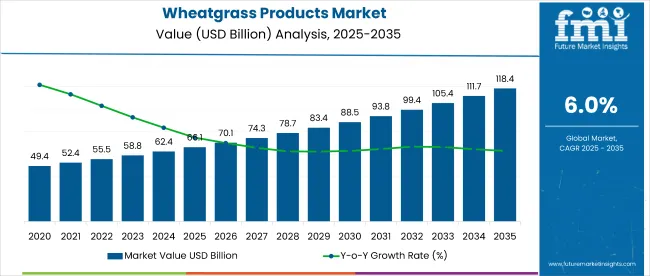

The global wheatgrass products market is valued at USD 66.1 billion in 2025 and is expected to reach USD 118.4 billion by 2035, reflecting a CAGR of 6%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 66.1 billion |

| Projected Value (2035F) | USD 118.4 billion |

| CAGR (2025 to 2035) | 6% |

Market expansion is driven by increased consumer awareness of wheatgrass’ health benefits, the global rise in chronic illnesses such as diabetes and cardiovascular conditions, and heightened demand for organic and natural food products. The popularity of detoxification trends and plant-based supplements will also support the rising adoption of wheatgrass-based food, beverages, and nutraceuticals globally.

The market holds approximately 3% of the global functional foods market and around 4.5% of the dietary supplements market, primarily driven by demand for detox and immunity-boosting products. Within the superfoods market, it represents nearly 6%, reflecting its rising popularity alongside spirulina, moringa, and chlorella.

In the organic food and beverage space, wheatgrass contributes about 2%, while its share in the nutraceuticals market stands close to 3.8%. Its strongest presence is observed in the plant-based and herbal supplements segments, where it exceeds 5%.

Government regulations impacting the market focus on convenient formats, clean-label packaging, and cross-sector integration into cosmetics and pharmaceuticals. Government regulations promoting organic farming and bans on synthetic additives will further boost organic wheatgrass product development.

Companies are investing in sustainable sourcing and expanding distribution through both offline retail and digital platforms. Continued R&D in the antioxidant and detox properties of wheatgrass is expected to unlock new commercial opportunities in the wellness sector.

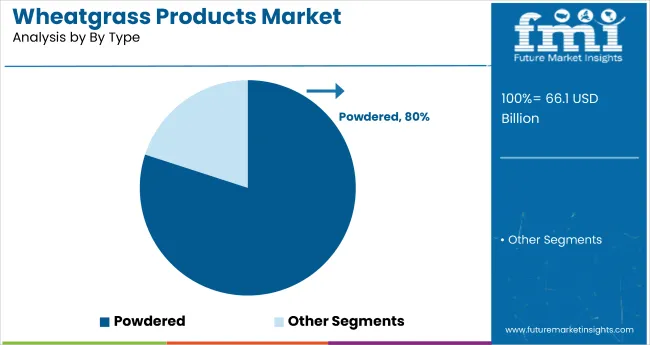

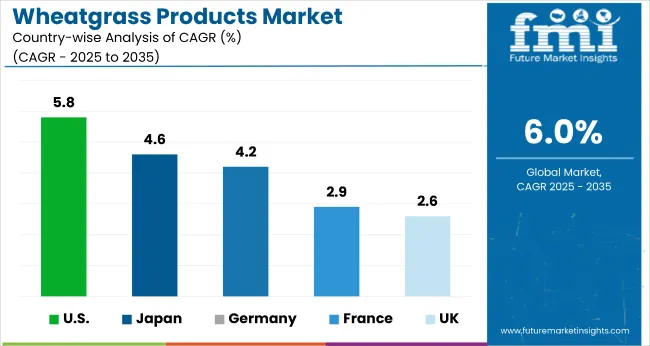

The USA is projected to be the fastest-growing market, expanding at a CAGR of 5.8%. Powdered will lead the type segment with a 80% share, while organic dominates the natural type with a 90% share in 2025.While, Japan and Germany markets are also expected to grow at CAGRs of 4.6% and 4.2%, respectively.

The global wheatgrass products market is segmented into type, nature, end-use application, packaging type, distribution channel. and region. By type, the market is bifurcated into juice and powder. Based on nature, the market is divided into natural and organic. By end use application, the market includes industrial (food & beverages, nutraceuticals, personal care & cosmetics, pharmaceuticals, pet food), and household.

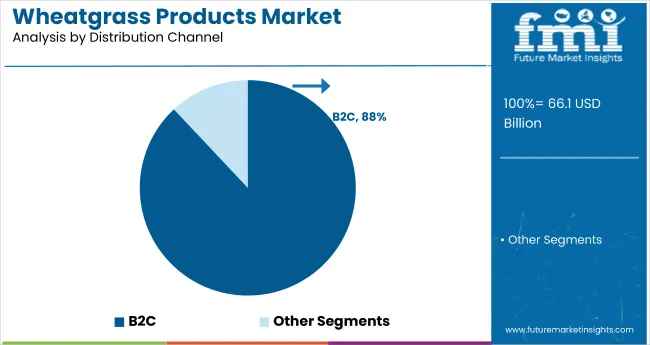

By packaging type, the market is segmented pouches, tins, bottles, sachets and capsules. Based on distribution channel, the market is categorized into b2b and b2c (hypermarket/supermarket, convenience store, specialty store, online retailers, and others [direct sales, health stores, and export distributors]). Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Powdered wheatgrass products are projected to lead the form segment, accounting for 80% of the global market share in 2025. Growth is driven by its ease of integration into everyday health routines like smoothies, shakes, and supplements.

Powdered formats also offer longer shelf life and ease of storage, making them more desirable among health-conscious and fitness-oriented consumers. Juice-based wheatgrass products are gaining popularity in ready-to-drink segments but remain secondary to powders in terms of volume and value.

Organic wheatgrass is expected to dominate the nature segment with a 90% market share in 2025. Consumers are increasingly shifting toward organic variants due to their perceived purity, absence of synthetic chemicals, and alignment with clean-label trends. The rising popularity of veganism and plant-based nutrition is boosting the organic segment, particularly in the USA, Brazil, and Germany.

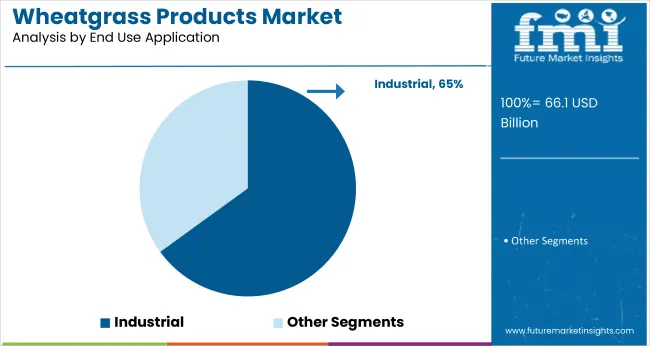

The industrial segment is anticipated to lead the end-use application segment, accounting for 65% of the global market share in 2025. Growth is driven by wheatgrass’s antioxidant and detoxifying benefits, making it ideal for supplements and functional foods. Pharmaceuticals and personal care applications are expanding steadily. Household consumption is rising but remains niche compared to industrial integration.

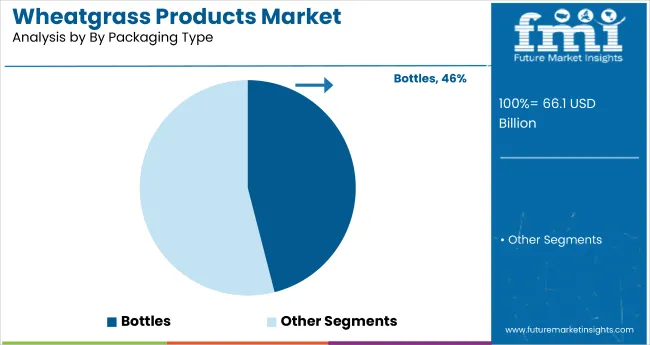

Bottles are projected to dominate the packaging type segment with a 46% market share in 2025. Bottles offer better storage and protection for wheatgrass juice and powdered products, supporting product longevity and visual appeal. Consumers prefer bottles for convenience and precise dosage control. Eco-conscious packaging innovations are also being adopted, with brands focusing on recyclable and biodegradable materials.

B2C channels is expected to lead the distribution channel segment, accounting for 88% of global market share in 2025. The rise of health-focused store formats and online wellness platforms is driving this trend. Online retailers are gaining momentum due to convenience and access to organic niche brands. B2B channels are primarily favored for industrial bulk supply.

The global wheatgrass products market is witnessing robust growth, driven by rising consumer focus on natural wellness, plant-based nutrition, and detoxification. Wheatgrass is gaining popularity for its high concentration of antioxidants, chlorophyll, and essential nutrients, aligning with clean-label, vegan, and functional health trends.

Recent Trends in the Wheatgrass Products Market

Challenges in the Wheatgrass Products Market

The USA leads the wheatgrass products market, driven by its mature health-conscious consumer base and strong retail infrastructure.

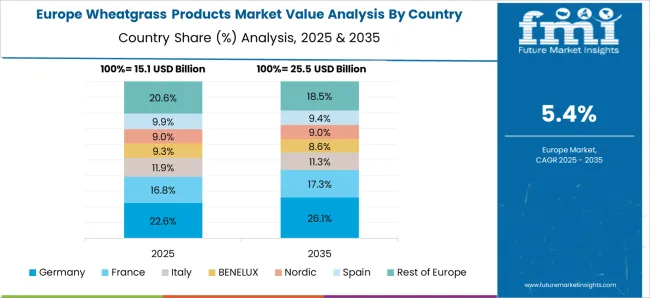

Japan follows with a CAGR of 4.6%, owing to its aging population and widespread use of functional foods. Germany ranks third at 4.2%, supported by strong demand for organic wellness products. France shows moderate growth at 2.9%, while the UK exhibits the slowest growth among these markets at just 2.6%, despite growing vegan trends.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

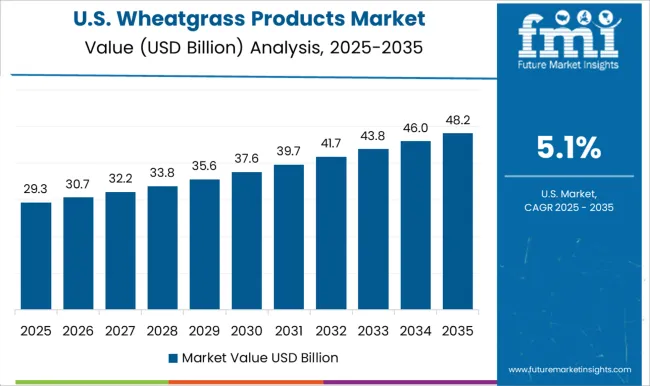

The wheatgrass products revenue in the USA is projected to expand at a CAGR of 5.8% from 2025 to 2035. As a mature and health-conscious market, the USA remains a key revenue generator for wheatgrass products. A high prevalence of gluten intolerance and chronic lifestyle diseases such as diabetes and obesity is driving demand for functional health products like wheatgrass. Major brands are leveraging retail shelf space in supermarkets and expanding through digital health platforms.

The sales of wheatgrass products in the UK are expanding at a CAGR of 2.6% from 2025 to 2035. Demand is being driven by the rising vegan population and increasing interest in plant-based detox and immunity-boosting solutions. Consumers in the UK are increasingly adopting wheatgrass in the form of smoothies, juices, and health supplements. Despite moderate growth, the market is supported by premium organic offerings.

The demand for wheatgrass products in Germany is projected to grow at a CAGR of 4.2% from 2025 to 2035. The country represents a major share of the European market, owing to heightened consumer interest in organic, immunity-boosting, and sustainable wellness products. Wheatgrass supplements are widely accepted in the personal care and nutraceutical sectors. German manufacturers are diversifying product offerings across capsules, beverages, and powdered blends.

The wheatgrass products market in France is projected to grow at a CAGR of 2.9% from 2025 and 2035. French consumers are gradually embracing wheatgrass as part of a broader shift toward natural and holistic nutrition. Although growth is moderate, demand is steadily increasing among urban populations, especially in Paris and Lyon. Organic powders and ready-to-drink formats are gaining appeal in health food chains and pharmacies.

The wheatgrass products market in Japan is expected to grow at a CAGR of 4.6% from 2025 to 2035. The country shows significant growth potential due to its aging population and widespread interest in functional foods. Japanese consumers are highly receptive to plant-based health solutions that support liver function, digestion, and blood purification, areas where wheatgrass excels. Powdered wheatgrass is preferred due to its stability and ease of mixing into traditional diets.

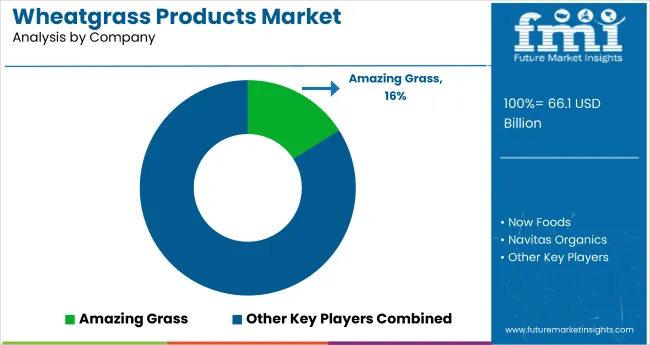

The wheatgrass products market is moderately fragmented, with a mix of global wellness brands and niche organic specialists sharing market space. Companies such as Now Foods, Myprotein, Navitas Organics, Amazing Grass, and Synergy Natural are leading the competition by investing in product innovation, expanding distribution networks, and launching clean-label offerings across powder and juice formats. These players are leveraging growing consumer awareness around plant-based detox and wellness trends.

Competitive strategies in this space include aggressive pricing in online channels, partnerships with global distributors, product diversification (e.g., ready-to-drink shots, blends with other superfoods), and a strong push toward certified organic labeling.

Leading firms are also focused on expanding their geographic footprint across North America, Europe, and Asia-Pacific through e-commerce and health food retail collaborations. Companies are particularly emphasizing traceability, sustainable sourcing, and eco-friendly packaging to align with modern consumer preferences.

Recent News in the Wheatgrass Products Industry

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 66.1 billion |

| Projected Market Size (2035) | USD 118.4 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in metric tons |

| By Type | Juice, Powder |

| By Nature | Natural and Organic |

| By End Use Application | Industrial (Food & Beverages, Nutraceuticals, Personal Care & Cosmetics, Pharmaceuticals, Pet Food), and Household |

| By Packaging Type | Pouches, Tins, Bottles, Sachets, And Capsules |

| By Distribution Channel | B2B and B2C (Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retailers, Others) |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Now Foods, Synergy Natural, Dynamic Greens Wheatgrass Juice, Navitas Organics, Myprotein, Pines International Inc., Herbco International Inc., Nutriblade, Girmes Wheatgrass, E-Phamax, Terrasoul Superfoods, Naturya, ABE'S Organics, Nature Bell, Amazing Grass, and Dr. Berg |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global wheatgrass products market is estimated to be valued at USD 66.1 billion in 2025.

The market size for the wheatgrass products market is projected to reach USD 118.4 billion by 2035.

The wheatgrass products market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in wheatgrass products market are juice and powder.

In terms of nature, natural segment to command 62.5% share in the wheatgrass products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Wheatgrass Products in EU Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA