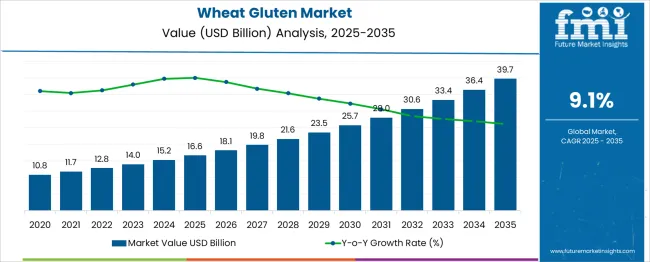

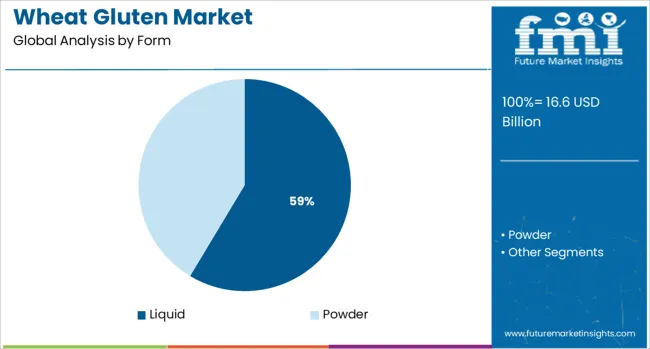

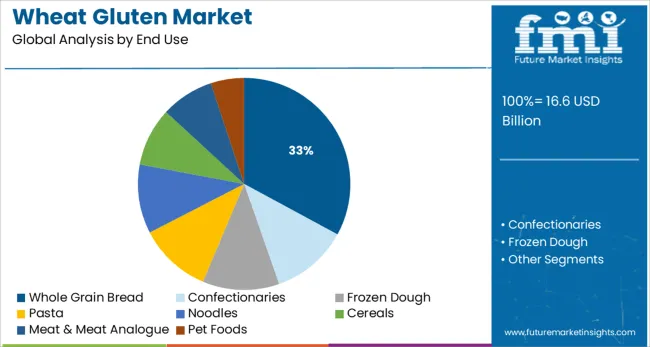

The wheat gluten market is projected to grow from USD 16.6 billion in 2025 to USD 39.7 billion by 2035, at a CAGR of 9.1%. Growth is shaped by rising consumer demand for plant-based food products, increased consumption of whole grain bread, and the widespread use of wheat gluten as a functional ingredient in various food products. The liquid form of wheat gluten will dominate the market, with 58.6% of the share in 2025, due to its versatility and ease of incorporation into food processing. The whole grain bread segment leads the end-use applications, contributing 32.9% of the market share as the trend towards healthier bread alternatives continues to rise.

Market growth is further driven by the increasing adoption of wheat gluten in vegan and plant-based diets, as well as its role as a key ingredient in meat analogs and other convenience foods. As health-conscious consumers demand better nutrition, wheat gluten’s role as a binding and texture-enhancing agent in plant-based meat products solidifies its presence in the global market. North America, Asia-Pacific, and Europe continue to be the key regions driving demand due to strong food processing industries and consumer preference for plant-based alternatives.

The wheat gluten market faces challenges from the rising demand for gluten-free diets due to health concerns such as celiac disease and gluten sensitivity. Despite these challenges, the continuous innovation in wheat gluten production processes and increasing consumer awareness about the benefits of plant-based foods will drive the market forward.

| Metric | Value |

|---|---|

| Wheat Gluten Market Estimated Value in (2025 E) | USD 16.6 billion |

| Wheat Gluten Market Forecast Value in (2035 F) | USD 39.7 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The liquid form of wheat gluten is projected to dominate the market with a share of 58.6% in 2025. This is primarily driven by its widespread use in industrial food processing, where it offers superior functional properties such as dough elasticity and moisture retention. The versatility of liquid wheat gluten makes it suitable for a wide range of applications, including bakery products, meat analogs, and processed foods. Its ease of incorporation into food formulations, cost-efficiency, and ability to enhance product texture have made it the preferred form for manufacturers, particularly in the bakery industry. Liquid wheat gluten’s growing use in the production of plant-based meat alternatives also contributes to its strong market position.

The whole grain bread segment is expected to lead the end-use applications, commanding 32.9% of the market share in 2025. This dominance is driven by increasing consumer preference for healthier, whole grain alternatives to traditional white bread. Wheat gluten plays a crucial role in improving the texture and elasticity of whole grain breads, making them more appealing to consumers. The health-conscious shift towards whole grains, combined with the growing demand for fiber-rich diets, has further propelled the use of wheat gluten in bread production. As more consumers prioritize nutritional value in their food choices, the demand for whole grain bread is set to continue growing, positioning this segment as a significant driver of the wheat gluten market.

Increasing cases of lactose intolerance and rising concerns about animal welfare are projected to propel consumers to become vegetarian or vegan. Thus, companies are striving to manufacture plant-based food and beverages with various healthy ingredients, including wheat gluten.

As per the Vegan Society, in 2024, 44% of people worldwide had tried vegan meat alternatives, 81% had tried plant-based milk, 25% had consumed vegan egg replacements, and 48% had tried other dairy alternatives. This trend is projected to continue in future years, thereby driving the global wheat gluten market growth.

While those people living with celiac disease and gluten intolerance can benefit from going gluten-free, it does have certain limitations. The inclusion of gliadin in wheat gluten can result in the occurrence of autoimmune reactions in some people.

Gluten sensitivity can also lead to muscle pain, abdominal pain, nausea, bloating, fatigue, depression, and weight gain. Driven by the above-mentioned factors, expansion of the global wheat gluten market size may get hampered in the upcoming years.

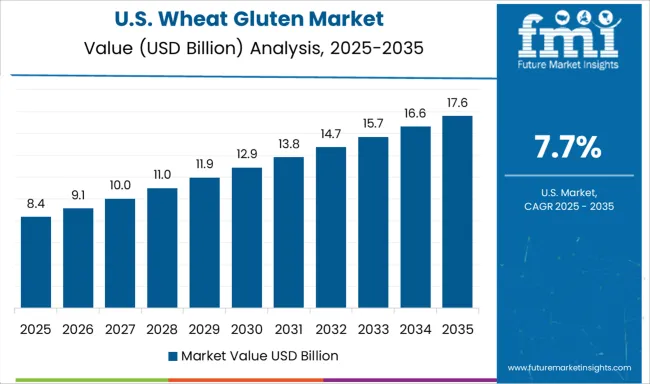

Based on region, North America is likely to remain at the forefront by generating the largest wheat gluten market share in the evaluation period. The increasing vegan population in the USA and Canada is one of the major factors that is contributing to the regional market growth.

As per the Vegan Society, in January 2025, nearly 629,000 people signed up for the Veganuary campaign from 228 countries, including the USA These numbers are expected to surge at a fast pace, thereby propelling the North America market.

Moreover, changing consumer preference for healthy food and beverages, as well as high demand for meat-free diets in this region would foster growth in future. The popularity of wheat gluten is likely to grow in North America with its increasing adoption in the diets of athletes and bodybuilders who suffer from gastric problems or celiac disease.

Asia Pacific is expected to remain in the second position in the assessment period. This growth is attributable to the increasing shift of people towards plant-based, regenerative, and sustainable food items consisting of immunity-boosting ingredients.

Rising prevalence of various disorders, such as blood pressure, cholesterol, and diabetes is another crucial factor that is likely to push sales of wheat gluten in India and China.

As per the World Health Organization (WHO), diabetes is considered to be a growing challenge in India with about 8.7% diabetic population belonging to the age group of 20 and 70 years.

Increasing life expectancy, tobacco usage, rapid urbanization, unhealthy diets, and sedentary lifestyles are responsible for driving the prevalence of diabetes in this country. These factors are expected to boost the need for wheat gluten across Asia Pacific.

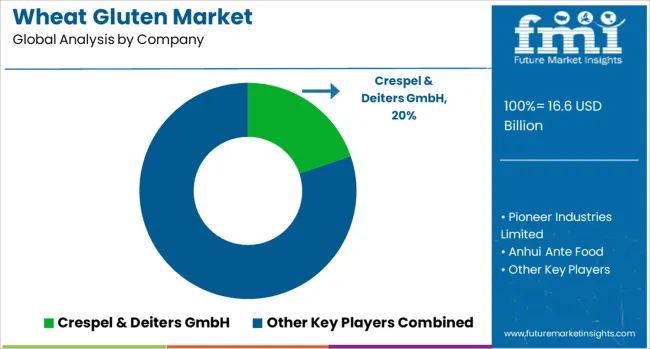

Some of the renowned companies operating in the global wheat gluten market include Crespel & Deiters GmbH, Pioneer Industries Limited, Anhui Ante Food, Ardent Mills LLC, MGP Ingredients, Anhui Ruifuxiang, Z & F Sungold Corporation, Royal Ingredients Group, Sungold Corporation, Tereos, Shandong Qufeng, Bryan W. Nash & Sons Limited, Kroener Staerke, Cargill Inc., and AB Amilina among others.

The global market is highly competitive in nature with the presence of several key players. The majority of the key players are investing in research and development activities, as well as embarking on mergers and acquisitions to gain a competitive edge in the global market and expand their existing portfolios.

A few other companies are striving to manufacture cutting-edge products with attractive offerings to cater to the ever-increasing demand for wheat gluten.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Form, End Use, Distribution Channel, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Crespel & Deiters GmbH; Pioneer Industries Limited; Anhui Ante Food; Ardent Mills LLC; MGP Ingredients; Anhui Ruifuxiang; Z & F Sungold Corporation; Royal Ingredients Group; Sungold Corporation; Tereos; Shandong Qufeng; Bryan W. Nash & Sons Limited; Kroener Staerke; Cargill Inc.; AB Amilina |

| Customization | Available Upon Request |

The global wheat gluten market is estimated to be valued at USD 16.6 billion in 2025.

The market size for the wheat gluten market is projected to reach USD 39.7 billion by 2035.

The wheat gluten market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in wheat gluten market are liquid and powder.

In terms of end use, whole grain bread segment to command 32.9% share in the wheat gluten market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Germ Market Analysis by Nature, Sales Channel and Form Through 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Market Share Distribution Among Cultured Wheat Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA