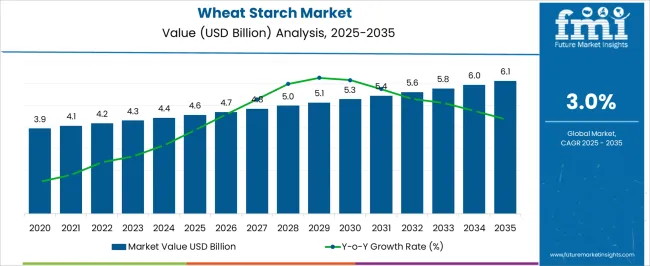

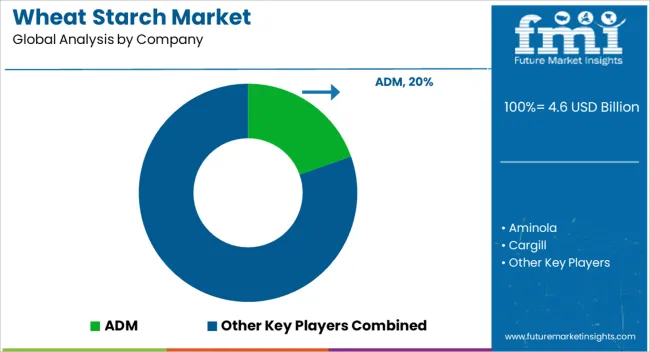

The wheat starch market is projected to grow from USD 4.6 billion in 2025 to USD 6.1 billion by 2035, with a CAGR of 3.0%. A Peak-to-Trough Analysis indicates gradual growth with some fluctuations, reflecting shifts in demand due to external factors like agriculture trends and food processing innovations. Between 2025 and 2030, the market grows from USD 4.6 billion to USD 5.3 billion, contributing USD 0.7 billion in growth, with a CAGR of 3.7%. This early-phase growth reflects increasing demand for wheat starch in food, beverage, and industrial applications, including as a thickening agent, stabilizer, and binding material. The market experiences a slight peak at USD 5.3 billion in 2030, followed by a deceleration between 2030 and 2032, where the market grows from USD 5.3 billion to USD 5.4 billion, adding USD 0.1 billion in growth, with a slower CAGR of 1.9%. This deceleration signals the market nearing maturity, with stabilization in demand as wheat starch becomes a standard ingredient across industries. From 2032 to 2035, the market grows from USD 5.4 billion to USD 6.1 billion, contributing USD 0.7 billion in growth, with a higher CAGR of 4.3%. This final acceleration is driven by increasing use in emerging markets and innovations in wheat starch-based products. The Peak-to-Trough Analysis shows early acceleration followed by stabilization, with a final surge as new applications and regional growth drive demand.

| Metric | Value |

|---|---|

| Wheat Starch Market Estimated Value in (2025 E) | USD 4.6 billion |

| Wheat Starch Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The wheat starch market is expanding steadily due to its broad application across food processing and industrial sectors. Increasing consumer preference for natural and clean-label ingredients has driven demand for native wheat starch, which is widely used for its functional properties such as thickening, binding, and moisture retention.

The rising production of processed foods and convenience meals has contributed to increased use of starch in formulations. Innovations in wheat starch processing have improved product purity and consistency, making it favorable for diverse applications.

Distribution channels have evolved to meet growing demand in food and beverage industries, which prioritize ingredient quality and supply reliability. The market outlook remains positive as manufacturers seek clean-label alternatives and improved texture in food products. Growth is expected to be led by the native wheat starch type, powder form, and food and beverage distribution channels.

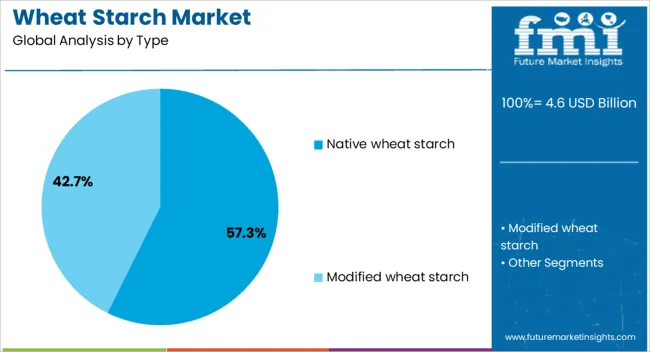

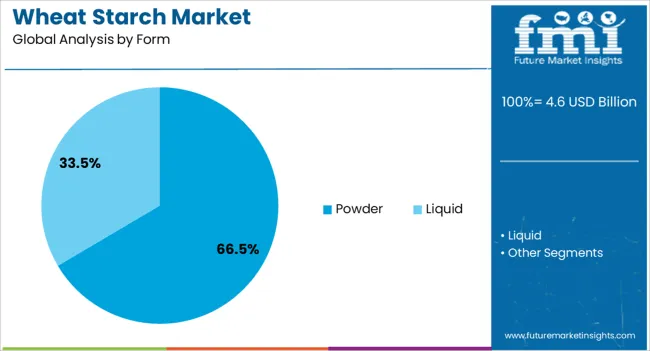

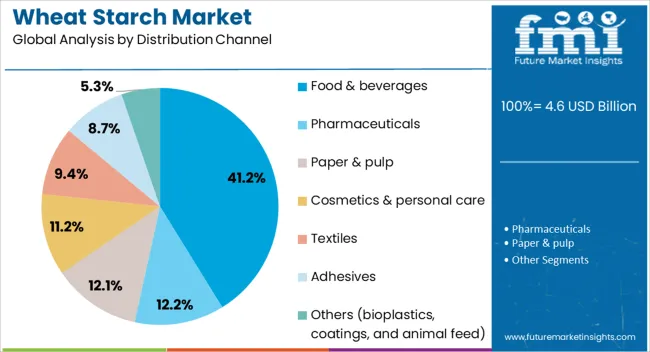

The wheat starch market is segmented by type, form, distribution channel, and region. By type, it is divided into native wheat starch and modified wheat starch. In terms of form, the market is classified into powder and liquid. Based on distribution channel, it is segmented into food and beverages, pharmaceuticals, paper and pulp, cosmetics and personal care, textiles, adhesives, and others (including bioplastics, coatings, and animal feed). Regionally, the wheat starch industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Native Wheat Starch segment is projected to hold 57.3% of the wheat starch market revenue in 2025, securing its position as the dominant type. This segment has grown due to its natural origin and versatile functional characteristics suitable for thickening, stabilizing, and texturizing foods.

Native wheat starch is preferred in food applications for its clean-label status and compatibility with organic and natural product trends. Additionally, food processors value native starch for its consistent performance in baking, sauces, and dairy products.

As demand for minimally processed ingredients rises, native wheat starch continues to meet consumer and regulatory expectations, driving segment growth.

The Powder form segment is expected to contribute 66.5% of the wheat starch market revenue in 2025, maintaining its lead as the most widely used form. Powdered wheat starch offers convenience in handling, storage, and incorporation into manufacturing processes.

It provides uniform particle size and moisture content, which ensures reliable performance in food processing. The powdered form facilitates easier blending with other ingredients and allows for precise dosing, essential for large-scale production.

Furthermore, the powder form is favored for extended shelf life and transport efficiency, supporting its widespread adoption in food manufacturing.

The Food & Beverages distribution channel is projected to account for 41.2% of the wheat starch market revenue in 2025, making it the largest end-use channel. Growth in this segment has been propelled by the demand for wheat starch as a key ingredient in bakery products, confectionery, sauces, and processed foods.

Food manufacturers seek wheat starch to improve product texture, consistency, and shelf life while meeting consumer demands for natural ingredients. The segment is supported by the rising trend of convenience foods and increased consumption of processed snacks and ready-to-eat meals.

As food innovation continues to focus on clean-label and functional ingredients, the food and beverages channel is expected to maintain its dominant role in driving wheat starch demand.

The wheat starch market is experiencing steady growth due to the increasing demand for starch in food and beverage, industrial, and pharmaceutical applications. Wheat starch is widely used as a thickening agent, stabilizer, and emulsifier, providing functional properties like texture, viscosity, and binding in a range of products. The growing demand for processed and convenience foods, along with the rise in industrial applications for adhesives, textiles, and paper, is driving the market. Despite challenges such as fluctuating wheat prices and competition from other starch types, wheat starch remains a versatile and widely used ingredient in various sectors.

The primary driver of the wheat starch market is the rising demand for processed and convenience foods that require starch for texture and consistency. Wheat starch, with its neutral flavor and functional properties, is extensively used in sauces, soups, gravies, baked goods, and dairy products. As consumer preferences shift towards ready-to-eat meals and packaged food products, the demand for wheat starch in the food and beverage industry continues to grow. Wheat starch is increasingly used in industrial applications such as adhesives, paper manufacturing, and textiles due to its binding and thickening properties. The versatility of wheat starch in multiple sectors, coupled with its cost-effectiveness compared to other starches, positions it as a key ingredient in various manufacturing processes, further driving market growth.

A significant challenge in the wheat starch market is the volatility of raw material prices, particularly wheat. Wheat is a commodity subject to fluctuations due to factors such as weather conditions, crop yields, and global supply chain disruptions. These price changes can affect the production cost of wheat starch, impacting its affordability for manufacturers and consumers. Wheat starch faces competition from other starches such as corn, potato, and tapioca, which are also widely used in food and industrial applications. These alternative starches often offer similar functional benefits and may be preferred in regions where wheat availability is limited or production costs are lower. To overcome these challenges, manufacturers must focus on innovation in wheat starch production to improve yield, reduce costs, and maintain competitive pricing.

The wheat starch market presents significant opportunities due to the growing consumer demand for clean label products and organic ingredients. As consumers become more conscious of the ingredients in their food and seek products with simple, recognizable components, there is an increasing preference for natural, non-GMO starches. Wheat starch, being a natural and versatile ingredient, is well-positioned to meet these demands in the food and beverage industry. The rising popularity of organic foods is providing an opportunity for wheat starch to be used in organic product formulations. As manufacturers focus on offering cleaner, more transparent products, the demand for wheat starch in organic and clean-label applications will continue to expand. The trend toward healthier eating and more eco-conscious consumer choices is expected to drive further growth in the wheat starch market.

A key trend in the wheat starch market is the advancement of starch modification technologies to enhance the functionality of wheat starch in various applications. Modified wheat starches, including pre-gelatinized and resistant starches, are gaining popularity in food formulations, offering improved texture, stability, and digestion properties. These modifications allow for the development of products with enhanced shelf life, reduced fat content, and better functionality. In addition, the demand for wheat starch in non-food applications, such as biodegradable plastics, adhesives, and coatings, is increasing. As sustainability trends influence the packaging and manufacturing industries, the use of wheat starch in eco-friendly alternatives to traditional plastic products is expected to rise. These advancements in starch modification and the diversification of wheat starch applications are driving innovation and shaping the future of the market.

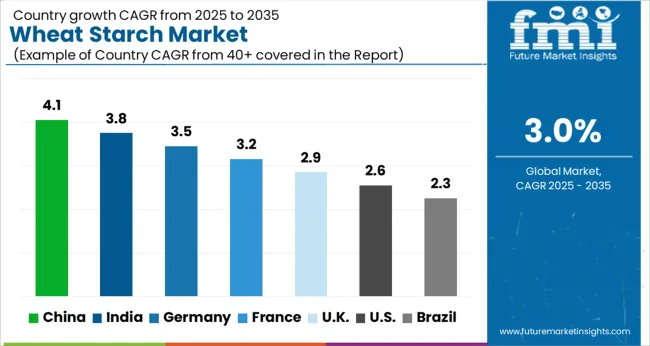

The wheat starch market is projected to grow at a global CAGR of 3.0% from 2025 to 2035. China leads with a growth rate of 4.1%, followed by India at 3.8% and Germany at 3.5%. The UK is expected to grow at 2.9%, while the USA shows a growth rate of 2.6%. The demand for wheat starch is being driven by its increasing application in the food and beverage industry, as well as its rising use in bio-based plastics and other industrial sectors. Emerging markets, particularly in China and India, are contributing significantly to the growth of the wheat starch market due to the expanding food processing industries. Meanwhile, developed economies like the UK and USA are witnessing steady growth in wheat starch usage, driven by demand for processed food products. The analysis spans over 40 countries, with the leading markets highlighted below.

India is projected to grow at a CAGR of 3.8% through 2035, supported by the growing food processing industry. The demand for wheat starch in India is rising due to its widespread use in food products such as noodles, sauces, and baked goods. The increasing population and expanding urban centers are contributing to the growing demand for processed foods, leading to a rise in wheat starch consumption. The agricultural base is strengthening, offering raw materials for wheat starch production, further stimulating market growth. As the country adopts more sustainable food packaging and processing solutions, wheat starch’s role in industrial applications is expected to rise.

China is projected to grow at a CAGR of 4.1% through 2035, leading the wheat starch market. The increasing demand for wheat starch in food applications, especially in the processed food industry, is driving the market. China’s food industry, which includes noodle production, snacks, and other baked goods, is a key consumer of wheat starch. The rising focus on sustainable packaging and biodegradable products is fueling the demand for wheat starch-based materials. China’s strong agricultural output also provides ample wheat supply, supporting the growth of wheat starch production.

Germany is projected to grow at a CAGR of 3.5% through 2035, supported by steady demand in the food and beverage industry. Germany’s focus on food quality, sustainability, and innovation drives demand for wheat starch, particularly in the production of noodles, sauces, and snacks. The country’s growing preference for clean-label and natural food ingredients is also increasing the demand for wheat starch as a food additive. Germany’s advanced technology in food processing and manufacturing also plays a role in driving the adoption of wheat starch in various industrial applications.

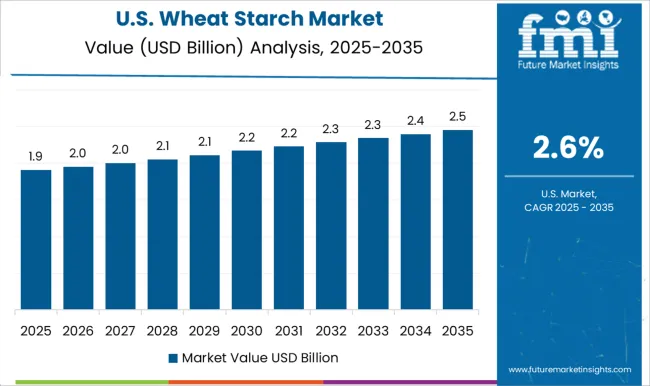

The United States is projected to grow at a CAGR of 2.6% through 2035, with steady demand for wheat starch in the food and beverage sector. Wheat starch is used widely in the USA for food applications, particularly in processed foods, sauces, and bakery products. The rising consumer demand for healthier and more sustainable food products is encouraging food manufacturers to use wheat starch as an alternative to synthetic additives. The growth of the gluten-free and organic food segments is also boosting the demand for wheat starch in the USA market.

The United Kingdom is projected to grow at a CAGR of 2.9% through 2035, with demand driven by the increasing consumption of processed and convenience foods. Wheat starch plays a crucial role in the UK food and beverage industry, particularly in bakery products, snacks, and sauces. With the growing trend towards plant-based and sustainable food solutions, the demand for wheat starch is expected to rise. The UK’s focus on reducing food waste and improving food quality further supports the need for wheat starch as a functional ingredient in various products.

The wheat starch market is driven by key players offering high-quality wheat starch products used in food, beverage, pharmaceutical, and industrial applications. ADM is a market leader, known for its advanced wheat starch solutions that cater to the food and beverage, biofuel, and textile industries, with a focus on providing high purity and functionality. Aminola specializes in producing wheat-based ingredients, including starches that offer high-quality performance for food processing, and health-related applications.

Cargill provides a wide range of wheat starches, focusing on their applications in food, pharmaceuticals, and bioengineering industries. Their products are designed to improve texture, stability, and viscosity in food applications while also being used in industrial processes.

Novasol Ingredients and Pruthvi Foods offer wheat starches that focus on functionality for the food industry, helping manufacturers improve texture, flavor, and shelf life of products. Roquette Frères and Tereos are key players providing high-quality wheat starch products for food and industrial applications, with a focus on enhancing product performance and meeting the growing demand for sustainable ingredients in food processing.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Native wheat starch and Modified wheat starch |

| Form | Powder and Liquid |

| Distribution Channel | Food & beverages, Pharmaceuticals, Paper & pulp, Cosmetics & personal care, Textiles, Adhesives, and Others (bioplastics, coatings, and animal feed) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ADM, Aminola, Cargill, Crespel & Deiters Group, Fengchen Group, Meelunie, Novasol Ingredients, Pruthvi Foods, Roquette Frères, and Tereos |

| Additional Attributes | Dollar sales by product type (food-grade starch, industrial-grade starch, modified starches) and end-use segments (food and beverage, pharmaceuticals, textiles, paper, biofuels). Demand dynamics are influenced by the growing consumption of processed foods, rising demand for biodegradable materials, and increasing applications of starch in pharmaceuticals and cosmetics. Regional trends show strong growth in North America and Europe due to rising demand for processed food products and sustainability trends, while Asia-Pacific is expanding rapidly due to the growth of food processing industries. |

The global wheat starch market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the wheat starch market is projected to reach USD 6.1 billion by 2035.

The wheat starch market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in wheat starch market are native wheat starch and modified wheat starch.

In terms of form, powder segment to command 66.5% share in the wheat starch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA