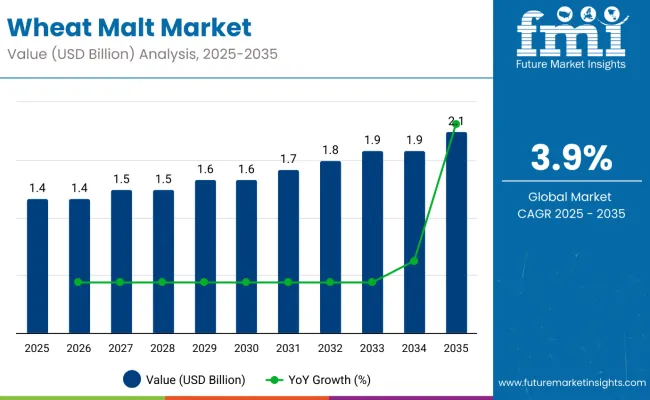

The wheat malt market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 1.4 billion |

| Forecast Value in 2035 (F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The market is expected to add an absolute dollar opportunity of about USD 0.7 billion during this period. This reflects a 1.5 times growth at a compound annual growth rate of 3.9%.The market evolution is expected to be shaped by rising demand across regions including North America, Europe, and Asia Pacific, and increasing consumption of malt-based products across various industries, especially bakery and beverages.

By 2030, the market is expected to reach USD 1.7 billion, contributing about USD 0.3 billion in incremental value over the first half of the decade. The remaining USD 0.4 billion is anticipated during the second half, reflecting a balanced growth pattern supported by rising consumer demand for malt-enriched products and expanding applications in craft and specialty brewing.

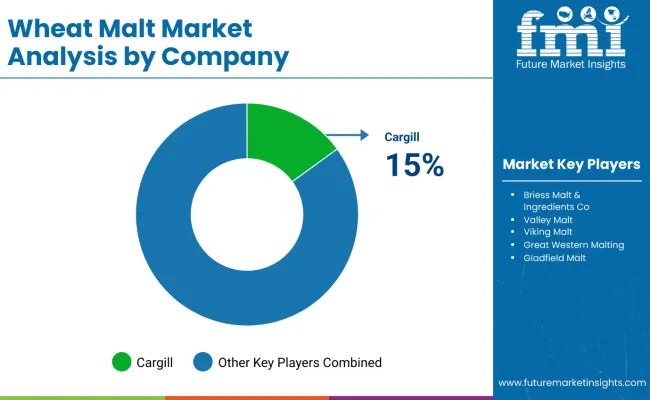

Companies such as Cargill, Briess Malt & Ingredients Co., Valley Malt, Viking Malt, Great Western Malting, Barrett Burston Malting Co. Pty. Ltd, Simpsons Malt Limited, Gladfield Malt, and Crisp Malting are strengthening their competitive positions through investments in specialty malt varieties, responsible sourcing, and capacity expansion to meet rising global demand. R&D is being directed toward enhancing malt quality, improving processing efficiency, and developing innovative applications in food and beverages.

The market holds a strong position across its parent industries, reflecting its expanding role in food and beverage applications. Within the bakery and confectionery segment, wheat malt accounts for nearly 66% of malted wheat flour consumption due to its flavor-enhancing and moisture-retaining properties. In the brewing industry, wheat malt accounts for about 40% of malt use, supported by its role in craft and specialty beer production. Within the health and functional food ingredients market, wheat malt commands a notable share, driven by consumer demand for protein-rich and nutrient-enhanced products. Across these parent markets, its contribution underscores both nutritional value and industrial versatility.

The market is evolving with advancements in malt processing and product innovation enhancing flavor profiles and nutritional benefits. Manufacturers are expanding applications into functional beverages, gluten-free bakery products, and natural food additives, supported by organic and non-GMO malt variants. Partnerships with foodservice providers and online retailers are broadening market reach. These trends are reshaping traditional malt usage and challenging other grain-based ingredients, driving diversity and growth in the wheat malt market landscape.

The market is segmented by type, form, end use, color, process, and region. By type, the market is bifurcated into white malt and red malt. Based on form, the market is divided into powder and liquid. In terms of end use, the market is categorized into beer industry, whiskey distilleries, food & beverages, and pharmaceutical. By color, the market is bifurcated into white and dark malt. By process, the market is segmented into base, crystal, raw, roast, and roll/flake malts. Regionally, the market spans across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

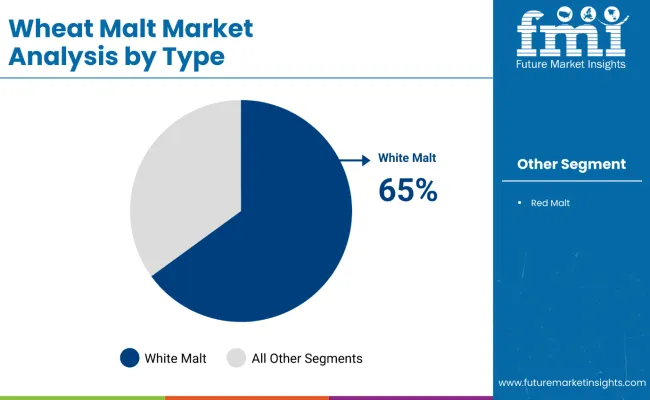

The white malt segment holds a 65% share in 2025, making it the most prominent type in the industry. Its widespread popularity is primarily due to its mild flavor profile and pale color, which make it especially suited for brewing light beers, lagers, and wheat beers. These beer types are highly favored in key regions like North America and Europe, where craft brewing and specialty beers continue to gain traction.

Beyond brewing, white malt is extensively used in bakery and confectionery products because it enhances flavor and improves texture, contributing to superior product quality. Furthermore, the rising consumer preference for healthier, protein-rich foods is accelerating demand for white malt, as its nutritional benefits align well with current dietary trends. This combination of versatility, culinary advantage, and health appeal solidifies white malt’s dominant position in the wheat malt market.

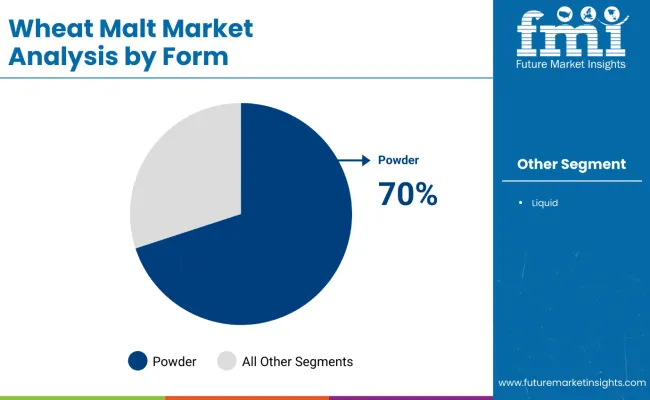

The powder segment in the market holds a dominant share of 70% as of 2025, making it the most significant form in the industry. Powdered malt is highly favored due to its ease of storage, handling, and longer shelf life compared to liquid malt. Its fine texture allows for better mixing and incorporation in a wide range of food and beverage applications, including bakery products, confectionery, and malted drink mixes.

The powder form offers manufacturers flexibility and consistency in product formulation, which is particularly valued in large-scale industrial production. Additionally, powdered malt is cost-effective to transport and store, further driving its preference among producers worldwide. Its versatility and functional benefits contribute decisively to its strong market position and steady growth in the wheat malt industry.

From 2025 to 2035, rising consumer demand for healthier, natural, and clean-label food and beverage products has significantly driven growth in the wheat malt market. Increasing preference for protein-rich, fortified, and organic malted products has encouraged producers to invest in advanced malting and processing technologies. These innovations help meet evolving dietary needs while expanding product portfolios to cater to both traditional brewing and modern functional food sectors.

Growing Consumer Health Awareness Drives Market Growth

The steady rise in consumer interest in natural ingredients and nutritional benefits is a major growth catalyst. Increasing demand for malt-based beverages, bakery items, and functional foods enriched with wheat malt supports market expansion. Manufacturers are improving malt quality, enhancing flavor, and optimizing nutritional content to meet consumer expectations for health and taste, particularly in craft beers and protein-enriched bakery products.

Innovation in Product Development Expands Market Opportunities

Recent advancements in malting processes, including organic and specialty malt formulations, have increased the market’s appeal beyond conventional beer brewing. These innovations provide better flavor profiles, enhanced nutritional value, and improved shelf life, opening new avenues in bakery, confectionery, and health-focused food segments. Companies embracing responsible sourcing and quality certifications gain competitive advantages, appealing to environmentally conscious and quality-driven consumers, strengthening long-term market growth.

| Countries | CAGR |

|---|---|

| India | 6.9% |

| China | 6.5% |

| Japan | 6.4% |

| USA | 3.9% |

| Germany | 3.6% |

| France | 3.5% |

| UK | 3.1% |

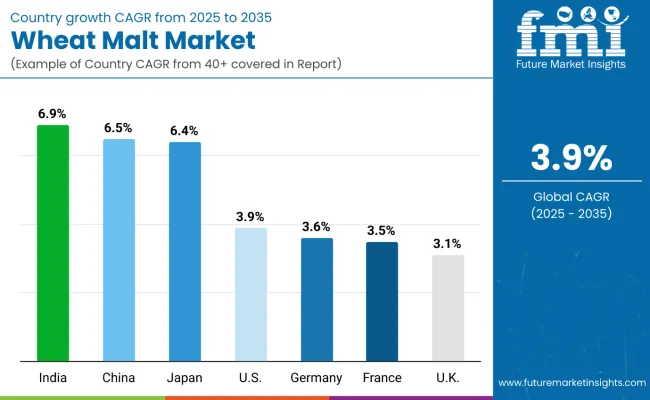

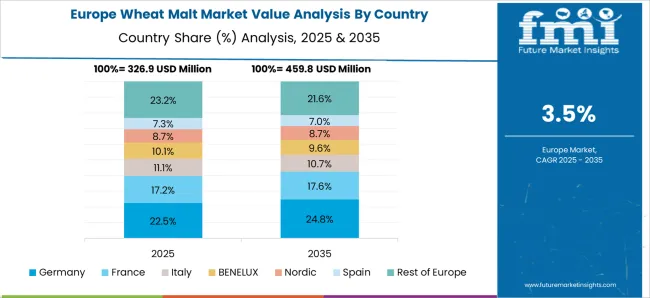

The market shows diverse growth rates across key countries, reflecting different market maturity and consumer trends. India leads with the highest CAGR of 6.9%, driven by strong demand for malted beverages, fortified bakery products, and rising health awareness amid rapid urbanization. China follows at 6.5%, supported by brewing modernization, higher disposable incomes, and government backing. Japan’sgrowth rate is 6.4%, boosted by technological advances and increased craft beer consumption. In contrast, the USA grows moderately at 3.9%, with a mature craft beer market. Germany (3.6%), the UK (3.1%), and France (3.5%) show steady growth, focusing on artisanal products and responsible sourcing. Emerging markets are outpacing mature ones in growth.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

The wheat malt market in India is expected to expand at a CAGR of 6.9% from 2025 to 2035, driven by increasing consumer demand for malted beverages and fortified bakery goods. Urbanization, lifestyle changes, and health awareness significantly boost market prospects. Domestic production is expanding to reduce import dependency. Marketing emphasizes malt’s nutritional benefits, aiding consumer education. Distribution channels grow, especially in urban and digital spaces. Interest in craft beers and wellness products bolsters demand. India experiences strong demand acceleration, positioning it as a vital growth region in the wheat malt market.

Demand for wheat malt in China is expected to expand at a CAGR of 6.5% from 2025 to 2035, driven by the expansion of large-scale craft and commercial breweries. Urbanization and rising disposable incomes boost demand in beverages and bakery applications. Investments in advanced malting and processing facilities raise product quality. Government initiatives support industry upgrades. Growing awareness of fortified and functional foods fosters market growth. Expanded distribution networks, including digital platforms, improve accessibility. Regional production hubs optimize supply chains. China stands as a key market for modern wheat malt production and consumption growth.

Revenue from wheat malt in Japan is expected to grow at a CAGR of 6.4% from 2025 to 2035, driven by technological advances in malt processing. The craft beer surge and malt-infused beverage expansion significantly increase demand. Enhanced processing techniques improve malt quality and versatility, extending applications into bakery and nutrition products. Rising consumer health consciousness supports innovation in protein enrichment and natural ingredients. Imports and domestic production investments strengthen supply chains. Regulatory frameworks assure food safety and quality. Collaboration between malt producers and beverage manufacturers expands product portfolios, driving market dynamism.

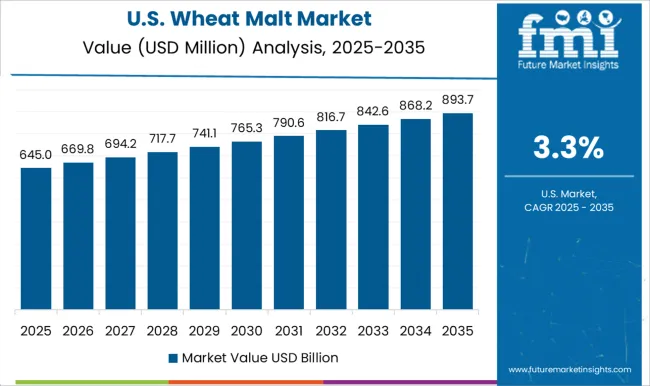

The wheat malt market in the USA is expected to expand at a CAGR of 3.9% from 2025 to 2035, driven by increasing demand for craft and specialty beers and healthier bakery products enriched with wheat malt’s nutritional benefits. Producers invest in advanced malting technologies and organic malt varieties to meet evolving consumer preferences. Distribution channels, including e-commerce and retail, are broadening market reach. The rise of craft breweries alongside increased malt-based beverage consumption further fuels demand. Regulatory support for responsible agricultural practices aids raw material supply. Innovations in malt extraction and processing boost product quality. Overall, the USA remains a crucial market with robust production capacity growth in wheat malt.

Demand for wheat malt in Germany is expected to grow at a CAGR of 3.6% from 2025 to 2035, driven by its rich brewing heritage and demand for high-quality malt used in both traditional and specialty beers. Innovations in malting processes enhance flavor and nutritional content, broadening applications into bakery and health food sectors. Stringent food safety and quality regulations ensure premium product standards. Export demand remains strong due to global recognition of German malt quality. Responsible production practices are increasingly adopted. Continuous innovation supports product diversification. Germany remains a leader in advanced malting technology adoption, maintaining a strong market position.

Sales of wheat malt in France are expected to grow at a CAGR of 3.5% from 2025 to 2035, supported by expanding bakery and beverage industries incorporating malt for flavor and nutrition. The rising consumer preference for artisanal and organic products fuels demand for high-quality malt. Producers focus on responsible sourcing and organic certifications to meet market trends. Malt usage in craft and specialty beverages is growing. Retail expansion and foodservice channels increase commercial opportunities. Innovations in formulation enhance shelf life and taste. Market expansion aligns with evolving consumer tastes and health awareness.

Revenue from wheat malt in the UK is expected to grow at a CAGR of 3.1% from 2025 to 2035, driven by a vibrant craft brewing scene and burgeoning artisanal bakery sector. Consumer demand for premium malt varieties encourages innovation and product diversification. Responsible sourcing practices are increasingly prioritized to align with regulatory standards and meet eco-conscious consumer needs. Malt demand rises due to specialty brews and fortified baked goods. Export activities significantly contribute to market growth. Efforts to improve malt quality and functional benefits are ongoing. The UK market benefits from strong domestic consumption and export demand.

The market is moderately consolidated, with key players distinguishing themselves through advanced malting technologies, product innovation, and strong regional presence. Leading companies such as Cargill, Briess Malt & Ingredients Co., and Viking Malt dominate by leveraging large-scale production capabilities and diverse product portfolios that include organic and specialty malts catering to brewing, bakery, and beverage sectors. Their strengths lie in efficient malting processes, stringent quality control, and extensive distribution networks.

Companies like Valley Malt and Great Western Malting focus on cost-effective production, supply chain optimization, and meeting rising demand for gluten-free, non-GMO, and specialty malt products in global markets. Regional players emphasize local sourcing, authentic malt quality, and customization for niche markets, especially in North America and Europe.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.4 billion |

| Type | White Malt and Red Malt |

| Form | Powder and Liquid |

| End Use | Beer Industry, Whiskey Distilleries, Food & Beverages, and Pharmaceutical |

| Color | White and Dark |

| Process | Base, Crystal, Raw, Roast, and Roll/Flake malt types |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and Oceania |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, South Korea, Australia and 40+ others |

| Key Companies Profiled | Cargill, Briess Malt & Ingredients Co., Valley Malt, Viking Malt, Great Western Malting, Barrett Burston Malting Co. Pty. Ltd, Simpsons Malt Limited, Gladfield Malt, and Crisp Malting |

| Additional Attributes | Dollar sales by type, form, end use, color, and process; rising demand for organic, non-GMO, and specialty malts; growth in craft beer, whiskey, and fortified bakery products; innovations in malting technologies; focus on responsible sourcing, traceability, and quality malt production |

The global wheat malt market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the wheat malt market is projected to reach USD 2.1 billion by 2035.

The wheat malt market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in wheat malt market are white malt and red malt.

In terms of form, powder segment to command 62.7% share in the wheat malt market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Malted Wheat Flour Market

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Market Share Distribution Among Cultured Wheat Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA