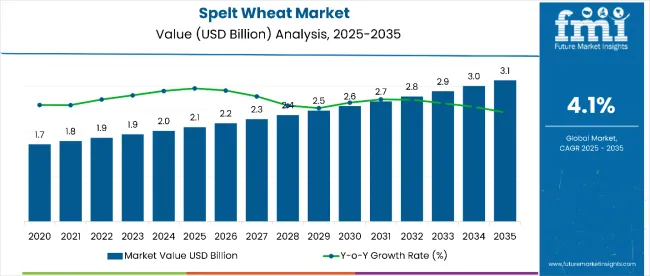

The spelt wheat market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. The spelt wheat market is projected to add an absolute dollar opportunity of USD 1.0 billion over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.1 billion |

| Forecast Value in (2035F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

This reflects a 1.52 times growth at a compound annual growth rate of 4.1%. The market’s evolution is expected to be shaped by rising demand for ancient grain alternatives in bakery products, nutritional supplements, and health-conscious consumer segments, particularly where gluten sensitivity awareness and digestive health benefits are prioritized.

By 2030, the market is likely to reach approximately USD 2.6 billion, accounting for USD 500 million in incremental value over the first half of the decade. The remaining USD 400 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product substitution for conventional wheat flour and gluten-free alternatives is gaining traction due to spelt’s favorable nutritional profile and digestive compatibility properties.

Companies such as Bob’s Red Mill Natural Foods and Ardent Mills are advancing their competitive positions through investment in organic certification processes and scalable milling technologies. Health-focused procurement models are supporting expansion into artisanal baking, functional food manufacturing, and premium retail segments. Market performance will remain anchored in organic certification standards, nutritional density benchmarks, and supply chain sustainability practices.

The spelt wheat market holds approximately 18% of the ancient grains market, driven by its nutritional superiority over modern wheat varieties and growing consumer awareness of digestive health benefits. It accounts for around 12% of the alternative flour market, supported by its baking versatility and nutty flavor profile that appeals to artisanal food manufacturers.

The market contributes nearly 8% to the organic grain market, particularly for products targeting gluten-sensitive consumers seeking wheat alternatives. It holds close to 6% of the health food ingredients market, where spelt flour is used for premium baking mixes, breakfast cereals, and functional food formulations.

The share in the specialty grain market reaches about 15%, reflecting its preference among health-conscious consumers and professional bakers seeking heritage grain alternatives to conventional wheat in certified organic and biodynamic food production.

The market is undergoing structural change driven by rising demand for nutrient-dense and easily digestible grain alternatives. Advanced processing methods using traditional stone milling and temperature-controlled techniques have enhanced flour quality, nutritional retention, and shelf stability, making spelt a viable premium alternative to conventional wheat flour.

Manufacturers are introducing organic certifications and heritage grain marketing strategies tailored for health food retailers and specialty bakeries, expanding their role beyond basic flour production. Strategic collaborations between organic farmers and specialty food distributors have accelerated adoption in premium food manufacturing.

Direct-to-consumer channels have widened access and awareness, reshaping traditional grain distribution networks and forcing conventional flour suppliers to develop specialty product lines.

The market is segmented by nature, variety, format, distribution channel, end use, and region. By nature, the market is bifurcated into organic and conventional. Based on variety, the market is divided into whole flour and white spelt flour. Based on format, the market is classified into flour, whole kernels, custom multigrain blends, and cracked. In terms of distribution channel, the market is characterized into direct, indirect, hypermarkets, supermarkets, and retailers.

By end use, the market is divided into the food industry, the feed industry, and other industries. Regionally, the market is analyzed across North America, Latin America, Europe, East Asia, South Asia and Pacific, Oceania, and the Middle East and Africa.

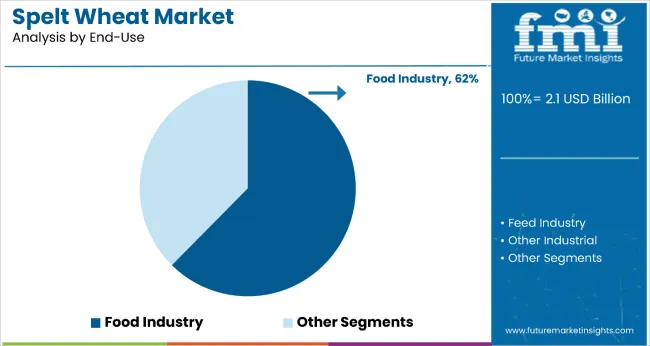

The food industry segment holds a leading 62% share in the end-use category, reflecting spelt wheat’s widespread adoption in bakery products, breakfast cereals, pasta manufacturing, and specialty food production. Food manufacturers increasingly prefer spelt flour due to its superior nutritional density, unique flavor profile, and marketing advantages as an ancient grain alternative.

The segment benefits from rising consumer demand for heritage grains and clean-label products that align with health and wellness trends. Spelt’s versatility in bread production, pastry applications, and breakfast cereal manufacturing has expanded its usage across multiple food categories.

Manufacturers are focusing on developing organic certified spelt-based products and premium positioning strategies, catering to both artisanal food producers and mainstream manufacturers seeking differentiated ingredients. As sustainability regulations strengthen and ancient grain certifications become more prevalent, spelt wheat’s role as a preferred heritage grain ingredient is expected to increase, supporting steady growth in food industry applications.

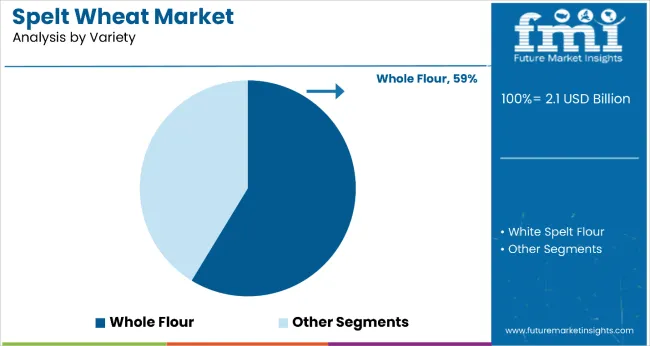

The whole flour segment dominates the variety category with a 59% market share, driven by increasing consumer preference for nutrient-dense flour options that retain the complete nutritional profile of the spelt grain. Whole spelt flour maintains the bran, germ, and endosperm, providing superior fiber content, protein levels, and mineral density compared to refined alternatives.

The product’s health positioning and compatibility with whole grain dietary recommendations further enhance its market appeal. Innovations in stone milling techniques and temperature-controlled processing have improved whole spelt flour quality while maintaining its nutritional integrity.

The segment continues to benefit from rising demand in artisanal bakeries and health food manufacturing, where whole grain content is prioritized. As design preferences evolve toward authentic heritage grain experiences and nutritional transparency, whole spelt flour is expected to maintain strong demand within the broader specialty flour landscape.

Spelt’s superior nutritional profile, easier digestibility compared to modern wheat, and heritage grain appeal make it an attractive alternative for health-conscious consumers seeking natural food options.

Growing awareness of gluten sensitivity and digestive health issues is further propelling adoption, especially among consumers seeking wheat alternatives that maintain baking functionality. Government support for heritage crop cultivation, along with innovations in organic farming techniques, is also enhancing product availability and quality consistency.

As consumer preferences shift toward ancient grains and artisanal food products, and as awareness of spelt’s nutritional benefits increases in emerging markets, the market outlook remains favorable. With consumers and food manufacturers prioritizing ingredient transparency, digestive wellness, and heritage grain authenticity, spelt wheat is well-positioned to expand across various bakery, breakfast cereal, and functional food applications.

From 2025 to 2035, heritage grain authentication systems were introduced in specialty food retail, improving product traceability, enhancing consumer confidence, and supporting premium pricing strategies. These developments position certification-ready spelt suppliers as key partners for brands seeking verified ancient grain credentials and transparent supply chain documentation.

Ancient Grain Health Positioning Drives Spelt Wheat Adoption

The growing recognition of spelt wheat’s superior nutritional profile and digestive benefits has been identified as the primary catalyst for growth in the spelt wheat market. In 2024, increased consumer awareness of gluten sensitivity and wheat intolerance prompted widespread adoption of spelt flour as a more digestible wheat alternative in artisanal bakeries and health food manufacturing.

By 2025, functional food developers were incorporating spelt-based ingredients into breakfast cereals, energy bars, and nutritional supplements to address consumer demand for ancient grain nutrition. These developments demonstrate that health-focused positioning rather than price competition is driving spelt wheat procurement cycles.

Manufacturers offering certified organic spelt with documented nutritional testing are well-positioned to capture sustained demand from health-conscious consumers and premium food brands.

Heritage Grain Authentication Creates Premium Market Opportunities

In 2024, specialty food retailers began implementing heritage grain authentication systems to verify spelt wheat origin, cultivation methods, and processing standards, leading to improved consumer confidence and premium product positioning. By 2025, artisanal bakeries and organic food manufacturers were adopting certified ancient grain verification programs for spelt-based products, supporting brand differentiation and marketing claims.

These implementations demonstrate that when spelt wheat adopts transparent authentication and traceability systems, consumer trust and premium pricing opportunities are significantly enhanced. Suppliers that offer heritage grain certification, organic verification, and supply chain documentation are positioned to capture growing demand from quality-focused food manufacturers and specialty retail channels seeking authentic ancient grain products.

| Country | CAGR |

|---|---|

| USA | 4.5% |

| Germany | 4% |

| France | 3.5% |

| UK | 2% |

| Japan | 1% |

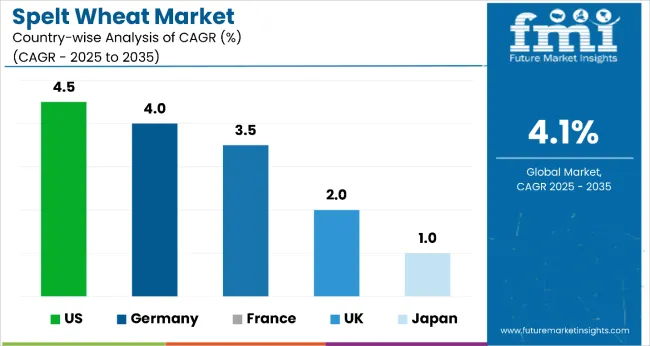

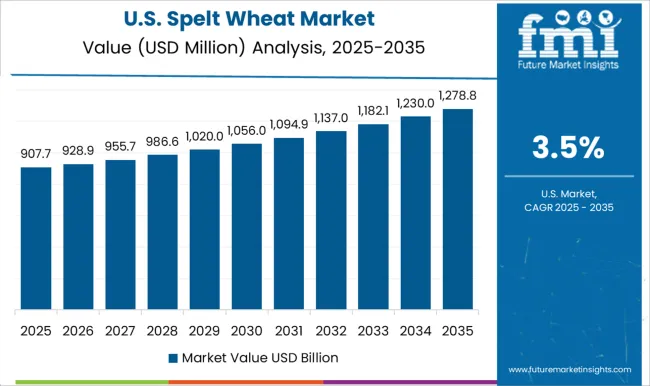

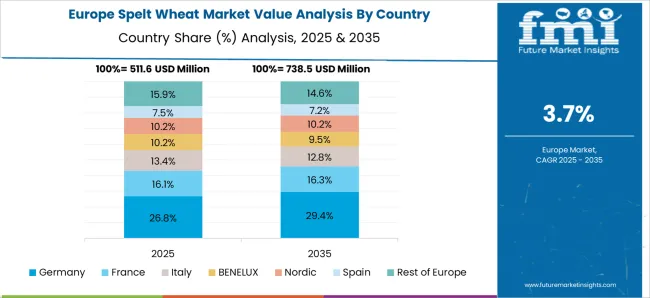

Between 2025 and 2035, the USA is expected to lead the global spelt wheat market with a CAGR of 4.5%, supported by rising consumer demand for organic ancient grains and increased retail penetration across health food sectors. Germany follows with a 4.0% CAGR, reflecting strong domestic production, EU-certified organic cultivation, and widespread artisanal adoption.

France is projected to expand at 3.5%, driven by heritage grain revival and premium bakery formulations. The UK trails with a 2.0% CAGR due to limited domestic output and import reliance, while Japan records the slowest growth at 1.0%, reflecting niche demand and restricted cultivation.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The spelt wheat market in the USA is projected to grow at a CAGR of 4.5% from 2025 to 2035, outperforming other major consumer nations. Growth is driven by health-conscious consumer preferences, expanding organic food retail, and rising adoption of ancient grains in premium bakery products.

California, Oregon, and Pennsylvania are primary consumption hubs, while import reliance on Canadian and European organic producers continues to rise. USDA-certified organic spelt flour remains a top choice among specialty bakeries and natural food brands. Demand is also growing in gluten-sensitive consumer segments and artisan breakfast cereal manufacturing.

The sales of spelt wheat in Germany are expected to expand at a CAGR of 4.0% from 2025 to 2035, supported by deep-rooted traditional use and strong organic certification practices. Southern regions such as Bavaria and Baden-Württemberg lead both cultivation and processing, aided by EU subsidies for heritage grains.

Organic spelt dominates due to consumer preference for clean-label ingredients and traceable farming practices. Stone milling techniques and artisanal product positioning support domestic and export markets, especially across Central and Northern Europe.

The revenue from spelt wheat in France is expected to grow at a CAGR of 3.5% from 2025 to 2035, driven by consumer interest in ancient grains and regional culinary traditions. Production clusters in the Rhône-Alpes and Provence regions supply artisanal bakeries and gourmet flour producers.

Government programs promoting agricultural biodiversity have supported the expansion of spelt cultivation. French bakers incorporate spelt into AOC-certified bread formulations, with organic variants favored in export products targeting premium bakery chains in Belgium and Switzerland.

The spelt wheat market in the UK is projected to grow at a CAGR of 2.0% from 2025 to 2035, lagging behind continental Europe due to smaller cultivation areas and import reliance. Regional production is concentrated in East Anglia and Yorkshire.

Demand is led by artisanal bakeries and health food retailers focusing on ancient grains for gluten-sensitive consumers. Imports from Germany and France are vital to meet processing volumes. Product formulation centers around clean-label bread and pastries, with spelt increasingly adopted in gluten-reduced mixes.

The demand for spelt wheat in Japan is forecast to grow at a modest CAGR of 1.0% from 2025 to 2035, reflecting niche but emerging interest in ancient grains among urban health-conscious consumers. Domestic cultivation remains limited due to climatic constraints, with the majority of spelt flour imported from European suppliers.

Premium health food retailers and organic bakeries in Tokyo and Osaka drive market demand. Spelt is mostly incorporated into functional food products and luxury bakery items, though it remains a specialty grain in the broader Japanese diet.

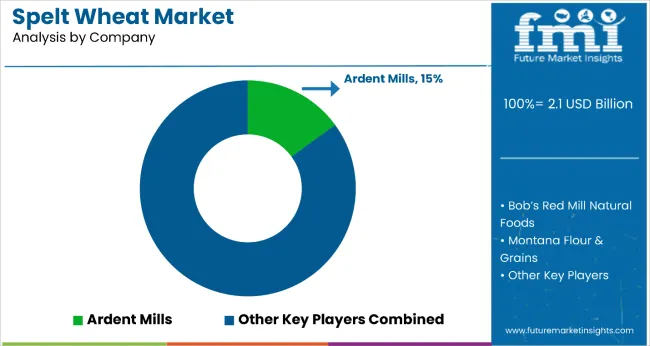

The spelt wheat market is moderately fragmented, featuring a mix of regional specialty grain processors and international organic food suppliers with varying degrees of heritage grain expertise and distribution capabilities. Bob’s Red Mill Natural Foods and Ardent Mills lead the North American specialty flour segment, supplying premium spelt products for health food retailers and artisanal bakeries. Their strength lies in organic certification standards and established relationships with natural food distributors.

Arnreiter Mühle GmbH and Pfahnl Backmittel GmbH differentiate through traditional European milling techniques, including stone grinding and temperature-controlled processing that preserves nutritional integrity and authentic flavor profiles for premium bakery applications. European Flour Millers and Blattmann Schweiz AG focus on certified organic spelt production and heritage grain authentication, addressing the growing demand for traceable ancient grain ingredients in specialty food manufacturing.

Regional players such as Montana Flour & Grains, Healthy Hildegard, and The Spelt Company Somerset Ltd dominate local cultivation and specialty processing in their respective markets, ensuring supply chain control and regional market penetration for artisanal food producers. Meanwhile, Einbrunger Mühle Karl Rölkens emphasizes traditional German milling standards and organic certification, creating value in heritage grain authenticity and premium positioning.

Entry barriers remain significant, driven by challenges in organic certification requirements, heritage grain authentication, and compliance with specialty food standards across multiple markets. Competitiveness increasingly depends on organic farming partnerships, traditional processing capabilities, and supply chain transparency for health-focused food manufacturers and premium retail environments.

Key Developments in Spelt Wheat Market

Ardent Mills released its FY24 ESG report highlighting key milestones such as the launch of innovative plant-based solutions, advances in sustainable farming practices, and ongoing efforts to support inclusion and employee well-being. These developments reinforce the company’s commitment to responsible ingredient sourcing and growth in specialty grains like spelt wheat.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Nature | Organic and Conventional |

| Variety | Whole Flour and White Spelt Flour |

| Format | Flour, Whole Kernels, Custom Multigrain Blends, and Cracked |

| Distribution Channel | Direct, Indirect, Hypermarkets, Supermarkets, and Retailers |

| End Use | Food Industry, Feed Industry, and Other Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Arnreiter Mühle GmbH, Pfahnl Backmittel GmbH, European Flour Millers, Blattmann Schweiz AG, Einbrunger Mühle Karl Rölkens, Ardent Mills, Bob’s Red Mill Natural Foods, Healthy Hildegard, Montana Flour & Grains, The Spelt Company Somerset Ltd. |

| Additional Attributes | Dollar sales by nature and end-use sector, growing usage in organic food manufacturing and artisanal bakery applications for health-conscious consumers, stable demand in heritage grain and specialty flour markets, innovations in stone milling and organic certification improve product quality, nutritional retention, and market positioning |

The global spelt wheat market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the spelt wheat market is projected to reach USD 3.1 billion by 2035.

The spelt wheat market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in spelt wheat market are organic and conventional.

In terms of variety, whole flour segment to command 47.8% share in the spelt wheat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Spelt Milk Market Analysis by Ingredients, Distribution Channel, Form, Flavor and Region Through 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA