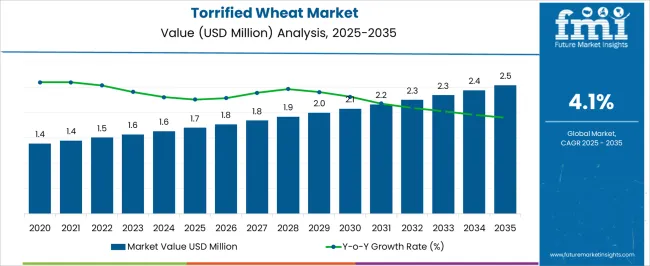

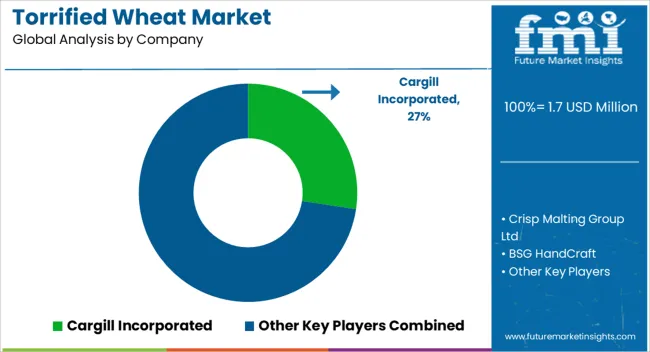

The Torrified Wheat Market is estimated to be valued at USD 1.7 million in 2025 and is projected to reach USD 2.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Torrified Wheat Market Estimated Value in (2025 E) | USD 1.7 million |

| Torrified Wheat Market Forecast Value in (2035 F) | USD 2.5 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The Torrified Wheat market is experiencing steady growth driven by increasing demand for versatile, nutrient-rich, and shelf-stable cereal products across the global food and beverage industry. In 2025, conventional torrified wheat is expected to dominate due to its compatibility with a wide range of applications, including ready-to-eat cereals, snacks, and bakery ingredients. The current market scenario reflects growing consumer preference for minimally processed, high-fiber foods that offer improved digestibility and longer shelf life.

The future outlook for this market is largely shaped by rising health awareness, expanding urban population, and increased demand from processed food manufacturers for functional grain ingredients. The market is also being supported by advancements in processing technologies that improve flavor, texture, and nutritional retention without compromising quality.

Additionally, supply chain improvements and growing investments in cereal-based food production are enabling wider market penetration As consumption of wheat-based products continues to rise in both developed and emerging regions, the Torrified Wheat market is positioned for sustainable expansion with opportunities in functional and fortified food segments.

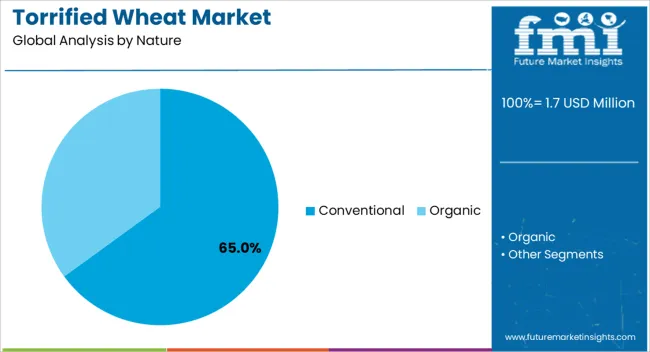

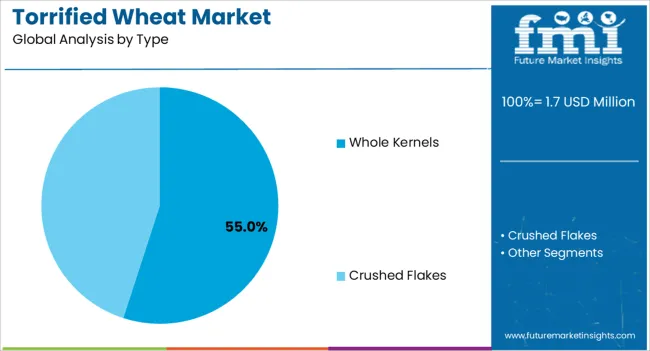

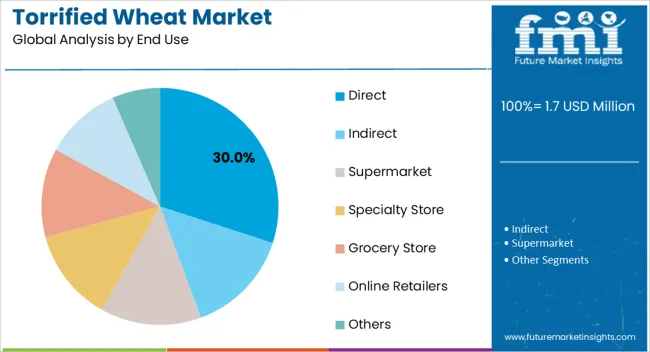

The torrified wheat market is segmented by nature, type, end use, and geographic regions. By nature, torrified wheat market is divided into Conventional and Organic. In terms of type, torrified wheat market is classified into Whole Kernels and Crushed Flakes. Based on end use, torrified wheat market is segmented into Direct, Indirect, Supermarket, Specialty Store, Grocery Store, Online Retailers, and Others. Regionally, the torrified wheat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional nature segment is projected to hold 65.0% of the Torrified Wheat market revenue share in 2025, making it the leading category. This dominance is being driven by the widespread adoption of traditional wheat varieties that are perceived as safe, reliable, and versatile in food processing applications. Conventional torrified wheat is favored by manufacturers for its consistent quality, established supply chain, and compatibility with various cereal, bakery, and snack formulations.

The processing of conventional wheat allows for improved digestibility and shelf stability, which is increasingly valued by consumers seeking convenient yet healthy dietary options. Additionally, production practices for conventional wheat have matured over decades, ensuring scalability and cost-efficiency for manufacturers.

The segment’s growth has also been facilitated by the rising incorporation of wheat into functional foods and ready-to-eat products, which requires grains that maintain their structural integrity and nutritional value during torrification As manufacturers continue to prioritize efficiency and product performance, conventional torrified wheat is expected to maintain its market leadership.

The whole kernels type is expected to account for 55.0% of the Torrified Wheat market revenue share in 2025, representing the leading type segment. This position is attributed to the preference for intact kernels, which preserve the natural nutritional profile of wheat, including fiber, protein, and micronutrients. Whole kernels are widely used in ready-to-eat cereals, snack mixes, and bakery products where textural quality and visual appeal are important.

The segment’s growth has been supported by increased consumer focus on clean-label and minimally processed foods, which emphasizes the value of retaining whole grain structure. Moreover, whole kernels provide versatility for manufacturers by allowing customization in cooking, flavoring, and packaging applications without compromising grain integrity.

The ability of whole kernels to maintain shape and consistency during torrification and subsequent processing steps has reinforced their adoption among food producers As trends toward health-conscious diets and functional foods continue, the demand for whole kernel torrified wheat is expected to remain strong.

The direct end-use segment is projected to hold 30.0% of the Torrified Wheat market revenue share in 2025, making it the largest end-use category. Growth in this segment is being driven by the increasing use of torrified wheat in ready-to-eat applications, including breakfast cereals, snack foods, and instant meal formulations.

Direct use of torrified wheat offers advantages such as reduced preparation time, consistent quality, and improved digestibility, which aligns with consumer demand for convenience and healthy food options. The segment has also benefited from the scalability of supply chains that facilitate direct incorporation of torrified grains into processed food products without additional milling or refinement.

Furthermore, manufacturers favor direct-use torrified wheat due to its compatibility with a variety of flavorings, fortification ingredients, and packaging formats As the consumption of convenience foods grows globally, the direct end-use segment is expected to continue leading the market, supported by innovations that enhance product functionality and appeal while maintaining nutritional benefits.

Torrified wheat, which is unmalted wheat used in beer production, is subjected to a heat treatment at temperatures up to 85°C, a process known as torrification. This treatment is necessary to gelatinize the starch in wheat, which involves pre-gelatinizing the starch and breaking down the cellular structure of the wheat. The end product is torrified wheat, which makes it easier for brewers to extract sugar from it.

Torrified wheat is commonly used in brewing, particularly in Belgian Witbiers and American Wheat beers, to enhance the body and head retention of the beer. Additionally, depending on the amount used and the recipe, it can impart a subtle nutty or biscuit-like flavor to the finished beer.

In our new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights into key factors driving demand for Torrified Wheat.

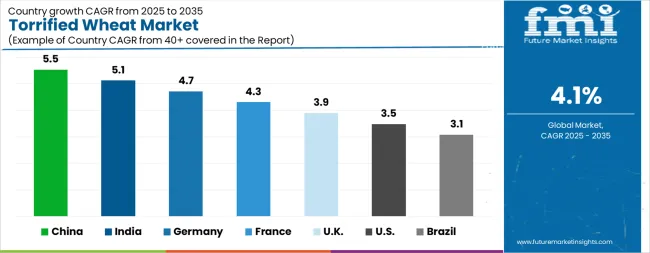

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The Torrified Wheat Market is expected to register a CAGR of 4.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.5%, followed by India at 5.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.1%, yet still underscores a broadly positive trajectory for the global Torrified Wheat Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.7%. The USA Torrified Wheat Market is estimated to be valued at USD 606.2 thousand in 2025 and is anticipated to reach a valuation of USD 853.8 thousand by 2035. Sales are projected to rise at a CAGR of 3.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 90.8 thousand and USD 55.2 thousand respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Million |

| Nature | Conventional and Organic |

| Type | Whole Kernels and Crushed Flakes |

| End Use | Direct, Indirect, Supermarket, Specialty Store, Grocery Store, Online Retailers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Incorporated, Crisp Malting Group Ltd, BSG HandCraft, Briess Malt & Ingredients Co, DuClaw Brewing Company, Country Malt Group, Muntons plc., GrainCorp Limited, Fawcett Bros. (Malting) Ltd, and Southern Tier Brewing Company |

The global torrified wheat market is estimated to be valued at USD 1.7 million in 2025.

The market size for the torrified wheat market is projected to reach USD 2.5 million by 2035.

The torrified wheat market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in torrified wheat market are conventional and organic.

In terms of type, whole kernels segment to command 55.0% share in the torrified wheat market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA