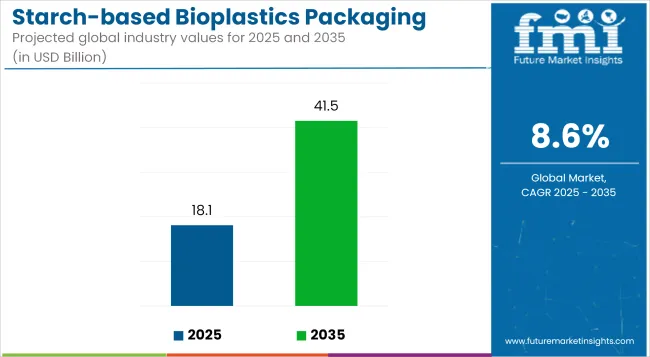

The starch based bioplastics packaging market is projected to grow from USD 18.1 billion in 2025 to USD 41.5 billion by 2035, registering a CAGR of 8.6% during the forecast period. Sales in 2024 reached an estimated USD 16.6 billion, indicating sustained growth momentum driven by rising environmental concerns and increasing bans on single-use plastics.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 18.1 billion |

| Industry Value (2035F) | USD 41.5 billion |

| CAGR (2025 to 2035) | 8.6% |

This expansion has been attributed to the growing preference for biodegradable and renewable packaging alternatives across industries such as food & beverage, personal care, and agriculture. Starch-based bioplastics, derived from natural resources like corn, potato, and cassava starch, are widely used in films, trays, containers, and compostable pouches. Their cost-effectiveness, industrial composability, and reduced carbon footprint are aligning with regulatory frameworks and shifting consumer expectations toward more sustainable packaging practices.

In 2025 Green Dot Bioplastics announces metallization is used in many flexible packaging applications to improve barrier performance, as well as for decoration and marketing differentiation. Green Dot Bioplastics is excited to announce initial film metallizing success in collaboration with Rol-Vac, LP, a leader in the metallization of plastic films and other flexible substrates.

“Film metallization is important to give compostable plastics necessary barrier properties”, said Mark Remmert, Green Dot CEO, “and we are excited that research at Green Dot Bioplastics has brought forth another breakthrough advancement for the industry”.

The shift toward renewable and biodegradable materials is accelerating growth in the starch-based bioplastics packaging market, as companies move away from conventional plastics to meet sustainability goals. These bioplastics are fully compostable under industrial conditions and leave no micro plastic residue, addressing critical environmental concerns.

Technological innovations have enhanced the functional performance of starch blends improving their tensile strength, heat resistance, and moisture barrier properties. Manufacturers are increasingly combining starch with other biodegradable polymers like PLA and PBAT to meet application-specific requirements. With packaging waste reduction targets tightening globally, starch-based bioplastics are being seen as a scalable solution, particularly in single-use packaging applications such as bags, food service ware, and agricultural films.

The market for starch-based bioplastics packaging is expected to witness sustained momentum, driven by policy mandates, material innovation, and consumer-led sustainability pressures. Growth opportunities are projected across regions such as Europe, where the EU Green Deal and Single-Use Plastics Directive support bio-based packaging, and in Asia-Pacific, where bioplastics adoption is rising in response to urbanization and eco-regulations.

Companies that can deliver high-performance, cost-competitive, and compostable packaging formats will be well-positioned. Strategic partnerships between raw material suppliers, packaging converters, and FMCG brands are likely to shape the next phase of industry expansion. As infrastructure for industrial composting improves, starch-based packaging is set to emerge as a cornerstone of the global circular packaging economy.

The market is segmented based on technology, material, product type, end-use industry, and region. By technology, the market includes blow molding, extrusion, injection molding, and others. In terms of material, the market is categorized into starch blended with PLA, starch blended with PHA, starch blended with PVOH, starch blended with PBS, and other starch-based blends.

By product type, the market is divided into rigid packaging including trays, bottles & containers, and caps & lids and flexible packaging, which includes films & wraps, bags & pouches, and sachets. Based on end-use industry, the market comprises home care, health care, personal care, food & beverage, automotive, and other industrial sectors. Regionally, the market is analysed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

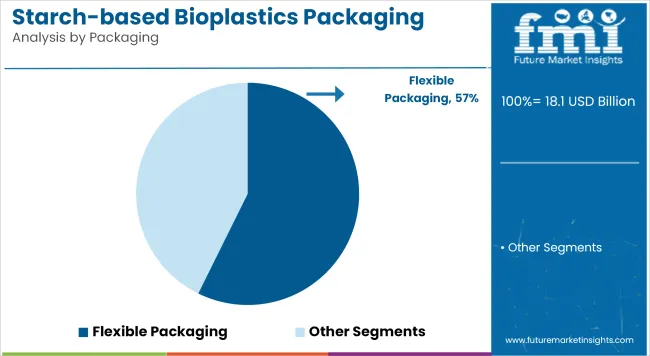

Flexible packaging is projected to account for 57.3% of the starch-based bioplastics packaging market by 2025, driven by increasing demand for compostable and lightweight alternatives in retail, e-commerce, and food service. The segment includes formats such as films and wraps, bags and pouches, and sachets, which are widely used for packaging snacks, personal care refills, detergents, and dry powders.

Starch-based flexible films, especially those blended with PLA (polylactic acid) or PVOH (polyvinyl alcohol), offer superior oxygen and moisture barrier properties, making them suitable for both food and non-food applications. These films are increasingly being adopted as monolayer compostable laminates, designed to replace multilayer synthetic plastic structures that are difficult to recycle.

In grocery and foodservice packaging, starch-based pouches are gaining popularity for dry mixes, sugar sachets, and takeaway wrappers, aligning with bans on single-use plastics across Europe and parts of Asia. Large brands in personal care and household cleaning sectors are investing in bio-based refill pouches and sachets, leveraging flexible formats for improved consumer convenience and reduced environmental footprint. Moreover, rapid advancements in printability, seal strength, and home-compost certification have strengthened the adoption of starch-based flexible formats among sustainability-driven SMEs and D2C brands.

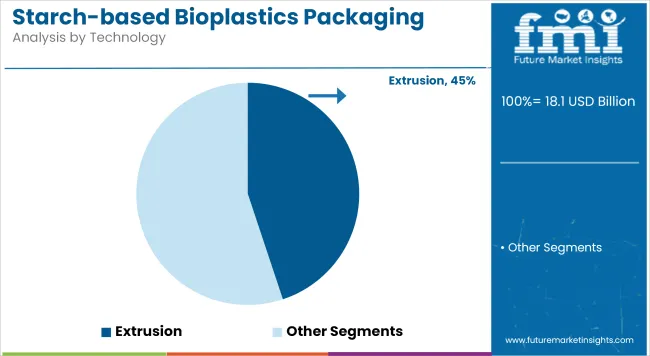

Extrusion is expected to account for 44.9% of the technology share in the starch-based bioplastics packaging market by 2025, making it the leading manufacturing process used for converting starch compounds into films, bags, wraps, and rigid sheets. This technology is particularly effective for processing starch blends with PLA or PBS (polybutylene succinate), which exhibit thermoplastic behaviour, allowing manufacturers to extrude thin, uniform sheets that retain durability while remaining fully biodegradable.

Extrusion lines are highly scalable and allow for the integration of bio-fillers, natural pigments, and functional additives, which enhance printability and mechanical strength. As brands and retailers demand packaging that performs like plastic but decomposes like paper, extrusion has enabled the creation of heat-sealable, water-resistant films with industrial or even home-compost certification.

The growth of automated pouching, wrapping, and thermoforming lines has further strengthened demand for extrusion-based starch packaging, particularly in the food and beverage and home care industries. Global packaging converters are increasingly upgrading to extrusion setups optimized for biodegradable resin processing, recognizing the role of extrusion in achieving cost-competitive and eco-compliant bioplastic packaging at scale.

Cost and Performance Constraints

Unless low-cost production and enhanced performance deliver environmental advantage to starch bioplastics, application is restricted on bulk scale. The material is typically lower in mechanical and moisture barrier properties than conventional plastics and thus becomes disapproved for most packaging applications. It forces companies to invest in better formulations, coating technology, and material science to drive barrier property and extension of service life to enable starch-based packages to excel in the market without sacrificing sustainability goals.

Consumer Trends and Government Policies

Increased regulatory and consumer support towards adopting greener packaging present lucrative opportunities for the starch-based bioplastics packaging market. Governments worldwide are implementing incentives, subsidies, and tax credits on the use of packaging material that may be biodegradable.

Web giants like Amazon and fast food giants like McDonald's are not far behind in adopting biodegradable packaging as a move to be at the forefront of adopting global trends of being environmentally friendly. Advancements in nanotechnology-based additives and bio-upscale add to the range of application of starch-based bioplastics to packaging applications.

The USA starch-based bioplastics packaging market is growing, driven in part by demand from the food and beverage sector, retail and consumer goods. The trend of major brands, including Starbucks and Walmart, seeking sustainable packaging solutions is a significant growth driver. Regulatory frameworks like state-level bans on single-use plastics layer yet more momentum of the market.

Improvements in compostability standards and increased consumer awareness will promote the candidacy of starch-based bioplastics over the next few years. Retail and E-commerce Expansion: Leading USA e-commerce merchants increasingly focus on sustainable biodegradable packaging solutions.

The complementary composition of starch esters is also a precursor of huge potential for bioplastics to substitute conventional plastic fillers in bio-reinforcements, thus, reducing the burden on the environment. The foodservice sector is also speeding adoption with compostable takeout and cutlery.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

The UK market for starch-based bioplastics is expanding as the government has pledged to ban single-use plastics by 2030. REACH regulations are also stimulating demand for compostable and renewable alternatives. Supermarket giants like Tesco and Sainsbury’s are spearheading the move towards starch-based alternatives for packaging.

Starch-based packaging solutions are also on the rise in the construction sector for not only insulation, but also protective materials. Supermarket Initiatives: Following suit, big grocery chains are switching to 100% biodegradable packaging, using starch-based trays and wraps instead of plastic options.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.9% |

Imposing restrictions under the Green Deal and the Circular Economy Action Plan, the EU acts as a key driver for its starch-based bioplastics packaging market. Germany, France, and Italy are ahead in adoption, backed by industrial support and government incentives for biodegradable plastics. European Union’s ban on single-use plastics drives explosive growth in compostable packaging.

Increasing demand for pallet wrapping and cushioning for starch based bioplastic films in sustainable logistics The cosmetics sector also gravitates toward starch-based bioplastics tubes and containers to lessen dependence on fossil fuels for personal care packaging.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.5% |

Owing to technological advances in biodegradable materials and government incentives to use eco-friendly packaging, the starch-based bioplastics market in Japan is growing. The nation’s Smart Packaging Initiative promotes the use of starch-based materials in food packaging, spurred by demand from convenience store chains like 7-Eleven and FamilyMart.

Electronics and Home Appliance Packaging: Japan’s consumer electronic industry is shifting towards biodegradable starch-based packaging for small appliances and accessories. Given the Czech Republic’s commitment to zero-waste solutions, starch-based bioplastics are a worthy alternative option within protective packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.6% |

Led by government composable plastic mandates and a growing investment in green technologies, South Korea's starch-based bioplastic market is exploding. Retail and fast-food companies have made some of the biggest commitments, including Lotte and CJ Group to sustainable packaging.

Packaging Explosion in South Korea: The South Korean food industry packaging is shifting towards starch-based pouches and wraps that are substituting petroleum-based packaging. Expanding even further also arrives through innovation in starch-based coatings with high barrier wherein products achieve better moisture barrier capability and longer shelf life.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.3% |

Further the starch-based bioplastics packaging market is very dynamic in nature consisting of a mix of dominant players and regional companies driving towards sustainability. Global companies specializing in sustainable packaging solutions world have pioneered contributions to the sector, thereby prompting vast advances in technology and innovation.

As sustainability becomes a growing concern for consumers and businesses alike, industry leaders are aligning their product portfolios with strict environmental compliance. This competitive landscape features a mix of leading enterprises and emerging players that serve as significant catalysts for the emerging biodegradable and compostable packaging solutions.

The overall market size for starch-based bioplastics packaging was USD 18.1 billion in 2025.

The starch-based bioplastics packaging market is expected to reach USD 41.5 billion in 2035.

The increasing demand for environmentally friendly packaging solutions, technological advancements in the packaging industry, favorable government initiatives for sustainable packaging, and growing consumer awareness are expected to drive the demand for starch-based bioplastics packaging during the forecast period.

The top 5 countries driving the development of the starch-based bioplastics packaging market are the USA, Germany, the UK, China, and India.

On the basis of application, the food & beverage industry is anticipated to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bioplastics Market Analysis - Size, Share & Forecast 2025 to 2035

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Algae-Based Bioplastics Market Share & Provider Insights

Algae-Based Bioplastics Market Analysis – Growth & Forecast 2024-2034

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA