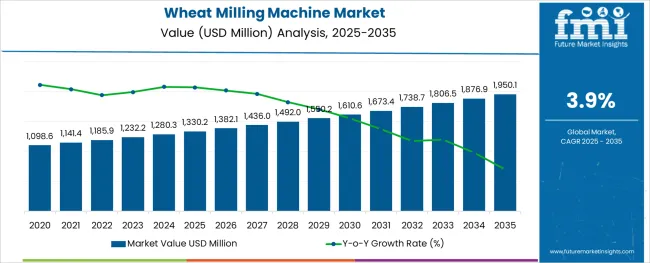

The Wheat Milling Machine Market is estimated to be valued at USD 1330.2 million in 2025 and is projected to reach USD 1950.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The wheat milling machine market is experiencing consistent growth as rising demand for processed and high-quality flour drives investment in modern milling technologies. Increased consumption of baked goods, convenience foods, and specialty flours has encouraged manufacturers to adopt advanced machinery that ensures efficiency, consistency, and reduced waste.

Regulatory focus on food safety and hygiene has further accelerated the transition from traditional to automated milling solutions. Growth opportunities are being shaped by technological improvements, such as energy-efficient designs and precision controls, enabling better yield and lower operating costs.

Future expansion is expected to benefit from the modernization of milling infrastructure in emerging economies and the consolidation of milling operations in developed markets. Strategic collaborations between equipment manufacturers and food producers are paving the way for tailored solutions that meet specific production needs while addressing sustainability and compliance requirements.

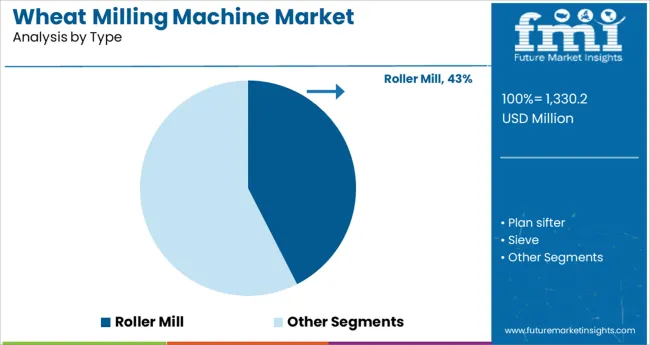

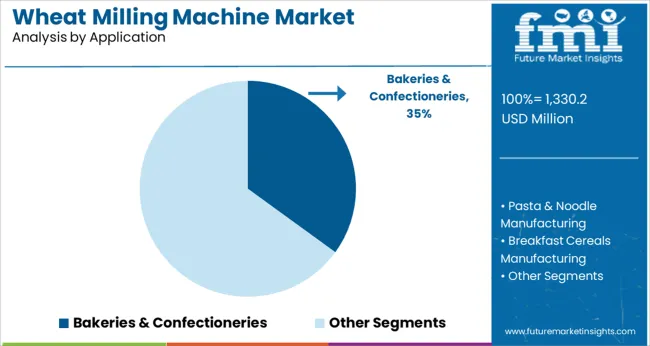

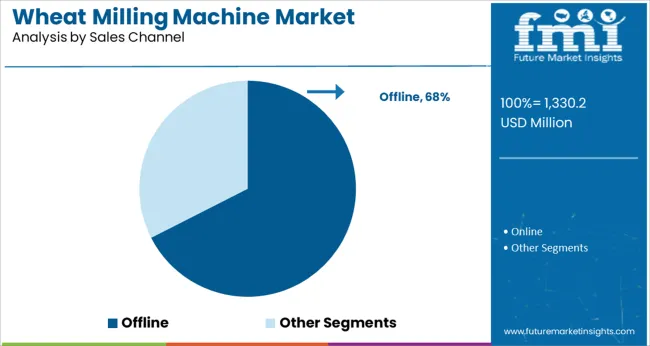

The market is segmented by Type, Application, and Sales Channel and region. By Type, the market is divided into Roller Mill, Plan sifter, and Sieve. In terms of Application, the market is classified into Bakeries & Confectioneries, Pasta & Noodle Manufacturing, Breakfast Cereals Manufacturing, and Animal Feed Manufacturing. Based on Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type, Application, and Sales Channel and region. By Type, the market is divided into Roller Mill, Plan sifter, and Sieve. In terms of Application, the market is classified into Bakeries & Confectioneries, Pasta & Noodle Manufacturing, Breakfast Cereals Manufacturing, and Animal Feed Manufacturing. Based on Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the roller mill segment is expected to account for 42.5 % of the total market revenue in 2025, making it the leading type segment. This leadership has been supported by the roller mill’s superior ability to produce consistent particle size and uniform flour quality compared to traditional stone or hammer mills.

Its robust design and adjustable settings have enabled efficient processing of large volumes of wheat with minimal energy consumption and reduced maintenance downtime. The capability to meet stringent quality standards required by commercial bakeries and food manufacturers has reinforced its adoption.

The roller mill’s flexibility to process various wheat grades and achieve high extraction rates has further strengthened its appeal to operators seeking reliability and productivity. These operational advantages have positioned the roller mill as the preferred choice for both industrial-scale and high-output milling environments.

In terms of application, bakeries and confectioneries are projected to hold 35.0 % of the wheat milling machine market revenue in 2025, emerging as the top application segment. This prominence has been influenced by the growing demand for premium baked goods, specialty breads, and confectionery products that require high-quality flour with specific properties.

The ability of modern milling machines to deliver consistent flour tailored to precise baking requirements has been critical in driving adoption within this segment. Increased investment by commercial bakeries in automated, hygienic, and high-capacity milling facilities has supported continued growth.

The focus on innovation in product offerings and the need to meet rising consumer expectations for freshness and quality have further enhanced the role of milling machines in bakeries and confectioneries. Their central position in supplying the fast-expanding food service and retail bakery industries has solidified this segment’s leadership.

Segmented by sales channel, the offline segment is forecast to capture 67.5 % of the market revenue in 2025, establishing itself as the leading channel. This dominance has been sustained by the complexity and capital-intensive nature of wheat milling machinery, which often necessitates personalized consultations, on-site demonstrations, and post-sales service provided through offline networks.

The trust developed through direct relationships with suppliers and the ability to customize solutions according to the buyer’s facility requirements have favored offline purchases. Additionally, the preference for in-person negotiations, installation support, and maintenance contracts has maintained offline as the preferred channel, especially for large-scale enterprises making significant investments.

The offline channel’s capacity to provide hands-on training, immediate technical assistance, and assurance of long-term support has further reinforced its stronghold in this market.

The rising demand for energy-efficient equipment from end users is one of the major factors propelling the global market. Manufacturers are introducing milling machines with energy-efficient features in response to the increased demand for machinery that performs more efficiently in terms of energy usage, capacity, and cost. Higher standards for the effectiveness of powder granulation machines are put up as people's awareness of energy saving increases. This kind of equipment must not only fulfill the functional specifications but also have energy efficiency, durability, usability, maintenance, and serviceability.

The benefits of large-scale manufacturing equipment have become apparent as science, technology, and other fields of research evolve. A strong technical assurance for the large-scale functioning of wheat flour grinding machines has been made possible by the advancement of mechanical structure design and processing technologies. Manufacturers are refining the construction of wheat milling equipment to make it more practical, ergonomic, and compact. This reduces production costs, frees up more space on the floor, and boosts worker productivity. The industry is utilizing modification methods more often, and flours are enriched with additives, micronutrients, and a range of components, which is increasing the demand for wheat flour globally.

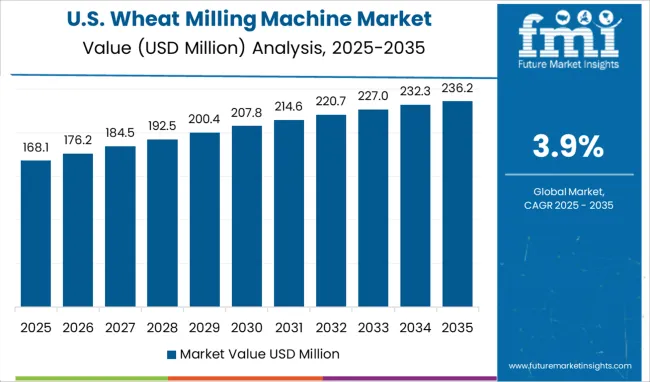

The historical prognosis for the wheat milling machine market reveals that the market's value expanded from USD 1,033.5 million in 2020 to USD 1,185.9 million in 2025. During the historical timeframe (2020 to 2025), the market observed a CAGR of 3.5%.

The wheat milling machine has been around for centuries and has been used in many different parts of the world. The first known use of the wheat milling machine was in Ancient Egypt. The Egyptians used the wheat flour machine for commercial use to process wheat into flour for bread making. The science of wheat milling entails examining, combining, grinding, sifting, and blending once more different types of wheat. The wheat is analyzed by the miller before being blended to fulfill the needs of the final product.

The wheat milling machine market is expected to grow significantly in the coming years. As more people become aware of the advantages that wheat flour has for their health, a roadmap for wheat milling equipment becomes increasingly crucial.

Wheat Milling Machine market value is expected to climb from USD 1,232.2 million in 2025 to USD 1,806.5 million in 2035 according to future projections. A CAGR of 3.9% is predicted to occur between 2025 and 2035.

Since wheat flour is used in bakery goods like bread, cookies, and pastries, the bakeries and confectioneries segment is expected to hold the largest market share. The market is expanding as a result of the increased demand for wheat flour used to make bakery & confectionery goods. For cakes and slices of bread, the majority of demand for bakery goods is driven by wheat and refined wheat flour.

Almost everywhere in the globe, there is a growing demand for bread, which has a favorable effect on the price of wheat flour which directly generates revenue for wheat milling machines as well. Numerous bakeries and confectioneries are turning to machines because of their high performance and simplicity of use. Hence, increased demand for wheat flour from restaurants, cafés, and other businesses is anticipated to drive the expansion of the flour market and the wheat milling machine industry at the same time.

A wheat milling machine is used in animal feed manufacturing to process raw wheat kernels into a powder that can be fed to animals. The wheat processing machine separates wheat bran from wheat flour. The end product is a nutritious and healthy animal feed that is highly digestible and palatable for animals. Because it has a higher proportion of protein than other existing cereals and has a higher concentration of amino acids, wheat bran is a product designed for animal feed.

Technically known as pericarp, this wheat bran is made up primarily of the outside of the processed wheat grain. Additionally, since it improves digestibility and raises the nutritional levels in the grains, roasted wheat is also utilized in animal feed, which increases milk production.

The wheat milling machine market in North America has been developing steadily in recent years. The United States dominates the wheat milling machine market in North America. Wheat from the United States offers diversity. For many citizens in the United States, whole-wheat flour is regarded as one of the most plentiful and essential resources. North America has a developed market for processed goods and is anticipated to expand steadily.

The distinctive qualities needed to manufacture a range of baked items and noodles are brought to market by the flour made from each unique class of American wheat. The demand for wheat grinding machines has been driven by the growing popularity of wheat-based foods in the region.

There are several factors that have contributed to the steady development of the United States wheat milling machine market. One of the most important factors is the increasing health consciousness of consumers in the region. Wheat-based foods are generally considered to be healthier than their processed counterparts, and this has led to an increase in demand for them.

Furthermore, due to the rising demand for organic wheat flour in goods like bread, pastries, confections, processed foods, and many other organic food items, North America has the largest per-capita use of organic wheat flour. The Wheat Milling Machine Market receives 35.6% of its total income from the United States.

Several factors are helping to drive the growth of the European wheat milling machine market. With the rise in the production of grains, notably wheat, the European region may see profitable opportunities in the market throughout the projection period. This demand is also being driven by the food industry, which is using more wheat flour in processed foods.

The rising demand for bakery products like bread, pasta, pizza, etc. is expected to boost profits in Europe for wheat milling machines. Government programs to boost agricultural output by offering subsidies help with this by incentivizing farmers to spend money on wheat cultivation. To meet the rising demand of the health-conscious population, major manufacturers are now concentrating on producing a wider variety of wheat with fewer negative health effects.

Germany makes for 22.4% of the Wheat Milling Machine market, while the CAGR in the United Kingdom is 6.7% over the projection period.

The market for wheat milling machines is expanding in the Asia Pacific at a significant pace. The reason behind this expansion is the increasing demand for wheat products in the region. Moreover, the Asia Pacific region is the world’s largest wheat-producing region. This region also has the highest consumption rate of wheat. Therefore, the demand for wheat milling machines is also high in this region.

The expansion of the market for wheat milling machine is also due to the growing popularity of healthy and organic food products. Consumers in the Asia Pacific region are becoming more health conscious and are willing to pay more for healthy and organic food products. This trend is expected to continue in the future, which will drive up the demand for wheat-grinding machines even further.

Japan represents a sizeable portion of the global market share, while China is the market leader in the Asia Pacific region.

| Country | China |

|---|---|

| CAGR | 6.3% |

| Growth Factor | China is the largest producer of wheat. A rising population base, increased fast food and bakery consumption, rising urbanization, and rising disposable income are all driving up demand for flour and related products. The fact that China has a well-established food and beverage industry and that businesses are investing more money in the creation of cutting-edge wheat flour products is partly to blame for the market's explosive growth. |

| Country | Japan |

|---|---|

| CAGR | 3.5% |

| Growth Factor | The ongoing efforts made by governments to increase the capacity for producing wheat as well as to increase the value of their exports by working with international firms. With rising disposable income, consumer lifestyles have significantly improved. The upscale goods that nowadays consumers like include cakes, biscuits, and premixes made of wheat flour which in turn increase the adoption of wheat milling machines. |

Growing Companies to Improve the Wheat Milling Machine Market Strength

New players in the market for wheat milling machines are providing cutting-edge goods and gaining a competitive edge by leveraging technological advancements. To keep up with shifting consumer preferences and end-user industry demands, these businesses consistently invest in Research and Development (R&D). Initiatives to elevate their profile in the forum are assisting the wheat milling machine business.

Leading Startups to Watch out for

| Start-up Company | Ghrats Fresh Atta |

|---|---|

| Country | India |

| Description | Three friends from Chandigarh founded Ghrats Fresh Atta with the goals of reviving an extinct custom, producing food responsibly, and creating jobs for others. |

| Start-up Company | Ardent Mills |

|---|---|

| Country | Canada |

| Description | The business specializes in wheat flour, quinoa, pulses, and organic and gluten-free goods that promote new trends in plant-based nutrition. With a focus on the expanding demands of today's consumers, its comprehensive portfolio enables it to satisfy the complicated needs of customers today. |

The competitive landscape of the wheat milling machine market is constantly changing. Companies are always looking for ways to improve their products and services to stay ahead of the competition. They invest heavily in research and development to bring new products to the market. The competition in the market is good for consumers as it leads to lower prices and better-quality products.

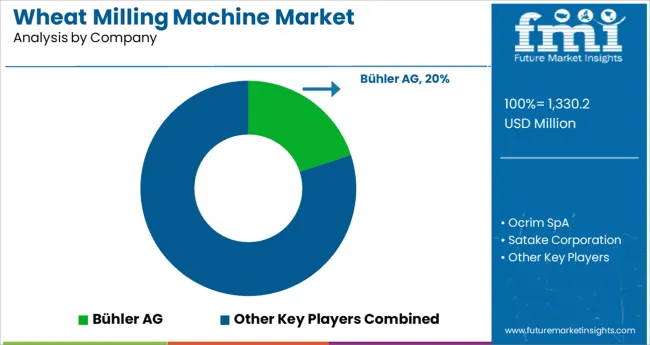

The market is highly fragmented with a large number of small and medium-sized manufacturers. The leading players in the market include Bühler AG, Ocrim SpA, Satake Corporation, Alapala Machine Industry & Trade Inc., and Henry Simon Group. These companies hold a significant share of the global market due to their strong brand presence and extensive product portfolios.

Pointing towards the Perfect Slice of Bread with the help of a Wheat Milling Machine, ft. Buhler AG, Ocrim SpA, and Henry Simon Group

Three business pillars support Bühler. Grains & Food Solutions guarantees wholesome, safe food and feed. Solutions from Consumer Foods provide delectable cuisine. Advanced Materials aid in the creation of structures and vehicles that are energy efficient. Its milling solutions include high-quality process technology for producing high-grade flour products from raw materials including wheat, oats, corn, and pulses.

Due to the enthusiasm of its creator, Guido Grassi, Ocrim has been active in the milling sector from its inception. The strength of everyone who believes in Ocrim and has always believed in it has allowed the company to specialize in the supply of wheat and corn milling plants, feed mills, and cereal processing systems in general, as well as and above all, starting in 1982, with the turnkey formula that has undoubtedly led it to be recognized as a great multinational company throughout the world.

A leading international supplier of goods and services for intelligent milling is Henry Simon. Today, Henry Simon provides the milling sector with a wide selection of dependable aftermarket parts and premium intelligent milling equipment. Grain milling equipment, a broad range of high-tech cleaning equipment, including optical sorters, high-performance grain and flour handling gear, accurate scale and packaging equipment, and products for servicing customers globally, are its core product lines.

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East and Africa (MEA); RoW |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Russia, Brazil, Argentina, Japan, Australia, China, India, Indonesia, South Korea |

| Key Segments Covered | Type, Application, Sales Channel, Region |

| Key Companies Profiled | Bühler AG; Ocrim SpA; Satake Corporation; Alapala Machine Industry & Trade Inc.; Henry Simon Group; Conagra Brands Inc; Archer Daniels Midland Company; Cargill Incorporated; The King Milling Company; Ardent Mills LLC |

| Report Coverage | Strategic Growth Initiatives, DROT Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, and Competitive Landscape. |

| Customization & Pricing | Available upon Request |

The global wheat milling machine market is estimated to be valued at USD 1,330.2 million in 2025.

It is projected to reach USD 1,950.1 million by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are roller mill, plan sifter and sieve.

bakeries & confectioneries segment is expected to dominate with a 35.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Market Share Distribution Among Cultured Wheat Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA