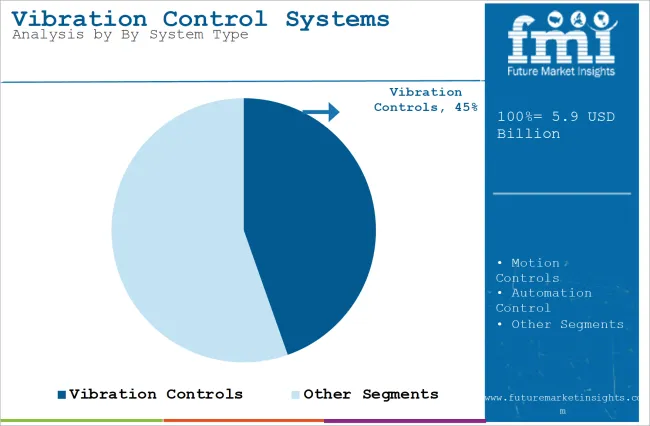

The section contains information about the leading segments in the industry. By System Type, vibration controls segment is estimated to grow at a CAGR of 5.9% throughout 2035. Additionally, automotive Industry is projected to expand at 5.3% by 2035.

| System Type | Value Share (2035) |

|---|---|

| Vibration Controls | 44.6% |

The Vibration Controls segment has the largest share in the vibration control systems market because of its crucial role in stability and performance in high-precision industries. These systems are used on a large scale in aerospace, automotive, and manufacturing for the prevention of mechanical failure to enhance operational efficiency. Technologies such as isolating pads, metal and rubber isolators, couplings (spool, shear), and anti-vibration cylinders prevent excessive vibrations that could lead to the destruction of sensitive machinery. Such wide applicability combined with regulatory requirements drives their demand.

While Motion Controls, for example, Springs, Mounts, Washers, and Automation Controls, such as Absorbers, Dampers, also have roles in the management of vibrations, they are generally more specialized. In fact, motion controls are normally used in less demanding applications, such as structural mounts, while automation controls usually target the damping of vibrations in industrial machinery. However, vibration controls are most directly associated with critical areas of operation where reliability is a key concern, such as wind power generation. More recently, the renewable energy sector has started to adapt vibration control systems mainly in offshore and onshore wind turbines to keep the turbines stable, reduce wear on mechanical components, and optimize performance. This alone suggests the increased demand for vibration control systems across new industries.

| End User | Value Share (2035) |

|---|---|

| Automotive | 14.6% |

Automotive Industry is the biggest user of vibration control systems, dominated by the automotive and aerospace industries. In the automobile industry, various types of mounts, suspension systems, and isolators are vital to dampening engine-induced vibrations and lessening road irregularities. These significantly enhance ride comfort, stability, and reduce noise, vibration, and harshness—NVH. With the rise of electric vehicles, the use of active suspension is growing, enabling real-time adjustments and improvement in ride quality. SAE says that in the premium and high-performance vehicle segments, meeting the stringent NVH standards worldwide requires advanced vibration control.

In automotive, vibration control systems guarantee the integrity of the structure by mitigating vibrations caused by engines, turbines, and other mechanical sources. Active vibration control (AVC) systems have been found to reduce vibration levels by as much as 50%, thereby enhancing passenger comfort and the durability. Other industries, such as Mining, Oil & Gas, and Utilities, do use vibration control systems more for the protection of their machinery, not having the same level of omnipresent need as the automotive industry.

The vibration control systems market is witnessing significant developments driven by advancements in automotive technologies and an evolving regulatory landscape. The market is benefiting from emerging trends such as the growing demand for enhanced vehicle safety, eco-friendly materials, and increased performance standards. As vehicle manufacturers focus on improving braking efficiency and reducing wear, innovations in automotive brake pad materials, including ceramic and metallic formulations, are shaping the sector.

Key players in the market are leveraging cutting-edge technologies to enhance brake pad systems durability and performance. These technologies aim to reduce noise, vibration, and harshness (NVH) while improving overall braking efficiency. In response to the growing demand for electric and hybrid vehicles, brake pad systems are being designed to support regenerative braking systems, which are expected to drive future demand for innovative solutions.

Geographic expansion will remain a critical strategy for leading companies, especially in emerging markets, where automotive production and sales are increasing. Additionally, start-ups and smaller players are likely to enter the market, fostering competition and accelerating innovation. This dynamic environment will propel the market forward, with companies continuously introducing novel products to meet the evolving needs of the automotive industry.

Recent Industry Developments:

In terms of system type, the industry is divided into vibration controls, motion controls and automation control. vibration controls is further segmented into isolating pads, isolators (metal, rubber), couplings (spool, shear, bolt, bush) and Anti-Vib cylinders (male, female).

Similarly motion controls is further segmented into springs (air, coil), hangers, washers & brushes and mounts (hydraulic, pneumatic). Again automation control is segmented into absorber (miniature, industrial, heavy industrial) and dampers (hydraulic, pneumatic, damping pads)

In terms of end user, the industry is divided into mining & quarrying, oil & gas, utilities, automotive, aerospace, food and Beverage, chemical manufacturing, electrical equipment, machinery manufacturing and others.

In terms of sales type, the industry is divided into O.E.M and aftermarket.

Key regions of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific and Middle East & Africa have been covered in the report.

The global vibration control systems industry is projected to witness a CAGR of 6.2% between 2025 and 2035.

The global vibration control systems industry stood at US$ 5.9 billion in 2025.

The global vibration control systems industry is anticipated to reach US$ 10.8 billion by 2035 end.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ Million) Forecast by System, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by End Users, 2017 to 2032

Table 4: Global Market Value (US$ Million) Forecast by Sales Type, 2017 to 2032

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 6: North America Market Value (US$ Million) Forecast by System, 2017 to 2032

Table 7: North America Market Value (US$ Million) Forecast by End Users, 2017 to 2032

Table 8: North America Market Value (US$ Million) Forecast by Sales Type, 2017 to 2032

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: Latin America Market Value (US$ Million) Forecast by System, 2017 to 2032

Table 11: Latin America Market Value (US$ Million) Forecast by End Users, 2017 to 2032

Table 12: Latin America Market Value (US$ Million) Forecast by Sales Type, 2017 to 2032

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: Europe Market Value (US$ Million) Forecast by System, 2017 to 2032

Table 15: Europe Market Value (US$ Million) Forecast by End Users, 2017 to 2032

Table 16: Europe Market Value (US$ Million) Forecast by Sales Type, 2017 to 2032

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Asia Pacific Market Value (US$ Million) Forecast by System, 2017 to 2032

Table 19: Asia Pacific Market Value (US$ Million) Forecast by End Users, 2017 to 2032

Table 20: Asia Pacific Market Value (US$ Million) Forecast by Sales Type, 2017 to 2032

Table 21: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 22: MEA Market Value (US$ Million) Forecast by System, 2017 to 2032

Table 23: MEA Market Value (US$ Million) Forecast by End Users, 2017 to 2032

Table 24: MEA Market Value (US$ Million) Forecast by Sales Type, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by System, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by End Users, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Sales Type, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ Million) Analysis by System, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by System, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by System, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by End Users, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by End Users, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by End Users, 2022 to 2032

Figure 14: Global Market Value (US$ Million) Analysis by Sales Type, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Type, 2022 to 2032

Figure 17: Global Market Attractiveness by System, 2022 to 2032

Figure 18: Global Market Attractiveness by End Users, 2022 to 2032

Figure 19: Global Market Attractiveness by Sales Type, 2022 to 2032

Figure 20: Global Market Attractiveness by Region, 2022 to 2032

Figure 21: North America Market Value (US$ Million) by System, 2022 to 2032

Figure 22: North America Market Value (US$ Million) by End Users, 2022 to 2032

Figure 23: North America Market Value (US$ Million) by Sales Type, 2022 to 2032

Figure 24: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 28: North America Market Value (US$ Million) Analysis by System, 2017 to 2032

Figure 29: North America Market Value Share (%) and BPS Analysis by System, 2022 to 2032

Figure 30: North America Market Y-o-Y Growth (%) Projections by System, 2022 to 2032

Figure 31: North America Market Value (US$ Million) Analysis by End Users, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by End Users, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Users, 2022 to 2032

Figure 34: North America Market Value (US$ Million) Analysis by Sales Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Sales Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Sales Type, 2022 to 2032

Figure 37: North America Market Attractiveness by System, 2022 to 2032

Figure 38: North America Market Attractiveness by End Users, 2022 to 2032

Figure 39: North America Market Attractiveness by Sales Type, 2022 to 2032

Figure 40: North America Market Attractiveness by Country, 2022 to 2032

Figure 41: Latin America Market Value (US$ Million) by System, 2022 to 2032

Figure 42: Latin America Market Value (US$ Million) by End Users, 2022 to 2032

Figure 43: Latin America Market Value (US$ Million) by Sales Type, 2022 to 2032

Figure 44: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 48: Latin America Market Value (US$ Million) Analysis by System, 2017 to 2032

Figure 49: Latin America Market Value Share (%) and BPS Analysis by System, 2022 to 2032

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by System, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) Analysis by End Users, 2017 to 2032

Figure 52: Latin America Market Value Share (%) and BPS Analysis by End Users, 2022 to 2032

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2022 to 2032

Figure 54: Latin America Market Value (US$ Million) Analysis by Sales Type, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Sales Type, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Sales Type, 2022 to 2032

Figure 57: Latin America Market Attractiveness by System, 2022 to 2032

Figure 58: Latin America Market Attractiveness by End Users, 2022 to 2032

Figure 59: Latin America Market Attractiveness by Sales Type, 2022 to 2032

Figure 60: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 61: Europe Market Value (US$ Million) by System, 2022 to 2032

Figure 62: Europe Market Value (US$ Million) by End Users, 2022 to 2032

Figure 63: Europe Market Value (US$ Million) by Sales Type, 2022 to 2032

Figure 64: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 68: Europe Market Value (US$ Million) Analysis by System, 2017 to 2032

Figure 69: Europe Market Value Share (%) and BPS Analysis by System, 2022 to 2032

Figure 70: Europe Market Y-o-Y Growth (%) Projections by System, 2022 to 2032

Figure 71: Europe Market Value (US$ Million) Analysis by End Users, 2017 to 2032

Figure 72: Europe Market Value Share (%) and BPS Analysis by End Users, 2022 to 2032

Figure 73: Europe Market Y-o-Y Growth (%) Projections by End Users, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) Analysis by Sales Type, 2017 to 2032

Figure 75: Europe Market Value Share (%) and BPS Analysis by Sales Type, 2022 to 2032

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Sales Type, 2022 to 2032

Figure 77: Europe Market Attractiveness by System, 2022 to 2032

Figure 78: Europe Market Attractiveness by End Users, 2022 to 2032

Figure 79: Europe Market Attractiveness by Sales Type, 2022 to 2032

Figure 80: Europe Market Attractiveness by Country, 2022 to 2032

Figure 81: Asia Pacific Market Value (US$ Million) by System, 2022 to 2032

Figure 82: Asia Pacific Market Value (US$ Million) by End Users, 2022 to 2032

Figure 83: Asia Pacific Market Value (US$ Million) by Sales Type, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by System, 2017 to 2032

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by System, 2022 to 2032

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by System, 2022 to 2032

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by End Users, 2017 to 2032

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by End Users, 2022 to 2032

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by End Users, 2022 to 2032

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by Sales Type, 2017 to 2032

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Type, 2022 to 2032

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Type, 2022 to 2032

Figure 97: Asia Pacific Market Attractiveness by System, 2022 to 2032

Figure 98: Asia Pacific Market Attractiveness by End Users, 2022 to 2032

Figure 99: Asia Pacific Market Attractiveness by Sales Type, 2022 to 2032

Figure 100: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 101: MEA Market Value (US$ Million) by System, 2022 to 2032

Figure 102: MEA Market Value (US$ Million) by End Users, 2022 to 2032

Figure 103: MEA Market Value (US$ Million) by Sales Type, 2022 to 2032

Figure 104: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 105: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 106: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 107: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 108: MEA Market Value (US$ Million) Analysis by System, 2017 to 2032

Figure 109: MEA Market Value Share (%) and BPS Analysis by System, 2022 to 2032

Figure 110: MEA Market Y-o-Y Growth (%) Projections by System, 2022 to 2032

Figure 111: MEA Market Value (US$ Million) Analysis by End Users, 2017 to 2032

Figure 112: MEA Market Value Share (%) and BPS Analysis by End Users, 2022 to 2032

Figure 113: MEA Market Y-o-Y Growth (%) Projections by End Users, 2022 to 2032

Figure 114: MEA Market Value (US$ Million) Analysis by Sales Type, 2017 to 2032

Figure 115: MEA Market Value Share (%) and BPS Analysis by Sales Type, 2022 to 2032

Figure 116: MEA Market Y-o-Y Growth (%) Projections by Sales Type, 2022 to 2032

Figure 117: MEA Market Attractiveness by System, 2022 to 2032

Figure 118: MEA Market Attractiveness by End Users, 2022 to 2032

Figure 119: MEA Market Attractiveness by Sales Type, 2022 to 2032

Figure 120: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vibration Damping Levelling Feet Market Size and Share Forecast Outlook 2025 to 2035

Vibration Fiber Optic Perimeter Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Vibration Sensor Market Size and Share Forecast Outlook 2025 to 2035

Vibration Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Vibration Isolation System industry Analysis in India - Size, Share, and Forecast Outlook 2025 to 2035

Vibration Analyzer Market Growth – Trends & Forecast 2025-2035

Vibration Level Switch Market Analysis by Technology, Industry, Application, and Region through 2035

Anti-Vibration Mounts Market

Noise Vibration Harshness (NVH) Testing Market

Noise And Vibration Coatings Market Size and Share Forecast Outlook 2025 to 2035

Bonding Honeycomb Vibration Isolation Platform Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Controlled Intelligent Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA