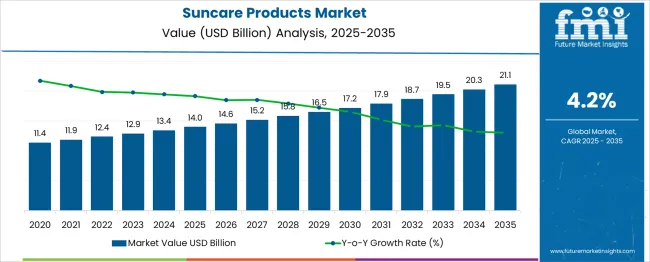

The Suncare Products Market is estimated to be valued at USD 14.0 billion in 2025 and is projected to reach USD 21.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 14.0 billion to USD 17.2 billion, reflecting steady growth supported by increasing awareness of skin protection and the expanding range of multifunctional sun protection solutions. Year-on-year analysis shows consistent increments, with values reaching USD 14.6 billion in 2026 and USD 15.2 billion in 2027, driven by growing demand for broad-spectrum and water-resistant formulations. By 2028, the market is forecasted to reach USD 15.8 billion, followed by USD 16.5 billion in 2029 and USD 17.2 billion by 2030.

Growth is anticipated to be reinforced by innovations such as mineral-based sunscreens, tinted SPF products, and hybrid skincare-suncare solutions. E-commerce platforms and personalized product offerings are expected to accelerate adoption across diverse demographics further. These dynamics position suncare products as an essential segment of the global skincare industry, with increasing opportunities for brands emphasizing dermatologist-recommended, eco-safe, and convenient application formats in both developed and emerging markets.

| Metric | Value |

|---|---|

| Suncare Products Market Estimated Value in (2025 E) | USD 14.0 billion |

| Suncare Products Market Forecast Value in (2035 F) | USD 21.1 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The suncare products market occupies a strong position within several beauty, skincare, and healthcare-related sectors. In the skincare products market, its share is approximately 10–12%, as sunscreens and after-sun care are integral to daily skincare routines alongside moisturizers and anti-aging products. Within the personal care and cosmetics market, its contribution stands at about 4–5%, given the dominance of hair care, color cosmetics, and other personal care items. In the dermatology and sun protection solutions market, suncare products account for nearly 55–60%, reflecting their critical role in UV protection and skin health maintenance. For the beauty and wellness products market, the share is around 3–4%, as this category includes a wide range of wellness and cosmetic products. In the over-the-counter (OTC) healthcare products market, suncare products represent about 6–8%, given their classification as preventive healthcare solutions in many regions. Growth is driven by rising awareness of skin cancer risks, premature aging due to UV exposure, and the increasing demand for multifunctional sunscreens with hydration and anti-pollution benefits. Innovations such as mineral-based formulas, tinted sunscreens, and eco-friendly products are gaining traction. With changing consumer lifestyles and a focus on preventive skin health, the suncare products market is expected to strengthen its role across these parent markets globally.

Consumer behavior is increasingly shifting toward daily use of suncare as a preventative wellness product rather than a seasonal or vacation-specific item. The expanding influence of dermatologists, skincare professionals, and social media platforms has driven higher adoption of sun protection as part of everyday routines. Furthermore, regulations encouraging the use of sun protection and the availability of broad-spectrum, reef-safe, and cosmetically elegant formulations are creating new opportunities for manufacturers.

The market is also being influenced by the expansion of product accessibility through both offline and digital retail channels, allowing brands to reach a wider and more informed customer base. Innovation in textures, active ingredients, and multifunctional solutions is reinforcing product appeal, while climate change and increased outdoor exposure continue to support long-term market expansion globally..

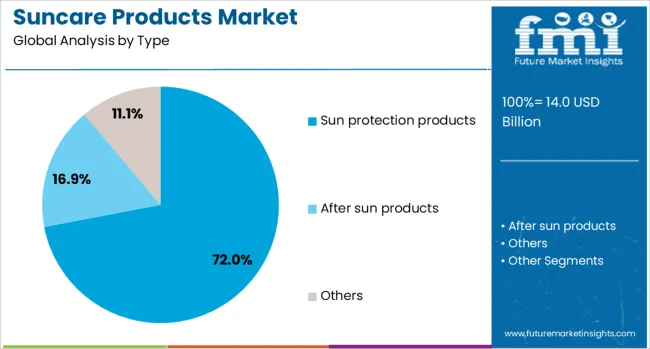

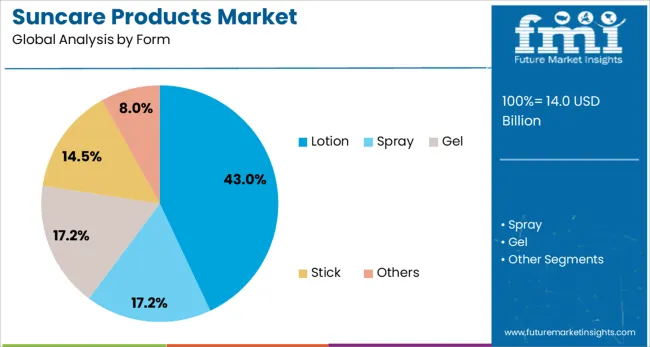

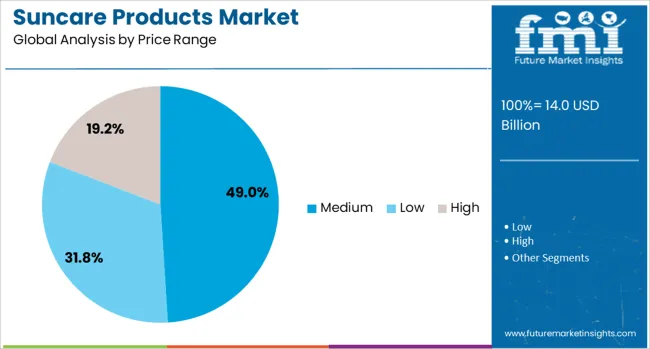

The suncare products market is segmented by type, form, price range, consumer group, distribution channel, and geographic regions. The sun care products market is divided by type into Sun protection products, after sun products, and Others. The suncare products market is classified by form into Lotion, Spray, Gel, Stick, and Others. Based on the price range of the sun care products, the market is segmented into Medium, Low, and High. The consumer group of the sun care products market is segmented into Women, Men, and Kids. The distribution channel of the sun care products market is segmented into Offline and Online. Regionally, the suncare products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sun protection products segment is projected to hold 72% of the Suncare Products market revenue share in 2025, establishing it as the leading type segment. This dominance has been influenced by heightened public education on the risks of sun exposure and the direct correlation between UV radiation and skin disorders.

Products under this segment are increasingly formulated with advanced filters, antioxidants, and skin-compatible ingredients to meet the demand for high-performance, wearable protection. As consumers seek preventive solutions for sunburn, hyperpigmentation, and photoaging, preference has shifted toward protective formulas with proven SPF and broad-spectrum efficacy.

The segment's growth has also been accelerated by regulatory mandates in many regions promoting the daily use of sun protection to reduce dermatological disease burdens. Moreover, the expanding market presence of dermatologically endorsed and cosmetically refined products has made sun protection a core category in skincare, driving its continued leadership in the overall suncare landscape..

The lotion form segment is expected to account for 43% of the Suncare Products market revenue share in 2025, making it the preferred formulation among consumers. This segment has gained momentum due to the ease of application, versatility across skin types, and widespread familiarity with lotion-based products. Its ability to deliver even coverage and maintain skin hydration has enhanced its usage in both face and body applications.

The segment has also benefited from technological advancements that allow the incorporation of lightweight, non-greasy, and water-resistant formulations. As consumers become increasingly conscious of skin feel and sensory attributes, lotion-based sunscreens have emerged as the most balanced option between protection and user experience.

Additionally, lotion formats have supported the integration of multifunctional benefits such as moisturization, anti-aging, and anti-pollution, further reinforcing their adoption. This combination of practical application, broad utility, and comfort has positioned the lotion form as the leading choice in suncare product formats..

The medium price range segment is projected to capture 49% of the Suncare Products market revenue share in 2025, positioning it as the dominant pricing tier. This segment has seen growth driven by its balance between affordability and quality, appealing to a wide spectrum of consumers seeking effective sun protection without premium-level costs.

Brands operating within this range have focused on delivering dermatologist-approved, high-performance products with accessible formulations that align with consumer expectations for safety and efficacy. The medium segment has also benefited from competitive pricing strategies, promotional campaigns, and availability across both retail and e-commerce platforms, making it easily accessible to middle-income groups globally.

This price tier has become the primary battleground for established and emerging brands looking to gain market share, especially in fast-growing regions. The combination of perceived value, trust in product performance, and widespread distribution has enabled the medium price range to lead consumer preference in the evolving suncare product market..

The suncare products market is growing due to heightened awareness of UV-related skin concerns and increased outdoor leisure activities. Strong demand for multifunctional products offering hydration and anti-aging benefits has boosted innovation. Opportunities exist in mineral-based formulations and premium sun protection for sensitive skin. Trends highlight the rise of hybrid formats like tinted sunscreens and on-the-go applications. However, restraints include fluctuating raw material costs, regulatory hurdles in ingredient approvals, and consumer skepticism about chemical filters. The overall outlook reflects consistent demand, supported by diversification across skin types, formats, and SPF ranges.

The primary growth driver for the suncare products market has been rising outdoor activity participation and higher UV exposure awareness. In 2024 and 2025, premium SPF creams and water-resistant sprays saw strong adoption among travelers and athletes. Skin protection routines became more integrated into daily grooming, with combination products gaining preference for convenience. Emerging markets reported significant penetration of entry-level SPF lotions, driven by improved retail access. This momentum indicates that brands emphasizing broad-spectrum protection and value-added skincare attributes will maintain a competitive edge across both mass and premium product segments.

Opportunities are expanding in mineral-based sunscreens and products formulated for sensitive or pediatric skin. In 2025, global players launched zinc oxide and titanium dioxide-based variants to address rising consumer preference for gentle alternatives. Growth prospects are evident in tinted sunscreens that combine makeup benefits with UV defense, offering strong appeal to urban consumers. Premium brands are leveraging dermatology partnerships to create dermatologist-recommended SPF solutions, strengthening trust in high-value markets. These opportunities underscore the shift toward differentiated offerings focusing on performance, aesthetics, and specialized care attributes for niche consumer groups.

Emerging trends highlight the surge of hybrid suncare formats and multifunctional products. In 2024, tinted moisturizers with SPF, anti-pollution shields, and spray-based portable sunscreens gained traction in Europe and Asia-Pacific. Stick formats designed for quick reapplication during outdoor activities were introduced by several major brands. Digital skin analysis tools in retail outlets boosted personalized SPF recommendations, enhancing consumer engagement. These developments signal a market leaning toward convenience-driven innovations that combine beauty, skin protection, and on-the-go utility, reshaping how consumers perceive and adopt suncare solutions in everyday routines.

The market faces restraints due to the high pricing of advanced sun care solutions and strict ingredient approval processes. In 2025, smaller brands struggled to compete with established players owing to the elevated costs of premium UV filters and specialized formulations. Regulatory delays in authorizing new filter technologies slowed innovation pipelines in North America and Europe. Additionally, consumer doubts over chemical filter safety discouraged repeat purchases, particularly in mature markets. These barriers highlight the necessity for transparent labeling, cost-optimized product development, and region-specific compliance strategies to sustain market growth across diverse economies.

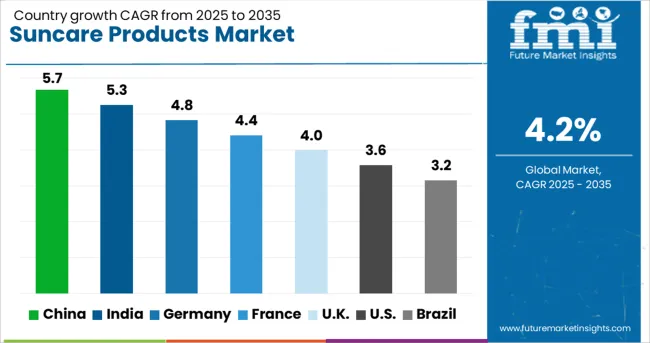

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

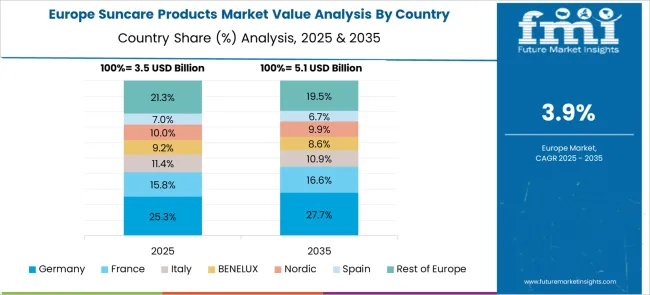

The global suncare products market is projected to grow at 4.2% CAGR during 2025–2035. China leads with 5.7% CAGR, driven by rising awareness of UV protection and demand for multifunctional skincare solutions. India follows at 5.3%, supported by urban consumer adoption and growth in premium sunscreen categories. Germany posts 4.8% CAGR, emphasizing dermatologically tested formulations and clean-label products. The UK grows at 4.0%, while the United States records 3.6%, reflecting slower growth in a mature but evolving market driven by innovation in mineral-based and reef-safe products. Asia-Pacific dominates with affordable, high-efficacy formats, whereas Western countries prioritize eco-compliant and dermatology-backed solutions.

China is forecasted to grow at 5.7% CAGR, supported by increasing demand for suncare products integrated with anti-aging and skin-brightening properties. Rising concerns over urban pollution and UV exposure fuel the popularity of daily-wear sunscreens and hybrid skincare formats. E-commerce channels play a critical role in market penetration, with influencers and beauty platforms promoting advanced sun protection solutions. Local brands focus on cost-effective, SPF-rich products, while international players dominate the premium segment with advanced formulations including antioxidants and blue-light protection.

The suncare products market in India is projected to grow at 5.3% CAGR, driven by a surge in awareness campaigns promoting sun protection and skin health. Growing urbanization and outdoor lifestyles stimulate demand for high-SPF creams and lightweight gel-based sunscreens. Expansion in modern retail and e-commerce enhances access to premium and mid-tier brands. Domestic manufacturers innovate with herbal and Ayurvedic-based sunscreens, while global brands introduce water-resistant and sport-specific products. Increasing consumer inclination toward tinted and non-sticky formulations further drives adoption in metro and tier-2 cities.

Germany is expected to grow at 4.8% CAGR, with demand driven by dermatologist-recommended formulations and broad-spectrum UV protection products. Consumers favor mineral-based sunscreens and products formulated for sensitive skin, reinforcing demand for premium brands. Regulatory compliance under EU guidelines prompts innovation in reef-safe and eco-certified ingredients. Growth in outdoor recreation activities supports the uptake of sport and water-resistant sun protection variants. The market also benefits from an increased preference for high-SPF and anti-aging combined suncare solutions.

The United Kingdom market is projected to expand at 4.0% CAGR, with steady demand across both pharmacy-led and e-commerce retail channels. Consumers prefer clean-label, fragrance-free formulations targeting sensitive and dry skin. Premium brands dominate urban markets with hybrid sun care incorporating anti-aging and hydration properties. Increased travel and tourism activity stimulates the need for convenient packaging formats, such as sticks and sprays. Brands are leveraging digital campaigns to educate consumers on year-round sun protection, addressing misconceptions about seasonal sunscreen use.

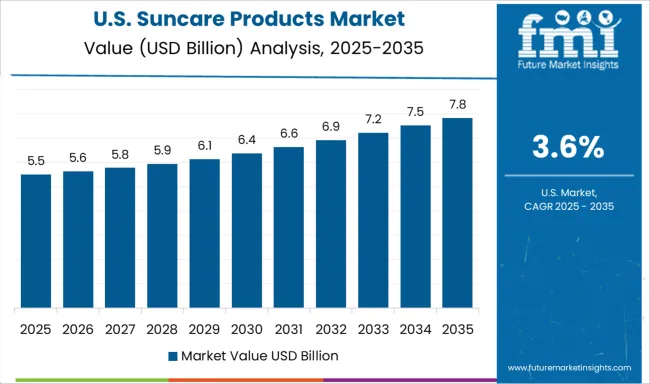

The United States market posts a 3.6% CAGR, reflecting maturity but growing interest in mineral-based and reef-safe formulations. Dermatologists and beauty influencers play a major role in promoting sunscreens with zinc oxide and titanium dioxide as safe alternatives. Increased focus on clean beauty accelerates demand for fragrance-free and cruelty-free sunscreens. Innovation in water-resistant and sport-specific products continues to capture outdoor lifestyle consumers. Additionally, hybrid suncare products combining anti-aging and SPF protection appeal to wellness-oriented buyers seeking multifunctional skincare solutions.

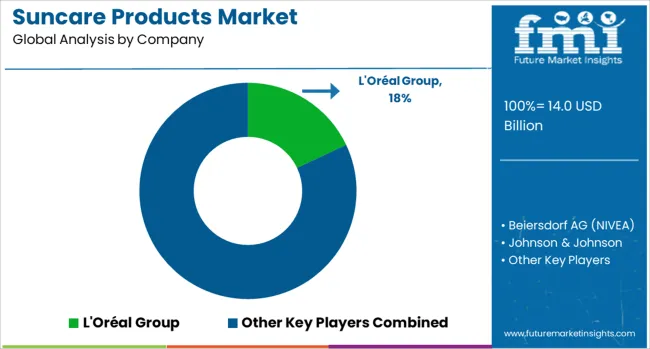

The suncare products market is moderately consolidated, with L'Oréal Group recognized as a leading player due to its extensive brand portfolio, advanced UV protection technologies, and global distribution network. The company offers a wide range of sunscreens, lotions, and sprays under premium and mass-market brands, addressing consumer needs for broad-spectrum protection and skincare benefits.

Key players include Beiersdorf AG (NIVEA), Johnson & Johnson, Edgewell Personal Care, and Shiseido Company. These companies provide diverse suncare solutions including creams, gels, sprays, and mineral-based formulations designed for daily use, outdoor activities, and sensitive skin. Their offerings emphasize UVA/UVB protection, water resistance, and multifunctional properties such as hydration and anti-aging benefits.

Market growth is driven by rising awareness of skin health, increased outdoor recreational activities, and growing demand for multifunctional and dermatologist-recommended formulations. Leading manufacturers are investing in innovations like lightweight textures, reef-safe mineral sunscreens, and advanced SPF technologies.

Trends include the development of tinted sunscreens, hybrid skincare-suncare products, and eco-friendly packaging to meet sustainability goals. While North America and Europe dominate due to high consumer awareness and premium product demand, Asia-Pacific is emerging as a key growth region fueled by lifestyle shifts and growing skin protection trends in urban populations.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.0 Billion |

| Type | Sun protection products, After sun products, and Others |

| Form | Lotion, Spray, Gel, Stick, and Others |

| Price Range | Medium, Low, and High |

| Consumer Group | Women, Men, and Kids |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L'Oréal Group, Beiersdorf AG (NIVEA), Johnson & Johnson, Edgewell Personal Care, and Shiseido Company |

| Additional Attributes | Dollar sales by product type (sun-protection, after-sun, self-tanning) and form (lotion/cream, spray, gel, wipes). Europe and North America led in 2024 (\~30–37% share), Asia-Pacific fastest-growing (\~33%). Buyers prioritize broad-spectrum SPF, mineral and clean-label formulations. Innovations include UV-monitoring wearables, personalized SPF dosing, and tinted, fast-absorbing lightweight sprays. |

The global suncare products market is estimated to be valued at USD 14.0 billion in 2025.

The market size for the suncare products market is projected to reach USD 21.1 billion by 2035.

The suncare products market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in suncare products market are sun protection products, after sun products, others and _self tanning.

In terms of form, lotion segment to command 43.0% share in the suncare products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Corn Co-Products Market

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA