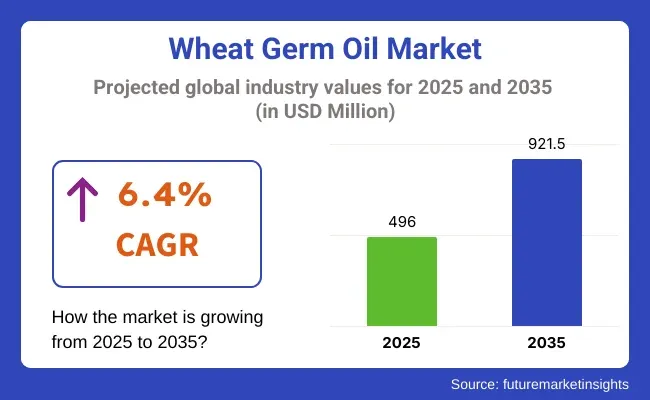

The world market of wheat germ oil in 2024 was USD 468.4 million. Demand for wheat germ oil grew in 2025, therefore the world market will be USD 496.0 million in 2025. The global revenue over the period of projection (2025 to 2035) will be 6.4% CAGR, and in 2035 will be USD 922.4 million.

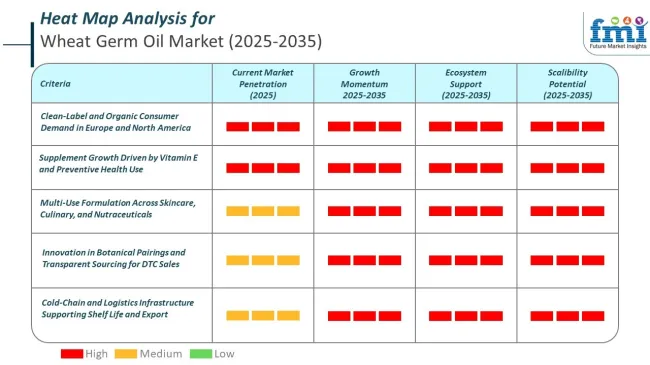

Its most powerful drivers of growth are rising consumer knowledge regarding the nutritional and health benefits of wheat germ oil, including high concentrations of vitamin E, omega-3 and omega-6 fatty acids, and antioxidants. These make it the ideal ingredient to include in cosmetics, dietary supplements, and functional food.

For beauty and skin care, wheat germ oil is bought because of its repairing and anti-aging properties to the skin. La Tourangelle, NOW Foods, and Weleda marketed wheat germ oil as part of their skin, hair, and well-being product offerings when natural and organic products gained popularity.

In the food and beverage sector, wheat germ oil has been more demanded as a functional nutrition oil in health foods, salad dressings, and marinades, largely favored in Europe and North America, where newer clean-label, functional, and plant-based nutrition is preferred.

Increased demand for organic ones that are cold-pressed is also responsible for the market growth as people also look for chemical-free and unprocessed ones. Market for sports nutrition is also a giant consumer as wheat germ oil is beneficial to restore muscle as well as also immune function.

The market is further aided by improved distribution channels, including eCommerce sites and health food stores, to enable niche players and organic brands to reach a wider global market. Rising vegan and holistic wellness trends further boost demand for wheat germ oil as a natural remedy ingredient and doctored skincare.

Per-capita consumption in the wheat germ oil market is highest in Japan and Italy. Daily use is most common in wellness-focused consumer segments. In Southeast Asia, volumes remain modest, used in skin formulations more than edible applications. Across the USA, per-person consumption is strongest in high-income households using it as a cooking oil substitute or cosmetic base. Uptake is limited in most low-income zones due to high product pricing.

Cold-chain infrastructure for the wheat germ oil market remains patchy. In South India and Central Africa, bulk storage lacks dedicated thermal control. Modern trade chains in Singapore and the UAE offer glass-bottle packaging with controlled humidity conditions. Foodservice usage remains low, limited to functional beverage chains and boutique cafés.

The following table shows a comparative analysis of six-month CAGR variation for both base year (2024) and current year (2025) for the worldwide wheat germ oil market. This analysis reveals key changes in performance along with revenue realization patterns which gives the stakeholders a clearer vision for growth trajectory during the year. H1, or the first half of the year, runs from January to June. H2 is the second half of the year, July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.0% |

| H2 (2024 to 2034) | 6.2% |

| H1 (2025 to 2035) | 6.3% |

| H2 (2025 to 2035) | 6.4% |

The market is estimated to experience a growth of 6.0% s in the first half (H1) of the period ranging from 2025 to 2035, followed by a slightly better CAGR of 6.2% in the second half (H2) of the same decade. From the latter half of H1 2025 to the latter half of 2035, the CAGR rises further to 6.3% in the first half and remains strong at 6.4% in the second half. H1, the sector saw a 30 BPS increase where as in the H2, the business y-o-y saw a degrowth of 20 BPS.

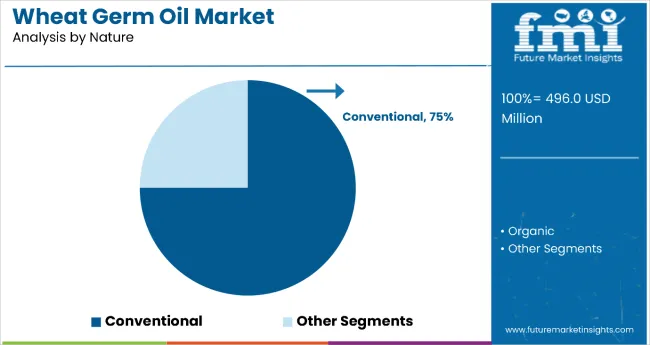

Conventional wheat germ oil dominates the market with approximately 75% of the market share in the nature category. This substantial leadership is attributed to conventional oil's cost-effectiveness and widespread accessibility across various industries including food processing, cosmetics, and dietary supplements.

Conventional wheat germ oil provides reliable quality at lower price points compared to organic alternatives, making it the preferred choice for large-scale manufacturers and cost-sensitive consumers seeking the nutritional benefits of wheat germ oil without premium pricing.

However, the organic segment is experiencing the fastest growth within the wheat germ oil market, driven by increasing consumer awareness of natural and chemical-free products. Organic wheat germ oil appeals to health-conscious consumers who prioritize products derived from organically grown wheat kernels without GMOs, synthetic pesticides, or artificial fertilizers.

As consumer preferences continue to shift toward sustainable and environmentally conscious choices, the organic segment is positioned for accelerated growth despite its smaller current market share.

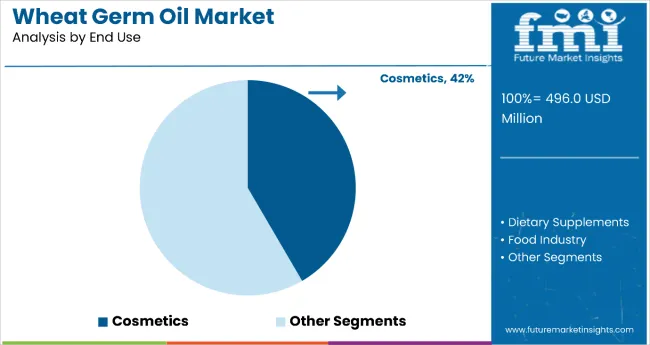

Cosmetics holds the dominant position with 41.6% of the market share in the end use category within the wheat germ oil market. This leadership is driven by wheat germ oil's exceptional vitamin E content and antioxidant properties that make it highly valuable for anti-aging skincare formulations, moisturizers, serums, and hair care products.

The oil's ability to nourish and rejuvenate skin while providing protection against environmental damage has made it a sought-after ingredient in premium cosmetic formulations.

The segment's dominance is reinforced by the growing global cosmetics industry and increasing consumer demand for natural and organic skincare products that deliver proven anti-aging benefits. Wheat germ oil's rich composition of essential fatty acids, vitamins, and antioxidants aligns perfectly with consumer preferences for clean beauty products that support skin health and vitality.

As the beauty industry continues to expand and consumers increasingly prioritize natural ingredients in their skincare routines, the cosmetics segment is expected to maintain its leading position through continued innovation in anti-aging and skin health solutions that leverage wheat germ oil's proven benefits.

Within Tier 1, the industry is highly consolidated with the presence of stalwarts and global players operating in edible oils, cosmetics, and nutraceuticals segments, with strong revenue contribution, global footprint, and product portfolio. Some of these companies have significant brand equity, extensive distribution networks, and investments toward R&D, producing high-quality wheat germ oil that can be used in culinary and cosmetic applications.

Enter ARCHER DANIELS MIDLAND (ADM), who can harness their ultra-modern processing capabilities and careful buildout of an agricultural supply chain to provide a reliable source of high-quality wheat germ oil for both nutritional and industrial applications.

A major name in the field, Botanic Innovations offers specialty oils - including both cold-pressed wheat germ oil for dietary supplements, as well as cold-pressed wheat germ oil for personal care formulations - complemented by certifications and quality standards. Typically engaged in large volume supply, private labeling deals, and other business to business (B2B) arrangements, Marketplace Tier 1 players will ensure that they are global market leaders.

Tier 2 consists of mid-sized companies that have established a niche which specializes in natural, organic or cold-pressed wheat germ oil, appealing to health-minded and environmentally conscious consumers. Henry Lamotte Oils GmbH and OLVEA Group are some of the key players in Europe, leveraging their sustainable sourcing practices, premium quality oils for cosmetics, food supplements, and functional foods.

Such companies tend to be regional leaders that may sell to formulators and retailers within the natural products space and further on a quality differentiation basis with organic certifications and customer service.

Tier 3 contains small-scale producers, startups and boutique wellness brands that specialize in direct-to-consumer business through e-commerce marketplaces and specialty retailers. The wheat germ oil capsules and bottled oils - available for home use - are among them: NOW Foods and Swanson Health, for example.

These companies tend to stress clean labels, affordability and focused marketing through social media and health influencers. The scale may not be great, but their ability to innovate and engage consumers quickly allows them to stake a claim on niche demand.Shift in Wheat Germ Oil Market Demand Trends and Key Brand Responses.

Avoid Single-Use Oils in Wellness Regimens

Shift: People are now interested in multi-use oils that not only can be used as a food item but can also be used in a wellness regimen. Wheat germ oil, being rich in vitamin E, omega-3 fatty acids, and antioxidants, is not a one-use wellness product anymore to be used simply for cooking, skin care, or hair treatment. The growing trend of minimalist and holistic living among urban millennials and Gen Z further propelled this trend, as they look for value-based, multi-functional products to streamline everyday rituals.

Strategic Response: Brands like Botani Australia launched a two-in-one wheat germ oil for topical use and ingestion, emphasizing its skin-friendly and heart-health benefits. The line helped drive a 14% boost in the direct-to-consumer (DTC) business, spearheaded specifically from online well-being platforms.

Aroma Magic India launched a "Rituals for Life" re-launch for wheat germ oil to highlight the metro city consumers' search for daily well-being staples and recorded 10% growth in the metro city market segment. Pack innovation comprises measuring droppers with straightforward dosages in kitchen application as well as dermatology application for improved consumers convenience.

Sustained demand for Infant and Maternity Product

Shift: Parents are increasingly choosing natural and safe oils for maternity health and baby care, particularly for baby massage oils, prenatal vitamins, and stretch marks creams. The richness of wheat germ oil in vitamin E is seen as softening and nourishing, and this attracts healthy mothers who opt for organic and toxin-free products. Demand is growing especially in Europe, North America, and Japan, where clinical safety assessment and organic accreditation are buying triggers.

Strategic Response: Earth Mama Organics introduced a wheat germ oil-enriched belly butter to target stretch mark prevention during pregnancy. The product affinity resulted in 11% growth in the organic maternity care segment. In Asia, Pigeon Japan launched a dermatologically tested baby massage oil with wheat germ oil, which picked up well in hospital retail chains and specialty baby boutiques.

Motherlove USA added wheat germ oil to its prenatal line of supplements with a focus on organic prenatal vitamins and growing 7% its market share within the organic supplements category. All these companies enjoy certified organic supply, clinical tests, and environment-friendly packaging that guarantees consumer trust.

Niche Demand in Pet Nutrition and Pet Grooming Products

Shift: As the humanization of pets increases, pet owners are spending on natural and botanical pet care products. Wheat germ oil is becoming increasingly recognized for pet coat health applications, joint wellness, and immune system support and thus is an in-demand ingredient in pet supplements, pet grooming oils, and pet-safe balms. Premium natural pet care continues to record solid growth in North American, Australian, and European markets.

Strategic Response: Wheat germ oil-enhanced pet chews from Zesty Paws USA, positioned for coat shine and joint health, accounted for a 12% niche sales boost through specialty pet shops. Blackmores in Australia extended into pet care with a wheat germ oil-based coat sheen spray for cats and dogs targeting green pet owners.

Brands are using vet-approved labels for pet health, hypoallergenic statements, and sustainability certifications to stand out in the saturated pet wellness category. Social media influencers and pet care blogs are driving product awareness.

Ingredient inclusion in Clean Label Men's Grooming Products

Shift: Men consumers increasingly demand natural, effective, and non-greasy personal care products. Wheat germ oil is being applied increasingly in conjunction with beard oils, shaving creams, and facial moisturizers, providing skin hydration with no heavy residue. North American, Indian, and European urban male consumers especially gravitate toward clean-label, sustainable grooming products featuring simple, familiar ingredients.

Strategic Response: Beardbrand USA launched Urban Garden beard oil, with wheat germ oil being a key component for beard health and skin nourishment, driving 9% sales growth in the metro market among 25-40 years male consumers. The Man Company India launched sulfates and parabens-free wheat germ shaving cream and achieved 10% metro market expansion.

These brands use masculine, clean branding and tend to bundle wheat germ oil products with wooden grooming kits, appealing to customers who have an interest in lifestyle. Subscription box and online sales are becoming major channels.

Artisan and Gourmet Culinary Oil Segment

Shift: There is increasing awareness of artisan oils for gourmet food preparation and finishing dishes, fueled by the home-cook trend and increased knowledge of functional ingredients and their function in cooking. Wheat germ oil with its nuttiness and nutritional profile is increasing in salad dressings, marinades, and cold uses, primarily in Europe and North America.

Strategic Response: La Tourangelle France launched a cold-pressed wheat germ oil line, which was positioned as a gourmet finishing oil for high-end cuisine, generating buzz in high-end retail and e-commerce gourmet channels. The product enjoyed a 15% sales increase in specialty food stores.

Primal Kitchen USA added wheat germ oil to its "Chef's Collection" of food products aimed at health-oriented foodies, featuring it in virtual cooking courses and influencer chef collaborations. Vistablene brand with vintage image and transparent glass containers highlight the artisanal nature of the oil and traceability.

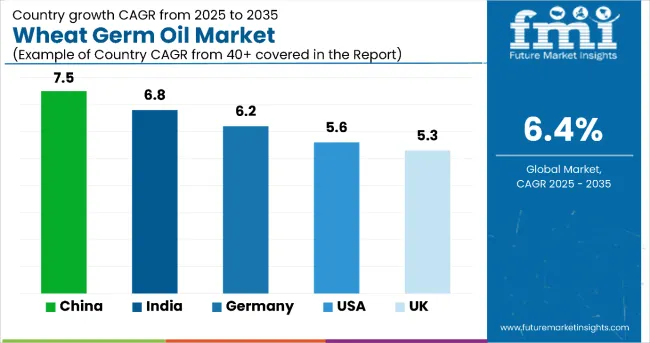

The following table shows the estimated growth rates of the top five countries. These territories are projected to exhibit high consumption of wheat germ oil through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.6% |

| Germany | 6.2% |

| China | 7.5% |

| United Kingdom | 5.3% |

| India | 6.8% |

The United States wheat germ oil market is positively influenced by an increasing consumption of wellness and preventive healthcare or clean-label products. With stronger demand for functional oils loaded with essential fatty acids, vitamin E, and antioxidants, wheat germ oil is becoming a natural answer for health supplements and skincare compositions. Regulatory cover potential by the FDA for natural supplements and increasing demand for non-synthetic ingredients remain a solid base for future growth.

Chinese consumers are the most optimistic for wheat germ oil demand and will drive the strongest growth: strong urbanization, growing middle-class and a proactive attitude towards health and wellness will all contribute to a strong demand until 2035. Abundant disposable incomes and exposure to global wellness trends have fueled demand for plant-derived, antioxidant-enriched offerings.

The popularity of wheat germ oil in skincare and hair care routines, as well as functional foods, taps into consumers' desire for products with traditional and medicinal benefits and appeals to Chinese consumers..

Wheat germ oil finds itself right at home in a country where the roots of traditional medicine run deep, especially in the case of Ayurveda. The oil’s inherent anti-inflammatory, antioxidant, and skin-nourishing properties appeal to consumers searching for natural remedies and immunity-boosting products.

Government initiatives under programme of “Ayushman Bharat” and campaigns to promote indigenous health products have contributed to regulating products for increased awareness and acceptance, while local manufacturing support under initiative of “Make in India” helps to improve domestic production and availability.

The German market’s expansion is spurred by the aging population concerned with preventive healthcare, coupled with a very health-conscious consumer base placing importance on eco-friendly and sustainably sourced products. Wheat germ oil, popular in both the food and personal care sectors for its heart health and anti-aging properties, is also coming into focus.

Within the natural cosmetics category, brands are including wheat germ oil in formulas mask for synthetic additive-free products. Germany’s robust organic food culture also provides an opportunity for wheat germ oil in cooking oils and nutritional supplements.

Consumer demand for clean-label products in the UK and the rising DIY wellness trend have boosted market growth for wheat germ oil. It appeals to health-conscious consumers who add it to smoothies, salads and use it as a skin care oil. As consumers are opting for home-based beauty treatments, the demand for wheat germ oil in natural beauty formulations also increases.

The wellness economy is thriving, and in the UK, manufacturers are working on innovative formats, including capsules, cold-pressed oils, and blends to meet ever-evolving consumer requirements.

wheat-germ-oil-market-analysis-by-company

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 496.0 million |

| Projected Market Size (2035) | USD 922.4 million |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD million/ Volume in million liters |

| Segments by Nature | Organic, Conventional |

| Segments by End Use | Cosmetics, Dietary Supplements, Pharmaceuticals, Food Industry, Feed Industry, Others |

| Segments by Sales Channel | B2B, B2C (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retailing) |

| Key Regions | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia & Belarus, and the Middle East & Africa |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | CONNOILS LLC, Swanson Health Products, General Nutrition Centers Inc., VIOBIN USA, NOW Foods LLC, GNLD International LTD., Inlife Pharma Pvt. Ltd., Country Life, NutriPlex Formulas Inc., KUNHUA BIOLOGICAL TECHNOLOGY CO. LTD, Archer Daniels Midland Company, Henan Ingredients Group Co. Ltd. |

| Additional Attributes | Growth driven by preventive health trends and demand for high-Vitamin E oils |

| Customization and Pricing | Customization and Pricing Available on Request |

The industry has been categorized into Organic and Conventional.

The industry has been categorized into Cosmetics, Dietary Supplements, Pharmaceuticals, Food Industry, Feed Industry, and Others.

The industry has been categorized into B2B and B2C.

B2C sales are further categorized into Store-Based Retail (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores) and Online Retailing.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The global industry is estimated at a value of USD 496.0 million in 2025.

Some of the leaders in this industry CONNOILS LLC, Swanson Health Products, General Nutrition Centers Inc., VIOBIN USA, NOW Foods, LLC, GNLD International LTD., Inlife Pharma Pvt. Ltd., and Others.

Europe is projected to hold a revenue share of 35.6% over the forecast period.

The industry is projected to grow at a forecast CAGR of 6.4% from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Litre) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 4: Global Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 8: Global Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 12: North America Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 14: North America Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 16: North America Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 20: Latin America Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 22: Latin America Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 24: Latin America Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 28: Western Europe Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Western Europe Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 36: Eastern Europe Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 38: Eastern Europe Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 52: East Asia Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 54: East Asia Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 56: East Asia Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Litre) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Nature, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Litre) Forecast by Nature, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Litre) Forecast by End Use, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Litre) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Nature, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Litre) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 10: Global Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 18: Global Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Nature, 2024 to 2034

Figure 22: Global Market Attractiveness by End Use, 2024 to 2034

Figure 23: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Nature, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 34: North America Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 38: North America Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 42: North America Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Nature, 2024 to 2034

Figure 46: North America Market Attractiveness by End Use, 2024 to 2034

Figure 47: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Nature, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 58: Latin America Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 62: Latin America Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Nature, 2024 to 2034

Figure 70: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Nature, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 82: Western Europe Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 86: Western Europe Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Nature, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Nature, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Nature, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Nature, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Nature, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Nature, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 154: East Asia Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 158: East Asia Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Nature, 2024 to 2034

Figure 166: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Nature, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Litre) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Nature, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Litre) Analysis by Nature, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Nature, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nature, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Litre) Analysis by End Use, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Litre) Analysis by Sales Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Nature, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Wheat Germ Oil in EU Size and Share Forecast Outlook 2025 to 2035

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA