Between 2025 and 2035, the Odour Control System market is expected to proliferate across industrial verticals, where there seems a high demand for effective odour management solutions like municipal wastewater treatment, petrochemical refining, and food & beverage processing, and pulp & paper manufacturing among others. Facing increased environmental and regulatory pressures to meet air quality standards, top companies are investing substantially in state-of-the-art odour control systems.

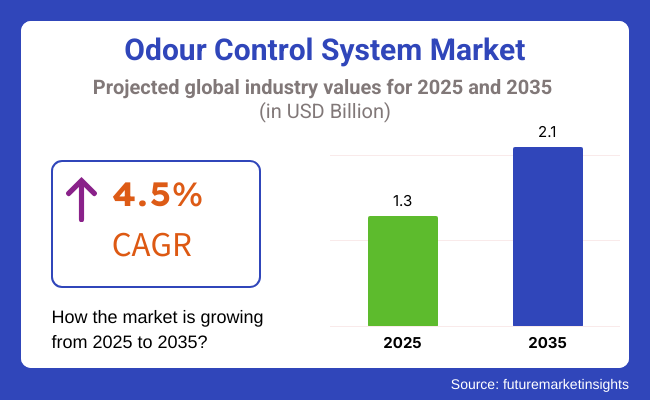

The market size is expected to grow from USD 1.3 Billion in 2025, at a CAGR of 4.5% to USD 2.1 Billion by 2035. With increasing population, urbanization and industrialization, concern about airborne pollution and bad smells coming from different plants has increased, eventually resulting in rapid growth of this market.

Wastewater treatment plants are one of the largest adopters of odour control technologies in the municipal sector. The release of hydrogen sulphide (H2S) and other malodorous chemical compounds from sewage systems is signalling local governments to implement high-tech biological, chemical and activated carbon-based filtration systems.

Likewise, industrial plants, most notably in the areas of petrochemicals and food processing, are investing in high-efficiency odour scrubbers, bio filters and thermal oxidizers to ensure regulatory compliance and build community relations.

With increasing environmental regulations across the globe, odour control systems are moving from a compliance-driven necessity to come a competitive investment in workplace, community and brand health. “We are also seeing the emergence of digital monitoring systems that provide real-time data of odour level data” which are also helping companies adopt more proactive odour management strategies.

Physical odour control and chemical odour control segments contribute major share in odour control system market due to which industries are rapidly adopting advanced air purification technologies to treat odour pollution, combat against environmental regulations and to improve workplace air quality.

These high-performance odour control systems serve an important role in neutralizing airborne contaminants, via eliminating volatile organic compounds (VOCs), which increase hygiene in public settings, as well as industrial settings, making them indispensable across waste treatment facilities, food processing units, chemical plants, and petrochemical refineries.

Among the more practical applications, physical odour control systems have been the most widely used, providing cost effective clean air, without the need for chemicals. In contrast to conventional odour masking methods, physical systems eliminate odour-causing molecules (via filtration, adsorption and oxidation), leading to long-lasting improvement of indoor air quality.

As industry leaders search for sustainable and maintenance-oriented systems, the demand for this efficient VOC and H₂S removal technology will drive the growth of adsorption-based odour control systems. Research shows that adsorption systems enhance deodorisation efficiency by as much as 95%, ensuring improved conformance to air quality standards.

With the boosting demand for ozone generators in wastewater and food processing industry, which utilize advanced oxidation technology to obliterate microbial odour, enhances proliferation of installation of ozone generators in hygiene-sensitive premise.

The incorporation of multi-stage adsorption and ionization systems with joint activated carbon and electrostatic precipitators for superior air purification has further fuelled adoption, ensuring improved efficacy in chemical and petrochemical sectors.

The need for such solutions has truly transformed the market with commercially advanced sensor-integrated control systems such that features like rapid & real-time tracking of odour level, remote alerts for automated filter regeneration among other features will continue to add depth in the market & will enable large scale adoption of such solutions driving growth for the segment.

UV-based odour control systems, including photolytic oxidation technology used to decompose airborne molecules of odour, are being adopted widely, strengthening the market growth, as they are compatible with low-ventilation and closed industrial setups.

While more energy efficient, sustainable, and low-maintenance than physical means of odour control, these systems struggle to manage high-intensity odours, require replacement of costly filters, and deliver reduced efficiency across varying humidity conditions. But new advances in nanotechnology-based adsorbents, AI-driven airflow optimization, and hybrid UV-carbon filtration systems are enhancing performance, durability, and adaptability, promising ongoing market growth for physical odour control options.

Due to the fact that chemical odour control systems have found solid market adoption, especially in wastewater treatment plants, oil refineries, and large-scale industrial facilities, it offers companies that require the use of chemical reactions to neutralize odour-causing gases such as hydrogen sulphide (H₂S), ammonia (NH₃), and sulphur compounds. Chemical systems perform to the molecular level, which means breaking down pollutants, which avoids risk of recurrence of odour more than physical filtration.

Municipalities are forced to comply with environmental emission limits, which has led to the deployment of high-efficiency wet scrubber systems implementing both acidic and alkaline liquid phase scrubbing for gas-phase odour removal for chemical scrubbers at municipal wastewater treatment facilities, thereby driving the chemistry scrubbing process market. Chemical scrubbers are over 99% effective at eliminating smells and gas emissions, providing improved community air and compliance with air quality regulations.

Furthermore, rise in application verticals for thermal oxidizers in chemical and petrochemical industries with high temperature incineration of odorous gases and VOCs, is expected to further boost the market demand, resulting in wider application in hazardous air pollutants (HAPs) abatement applications.

The adoption of dual-stage chemical scrubbing with acid-base neutralization for multi-contaminant removal has further enhanced ownership by allowing enhanced efficiency on more complex odour control operations.

The implementation of AI-powered chemical dosing control system based on real-time rust pH and ORP (oxidation-reduction potential) monitoring for quick reagent consumption has heightened the market development curve owing to which cost savings in process operations and efficiency has improved drastically.

The sign of market growth has also been supported by the prevalence of catalytic oxidation systems for low-temperature odour destruction with the help of metal oxide catalysts, which provides improved energy efficiency and decreased secondary emissions.

If it is indeed recent research, means that when considering high-efficiency gas removal, flexibility, and chemical neutralization, chemical odour control systems have their advantages, there are some drawbacks in practice such as chemical consumption (high), corrosiveness, and workload is relatively large.

However, new advancements in AI-driven chemical dosing, regenerative thermal oxidation (RTO) technology and bio-compatible scrubbing solutions are delivering cost efficiency and sustainability, reliability, and longevity; factors set to drive chemical-channelled odour abatement solution’s continued market growth.

The waste treatment facilities and food & beverage segments are forecasted to provide the major market drivers for industries employing advanced odour control systems for management of emissions to meet regulatory requirements as well as to improve air quality in production and processing environments.

Waste treatment facilities have become now among the largest consumers of odour control systems, as municipalities, industrial plants and landfill operators deploy higher efficiency odour abatement technologies to mitigate issues of public health and regulatory compliance. Unlike traditional deodorizing methods, modern odour control solutions provide permanent odour neutralisation to reduce long-term environmental impact.

As cities invest in sustainable sanitation infrastructure, there is a growing market for municipal wastewater treatment plants that have high-efficiency bio filters and chemical scrubbers for hydrogen sulphide (H₂S) removal. Research shows that optimized odour control can decrease complaints by as much as 80%, leading to improved acceptance within the communities and the public.

Growth in odour control solution in the landfill gas management, such as thermal oxidation and bio filtration for methane and volatile organic compound (VOC) control has bolstered demand and ensured increased adoption in solid waste process, thus further propelling market expansion.

Earlier preventive odour management strategies have been enhanced with the development of real-time odour monitoring sensors, with AI-enabled air quality mapping and predictive odour dispersion modelling techniques resulting in widespread adoption.

While effective ambient odour management is important for regulatory compliance and environmental stewardship, odour control systems at waste treatment plants are generally hampered by high capital costs, complex integration, and maintenance-heavy scrubber operations.

Nonetheless, the next-generation AI-driven odour-mapping systems, energy-efficient bio-scrubber technologies, and hybrid filtration-chemical intervention technologies are enhancing operational efficacy, versatility, and cost-effectiveness, paving the way for sustained growth of odour control systems in waste treatment applications.

Odour control solutions have seen robust market adoption in the food & beverage industry, particularly in meat processing plants, dairy facilities, breweries and other food packaging and processing units as manufacturers increasingly invest in odour control solutions for eliminating production related odour and maintaining air quality for workplaces. Active odour control technologies also avoids inter screening cross-contamination and to be more compliant with food safety standards compared to passive ventilation.

Producers have been increasingly seeking odour control for their meat and seafood processing plants, and have carbon-based odour control that includes bio tricksling filters and ozone-based systems for ammonia and protein decomposition odour removal, so as to meet heightened demands for sanitation and consumer confidence in production methods.

The increasing penetration of odour control solutions for the breakdown of organic compounds through adsorption and catalytic oxidation in dairy and fermentation-based industries has also boosted the adoption odour treatment products in several odour-sensitive production lines.

Moreover, smart odour monitoring and air purification systems with AI-driven analytics and automated scrubbing system control have further catalysed adoption, which ensures better operational proficiency and compliance with regulatory requirements.

While it has its benefits such as improved hygiene, food safety, and air quality management, odour control in food & beverage industries comes with its own set of challenges, like high operational costs, variability in the intensity of odours, and the possibility of affecting the food or beverage flavour. However, novel applications in enzyme-based odour neutralization, AI-assisted real-time odour tracking and eco-friendly adsorption materials are increasing efficiency, sustainability, and cost-management fuelling growth for odour control systems in the food & beverage domain.

North America accounts for a significant share of the global odour control systems market, owing to stringent environmental regulations and the abundance of industries that require odour control systems for better obtrusion. The United States Environmental Protection Agency (EPA) and local authorities have established strict air quality standards, requiring facilities to use effective odour control technologies.

North America's wastewater treatment sector is one of the largest users of MAP installations, and this is only expected to expand as municipalities and utilities continue to invest in advanced solutions for odour complaints and the maintaining of public trust. Demand from the food and beverage sector is also a significant factor driving the market, especially as companies are under pressure to meet consumer demand for sustainable production practices.

In addition, the petrochemical and refining industry routinely utilizes complex odour control systems, which are reliance in order to control odour emission from chemical processes. This involves chemical scrubbers, bio filtration units, and thermal oxidation systems to neutralize odour emissions.

Thus, with the rising awareness regarding environmental impact and continued expenditure on industrial and municipal infrastructure, North America is expected to retain its stronghold in the global odour control systems market.

Europe is another significant market, with countries like Germany, the United Kingdom, and France are at the forefront of adopting odour control technologies. Under the European Union’s strict environmental policies and goals of cut greenhouse gas emissions, industries and municipalities have paid attention to air quality measures.

Wastewater treatment and food processing are key sectors driving demand for odour control systems. For example, wastewater treatment plants in cities are under great pressure to reduce odour emissions, resulting in the growing use of biological filters, activated carbon and chemical scrubbers.

Another segment of the market is the petrochemical and industrial manufacturing. Strict regulation requires facilities to use high technology odour mitigation systems that match air quality standards. Furthermore, the increasing emphasis on sustainable practices has prompted companies to invest in environmentally friendly and energy-efficient odour control solutions.

Odour Control System market in Asia-Pacific is expected to be the fastest growing market due to rapid urbanization and industrialization, along with the growing population. Countries like China, India, Japan and South Korea have also seen growth in municipal and industrial waste water treatment infrastructure, which is leading to rising investments in odour control technologies.

In China, state-owned enterprises centralization through government policies aimed at announcing and enacting improvement and treatment of air pollution has led to large-scale investments in wastewater treatment plants, processing plants, and manufacturing units. Likewise, the urban spread of India and launch of national sanitation programmes have opened up various avenues for the odour control system providers, in particular urban wastewater treatment and solid waste management.

Digital odour monitoring systems, which allow for pre-emptive maintenance and real-time data analysis, are being adopted primarily among technologically inclined nations, with Japan and South Korea at the forefront. Industrial odour management is therefore able to take advantage of more effective, efficient technologies.

Rising Regulatory Demands & Expensive Installation

However, the Odour Control System Market has its own share of challenges, such as strict environmental regulations, high initial installation costs and complexities in maintenance. Governments across the globe are imposing strict air quality and emission control standards which is pressurizing the industries to use advanced odour control solutions.

But the cost of fitting out these systems with existing industrial architecture is prohibitive, involving bespoke engineering and specialized infrastructure. Moreover, corrective maintenance is required to ensure continued operational efficiency, raising operational costs.

Organizations need affordable, scalable solutions that comply with new, ever-evolving regulatory frameworks but also ensure sustainability in the long run. Modular odour control systems, automated filtration technologies and energy-efficient scrubbers will help address these challenges.

Growing Demand for Industrial Air Quality Management and Smart Monitoring

The global realization of the health and socioeconomic issues caused by pollutants contributes to the expansion of the Odour Control System market with promising opportunities. Wastewater treatment, chemical processing, and food production industries need sophisticated odour mitigation strategies for environmental compliance and improved workplace safety. There is a shift towards intelligent odour measurement systems that use on-line sensors and automatic detection technologies.

This allows industries to ensure optimal air quality levels while minimizing energy use and operational expenditures. The incorporation of data-driven analytics, predictive maintenance tools and eco-friendly filtration materials into odour control systems will provide a competitive advantage to companies in the changing landscape of industrial settings.

The Odour Control System Market will undergo sustained growth from 2020 to 2024 due to increasing environmental concerns, enforcement of regulations, and emerging technological advancements. Industries increase used bio filters, activated carbon scrubbers, and chemical scrubbers to detect industrial emissions.

Nevertheless, in some parts of the world, expensive costs and low awareness resulted in a continuation of the slow pace of adoption. In response, companies engineered energy-efficient, compact odour control systems that could fit seamlessly within pre-existing industrial workflows. The integration of real-time air quality monitoring allowed for improved regulatory compliance and optimized system performance, further minimizing the environmental footprint of the feedlots.

With an emphasis on product features such as AI-driven odour detection, cloud-based analytics and smart filtration solutions, the market will undergo transformational changes between 2025 to 2035.

In terms of operational efficiency, predictive maintenance and automated control systems will make operations more efficient, further reducing downtime and maintenance costs. Sustainable goals will drive the evolution of biodegradable, chemical-free methods of odour control, leading to the reduction of chemical treatments.

In addition, the growing requirement for small, portable odour control systems would allow industries to utilize appropriate temporary and portable solutions for dynamic industrial procedures. The next stage of market evolution will be driven by those companies that embrace AI-powered monitoring, materials that are sustainable, and energy-efficient filtration technologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strengthening of air quality regulations across industries |

| Technological Advancements | Increased adoption of chemical scrubbers and bio filters |

| Industry Adoption | Growth in wastewater treatment, food processing, and chemical industries |

| Supply Chain and Sourcing | Challenges in securing high-quality filtration materials |

| Market Competition | Presence of established manufacturers and filtration system providers |

| Market Growth Drivers | Increasing industrialization and demand for workplace air quality improvements |

| Sustainability and Energy Efficiency | Early-stage implementation of eco-friendly odour control systems |

| Integration of Smart Monitoring | Limited real-time tracking and system optimization |

| Advancements in Portable Solutions | Use of fixed-location odour control units |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global emission control policies promoting eco-friendly odour solutions. |

| Technological Advancements | Integration of AI-powered odour detection and real-time monitoring analytics. |

| Industry Adoption | Expansion into pharmaceutical, renewable energy, and urban waste management applications. |

| Supply Chain and Sourcing | Investment in sustainable filtration media and localized supply chains for improved efficiency. |

| Market Competition | Rise of start-ups developing smart, automated, and mobile odour control solutions. |

| Market Growth Drivers | Expansion of green technology solutions and demand for carbon-neutral odour management systems. |

| Sustainability and Energy Efficiency | Full-scale adoption of low-energy, chemical-free, and biodegradable odour filtration solutions. |

| Integration of Smart Monitoring | AI-powered remote diagnostics, cloud-based analytics, and automated odour control adjustments. |

| Advancements in Portable Solutions | Growth in demand for mobile, temporary, and modular odour control systems for dynamic industrial needs. |

The United States odour control system market is witnessing steady growth on account of stringent Environmental Protection Agency (EPA) regulations, rising demand from wastewater treatment facilities, and increasing industrial expansion. The Clean Air Act (CAA) and state-wise air quality standard are compelling the industries to use the advanced odour control technologies to reduce the emissions.

Chemical scrubbers, bio filters, and activated carbon filtration systems have a strong and consumer-rich end user in industries such as wastewater treatment and petrochemical. Also, odour neutralization solutions are gaining traction in food processing and livestock industries as a solution to enhance air quality.

USA odour controls system market rising technological advances in odour detection along with ai-integrated monitoring system to fuel growth

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The United Kingdom odour control system market is anticipated to grow during the forecast period attributed to stringent government regulations regarding air quality, rising investments in municipal waste management sector and growing adoption of bio-based technologies for odour removal. Odour emission regulations in UK Environmental Agency are promoting the adoption of chemical scrubbing and activated carbon based filtration systems by industries.

The public health and environmental protection regulations are making high-efficiency odour control solutions an important factor for wastewater treatment and landfill sectors among the major consumers. In addition, renewable energy plants, especially biogas plants, invest in modern odour neutralisation systems.

However, the increased emphasis on environmental sustainability and the growing investments in green odour control technologies will boost the demand for odour control systems over moderate growth in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The European Union smell control system market is experiencing stable growth due to strict environmental regulations, the increasing requirement in industrial air treatment, and growing investment in sustainable waste management solutions. Germany, France and the Netherlands are among the biggest adopters of bio filters, activated carbon scrubbers and chemical odour removal technologies.

EU regulations like the Industrial Emissions Directive (IED) and Air Quality Standards increase pressure on municipalities and industries to use high performance odour abatement solutions. Furthermore, the development of smart cities and IoT-based air quality monitoring systems is propelling market growth.

The EU odour control system market will grow gradually owing to continuous investment in sustainable and high efficiency odour control technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan odour control system market has been showing a positive growth owing to stringent air pollution control policies, increasing urbanization trend and high adoption of smart air quality monitoring solutions. Japan’s Air Pollution Control Act and municipal regulations are key sales drivers for high-efficiency odour control systems for a number of applications, including wastewater treatment, chemical industries and food processing.

Also investing in advanced gas-phase filtration and scrubber systems are the electronics and pharmaceutical industries that demand high-purity air environments. The combination of Japan’s heavy investment in automation and with a unique solution such as AI-based odour detection is giving rise to opportunities for smart air purification solutions that's still in its early stage.

The Japanese odour control system market will be stable growing, given robust regulatory driver, and increasingly popular use of advanced odour control technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The South Korea odour control system market has an upward tendency due to the increase in demand for air pollution - control solutions and growing adoption of odour control system in manufacturing sector, government support towards environmental sustainability. South Korea is in the process of implementing the Air Quality Management Act, stimulating industries to replace their odour filtration systems with better performing ones.

There is an increasing demand for improved odour management in the management of sewage treatment, petrochemical processing, and landfill sites as the certificate of a successful industrial and urban infrastructure expands rapidly. Moreover, the rise of smart cities and industrial automation is fuelling demand for IoT-integrated and AI-driven air quality monitoring solutions.

Given that investments in clean air technologies continue and there is growing public awareness of odour pollution, the South Korean odour control system market is expected to witness steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The odour control system industry has expanded significantly owing to growing concerns for air quality management, increasingly stringent environmental policies, and tighter pollution norms across various sectors. Innovations such as biofilters leveraging novel biomaterials, chemical scrubbers with advanced absorption mechanisms, activated carbon systems employing novel adsorption techniques, and even artificial intelligence-powered solutions generating real-time optimization strategies based on vast reams of telemetry data have the potential to deliver solutions that are more effective, standards-compliant, and resource-efficient.

This expanding domain serves the needs of a wide spectrum of global environmental technology vendors and specialist air purification companies. They are driving continuous enhancements in gas-phase filtration methods, multi-step odour removal processes, and industrial emissions management approaches to create healthier, safer, and more sustainable work environments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Evoqua Water Technologies LLC | 15-20% |

| CECO Environmental Corp. | 12-16% |

| Ecolab Inc. (Nalco Water) | 10-14% |

| AER Control Systems LLC | 7-11% |

| Monroe Environmental Corp. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Evoqua Water Technologies LLC | Develops bio filtration and chemical scrubber systems for wastewater treatment, industrial emissions, and landfill odour control. |

| CECO Environmental Corp. | Specializes in gas-phase filtration, thermal oxidizers, and multi-stage odour mitigation solutions for industrial facilities. |

| Ecolab Inc. (Nalco Water) | Manufactures AI-driven odour control chemicals, mist eliminators, and industrial scrubber systems. |

| AER Control Systems LLC | Provides advanced air purification and fume extraction systems for commercial and industrial odour abatement. |

| Monroe Environmental Corp. | Offers custom-designed odour control systems, integrating wet scrubbers and carbon adsorption for odour-intensive industries. |

Key Company Insights

Evoqua Water Technologies LLC (15-20%)

Evoqua is the market leader in odour control systems, across high efficiency biological filtration and wet scrubber technologies, serving municipal and industrial customers with a complete odour management solution.

CECO Environmental Corp. (12-16%)

CECO is a leading provider of gas-phase filtration, high efficiency chemical scrubbers, and thermal oxidation systems to improve air quality

Ecolab Inc. (Nalco Water) (10-14%)

Odour control chemicals and high-level scrubbers from Ecolab guarantee the economical and AI-optimized treatment of industrial emissions.

AER Control Systems LLC (7-11%)

Company ProfileAER Control designs high-efficiency fume and odour extraction systems for the effective removal of airborne contaminants in industrial settings.

Monroe Environmental Corp. (5-9%)

Monroe creates bespoke odour control systems, combining wet scrubbers, bio filters and activated carbon adsorption.

Other Key Players (40-50% Combined)

Several environmental engineering and industrial air purification companies contribute to next-generation odour control system innovations, AI-driven emissions monitoring, and sustainable air purification solutions. These include:

The overall market size for Odour Control System Market was USD 1.3 Billion In 2025.

The Odour Control System Market expected to reach USD 2.1 Billion in 2035.

The demand for the Odour Control System Market will be driven by increasing environmental regulations, the need for effective air quality management in industries such as wastewater treatment, food processing, and chemicals. Rising urbanization, along with growing awareness of health and hygiene, will further propel market growth.

The top 5 countries which drives the development of Odour Control System Market are USA, UK, Europe Union, Japan and South Korea.

Physical and Chemical Odour Control Systems Drive Market Growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by System, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by System, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by System, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by System, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by System, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by System, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by System, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by System, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by System, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by System, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by System, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by System, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by System, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by System, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by System, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by System, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by System, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by System, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by System, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by System, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by System, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by System, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by System, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by System, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by System, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by System, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by System, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by System, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by System, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by System, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by System, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by System, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by System, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by System, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by System, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by System, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

Dust Control System Market Size and Share Forecast Outlook 2025 to 2035

Noise Control System Market Analysis - Size, Share, and Demand Forecast Outlook 2025 to 2035

Door Controller Systems Market

Version Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Charge Controller System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Driveline Control Systems and Devices Market Size and Share Forecast Outlook 2025 to 2035

Vibration Control Systems Market Growth - Trends & Forecast 2025 to 2035

Automated Control System Market Growth – Trends & Forecast 2024-2034

Aspiration Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Hemorrhage Control System Market Size and Share Forecast Outlook 2025 to 2035

Compressor Control System Market

Command and Control System Market Size and Share Forecast Outlook 2025 to 2035

Fertigation Control System Market Size and Share Forecast Outlook 2025 to 2035

Distributed Control System Market

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Air Pollution Control Systems Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA